Capital Requirements Regulation 2 (CRR2)

The conversation focuses on the impact of Capital Requirements Regulation 2 (CRR2) on financial institutions. It discusses the challenges and changes brought by CRR2, including enhanced risk management, compliance requirements and the need for improved resource management and transparency.

Capital Requirements Regulation 2 (CRR2): RTS on Assessment Methodology for FRTB IMA

Particularly in relation to Capital Requirements Regulation 2 (CRR2), the recently created technical standards for the Fundamental Review of the Trading Book/Internal Model Approach (FRTB IMA) mark a substantial advancement in regulatory frameworks. These guidelines, which are in line with Regulation (EU) No 575/2013's Article 325az(8), are crucial in helping competent authorities assess a financial institution's compliance with the internal model approach.

These regulatory technical standards (RTS) have a broad scope that addresses many important topics. They offer a thorough foundation for governance systems in financial institutions, guaranteeing that a reliable and open risk management procedure is in place. This involves putting internal risk measurement models into practice, which is crucial for organizations to precisely evaluate and control the risks associated with their trading operations.

These guidelines also address the requirement for complex models to estimate the risk of internal default. This is a critical component in the changing financial landscape of today, as an institution's stability and reputation can be greatly impacted by its capacity to anticipate and plan for possible defaults.

These RTS stand out for being innovative and progressive in that they prioritize risks related to the environment and climate change. The guidelines acknowledge the risks related to climate change and the growing significance of sustainable finance by incorporating these aspects into internal model stress testing procedures. This strategy guarantees that institutions are ready for the financial ramifications of these risks in addition to being in line with worldwide trends toward environmental consciousness.

There is a clear instruction for institutions themselves, even though the competent authorities in charge of monitoring compliance are the standards' main audience. The guidelines outline the reporting and documentation needs for institutions, which is essential to preserving an open and consistent foundation for model evaluation throughout the sector.

Impact of Capital Requirements Regulation 2 (CRR2) on Financial Institutions

A significant change in the financial regulatory landscape has occurred with the implementation of the Fundamental Review of the Trading Book/Internal Model Approach (FRTB IMA) under Capital Requirements Regulation 2 (CRR2). These changes, which are in line with Article 325az(8) of Regulation (EU) No 575/2013 of the European Union, are radically changing how financial institutions handle risk management and compliance standards.

The Regulatory Technical Standards (RTS), which cover essential aspects of financial operations, are the foundation of CRR2. These standards provide governance frameworks and risk assessment models a lot of weight. It is impossible to exaggerate how crucial these elements are to the accurate assessment and efficient management of trading risks. CRR2 makes sure that financial institutions have the frameworks and instruments needed to handle the complexity of today's financial markets by focusing on four essential components.

Specifically, these CRR2 regulations are designed to strengthen the basic foundation upon which financial institutions operate. To do this, they impose strict governance frameworks, which act as the foundation for open and effective risk management procedures. Furthermore, CRR2 highlights the requirement for sophisticated and precise risk assessment models. These models play a critical role in enabling financial institutions to evaluate and reduce the range of risks related to trading activities, such as credit risk, operational difficulties, and market volatility.

Moreover, financial institutions must have a more comprehensive and progressive approach to risk management in order to execute these RTS under CRR2. This calls for a deep comprehension of conventional financial hazards in addition to a requirement for knowledge and incorporation of new risks, such as those associated with market dynamics and technological improvements.

Capital Requirements Regulation 2 (CRR2) and Risk Management Enhancement

The Capital Requirements Regulation 2 (CRR2) Regulatory Technical Standards (RTS) are a key component in the transformation of financial institutions' governance frameworks. The core of this change is the creation and application of clear, strong risk management procedures, with a focus on improving internal risk measurement models. Accurately anticipating and being ready for defaults has become more and more important in today's quickly changing financial business. This capacity is critical to preserving an institution's financial stability and is also important for preserving its good name.

Financial institutions must conduct a thorough assessment of their current risk management procedures in order to incorporate these expanded governance frameworks under CRR2. Adopting new techniques and technology may be necessary to increase the precision of risk prediction models. Institutions must also continue to maintain a greater degree of transparency in their risk assessment procedures in order to guarantee that all relevant parties are aware of the risks that are being handled.

The Role of Environmental Factors in Capital Requirements Regulation 2 (CRR2)

A major development in the regulatory landscape is the incorporation of environmental and climate change risks in the RTS under Capital Requirements Regulation 2 (CRR2). Through the incorporation of these variables into stress testing procedures, CRR2 exhibits a keen understanding of how financial risks change over time in relation to environmental concerns around the world. This strategy deliberately prepares financial institutions for the financial ramifications of environmental and climate-related risks, rather than just following sustainable finance trends.

Financial institutions must incorporate environmental variables into their risk assessment frameworks as a requirement of this integration, which may require substantial adjustments to the way risks are measured and handled. Additionally, it gives organizations the chance to innovate in risk assessment by creating models that more precisely take environmental changes' effects on financial stability into consideration. In addition to meeting legal requirements, institutions who take this action establish themselves as progressive figures in the field of sustainable finance.

Compliance and Documentation under Capital Requirements Regulation 2 (CRR2)

The Financial Institutions Compliance Landscape is significantly shaped by the Capital Requirements Regulation 2 (CRR2). It lays forth detailed guidelines for reporting and documentation needs, which are essential for promoting a consistent and open approach throughout the financial industry. These rules play a crucial role in guaranteeing that the financial institutions and the supervising bodies follow a uniform compliance structure.

Key Aspects of CRR2 Compliance and Documentation:

- Detailed Documentation Requirements:Financial institutions must adhere to certain documentation requirements as mandated by CRR2. This covers thorough documentation of risk management procedures, internal model verifications, and stress test outcomes.

- Regular Reporting Obligations: Institutions must provide the appropriate authorities with reports on a regular basis. Aspects like credit risk, market risk, and the efficacy of internal risk management models should all be included in these reports.

- Transparency in Model Assessment: The rule places a strong emphasis on the openness of financial organizations' internal model-based risk assessment and management processes. This makes sure these models can be properly reviewed and validated by authorities with the necessary skills.

- Harmonized Approach Across the EU: CRR2 attempts to create a more unified financial environment by standardizing the approach to documentation and compliance within the European Union.

- Guidance for Competent Authorities: In addition to establishing guidelines for financial institutions, CRR2 also offers competent authorities advice on how to monitor and evaluate compliance in an efficient manner, guaranteeing uniformity in regulatory oversight.

- Emphasis on Risk Management and Governance: The necessary documentation and reporting procedures under the rule highlight the significance of strong risk management and governance frameworks.

Innovations and Challenges in Implementing Capital Requirements Regulation 2 (CRR2)

The financial industry's compliance procedures are about to undergo a radical change with the implementation and enforcement of the Regulatory Technical Standards (RTS) under the Capital Requirements Regulation 2 (CRR2). Financial institutions are required by this regulatory evolution to thoroughly analyze and maybe reorganize their current operational structures. These adjustments are necessary in order to comply with the stricter regulatory requirements that CRR2 has instituted.

One significant modification brought about by the RTS under CRR2 is the requirement that environmental and climate change considerations be taken into account when implementing risk management procedures. This criterion represents a major shift from the conventional risk management paradigms. Financial organizations are currently being urged to go beyond the bounds of conventional financial risk management by including environmental sustainability into their risk assessment models.

In addition to being in line with international environmental and sustainability trends, the inclusion of environmental considerations in risk assessments under CRR2 offers special chances for methodological innovation in risk assessment. Financial institutions are under pressure to create new models and strategies that take environmental risks and the long-term effects of climate change into account. This change may result in the development of more sophisticated, progressive risk management plans that take a wider variety of factors and possible outcomes into account.

Moreover, the emphasis on climate and environmental risks under CRR2 highlights how ESG (environmental, social, and governance) aspects are becoming more and more significant in the financial industry. Financial institutions can improve their resilience against new risks and make a positive contribution to global sustainability initiatives by integrating these features into their compliance and risk management procedures.

Resource Management and Transparency in Capital Requirements Regulation 2 (CRR2)

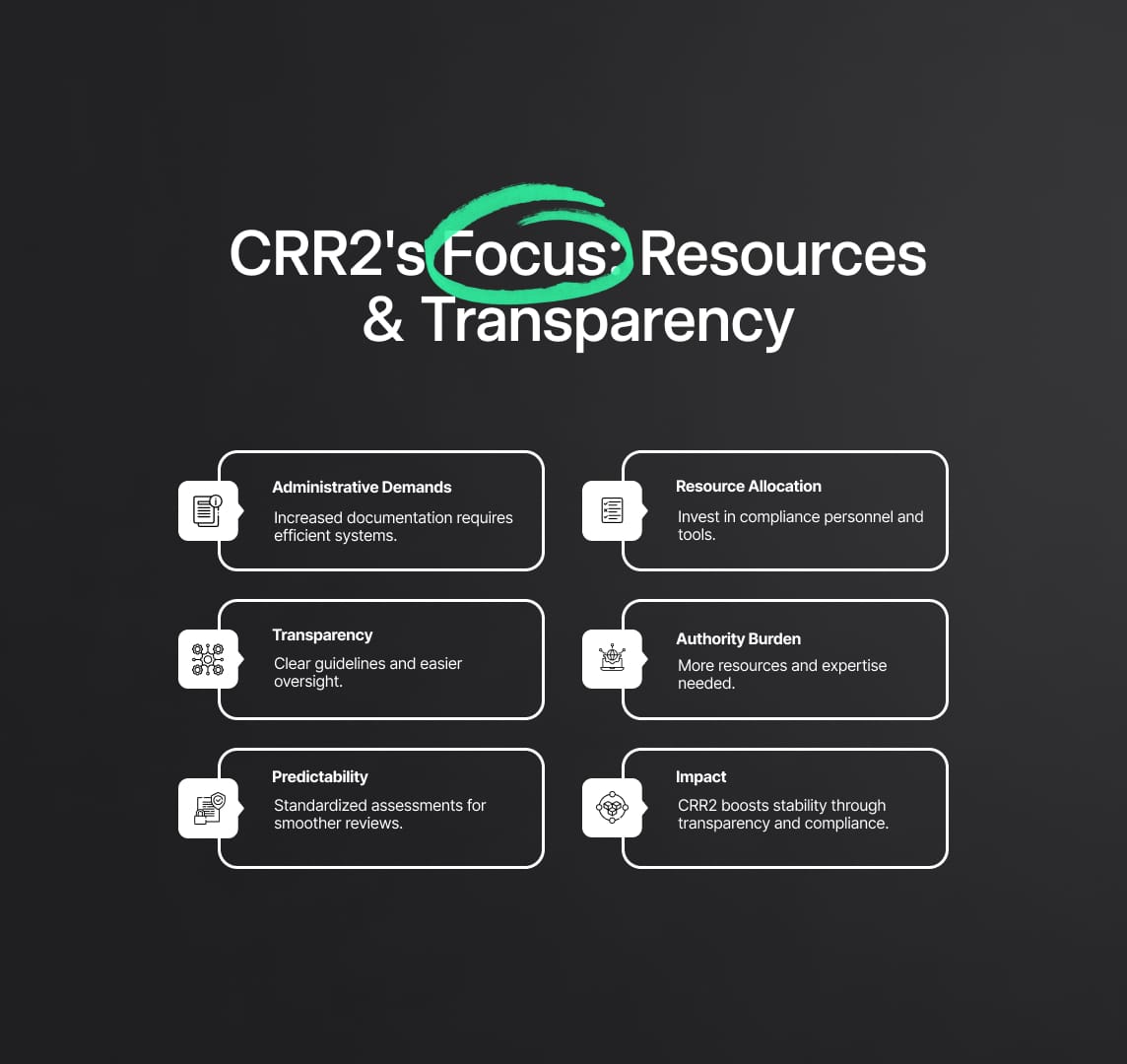

The financial sector is placing a greater emphasis on resource management and transparency with the implementation of Capital Requirements Regulation 2 (CRR2). For financial institutions and regulatory bodies, this rule presents a number of opportunities as well as challenges, especially with regard to its tightened documentation requirements.

Key Aspects of Resource Management under CRR2:

- Increased Administrative Tasks: The detailed documentation requirements under CRR2 are likely to result in a surge in administrative duties. This necessitates:

- Efficient document management systems.

- Automation of reporting processes where possible.

- Training staff to handle increased documentation workload effectively.

- Effective Resource Allocation: With the new standards in place, institutions will need to strategically allocate resources to manage compliance effectively. This involves

- Hiring or training personnel with specialized knowledge in CRR2 compliance.

- Investing in technology and tools for better risk assessment and reporting.

- Allocating budget towards compliance and reporting activities.

Transparency and Predictability Enhancements:

- Enhanced Transparency: The RTS under CRR2 mandates a high level of transparency in compliance processes, which benefits the industry by:

- Providing clear guidelines for financial institutions to follow.

- Facilitating easier oversight and auditing by regulatory bodies.

- Building trust with stakeholders through open and clear communication of compliance practices.

- Predictability in Compliance Assessments: The guidelines for assessment methods aim to make compliance checks more predictable, helping authorities and institutions alike:

- Standardize assessment procedures across different institutions.

- Reduce ambiguities in compliance requirements, leading to fewer disputes.

- Allow for more efficient planning and preparation for compliance reviews.

Challenges for Competent Authorities:

- Resource and Expertise Burden: While aiming to improve compliance, CRR2 also imposes additional burdens on the authorities, requiring:

- Expansion of their teams with experts in various aspects of CRR2.

- Continuous training for staff to stay updated with evolving standards.

- Adequate technological support for handling complex assessments and reporting.

In summary, resource management and transparency are given a lot of weight by the Capital Requirements Regulation 2 (CRR2), which also modifies the way the financial sector approaches risk management and compliance. Institutions and regulatory agencies need to make investments in effective resource allocation, use technology to improve compliance management, and guarantee ongoing CRR2 standard training and development in order to adapt. The financial sector's stability and credibility could be enhanced by the transition towards a more transparent and ordered environment via CRR2.

Reduce your

compliance risks