Basel III Reform: EU Implementation

The Basel III framework enhances global financial stability by increasing bank capital requirements. Key measures include higher CET1 ratios, Capital Conservation and Countercyclical Buffers, and new liquidity and leverage standards.

Introduction

The Basel III framework, designed to bolster global financial stability following the 2008 financial crisis, represents a significant evolution in international banking regulations. Its primary goals include strengthening bank capital requirements, enhancing risk management, and improving the overall resilience of the banking sector. These reforms are crucial for preventing the recurrence of financial crises and ensuring that banks can withstand economic shocks.

Basel 3: Bank Capital Requirements

One of the core components of Basel III is the enhancement of bank capital requirements. Basel III introduces more stringent definitions and higher quality of capital, emphasizing common equity tier 1 (CET1) as the predominant form of bank capital. CET1 capital is the highest quality capital, consisting mostly of common shares and retained earnings. Banks are required to hold a minimum of 4.5% of CET1, up from the 2% under Basel II.

In addition to the increased CET1 requirements, Basel III introduces the Capital Conservation Buffer (CCB) and the Countercyclical Capital Buffer (CCyB). The CCB requires banks to hold an additional 2.5% of CET1 capital to absorb losses during periods of financial and economic stress, bringing the total minimum CET1 capital requirement to 7%. The CCyB, ranging from 0% to 2.5%, can be activated by national regulators to curb excessive credit growth and ensure that banks build up capital defenses during periods of rapid credit expansion.

Risk Management Practices

Basel III also focuses on improving banks' risk management practices. One key aspect is the introduction of the leverage ratio, a non-risk-based measure that serves as a backstop to the risk-weighted capital requirements. The leverage ratio requires banks to hold a minimum level of capital relative to their total assets, without considering the riskiness of those assets. This aims to constrain the build-up of leverage in the banking sector and enhance the robustness of individual banks.

Furthermore, Basel III enhances the framework for managing liquidity risk through the introduction of the Liquidity Coverage Ratio (LCR) and the Net Stable Funding Ratio (NSFR). The LCR requires banks to hold a sufficient stock of high-quality liquid assets (HQLA) to cover net cash outflows over a 30-day stress period. The NSFR aims to promote resilience over a longer time horizon by requiring banks to maintain a stable funding profile relative to the composition of their assets and off-balance-sheet activities.

Improving Overall Resilience

The reforms introduced by Basel III are designed to improve the overall resilience of the banking sector. By requiring higher levels of high-quality capital, imposing more stringent risk management practices, and ensuring adequate liquidity, Basel III aims to make banks more resilient to economic shocks and financial crises.

The European Banking Authority (EBA) plays a pivotal role in implementing Basel III within the European Union. The EBA's responsibilities include developing technical standards, guidelines, and recommendations to ensure that the Basel III framework is effectively integrated into EU law. The EBA also monitors the implementation of these standards and assesses their impact on the banking sector.

In addition to its regulatory role, the EBA provides support and guidance to national supervisory authorities and banks. This includes conducting stress tests to assess the resilience of banks under adverse economic scenarios and providing technical advice on risk management practices. The EBA's work ensures a consistent and harmonized application of Basel III across the EU, promoting financial stability and protecting the interests of depositors and investors.

Basel Standards Implementations: Implications for the EU Banking Sector

The implementation of Basel III has far-reaching implications for the EU banking sector. It promotes a more stable and resilient banking system, capable of withstanding economic shocks and reducing the risk of financial crises. This stability is crucial for maintaining investor confidence and ensuring the smooth functioning of financial markets.

Moreover, the enhanced capital and liquidity requirements encourage banks to adopt more prudent risk management practices, reducing the likelihood of excessive risk-taking. This is particularly important in the context of the EU's broader efforts to promote sustainable finance and address emerging risks such as climate change and technological innovation.

Bank Capital Standards in the EU: The Final Phase of Basel III Implementation

On June 20, 2024, José Manuel Campa, chair of the European Banking Authority (EBA), delivered a pivotal speech titled "Strengthening Bank Capital Standards in the EU: The Final Phase of Basel III Implementation." This address underscored the significant strides made and outlined future steps in this critical implementation phase, highlighting the paramount importance of robust prudential regulation.

Basel III: Prudential Regulation Approach

Prudential Regulation's Importance: Prudential regulation is indispensable for maintaining the stability and resilience of the global financial system. It acts as a protective barrier against systemic risks and financial crises, safeguarding depositor funds and promoting the overall health of financial institutions. By fostering market discipline and transparency, prudential regulation enhances investor confidence and facilitates efficient capital allocation within the banking sector. Robust prudential frameworks protect individual institutions from excessive risk-taking, contributing to macroeconomic stability and sustainable economic growth.

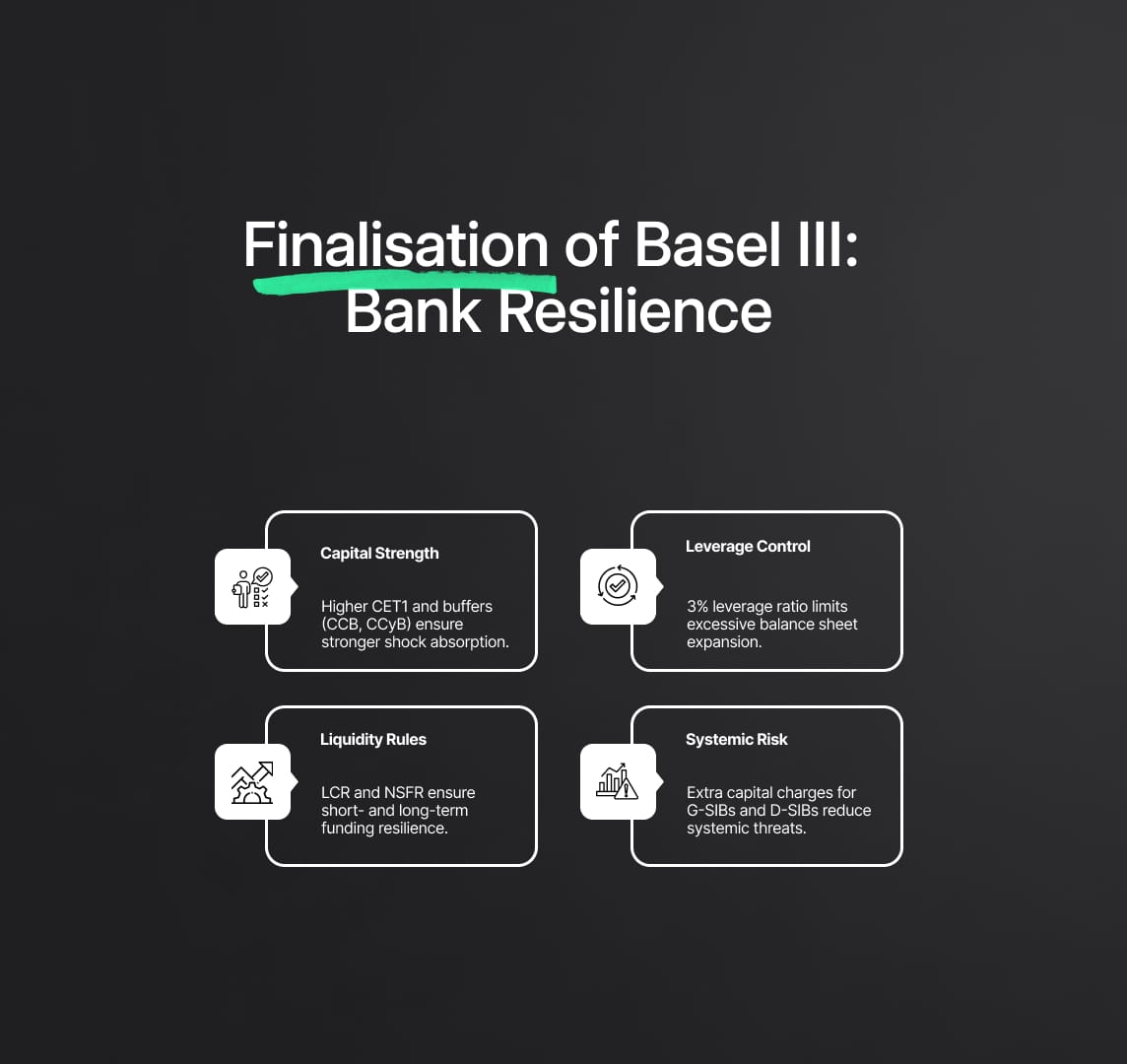

Finalisation of Basel III: Bank Resilience

The finalisation of the Basel III framework marks a significant milestone in global financial regulation. This comprehensive framework introduces enhanced requirements aimed at promoting a safer and more stable banking environment in the post-2008 era. Key aspects of Basel III that bolster the resilience of banks include:

1. Strengthening Capital Quality and Quantity:

- Common Equity Tier 1 (CET1): Basel III places a greater emphasis on CET1 capital, which consists of the highest quality capital elements such as common shares and retained earnings. Banks are required to maintain a minimum CET1 ratio of 4.5% of risk-weighted assets (RWAs), up from 2% under Basel II. This ensures that banks have a solid capital base to absorb losses.

- Capital Conservation Buffer (CCB): An additional 2.5% of CET1 capital is mandated as a buffer to be built up during periods of economic growth. This buffer is designed to be drawn down in times of financial stress, allowing banks to continue operations and lending.

- Countercyclical Capital Buffer (CCyB): This buffer, which ranges from 0% to 2.5%, can be imposed by national authorities to counteract excessive credit growth and buildup of systemic risk. It aims to protect the banking sector from periods of excess aggregate credit growth.

2. Introducing Leverage Ratio:

- Leverage Ratio Framework: Basel III introduces a leverage ratio as a non-risk-based measure to act as a supplementary backstop to the risk-weighted capital requirements. The leverage ratio is set at a minimum of 3%, calculated as the ratio of Tier 1 capital to average total consolidated assets. This measure helps constrain the buildup of leverage in the banking sector, promoting greater stability.

3. Enhancing Liquidity Risk Management:

- Liquidity Coverage Ratio (LCR): The LCR requires banks to hold sufficient high-quality liquid assets (HQLA) to cover net cash outflows over a 30-day stress period. This ensures that banks have the liquidity to survive short-term disruptions.

- Net Stable Funding Ratio (NSFR): The NSFR promotes longer-term resilience by requiring banks to maintain a stable funding profile relative to the composition of their assets and off-balance-sheet activities. This ratio is designed to ensure that banks have an adequate stable funding structure to support their operations during prolonged periods of stress.

4. Addressing Systemic and Procyclical Risks:

- Global Systemically Important Banks (G-SIBs): Basel III introduces additional capital surcharges for G-SIBs to mitigate the risk these large institutions pose to the global financial system. These surcharges are designed to reduce the likelihood of failure and the systemic impact of such failures.

- Capital Buffers for Domestic Systemically Important Banks (D-SIBs): National regulators are encouraged to implement additional capital requirements for D-SIBs to enhance their resilience and mitigate domestic systemic risks.

EBA’s Role in Basel III Implementation

Operationalising the Banking Package in Europe

The implementation of Basel III in the European Union is a complex and multifaceted process, spearheaded by the European Banking Authority (EBA). The EU Banking Package has assigned the EBA 140 mandates, which include developing 60 technical standards, 29 guidelines, and 37 reports and opinions. These mandates are crucial for implementing and monitoring Basel III requirements in the EU, ensuring that the banking sector remains robust, transparent, and resilient.

To provide clarity on the development of these mandates, the EBA published a comprehensive roadmap in December 2023. This roadmap outlines the approach to delivering on Level 2 requirements, offering a detailed and phased plan to address operational challenges and ensure timely implementation.

Supervisory Reporting and Pillar 3 Disclosures

The EBA adopts a two-step sequential approach to supervisory reporting and Pillar 3 disclosures, which are critical components for Basel III implementation. This approach ensures a structured and efficient transition to the new regulatory standards, focusing on enhancing transparency and accountability in the banking sector.

Step 1: CRR III and CRD VI Driven Mandates

The first phase of this approach concentrates on mandates driven by the Capital Requirements Regulation III (CRR III) and the Capital Requirements Directive VI (CRD VI). These mandates are essential for implementing and monitoring Basel III requirements in the EU, including updating the Pillar 3 framework. The consultation papers for Step 1 disclosures and reporting were published on December 14, 2023. Key aspects of Step 1 include:

- Updating the Pillar 3 Framework: The updated Pillar 3 framework emphasizes enhanced transparency in risk disclosures, enabling stakeholders to better understand banks' risk profiles, capital adequacy, and risk management practices. This includes detailed requirements for disclosing information on capital structure, risk exposures, and internal risk assessment processes.

- Consultation Papers: The consultation papers cover a wide range of topics critical to Basel III implementation, excluding crypto assets and operational risk, which are addressed separately. These papers solicit feedback from stakeholders, ensuring that the final regulations are comprehensive and practical.

Step 2: Broader Reporting and Disclosure Requirements

The second phase addresses reporting and disclosure requirements not directly linked to Basel III, along with those dependent on other Level 2 policy mandates with extended development timelines. This phase ensures that all aspects of the banking sector's regulatory environment are aligned and cohesive. Key elements of Step 2 include:

- Crypto Assets and Operational Risk: Consultation papers covering these areas were released in February 2024. The integration of crypto assets into the regulatory framework reflects the evolving financial landscape and the need for robust oversight. Similarly, the focus on operational risk aims to strengthen banks' resilience to internal and external operational disruptions.

- Draft Technical Standards: These standards encompass the business indicator, supervisory reporting mapping, and considerations on mergers and acquisitions. The development of these standards ensures that banks have clear guidelines for reporting and compliance.

Final Draft Technical Standards and Transition Provisions

The final draft technical standards for Step 1 disclosure and reporting are expected to be published in June/July 2024. These standards will cover all relevant topics, including transitional provisions for crypto assets exposures, ensuring that banks have adequate time and guidance to adapt to the new requirements. The first disclosure reference date is set for March 31, 2025, marking a significant milestone in the full implementation of Basel III in the EU.

By adopting this structured approach, the EBA ensures that the implementation of Basel III is both thorough and efficient, providing the necessary oversight and guidance to the banking sector. This meticulous planning and execution underscore the EBA’s commitment to fostering a stable, transparent, and resilient banking environment in the European Union.

Interest Rate Risk in the Banking Book (IRRBB)

On January 24, 2024, the European Banking Authority (EBA) published a comprehensive heatmap following an in-depth scrutiny of the implementation of Interest Rate Risk in the Banking Book (IRRBB) standards within the European Union. This heatmap is an essential tool, highlighting several policy aspects that require further examination, particularly with regard to proportionality. Effective management of IRRBB is crucial for maintaining the stability and solvency of banks, as it directly impacts their ability to manage the risks associated with fluctuations in interest rates.

Key Components of IRRBB

1. Measurement and Management: Banks are required to measure and manage their interest rate risk exposure in both economic value and earnings perspectives. The EBA guidelines stipulate that banks should use a range of scenarios, including both parallel and non-parallel shifts in interest rates, to assess their IRRBB exposure.

2. Supervisory Outlier Tests (SOTs): These tests are a critical component of the IRRBB framework. SOTs help identify banks with high levels of IRRBB by applying standardized shocks to their interest rate-sensitive positions. Banks failing these tests may face supervisory actions, such as capital add-ons or other remedial measures.

3. Internal Models: The use of internal models for IRRBB is permitted, but these models must meet stringent validation and approval criteria set by the EBA. Banks must demonstrate that their models accurately capture the risks associated with their specific portfolios and business models.

4. Disclosure Requirements: Transparency is a key aspect of the IRRBB framework. Banks are required to disclose their IRRBB exposure, including the methodologies used for measurement and the results of their internal assessments. This information must be made available to market participants, fostering greater market discipline.

5. Proportionality Principle: The EBA acknowledges that smaller banks or those with less complex operations may face challenges in meeting the same requirements as larger institutions. As such, the proportionality principle allows for tailored approaches based on the size, complexity, and risk profile of each bank. This ensures that all banks, regardless of their scale, can effectively manage IRRBB without undue burden.

Integration of ESG Risks

Reflecting the increasing importance of Environmental, Social, and Governance (ESG) risks, the EU Banking Package includes comprehensive provisions to expedite the integration of these risks into the financial system. The EBA's mandates cover supervisory reporting, disclosures, stress testing, and the prudential treatment of exposures related to ESG factors. These mandates are a part of the EBA's broader sustainable finance roadmap, designed to support the transition towards a sustainable economy and mitigate the risks posed by climate change and broader ESG issues.

Key ESG Risk Integration Initiatives

1. Supervisory Reporting: Banks are required to report on their ESG risk exposures as part of their regular supervisory reporting. This includes data on climate-related risks, such as carbon emissions and the potential impact of climate change on their operations and portfolios.

2. Disclosures: Enhanced disclosure requirements mandate that banks provide detailed information on their ESG risk management practices. This includes their strategies for mitigating ESG risks, the governance structures in place to oversee these efforts, and the metrics used to measure progress.

3. Stress Testing: ESG risks are incorporated into the stress testing frameworks. Banks must evaluate how severe but plausible climate-related scenarios could impact their financial position and resilience. These stress tests help identify vulnerabilities and inform risk management strategies.

4. Prudential Treatment: The EBA is developing guidelines for the prudential treatment of ESG exposures. This includes considering whether certain exposures should attract higher capital charges due to their associated risks, thereby incentivizing banks to manage and reduce their ESG risk profiles.

Crypto Assets Regulation

As of March 2024, the EBA had published consultations for 19 out of the 20 mandates under the Markets in Crypto Assets Regulation (MiCA), with 17 consultations already closed. These consultations are crucial for establishing a robust regulatory framework for crypto assets within the EU, addressing the unique risks and challenges posed by these emerging financial instruments.

Key Elements of MiCA Regulation

1. Classification of Crypto Assets: The EBA's final consultation paper on the joint-European Supervisory Authorities’ guidelines for classifying crypto-assets will soon be published. This classification framework is essential for determining the regulatory requirements applicable to different types of crypto assets.

2. Supervision of Significant Asset-Referenced Tokens and E-Money Tokens: Starting in Q4 2024, the EBA will commence supervision of issuers of significant asset-referenced tokens and e-money tokens. This supervision aims to ensure that these issuers adhere to high standards of transparency, security, and consumer protection.

3. Regulatory Requirements: The EBA's mandates under MiCA include detailed regulatory requirements for crypto asset service providers. These requirements cover areas such as capital adequacy, governance, risk management, and anti-money laundering (AML) measures.

4. Market Integrity and Consumer Protection: Ensuring market integrity and protecting consumers are central goals of the MiCA regulation. The EBA is developing frameworks to prevent market abuse and enhance the transparency and reliability of crypto asset markets.

5. Technological Innovation and Adaptation: The regulatory framework is designed to be adaptable to future technological developments in the crypto space. This flexibility ensures that the regulation remains relevant and effective in the face of rapid innovation.

Technology and Innovation in the Banking Sector: Basel 3 Implementation

EBA’s Cyber and Innovation Agenda

The European Banking Authority (EBA) has developed a comprehensive cyber and innovation agenda to ensure that technological advancements are effectively integrated into the banking sector. This multifaceted agenda addresses the rapid technological evolution and its implications for financial stability, cybersecurity, and regulatory compliance within the framework of Basel 3.

Implementing Existing Legislation

1. Digital Operational Resilience Act (DORA)

Enacted on January 16, 2023, DORA is a cornerstone in enhancing the digital operational resilience of financial institutions across the EU. The act mandates the European Supervisory Authorities (ESAs) to deliver 13 joint products, including 8 Regulatory Technical Standards (RTS), 2 Implementing Technical Standards (ITS), 2 Guidelines (GL), and 1 report.

- First Batch of DORA Policy Products: Submitted to the European Commission on January 17, 2024, these products set the foundational requirements for operational resilience, ensuring that banks can withstand, respond to, and recover from all types of ICT-related disruptions and threats.

- Second Batch: Influenced by public feedback and expected by July 2024, this batch will refine and expand on the initial standards, incorporating industry input to address practical implementation challenges and enhance the robustness of the regulatory framework.

2. Markets in Crypto-Assets Regulation (MiCAR)

Following its enactment on June 29, 2023, MiCAR establishes a comprehensive regulatory framework for crypto-assets within the EU. The EBA is tasked with developing 20 Level 2 and Level 3 mandates under MiCAR, with completion expected by June 2024.

- Consultations and Finalizations: As of March 2024, the EBA has consulted on 19 mandates, with the final consultations pending. These consultations ensure that the regulatory framework is comprehensive, addressing the unique risks associated with crypto-assets while promoting innovation.

- Supervision of Issuers: Starting from Q4 2024, the EBA will supervise issuers of significant asset-referenced tokens and e-money tokens. This supervision aims to ensure compliance with MiCAR, enhancing transparency, consumer protection, and market integrity in the evolving landscape of digital assets.

Enhanced Capital Requirements

The final phase of Basel III implementation significantly enhances the capital requirements for banks, ensuring that they are better equipped to handle financial shocks. These enhanced requirements are a cornerstone of Basel III, aiming to fortify the financial stability and resilience of banks within the EU.

Key Components of Enhanced Capital Requirements

1. Higher Quality of Capital: Basel III places a greater emphasis on the quality of capital that banks must hold. The framework prioritizes Common Equity Tier 1 (CET1) capital, which consists of the most loss-absorbing forms of capital such as common shares and retained earnings. Banks are required to maintain a minimum CET1 ratio of 4.5% of risk-weighted assets (RWAs), up from the previous 2% under Basel II.

2. Capital Conservation Buffer (CCB): In addition to the minimum CET1 requirement, banks must hold an additional 2.5% of CET1 as a capital conservation buffer. This buffer is designed to be used during periods of financial stress, allowing banks to absorb losses while maintaining their ability to lend.

3. Countercyclical Capital Buffer (CCyB): The CCyB ranges from 0% to 2.5% of RWAs and can be adjusted by national regulators. This buffer aims to protect the banking sector from periods of excessive credit growth and to ensure that banks build up capital reserves during economic upswings that can be drawn down during downturns.

4. Leverage Ratio: Basel III introduces a leverage ratio as a non-risk-based measure to complement the risk-based capital requirements. The leverage ratio requires banks to hold a minimum of 3% Tier 1 capital against their total exposure, limiting the extent to which banks can leverage their equity capital.

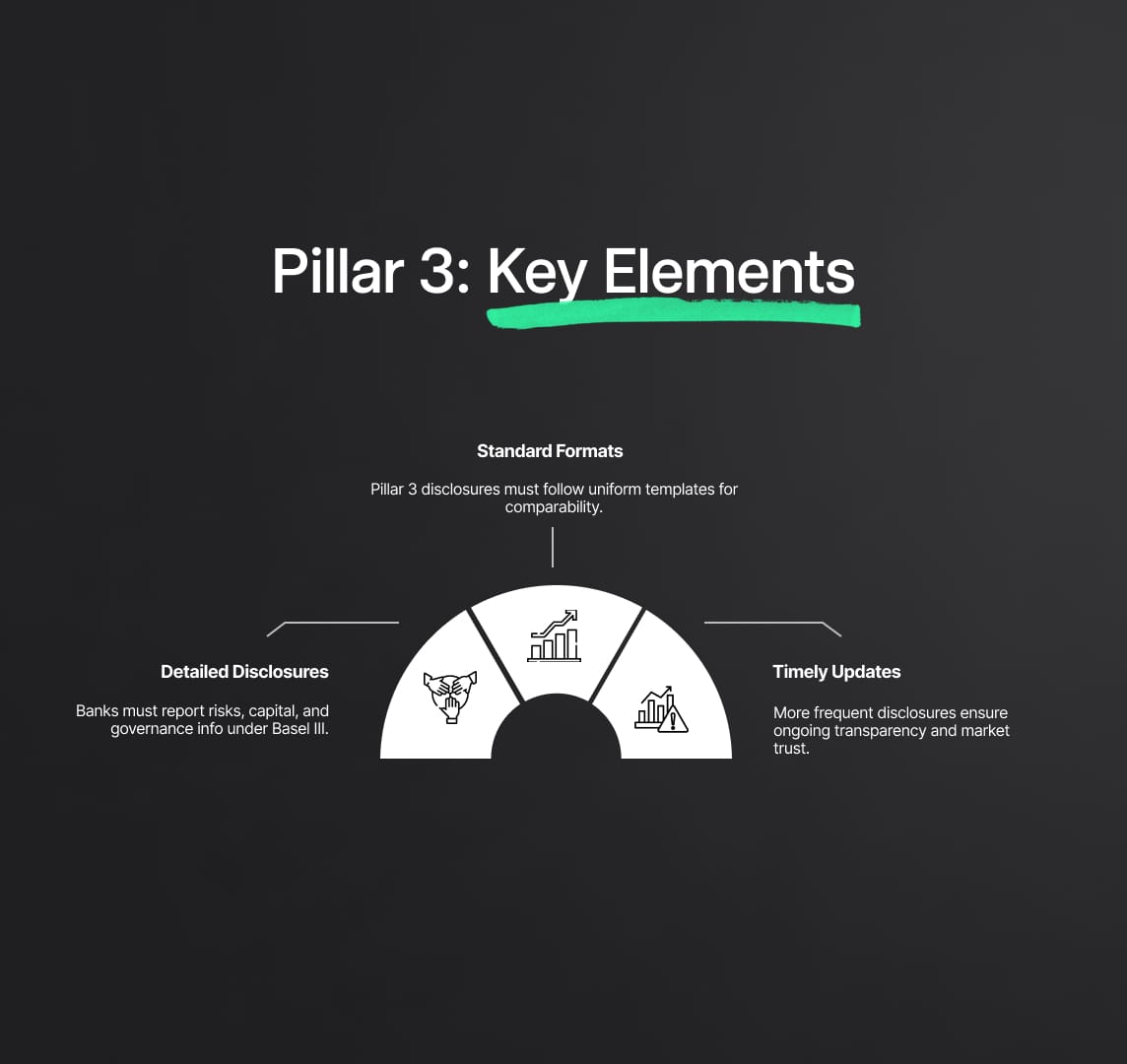

Pillar 3 framework Under Basel 3

The updated Pillar 3 framework under Basel III is designed to enhance the transparency of banks' risk exposures, capital adequacy, and risk management practices. This increased transparency is critical for improving market discipline and fostering greater confidence among stakeholders.

Key Elements of the Updated Pillar 3 Framework

1. Enhanced Disclosure Requirements: Basel III mandates that banks disclose detailed information about their risk exposures, capital structure, and risk management processes. This includes quantitative disclosures such as capital ratios, RWAs, and leverage ratios, as well as qualitative disclosures about risk management strategies and governance structures.

2. Standardized Reporting Formats: To facilitate comparability, Basel III requires banks to use standardized reporting formats for their Pillar 3 disclosures. This standardization ensures that stakeholders can easily compare the financial health and risk profiles of different banks.

3. Frequency and Timeliness of Disclosures: Basel III increases the frequency and timeliness of disclosures, requiring banks to provide more regular updates on their financial condition. This ongoing transparency helps market participants to make informed decisions and fosters a more dynamic and responsive financial system.

Support for Sustainable Finance

Basel III’s integration of Environmental, Social, and Governance (ESG) risks into the regulatory framework underscores the EU’s commitment to promoting sustainable finance. By addressing climate-related and other sustainability risks, Basel III supports the transition towards a more sustainable and resilient financial system.

ESG Risk Integration

1. ESG Risk Reporting: Banks are required to report their exposure to ESG risks as part of their supervisory reporting. This includes data on carbon emissions, climate-related risks, and other environmental impacts that could affect their financial stability.

2. Enhanced Stress Testing: Basel III mandates that banks include ESG scenarios in their stress testing frameworks. These scenarios help banks to understand the potential financial impacts of environmental and social risks and to develop strategies for mitigating these risks.

3. Prudential Treatment of ESG Exposures: The EBA is developing guidelines for the prudential treatment of ESG exposures. This includes considering whether certain exposures should attract higher capital charges due to their associated risks, incentivising banks to manage and reduce their ESG risk profiles.

Market Access and Competition

The EU Banking Package aims to deepen and facilitate access to the EU single market, improving supervision tools for both EU and third-country banks operating within the region. This initiative is designed to enhance competition, promote financial stability, and ensure a level playing field for all market participants.

Key Measures to Enhance Market Access and Competition

1. Harmonised Regulatory Standards: Basel III establishes harmonised regulatory standards across the EU, ensuring that all banks, whether domestic or foreign, operate under the same rules. This reduces regulatory arbitrage and promotes fair competition.

2. Enhanced Supervisory Cooperation: The EBA works closely with national supervisory authorities to ensure consistent application of Basel III standards. This cooperation includes joint supervision of cross-border banks and coordinated responses to emerging risks.

3. Facilitating Market Entry: The EU Banking Package includes measures to facilitate the entry of third-country banks into the EU market. This includes streamlined authorization processes and clear regulatory guidelines, making it easier for foreign banks to establish operations in the EU.

4. Consumer Protection and Market Integrity: Enhanced consumer protection measures ensure that the benefits of increased competition do not come at the expense of market integrity. The EBA's regulatory framework includes strict conduct rules and robust mechanisms for addressing consumer complaints and ensuring fair treatment.

Managing Interest Rate Risks

The European Banking Authority (EBA) will continue to prioritize managing interest rate risks as a critical component of Basel III implementation. Interest rate risk in the banking book (IRRBB) refers to the potential impact of changes in interest rates on a bank's earnings and economic value. Effective management of IRRBB is crucial for maintaining financial stability and solvency, especially in a dynamic economic environment.

1. Enhanced Measurement Techniques: Banks are required to adopt advanced measurement techniques for IRRBB, including gap analysis, duration analysis, and simulation models. These techniques help in assessing the potential impact of interest rate changes on both earnings and the economic value of equity.

2. Dynamic Stress Testing: The EBA mandates regular stress testing for interest rate risk scenarios, incorporating both parallel and non-parallel shifts in interest rates. These stress tests help banks identify vulnerabilities and develop strategies to mitigate potential adverse impacts.

3. Supervisory Review and Evaluation Process (SREP): The EBA's SREP framework includes a thorough assessment of banks' IRRBB management practices. This evaluation ensures that banks have robust risk management frameworks in place, including adequate capital buffers to absorb potential losses from interest rate fluctuations.

4. Disclosure Requirements: Transparency in IRRBB is essential for market discipline. Basel III/ Basel 3 requires banks to disclose detailed information about their interest rate risk exposures, measurement methodologies, and stress test results. This enhances stakeholder confidence and facilitates better risk assessment by market participants.

Banks' Sustainability Efforts

Sustainability remains a top priority under Basel III, with the EBA playing a crucial role in integrating Environmental, Social, and Governance (ESG) factors into banks' risk management frameworks and operational practices. The focus on sustainability aligns with global efforts to address climate change and promote responsible banking practices.

1. ESG Risk Integration: The EBA requires banks to incorporate ESG risks into their overall risk management frameworks. This includes identifying, measuring, and managing risks related to climate change, environmental degradation, and social factors.

2. Sustainable Finance Reporting: Banks are mandated to report on their sustainability efforts, including their exposure to climate-related risks and the impact of their operations on the environment. This reporting is aligned with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations.

3. Green Stress Testing: The EBA has introduced green stress testing to evaluate the resilience of banks under different climate scenarios. These stress tests assess the potential impact of physical and transition risks related to climate change on banks' financial stability.

4. Prudential Regulation Adjustments: The EBA is working on adjusting prudential regulations to account for ESG risks. This includes potential adjustments to capital requirements for exposures to environmentally harmful industries, incentivizing banks to support sustainable projects and investments.

Key Areas of Technological Focus

1. Cybersecurity: With the increasing digitalization of banking services, cybersecurity is a paramount concern. The EBA mandates stringent cybersecurity measures, including regular vulnerability assessments, incident response planning, and robust data protection protocols to safeguard against cyber threats.

2. RegTech and SupTech: The EBA is promoting the adoption of regulatory technology (RegTech) and supervisory technology (SupTech) to enhance compliance and supervisory processes. These technologies enable real-time monitoring, data analytics, and automated reporting, improving efficiency and accuracy in regulatory oversight.

3. Artificial Intelligence and Machine Learning: The EBA encourages the responsible use of artificial intelligence (AI) and machine learning (ML) in banking operations. Guidelines are being developed to ensure that AI and ML applications in credit scoring, fraud detection, and risk management are transparent, fair, and free from bias.

4. Blockchain and Distributed Ledger Technology (DLT): The EBA is exploring the potential of blockchain and DLT to enhance transaction security, transparency, and efficiency. These technologies are particularly relevant in areas such as cross-border payments, smart contracts, and digital identity verification.

Reduce your

compliance risks