Banking Sector: Fintech Transformation

The banking sector's future hinges on embracing tech innovations, fintech, and ESG compliance. Success requires adapting to digital transformation and effective talent management. Banks leading this change will define the industry's future.

Three Transformative Forces in Banking Sector: Fintech Trends

Three key factors that are changing the banking industry's future are driving a fundamental shift of the financial landscape. These include the fiercer rivalry for highly qualified workers, the quick development of technology (particularly in the area of artificial intelligence), and the growing importance of Environmental, Social, and Governance (ESG) norms. The most important difficulty facing banking executives in the coming ten years is going to be finding and keeping great people, according to a recent study conducted in collaboration with Economist Impact. The aforementioned difficulty highlights the necessity of a revolution in personnel management practices as a means of fostering an innovative atmosphere. In addition to being essential for drawing in and keeping elite talent, such an atmosphere is also critical for realizing the full potential of AI and other cutting-edge technologies in the banking sector.

The rapid expansion of fintech and the more widespread adoption of open banking systems are expected to accelerate the ongoing digital transformation of the banking industry. These developments are quickly changing the traditional banking structure and bringing in more flexible and client-focused services. Financial institutions are well-positioned to lead the sector if they can adeptly integrate technology to offer customized banking experiences. This change entails not only technological prowess but also a previously unheard-of level of accuracy and customization in the understanding and response to consumer wants.

Moreover, the banking sector is starting to noticeably benefit from the growing emphasis on ESG norms. Following these guidelines offers several benefits in addition to being a matter of regulatory compliance. Among these are the shift to net-zero emissions, which progressive banks are starting to prioritize, and the strengthening of sustainability credentials, which may greatly boost a bank's standing and attract more clients.

In this changing environment, fintech solution integration is essential. Fintech represents a radical shift in the design, provision, and client experience of financial services; it is more than just a technical advancement. At the forefront of this transition are blockchain, cryptocurrency, and AI-powered financial advising services, which highlight the importance of fintech in bringing about change.

Banking Sector: Talent Management Revolution

The rapid speed of technical improvements and the growing competition from fintech startups are driving a talent management revolution in the banking industry. This sector, which was once thought to be a stronghold of stability, is presently spearheading a significant change in the way it recruits, retains, and develops talent.

Adapting to Technological Evolution in Banking

Banks are realizing more and more that they must modify their talent management plans to keep up with the quick advancement of technology. This adaptation involves developing a workforce that is adaptable and creative in addition to hiring people with the appropriate technical skills. The incorporation of artificial intelligence and machine learning into banking procedures need a workforce that is both technically adept and flexible enough to adjust to the rapidly evolving technology sector.

Fostering an Innovative and Adaptable Work Culture

It is vital to establish an atmosphere that promotes creativity and adaptation. Banks must promote an environment that values innovation and encourages creativity. Moving away from conventional, hierarchical structures and toward more collaborative and dynamic workspaces is part of this cultural shift. This will make banks more appealing to a wider pool of talent, particularly those who are motivated by innovation and the chance to work on cutting-edge projects.

Enhancing Employee Engagement and Retention

Another crucial component of the talent management revolution in the banking industry is attracting and keeping top people. These days, banks are investing in extensive professional development programs, giving possibilities for lifelong learning, and encouraging a healthy work-life balance in addition to delivering financial incentives. Banks may cultivate a more committed and driven workforce by coordinating organizational objectives with individual workers' personal and professional goals.

Leveraging AI and Emerging Technologies

To obtain a competitive edge, AI and other developing technologies must be used effectively. Successfully incorporating these technologies into their operations allows banks to streamline their workflows and provide their clients with better services. But in order to take full use of new technologies, banks need employees who are proficient and at ease with them. This necessitates continuous training and development initiatives to guarantee that staff members are always up to date on the newest developments in technology.

Fintech's Impact on the Banking Sector

The traditional banking business is undergoing a big upheaval in various aspects due to the rise of fintech. In order for banks to remain relevant in the quickly evolving financial landscape of today, this transformation is imperative.

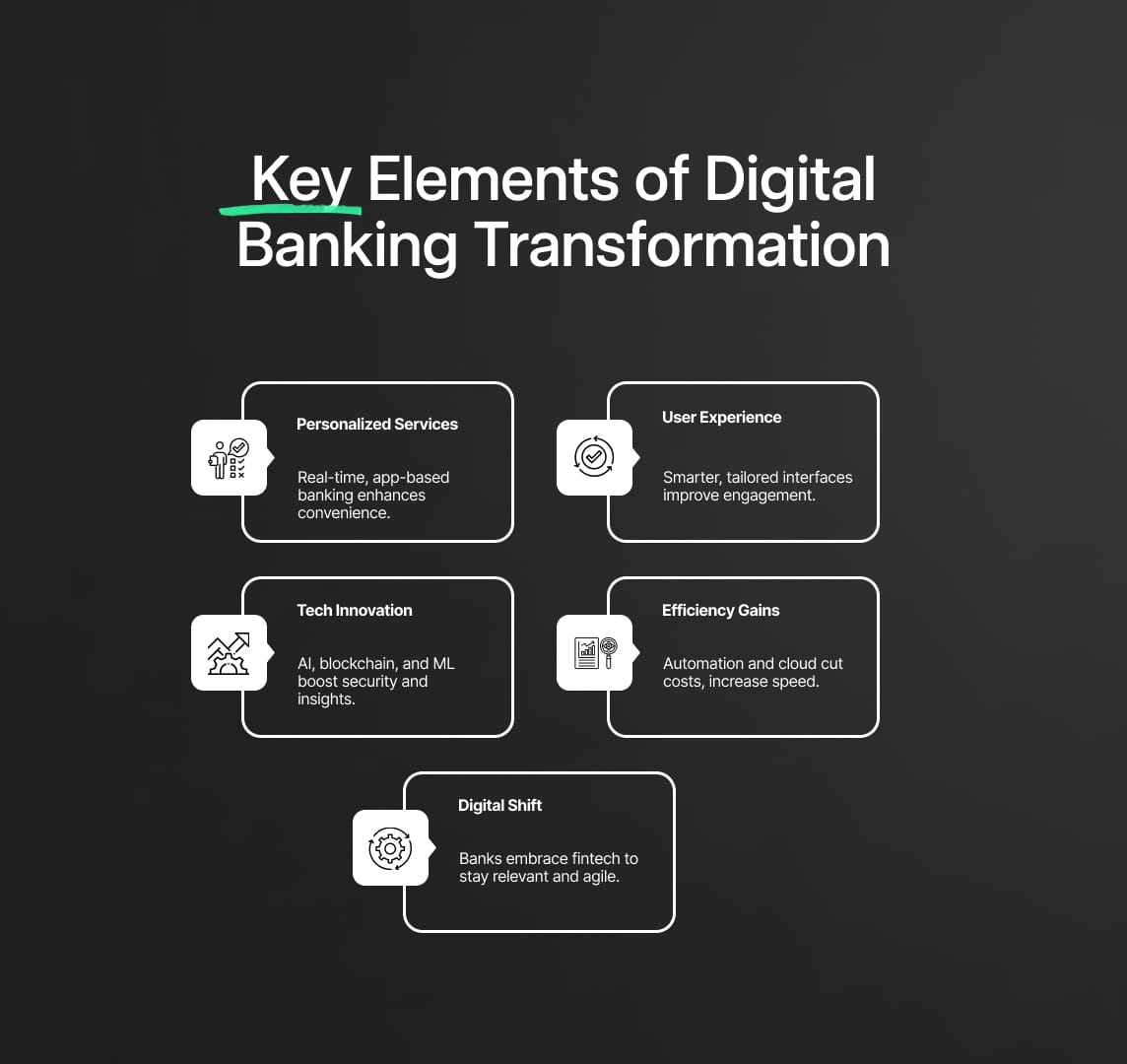

- Agile and Customer-Centric Services:

- Fintech enables the development of more personalized banking experiences.

- Use of mobile banking apps and online platforms for customer convenience.

- Introduction of real-time payment processing and digital wallets.

- Innovative Financial Technologies:

- Blockchain technology is revolutionizing secure transactions and record-keeping.

- AI-driven financial advisory services are providing personalized investment advice.

- Use of machine learning algorithms for fraud detection and risk management.

- Enhanced Customer Experience:

- Chatbots and AI-driven interfaces for improved customer support.

- Tailored financial products based on individual customer data analysis.

- Seamless user interfaces and easier navigation of banking services.

- Streamlining Banking Operations:

- Automation of routine tasks leading to operational efficiency.

- Cloud computing for scalable and cost-effective data management.

- Enhanced cybersecurity measures to protect sensitive financial data.

- Impact on Traditional Banking Models:

- Traditional banks are adopting fintech solutions to remain competitive.

- Collaboration between banks and fintech startups for innovative solutions.

- Shift from physical branches to digital-first banking approaches.

The banking industry's move toward fintech emphasizes how critical it is to adopt new technologies in order to boost client satisfaction, increase operational effectiveness, and guarantee the security of financial transactions. The incorporation of these cutting-edge technologies represents a fundamental shift in the way that banking services are provided and experienced in the contemporary day, not merely a passing fad.

Banking Sector: Embracing Digital Transformation

The banking industry is undergoing a digital revolution as it moves from antiquated models to more dynamic and cutting-edge technologies. In an increasingly digital world, modernizing IT infrastructure has become essential for banks to maintain their security and competitiveness. This change involves not simply implementing new technology but also reevaluating how banks function and interact with their clientele.

Key Components of Digital Transformation in Banking

- Adoption of Cloud Computing: Because cloud computing is scalable, flexible, and economical, banks can react swiftly to shifts in the market and client needs. Additionally, this technology makes it easier to create new financial services and products, which improves the clientele's entire experience.

- Enhanced Cybersecurity Measures: Cyber risks are becoming more likely as the financial industry digitizes. Banks are spending money on cutting-edge cybersecurity solutions to safeguard private information and uphold client confidence.

- Big Data Analytics: Banks can obtain more profound understanding of the interests and behaviors of their customers by employing big data analytics. This data-driven strategy enhances client pleasure and loyalty by personalizing banking experiences.

- Mobile Banking and AI Integration: The way that customers interact with banks is changing as a result of the combination of AI and mobile banking. Convenience and improved user experience are provided by AI-driven chatbots, tailored financial advice, and frictionless mobile transactions, which are quickly becoming standard.

The Role of ESG in Banking and Fintech

- Regulatory Adherence and Risk Management: Banks and fintech companies can reduce the risks associated with environmental and social issues by adhering to ESG guidelines. It also guarantees compliance with the increasing number of rules in this field.

- Access to New Markets and Investment Opportunities: Banks that adhere to ESG guidelines are in a good position to investigate new markets, especially those related to green and sustainable financing. This covers financial contributions to eco-friendly and renewable energy initiatives.

- Enhancing Reputation and Customer Appeal: A bank's reputation is enhanced by a strong ESG commitment, which enables it to better reflect the values of investors and customers who care about the environment and society. This increases investor confidence in addition to drawing in a larger client base.

- Long-term Sustainable Growth: For banks and fintech companies, ESG compliance promotes long-term sustainable growth in addition to short-term benefits. These institutions are getting ready for a future in which social and environmental governance will be increasingly more important by emphasizing sustainable practices.

Adapting to Technological Advancements in the Banking Sector

The ability of the banking industry to incorporate technological innovations will have a significant impact on its future. The industries standards will be defined by organizations that quickly adapt and use cutting-edge technologies like advanced data analytics, blockchain, and artificial intelligence. This technological revolution aims to redefine the consumer experience in addition to increasing operational efficiency. Banks will have a competitive edge if they use technology to provide smooth, secure, and personalized financial services.

The Role of Fintech in Shaping the Banking Sector's Future

Fintech is leading the charge in the restructuring of the banking industry. It plays a crucial role in launching innovative financial services and solutions that satisfy evolving consumer demands. The market will probably be led by banks who work with fintech companies or incorporate their innovations into their offerings. This partnership is changing how customers engage with financial institutions by offering anything from advanced financial management tools to mobile banking options.

Sustainability and ESG Compliance: Banking Sector's New Norm

In the banking industry, sustainability and compliance with ESG (Environmental, Social, and Governance) standards are becoming prerequisites for success. In addition to complying with legal requirements, banks that operate in accordance with these principles are attracting the interest of an increasing number of environmentally concerned investors and consumers. Long-term growth and profitability depend heavily on investments in green and sustainable projects, which are being made easier by the integration of ESG criteria.

Talent Management: A Key Driver in the Banking Sector's Evolution

The banking industry is seeing a rise in the strategic importance of effective talent management. Organizations that are able to draw in, hold on to, and develop personnel will be better positioned to manage the industry's rapid changes. This entails developing a culture of ongoing learning and innovation in addition to selecting people with the appropriate talents. Banks can guarantee they have the know-how required to negotiate the intricacies of a technologically advanced and highly regulated market by making investments in their personnel.

Navigating the Changing Landscape: The Banking Sector's Path Forward

Banks need to be flexible and progressive if they want to prosper in the future. It is now necessary to embrace digital transformation, implement fintech solutions, follow ESG guidelines, and innovate talent management if one wants to succeed and survive. The banking industry's future will be determined by its capacity to adjust to these developments. Those who aggressively embrace these changes will not only survive, but will also be at the forefront of the upcoming banking revolution.

Read More

Reduce your

compliance risks