CRR and BRRD: Regulation (EU) 2024/1618 Amendments

The EU has revised the Capital Requirements Regulation (CRR) and Bank Recovery and Resolution Directive (BRRD) through Commission Implementing Regulation (EU) 2024/1618. These changes enhance financial robustness, stability, and transparency for credit institutions and investment firms.

The European Union has recently promulgated substantial revisions to the Capital Requirements Regulation (CRR) and the Bank Recovery and Resolution Directive (BRRD), encapsulated in the Commission Implementing Regulation (EU) 2024/1618. These amendments, which modify the Implementing Regulation (EU) 2021/763, are integral to the ongoing evolution of the EU's regulatory framework aimed at enhancing the financial robustness and operational stability of credit institutions and investment firms. The primary objective of these regulatory refinements is to fortify the prudential standards governing capital adequacy and to refine the mechanisms for recovery and resolution in the event of financial distress.

Regulatory Update: Capital Requirements Regulation (CRR) and Bank Recovery and Resolution Directive (BRRD)

The latest amendments target the twin pillars of regulatory oversight encapsulated by the CRR and the BRRD. The CRR, as codified in Regulation (EU) No 575/2013, establishes stringent prudential requirements for credit institutions, including provisions for capital, liquidity, and leverage ratios. Concurrently, the BRRD, articulated in Directive 2014/59/EU, outlines a comprehensive framework for the recovery and resolution of credit institutions and investment firms, ensuring that institutions can be resolved without severe systemic disruption and without recourse to taxpayer funding.

The Commission Implementing Regulation (EU) 2024/1618 specifically amends the Implementing Regulation (EU) 2021/763 to incorporate new requirements and adjustments necessitated by evolving market conditions and the need for greater clarity and transparency in regulatory reporting. These amendments are aligned with the broader regulatory agenda set by Regulation (EU) 2022/2036, which introduced crucial enhancements to the prudential treatment of global systemically important institutions (G-SIIs) and other significant entities.

CRR and BRRD: Enhancements to Supervisory Reporting and Public Disclosure

The regulatory amendments are primarily focused on refining the supervisory reporting and public disclosure requirements related to the minimum requirement for own funds and eligible liabilities (MREL) and the total loss-absorbing capacity (TLAC). These adjustments are pivotal for ensuring that credit institutions and investment firms maintain sufficient capital buffers and loss-absorbing instruments to withstand financial shocks and facilitate an orderly resolution process.

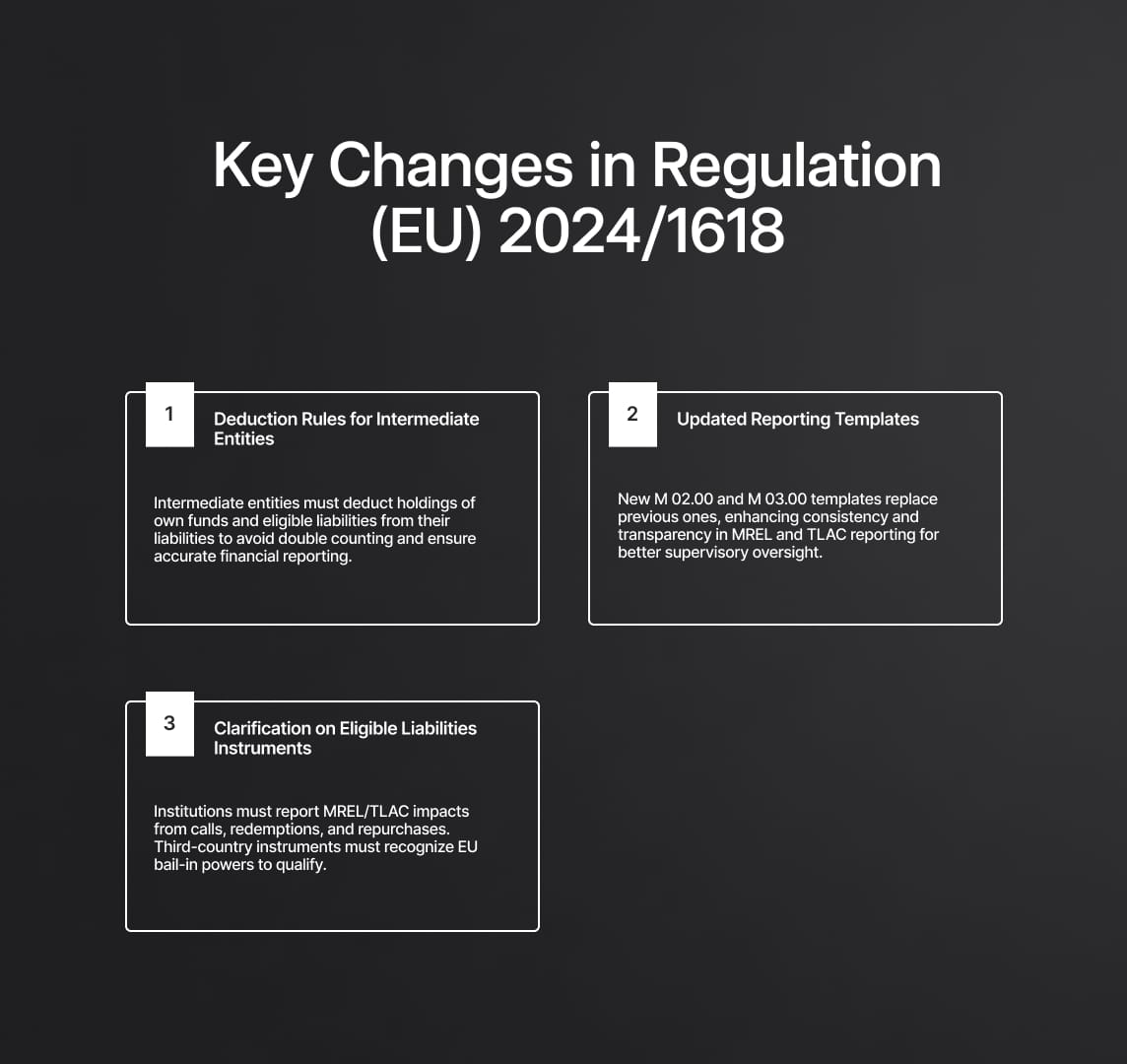

Under the updated framework, the amendments address the following key areas:

- Deduction Requirements for Intermediate Entities: The amendments mandate that intermediate entities within a resolution group deduct holdings of own funds instruments and eligible liabilities instruments from their eligible liabilities. This deduction is essential to prevent the double counting of loss-absorbing capacity within resolution groups, thereby providing a more accurate depiction of an institution’s financial resilience.

- Harmonization of Reporting Templates: The revisions introduce new templates for the public disclosure of MREL and TLAC information, replacing existing templates in the Implementing Regulation (EU) 2021/763. These new templates standardize the data reporting process, facilitating consistent and transparent disclosures across the EU.

- Clarifications on Eligible Liabilities Instruments: The amendments provide detailed instructions on the treatment of eligible liabilities instruments, particularly those governed by third-country laws. Institutions must ensure that such instruments comply with Article 55 of Directive 2014/59/EU, which requires contractual recognition of bail-in powers.

Compliance and Risk Management: MREL and TLAC reporting

The implementation of these amendments necessitates rigorous adjustments by credit institutions and investment firms to their internal reporting mechanisms and compliance protocols. Entities must adapt to the enhanced requirements for MREL and TLAC reporting, ensuring that their financial disclosures accurately reflect their capital positions and loss-absorbing capacities. This necessitates a thorough understanding of the new regulatory templates and the specific requirements for eligible liabilities instruments.

Moreover, the regulatory changes underscore the importance of maintaining robust risk management frameworks that can effectively integrate the revised capital and resolution requirements. Institutions must ensure that their risk management practices are aligned with the updated regulatory standards to mitigate potential financial vulnerabilities and enhance their overall stability.

In summary, the recent amendments to the CRR and BRRD represent a critical step in the EU's ongoing efforts to strengthen the resilience of its financial system. By enhancing the clarity and consistency of supervisory reporting and public disclosure requirements, these regulatory updates aim to provide a more transparent and robust framework for managing financial risks and ensuring the stability of credit institutions and investment firms.

Capital Requirements Regulation and the Bank Recovery and Resolution Directive Amendments: Legislative Context

The amendments to the Capital Requirements Regulation (CRR) and the Bank Recovery and Resolution Directive (BRRD) were formalized through the Commission Implementing Regulation (EU) 2024/1618, which serves as an update to the previously established Implementing Regulation (EU) 2021/763. This regulatory action is a critical component of the EU’s broader strategy to enhance the prudential framework governing credit institutions and investment firms within the Union.

At the heart of these regulatory updates lies the objective of aligning the new provisions with the overarching mandates of Regulation (EU) No 575/2013 (the CRR) and Directive 2014/59/EU (the BRRD). The CRR establishes the prudential requirements for credit institutions, focusing on capital adequacy, liquidity, and leverage ratios. It is designed to ensure that institutions maintain sufficient capital buffers to absorb potential losses, thereby safeguarding their solvency and protecting the financial system as a whole.

Conversely, the BRRD provides a comprehensive framework for the recovery and resolution of failing credit institutions and investment firms. This directive ensures that institutions can be resolved without severe systemic disruption and without resorting to public financial support. It emphasizes the importance of having robust resolution plans and the necessary tools to manage financial crises effectively.

The Commission Implementing Regulation (EU) 2024/1618 specifically addresses the supervisory reporting and public disclosure requirements related to the minimum requirement for own funds and eligible liabilities (MREL) and the total loss-absorbing capacity (TLAC). These components are pivotal in the regulatory architecture, as they ensure that institutions have sufficient financial resources to support an orderly resolution.

Key Legislative Provisions: Regulation (EU) No 575/2013 (CRR)& Directive 2014/59/EU (BRRD)

Regulation (EU) No 575/2013 (CRR): The CRR sets forth the prudential requirements for credit institutions, mandating the maintenance of adequate capital and liquidity buffers. Article 430(7) and Article 434a of the CRR outline the specific reporting and disclosure requirements for institutions, ensuring transparency and consistency in financial reporting.

Directive 2014/59/EU (BRRD): The BRRD establishes a harmonized framework for the recovery and resolution of credit institutions and investment firms. Article 45i(5) and Article 45i(6) of the BRRD specify the requirements for the public disclosure of MREL, ensuring that stakeholders have access to critical information regarding an institution's financial health and its ability to absorb losses in the event of a crisis.

Commission Implementing Regulation (EU) 2021/763: This regulation sets out the implementing technical standards for the application of the CRR and the BRRD with regard to supervisory reporting and public disclosure. The recent amendments introduced by Implementing Regulation (EU) 2024/1618 update these standards to reflect the latest regulatory developments and to enhance the clarity and accuracy of financial disclosures.

Objectives of the Amendments

The primary objectives of the amendments introduced by the Commission Implementing Regulation (EU) 2024/1618 are to:

- Enhance Transparency: By updating the reporting and disclosure templates, the regulation aims to provide a clearer and more comprehensive picture of an institution’s financial position and its ability to absorb losses.

- Standardize Reporting: The new templates standardize the data reporting process across all EU member states, ensuring consistency and comparability of financial information.

- Prevent Double Counting: The amendments introduce specific deduction requirements for intermediate entities within a resolution group, preventing the double counting of eligible liabilities and ensuring a more accurate representation of financial resilience.

- Clarify Regulatory Requirements: The updated regulation provides detailed instructions on the treatment of eligible liabilities instruments, particularly those governed by third-country laws, ensuring compliance with Article 55 of Directive 2014/59/EU.

These amendments are a testament to the EU’s commitment to maintaining a resilient and stable financial system. By continuously refining the regulatory framework, the EU aims to ensure that credit institutions and investment firms are well-prepared to manage financial risks and to support an orderly resolution process in times of crisis.

Key Changes in the Regulation

1. Deduction Requirements for Intermediate Entities

The introduction of Regulation (EU) 2022/2036 imposes stringent deduction requirements for intermediate entities within a resolution group, marking a significant shift in the regulatory landscape. These intermediate entities are now mandated to deduct from their eligible liabilities any holdings of own funds instruments and eligible liabilities instruments that are utilized to comply with internal Total Loss-Absorbing Capacity (TLAC) or internal Minimum Requirement for Own Funds and Eligible Liabilities (MREL).

This deduction specifically targets instruments issued by entities that are not designated as resolution entities but are part of the same resolution group. The rationale behind this regulatory adjustment is to eliminate the risk of double counting eligible liabilities within the resolution group, thereby providing a more precise and transparent representation of an institution’s financial position. This measure is critical for ensuring the accuracy of reported capital adequacy and loss-absorbing capacity, which are essential for maintaining financial stability.

Templates for Reporting and Disclosure

The regulatory amendments necessitate comprehensive updates to the reporting and disclosure templates mandated by the European Supervisory Authorities (ESAs). Specifically, the templates M 02.00 and M 03.00 within Annex I of the Implementing Regulation (EU) 2021/763 have been superseded by new versions that reflect the latest regulatory requirements.

These templates are integral to the supervisory reporting framework, providing a detailed breakdown of an institution’s MREL and TLAC capacity and composition, creditor ranking, and other critical contract-specific information. The harmonization of these templates aims to standardize the reporting processes across all EU member states, ensuring consistency, comparability, and transparency in financial disclosures. This standardization is pivotal for regulatory authorities to effectively monitor and assess the financial health and stability of institutions, and it facilitates better risk management and resolution planning.

3. Clarifications on Eligible Liabilities Instruments

The updated regulation introduces explicit clarifications and detailed instructions regarding the treatment of eligible liabilities instruments. Entities are now required to explicitly report the impact of permissions to call, redeem, repay, or repurchase eligible liabilities instruments on their MREL and TLAC requirements. This requirement ensures that institutions maintain an accurate and transparent record of their capacity to meet regulatory obligations. The regulation also addresses the complex issue of instruments governed by third-country laws. Under Article 55 of Directive 2014/59/EU, such instruments must include contractual recognition of bail-in powers to qualify as eligible liabilities. This stipulation is critical for ensuring that all instruments contributing to MREL and TLAC are fully compliant with EU regulatory standards, thereby enhancing the robustness and resilience of the financial system.

The regulatory amendments encapsulated in the Commission Implementing Regulation (EU) 2024/1618 underscore the EU's commitment to maintaining a resilient financial framework. By refining the requirements for reporting, disclosure, and the treatment of eligible liabilities, these changes aim to enhance the transparency, accuracy, and stability of financial institutions across the EU. Institutions must diligently adapt to these new requirements to ensure compliance and to support the overarching goal of financial stability and robustness.

BRRD and CRR Amendments: Implications for Financial Institutions

Enhanced Compliance Requirements

The recent amendments to the Capital Requirements Regulation (CRR) and the Bank Recovery and Resolution Directive (BRRD) impose significant new compliance obligations on financial institutions. One of the most critical changes is the new deduction rules for intermediate entities within resolution groups. To comply with these updated requirements, institutions must undertake comprehensive revisions of their internal accounting practices and systems.

This entails ensuring that holdings of own funds instruments and eligible liabilities instruments used for internal TLAC or internal MREL compliance are accurately deducted. Such deductions must reflect holdings issued by entities that are not resolution entities but are part of the same resolution group. Financial institutions will need to update their accounting systems to accurately capture these changes and ensure that all relevant data is correctly reported in compliance with the new templates outlined in the amended Implementing Regulation (EU) 2021/763. Moreover, these institutions must ensure that their internal reporting mechanisms are robust enough to handle these requirements, guaranteeing accuracy and regulatory compliance.

Improved Transparency and Risk Management

The standardised reporting templates introduced by the amendments are designed to significantly enhance transparency within the financial system. By providing a clear and consistent framework for reporting MREL and TLAC capacities, these templates facilitate a more detailed and accurate understanding of the financial health and risk exposures of credit institutions and investment firms. This standardized approach ensures that stakeholders, including regulatory authorities, investors, and market participants, have access to reliable and comparable data. Enhanced transparency is critical for market confidence, as it allows stakeholders to make informed decisions based on accurate and consistent information. Furthermore, improved transparency in reporting is expected to contribute to the overall stability of the financial sector, as it enables more effective risk management and monitoring by regulatory authorities.

Strategic Adjustments for Eligible Liabilities

Financial institutions must also make strategic adjustments to their management of eligible liabilities instruments in response to the new regulatory requirements. The updated rules on deductions and permissions for the redemption or repayment of these instruments necessitate a thorough review of existing liabilities. Institutions must ensure compliance with the subordination requirements specified in the amendments. This involves understanding and implementing the requirements for liabilities instruments governed by third-country laws, which must meet the conditions set forth in Article 55 of Directive 2014/59/EU. Additionally, institutions must strategically manage their liabilities to optimize their capital structure while ensuring compliance with the new MREL and TLAC requirements. This includes planning for the impact of any permissions to call, redeem, repay, or repurchase eligible liabilities instruments on their overall regulatory capital and loss-absorbing capacity.

The regulatory changes underscore the need for financial institutions to adopt a proactive and comprehensive approach to compliance and risk management. By ensuring that their internal systems and processes are aligned with the new requirements, institutions can maintain regulatory compliance, enhance transparency, and strengthen their overall financial resilience. The effective management of eligible liabilities instruments, in particular, will be crucial for institutions to navigate the complexities of the updated regulatory framework and to support the stability and robustness of the financial system.

Reduce your

compliance risks