Basel Committee on Banking Supervision: GSII Identification

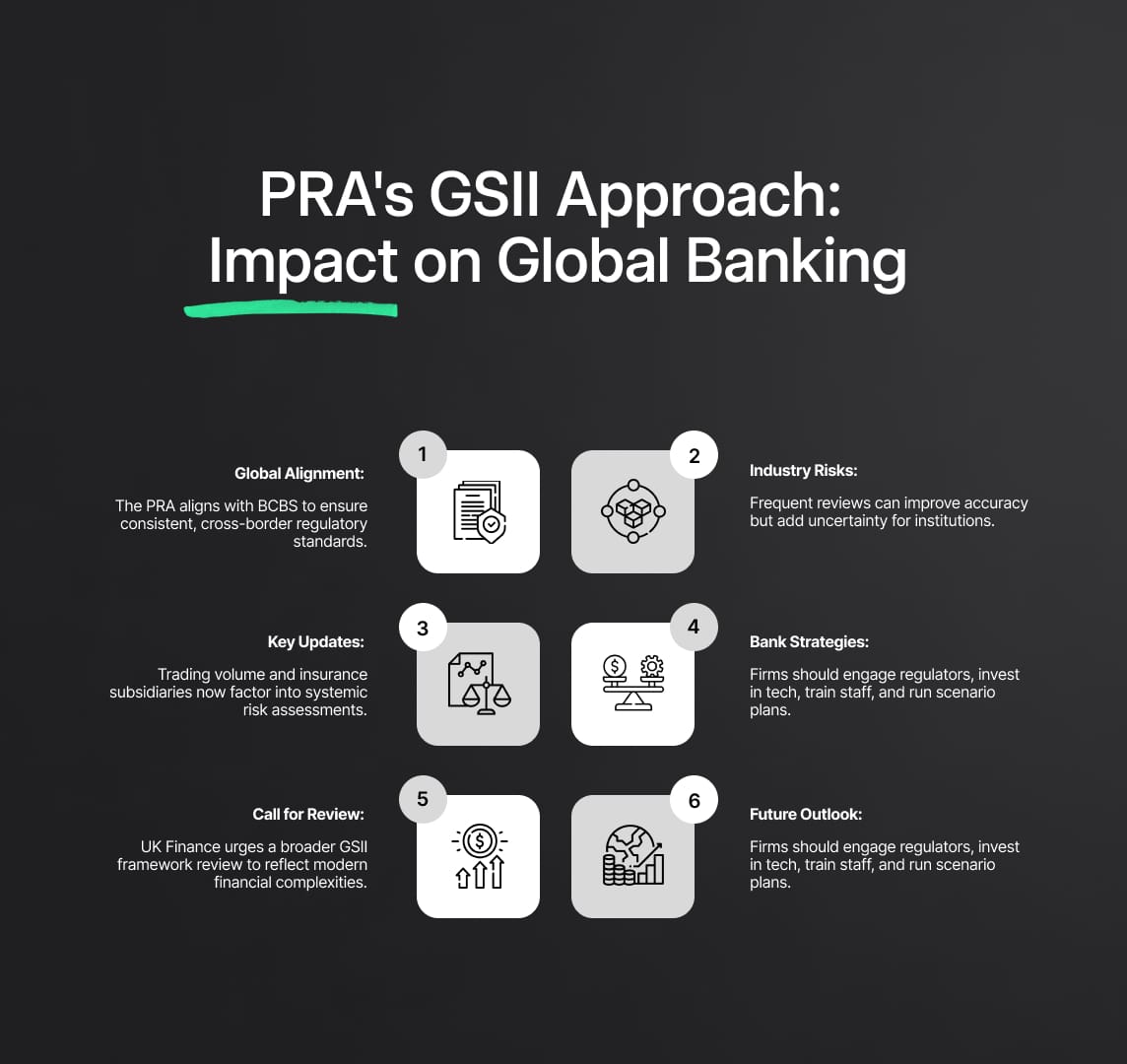

The PRA's updated framework on GSIIs highlights a global shift towards synchronized financial regulations. As banks span continents, unified rules become vital. The inclusion of trading volume and insurance subsidiaries reflects modern banking's multifaceted nature.

Basel Committee on Banking Supervision: Review of Global Systemically Important Institutions (GSII) Buffers and Methodologies

The Prudential Regulation Authority (PRA) has recently proposed an update to the UK Technical Standards (UKTS) on the identification of Global Systemically Important Institutions (GSIIs). These updates come in response to recent amendments to the Basel Committee on Banking Supervision's (BCBS) methodology for identifying GSIIs. GSIIs are banks that, due to their size, complexity, and systemic interconnectedness, could potentially cause significant disruption to the global financial system and worldwide economy if they were to fail. As such, they are required to hold higher levels of loss-absorbing capacity than the minimum levels agreed in Basel III, achieved by maintaining a GSII buffer. This promising move towards aligning UK and BCBS methodologies also includes the addition of trading volume as a new category and the inclusion of insurance subsidiaries in data consolidation. However, UK Finance has encouraged a broader review of the 12-year old GSII assessment framework by the BCBS, citing the evolution and effectiveness of resolution techniques over the past decade.

Global Banking Regulation: Implications of the PRA's Updated Approach to GSII

The financial world, with its complex interwoven networks, is undergoing a profound transformation. Central to this metamorphosis is the recent proposition by the Prudential Regulation Authority (PRA) regarding updates to the UK Technical Standards (UKTS) on the identification of Global Systemically Important Institutions (GSIIs). As a pivotal development in global banking, understanding its nuances becomes imperative for stakeholders.

A Global Quest for Harmonization

The PRA's move to align its methodology with that of the Basel Committee on Banking Supervision (BCBS) signifies a broader shift towards international regulatory coherence. In an era where financial institutions operate across borders, weaving a web of transactions that span continents, synchronized regulations are not just desirable—they're indispensable. This congruence ensures that banks, irrespective of their operational base, face a level playing field, thereby fostering both competition and collaboration.

Why the Change Matters

The changes, particularly the introduction of trading volume as a classification and the assimilation of insurance subsidiaries data, are emblematic of a regulatory body that's attuned to the changing pulse of the financial sector. Modern banking is not just about traditional lending or deposit activities. The inclusion of trading volume acknowledges the significant role trading plays in a bank's risk profile. Similarly, by considering insurance subsidiaries, the PRA recognizes the multifaceted nature of financial conglomerates, where insurance and banking activities often intertwine.

Challenges and Opportunities of Broader Review

UK Finance's advocacy for a wider review of the GSII framework echoes a sentiment that many in the industry share. Financial practices, products, and risks have seen a sea change over the past decade. Given this, a periodic and comprehensive reassessment of regulations isn't just prudent—it's essential. However, broader reviews can be a double-edged sword. While they can lead to more accurate and reflective regulations, they can also introduce a level of uncertainty for institutions, necessitating them to be perpetually prepared for shifts in the regulatory landscape.

Strategies for a Fluid Landscape

For GSIIs, the challenges posed by these updates are manifold, but they aren't insurmountable. Some strategies to consider include:

- Continuous Engagement: Banks must maintain an ongoing dialogue with regulators, ensuring they're not just reactive but proactive in their approach.

- Investment in Technology: With the complexity of new data requirements, leveraging technology for data collection, analysis, and reporting becomes paramount.

- Internal Training and Development: Regular training sessions can ensure that all staff, from the front office to risk management teams, are well-versed with the changing regulatory dynamics.

- Scenario Planning: Financial institutions should regularly conduct scenario analyses, considering possible regulatory changes, their potential impact, and the bank's response strategy.

Looking Ahead

The financial world is in a state of flux, driven by technological advancements, geopolitical changes, and evolving customer preferences. In such a landscape, the PRA's proposed updates serve as a testament to the need for regulations that are both reflective of current realities and flexible enough for future uncertainties. For banks and other financial institutions, the task is clear: stay informed, be adaptable, and always be prepared for the next wave of change.

Reduce your

compliance risks