ARTs and EMTs: Supervisory Framework Under MiCAR

EBA updates ARTs and EMTs supervision under MiCAR, focusing on significance assessments, supervisory transitions, and enhanced reporting for improved regulatory oversight and issuer compliance.

On October 22, 2024, the European Banking Authority (EBA) made significant strides in defining the procedural aspects related to asset-referenced tokens (ARTs) and e-money tokens (EMTs) supervision under the Markets in Crypto Assets Regulation (MiCAR). The newly published Decision outlined the framework for conducting significance assessments of ARTs and EMTs, the subsequent transfer of supervisory responsibilities, and the establishment of supervisory colleges for those classified as significant ARTs (s-ARTs) and significant EMTs (s-EMTs). In this article, we explore the technical nuances and implications of these updates, focusing on the assessment procedures, reporting requirements, and supervisory coordination mechanisms as outlined by the EBA.

Source

[2]

Supervisory Framework for ARTs and EMTs Under MiCAR

MiCAR, which came into force in 2023, introduced a comprehensive regulatory regime for ARTs and EMTs, aiming to provide clear guidelines on their issuance, operation, and supervision within the European Union (EU). The EBA is tasked with directly supervising ARTs and EMTs that are deemed significant based on various quantitative and qualitative criteria. These tokens serve as pivotal elements in the rapidly evolving crypto-asset space and require robust oversight to ensure financial stability and investor protection.

The EBA's Decision EBA/DC/558, adopted on September 17, 2024, provides critical regulatory details on how ARTs and EMTs are to be assessed and classified as significant. The Decision leverages Articles 43, 44, 56, and 57 of MiCAR and introduces a procedural framework that sets out rules for both standard and voluntary significance assessments. The EBA must also reassess these tokens annually, ensuring that ARTs and EMTs maintain their significance classification as per evolving market conditions. The significance assessments are grounded in several quantitative criteria such as the number of token holders, the value of the reserve assets, and the average number of daily transactions, but also include more qualitative factors like the token's interconnectedness with the broader financial system and the issuer’s role in the global market.

The Decision also addresses the transfer of supervisory responsibilities from national competent authorities (NCAs) to the EBA and mandates the creation of supervisory colleges to coordinate oversight on significant tokens. This regulatory structure ensures uniform supervision across the EU, enhancing the overall regulatory rigor in the fast-growing digital assets space.

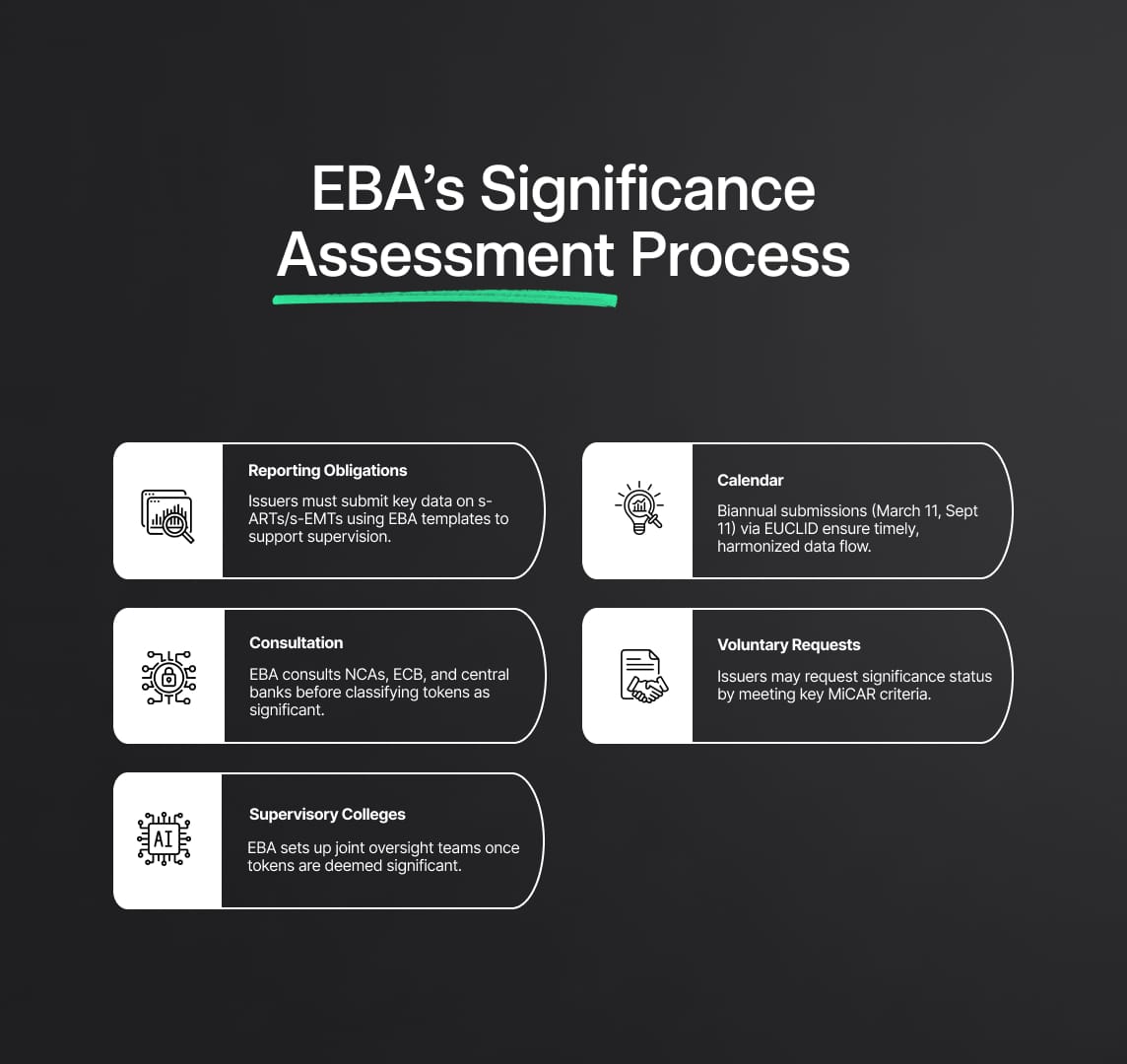

EBA’s Significance Assessment Process

The EBA’s significance assessment process, as dictated by MiCAR, revolves around identifying ARTs and EMTs that meet specific significance criteria. These include the number of token holders, the size of the reserve of assets, the average daily transaction volume, the issuer's involvement in other financial activities, and the degree of interconnectedness with the broader financial system. According to Article 43 of MiCAR, an ART or EMT is classified as significant if it meets at least three of the criteria mentioned above, thus triggering the enhanced supervisory measures defined by the EBA.

The significance assessment process is pivotal as it determines which tokens will fall under the EBA’s direct supervision. These assessments are conducted regularly, at least twice a year, but issuers may also request voluntary assessments if they believe their tokens meet the criteria.

The following points summarize the key procedural elements as outlined in the EBA’s decision:

- Reporting Obligations: Issuers of s-ARTs and s-EMTs must regularly report detailed data to the EBA, including the number of token holders, transaction volumes, and the reserve of assets. These data points are crucial for the establishment and ongoing management of supervisory colleges. The reporting templates provided in Annexes to Decision EBA/DC/558 ensure that issuers submit consistent and comprehensive data.

- Harmonized Reporting Calendar: The EBA has introduced a harmonized reporting calendar for NCAs to ensure consistent and timely submission of data across the EU. This calendar aligns with specific reference periods (January to June and July to December) and remittance dates (March 11 and September 11), ensuring a structured flow of information necessary for significance assessments. The EBA's use of the EUCLID platform (European Centralised Infrastructure of Data) streamlines data submission and ensures a secure method of communication for issuers and NCAs.

- Consultation Procedures: The EBA's decision outlines the timeline and steps to be followed when consulting with related parties (NCAs, the European Central Bank (ECB), and other relevant national central banks) as part of the assessment process. Articles 44 and 57 of MiCAR mandate that the EBA must seek input from the ECB and central banks where the ART or EMT issuer operates, ensuring that all stakeholders have an opportunity to review and provide observations on the token's classification.

- Voluntary Classification Requests: Issuers may submit voluntary requests for their tokens to be classified as significant. The EBA has established a specific template for NCAs to use when notifying the EBA of such requests, ensuring a standardized process. According to Article 44 and 57 of MiCAR, issuers are required to demonstrate that their ART or EMT meets at least three of the significance criteria. The EBA must respond to these requests promptly, following a structured consultation process.

- Supervisory Colleges: Upon classification as significant, the EBA is responsible for establishing supervisory colleges for both ARTs and EMTs. These colleges bring together relevant authorities, ensuring coordinated oversight across jurisdictions and comprehensive supervisory engagement. The supervisory colleges are mandated by Article 119 of MiCAR, which requires the EBA to chair these colleges and facilitate the exchange of information among national authorities to ensure unified supervision across the EU.

Transitioning Supervisory Responsibilities: A Seamless Hand-Off

One of the most critical aspects of the EBA's decision concerns the transition of supervisory responsibilities from national authorities to the EBA once a token is classified as significant. The process is designed to ensure a smooth handover of responsibilities, with clear procedural steps for both the EBA and NCAs.

The decision mandates the creation of a "handover file" to be shared between the current supervising NCA and the EBA. This file includes detailed information about the issuer, the token, the reserve of assets, and any ongoing supervisory activities. The handover must occur within 20 working days of the notification that a token has been classified as significant.

This transition is especially important in cases of s-ARTs and s-EMTs, as the EBA assumes direct supervisory powers. For s-EMTs, which may be issued by electronic money institutions, a dual supervision framework applies, where both the EBA and the home NCA share supervisory responsibilities. This dual approach ensures comprehensive oversight while taking into account the issuer’s other financial activities, such as offering additional financial services. The process for this transition is outlined in Article 5 of the EBA’s Decision, detailing how the exchange of information between the EBA and NCAs must occur to ensure a seamless transfer of supervisory competences.

In addition, the EBA decision also sets out procedures for pre-transition activities, where the authority responsible for current supervision must complete any pending procedures before the formal transfer of supervisory responsibilities. The issuing NCA is required to provide a final status of all supervisory actions in process, ensuring that no critical gaps exist in supervision during this transfer.

The structured framework created by the EBA ensures not only regulatory rigor but also transparency and predictability for both issuers and authorities. This is expected to strengthen the oversight of ARTs and EMTs, particularly those with significant market presence, thereby bolstering investor confidence and ensuring market stability.

Incorporating these regulatory details from the EBA/DC/558 decision and MiCAR will better equip issuers to navigate the evolving regulatory environment for ARTs and EMTs while contributing to a more secure and transparent crypto-asset market in the European Union.

Procedural and Reporting Templates

To facilitate the classification and reporting processes for asset-referenced tokens (ARTs) and e-money tokens (EMTs), the EBA has introduced a comprehensive series of templates that both national competent authorities (NCAs) and issuers must utilize. These templates are integral to ensuring standardized data collection, seamless communication, and a structured approach to oversight across the EU. The templates cover various elements, such as voluntary classification requests, observations on draft significance decisions, and the reporting of critical data related to token holders, transaction volumes, and reserve assets.

The Annexes to the EBA’s Decision EBA/DC/558 are crucial tools in this process. For instance, Annex 4 provides detailed templates designed to report information necessary for the establishment of supervisory colleges. These colleges play a pivotal role in coordinating supervision between the EBA and relevant NCAs for significant ARTs (s-ARTs) and significant EMTs (s-EMTs). The data collected through these templates enable the EBA to assess the scope and activities of issuers more effectively, ensuring that supervisory colleges are equipped with the necessary insights to manage systemic risks associated with significant tokens.

Furthermore, the Annex 3 template is essential during the handover process, ensuring that all relevant supervisory information is transferred from the NCAs to the EBA when a token is classified as significant. This handover file includes critical documentation such as the issuer’s white papers, marketing communications, compliance with regulatory capital requirements, and stress testing outcomes. The procedural rigor outlined in Articles 5 and 6 of the decision ensures that no critical data or supervisory gaps arise during this transition, thereby preserving the continuity and effectiveness of supervision under the MiCAR framework.

Broader Implications for ARTs and EMTs Issuers

For issuers of ARTs and EMTs, these procedural updates mark a substantial change in the regulatory landscape. MiCAR introduces a harmonized supervisory regime, bringing crypto assets under a unified EU-wide regulatory framework. For issuers whose tokens meet the significance criteria outlined in Articles 43 and 56 of MiCAR, the classification as significant ARTs (s-ARTs) or significant EMTs (s-EMTs) brings enhanced scrutiny and more stringent reporting obligations. These issuers are required to report regularly on key performance metrics such as the number of token holders, transaction volumes, and reserve assets using the standardized templates introduced by the EBA.

Additionally, the classification of a token as significant mandates the involvement of supervisory colleges, which provide a collaborative platform for oversight involving the EBA and NCAs. These colleges are responsible for ensuring that issuers adhere to the rigorous regulatory standards outlined in MiCAR and for monitoring the systemic risks that significant tokens may pose to the broader financial system. Issuers of s-ARTs and s-EMTs will need to engage closely with these supervisory bodies, providing timely and accurate data to maintain compliance and avoid penalties.

The dual supervision model applied to s-EMTs underscores the complexity of the regulatory environment for e-money tokens, particularly when these issuers engage in other financial services. In such cases, both the EBA and the issuer’s home NCA share supervisory responsibilities, as detailed in Article 119 of MiCAR. This approach ensures comprehensive oversight, but it also requires issuers to develop robust data management and communication systems to navigate the requirements of multiple supervisory authorities effectively.

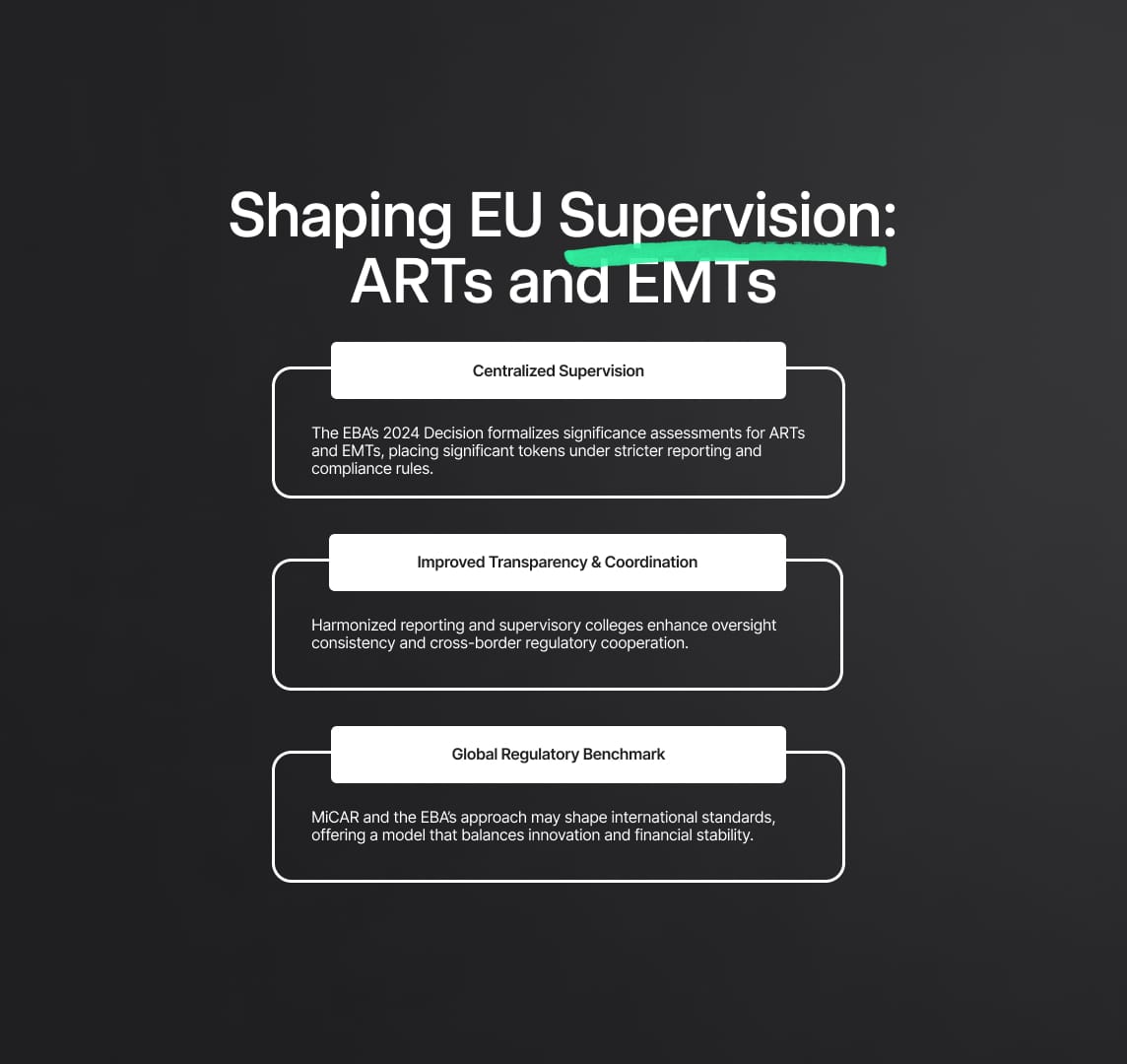

Shaping the Future of ARTs and EMTs Supervision in the EU

The EBA’s 2024 Decision represents a critical shift in how asset-referenced tokens (ARTs) and e-money tokens (EMTs) are supervised within the EU. By formalizing the significance assessment process and creating a structured mechanism for the transfer of supervisory responsibilities, the EBA has positioned itself as a key player in the future of digital asset regulation. These updates will have profound effects on how these tokens are monitored, with issuers of significant tokens facing increased scrutiny, more frequent reporting obligations, and stricter compliance demands.

The long-term impact of these regulatory changes is expected to be multifaceted. First, the harmonized reporting calendars and detailed procedural requirements will bring greater transparency and consistency to the market for ARTs and EMTs. This consistency is likely to foster greater investor confidence, as regulatory oversight becomes more predictable and comprehensive across the EU. Second, the establishment of supervisory colleges for significant tokens will enhance cross-border cooperation among regulators, reducing the risk of regulatory arbitrage and ensuring that s-ARTs and s-EMTs are supervised in a manner that reflects their systemic importance.

As the regulatory landscape continues to evolve, issuers must remain agile in adapting to these new requirements. The EBA’s role in direct supervision of significant tokens will likely expand, potentially setting a precedent for global crypto asset regulation. The MiCAR framework could serve as a blueprint for other jurisdictions seeking to regulate digital assets in a way that balances innovation with the need for financial stability. These developments will not only shape the future of ARTs and EMTs within the EU but will also influence how digital assets are governed globally, as other regulatory bodies look to the EBA's approach as a benchmark for effective oversight in this fast-evolving ecosystem.

Reduce your

compliance risks