CBDC: BIS Survey Results

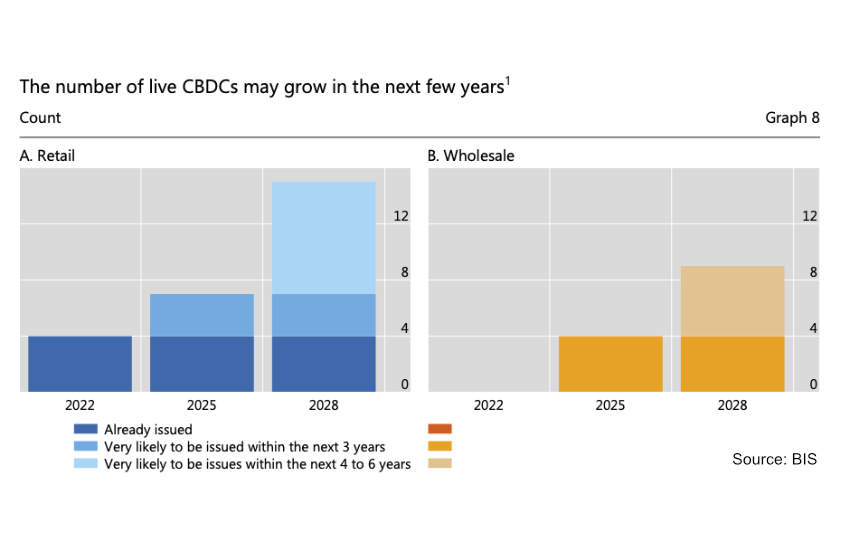

The 2022 BIS survey reveals that 93% of 86 central banks are actively exploring CBDCs, marking a shift towards digital finance. Retail CBDCs advance faster than wholesale counterparts. By 2030, expect 15 retail and 9 wholesale CBDCs in circulation, potentially impacting stablecoins and cryptoassets.

CBDC: Insights from 2022 BIS Survey

The 2022 Bank for International Settlements (BIS) survey has revealed that the exploration and experimentations of central bank digital currencies (CBDCs) are no longer a fringe concept, but a growing reality. The survey, participated by 86 central banks worldwide, highlights that 93% of them are actively engaged in some form of CBDC work. This represents a significant shift towards digital innovation in the world of finance. The research also brings to light that the progress in retail CBDCs outpaces that of wholesale CBDCs. The majority of central banks perceive the dual value of having a retail CBDC and a fast payment system. Looking ahead, by 2030, we could potentially see 15 retail and nine wholesale CBDCs in circulation. While stablecoins and other cryptoassets are currently not widely used for payments outside the crypto ecosystem, the landscape may change as CBDC development progresses.

CBDC: Navigating the Global Rise of Central Bank Digital Currencies

As we chart the course into the future of finance, the 2022 Bank for International Settlements (BIS) survey sheds light on a transformative trend - the rise of Central Bank Digital Currencies (CBDCs). This emerging digital revolution, far from being a fringe concept, is now actively explored by a whopping 93% of central banks worldwide. With a projected circulation of 15 retail and nine wholesale CBDCs by 2030, we are on the brink of an evolution that could redefine the financial landscape across all institution types and regulatory jurisdictions.

For Central Banks, the advent of CBDCs signifies an urgent need to update or establish new policies for their issuance, monitoring, and management. As digital innovation champions, they will need to build robust CBDC policy frameworks and establish efficient supervisory mechanisms. This could also imply a reconsideration of their traditional monetary policies.

Commercial Banks may face disruption to their traditional banking models. Integration of CBDCs into their payment systems is on the horizon, and so is the need for strategic partnerships with central banks or fintechs. The change is inevitable and preparation is key.

Financial Services Companies and Payment Service Providers might be looking at increased competition in the digital payment space. Technological upgrades to handle CBDC transactions and innovations to stay competitive will be vital. Amid the shift, the opportunity lies in facilitating more efficient, secure, and cost-effective cross-border transactions.

Moreover, for Cryptocurrency Exchanges, the rise of CBDCs could lead to wider acceptance and integration of cryptoassets into the global financial system. Adapting their platforms to support CBDCs, while ensuring compliance with emerging regulations, will be instrumental.

The wave of CBDCs is set to sweep across the globe, affecting various regulatory jurisdictions. Laws and regulations concerning digital currencies, including emerging CBDC regulations, Basel III directives, and payment service directives like PSD2 in the EU, will be central to this transformation.

The timeline for this significant transition is shorter than it may seem. With substantial changes projected within the next 5-7 years, financial institutions need to kickstart their preparatory measures now. The future of finance is here, and the clock is ticking.

The age of CBDCs is approaching fast, and the financial institutions that embrace this digital evolution will lead the charge into a new era of global economic integration. Stay ahead of the curve, decode the implications of CBDCs, and unlock the limitless potential of the digital financial revolution.

Read More

Reduce your

compliance risks