Capital Requirements Regulation (CRR3): Basel III Alignment

CRR3 enhances EU banking resilience and transparency, aligning with Basel III. It introduces BIC for risk management, supported by the EBA's roadmap for strategic, phased implementation, fostering global competitiveness.

A project called the Capital Requirements Regulation (CRR3) aims to harmonize with Basel III, a global regulatory framework for stronger banks and banking systems. As part of the alignment process, exposures are graded according to both quantitative and qualitative standards. This classification is a component of a larger initiative to create minimum capital requirements and encourage more stringent risk management techniques in order to guarantee the stability and integrity of the financial system. For instance, banks must maintain sufficient capital to cover their risk-weighted assets, which are determined by taking into account the relative risk of the various asset types they own.[1][2].

Source

[1]

A game-changer in the European Union's efforts to improve the banking industry's resilience to economic downturns is the Capital Requirements Regulation (CRR3). This extensive legislation is carefully crafted to strengthen banks by imposing strict guidelines on capital sufficiency, liquidity, leverage, and risk exposure. CRR3, led by the European Banking Authority (EBA), is evidence of the EU's commitment to reshaping operational risk management in banking in accordance with the prestigious Basel III regulations. The objective is to create a more transparent, consistent, and resilient environment within European financial institutions, thus creating a new standard for worldwide banking regulation.

Broadening the Horizons of Banking Stability with CRR3

The goal of CRR3's strategic objective is to essentially fortify the architecture of the financial system, going beyond simple regulatory compliance. The legislation makes sure that banks are prepared to deal with changes and difficulties in the economic environment by requiring significant capital buffers and strict liquidity requirements. This Basel III framework compatibility is essential since it raises European banks' profile internationally and standardizes banking operations throughout the EU, ensuring fair and competitive competition in the global market.

The breadth of the law is remarkably extensive, encompassing a broad range of banking risks such as credit risk, market risk, and operational risk in particular. Through the implementation of a comprehensive strategy, CRR3 guarantees that the banking industry is not only ready to meet present difficulties but also future-proof against new dangers. The EU's proactive approach to risk management demonstrates its vision in developing a safe and flexible banking environment.

Elevating Banking Practices through Harmonised Standards

The focus that CRR3 places on harmonizing banking practices throughout member states is among its most important features. Harmonization is essential because it levels the playing field for all institutions by removing regulatory framework gaps and inconsistencies that could be exploited. It guarantees that banks operate to the same high standards of operation regardless of their size or location within the EU, fostering justice and honesty in the financial industry.

Additionally, the EU's commitment to not only preserving but also boosting the worldwide competitiveness of its banking industry is demonstrated by CRR3's compliance with international standards such as those established by the Basel Committee on Banking Supervision. In addition to facilitating easier cross-border banking activities, this strategic alignment draws investment and strengthens the EU's standing as a preeminent financial hub.

Enhancing the Banking Regulatory Environment with CRR3

With the introduction of changes under the Capital Requirements Regulation (CRR3), the European Banking Authority (EBA) has demonstrated a proactive and forward-thinking attitude to its strategic purpose of improving the banking regulatory system within the European Union. These changes represent a major step towards improving the management of operational risks in the banking industry because they concentrate particularly on operational risk under Pillar 3 and supervisory reporting requirements.

A major part of this effort, which aims to completely update the supervisory reporting requirements and Pillar 3 disclosures, is the EBA's public consultation. The EBA's commitment to promoting transparency, stakeholder engagement, and regulatory excellence is demonstrated by this endeavor, which is an integral part of a larger plan to smoothly integrate the EU Banking Package with the Basel III reforms.

The goal of CRR3 is to improve banks' ability to manage operational risk by adjusting the methodology used to determine their own financial requirements. In order to guarantee financial institutions' resilience and dependability in the face of operational difficulties, it is essential that they retain enough capital reserves, which is ensured by this recalibration. The CRR3 modifications are expected to significantly improve banks' operational risk management and approach, which will increase the stability of the European financial system as a whole.

Broadening Impacts on the Banking Sector and Financial Ecosystem

Banks must make a number of significant adjustments in order to implement CRR3, especially with regard to fortifying their capital and liquidity regimes. Although these changes may initially raise banks' operating expenses, the ultimate goal is significantly more strategic: to develop a banking industry that is dependable, resilient, and equipped to weather financial downturns. The significance of transparency is underscored by CRR3, which requires banks to furnish comprehensive and lucid disclosures regarding their risk management approaches, sufficiency of capital, and associated risks.

The purpose of this emphasis on more transparency is to strengthen market discipline. It guarantees that key data necessary for making educated decisions is available to investors, analysts, and other stakeholders. CRR3 encourages market players to gain a better knowledge of the operational health and inherent risks of financial institutions by pressuring banks to share information about their risk management procedures and operational frameworks. By facilitating better informed loan and investing decisions, this transparency not only helps to foster confidence between investors and clients, but it also plays a vital role in stabilizing the financial sector. The Broad Importance of CRR3 in the Financial Industry.

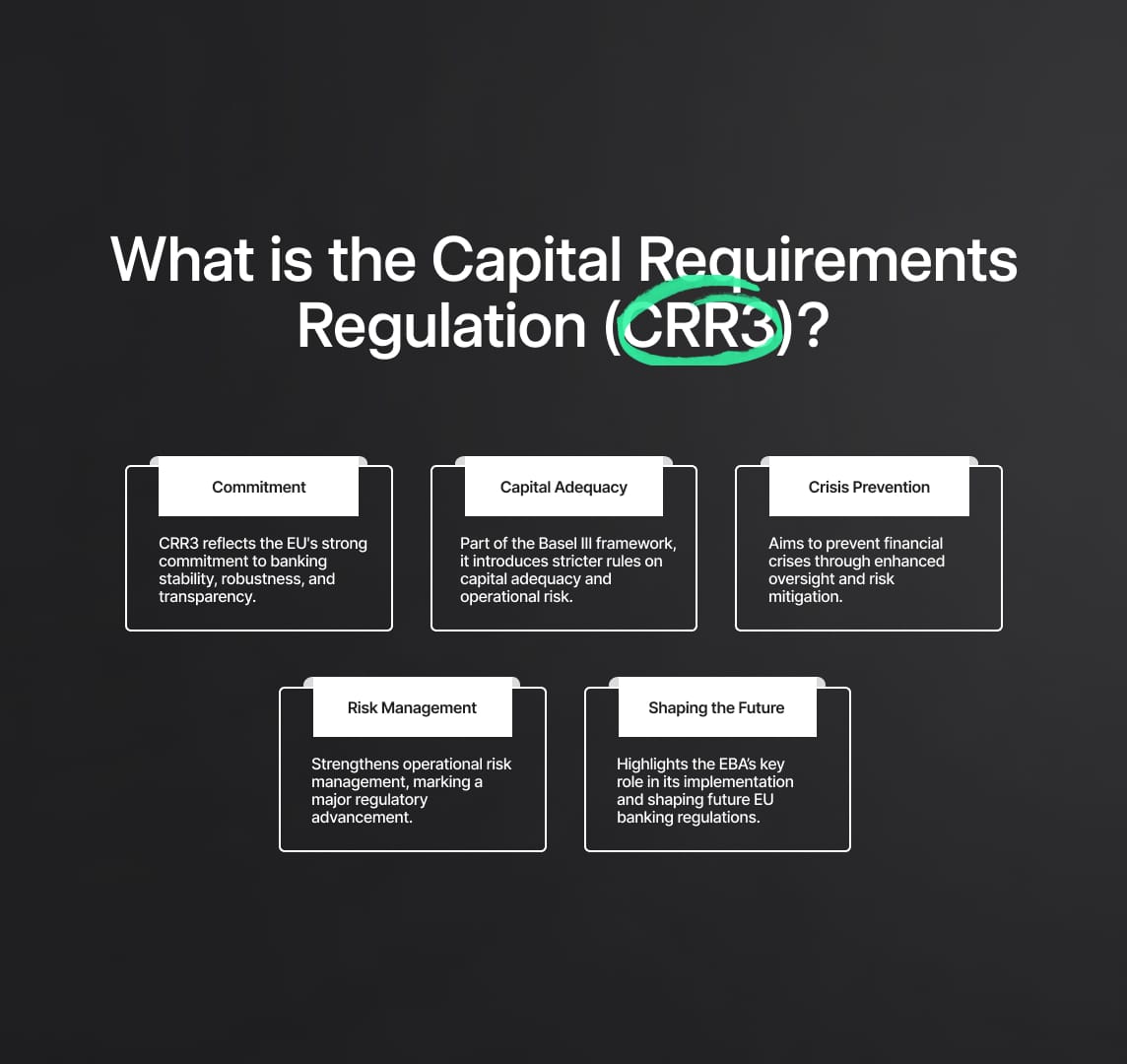

What is the Capital Requirements Regulation (CRR3)?

A key piece of legislation, the Capital Requirements Regulation (CRR3), demonstrates the European Union's unwavering commitment to bolstering the stability, robustness, and transparency of the banking industry. CRR3, which is positioned as a crucial component of the larger Basel III framework, heralds in a period of strict regulatory requirements with a particular emphasis on operational risk management and capital adequacy. Through the deployment of stringent oversight and control systems, these criteria are carefully designed to address and mitigate financial risks with the goal of averting future financial crises. This rule marks a significant advancement in operational risk management and emphasizes the crucial role the European Banking Authority (EBA) played in ensuring its implementation. It also charts a new direction for the future of banking laws in the EU.

Enhancing the Risk-Based Capital Framework

CRR3 is primarily a purposeful attempt to strengthen the foundation of the whole financial system by strengthening the EU banking sector's resilience to market shocks. The following crucial measures are introduced by the regulation in order to accomplish this goal:

- Harmonization of Supervisory Powers: To provide consistent monitoring and enforcement throughout the European Union, CRR3 requires a standard set of supervisory agencies. Maintaining a fair playing field among banks depends on this harmonization, which makes sure that all institutions follow the same strict regulatory compliance and inspection requirements regardless of their size or the EU member state in which they operate.

- Improvement of Risk Control measures: The regulation requires banks to have advanced risk control measures in place. The detection, evaluation, and mitigation of a wide range of risks—including but not limited to credit, market, and operational risks—are highly valued under this directive. CRR3 guarantees that banks are better prepared to manage and mitigate the possible implications of financial risks on their operations and the whole economy by mandating them to strengthen their risk management procedures.

- Expansion of Transparency and Proportionality: One of the main goals of CRR3 is to make more disclosures required under Pillar 3. As of right now, banks have to give a clearer, more comprehensive explanation of their risk profiles, capital sufficiency, and risk management procedures. This action supports transparency while simultaneously adjusting disclosure standards to account for the institutions' size and complexity. By doing this, CRR3 makes sure that all relevant and thorough information is accessible to all stakeholders, including investors, regulators, and the general public. This improves market discipline and enables informed decision-making.

Revolutionary Approach to Operational Risk Management

By using the Business Indicator Component (BIC) methodology, CRR3 promotes a paradigm shift in operational risk management. This novel method, which focuses on the Business Indicator (BI), a metric obtained from a bank's financial records that precisely represents its operational risk exposure, streamlines the computation of operational risk capital requirements. Important elements consist of:

- Simplification and Streamlining: By eliminating the complicated and various methods previously employed, the BIC technique provides a more direct process for evaluating operational risk.

- Focused Risk Assessment: CRR3 encourages banks to implement a more targeted and efficient risk assessment and management approach by requiring the disclosure of historical operational risk losses without affecting the BI calculation.

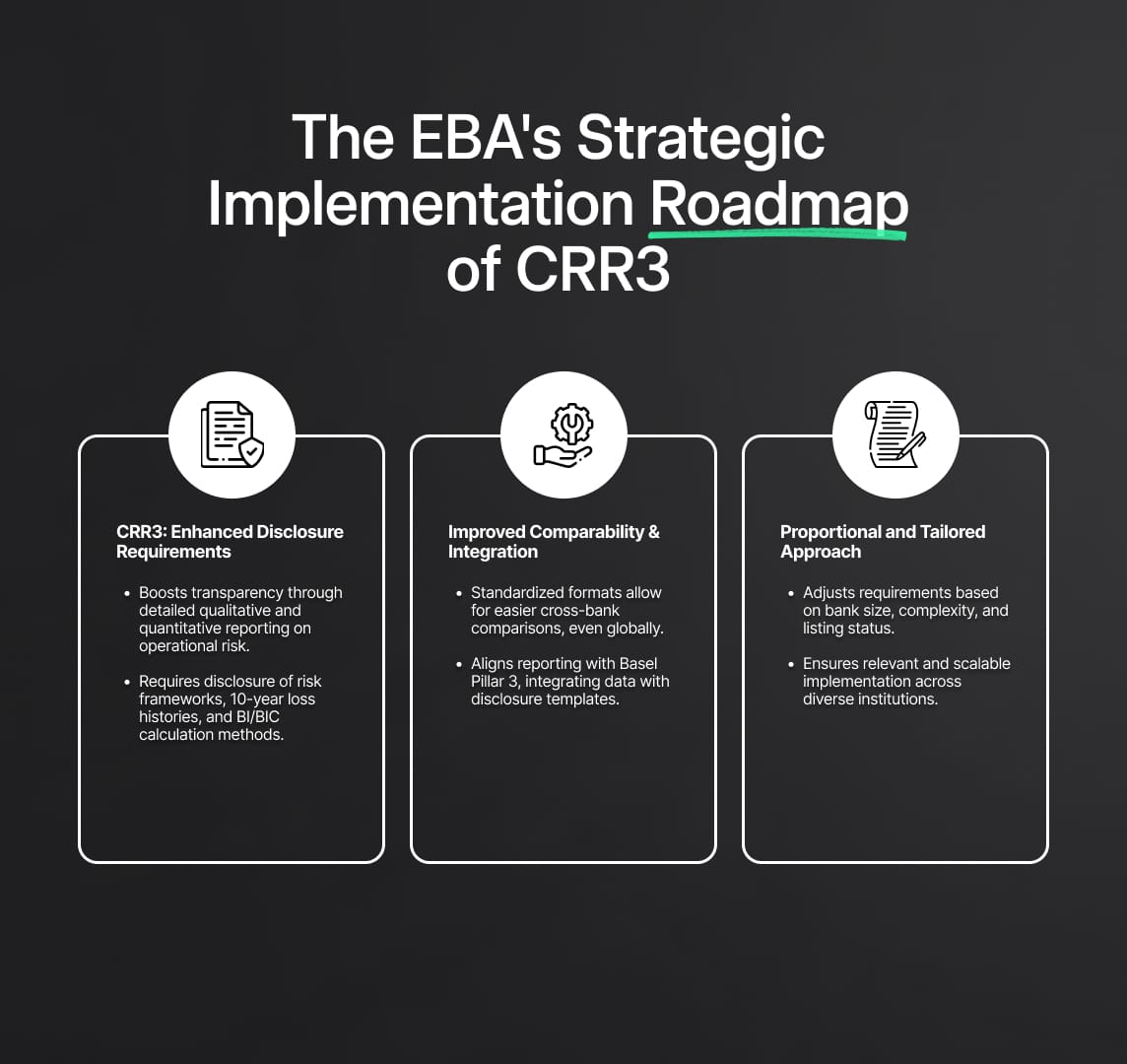

The EBA's Strategic Implementation Roadmap of CRR3

A thorough strategy for the gradual adoption of CRR3 is provided in the "EBA Roadmap on Strengthening the Prudential Framework," which was released in December 2023. It highlights the following points:

- Alignment with Basel III Requirements: Enhances worldwide competitiveness and compliance by guaranteeing that CRR3's mandates are completely in line with the international Basel III standards.

- Prioritization of Essential Mandates: The tiered approach addresses broader reporting and disclosure obligations after prioritizing essential mandates for Basel III compliance. This strategic framework serves as the foundation for an effective and cohesive regulatory evolution.

CRR3: Comprehensive Enhancement of Disclosure Requirements

The updated disclosure standards of CRR3 represent a major step forward in encouraging transparency in the banking industry. Banks are required by these regulations to submit a wealth of qualitative and quantitative data regarding their operational risk management plans, including:

- Operational Risk Management Framework: Banks are required to provide an overview of their framework for managing operational risk, including information about their policies, procedures, and controls.

- Historical Operational Risk Losses: By disclosing operational risk losses over the preceding ten years, institutions are obliged to offer a more comprehensive view of their risk exposure and management effectiveness.

- Extensive Disclosure of the Calculations Underpinning the BI and BIC: The regulation requires full disclosure of the calculations underlying the BI and BIC, improving the operational risk assessment process's accountability and openness.

Advancing Comparability and Integration

In order to comply with the Basel Committee on Banking Supervision's Pillar 3 guidelines, CRR3 makes sure that its disclosure formats do the following:

- Facilitate Effective Comparison: CRR3 gives stakeholders the ability to compare information between different banks, including those that are not in the EU, by standardizing disclosure formats.

- Integrate Disclosure and Reporting Frameworks: This improves the effectiveness and thoroughness of disclosures by providing a logical mapping between operational risk reporting data and quantitative disclosure templates.

Proportionality and Tailored Application

Since financial institutions vary widely from one another, CRR3 takes the proportionality principle into account and modifies disclosure criteria and frequency to suit the unique features of each institution. This methodology guarantees that the implementation of the rule is customized to the specific size, intricacy, and competitive standing of every bank, regardless of listing status.

Looking Ahead: The Future of CRR3 Implementation

An important milestone in the implementation of CRR3 will be reached soon with the finalization of the draft Implementing Technical Standards (ITS) amending the Commission Implementing Regulation (EU) 2021/637, which incorporates the enhanced operational risk disclosure framework. The goal of this comprehensive package is to lay the foundation for a more transparent, robust, and stable banking industry in the European Union by integrating feedback from the consultation period and other requirements discovered via ongoing policy development. It is slated for submission by the end of June 2024.

Reduce your

compliance risks