DORA Regulation: DNB's 2024 Guidelines

DORA (Regulation EU 2022/2554) enhances EU financial sector resilience by mandating stringent ICT risk management, focusing on third-party providers, with a crucial information register for regulatory oversight and compliance.

The Digital Operational Resilience Act (DORA), formally known as Regulation (EU) 2022/2554, is a pivotal element of the European Union's strategy to enhance the digital resilience of its financial sector. Set for full implementation on January 17, 2025, DORA imposes rigorous requirements on financial institutions across the EU, particularly in managing risks associated with Information and Communication Technology (ICT), especially those arising from third-party service providers. A critical aspect of DORA is the establishment and meticulous maintenance of an information register that documents all contractual agreements with ICT third-party service providers. This guide delves into the essential elements of DORA, integrating insights from the Dutch Central Bank (De Nederlandsche Bank, DNB) and the European Supervisory Authorities (ESAs) to provide a comprehensive understanding of the requirements and strategies for effective compliance.

Source

[1]

[2]

Understanding the DORA Regulation

DORA is designed to ensure that financial institutions can withstand, respond to, and recover from ICT-related disruptions, thereby safeguarding the stability and integrity of the financial sector. The regulation applies broadly, encompassing banks, insurance companies, investment firms, and payment service providers. By standardizing digital resilience requirements across these entities, DORA aims to create a unified framework for managing ICT risks throughout the European Union. This harmonization is crucial for fostering a more secure and resilient financial environment, reducing vulnerabilities that could lead to systemic risks.

The Role and Importance of the Information Register

At the core of DORA’s regulatory framework is the mandate for financial entities to maintain a detailed information register. This register, as outlined in Article 28, paragraph 3 of the regulation, is far more than an administrative requirement; it is a vital tool for monitoring ICT third-party risks and ensuring comprehensive regulatory oversight. Financial institutions must keep this register continuously updated at the entity, sub-consolidated, and consolidated levels, reflecting the dynamic nature of ICT dependencies and risks.

The information register is composed of a series of templates, each designed to capture specific data points critical for effective risk management and regulatory compliance.

DORA Regulation: Detailed Breakdown of Templates

RT.01 Series: These templates are used to identify the entities responsible for maintaining the register, as well as those within the scope of consolidation and their branches. This foundational information ensures that the register covers all relevant entities within the institution.

RT.02 Series: These templates capture details on contractual arrangements with ICT third-party providers, including general information about the services provided and specific contractual terms. This includes information on contract duration, renewal conditions, termination clauses, and SLAs.

RT.03 Series: This series identifies the entities and ICT third-party providers involved in signing contractual arrangements. It ensures that there is a clear record of all parties responsible for delivering and managing ICT services.

RT.04 Series: These templates focus on identifying the entities within the financial institution that utilize ICT services. This mapping is crucial for understanding the dependencies across the organization and for assessing the potential impact of service disruptions.

RT.05 Series: This series lists ICT third-party service providers and maps the ICT service supply chains, including subcontractors. By capturing the entire supply chain, institutions can identify potential points of failure and assess the risks associated with each link in the chain.

RT.06 Series: These templates are used to identify the specific functions supported by ICT services. This is particularly important for determining which parts of the institution’s operations are most reliant on external ICT services.

RT.07 Series: The final series assesses the ICT services, especially those supporting critical or important functions. This assessment is key to understanding the level of risk associated with each service and prioritizing risk mitigation efforts accordingly.

Each template in the information register is interconnected through relational keys, such as contractual arrangement reference numbers, Legal Entity Identifiers (LEIs), and function identifiers. This interconnectedness ensures that all data points can be easily aggregated and analyzed, providing a comprehensive view of the institution’s ICT risk landscape.

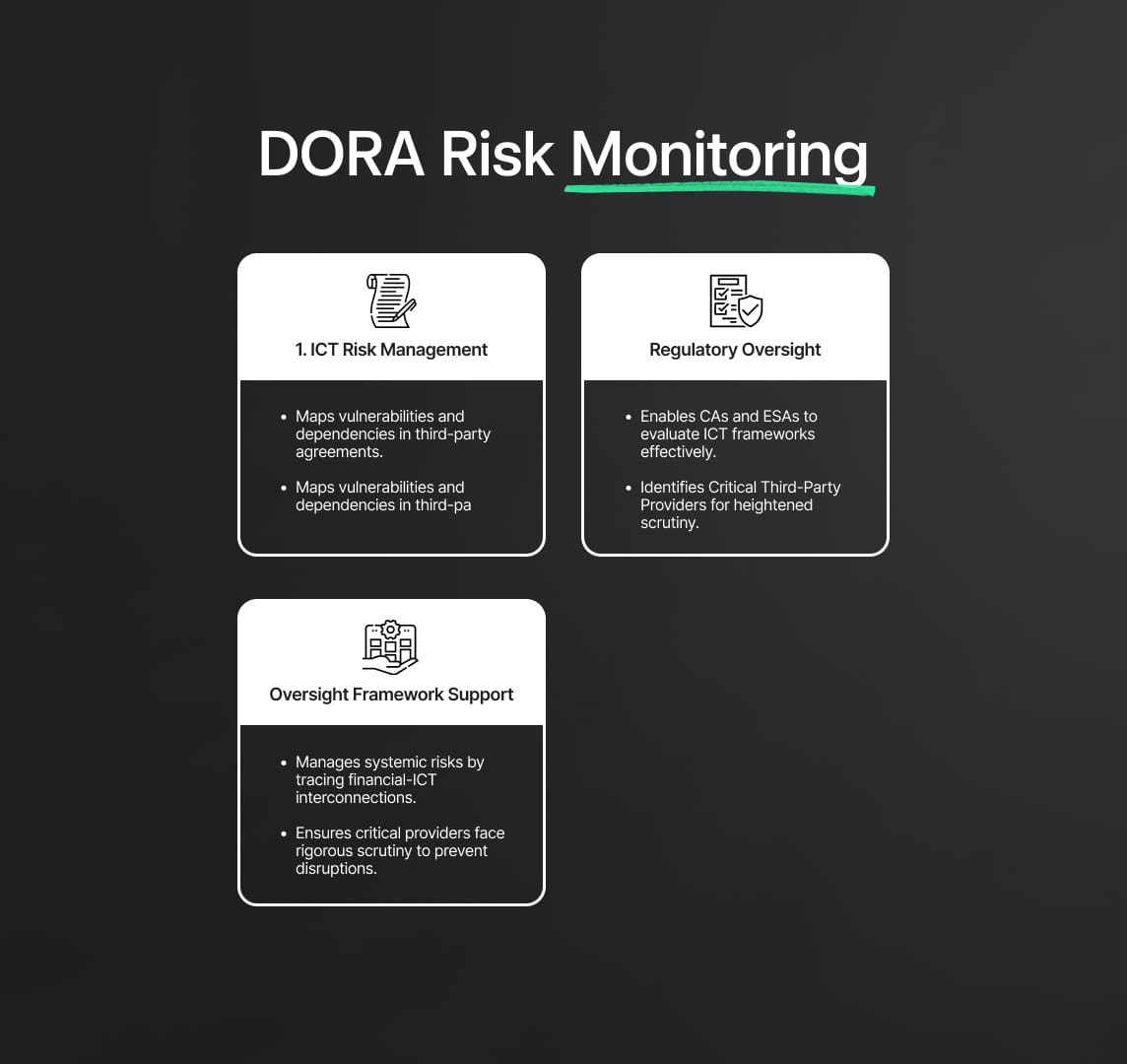

DORA Risk Monitoring

The primary function of the information register is to facilitate effective monitoring and management of ICT risks associated with third-party service providers. By maintaining detailed and up-to-date records of all ICT third-party agreements, financial institutions can systematically identify potential vulnerabilities within their ICT ecosystems. This proactive approach is crucial for implementing risk mitigation strategies that ensure operational continuity, even during disruptions.

The information register enables institutions to map out critical dependencies and assess the impact of third-party service disruptions on their operations, a key component in developing resilient business continuity plans and disaster recovery strategies.

Regulatory Oversight

The information register also serves as a critical resource for Competent Authorities (CAs) and the European Supervisory Authorities (ESAs). These bodies rely on the data contained within the register to supervise ICT risk management practices across the financial sector effectively. The register’s detailed records allow regulators to evaluate the adequacy of a financial institution’s ICT risk management framework and ensure alignment with DORA’s stringent standards. Additionally, the register facilitates the identification of Critical Third-Party Providers (CTPPs)—those ICT service providers whose failure could pose significant risks to the financial institution and the broader financial system. By identifying these CTPPs, regulators can implement heightened oversight measures to mitigate systemic risks.

Supporting the DORA Oversight Framework

Beyond its roles in risk monitoring and regulatory oversight, the information register is instrumental in supporting the broader DORA Oversight Framework. This framework is designed to manage systemic risks posed by significant or interconnected ICT providers across the EU’s financial sector. The register aids in identifying and categorizing these providers, ensuring that the most critical risks are subject to the highest levels of scrutiny. For instance, the register helps regulators trace interconnections between financial institutions and their ICT providers, identifying potential points of failure that could cascade through the financial system.

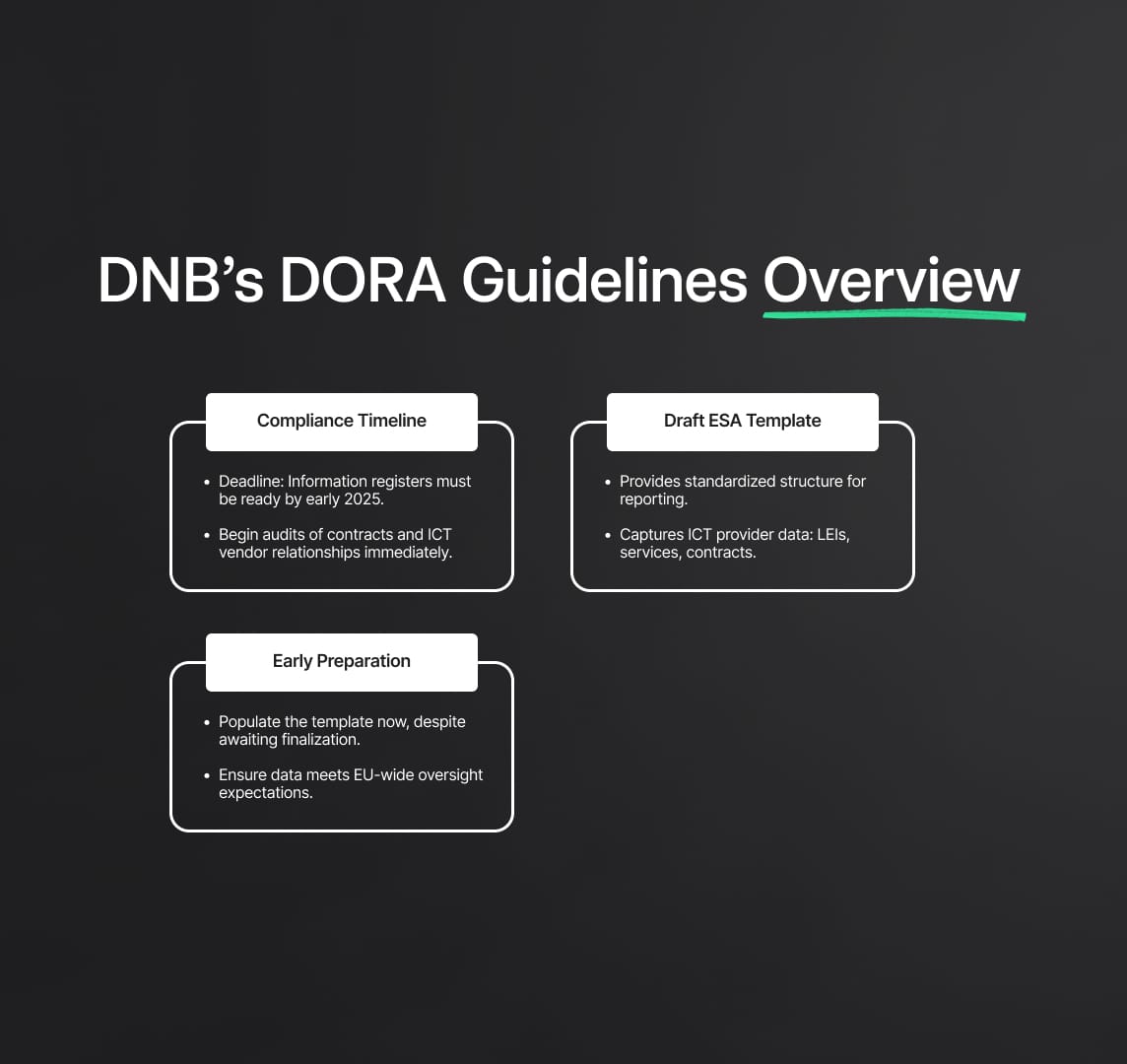

DNB’s Guidelines for Reporting the Information Register Under the DORA Regulation

On August 22, 2024, the Dutch Central Bank (DNB) issued detailed guidelines to assist financial institutions in the Netherlands with preparing and submitting their information registers in compliance with DORA. These guidelines are essential for ensuring that institutions meet DORA’s stringent reporting requirements, which aim to enhance the digital resilience of the financial sector across the EU.

Timeline for Compliance

The DNB has set a firm deadline for financial institutions to have their information registers fully prepared for reporting by early 2025. This timeline is non-negotiable and aligns with the broader European schedule for DORA’s full implementation. Compliance with this deadline is crucial to avoid regulatory scrutiny, which could result in fines, increased oversight, or other penalties. The DNB emphasizes the urgency of beginning preparations immediately, noting that compiling, validating, and organizing the required data is an extensive and time-consuming process.

Meeting this deadline requires a thorough audit of existing ICT third-party relationships, including the review of all contracts, service agreements, and risk assessments related to ICT services provided by external vendors. The DNB’s insistence on this timeline underscores the rigorous regulatory expectations under DORA and the significant consequences of delays in preparation.

Draft Template Provided by ESAs

To standardize reporting across the EU, the European Supervisory Authorities (ESAs) have developed a draft template for the information register. Although the template is expected to be finalized soon, the DNB advises financial institutions to begin populating it with relevant data immediately. The draft template is designed to ensure consistency and completeness in the data reported, which is critical for enabling effective oversight by the ESAs and other regulatory bodies.

The draft template is comprehensive, capturing all necessary data points related to ICT third-party service providers. These data points include:

Identification of ICT Third-Party Providers: Detailed information about each service provider, including their Legal Entity Identifiers (LEIs), geographical location, and the nature of the services provided.

Services Provided: Specific ICT services offered by each third-party provider, including scope, criticality, and any subcontracting arrangements.

Contractual Terms: Key contractual terms governing relationships with ICT third-party providers, such as contract duration, renewal and termination conditions, service level agreements (SLAs), and any clauses related to risk management and compliance.

By using this template, financial institutions can align their reporting processes with EU-wide expectations, ensuring that the data submitted is easily reviewed, compared, and analyzed by supervisory authorities. The DNB’s guidance to start populating the template immediately—even before its finalization—highlights the importance of early preparation.

Anticipated Reporting Format: xBRL-CSV

A key technical aspect of the DNB’s guidelines is the anticipated use of the xBRL-CSV standard for steady-state reporting by 2025. The xBRL-CSV format, featuring a table-oriented layout commonly referred to as ‘plain CSV,’ is chosen for its efficiency in handling large and complex datasets. This format is particularly beneficial for financial institutions reporting on numerous ICT third-party relationships, as it supports the detailed and structured reporting required under DORA.

The xBRL-CSV format is designed to be compatible with existing ICT systems within financial institutions, minimizing the need for significant IT overhauls. This compatibility allows institutions to integrate the xBRL-CSV format into their current data management and reporting workflows with relative ease. The format’s structured nature also facilitates automated data processing, ensuring that the reported information can be quickly and accurately analyzed by regulatory authorities.

The DNB recommends that financial institutions begin transitioning to the xBRL-CSV format as soon as possible. This transition involves adapting internal reporting systems to accommodate the new format and training staff on xBRL-CSV reporting. Early adoption of this format will help institutions avoid a last-minute rush to comply with the 2025 deadline and ensure that their reporting processes are well-established and tested in advance.

Alternative Reporting Method: Excel Template

Recognizing that not all financial institutions may fully implement the xBRL-CSV standard by 2025, the DNB has outlined an alternative reporting method using a predefined Excel template. This method is designed to accommodate institutions that may face technological or resource constraints, providing a more accessible means of complying with DORA’s reporting requirements.

Under this approach, financial institutions can prepare and submit their information registers using the Excel template provided by the DNB. The DNB will then convert these Excel files into the required xBRL-CSV format before submitting the data to the ESAs. This conversion ensures that all institutions, regardless of technological capabilities, can meet the stringent reporting requirements set forth by the DORA Regulation.

The Excel template is user-friendly, capturing all necessary data points required by DORA. It serves as a practical solution for smaller institutions or those with limited IT infrastructure, ensuring a smooth transition to DORA compliance. However, the DNB strongly encourages institutions using this method to view it as temporary and to plan for a full transition to the xBRL-CSV standard in the longer term. This proactive approach will better position institutions to handle future regulatory requirements and ensure ongoing compliance with evolving digital resilience standards.

Strategic Management of ICT Third-Party Risks under the DORA Regulation

Beyond the technical aspects of compliance and reporting, DORA mandates that financial institutions adopt a comprehensive and strategic approach to managing ICT third-party risks. This strategic framework is essential not only for meeting regulatory requirements but also for enhancing the overall resilience of financial institutions.

The ICT Third-Party Risk Strategy

A cornerstone of DORA's approach is the requirement for financial institutions to develop a formalized ICT third-party risk strategy. This strategy must be comprehensive, addressing all aspects of risk associated with ICT third-party providers, and it must be formally approved and overseen by the institution's management body. The involvement of the management body is crucial, ensuring that ICT risk management is integrated into the broader governance framework of the institution and receives the attention and resources necessary for effective implementation.

Continuous Risk Assessment and Monitoring

The ICT third-party risk strategy under DORA is not static; it is a dynamic framework that must evolve in response to changing risks and dependencies. At the heart of this strategy.

Conclusion

The DORA Regulation, formally known as the Digital Operational Resilience Act (DORA), marks a significant advancement in the European Union’s efforts to safeguard the financial sector against the growing complexities of digital risks. As financial institutions prepare for the full implementation of DORA by January 2025, the regulation's rigorous requirements underscore the need for comprehensive management of Information and Communication Technology (ICT) risks, particularly those linked to third-party service providers.

Central to DORA’s framework is the mandatory creation and maintenance of a detailed information register. This register serves as a critical tool for both monitoring ICT third-party risks and ensuring robust regulatory oversight. The guidelines issued by the Dutch Central Bank (DNB) and the European Supervisory Authorities (ESAs) highlight the importance of early preparation, emphasizing the adoption of standardized reporting formats like xBRL-CSV to meet DORA’s stringent compliance requirements.

By integrating DORA’s requirements into their risk management strategies, financial institutions can not only ensure compliance with the Digital Operational Resilience Act but also enhance their overall resilience in the face of digital threats. The proactive approach mandated by DORA, from continuous risk assessment to detailed documentation of ICT service supply chains, will be crucial in maintaining operational continuity and protecting the stability of the broader financial system. As the deadline approaches, institutions that prioritize adherence to DORA will be better equipped to navigate the challenges of the digital landscape, ensuring their long-term stability and compliance with this pivotal regulation.

Reduce your

compliance risks