AIFMD and UCITS IV Updates: Liquidity and Redemption Frameworks

ESMA's AIFMD and UCITS IV updates strengthen liquidity management and redemption policies, enhancing EU financial stability and investor protection.

On 12 December 2024, the European Securities and Markets Authority (ESMA) published a consultation paper on draft Regulatory Technical Standards (RTS) for open-ended loan-originating Alternative Investment Funds (AIFs) under the revised Alternative Investment Fund Managers Directive (AIFMD). This consultation represents a key step in aligning liquidity management and redemption frameworks for open-ended loan-originating AIFs.

The update arises from Directive (EU) 2024/927, which amends both AIFMD and the UCITS IV Directive. The changes aim to enhance investor protection, harmonize supervisory reporting, and strengthen liquidity management across EU member states. ESMA’s goal is to establish a robust framework ensuring open-ended loan-originating AIFs meet liquidity standards that balance investor redemptions and asset management practices effectively.

What You Need to Know About AIFMD and UCITS IV

The update builds on the AIFMD and UCITS IV Directive, two key regulatory frameworks in the EU. Both directives focus on harmonizing fund regulation, enhancing investor protection, and ensuring market stability across member states.

The AIFMD, adopted in 2011, provides a unified framework for managing Alternative Investment Funds (AIFs) such as private equity, hedge funds, and real estate. It introduces rules for liquidity risk management and operational transparency, emphasizing robust systems to manage liquidity risks, particularly for loan-originating AIFs, which traditionally operate as closed-ended funds.

In contrast, the UCITS IV Directive governs retail funds, ensuring Undertakings for Collective Investment in Transferable Securities (UCITS) adhere to strict liquidity, diversification, and disclosure standards. Together, they promote consistent supervisory practices across the EU.

The RTS under AIFMD clarifies requirements for open-ended LO AIFs, focusing on liquidity management, liquid assets, and redemption policies. By aligning AIFMD with UCITS IV, this update mitigates liquidity risks, enhances investor confidence, and ensures regulatory consistency while allowing open-ended LO AIFs to thrive under controlled conditions.

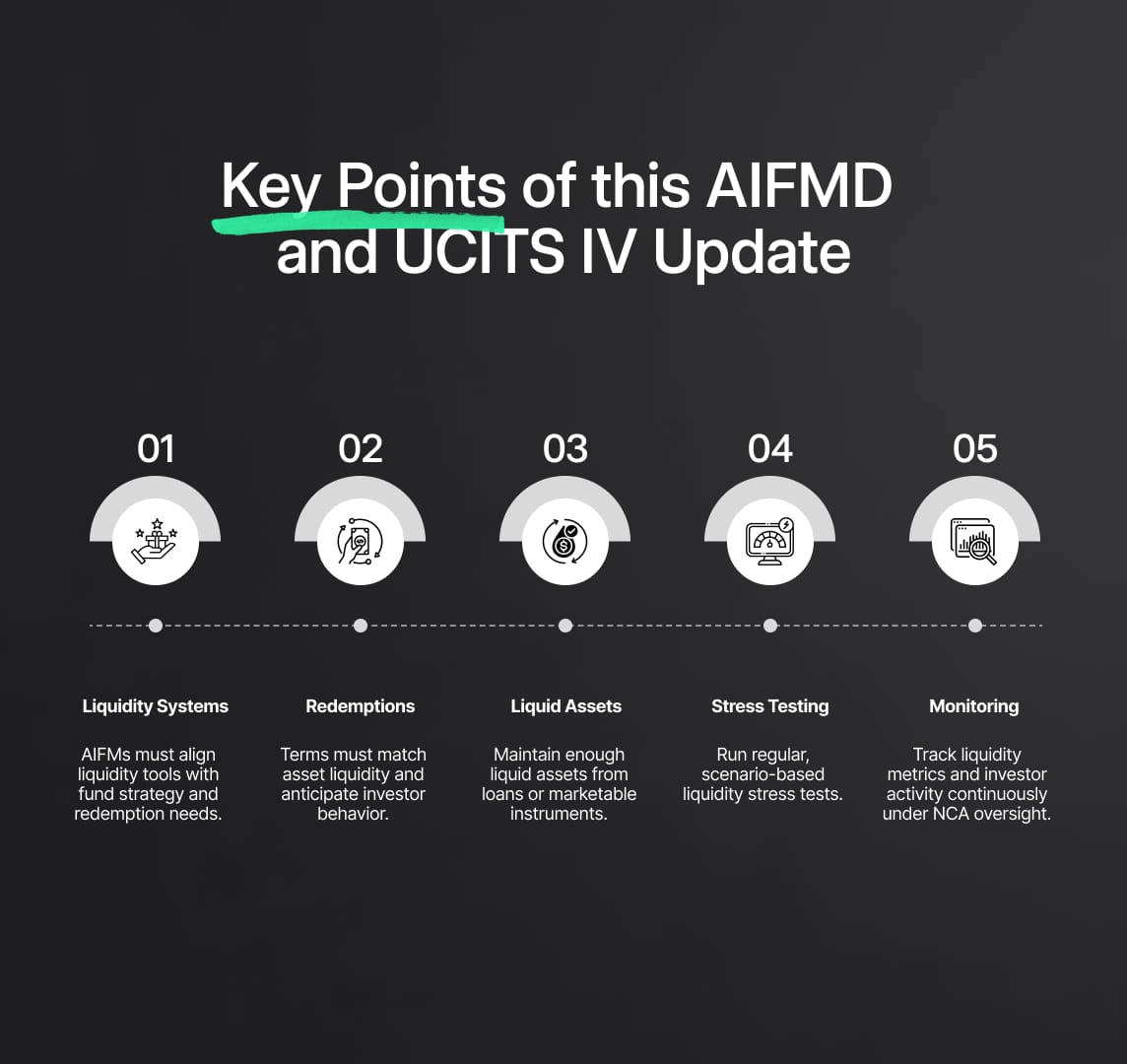

Key Points of this AIFMD and UCITS IV Update

The AIFMD and UCITS IV updates, as outlined in ESMA’s consultation paper, introduce critical measures to enhance the regulatory framework for open-ended loan-originating AIFs (LO AIFs). These key points focus on improving liquidity risk management, redemption policies, asset availability, and stress testing requirements to ensure alignment with investor interests and market stability.

1. Sound Liquidity Management Systems

The cornerstone of the update is the requirement for AIFMs (Alternative Investment Fund Managers) to demonstrate that their liquidity risk management systems are compatible with the investment strategy and redemption policy of the open-ended LO AIFs. This involves creating a robust structure to mitigate liquidity risks that arise from the inherent nature of loan-originating funds, where assets are typically illiquid.

AIFMs must:

- Develop comprehensive liquidity management systems, ensuring a clear assessment of liquidity risks and the fund’s ability to meet redemption requests.

- Monitor liquidity profiles on an ongoing basis, considering the investment strategy and redemption frequency.

- Align liquidity measures with investor treatment, ensuring fair and consistent practices across all unitholders.

The regulatory framework emphasizes that adopting a sound liquidity management system is not a blanket approval for AIFMs to launch open-ended LO AIFs. Instead, managers must provide convincing evidence to national competent authorities (NCAs) that their funds can effectively handle liquidity risks without compromising financial stability.

2. Redemption Policies Tailored to Liquidity Risks

The RTS provides specific parameters for designing appropriate redemption policies for open-ended loan-originating AIFs. Redemption structures must consider the unique liquidity profile of loan assets and address investor needs without endangering the fund’s stability.

Key considerations for redemption policies include:

- Redemption Frequency: The frequency of redemptions offered must reflect the fund’s liquidity strategy and underlying loan assets. AIFMs must determine if redemptions can be managed weekly, monthly, or on other tailored schedules.

- Notice Periods: Extended notice periods can help AIFMs manage redemption pressures effectively. Longer notice periods allow sufficient time to liquidate assets without incurring significant value discounts.

- Investor Behavior: Managers must anticipate investor behavior, including redemption patterns and the potential impact of concentrated investor bases.

- Cash Flow Alignment: Policies must align with the fund’s expected cash flows, such as loan repayments, to ensure that redemption demands do not exceed the fund’s liquidity capacity.

The redemption policy must balance flexibility for investors with the long-term sustainability of the fund, ensuring that liquidity mismatches are minimized.

3. Availability and Definition of Liquid Assets

The availability of liquid assets is a critical component of the update under AIFMD and UCITS IV. Open-ended loan-originating AIFs must maintain a sufficient proportion of liquid assets to meet their redemption obligations.

ESMA’s RTS outlines the following requirements:

- Cash Flow from Loans: The primary source of liquidity is expected to come from cash flows generated by the loans themselves, such as interest payments or principal repayments.

- Other Liquid Investments: AIFMs may classify other assets as “liquid” if they can be converted into cash within the notice period without significant loss in value. For example, assets with active secondary markets may be considered liquid.

- Prudent Approach: AIFMs are required to exercise a conservative and prudent approach when identifying assets as liquid, ensuring that liquidity projections are realistic and achievable.

- Diversification and Rescheduling Risks: Managers must factor in risks associated with loan defaults, rescheduling, and amortization schedules.

The regulation ensures that AIFMs calibrate liquidity reserves appropriately, accounting for loan maturities, investor demands, and potential market shocks. This approach minimizes systemic risks while improving investor confidence in open-ended LO AIFs.

4. Rigorous Liquidity Stress Testing

The RTS introduces tailored Liquidity Stress Testing (LST) requirements for open-ended loan-originating AIFs to assess the impact of adverse market conditions. AIFMs must conduct stress tests at least quarterly or more frequently, depending on the liquidity profile of the fund.

The key features of LST include:

- Separation of Asset and Liability Risks: AIFMs must stress-test the fund’s assets (e.g., loan defaults) and liabilities (e.g., high redemption volumes) independently and combine the results to assess overall liquidity resilience.

- Conservative Scenarios: Stress tests must include scenarios such as sharp interest rate changes, widening credit spreads, and significant investor redemptions. These conservative measures reflect low-probability but high-impact events.

- Frequency and Adaptability: The frequency of stress tests must adapt to the fund’s specific characteristics, such as leverage levels, investor concentration, and asset liquidity.

- Documentation and Monitoring: Results of stress tests must be well-documented, and managers must adjust liquidity management tools as needed to address vulnerabilities.

By implementing rigorous LST, AIFMs can proactively identify weaknesses in their liquidity frameworks and take corrective measures to safeguard fund stability.

5. Ongoing Monitoring and Supervisory Oversight

The RTS requires continuous monitoring and oversight of key liquidity parameters to ensure that the open-ended LO AIF’s liquidity management system remains compatible with its strategy. AIFMs must track:

- Liquid Asset Levels: Ensuring compliance with predefined liquidity thresholds.

- Loan Repayment Schedules: Monitoring loan amortization and identifying early signals of defaults or impairments.

- Investor Behavior: Tracking subscriptions, redemptions, and overall investor activity to predict potential liquidity issues.

- Portfolio Concentration: Assessing risks arising from concentrated positions or correlated assets.

NCAs will play a crucial role in supervising AIFMs’ compliance with these monitoring requirements, ensuring that liquidity management tools remain adequate under varying market conditions.

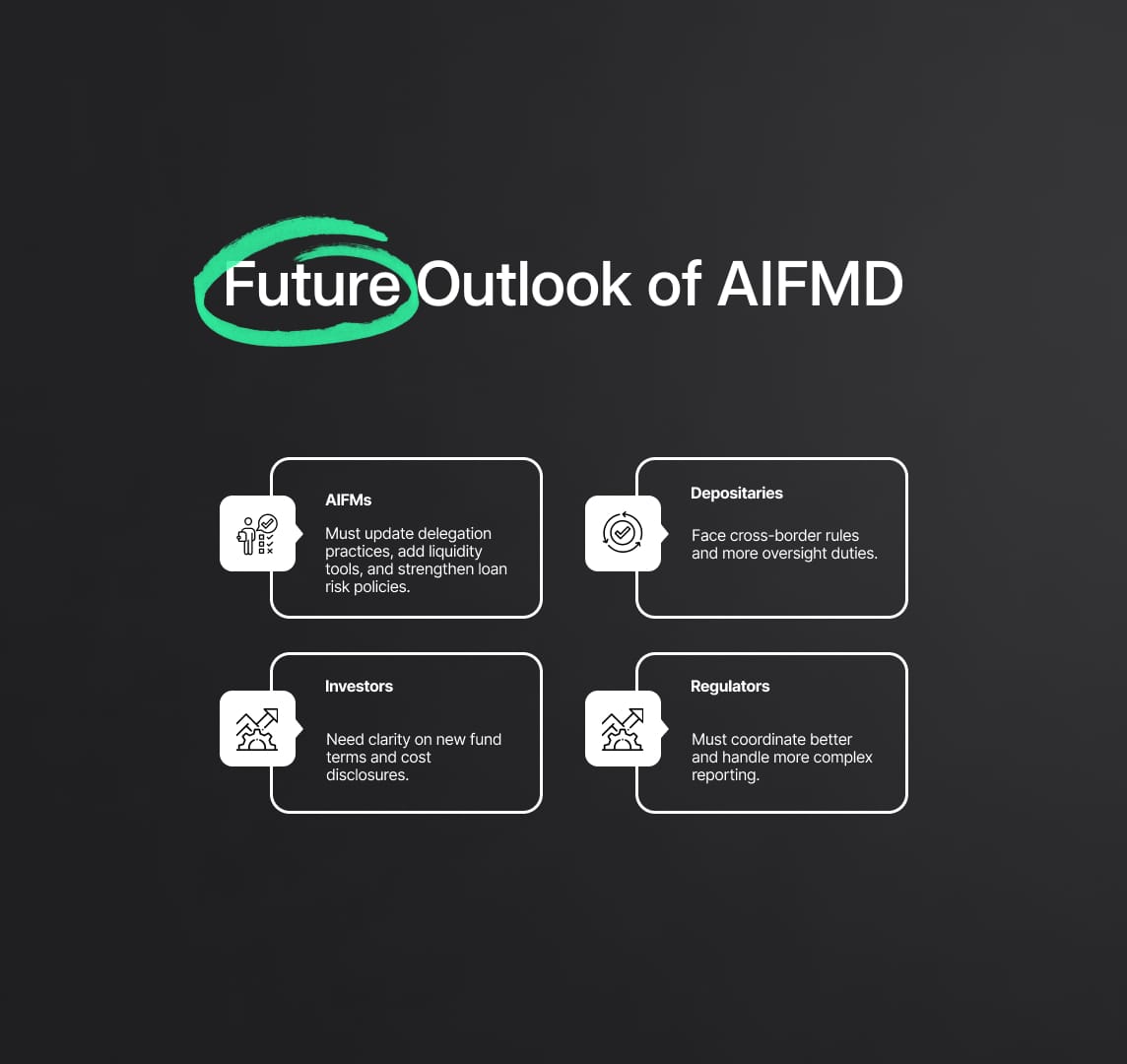

Alternative Investment Fund Managers Directive (AIFMD): Future Impact

Below is an analysis of the potential challenges faced by Alternative Investment Fund Managers (AIFMs), depositaries, investors, and regulators in implementing these updates.

Alternative Investment Fund Managers (AIFMs)

Challenges:

- Delegation and Substance Requirements: AIFMs must now provide detailed information about their delegation arrangements, including the human and technical resources dedicated to overseeing delegated functions. This necessitates a thorough review and possible restructuring of current delegation practices to ensure compliance.

- Liquidity Management Tools (LMTs): AIFMs managing open-ended funds are required to incorporate at least two LMTs into their fund structures. Selecting appropriate tools that align with each fund's investment strategy and liquidity profile may require significant adjustments to existing liquidity management frameworks.

- Loan Origination Framework: For AIFMs involved in loan origination, the new rules mandate the implementation of specific risk management policies and procedures. Adhering to these requirements may involve developing new systems and controls, particularly for those without existing frameworks.

Depositaries

Challenges:

- Cross-border Service Provision: The updates introduce the possibility for depositaries to offer services across borders. However, the lack of a full-fledged cross-border depositary passport means that depositaries must navigate varying national regulations, potentially increasing operational complexity and compliance costs.

- Enhanced Oversight Responsibilities: Depositaries are now tasked with ensuring that AIFMs comply with the new liquidity standards and stress testing protocols. This expansion of duties may require additional resources and the development of new monitoring systems to effectively oversee AIFM activities.

Investors

Challenges:

- Understanding New Fund Structures: The introduction of LMTs and changes in redemption policies may affect fund liquidity and redemption terms. Investors need to thoroughly understand these new mechanisms to make informed investment decisions, which may require enhanced communication and education efforts from fund managers.

- Increased Disclosure Requirements: With AIFMs obligated to provide more detailed information about fees, charges, and expenses, investors will have access to more data. However, interpreting this information to assess the true cost and value of investments may pose a challenge, especially for less sophisticated investors.

Regulators

Challenges:

- Supervisory Coordination: The updates aim to harmonize rules across member states, necessitating increased coordination among national competent authorities (NCAs). Ensuring consistent application and enforcement of the new rules across jurisdictions may require developing new collaborative frameworks and communication channels.

- Monitoring Compliance with Enhanced Reporting: The expanded reporting obligations for AIFMs mean that regulators will receive more data. Effectively analyzing this information to monitor compliance and identify potential risks will require enhanced analytical tools and possibly increased staffing.

In summary, while the updates to AIFMD and UCITS IV aim to enhance investor protection and market stability, they also present various challenges to stakeholders. Addressing these challenges will require careful planning, resource allocation, and, in some cases, significant changes to existing operational and compliance frameworks.

The Road Ahead: AIFMD and UCITS IV

The updated RTS for open-ended loan-originating AIFs under the revised AIFMD and UCITS IV Directives represents a critical evolution in European financial regulation. By enhancing liquidity management, stress testing, and redemption frameworks, ESMA aims to address the unique risks posed by open-ended structures in the loan-originating market.

This consultation aligns with broader regulatory trends emphasizing:

- Financial stability through rigorous liquidity frameworks.

- Investor protection via increased transparency and robust risk management.

- Market harmonization to eliminate inconsistencies across EU Member States.

Looking ahead, it is anticipated that further refinements in liquidity management tools, stress testing methodologies, and reporting requirements will emerge as ESMA finalizes the RTS by Q3/Q4 2025. Institutions impacted by these changes must proactively align their strategies and operations to meet the evolving regulatory expectations.

In summary, these updates not only enhance the resilience of open-ended loan-originating AIFs but also signal a clear regulatory trend towards tighter supervision of AIFMD and UCITS IV frameworks, ensuring the sustainable growth of Europe’s alternative investment market.

Reduce your

compliance risks