AML Compliance Failure: Credit Europe Bank

BaFin's €40K fine on Credit Europe Bank for AML lapses highlights stringent EU regulations. Vital reminder for banks to update client data, maintain compliance, and avoid hefty penalties. A key case in understanding EU's rigorous financial integrity standards.

Credit Europe Bank Fined for Compliance Failure in Anti-Money Laundering Measures

The recent enforcement action against the German branch of Credit Europe Bank N.V. by the Federal Financial Supervisory Authority (BaFin), which resulted in a €40,000 fine, highlights how crucial AML (Anti-Money Laundering) compliance is for the banking industry. This event should serve as a clear warning to financial institutions around the world about the strict requirements of anti-money laundering rules and the penalties for non-compliance.

AML compliance is a crucial component of financial activities, especially in the EU, where laws are stringently regulated. Comprehensive internal controls and procedures must be put in place by banks and other financial institutions in order to guarantee the continuous accuracy of client data. This involves routinely updating client data, like addresses, to reduce the possibility of money laundering through the use of anonymous account activities.

The Credit Europe Bank N.V. case demonstrates a serious breakdown in upholding these essential AML procedures. In addition to violating EU regulations, the insufficiency of customer information updates jeopardizes the stability of the financial system. Updating client data on a regular basis is not just required by law, but it's also an essential step in the battle against financial crimes and money laundering.

Furthermore, this instance shows how regulatory agencies like BaFin enforce AML compliance in a proactive manner. Even though the punishment was high, it served as a warning to all financial institutions about the need of abiding by AML requirements in addition to being a punitive action. It highlights how important it is for banks to keep an eye on and improve their internal controls and AML measures.

In addition to avoiding fines, banks and other financial institutions must adhere to AML regulations in order to preserve the integrity and confidence of the financial system. It entails a dedication to strict oversight, frequent employee education on AML protocols, and the establishment of efficient mechanisms for identifying and reporting questionable activity.

AML Compliance: The Credit Europe Bank Case

The German branch of Credit Europe Bank N.V. was the target of a recent enforcement action by the Federal Financial Supervisory Authority (BaFin), which resulted in a €40,000 fine. This action highlighted the importance of AML (Anti-Money Laundering) compliance in the financial industry. Important facets of this case consist of:

- Strict Regulations: This event highlights the strict AML laws that financial institutions, especially those operating in the EU, have to abide by.

- Consequences of Non-Compliance:

- Financial Penalties: One clear illustration of the financial repercussions of noncompliance with AML requirements is the substantial punishment levied against Credit Europe Bank.

- Reputational Damage: In addition to resulting in monetary losses, non-compliance can seriously harm a financial institution's standing by undermining the confidence of partners and clients.

- Impact on the World: The enforcement action's ramifications go beyond the EU, informing financial institutions all around the world of the importance of strict AML compliance.

- Proactive Regulatory Oversight: By taking prompt action, BaFin has shown that regulatory organizations actively monitor and enforce AML compliance, protecting the integrity of financial systems.

- Reminder to the Financial Industry: In order to prevent similar consequences, this case serves as a crucial reminder to all banks and other financial institutions about the significance of upholding strict AML procedures.

This incident emphasizes how important it is to maintain vigilant and take proactive steps to comply with the constantly changing set of financial requirements. It acts as a vital wake-up call for the financial industry, emphasizing how vital it is to follow AML regulations in order to protect the integrity and stability of financial institutions around the world.

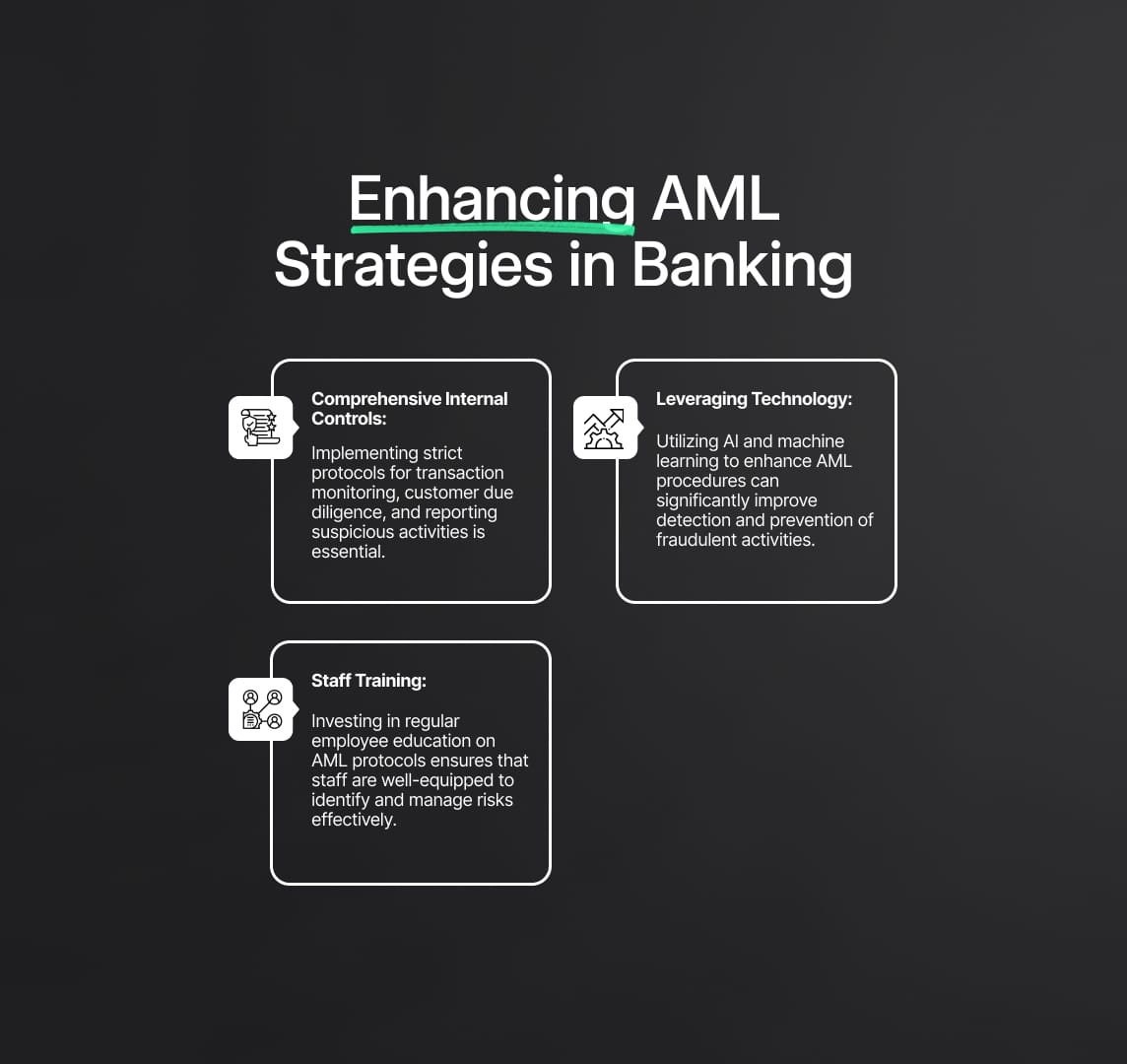

Enhancing AML Strategies in Banking: A Closer Look

Compliance with AML (Anti-Money Laundering) regulations is an essential part of banking operations, especially in areas like the European Union where regulations are very strict. The Credit Europe Bank issue has drawn attention to the strict implementation of anti-money laundering laws by organizations like BaFin. In this context, banks are required to not only adhere to these rules but also to set the standard for implementing successful AML procedures.

Developing Comprehensive Internal Controls for AML Compliance

Comprehensive internal controls must be developed and maintained in order to ensure effective AML compliance. Ensuring the accuracy and integrity of client data is crucial for combating illicit money laundering operations, and these controls play a key role in maintaining that integrity. This entails putting in place strict protocols for transaction monitoring, customer due diligence, and reporting questionable activity. These days, banks are more concerned with developing a solid framework that can change with the evolving nature of financial crimes.

Leveraging Technology in AML Compliance

The use of technology to improve AML procedures is becoming more and more important in the aftermath of the Credit Europe Bank case. Artificial intelligence (AI) and machine learning in particular are becoming more and more important in detecting and stopping fraudulent activity. These technologies are vital resources for banks dedicated to maintaining AML requirements because they can process massive amounts of data and identify patterns suggestive of money laundering.

The Impact of Non-Compliance on Financial Institutions

The circumstances surrounding Credit Europe Bank serve as a stark reminder of the severe and varied repercussions of non-compliance. Financial institutions are becoming more conscious of the consequences that go beyond pecuniary penalties.

Financial Penalties and Reputational Damage

Penalties for noncompliance can be severe, as demonstrated by Credit Europe Bank. But the effects go beyond monetary losses. Customer confidence and trust may be undermined by the long-lasting harm non-compliance can have to one's reputation. This erosion of trust may discourage potential customers and result in a large drop in the bank's customer base, which would ultimately hurt its position in the market.

Strengthening Compliance Measures

Financial institutions are being prompted to reevaluate and strengthen their AML compliance processes due to the increased emphasis on internal procedures. It is more important than ever to invest in staff training. Employees are better able to recognize and manage risks when they are trained on the most recent AML laws and procedures. Furthermore, the correct and timely updating of customer data is becoming increasingly dependent on the integration of new technology, especially artificial intelligence (AI), which helps banks maintain an advantage in the fight against money laundering.

Reduce your

compliance risks