DAC 8 Regulation: how it affects crypto industry?

The EU's approach to crypto-assets, particularly through directives like DAC8, strikes a balance between innovation and regulation. Emphasizing user protection, tax justice, and market stability, the EU demonstrates a forward-thinking strategy.

Grand “Answer”:

The DAC 8 Regulation, proposed by the European Parliament and Council, aims to provide a regulatory framework for the crypto industry, addressing areas that currently fall outside the scope of existing EU financial regulation [1]. It seeks to protect consumers and investors from substantial risks related to services such as crypto exchanges, trading platforms, and custodial wallet providers [1][2]. The regulation also aims to address market manipulation risks and reduce regulatory fragmentation, thus promoting fair competition and supporting innovation in the crypto market [1][2]. Furthermore, the legislation aims to provide legal clarity on how existing EU financial regulations apply to crypto assets and related activities [1]. However, this regulation will also impose compliance costs on 'stablecoin' issuers and providers of services related to crypto-assets that currently fall outside EU financial regulation [1][2].

Source

[1]

[3]

DAC8 Regulation: Crypto-Asset Transparency

From the age-old barter system to today's digital currencies, finance has never ceased to evolve. Its dynamic nature reflects the interplay of technology, policy, and global trends. Few innovations, however, have disrupted the global financial panorama as powerfully as crypto-assets. These digital currencies, powered by decentralized ledger technologies, promise to redefine how the world perceives value, conducts transactions, and interacts across borders. Positioned at the heart of global finance, the European Union (EU) stands at a crucial juncture. The bloc, known for its proactive financial policies and stringent standards, now faces the task of integrating these emerging digital entities into its vast economic machinery. The EU's answer to this challenge? A renewed emphasis on transparency, regulation, and the meticulous revision of the Directive on Administrative Cooperation (DAC). Through this exploration, we shall delve deep into the EU's vision, strategy, and commitment to sculpting a transparent and standardized crypto-asset landscape.

A Global Disruptor

Since the advent of Bitcoin in 2009, the global financial ecosystem has been in a continuous state of flux. Crypto-assets, with their borderless nature and decentralized ethos, pose both a promise of unparalleled financial democratization and a challenge to existing centralized systems. Their rapid ascent has seen a proliferation of cryptocurrencies, each with its unique value proposition, utility, and community of followers. This global phenomenon demanded a coordinated response, especially from major economic conglomerates like the EU.

EU’s Historic Stance on Finance

Historically, the EU has been a beacon of financial regulation and standardization. With directives like MiFID (Markets in Financial Instruments Directive) and PSD2 (Payment Services Directive), the EU has consistently demonstrated its commitment to protecting investors, ensuring market transparency, and fostering innovation. These regulations have not only bolstered investor trust but have also made the EU's financial system more resilient and inclusive.

For the EU, crypto-assets represent a new frontier. While they offer opportunities for enhanced financial efficiency, inclusivity, and democratization, they also present risks associated with volatility, security concerns, and potential misuse for illicit activities. Recognizing these dual aspects, the EU embarked on a journey to integrate crypto-assets into its regulatory framework, ensuring that the potential benefits are harnessed while mitigating associated risks.

Revamping the DAC

Central to the EU's strategy on crypto-asset regulation is the revision of the Directive on Administrative Cooperation (DAC). This directive, which initially focused on fostering cooperation among member states on taxation matters, is now being expanded to encompass crypto-asset transactions. The revised DAC envisions:

- A harmonized approach to crypto-asset taxation across member states.

- Stringent reporting standards for crypto exchanges and wallet providers, ensuring transparency and accountability.

- Robust mechanisms to track and report suspicious activities, further safeguarding the EU's financial system from potential threats.

DAC8: Complementary Crypto Regulation in the EU

The European Union (EU), in particular, was met with the challenge of integrating this burgeoning market into its established financial ecosystem. When DAC8 was eventually incorporated into the EU’s financial regulations, it came at a time when the crypto market was already facilitating billions in transactions daily, launching new digital currencies, and showcasing its undeniable impact on global financial structures.

The rapid evolution of the crypto market, characterized by its decentralized nature and international outreach, presented both opportunities and threats. The lack of regulations and oversight in the earlier years led to concerns about money laundering, investor protection, tax evasion, and market manipulation. This necessitated the EU to establish a firm regulatory framework that could address these challenges while still promoting innovation and growth.

The Directive on Administrative Cooperation 8 (DAC8) was not merely an addition to a list of financial regulations. It was a manifestation of the EU's commitment to acknowledging, understanding, and effectively integrating crypto-assets into its financial fabric. The directive was built on three key pillars:

- Transparency: In an industry renowned for its opacity, DAC8 made a bold move to emphasize complete transparency. All crypto-asset service providers, from massive exchanges to niche wallet services, were mandated to disclose their transactions, especially those involving EU clientele. Such a directive went beyond mere disclosure; it was aimed at rooting out shadowy operations, ensuring that every transaction could be traced and verified. This pivotal step was not just about investor security but also about aligning the crypto industry with the stringent standards of traditional finance.

- Trust and Security: For the average investor, the crypto realm often seemed like the Wild West – full of potential but riddled with risks. The clear reporting guidelines ushered in by DAC8 changed this perception. Now, with standardized and transparent reporting norms, investors could be confident that their assets were managed with the same diligence and security as any other financial instrument. The knock-on effect of this trust was evident – there was a marked surge in investments, and the EU saw an influx of startups and businesses aiming to provide crypto-related services, all operating under the safety net of this directive.

- Scope: The visionary approach of the DAC8 was evident in its comprehensive scope. While Bitcoin and Ethereum – the behemoths of the crypto world – were obviously covered, the directive went further. Recognizing the dynamic nature of the industry, DAC8 was drafted to be all-encompassing. This meant that even assets which hadn't been conceptualized in 2026 were still under its purview. Such foresight ensured that the EU would not be playing catch-up with every new crypto innovation.

DAC 8 Regulation: Crypto-asset Service Providers' Responsibilities

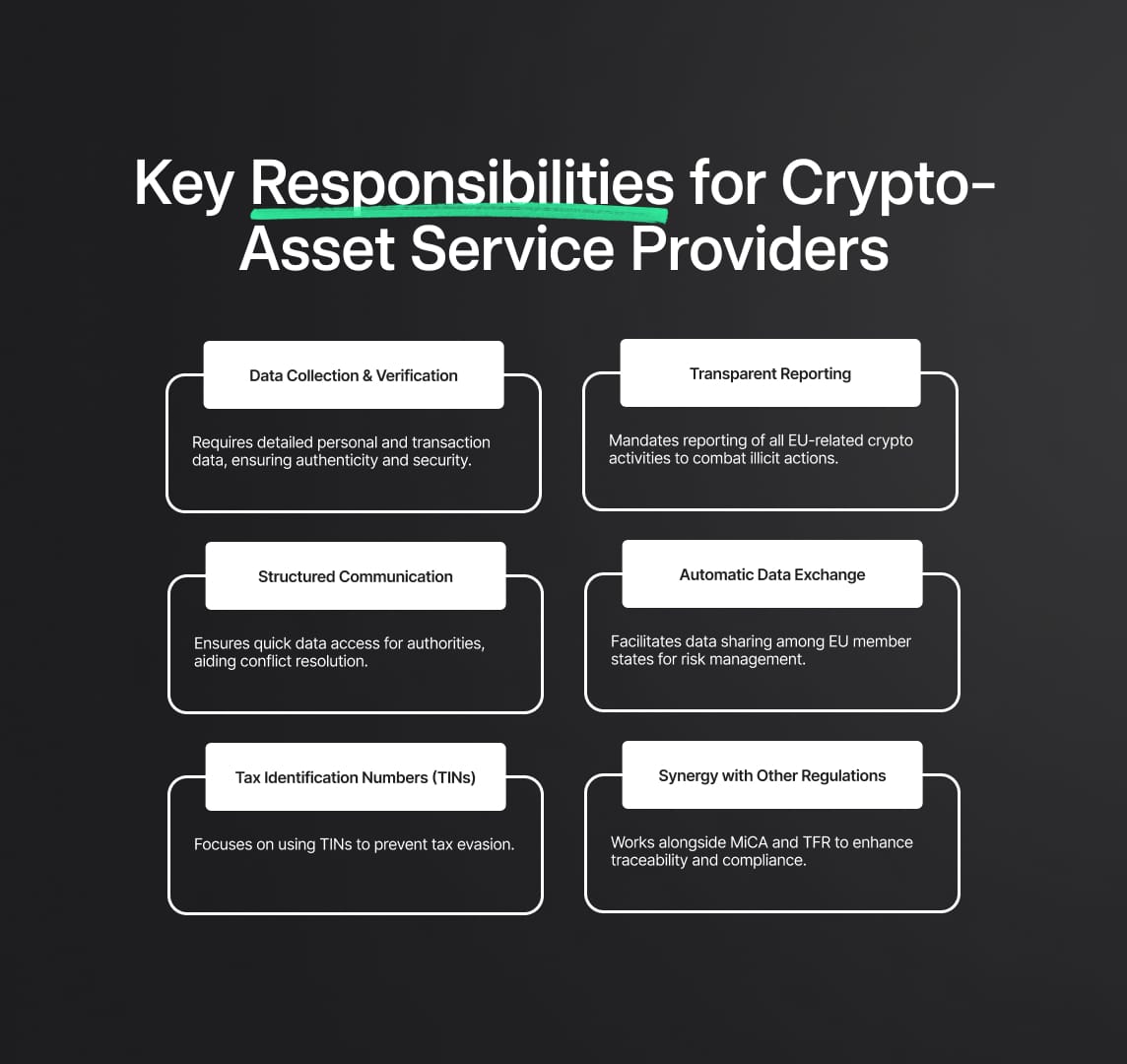

Data Collection & Verification: In the era of digital advancements, data stands as the backbone of any operation. DAC8 prioritizes this by introducing a robust data collection mechanism. This isn't confined to mere superficial details. Instead, the depth it seeks ranges from basic personal details to intricate transaction histories, encompassing the multiple wallet addresses a user might possess. The emphasis here is not just on collection but also verification. Given the anonymous nature of crypto transactions, verifying the authenticity of these details becomes paramount. It serves dual purposes: enhancing the security of users' assets and ensuring genuine details are available for administrative purposes.

Transparent Reporting: Crypto-asset service providers, under DAC8, find themselves held to a rigorous standard of transparency. Any activity, regardless of its size or nature, involving an EU-based entity or individual needs reporting. While one might be quick to associate this with tax implications, the directive's vision is broader. Transparent reporting is a tool to ward off illicit activities, safeguarding the interests of users and maintaining the credibility of the crypto market.

Structured Communication: Information, when not accessible, loses its value. DAC8 acknowledges this by emphasizing seamless communication pathways. These dedicated channels ensure swift access to data by primary authorities, be it for routine checks or specific investigations. Such provisions ensure that in the face of disputes, the necessary data is readily available, leading to swift conflict resolution.

Automatic Data Exchange: To enhance the efficiency of monitoring and the proactive management of potential risks, DAC8 introduces an automatic data exchange framework. This system ensures that member states remain in the loop regarding crypto-transactions, fostering a sense of shared responsibility and facilitating collective action when necessary.

TINs Emphasis: Tax evasion has often been a criticism thrown at the crypto world. DAC8 addresses this by emphasizing the importance of Tax Identification Numbers (TINs). By doing so, it ensures that individuals and entities can be pinpointed and identified without ambiguity. This not only promotes tax justice but significantly deters potential tax evaders.

Synergy with Other Regulations: DAC8, monumental as it is, doesn't stand alone in its mission. It is supported and complemented by other regulations. The Regulation on Markets in Crypto-Assets (MiCA), for instance, delves into the nuances of crypto-assets, especially those beyond the purview of current financial services legislation. Meanwhile, the Transfer of Funds Regulation (TFR) fortifies the traceability aspect, dictating that transfers of funds be accompanied by comprehensive information about both the payer and payee.

In sum, DAC8, with its well-defined provisions, not only seeks to regulate but also to integrate and legitimize the crypto-asset market within the EU's financial framework, ensuring that innovation and security go hand in hand.

The DAC Evolution

The Directive on Administrative Cooperation (DAC) stands as a testament to the European Union’s commitment to adaptability and progression in financial regulatory measures. Over the years, this directive has borne witness to the rapid evolutions of the financial environment, particularly with the advent of new digital and technological advancements. From its inception, the DAC was conceived as a tool for fostering cooperation among European tax authorities. However, its journey from being just a cooperative tool to evolving into a comprehensive regulatory framework has been a remarkable one, accommodating the multi-dimensional challenges ushered in by the digital age.

The backdrop to this evolutionary journey was painted by an increasing reliance on digital financial instruments, rapid globalization of financial markets, and the subsequent birth of crypto-assets, which stood out as the most disruptive among all. While crypto-assets promised unprecedented advantages such as decentralization, swift transactions, and enhanced security, they also brought forth concerns related to transparency, tax evasion, and the potential for illegal activities. It became evident that a conventional approach wouldn't suffice. The DAC had to evolve, and it had to do so swiftly.

The metamorphosis of the DAC, culminating in the introduction of DAC8, was shaped predominantly by two pivotal influences:

European Commission's 2022 Initiative: The year 2022 saw a decisive shift in the European Commission's stance towards crypto-assets. Instead of merely observing from the sidelines, the Commission took the proactive step of engaging stakeholders directly. It solicited feedback from a broad spectrum, including financial institutions, crypto exchanges, tech innovators, and even everyday users. This consultation was not just a formality; it was a genuine attempt to understand the breadth and depth of the challenges and opportunities posed by crypto-assets.

The feedback was resounding. An overwhelming majority of stakeholders expressed the need for integrating crypto-asset service providers into a broader regulatory framework. They believed that only through formal integration could the full potential of crypto-assets be harnessed while mitigating associated risks. Taking heed, the European Commission promptly acted on this feedback, paving the way for the birth of DAC8. This directive wasn't just a new regulation—it symbolized Europe's forward-thinking approach and willingness to embrace the future of finance.

OECD’s Guidelines: The Organization for Economic Co-operation and Development (OECD), a global consortium committed to shaping better policies for better lives, played a crucial role in the DAC's evolution. Recognizing the global ramifications of crypto-assets, the OECD undertook the monumental task of drafting guidelines that aimed to bring some order to this new chaotic financial frontier. Their guidelines focused intently on standardized reporting procedures, ethical operations, and global best practices.

These OECD guidelines did more than just provide a rulebook. They offered a vision—a vision where crypto-assets could coexist harmoniously with traditional finance under a shared umbrella of trust and transparency. By doing so, they provided the European Union with a roadmap, ensuring that DAC8 was not only progressive but also aligned seamlessly with global standards.

A Comprehensive Look at the EU’s Approach to Crypto-assets

Crypto-assets have emerged as a powerful force in the global financial landscape, presenting both unparalleled opportunities and complex challenges. At the heart of this digital revolution is the inherently decentralized nature of these assets, which operates on a global scale, defying the traditional borders and boundaries of financial systems. This novel characteristic has posed significant challenges for regulators across the world, forcing them to rethink their strategies and approaches.

The European Union, ever at the forefront of global regulatory changes, responded to this challenge with precision and foresight, as epitomized by the introduction of directives such as DAC8. This directive wasn't just a regulatory response; it was a statement, a testament to the EU's adaptability and commitment to harnessing innovation without compromising on its foundational principles.

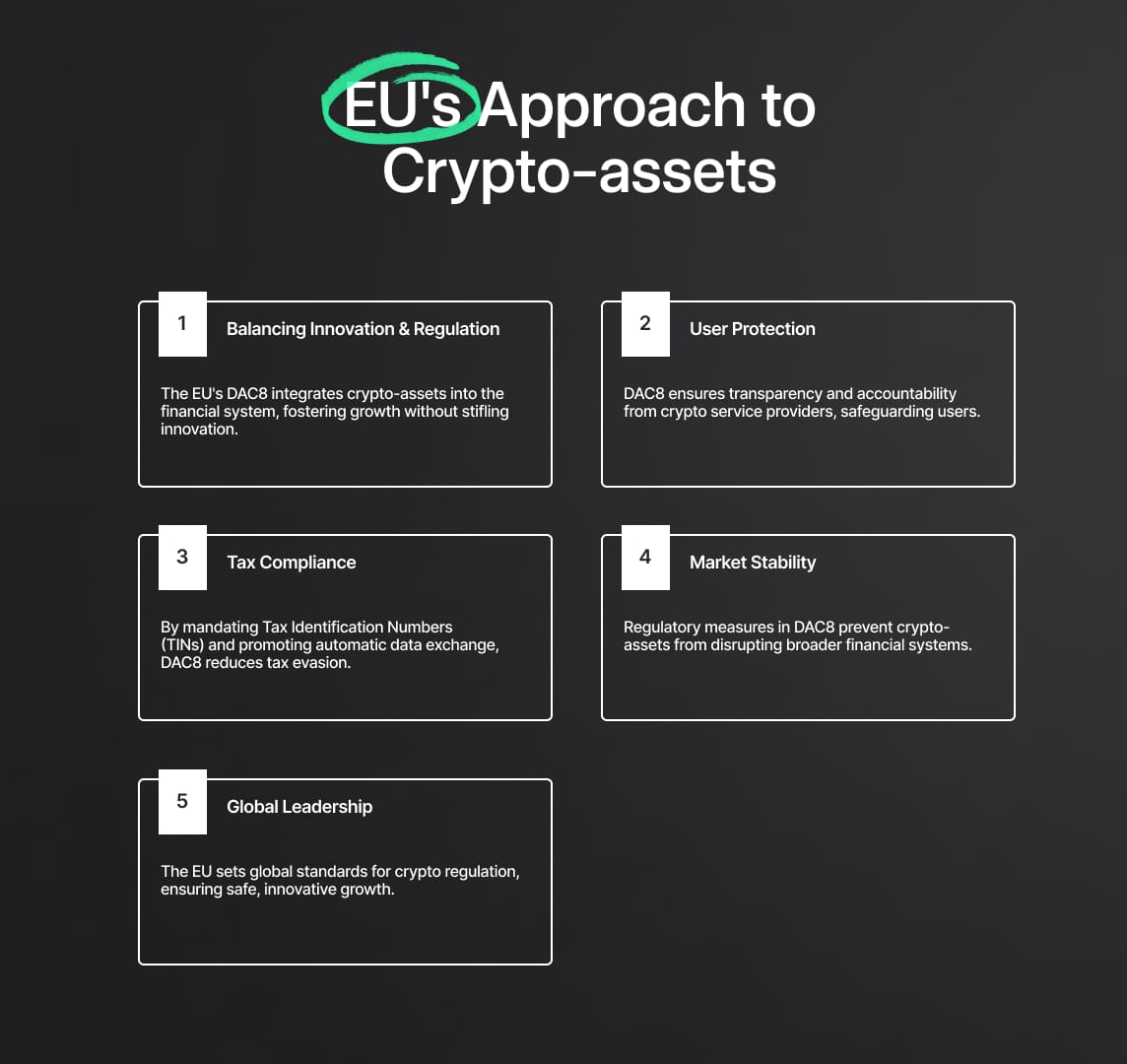

One of the standout features of the EU's approach is its ability to balance between fostering innovation and ensuring stringent regulation. Crypto-assets are not just digital currencies; they are harbingers of a new era of financial interaction, offering faster transaction times, reduced fees, and greater financial inclusivity. Recognizing this transformative power, the EU has been careful not to stifle the growth and potential of this emerging sector. Instead, it seeks to integrate it into the existing financial fabric, ensuring that as the sector grows, it does so sustainably and securely.

But the EU's commitment doesn't stop at simply accommodating crypto-assets. Central to its approach is the emphasis on user protection. In the often-volatile world of digital assets, where the risks are as significant as the rewards, ensuring that users, both individual and institutional, have a safety net is paramount. The provisions of DAC8 underscore this commitment, with measures that ensure transparency, accountability, and responsibility from crypto-asset service providers.

Moreover, the EU's focus on tax justice, as reflected in DAC8's detailed reporting requirements, ensures that the benefits of crypto-assets are felt across the board. By emphasizing Tax Identification Numbers and automatic data exchange, the directive ensures that everyone pays their fair share, reducing the potential for tax evasion and ensuring a level playing field for all stakeholders.

The overarching goal, however, remains market stability. Financial markets are interlinked, and a shock in one sector can have ripple effects across the board. By ensuring that the crypto-asset sector is well-regulated and operates transparently, the EU is taking proactive steps to safeguard the broader financial system from potential shocks originating from this nascent sector.

In conclusion, the world of crypto-assets is a brave new frontier, filled with promise and potential. It is a testament to the European Union's vision that it has managed to chart a course through this complex terrain with such aplomb. The introduction and adoption of DAC8, with its emphasis on crypto transparency, have undoubtedly positioned the EU as a global leader, setting benchmarks for others to follow. It's a clear message that innovation and regulation can coexist harmoniously, driving progress while ensuring safety and stability for all.

Grand Answer: Your AI Partner

Designed to support compliance officers, legal counsels, and other professionals responsible for adhering to regulatory standards, Grand Answer aims to facilitate an efficient and straightforward compliance process.

Reduce your

compliance risks