CRD IV Update: Enhanced ITS Transparency by NCAs

CRD IV Framework Enhances Banking Stability: Focus on remuneration policies within EU financial institutions under Article 94 of Directive 2013/36/EU. It mandates transparent, risk-aligned pay structures to prevent excessive risk-taking and foster financial stability.

The Commission Implementing Regulation has made amendments to the Implementing Technical Standards (ITS) in Regulation (EU) No. 650/2014. This change pertains to the information that National Competent Authorities (NCAs) are required to disclose. The disclosure is to be in accordance with the Capital Requirements Directive IV (CRD IV). This directive lays down the prudential requirements for credit institutions and investment firms. The CRD IV is a part of the European Union's regulatory framework aimed at strengthening the resilience of EU banks. Unfortunately, without additional context or source material, I can't provide more specifics about the nature of these amendments or their potential impact.

The Capital Requirements Directive IV (CRD IV) is a pivotal development in the European Union's (EU) financial regulatory landscape, comprising a detailed regulatory package that includes Directive 2013/36/EU, Regulation (EU) No 575/2013, and the Liquidity Coverage Ratio (LCR) Delegated Regulation (EU) 2015/61. Designed to enhance the resilience, stability, and transparency of the banking sector, CRD IV aims to mitigate systemic risks and promote a secure banking environment across the EU. This regulation plays a crucial role in ensuring the banking industry's integrity and robustness against the challenges of a dynamic and interconnected global financial system.

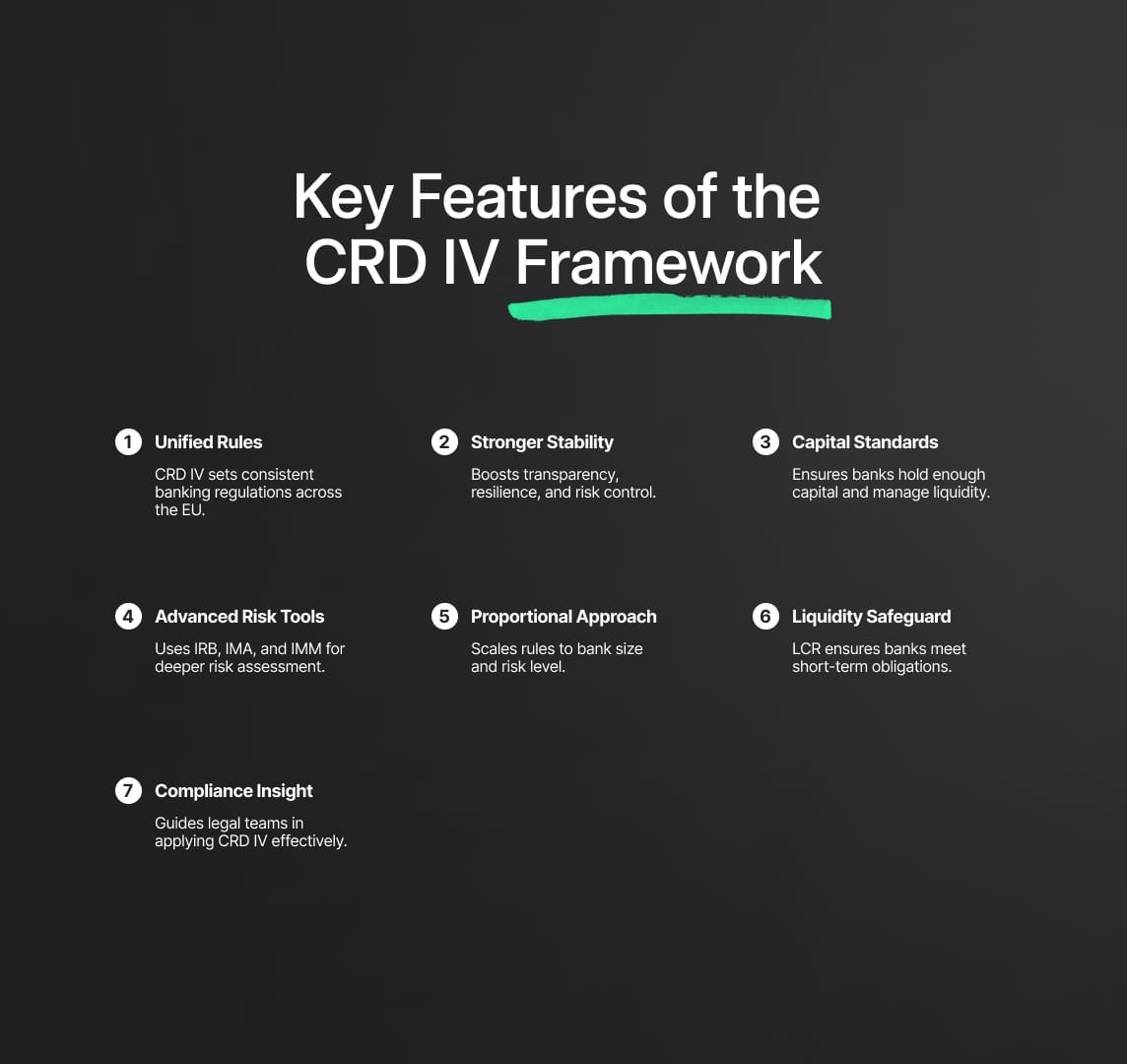

Key Features of the CRD IV Framework

- Comprehensive Regulatory Suite: Incorporates directives and regulations to strengthen the banking sector’s infrastructure.

- Enhancement of Financial Ecosystem: Targets the improvement of resilience, stability, and transparency within the banking industry.

- Systemic Risk Reduction: Aims to curb systemic risks and foster a secure banking environment throughout the EU.

Strategic Objectives and Operational Focus:

- Capital Adequacy and Risk Management: Addresses capital adequacy, risk management, and liquidity standards to ensure banks remain well-capitalized and liquid.

- Harmonized Rules: Sets forth a harmonized set of rules across EU member states, eliminating regulatory fragmentation.

- Enhanced Reporting Obligations: Emphasizes the importance of reporting obligations and the evaluation of capital requirements for rigorous oversight.

In-depth Risk Assessment and Management:

- Implements stringent criteria for assessing various risks including credit, market, operational, and liquidity risk.

- Adopts advanced approaches such as the IRB Approach for Credit Risk, the IMA for Market Risk, and the IMM for Counterparty Credit Risk, requiring comprehensive documentation and validation.

Principle of Proportionality:

- Recognizes the diversity within the banking sector, offering flexibility based on the size, complexity, and risk profile of institutions.

- Ensures regulations are scalable, preventing undue burdens on smaller banks while maintaining financial stability and consumer protection.

Liquidity Management:

- Introduces the Liquidity Coverage Ratio (LCR) to maintain high-quality liquid assets, enhancing banks' ability to meet short-term obligations and prevent liquidity shortages.

For Legal and Compliance Professionals:

This detailed exposition on the CRD IV framework, including the recent enhancements to Implementing Regulation (EU) No 650/2014, is tailored for legal and compliance professionals in the banking industry. It provides a thorough understanding of the regulatory developments and their implications for operational and compliance strategies. By exploring the technical details of CRD IV, this analysis equips legal and compliance officers with the insights needed to navigate its complexities, ensuring adherence to regulatory compliance standards and fostering a culture of risk awareness and financial prudence within the EU banking sector.

Strategic Enhancements to Reporting Standards and Prudential Oversight

Recent amendments to Implementing Regulation (EU) No 650/2014 represent a pivotal evolution in the European Union's (EU) approach to financial regulation within the Capital Requirements Directive IV (CRD IV) framework. These strategic enhancements are aimed at bolstering the rigor, efficacy, and transparency of financial reporting and prudential oversight across EU financial institutions. Key aspects of these enhancements include:

- Mandated Annual Reporting: Article 143(1) of the Directive requires competent authorities to conduct a comprehensive annual update of all prudential information from the previous fiscal year by June 30th. This ensures timely and accurate data reflection on each financial institution's resilience and compliance with prudential norms, reinforcing the CRD IV regulation's goal of enhancing financial stability across the EU.

- Expanded Reporting Requirements:

- Immediate Alteration Reporting: Institutions must report any changes to previously disclosed information promptly, ensuring ongoing accuracy in their prudential standing.

- Detailed Disclosures: The amendments demand detailed disclosures on capital adequacy, liquidity ratios, leverage ratios, and risk management practices, among other prudential indicators. This level of detail aims to significantly enhance transparency and accountability within the financial sector.

- Technical and Operational Challenges:

- Financial institutions face challenges in augmenting their internal reporting mechanisms and data management capabilities to comply with these expanded requirements.

- The need for accurate and complete data aggregation necessitates sophisticated analysis tools.

- Agile and responsive reporting systems are essential to accommodate real-time changes in prudential status.

- Impact on the Regulatory Landscape:

- These measures are expected to provide regulators and stakeholders with a more detailed and dynamic view of financial institutions' prudential health, facilitating informed oversight and decision-making.

- An increased focus on transparency and accountability is anticipated to build greater trust in the financial system among investors, customers, and the public.

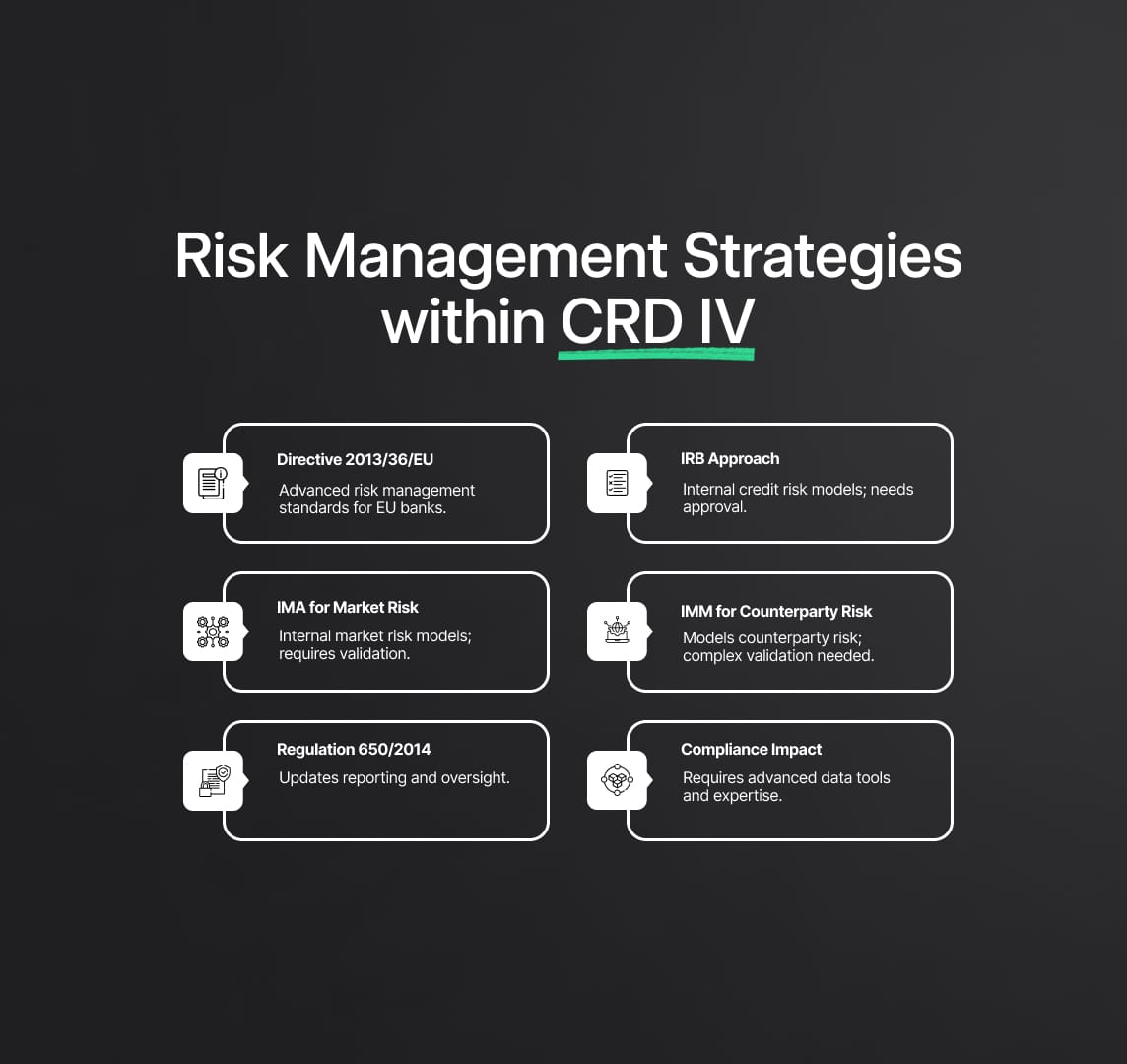

Risk Management Strategies within CRD IV

Understanding and implementing the advanced risk management strategies outlined in Directive 2013/36/EU is crucial for maintaining operational standards and supervisory mechanisms within the EU's banking sector. This directive underscores the adoption of sophisticated risk management methodologies, including:

- Internal Ratings Based (IRB) Approach for Credit Risk: A method requiring detailed documentation and a robust oversight framework to ensure precision and effective risk evaluation.

- Internal Model Approach (IMA) for Market Risk and Internal Model Method (IMM) for Counterparty Credit Risk: Strategies that highlight the importance of exhaustive risk assessments and the implementation of effective mitigation strategies.

The amendments to Implementing Regulation (EU) No 650/2014, specifically focusing on reporting standards and prudential oversight, signify a crucial advancement in strengthening the EU's financial regulatory framework. Legal and compliance professionals are tasked with navigating these enhanced requirements, necessitating a deep technical understanding and the utilization of advanced data management solutions. As the financial landscape continues to evolve, these strategic enhancements reaffirm the EU's dedication to maintaining the highest standards of financial stability, transparency, and prudential supervision, thereby contributing to the resilience and sustainability of the European financial ecosystem.

Internal Ratings Based (IRB) Approach for Credit Risk

The IRB Approach allows banks to use their own estimated risk parameters for the purpose of calculating regulatory capital. This method demands a comprehensive understanding of credit risk and relies on a bank’s internal data to estimate probabilities of default (PD), loss given default (LGD), exposure at default (EAD), and maturity (M) for different segments of their credit portfolio. Adopting the IRB Approach requires regulatory approval, underscoring the need for meticulously documented risk assessment procedures and validation of risk estimation models. Banks must demonstrate that their models are not only statistically sound but also relevant to their current and prospective risk profiles.

Internal Model Approach (IMA) for Market Risk

The IMA for Market Risk permits institutions to calculate required capital for market risk based on their own quantitative models rather than standardized approaches. This approach demands an advanced capability to model and quantify market risks across various financial instruments and markets. Institutions opting for the IMA need to ensure their models accurately capture the risk of loss under normal and stressed conditions, incorporating sophisticated techniques for measuring risks associated with specific risk factors, including interest rates, equity prices, foreign exchange rates, and commodities prices. Regulatory approval for using the IMA hinges on demonstrating the comprehensiveness, accuracy, and consistency of the risk modeling processes.

Internal Model Method (IMM) for Counterparty Credit Risk

The IMM for Counterparty Credit Risk allows institutions to assess regulatory capital requirements for counterparty credit risk associated with derivative transactions, repos, and securities financing activities using their own internal models. This method requires the development and application of complex mathematical models to estimate potential future exposure over the life of each transaction, taking into account the effects of netting agreements, collateral arrangements, and the potential for risk mitigation through credit derivatives. The adoption of IMM demands an extensive validation process to ensure that the models are robust, effectively capture the risk of counterparty default, and are sensitive to changes in market conditions.

Documentation and Model Validation under CRD IV

In the realm of advanced risk management strategies, as stipulated by the Capital Requirements Directive IV (CRD IV), financial institutions are mandated to uphold stringent documentation and model validation protocols. This rigorous approach is essential for ensuring the reliability and efficacy of risk management frameworks. Here are the key components that institutions must meticulously manage:

- Comprehensive Documentation: This is a critical requirement for institutions utilizing advanced risk management models. The documentation should include:

- Detailed descriptions of the risk management models employed.

- Clear articulation of the assumptions made within these models.

- Descriptions of data sources utilized for model operations.

- Methodologies adopted for the estimation of model parameters.

- Regular Model Validation Exercises: To verify the ongoing effectiveness of these models, institutions must engage in consistent model validation practices, such as:

- Back-testing against historical data to evaluate model accuracy.

- Benchmarking against industry standards to ensure competitive performance.

- Stress Testing to assess model resilience under extreme but plausible scenarios.

Cultivating a Culture of Continuous Improvement and Adaptability

The complexities of navigating advanced risk management strategies under the CRD IV framework necessitate a commitment to continuous improvement and adaptability from financial institutions. This encompasses:

- Adherence to not only the letter but the spirit of regulatory mandates.

- Proactive efforts to enhance risk management practices in anticipation of and response to evolving financial risks.

- Legal and compliance officers staying updated on regulatory developments, promoting interdisciplinary collaboration within organizations, and ensuring the integration of risk management strategies into the broader organizational risk culture.

The CRD IV Framework: Adapting to Diverse Banking Landscapes

The CRD IV framework represents a landmark in the EU's banking regulation, characterized by its adaptability and flexibility to cater to the diverse needs of member states and the banking sector at large. This adaptability is crucial for several reasons:

- Nuanced Application of Directive Provisions: It allows for the directive's provisions to be applied in a manner that reflects the unique economic, legal, and operational contexts of different jurisdictions.

- Sector-Specific Considerations: The directive acknowledges the diversity within the banking sector, providing tailored provisions and exemptions to address sector-specific challenges effectively.

- Fostering a Versatile Regulatory Ecosystem: By accommodating national contexts and sector-specific challenges, the CRD IV framework promotes a regulatory ecosystem that is cohesive yet flexible enough to uphold the EU's financial stability objectives.

For legal and compliance officers, understanding and navigating the CRD IV framework's intricacies is paramount. This involves ensuring that financial institutions not only comply with regulatory requirements but also leverage these guidelines to enhance their risk management practices continually. By doing so, institutions can fortify their resilience against financial risks, contributing to the overall stability and integrity of the European banking sector.

Enhanced Flexibility for National Regulatory Authorities

CRD IV empowers national regulatory authorities with a suite of options and discretions, facilitating the customization of regulatory measures to align with domestic financial systems and banking practices. These discretions include but are not limited to alterations in the calculation of capital ratios, the implementation of liquidity requirements, and the application of leverage ratios. This level of flexibility is instrumental in enabling countries to address specific systemic risks inherent to their financial markets, thereby enhancing the resilience of the banking sector at both a national and EU-wide level.

Sector-Specific Adaptations within CRD IV

The banking industry's complexity is acknowledged through CRD IV's provision for sector-specific adaptations, ensuring that regulations are not one-size-fits-all but rather tailored to the distinct characteristics and risk profiles of different banking models. For instance, the directive offers a nuanced approach to the regulatory treatment of exposures secured by mortgages on immovable property, recognizing the lower risk profile typically associated with such exposures. Similarly, covered bonds, known for their high credit quality and low risk, are subject to specific exemptions and treatments under the CRD IV framework.

These sector-specific considerations are crucial for maintaining the stability and integrity of the banking sector, allowing institutions to operate within a regulatory framework that acknowledges their unique business models and risk exposures. It also underscores the importance of legal and compliance officers in interpreting and implementing these regulations accurately, ensuring that their institutions remain compliant while optimising their operational strategies within the bounds of CRD IV.

Navigating Options and Discretions for Strategic Deployment

The strategic deployment of systemic risk buffers represents another area where CRD IV's flexibility is evident. Member states have the discretion to set higher capital buffer requirements for banks that are systematically important or pose a greater risk to the financial system. This not only aids in preventing systemic crises but also allows for a more tailored approach to risk management, reflecting the economic conditions and financial stability concerns specific to each member state.

Implications for Legal Professionals and Chief Compliance Officers

For legal professionals and chief compliance officers, the directive's flexibility necessitates a deep understanding of both the overarching aims of CRD IV and the specific options and discretions available. They must navigate these regulatory provisions with expertise, ensuring that their institutions not only comply with the minimum standards set forth by the EU but also leverage the directive's flexibility to address national and sector-specific challenges effectively.

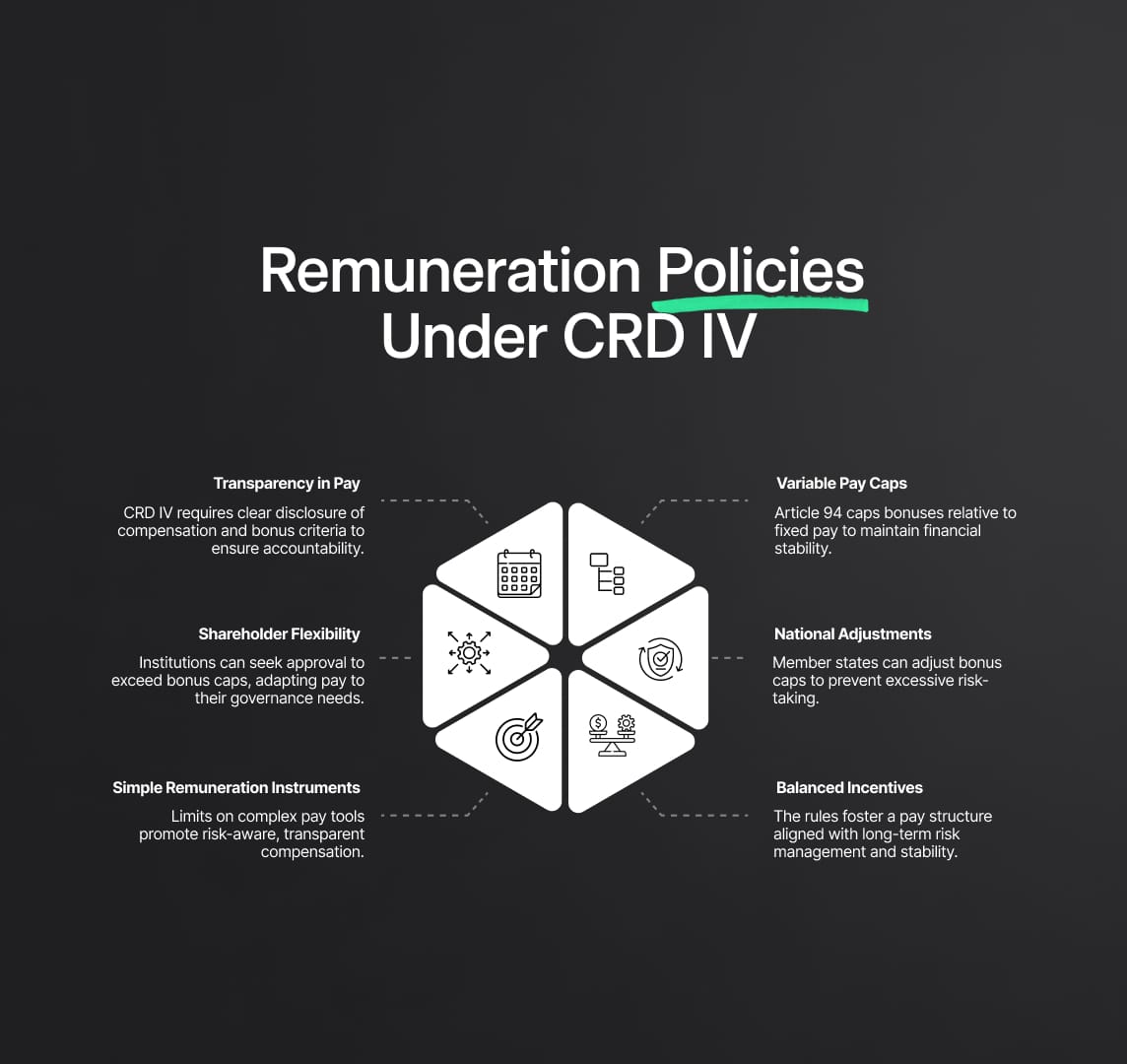

Remuneration Policies for Financial Institutions Under CRD IV

The Capital Requirements Directive IV (CRD IV), specifically Article 94 of Directive 2013/36/EU, plays a crucial role in reshaping remuneration policies across the European Union's financial sector. It's a key element of the EU's strategy to bolster the banking sector's stability, transparency, and resilience. Here's a deep dive into the regulation's approach to remuneration structures in banks and investment firms, aiming to reduce systemic risk and encourage sustainable economic growth.

Key Aspects of CRD IV's Remuneration Framework:

- Risk Management and Remuneration Caps:

- Enhancing Transparency and Accountability:

- CRD IV mandates financial institutions to disclose detailed information about their compensation practices, including bonus criteria and performance assessment metrics.

- This level of transparency enables stakeholders, such as regulators, shareholders, and the public, to assess how well remuneration aligns with long-term institutional goals and risk tolerance.

- Proportionality of Pay Components:

- Flexibility and Shareholder Involvement:

- CRD IV provides institutions the flexibility to seek shareholder approval to exceed the predefined bonus caps, acknowledging the diversity of governance models across EU banks.

- This adaptable approach permits institutions to tailor their remuneration strategies to their unique operational contexts, within the framework of risk management and financial stability principles.

- Restrictions on Remuneration Instruments:

- To promote risk-aware compensation, CRD IV imposes restrictions on the use of complex financial instruments in variable pay.

- By advocating for simpler, transparent remuneration instruments, it ensures that variable compensation genuinely reflects performance and aligns with the institution's long-term viability.

- Article 94 enforces a balance between incentive schemes and the need for financial stability by setting a cap on the variable-to-fixed compensation ratio.

- The directive specifies limits on the proportion of variable compensation compared to fixed salaries to ensure stability within remuneration packages.

- Aiming to prevent instability that may arise from an overreliance on bonuses, it fosters a balanced remuneration structure.

- This cap is adjustable at the national level, establishing a threshold to deter excessive risk-taking by tying bonuses closely to risk management capacities.

Reduce your

compliance risks