Credit Risk: EBA Regulatory Standard for Unfinished Property

EBA seeks feedback on draft RTS for unfinished property, aiming for a harmonized EU framework, ensuring prudential treatment and a level playing field.

On May 13, 2024, the European Banking Authority (EBA) published a Consultation Paper on potential regulatory technical standards (RTS) for unfinished property under Capital Requirements Regulation (CRR) Article 124(12). The standards for allocating risk weights to mortgages on real estate, including financing for residential and commercial properties, are outlined in this article.

Properties that are still under construction are eligible for favorable risk weight treatment for retail immovable property under Article 125(1) CRR, subject to certain requirements being met. The Consultation Paper makes clear what the government must do to guarantee that construction is completed on schedule. By creating a uniform EU framework for the prudential regulation of residential real estate risks that are still under development, the proposed RTS seek to level the playing field and provide comparability of own funds needs among EU member states.

EBA & Credit Risk: Feedback on Regulatory Proposals

The European Banking Authority (EBA) encourages stakeholders to participate in the regulatory process by requesting input on the suggestions it has made and outlining them in this paper. Your opinions are very important to us as we develop the financial institutions regulatory framework. Here is your opportunity to get involved and have your voice heard:

- Comment Guidelines: The best comments are those that directly answer the questions put forth, highlight the important points, give concise justifications, cite credible sources, and present alternate regulatory solutions.

- Submission Procedure: Please use the'send your comments' option on the consultation page to submit your comments by August 13, 2024, via the specified platform. Submissions sent after the deadline or via other sources might not be accepted.

- Publication of Responses: By expressly stating their preference in the consultation form, participants can decide whether or not their remarks should be published publicly. Requests for disclosure of confidential responses may be made in accordance with the EBA's document access guidelines.

- Data Protection: When it comes to processing personal data, the EBA complies with Regulation (EU) 1725/2018. Visit the EBA website's Legal Notice section for further details on data protection.

Engagement in this consultation process is vital for fostering transparency and ensuring effective regulation within the European banking sector.

Prudential Treatment for Real Estate Exposures Under Construction

The Capital Requirements Regulation (CRR), which covers both residential and commercial lending, specifies standards for determining risk weights for mortgages secured by immovable property. Interestingly, given certain restrictions, retail immovable property that is still under construction is eligible for preferred risk weight treatment under Article 124(3)(a)(iii).

The quantity of residential units, the status of the primary dwelling, and the constraints on indirectly financing Acquisition, Development, and Construction (ADC) risks are some of these conditions. Governmental organizations may also use legal authority or comparable methods to guarantee the timely completion of construction projects.

The European Banking Authority (EBA) is charged with creating comparable legislative frameworks to guarantee timely completion in accordance with Article 124(12) of the CRR. In order to ensure that there are legal responsibilities for timely construction, central governments or other comparable institutions give counter assurances.

The overall goals of these Regulatory Technical Standards (RTS) are to create a uniform prudential treatment framework for the EU, guarantee uniformity in own funds requirements, and encourage fair competition among European banks.

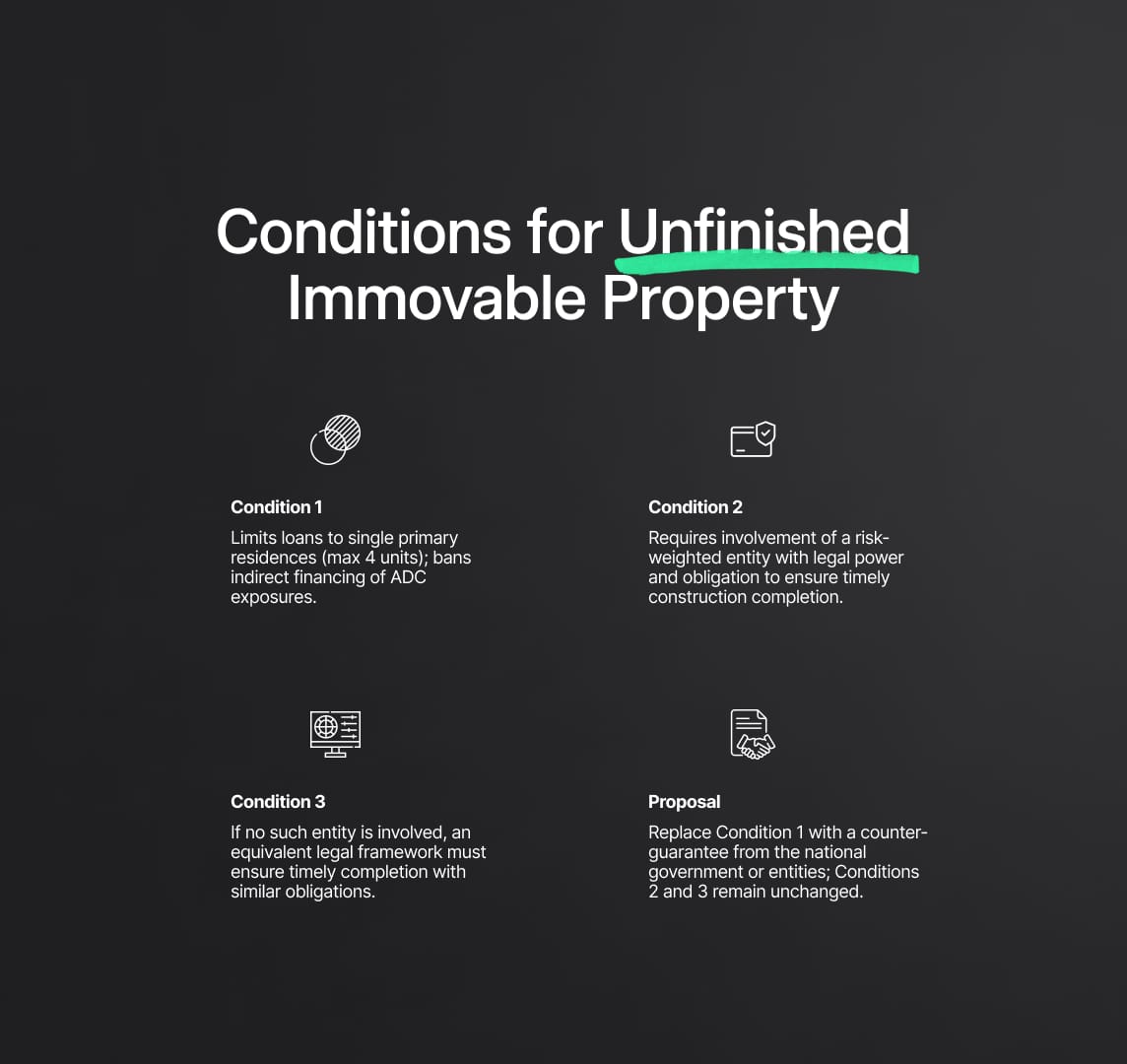

Conditions for Unfinished Immovable Property

The Capital Requirements Regulation (CRR), in Article 124(3)(a)(iii), establishes particular requirements for granting preferential risk weight treatment to unfinished immovable property backed by residential mortgages. These requirements are intended to ensure responsible financing practices while taking into account circumstances involving proposed or ongoing development. Now let's examine the main requirements and their consequences that this text outlines:

- Condition 1: The first listed restriction restricts loans to single primary residences with a maximum of four housing units. Additionally, indirect financing of acquisition, development, and construction (ADC) exposures is prohibited under this criterion.

- Condition 2: An entity risk-weighted as such, or a national government, regional government, or local authority, must be involved. For these organizations to guarantee that construction is completed on schedule, they must be able to act legally. They must also be required to guarantee completion or offer a legally-binding guarantee that they will do it in a fair amount of time.

- Condition 3: In the event that the requirements of Condition 2 are not satisfied, an equivalent legal framework must be in place to ensure completion within a reasonable amount of time. The legal authorities and duties mentioned in Condition 2 ought to be reflected in this system.

- Proposed Method: It is suggested that a counter-guarantee supplied by the national government or an organization covered by Articles 115(2) or 116(4) of the CRR take the place of Condition 1. Remaining unaltered are conditions 2 and 3, which stress the significance of legal authority and legally enforceable agreements for prompt fulfillment.

To summarise, the purpose of these criteria is to guarantee the careful handling of unfinished immovable property by striking a balance between risk management and the necessity of regulatory flexibility in the banking sector of the European Union.

Establishing Equivalence in Legal Mechanisms for Property Construction Completion

The European Commission seeks to maintain stringent prudential rules while taking proportionality into account, citing the Treaty on the Functioning of the European Union and Regulation (EU) No 575/2013, namely Article 124(12). The main objective is to assess legislative frameworks that are considered comparable in accordance with Regulation (EU) 575/2013's Article 124(3)(a)(iii).

These systems have to ensure that organizations, with the exception of central governments or organizations covered by special legislation, have the legal ability to guarantee the timely completion of property building. Moreover, a counter-guarantee supplied by central governments or organizations bound by specific legislation is required to protect these duties. The European Supervisory Authorities conducted open public discussions and an examination of the potential costs and advantages before developing this regulation, which is based on draft regulatory technical standards put out by the European Banking Authority. In the process, counsel has also been sought from the Banking Stakeholder Group, which was founded in accordance with Regulation (EU) No 1093/2010.

Regulatory Changes for Risk Weight Treatment

The Capital Requirements Regulation (CRR) provides guidelines for assigning risk weight to mortgages that are backed by real estate under Article 124. In particular, properties that are still under construction are eligible for favorable risk weight treatment under Article 124(3)(a)(iii), given certain requirements are fulfilled. These requirements could restrict loans to specific principal residences or include national governments or other legally empowered organizations in order to guarantee the timely completion of development projects. As per Article 124(12) of the CRR, the European Banking Authority (EBA) is assigned with the responsibility of formulating comparable legal frameworks. Any Regulatory Technical Standards (RTS) must be supported by an Impact Assessment (IA) that weighs the advantages and disadvantages of the proposed changes, per EBA standards.

Main regulatory changes:

- Introduction of Preferential Treatment: Preferential risk weight treatment is extended to properties that are still under construction by Article 124(3)(a)(iii) CRR.

- Conditions for Eligibility: Preferential treatment eligibility is subject to certain requirements, which may include limiting financing to specified primary residences or involve central governments or other legally recognized institutions.

- EBA mandate: The EBA is tasked with creating comparable legislative frameworks to guarantee on-time building completion.

- Impact Assessment (IA): An IA that is attached to regulatory changes examines the possible costs and benefits while taking into account the identification of problems and a baseline scenario in which specific conditions are not common throughout EU Member States, making them outdated.

The purpose of this consultation paper and its corresponding IA is to give interested parties a thorough grasp of the proposed regulatory changes and how they might affect the banking industry and real estate development.

Establishing Equivalent Legal Mechanisms for Property Construction Completion

A disparity between Article 124(3)(a)(iii) CRR, which specifies requirements for preferential risk weight treatment, and the low prevalence of involved central governments or bodies with necessary legal authority among EU Member States is brought to light by the problem identification and baseline scenario. This usually makes the current situation outdated, so it is important to define what a comparable legal procedure looks like.

The Regulatory Technical Standards (RTS) policy objectives seek to create a uniform framework for the prudential handling of residential real estate that is still under construction throughout the European Union, guaranteeing that own funds criteria are met consistently.

The European Banking Authority (EBA) evaluated two methods when weighing options:

- Baseline approach: Subject to the circumstances specified in Article 124(3)(a)(iii) CRR, it is based on a counter-guarantee given by central governments or comparable institutions.

- Alternative approach: An alternate strategy that raises concerns regarding minimum creditworthiness, guarantee requirements, and scope, as well as completion guarantees.

Application and equivalency are given top priority in the evaluation. The rarity of the setup in EU Member States makes option a. unlikely to cover current programs. Although option b. broadens eligibility, it also presents questions about risk assessment equivalency, specifically with relation to guarantee criteria and triggers. The baseline method (Option a.) is ultimately the best choice because it guarantees stringent prudential norms and effective equivalency with CRR regulations.

Reduce your

compliance risks