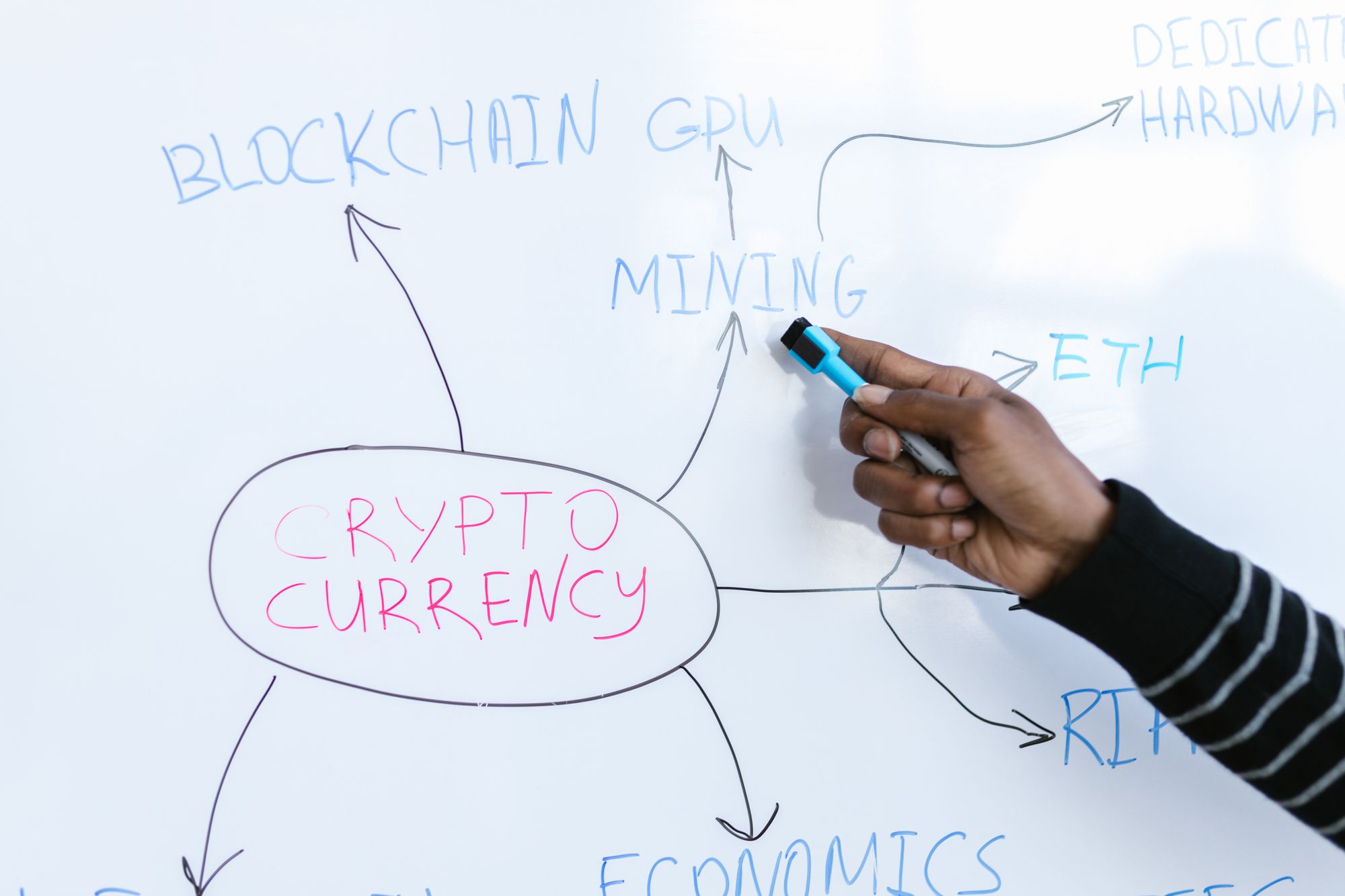

Crypto currencies portfolio management guidelines

Portfolio management is a critical aspect of investing in the cryptocurrency market and requires a well-researched and informed approach. One key aspect to consider is the different types of crypto assets available and their varying levels of risk and return potential.

Crypto currencies have gained popularity as a form of investment, but managing these assets can be a challenging task. The crypto market is known for its volatility, and without proper portfolio management, investors can easily end up losing their investment.

Navigating Crypto Management: Strategies for Success

Embarking on the journey of crypto management requires a nuanced understanding of key elements. Let's delve into the crucial aspects and unveil strategies to navigate the crypto landscape effectively:

- Diversification for Resilience:

- Crypto portfolio management demands a well-researched approach, with diversification playing a pivotal role.

- Different crypto assets carry varying risk and return potential; research suggests that a diversified mix can enhance returns and mitigate risks (Hsu, 2019).

- Rebalancing for Stability:

- Periodically adjusting the investment balance ensures alignment with the desired risk/return profile.

- Rebalancing safeguards against potential losses and maintains a well-diversified portfolio in the dynamic cryptocurrency market.

- Stop-Loss Orders for Protection:

- Incorporating stop-loss orders is a strategic move in crypto investments.

- These orders automatically trigger the sale of assets if their value falls below a set threshold, providing a protective mechanism during market downturns.

- Staying Informed for Agility:

- Keeping abreast of the latest developments is paramount in the crypto realm.

- Regularly monitoring news, trends, and regulatory changes helps limit risk exposure and ensures adaptability to evolving market conditions.

- Clear Investment Strategy for Long-Term Success:

- A well-defined investment strategy forms the bedrock of successful crypto portfolio management.

- Setting explicit goals, understanding risk tolerance, and defining expected returns create a disciplined and consistent management approach, fostering better long-term results.

In essence, successful crypto management involves a strategic interplay of diversification, rebalancing, protective measures, continuous learning, and a clear investment roadmap. By adopting these strategies, investors can navigate the complexities of the crypto market with confidence and resilience.

Compliance and Crypto Currency Management: A Vital Connection

Anti-Money Laundering (AML) and Know Your Customer (KYC) Requirements

Anti-money laundering (AML) and know your customer (KYC) requirements are critical components of crypto compliance. AML laws are designed to prevent the use of crypto assets for illegal activities, such as money laundering and terrorist financing. KYC requirements ensure that customers are who they claim to be and that they are not engaging in any illegal activities.

Record Keeping and Reporting

Record keeping and reporting are also important aspects of compliance in the crypto market. Keeping accurate records of transactions and holdings helps to secure that the portfolio is compliant with regulatory requirements, and reporting these transactions to the relevant authorities can help to prevent illegal activities that are increasingly spreading in the crypto trading field.

Third-Party Providers and Partners

It is also important to consider the compliance of third-party providers and partners, such as exchanges and wallet providers. Using providers that have strong compliance policies and practices can ensure adherence to the laws and regulation standards.

Risk Management and Compliance Monitoring

Risk management and compliance monitoring are key components of a comprehensive compliance strategy. The perpetual monitoring of the portfolio in order to ensure compliance with regulatory requirements and best practices can help to minimize the risk of loss and protect investments.

Finally, it is essential to be aware of the regulatory environment surrounding cryptocurrencies and to take steps to ensure that your investments are in compliance with local laws and regulations.

Doing so, you can protect your assets and reduce the risk of any legal repercussions. In addition, keeping a close eye on regulatory developments can also give you a competitive edge in the market, as you will be better positioned to take advantage of new opportunities as they arise.

However, navigating the complex regulatory landscape can be challenging, especially for those who are new to the crypto market. In this case, it may be helpful to seek the advice of a financial advisor or an expert in the field. This can ensure that you are making informed decisions and taking all necessary steps to protect your investments.

In summary, while there are many factors to consider in digital currencies portfolio management, staying informed about the regulatory environment and taking steps to ensure compliance with local laws and regulations is crucial. By doing so, you can reduce your risk and increase your chances of success in the dynamic and ever-evolving cryptocurrency market.

Reduce your

compliance risks