Corporate Sustainability Reporting Directive(CSRD) Effects

The CSRD will transform financial institutions' reporting, requiring comprehensive disclosure of environmental, social, and governance aspects. It enables accurate assessment of climate-related investment risks.

Grand “Answer”:

The Corporate Sustainability Reporting Directive (CSRD) will significantly impact financial institutions by requiring them to provide more comprehensive information regarding their environmental, social, and corporate governance.[1] This initiative is designed to help investors and other stakeholders accurately assess investment risks that may stem from various factors including climate change.[1] Consequently, financial institutions will need to adapt their reporting systems and strategies to comply with these new requirements. This could entail substantial changes in their operations and potentially higher costs.[2] However, the CSRD may also foster a more sustainable and transparent financial ecosystem in the long run.[2]

Source

[1]

Corporate Sustainability Reporting Directive: Genesis and Objectives

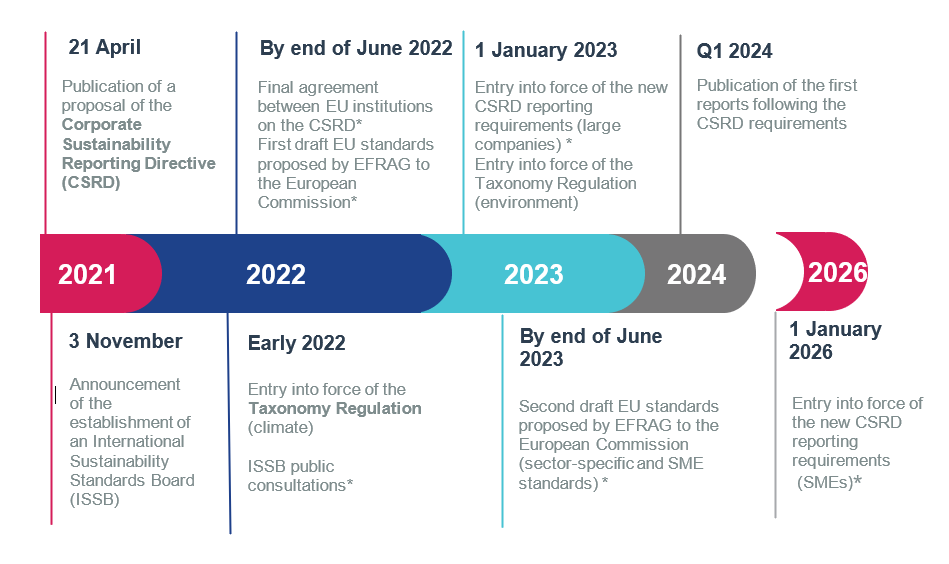

The Corporate Sustainability Reporting Directive (CSRD) was conceived as a response to the global demand for increased transparency in corporate sustainability practices. This was an initiative unveiled by the European Commission in April 2021, marking a significant milestone in the standardization of sustainability reporting throughout the European Union (EU). The establishment of CSRD became an integral part of the EU's Sustainable Finance Action Plan, whose core objective was to channel and direct private investment towards sustainable avenues, assisting the EU's shift towards a sustainable economy.

The CSRD serves as an impressive enhancement to the previous Non-Financial Reporting Directive (NFRD), laying the groundwork for improvements in the scope, quality, and comparability of sustainability reports submitted by corporations. This evolution reflects the growing worldwide emphasis on corporate sustainability and corporate social responsibility. These elements have become critical in a business landscape increasingly characterized by social awareness and environmental consciousness in the 21st century.

CSRD introduces several strategic modifications to the NFRD, including:

- Inclusion of all large corporations within its scope, regardless of their public listing status. This expansion extends the applicability of sustainability reporting beyond publicly listed companies.

- Mandatory reporting for Small and Medium-sized Enterprises (SMEs) that are listed, except micro-enterprises. This move signifies the democratization of sustainability practices, incorporating businesses of various sizes and structures.

- A mandate for corporations to comply with the European Single Electronic Format regulation for their sustainability reports. This standardization of the format enhances the ease of comparing and understanding such reports.

The European Parliament's Committee on Legal Affairs (JURI) ratified the CSRD proposal on 15th March 2022, adding further credibility and weight to its implementation. The committee also proposed significant changes, such as the inclusion of SMEs operating in high-risk economic sectors and the addition of more reporting indicators for high-risk industries.

CSRD Impact

The Corporate Sustainability Reporting Directive (CSRD) is perceived as a critical tool for advancing sustainable investments across Europe. As an upgrade to the EU’s Non-Financial Reporting Directive (NFRD), the CSRD provides crucial support to the development of an inclusive and sustainable economic and financial ecosystem. Its objectives align with the long-term ambitions of the European Green Deal, a strategic plan for making the EU's economy sustainable, and the United Nations Sustainable Development Goals.

CSRD encourages corporations to be more transparent about their sustainability efforts by providing a more thorough and comprehensive perspective than its predecessor. This transparency allows stakeholders, including investors, customers, employees, and the general public, to make more informed decisions when engaging with organizations.

The significant benefits of the CSRD are manifold:

- It offers a more comprehensive view of corporate sustainability practices, encouraging informed decision-making among stakeholders.

- It enhances corporate transparency regarding sustainability efforts, motivating companies to prioritize sustainability.

- It aligns with global reporting standards, thereby improving the comparability and reliability of sustainability reports.

Additionally, the CSRD seeks to align with internationally recognized sustainability reporting frameworks, such as the Task Force on Climate-Related Financial Disclosures (TCFD), the Sustainability Accounting Standards Board (SASB), and the Global Reporting Initiative (GRI). This alignment with international standards ensures that the updated reporting requirements will be globally acceptable and facilitate cross-border comparison of corporate sustainability disclosures.

Challenges and Opportunities with the Corporate Sustainability Reporting Directive (CSDR)

The implementation of the Corporate Sustainability Reporting Directive (CSRD) presents both obstacles and opportunities for corporations. An increased reporting burden may cause administrative and financial strains for corporations. Further, the overlapping requirements with other existing EU standards such as the Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomy Regulation might create potential confusion.

Despite these challenges, the CSRD provides multiple benefits. Firstly, it offers a structured reporting framework, simplifying the disclosure process for corporations. Secondly, it is expected to enhance the quality and accessibility of company data, assisting businesses in fulfilling their reporting obligations under the EU Taxonomy and SFDR more efficiently.

Key opportunities offered by the CSRD include:

- A uniform structure for reporting that simplifies the disclosure process and mitigates the complexity associated with different reporting formats.

- Enhanced quality and accessibility of company data, making it easier for businesses to fulfill their reporting obligations and for stakeholders to understand corporate sustainability initiatives.

- Better compliance with EU Taxonomy and SFDR due to more streamlined and standardized reporting.

Central to the CSRD is the "double materiality" concept, which requires corporations to consider the reciprocal impacts between sustainability factors and their operations. This innovative approach provides an opportunity for businesses to evaluate their sustainability impact comprehensively, thereby improving decision-making processes and stakeholder engagement. By fostering transparency and accountability in sustainability reporting, the CSRD assists corporations in transitioning towards a sustainable economy – a shift that is not only crucial for the environment but is also instrumental in defining the future of global business.

Grand Answer: Your AI Partner

Reduce your

compliance risks