ADC Exposures Under Capital Requirements Regulation (CRR)

On May 17, 2024, EBA released draft guidelines for ADC exposures in residential property. These aim to mitigate risks under CRR, allowing a 100% risk weight under specific conditions. Comments accepted until August 19, 2024.

Acquisition, Development, and Construction (ADC) exposures represent financing arrangements for land acquisition, site preparation, and construction of new properties. By their nature, ADC exposures carry elevated residual risks compared to traditional mortgage lending, requiring banks to hold additional capital under the Capital Requirements Regulation (CRR).

Key Regulatory Framework (CRR & CRR3)

- Article 126a CRR: Imposes a baseline 150 % risk weight on ADC exposures, reflecting higher credit and construction risk.

- Conditional Relief: A reduced 100 % risk weight is available for residential ADC exposures that satisfy strict criteria:

- Pre-sales or pre-leases with at least 10 % of the purchase price paid as a cash deposit.

- Obligor equity of at least 35 % of the property’s completed value.

- Compliance with additional EBA-defined safeguards for public housing and not-for-profit developers.

EBA Consultation (EBA/CP/2024/12)

The European Banking Authority’s consultation paper EBA/CP/2024/12 proposes quantitative thresholds that exceed prevailing market practice, ensuring capital relief is granted only when residual risks are demonstrably mitigated. Notable proposals include:

- 10 % minimum cash deposit on pre-sale contracts.

- 35 % obligor equity contribution upon project completion.

Industry Feedback & Strategic Implications

Market participants have raised concerns about:

- Threshold stringency and alignment with national legal frameworks.

- Definition of eligible collateral and equity.

- Impact on capital adequacy models and risk management systems.

Banks must now recalibrate their underwriting standards, data infrastructure, and capital calculation methodologies under CRR3 to optimize the cost of capital for ADC lending. Failure to meet the new criteria may increase funding costs and erode competitiveness in the property development sector.

Broader Market Impact

Tighter financing conditions under CRR are likely to:

- Influence the supply and cost of new residential developments.

- Shift lending toward lower-risk ADC projects or alternative non-bank financing channels.

Financial institutions and developers alike must engage proactively with evolving CRR guidelines, balancing prudential soundness against the need to finance viable property development.

Source

[1]

The Pivotal Role of the Capital Requirements Regulation (CRR) in Mitigating Residual Risks

The Capital Requirements Regulation (EU) No 575/2013 (CRR) forms the bedrock of prudential supervision in the EU banking sector, compelling institutions to hold sufficient capital, loss-absorbing liabilities, and liquid assets to withstand periods of economic stress. Together with the Capital Requirements Directive (CRD IV), the CRR creates a harmonized “single rulebook” that enshrines Basel III standards across all Member States—promoting a level playing field, curbing regulatory arbitrage, and bolstering confidence in financial stability.

- Risk-weighted Assets (RWAs): Under CRR, banks assign a risk weight to each asset based on its credit and operational risk profile. Higher risk weights translate directly into higher capital charges, ensuring that exposures with greater residual risks (e.g., ADC financing) are backed by commensurately more capital.

- ADC Exposures Under CRR3: By explicitly categorizing Acquisition, Development, and Construction (ADC) exposures as high-risk, Article 126a enforces a 150 % risk weight, with a conditional reduction to 100 % when stringent de-risking criteria are met. This mechanism discourages speculative lending and preempts asset-price bubbles.

- Macroprudential Safeguard: The CRR’s targeted approach to ADC exposures not only protects individual banks from construction-related losses but also mitigates systemic vulnerabilities arising from real-estate market cyclicality.

Through these provisions, the CRR aligns incentives, steering banks toward financing projects with demonstrable risk mitigation—thereby safeguarding both institutional solvency and the broader economy against property-market downturns.

Defining ADC Exposures: The Regulatory Blueprint

Article 4(1), point 79 CRR precisely delineates ADC exposures as loans or credit facilities extended to corporates or special purpose entities (SPEs) for:

- Land Acquisition for Development: Financing the purchase of land intended for subsequent development.

- Development and Construction: Funding the erection, renovation, or significant redevelopment of residential or commercial immovable property.

“‘acquisition, development and construction exposures’ or ‘ADC exposures’ means exposures to corporates or special purpose entities financing any land acquisition for development and construction purposes, or for the development and construction of any residential or commercial immovable property.”

This gatekeeping definition ensures that only genuinely speculative property-development financing attracts the elevated CRR capital treatment under Article 126a. Ambiguity here could lead to:

- Inconsistent Application: Divergent interpretations by banks and supervisors, undermining the CRR’s single-rulebook objectives.

- Misclassification Risk: Capturing loans backed by obligor income rather than project cash flows, potentially misapplying ADC risk weights to exposures lacking true development risk.

By anchoring the EBA’s draft guidelines (EBA/CP/2024/12) to this clear definition, the European Banking Authority aims to foster uniformity, bolster transparency, and ensure that ADC exposures are subject to capital requirements that faithfully reflect their inherent residual risks.

Distinguishing ADC Exposures from Other Real Estate Categories

Understanding how Acquisition, Development, and Construction (ADC) exposures differ from other real estate financing is essential for accurately assessing residual risks and applying the correct Capital Requirements Regulation (CRR) treatment.

Key Differences in Risk Profiles and CRR Treatment

- Nature of the Exposure

- ADC Exposures: Financing land acquisition, site improvements, or construction of unfinished properties. Income generation is uncertain until project completion, leading to higher residual risks.

- Completed Property Mortgages: Loans secured by existing residential or commercial buildings with established market values and, often, stable rental income.

- Regulatory Articles and Risk Weights

- Article 126a CRR: Default 150 % risk weight for ADC exposures; reducible to 100 % under strict de-risking conditions.

- Articles 124 & 126 CRR: Exposures fully secured by mortgages on completed properties may receive a 50 % risk weight if criteria—such as reliable valuation and prudent loan-to-value limits—are met.

- CRR3 Enhancements

- Introduction of Income Producing Real Estate (IPRE) vs. non-IPRE classifications.

- Option to use loan-splitting or whole-loan approaches for specialized lending, ensuring risk weights reflect the underlying residual risks of each portion.

- Objective, Criteria-Based Definitions

- Article 4(1)(79) CRR: Clearly defines ADC exposures by activity—land acquisition or construction—rather than subjective assessments of intent to resell.

- This precision minimizes regulatory arbitrage and promotes consistent application across EU Member States.

By maintaining these clear distinctions, banks can align underwriting, risk management, and capital calculations with the CRR’s expectations—ensuring that each real estate exposure category carries capital commensurate with its inherent residual risks.

Table 1: CRR Definitions for ADC and Related Terms

| Term | CRR Article Reference | Definition |

|---|---|---|

| ADC exposure | Art. 4(1)(79) | Exposures to corporates or special purpose entities financing land acquisition for development and construction, or the building/redevelopment of residential or commercial property. |

| Credit Institution | Art. 4(1)(1) | An undertaking taking deposits or other repayable funds from the public and granting credits for its own account. |

| Investment Firm | Art. 4(1)(2) | A person defined in Article 2(1A) of Regulation 600/2014/EU, other than a credit institution. |

| Public Sector Entity | Art. 4(1)(8) | A non-commercial administrative body or undertaking owned/sponsored by government with explicit public guarantees. |

| Management Body | Art. 4(1)(36) | The body/entities setting strategy, objectives, and oversight of an institution, including those effectively directing its business. |

| Immovable Property | – | Land and buildings, as referenced across CRR Articles 124–126a, 208, and 229. |

| Special Purpose Entity (SPE) | – | An entity formed specifically to finance and/or operate assets, commonly used in ADC and specialized lending. |

The CRR Framework for ADC Exposures: Risk Weights and Conditions

Article 126a CRR: Default 150 % Risk Weight for ADC Exposures

Under Article 126a of the Capital Requirements Regulation (CRR), all Acquisition, Development, and Construction (ADC) exposures are subject to a 150 % risk weight by default. This elevated capital charge reflects the heightened residual risks inherent in ADC financing:

- Construction and Completion Risk: Projects may encounter delays, cost overruns, or technical setbacks before becoming income-generating.

- Market Absorption Risk: Uncertainty exists around selling or leasing units at projected prices.

- Future Cash-Flow Dependence: Repayment often hinges on the successful disposition or leasing of the finished property, not on established borrower income streams.

By assigning a 150 % risk weight, the CRR ensures banks maintain a robust capital buffer against potential losses in ADC portfolios, discouraging excessive concentration in speculative property development and aligning capital charges with the Basel III principle of risk sensitivity.

Pathway to 100 % Risk Weight for Residential ADC Exposures

Article 126a(2) CRR offers a conditional reduction to a 100 % risk weight, but only for residential ADC exposures that satisfy both of the following:

- Sound Origination & Monitoring Standards

Institutions must comply with:- Article 74 CRD IV (governance, recovery, and resolution planning)

- Article 79 CRD IV (risk management committee functions)

- At Least One Risk-Mitigating Condition

- Pre-sales or Pre-leases

- Legally binding contracts with a substantial cash deposit (forfeitable upon termination) or equivalent financing guarantees.

- Contracted payments (including progress instalments) must represent a significant portion of total envisaged sales/leasing.

- Obligor-Contributed Equity

- Pre-sales or Pre-leases

- The borrower must contribute an appropriate amount of equity, placing substantial equity at risk relative to the property’s completed value.

Note: The CRR itself does not quantify “substantial cash deposit,” “significant portion,” or “appropriate amount of equity.” Under Article 126a(3) CRR, the European Banking Authority (EBA) must issue guidelines by 10 July 2025 clarifying these terms, prompting the EBA’s consultation paper EBA/CP/2024/12.

Policy Implications for Residential ADC Lending

- Capital Efficiency: Meeting the EBA’s forthcoming thresholds can materially lower capital charges, enhancing the attractiveness of residential ADC financing.

- Strategic Focus: Banks may preferentially allocate capital toward qualifying residential ADC projects, potentially reshaping market dynamics between residential and commercial development lending.

- Regulatory Consistency: The EBA’s detailed specifications will harmonize interpretation across Member States, preserving the CRR’s “single rulebook” objective.

By coupling a high default risk weight with a clearly defined, conditional pathway to relief, the Capital Requirements Regulation (CRR) balances the imperative of prudential soundness against supportive measures for responsibly de-risked residential ADC exposures.

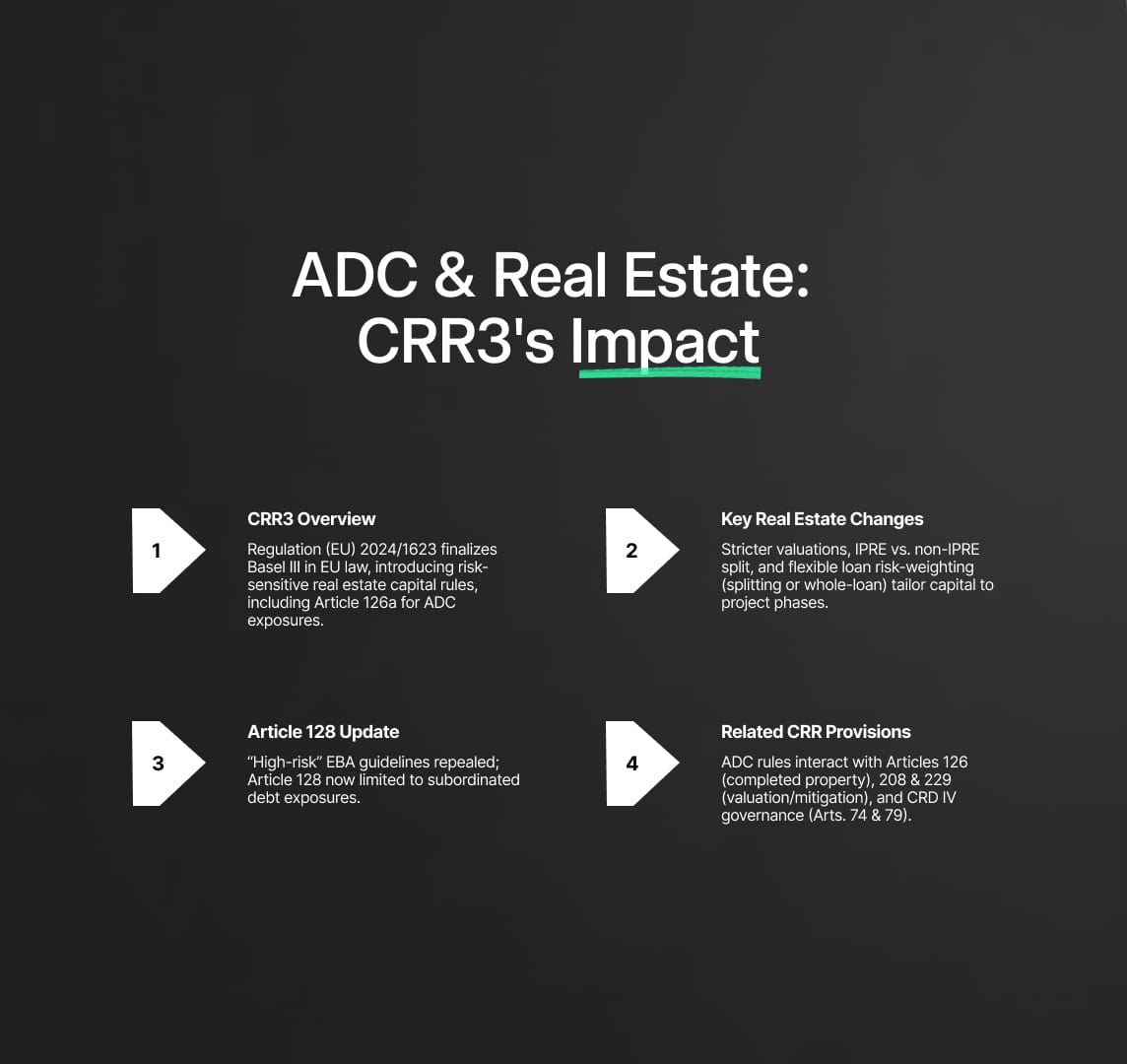

The Impact of CRR3 Amendments on ADC and Broader Real Estate Exposure Treatment

1. Overview of CRR3 Enhancements

Regulation (EU) 2024/1623 (commonly referred to as CRR3) finalizes Basel III reforms within EU law, introducing more risk-sensitive treatments for all real estate exposures. These changes create the context in which Article 126a CRR governs ADC exposures, ensuring that capital requirements reflect true residual risks across the property lifecycle.

2. Key CRR3 Changes for Real Estate Exposures

- Revised Exposure-to-Value (ETV) Methodologies

- Stricter valuation rules ensure accurate loan sizing relative to market value.

- Granular Classification: IPRE vs. non-IPRE

- Income Producing Real Estate (IPRE): Properties already generating cash flows (e.g., rental buildings).

- Non-IPRE: Projects not yet income-generating, including land and developments under construction.

- Flexible Risk-Weighting Approaches

- Loan-Splitting Approach: Separates a single exposure into tranches (e.g., land vs. construction phases), each with its own risk weight.

- Whole-Loan Approach: Applies one risk weight to the entire exposure when splitting is impractical.

These innovations sharpen the calibration of capital charges to the Capital Requirements Regulation (CRR)’s underlying risk, reinforcing prudent lending across both completed and in-development real estate.

3. Repeal of “High-Risk” Guidelines under Article 128

CRR3’s amendment of Article 128 restricts its scope to subordinated debt exposures, rendering the previous EBA “high-risk” guidelines obsolete. By replacing broad categorizations with targeted classes, like ADC, CRR3 streamlines regulatory treatment and eliminates overlap between generic high-risk rules and dedicated provisions.

4. Complementary CRR Provisions Affecting ADC Treatment

To fully grasp ADC capital requirements, institutions should consider related CRR articles:

- Article 126 (Mortgages on Completed Commercial Properties)

- Risk Weight: 50 % if the property’s value and borrower’s credit quality are independent.

- Benchmark: Highlights the contrast with the 150 % ADC default weight under Article 126a.

- Article 208 (Credit Risk Mitigation Principles)

- Establishes sound valuation, legal certainty, and enforceability standards for collateral—vital context for any property-backed lending.

- Article 229(1) (Property Valuation Rules)

- Sets methodologies for valuing immovable property, directly informing equity-at-risk calculations under Article 126a(2)(b).

- CRD IV Articles 74 & 79 (Governance & Risk Management)

- Institutions must satisfy these governance and risk committee requirements to access the 100 % residential ADC risk-weight pathway.

5. ADC Risk Weights & Conditions under Article 126a

| Treatment Category | Risk Weight | Application Conditions | CRR Reference |

|---|---|---|---|

| Default ADC Exposure | 150 % | Applies to all exposures meeting the ADC definition (Art. 4(1)(79)), unless residential ADC conditions are met. | Art. 126a(1) |

| Preferential Residential ADC Exposure | 100 % |

1. Exposure to residential property 2. Compliance with CRD IV Articles 74 & 79 (governance & risk management) 3. One of: a) Pre-sales/pre-leases: Legally binding with significant cash deposits or equivalent guarantees b) Equity at Risk: Substantial obligor-contributed equity upon completion |

Art. 126a(2) |

By embedding CRR3’s risk-sensitive refinements and leveraging related CRR provisions, banks can ensure that capital buffers for ADC exposures genuinely correspond to their residual risks, supporting both sector stability and responsible property development.

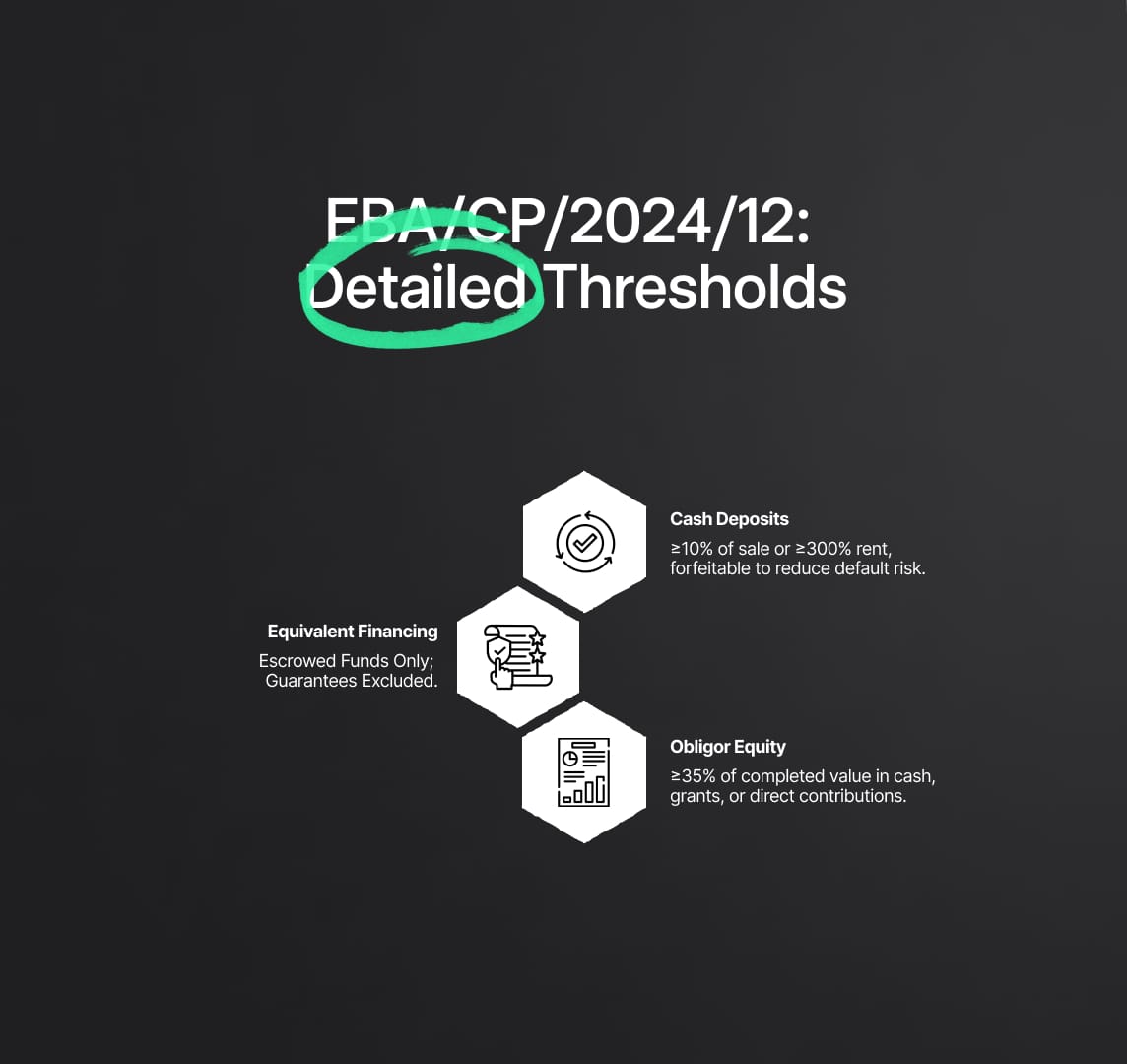

EBA’s Mandate under CRR Article 126a(3) and Purpose of EBA/CP/2024/12

Residual risks in ADC exposures hinge on precise definitions of de-risking conditions. Under CRR Article 126a(3), the European Banking Authority (EBA) is required to publish binding Capital Requirements Regulation (CRR) guidelines by 10 July 2025 to clarify four key terms in Article 126a(2):

- Substantial cash deposits

- Financing ensured in an equivalent manner

- Significant portion of total contracts

- Appropriate amount of obligor-contributed equity

To fulfill this mandate, the EBA released Consultation Paper EBA/CP/2024/12 on 17 May 2024, followed by a public consultation (closing 19 August 2024) and a public hearing on 20 June 2024. These draft guidelines aim to harmonize the interpretation of de-risking criteria for a reduced 100 % risk weight on residential ADC exposures—promoting consistent capital treatment, enhancing supervisory efficiency, and ensuring that banks hold capital commensurate with their true residual risks in property-development financing.

Detailed Definitions & Thresholds in EBA/CP/2024/12

1. “Substantial Cash Deposits”

- Rationale: Aligns the purchaser’s or tenant’s incentives with project completion, reducing developer default risk and safeguarding against market-value deterioration.

- Pre-sale Threshold: ≥ 10 % of the agreed sale price, forfeitable upon contract termination.

- Pre-lease Threshold: ≥ 300 % of one month’s rent, forfeitable upon termination.

- SEO Focus: By setting these deposits above prevailing market norms, the EBA ensures that qualifying ADC exposures meaningfully mitigate residual risks before banks can apply the lower CRR risk weight.

2. “Financing Ensured in an Equivalent Manner”

- Rationale: Allows non-cash equivalents only if they replicate the risk-mitigating effect of a cash deposit.

- Eligible Forms:

- Instalments already paid into a segregated account; or

- Cash equivalents (e.g., surety held in escrow), both subject to the same quantitative thresholds as cash deposits.

- Exclusions: General CRM-approved collateral or third-party guarantees are not considered equivalent, preserving the safeguard of direct, forfeitable funds.

4. “Appropriate Amount of Obligor-Contributed Equity”

- Rationale: Ensures developers have significant “skin in the game,” absorbing cost overruns and aligning incentives.

- Threshold: ≥ 35 % of the property’s value upon completion (per CRR Article 229(1)).

- Eligible Equity Forms:

- Segregated cash investments.

- Subsidies or grants earmarked for the project.

- Marketable assets exclusively backing the project.

- Out-of-pocket development or construction expenses.

- Land/improvements directly contributed at market value.

By prescribing these quantitative de-risking measures, the EBA’s guidance under EBA/CP/2024/12 empowers banks to apply the 100 % CRR risk weight only when residual risks in residential ADC exposures are demonstrably reduced, ensuring capital adequacy, market confidence, and alignment with Basel III principles.

Tailored CRR Provisions for Public Housing & Not-for-Profit ADC Exposures

Recognizing the social mandate and lower residual risks of public housing and not-for-profit developers, the Capital Requirements Regulation (CRR), through Article 126a(3), allows institutions to apply adjusted de-risking criteria for these ADC exposures. Under the EBA’s draft guidelines (EBA/CP/2024/12), banks may opt in to this specialized framework when all of the following conditions are met:

- Property Use

- Exclusively leased for social or public housing, as defined by national regulations on applicant eligibility and construction standards.

- Reduced Cash-Deposit Threshold

- Pre-lease contracts require a 100 % deposit of one month’s rent (vs. 300 % under the general framework), payable into a segregated account and forfeitable on tenant withdrawal.

- Expanded “Equivalent Financing”

- In addition to upfront instalments or escrowed cash, penalty clauses in the lease (subject to the 100 % rent threshold) qualify as risk-mitigants equivalent to cash, reducing banks’ capital requirements under CRR.

- Higher Pre-Lease Coverage

- At least 75 % of total units must be under legally binding pre-lease or lease contracts—a stricter benchmark than the 50 % required for standard residential ADC exposures, to reflect consistent demand and public-sector backing.

Industry Feedback & EBA’s Rationale

- Threshold Stringency vs. Market Practice

- Stakeholders (e.g., GBIC, ESBG) argue that many public-housing developers cannot meet high equity or contract-coverage ratios without government subsidies, risking most ADC exposures reverting to a 150 % risk weight under CRR.

- Definition of Eligible Equity & Collateral

- Proposals to include broader collateral types (land charges, rated guarantees) were largely rejected by the EBA to preserve clarity and prevent dilution of credit quality.

- National Legal Constraints

- Consumer-protection caps (e.g., 5 % pre-sale deposits in France) conflict with EBA’s minimum 10 % threshold, illustrating the challenge of a “one-size-fits-all” approach to residual-risk mitigation.

- EBA’s High-Bar Philosophy

- A substantial one-third reduction in capital charge (150 % → 100 %) demands de-risking metrics that “exceed current market practices,” reinforcing the CRR’s goal of aligning capital with true project risk.

By offering this optional framework for public housing and not-for-profit ADC exposures, the CRR balances social objectives with prudential safeguards, provided banks can implement the stricter yet socially calibrated criteria to secure the 100 % risk weight under Article 126a.

Status and Timeline: From Consultation to Final Guidelines

1. Key Milestones for EBA/CP/2024/12

- 17 May 2024: EBA publishes Consultation Paper EBA/CP/2024/12, launching the review of de-risking criteria for residential ADC exposures under CRR Article 126a(3).

- 20 June 2024: Public hearing gathers feedback from banks, developers, and national supervisors on proposed thresholds for mitigating residual risks.

- 19 August 2024: Consultation period closes, with extensive industry input on equity ratios, pre-sale/pre-lease deposits, and contract-coverage metrics.

- Quantitative Impact Study (QIS): Conducted in parallel to evaluate capital-requirement effects of the proposed 100 % vs. 150 % risk-weight options.

- 10 July 2025: Deadline for EBA to issue final CRR guidelines, as mandated by Article 126a(3).

2. “Comply or Explain” under EBA’s Founding Regulation

- Final guidelines will be formalized as EBA/GL/YYYY/XX.

- Article 16 of Regulation 1093/2010 imposes a “comply or explain” regime:

- National authorities and credit institutions must confirm their intention to comply or justify any deviations.

- EBA publishes compliance status, ensuring transparency and consistent supervisory oversight of CRR treatment for ADC exposures.

Table: Timeline & Next Steps for ADC Risk-Weight Guidelines

| Date | Event | Relevance to CRR & ADC Exposures |

|---|---|---|

| 17 May 2024 | Publication of EBA/CP/2024/12 | Launches consultation on de-risking thresholds for residential ADC under CRR |

| 20 June 2024 | Public hearing | Real-time industry feedback on mitigating residual risks in ADC financing |

| 19 August 2024 | Consultation closes | Collates stakeholder views on quantitative criteria (e.g., 10 % deposits, 35 % equity) |

| QIS period | Quantitative Impact Study | Assesses capital-charge impact of proposed 100 % vs. 150 % risk weights |

| 10 July 2025 | Final guidelines due (CRR Art. 126a(3) deadline) | EBA issues binding rules, triggering “comply or explain” under Regulation 1093/2010 |

By adhering to this timeline, credit institutions can align internal models, data systems, and risk-management frameworks with the forthcoming CRR3 amendments, ensuring that capital buffers for ADC exposures accurately reflect their residual risks and maintain compliance with EU prudential standards.

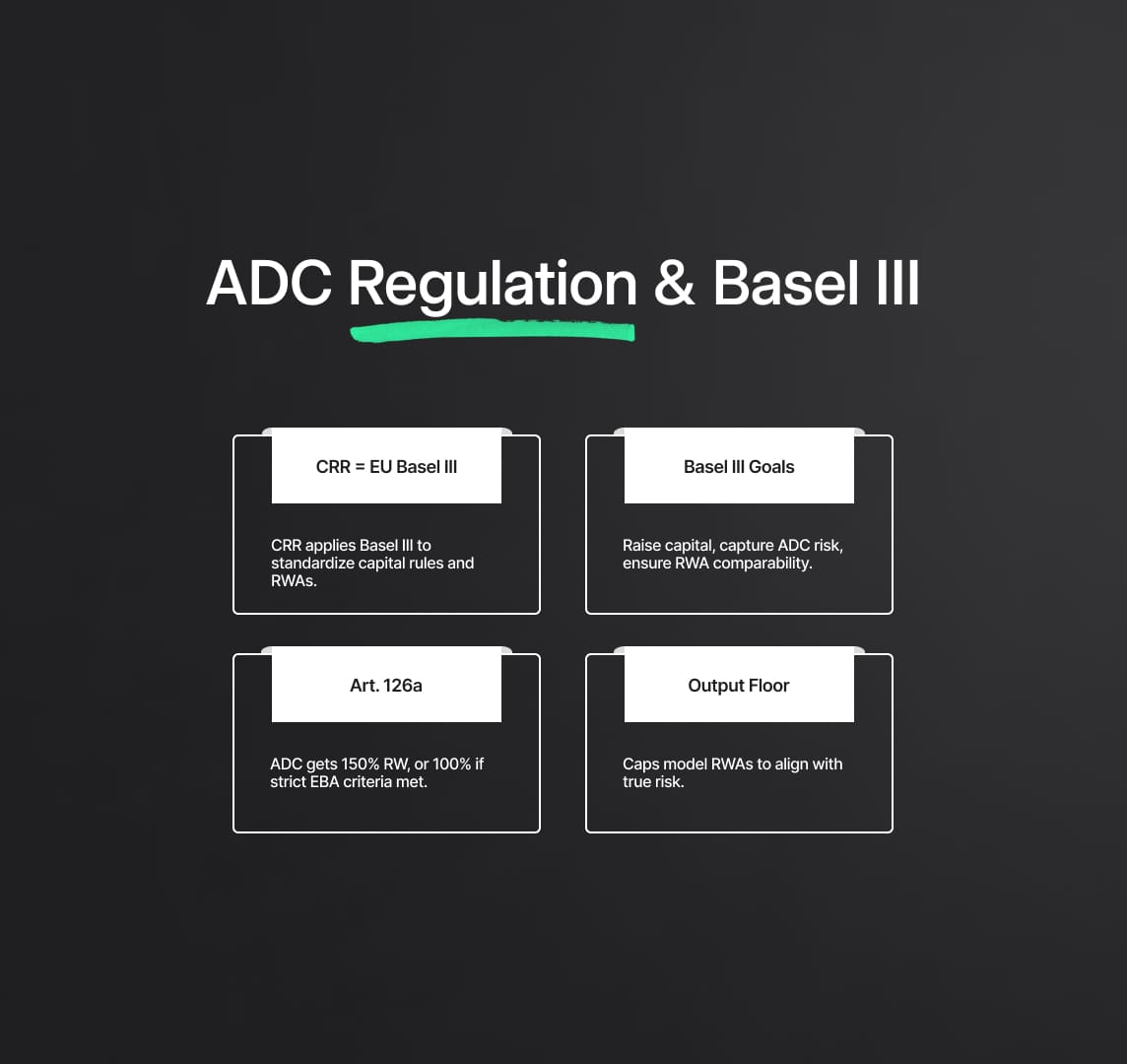

Connecting the Dots: ADC Regulation and the Basel III Framework

1. CRR as the EU’s Implementation of Basel III Standards

- Capital Requirements Regulation (CRR) & Capital Requirements Directive IV (CRD IV) transpose the Basel III framework into EU law, with successive refinements via CRR II and CRR3.

- Aim: bolster bank resilience post-2008 crisis by raising the quality and quantity of regulatory capital, enhancing risk capture (especially for ADC exposures), and introducing liquidity and macroprudential buffers.

- Uniform application across EU Member States fosters a level playing field, curbing regulatory arbitrage and ensuring comparable risk-weighted assets (RWAs) calculations.

2. Basel III Objectives: Risk Sensitivity, Capital Adequacy & Comparability

- Risk Sensitivity: Basel III targets asset classes previously under-weighted—e.g., high-volatility commercial real estate (HVCRE) and Acquisition, Development & Construction (ADC) exposures, which by design carry elevated residual risks.

- Capital Adequacy: Default higher risk weights (e.g., 150 %) for speculative construction loans ensure banks hold capital buffers that mirror true underlying risks.

- Comparability: Enhanced standardized and internal-model approaches, plus an output floor set at 72.5 % of standardized RWAs, limit divergence in capital requirements across institutions.

3. CRR Article 126a & the EU’s Prescriptive Single Rulebook

- Article 126a CRR directly echoes Basel III by imposing a default 150 % risk weight on ADC exposures, with a conditional 100 % option for residential projects that meet de-risking criteria.

- The European Banking Authority (EBA) supplements this with detailed guidelines (EBA/CP/2024/12) on quantifying de-risking conditions—exceeding the granularity of Basel texts to ensure uniform application of Capital Requirements Regulation (CRR) across diverse legal frameworks.

- Comparable EBA Regulatory Technical Standards (RTS) under the IRB approach for specialized lending reinforce this calibrated, risk-sensitive treatment.

4. The Output Floor: A Robust Backstop for ADC and Beyond

- Basel III Output Floor (72.5 %): Caps the extent to which internal-model RWAs can fall below standardized-approach RWAs, safeguarding minimum capital levels.

- By embedding rigorous, risk-sensitive standardized rules for ADC exposures—including definitive risk weights and de-risking thresholds under CRR3—the EU amplifies the output floor’s credibility.

- Result: a durable backstop that aligns capital requirements with true residual risks, reducing variability in RWA calculations and enhancing comparability of banks’ capital ratios.

By mapping CRR onto the Basel III pillars, risk sensitivity, capital adequacy, and comparability, the EU’s framework for ADC exposures ensures that banks hold capital proportional to their true residual risks, while maintaining a unified rulebook that underpins financial stability across the Single Market.

Strategic Imperatives for Financial Institutions under CRR ADC Rules

Financial institutions must proactively adapt to the evolving Capital Requirements Regulation (CRR) framework for Acquisition, Development, and Construction (ADC) exposures, particularly in light of the forthcoming EBA guidelines under CRR Article 126a(3). The following strategic priorities will be critical for maintaining competitiveness and ensuring capital and risk management remain aligned with regulatory expectations.

1. Capital Adequacy & RWA Optimization for ADC Exposures

- 150 % vs. 100 % Risk Weight: The delta between a default 150 % risk weight and a conditional 100 % risk weight for residential ADC exposures translates into a one-third reduction in required capital.

- Portfolio-Level Impact Analysis: Banks must inventory existing and pipeline ADC loans, segmenting those likely to qualify for the reduced risk weight. A failure to meet the EBA’s de-risking criteria (e.g., 10 % pre-sale deposit, 35 % obligor equity) will drive up aggregate risk-weighted assets (RWAs) and, by extension, capital requirements.

- Capital Planning & Stress Testing: Integrate updated ADC RWA calculations into ICAAP/ILAAP models and run sensitivity tests under adverse real-estate scenarios to quantify potential capital shortfalls.

2. Evolving Risk Management & Underwriting Standards

- CRD IV Governance Requirements: To access the 100 % risk weight, institutions must demonstrate “sound origination and monitoring standards” per CRD IV Articles 74 & 79, covering internal governance, recovery planning, and risk-committee oversight.

- Enhanced Due Diligence:

- Contract Review: Scrutinize pre-sale/pre-lease agreements for deposit size, forfeiture clauses, and legal enforceability.

- Equity Validation: Verify obligor-contributed equity meets the EBA’s “appropriate amount” threshold and is segregated as required.

- Valuation Rigor: Align with CRR Article 229(1) to ensure property-completion values underpin equity and ETV calculations.

- Lifecycle Monitoring: Implement dashboards tracking construction milestones, pre-sale coverage ratios, and any triggers that could invalidate the lower risk weight.

3. Data, Systems & Regulatory Reporting

- Granular Data Capture: ADC risk-weight eligibility hinges on precise metrics, cash-deposit ratios, equity-to-value percentages, and contract-coverage rates. Upgrade loan-management systems to:

- Aggregate Exposures: Link all credit lines and subordinate obligations against single ADC projects.

- Automate Ratio Calculations: Generate real-time ETV and equity-at-completion metrics.

- Audit Trail & Transparency: Maintain detailed records of underlying documents (escrow statements, valuation reports, contract registers) to support supervisory reviews.

- Alignment with EBA Reporting Standards: Prepare for forthcoming Data Point Models (DPM) and XBRL taxonomies that will incorporate ADC-specific fields.

4. Operational Readiness & Strategic Portfolio Management

- Training & Change Management: Educate origination, risk, legal, and IT teams on CRR 3’s ADC provisions and the EBA’s quantitative thresholds to prevent misclassification.

- Transitional Planning: Establish an implementation roadmap to incorporate final EBA guidelines (due by 10 July 2025), including:

- Policy & Procedure Updates: Revise credit-policy manuals, underwriting checklists, and governance charters.

- Portfolio Re-Assessment: Re-classify existing ADC loans against the final criteria to confirm or adjust risk weights.

- Strategic Lending Focus: Given the material capital saving, institutions may shift toward ADC projects with clear de-risking characteristics. This could mean:

- Prioritizing residential ADC with strong pre-sale pipelines.

- De-emphasizing complex or borderline ADC deals where achieving the 100 % risk weight is uncertain.

By addressing these imperatives, rigorous RWA analysis, enhanced risk management, robust data infrastructure, and careful operational planning—banks can navigate the CRR’s ADC regime effectively, balancing residual-risk mitigation with competitive capital efficiency.

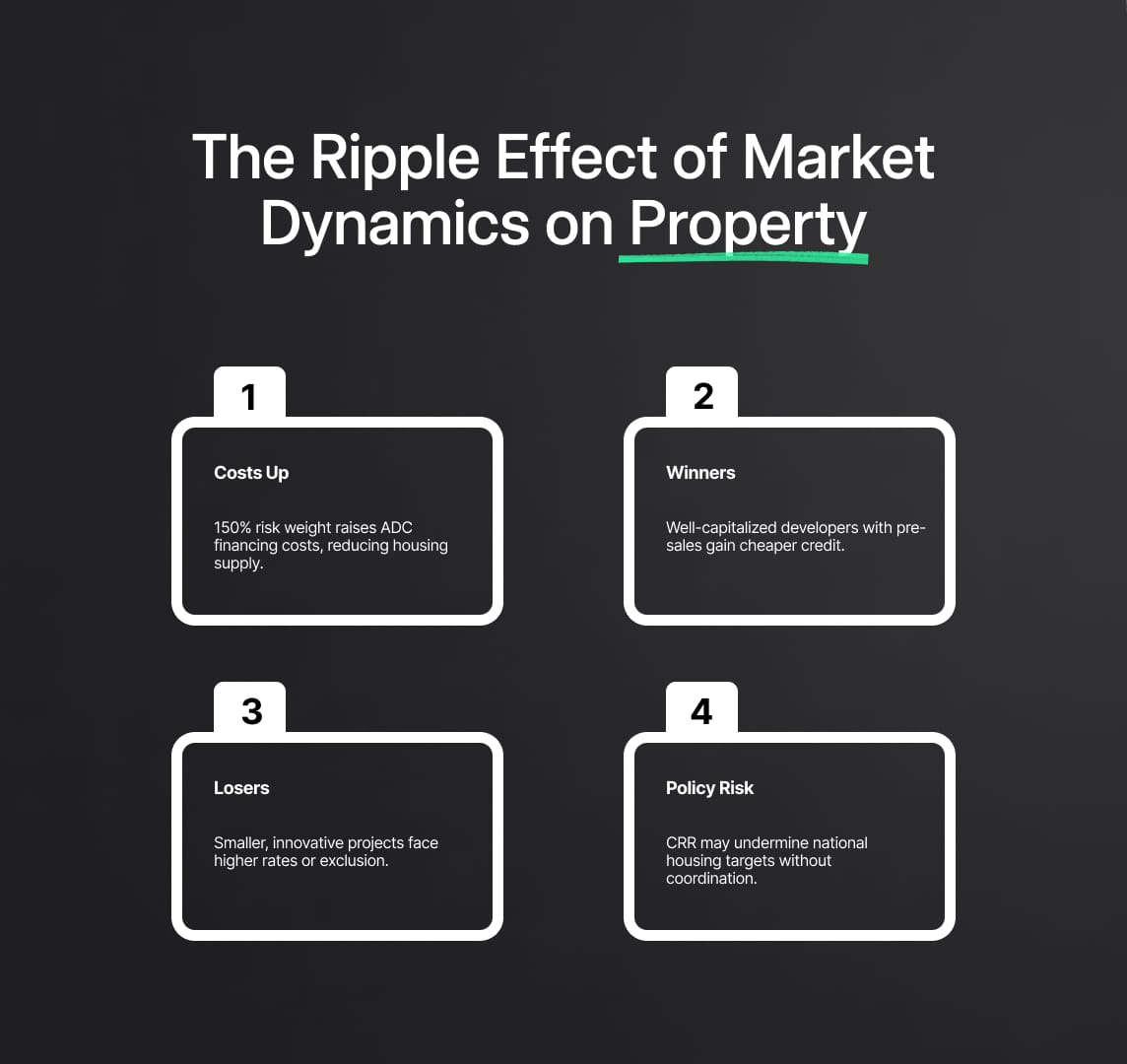

Market Dynamics: The Ripple Effect on Property Development

The stricter, more risk-sensitive capital requirements for ADC exposures under the Capital Requirements Regulation (CRR), especially once the EBA’s final guidelines are in force, will echo across the EU property-development landscape. Key market participants must understand how residual risks, financing costs, and supply dynamics will shift.

1. Impact on Residential Supply & Development Costs

- Higher Cost of Capital:

- Projects failing to meet the EBA’s de-risking thresholds (e.g., 35 % obligor equity, 50 % pre-sale/lease coverage) will attract a 150 % risk weight, driving up banks’ funding costs.

- Banks will pass increased capital charges to developers through higher interest rates, tighter loan covenants, or upfront fees—squeezing project margins.

- Supply Constraints:

- Elevated financing costs may render marginal schemes unviable, shrinking the pipeline of new housing.

- Regions already facing shortages and affordability pressures risk widening the supply-demand gap, as warned by industry bodies like Finance Iceland and the German Banking Industry Committee.

2. Strategic Considerations for Stakeholders

- Developers:

- Must bolster equity contributions or secure third-party investment to clear EBA thresholds.

- Increase pre-sale/pre-lease marketing efforts pre-construction to lock in contracts, ensuring compliance with the 100 % risk-weight criteria.

- Revisit feasibility models to factor in potentially higher funding spreads under CRR3.

- Investors:

- Projects meeting the 100 % risk-weight criteria will offer more attractive risk-adjusted returns, shifting capital toward de-risked residential developments.

- Deals outside these parameters may see yield premia increase to offset higher financing risks.

- Banks:

- May tighten ADC underwriting, prioritizing projects that clearly satisfy EBA’s quantitative tests for residual-risk mitigation.

- Could selectively allocate credit to larger, seasoned developers with established balance-sheet strength, reducing exposure to smaller or more innovative schemes.

- Non-Bank Lenders:

- As bank financing becomes more burdensome, shadow-bank actors may fill gaps—though they typically operate under lighter prudential rules, shifting credit risk outside the traditional banking perimeter.

3. Potential Market Fragmentation & Innovation Impact

- Bifurcated Market:

- Well-capitalized developers will benefit from lower capital charges and faster credit approval, while smaller players may face restricted access or higher funding costs, potentially accelerating market consolidation.

- Innovation Headwinds:

- Non-standard residential models (e.g., co-living, modular construction, net-zero carbon projects) may struggle to align with prescriptive EBA criteria, defaulting to a 150 % risk weight and higher funding costs, thus dampening creative housing solutions.

4. Interplay with National Housing Policies

- Policy Tension:

- National governments aiming to boost housing supply and affordability might see prudential rules inadvertently counteracting fiscal incentives or planning reforms.

- Regulators and policymakers must coordinate to balance micro-prudential safety with macro-economic housing objectives, ensuring that CRR does not unintentionally stifle critical residential construction.

Ensuring Regulatory Compliance and Future-Proofing Strategies for ADC Exposures

Strong residual-risk management under the Capital Requirements Regulation (CRR), coupled with the upcoming EBA guidelines, is both a compliance necessity and a strategic opportunity. Financial institutions that excel in implementing these rules can optimize capital and gain a market edge.

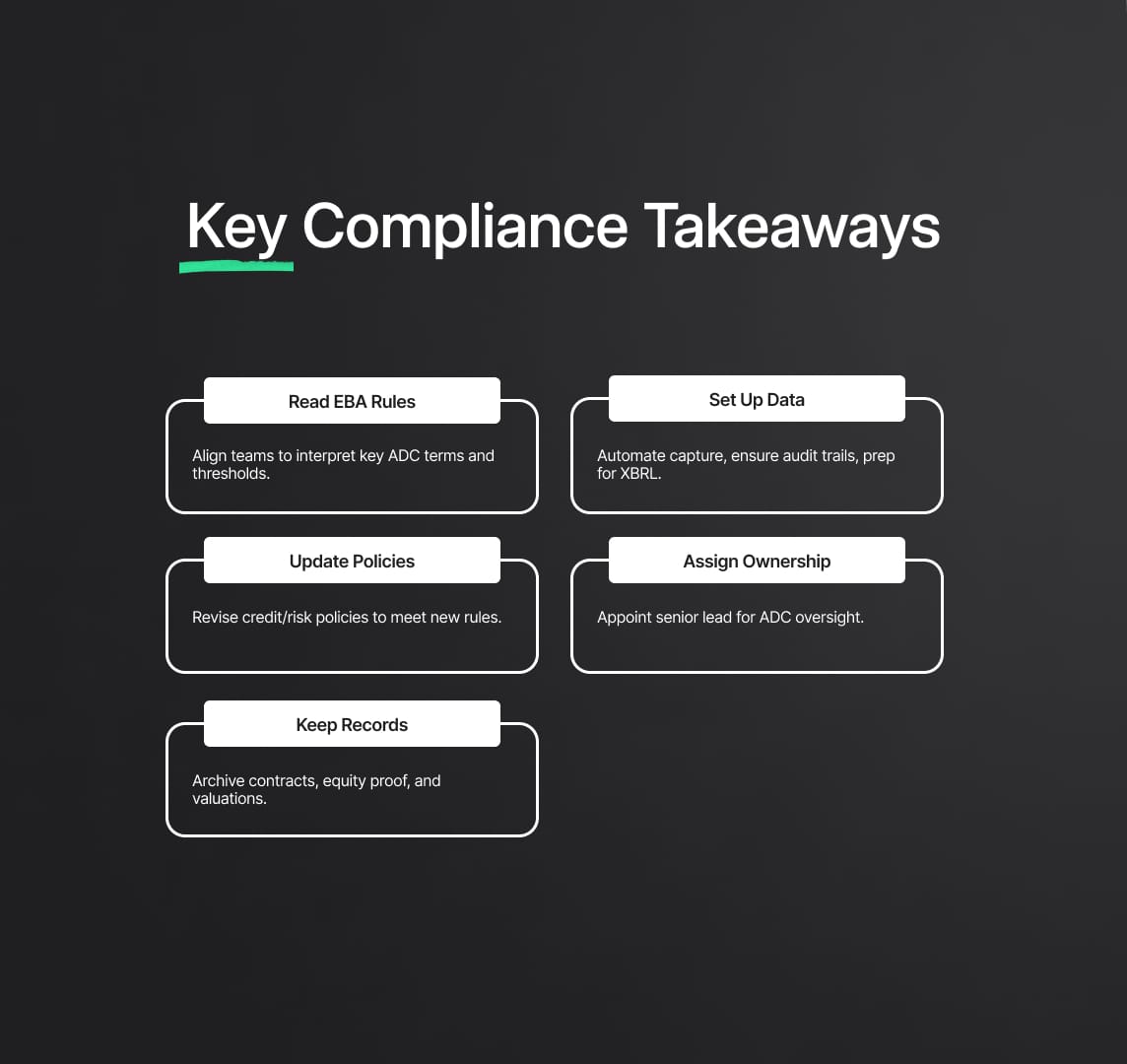

Key Compliance Takeaways

- Master the Final EBA Guidelines

- As soon as the EBA issues its guidance (due 10 July 2025), convene cross-functional teams (risk, compliance, IT, legal) to interpret precise definitions, quantitative thresholds, and calculation methodologies for:

- Substantial cash deposits

- Equivalent financing instruments

- Contract-coverage ratios

- Obligor-contributed equity

- As soon as the EBA issues its guidance (due 10 July 2025), convene cross-functional teams (risk, compliance, IT, legal) to interpret precise definitions, quantitative thresholds, and calculation methodologies for:

- Build Robust Data Infrastructure

- Capture & Verify: Automate collection of pre-sale/pre-lease contract data, deposit amounts, equity components, and completion valuations in lending systems.

- Store & Audit: Maintain an auditable record for every ADC exposure—essential for demonstrating eligibility for the 100 % risk weight under CRR Article 126a(2).

- Report & Monitor: Align with forthcoming EBA Data Point Models (DPM) and XBRL taxonomies to streamline supervisory reporting on ADC exposures.

- Update Policies & Frameworks

- Credit Policy: Embed de-risking criteria into underwriting manuals—specifying mandatory checks for deposit forfeiture clauses, segregated-account evidence, and equity substantiation.

- Risk Management: Enhance governance in line with CRD IV Articles 74 & 79, ensuring the risk committee oversees ADC portfolio performance and rule adherence.

- Internal Controls: Introduce periodic controls to verify that ongoing construction and sales milestones continue to satisfy the EBA’s thresholds.

- Strengthen Governance & Oversight

- Appoint clear ownership for ADC compliance—ideally at the senior risk or CRO level—to oversee:

- Implementation of EBA guidelines

- Regular portfolio reviews

- Coordination with auditors and supervisors

- Appoint clear ownership for ADC compliance—ideally at the senior risk or CRO level—to oversee:

- Maintain Comprehensive DocumentationThis documentation underpins capital-optimization efforts and provides evidence during supervisory reviews.

- For every ADC transaction, archive:

- Legally binding contracts and forfeiture clauses

- Escrow or segregated-account statements

- Detailed equity contribution schedules

- Valuation reports per CRR Article 229(1)

Anticipating Future ADC Regulatory Trends

- Ongoing Risk-Sensitivity Enhancements

- Expect further calibration of risk weights and de-risking metrics as real-estate markets evolve and new risk factors emerge.

- EBA Clarifications & Q&As

- Monitor the EBA’s website for post-implementation Q&As or supplementary guidance addressing real-world application issues.

- Heightened Supervisory Scrutiny

- The ECB and national authorities will likely focus on ADC portfolios, especially in jurisdictions with property-market vulnerabilities, requiring robust controls and timely remediation of any compliance gaps.

- Integration of ESG Risks

- Anticipate the inclusion of Environmental, Social, and Governance criteria into ADC risk assessments, valuation models, and capital calculations, aligning prudential and sustainability objectives.

Conclusion: Turning Compliance into Competitive Advantage

The evolving Capital Requirements Regulation (CRR) framework for ADC exposures, reinforced by the EBA’s forthcoming guidelines, demands institutions to refine data systems, risk-management practices, and governance structures. By doing so:

- Capital Efficiency: Institutions that accurately identify and document qualifying ADC transactions can significantly reduce risk-weighted assets (RWAs), freeing up capital for strategic lending.

- Market Leadership: A first-mover advantage in compliance can translate into more competitive financing terms for developers, enhancing market share in ADC lending.

- Sustainable Growth: Rigorous application of de-risking criteria promotes sound project planning and stronger equity commitments, fostering a more resilient and transparent property-development sector.

Proactive engagement with these regulatory imperatives will not only ensure compliance but also position banks to leverage CRR and EBA requirements as catalysts for innovation, operational excellence, and sustainable competitive differentiation in ADC financing.

Reduce your

compliance risks