Capital Requirements Regulation (CRR): PRA Consultation Paper CP13/24

The Prudential Regulation Authority (PRA) proposes updates in CP13/24 to restate Capital Requirements Regulation (CRR) provisions in the PRA Rulebook, improving clarity and alignment with international standards.

On 15 October 2024, the Prudential Regulation Authority (PRA) issued Consultation Paper CP13/24—Remainder of CRR: Restatement of assimilated law. This critical document outlines the PRA's proposals for restating provisions from the Capital Requirements Regulation No. 575/2013 (CRR) into the PRA Rulebook and associated policy materials, including supervisory statements and statements of policy. The consultation also suggests significant updates to credit ratings mapping tables from some assimilated technical standards and incorporates these into the PRA Rulebook.

This article delves into the technical details of the proposals, exploring how they will affect the regulatory landscape for financial institutions operating in the UK.

Source

[1]

Capital Requirements Regulation (CRR)

The Financial Services and Markets Act 2023 (FSMA) laid the groundwork for the revocation and subsequent restatement of financial services assimilated law through secondary legislation. This change has directly impacted CRR provisions, which the PRA is now incorporating into its rulebook to ensure that UK firms remain compliant with prudential standards post-Brexit. The CRR was initially developed as part of the EU's Basel III regulatory framework, ensuring that banks maintain adequate capital and liquidity levels to safeguard financial stability.

As part of the transition, HM Treasury’s commencement regulations under FSMA 2023 will facilitate the revocation of CRR provisions and their restatement under the PRA's jurisdiction. The PRA's new regulatory framework will prioritize flexibility, allowing for UK-specific modifications, while still aligning with international standards like Basel III.

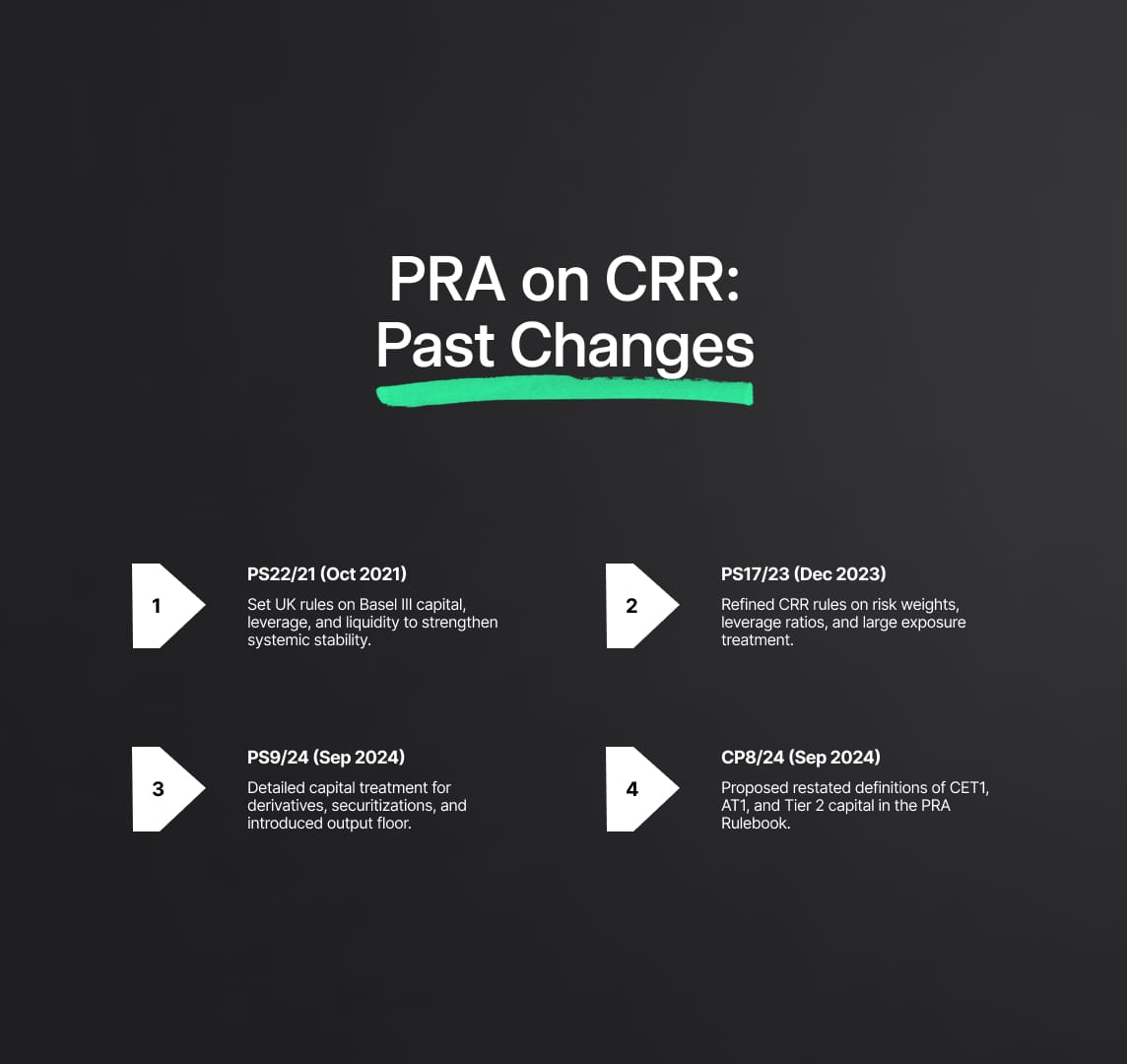

PRA on CRR: Previous Restatements and Amendments

The PRA has already begun the process of restating and modifying CRR-related regulations, as demonstrated in several key publications:

- PS22/21 – Implementation of Basel Standards: Final rules (October 2021): This paper addressed the UK’s approach to implementing the Basel III framework, with a particular focus on capital adequacy, the leverage ratio framework, and liquidity coverage ratios. The PRA emphasized ensuring robust capital buffers and liquidity to enhance systemic stability.

- PS17/23 – Implementation of Basel 3.1 standards near-final part 1 (December 2023): This document focused on refining the CRR provisions to align with Basel 3.1. Revisions included improvements in the risk-weighting frameworks for asset classes, adjustments to the leverage ratio, and updates to the treatment of large exposures, ensuring that institutions are better equipped to handle market fluctuations.

- PS9/24 – Implementation of Basel 3.1 standards near-final part 2 (September 2024): Building on PS17/23, this part addressed more granular aspects of capital treatment for derivatives, securitizations, and the introduction of the output floor, which prevents risk-weighted assets (RWAs) from falling below a minimum level compared to standardized approaches.

- CP8/24 – Definition of Capital: Restatement of CRR requirements in PRA Rulebook (September 2024): This consultation focused on restating the definition of capital in line with CRR provisions, particularly defining Common Equity Tier 1 (CET1), Additional Tier 1 (AT1), and Tier 2 capital components. The goal was to maintain a consistent and accurate framework for capital adequacy, critical for meeting minimum capital requirements under Basel III.

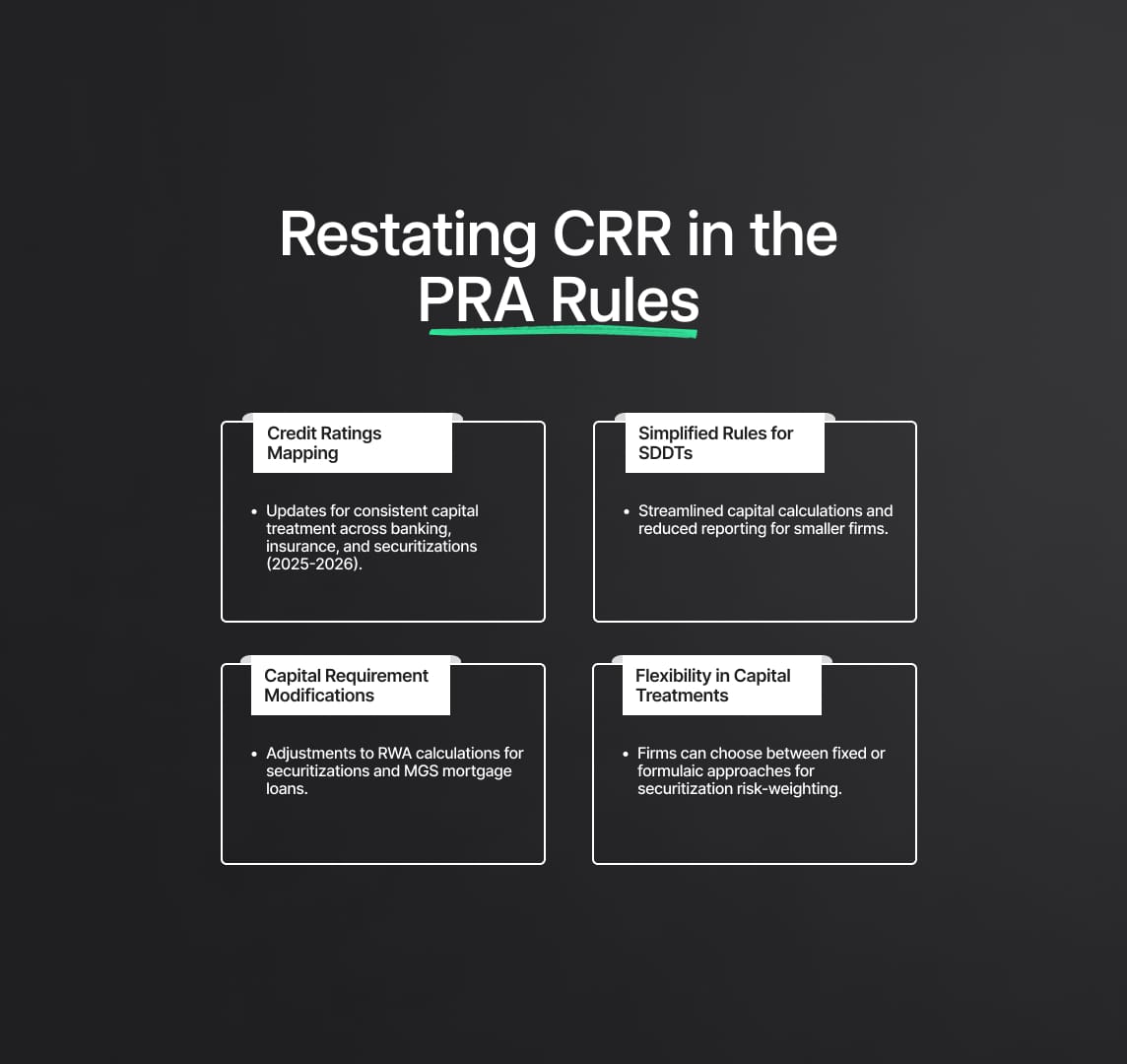

Restating CRR Provisions in the PRA Rulebook

The main objective of CP13/24 is the restatement of assimilated CRR provisions into the PRA Rulebook without substantial changes. This ensures continuity and maintains the regulatory framework’s robustness post-Brexit. While the majority of provisions are carried over with minimal changes, the PRA is proposing several key modifications to enhance the clarity and operability of the rules within the UK’s unique regulatory environment.

By transitioning from EU-based CRR rules to UK-specific rules, the PRA ensures that regulatory requirements remain aligned with Basel standards while accommodating specific needs of UK financial institutions, thus simplifying compliance processes without compromising the rigor of prudential regulation.

Key Areas of Restatement and Modifications

- Credit Ratings Mapping Tables: One significant aspect of the proposal is the update and restatement of credit ratings mapping tables. These tables are used to map external credit ratings from agencies like S&P or Moody’s to credit quality steps (CQS).

The CQS are crucial for calculating the risk weights applied to a firm’s exposures, which in turn influence the capital that must be held against those exposures.For instance, the Securitization External Ratings-Based Approach (SEC-ERBA) requires firms to use external ratings to determine capital charges for rated securitizations. The PRA’s proposal seeks to align these mappings with frameworks like Solvency II, ensuring that securitized exposures are treated appropriately under both insurance and banking regulations. Moreover, synthetic securitizations will also see updated mappings, enhancing the consistency in capital treatment across securitization types.

- Insurance-related mapping: Proposed implementation for these changes is set for 1 July 2025.

- Banking and securitisation mapping: These would take effect on 1 January 2026.

- Simplification for Small Domestic Deposit Takers (SDDTs): Another significant aspect of CP13/24 is the simplification of CRR requirements for SDDTs. This reflects ongoing efforts to tailor regulatory requirements proportionately to the size and complexity of smaller firms. The Interim Capital Regime (ICR) offers these institutions a simpler, more streamlined method of calculating capital requirements, while still adhering to prudential standards.

The proposed simplifications address prudential consolidation rules for smaller firms, allowing for reduced group-level reporting obligations. Additionally, the PRA suggests aligning the leverage ratio exemption for SDDTs with those applicable to larger firms, albeit with proportional adjustments to ensure capital adequacy while reducing unnecessary compliance burdens.These measures are intended to foster competition in the UK banking sector by enabling smaller domestic institutions to operate more effectively and with greater regulatory clarity, all while maintaining resilience against potential market disruptions.

- Modified Rules for Capital Requirements: While the majority of CRR provisions will be restated without modification, the PRA has identified several areas where targeted amendments are necessary to address the evolving nature of financial markets and the UK's post-Brexit regulatory landscape.For example, securitized assets under the Securitization Standardized Approach (SEC-SA) will see modifications with a more formulaic p-factor, enhancing the risk-weighted assets (RWA) calculations to reflect the true risk profile of the assets.

The PRA also proposes to allow firms flexibility in choosing between a fixed p-factor and a formulaic approach depending on the nature of the securitization and the underlying assets, giving firms better control over their capital allocation.Furthermore, updated capital treatments for mortgage loans under the Mortgage Guarantee Scheme (MGS) clarify how credit risk mitigations should be assigned. These changes ensure that the government-backed scheme and private insurers are appropriately reflected in capital requirements, benefiting both firms and consumers through more accurate risk assessments.

HM Treasury and CRR Revocation

As part of the broader effort to transfer assimilated EU laws into UK-specific regulations, HM Treasury has already signaled its intention to revoke the remainder of assimilated laws under the CRR. CP13/24 outlines how the PRA will replace these revocations with regulator-specific rules and statements of policy, thus enhancing the UK’s prudential regulatory framework.

Additionally, the revocation of CRR provisions related to Total Loss Absorbing Capacity (TLAC) and Minimum Requirement for Own Funds and Eligible Liabilities (MREL) will shift the regulatory oversight to the Bank of England. This change ensures that UK-specific tools are used for managing systemically important institutions, thus aligning the UK’s resolution framework with its broader post-Brexit regulatory goals.

Implementation Timeline and Next Steps

The PRA has outlined a clear timeline for implementing the proposals set forth in CP13/24:

- Response Deadline: Stakeholders are invited to submit their feedback by 15 January 2025.

- Main Implementation Date: With few exceptions, the PRA proposes that the draft rules will come into effect on 1 January 2026.

- Simplified Rules for SDDTs: These are scheduled for 1 January 2027 to allow ample time for smaller firms to adapt to the new requirements.

- Credit Ratings Mapping: As previously noted, the insurance-related mapping updates will come into force by 1 July 2025, while the banking and securitisation-related changes will take effect in January 2026.

CRR Restatement for UK Firms

This restatement of CRR is vital for ensuring that UK financial institutions remain compliant with global prudential standards, particularly those derived from the Basel III framework. By integrating the CRR into the PRA Rulebook, the PRA ensures continuity, consistency, and clarity for financial institutions operating under its jurisdiction.

The importance of credit risk mitigation measures, clear guidelines on securitization, and the correct application of capital buffers cannot be overstated. These tools are fundamental in helping banks absorb shocks from financial or economic stress, ultimately protecting the broader financial system. Additionally, the modifications proposed for smaller institutions reflect the PRA’s commitment to proportional regulation, which seeks to reduce the compliance burden on firms that do not pose the same systemic risks as larger institutions.

Reduce your

compliance risks