DORA Regulation: Financial Resilience

DORA Regulation transforms the financial sector with a focus on cybersecurity, sustainability, and transparency. Financial institutions must strengthen cybersecurity, invest in tech and talent, foster a culture of improvement.

DORA Regulation: Continuous Enhancement of Financial Sector Security

Elevating Financial Sector Resilience: Insights from Daniel Barr, Director General of the Swedish Financial Supervisory Authority

- Contextualizing Financial Robustness:

- In a thought-provoking interview, Daniel Barr, Director General of the Swedish Financial Supervisory Authority, delves into the imperative of fortifying the financial sector's robustness.

- The discourse gains heightened relevance amid geopolitical shifts, notably influenced by events like Russia's invasion of Ukraine, spotlighting cybersecurity as a paramount concern in the financial industry.

- Key Legislative Advancement – DORA Implementation:

- A pivotal element in this landscape is the implementation of the European Union's Digital Operational Resilience Act (DORA).

- DORA signifies a critical stride in financial regulation, amplifying regulatory bodies' oversight capabilities and delineating stringent requirements for financial institutions in managing IT and information security risks.

- This legislation transcends a mere compliance checklist, representing a fundamental shift towards cultivating a more resilient and secure financial ecosystem against digital threats.

- Continuous Improvement Mandate:

- Director General Barr underscores the ongoing responsibility of financial entities, emphasizing that meeting baseline requirements is insufficient.

- Advocates for fostering a culture of continuous improvement and proactive risk management, vital for sustaining resilience amid evolving cyber threats and technological advancements.

- Financial Sector's Societal Role:

- Barr accentuates the broader role of the financial sector in responding to societal changes, particularly those propelled by digitalization and climate change.

- Highlights the significant responsibility of financial institutions to adapt transparently, especially in their sustainability efforts, enabling informed decisions by consumers and investors.

- DORA Regulation – Beyond Compliance:

- The focus on DORA Regulation transcends mere compliance, establishing a new operational resilience standard in the financial sector.

- By emphasizing DORA and its implications, the content becomes a valuable resource for understanding the evolving landscape of financial regulation and cybersecurity in the EU.

This insightful discussion with Director General Daniel Barr not only illuminates the challenges but also positions DORA as a linchpin in fortifying the financial sector's resilience and ushering in a new era of operational security.

DORA Regulation: A Game-Changer in Financial Cybersecurity

The Digital Operational Resilience Act (DORA) is a critical development in the financial regulatory environment of the European Union. Highlighted by Daniel Barr, Director General of the Swedish Financial Supervisory Authority, DORA underscores the increasing importance of cybersecurity in the financial sector. This emphasis is particularly relevant given the current geopolitical tensions, including Russia's invasion of Ukraine, which have brought digital threats into sharp focus. DORA represents more than just compliance; it signifies a shift towards creating a financial ecosystem that is resilient against a range of digital challenges.

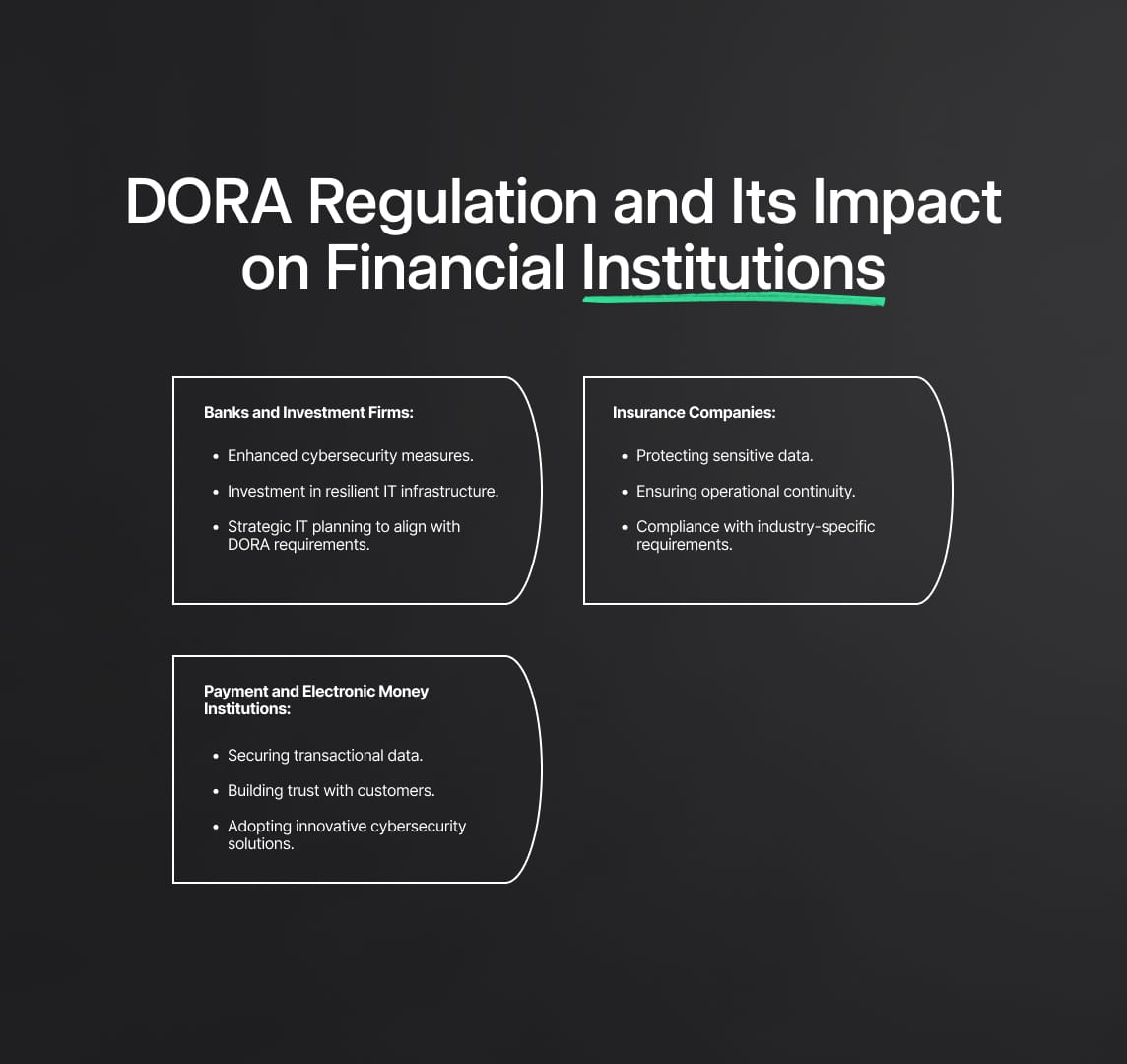

DORA Regulation and Its Impact on Financial Institutions

The Digital Operational Resilience Act (DORA) introduces comprehensive changes across the financial sector in the European Union. Its impact is far-reaching, affecting various types of financial institutions, each facing unique challenges and opportunities.

Banks and Investment Firms: Strengthening Cybersecurity Frameworks

- Enhanced Cybersecurity Measures: Banks and investment firms are required to significantly bolster their cybersecurity defenses. This involves adopting advanced security technologies and protocols to protect against a wide array of cyber threats.

- Investment in IT Infrastructure: These institutions may need to make substantial investments in their IT infrastructure. This includes upgrading systems to be more resilient and secure, which is essential for safeguarding sensitive financial data and ensuring uninterrupted financial services.

- Strategic IT Planning: Banks and investment firms must strategically plan their IT enhancements to align with DORA requirements, ensuring that their operations remain secure and efficient.

Insurance Companies: Prioritizing Digital Resilience

- Protecting Sensitive Data: Insurance companies, which handle vast amounts of personal and financial data, must intensify their efforts to secure this information against cyber threats.

- Operational Continuity: Ensuring operational continuity in the face of digital disruptions is crucial. This means having robust recovery and response plans in place to quickly address any breaches or downtime.

- Compliance with Industry-Specific Requirements: Insurance firms must also align their cybersecurity strategies with industry-specific regulatory requirements, adding another layer of complexity to their compliance efforts.

Payment and Electronic Money Institutions: Addressing Unique Digital Risks

- Securing Transactional Data: These institutions are at the forefront of digital financial transactions and thus face unique risks. They need to implement comprehensive security measures to protect transactional data and maintain the integrity of their payment systems.

- Building Trust with Customers: As digital payment solutions become more prevalent, these entities must ensure the highest levels of security to build and maintain trust with consumers.

- Innovative Security Solutions: Adopting innovative cybersecurity solutions, like advanced encryption and multi-factor authentication, is essential to safeguard against evolving cyber threats in the digital payment landscape.

Challenges for Smaller Financial Institutions

- Increased Operational Costs: Smaller institutions might find the increased operational costs for compliance challenging. Upgrading systems and maintaining enhanced security measures require significant financial investment, which can be a substantial burden for smaller entities.

- Resource and Technology Needs: The need for specialised cybersecurity resources and cutting-edge technology to meet DORA standards poses another significant challenge. Smaller institutions may struggle to allocate the necessary budget and find the right talent to manage these advanced systems.

DORA Regulation and Sustainability in the Financial Sector

Navigating DORA: Transforming Financial Operations with a Triple Focus

- DORA's Triple Emphasis:

- The Digital Operational Resilience Act (DORA) stands as a transformative regulation in the European Union, addressing cybersecurity while uniquely emphasizing sustainability and transparency within the financial sector.

- Ethical Integration in Core Operations:

- Marks a significant shift toward incorporating ethical considerations into the fundamental operations of financial institutions.

- Signals a broader movement in which DORA encourages a proactive and honest approach regarding sustainability efforts.

- Combatting 'Greenwashing':

- DORA tackles the prevalent issue of 'greenwashing' by compelling financial entities to be transparent about their sustainability initiatives.

- Aims to reduce misleading claims and ensures authenticity in environmental impact reporting, fostering a culture of responsibility.

- Reshaping Investment Strategies:

- Plays a pivotal role in shaping investment strategies, aligning them with the global emphasis on sustainability.

- Ensures financial institutions integrate ethical practices into investment decision-making, prompting a conscientious approach to asset valuation.

- Beyond Compliance – Responsible Investing:

- DORA propels the financial sector towards a model valuing sustainability not just as a compliance requirement but as a fundamental aspect of responsible investing.

- Encourages a holistic approach where long-term environmental and social impacts are considered alongside traditional financial metrics.

- Cultural Shift Towards Responsibility:

- Fosters a cultural shift, positioning DORA as a catalyst for cultivating authenticity, responsibility, and transparency within financial operations.

- Reflects a transformative journey where financial institutions embrace ethical and sustainable practices as integral elements of their identity.

In essence, DORA emerges as a legislative force guiding the financial sector towards a more ethical, transparent, and sustainable future, underscoring its role not only in cybersecurity but also in shaping responsible financial practices.

DORA Regulation: Ensuring Continuous Adaptation and Resilience

In the realm of cybersecurity, DORA regulation mandates financial institutions to be in a state of constant vigilance and adaptation. The dynamic nature of cyber threats, which evolve rapidly and unpredictably, requires a proactive and responsive approach to cybersecurity. Financial institutions, under the guidance of DORA, are required to continuously update and test their cybersecurity measures. This is not a static process but an ongoing journey of improvement and refinement in response to the emerging digital landscape.

Developing resilience is another key aspect under DORA. Financial institutions are expected to build robust risk management strategies that can withstand and quickly recover from cyber incidents. This focus on resilience is crucial not just for the institutions themselves but for the stability and robustness of the wider financial system. By fostering a culture where cybersecurity is continuously advanced and not just compliant with current standards, DORA ensures that the financial sector is not only prepared for the challenges of today but is also future-proofed against the threats of tomorrow.

The impact of DORA in these areas is profound. The regulation not only elevates the standards for cybersecurity and operational resilience but also redefines the role of financial institutions in championing sustainable practices. As such, DORA is not just a regulatory framework; it is a catalyst for a more ethical, transparent, and resilient financial sector.

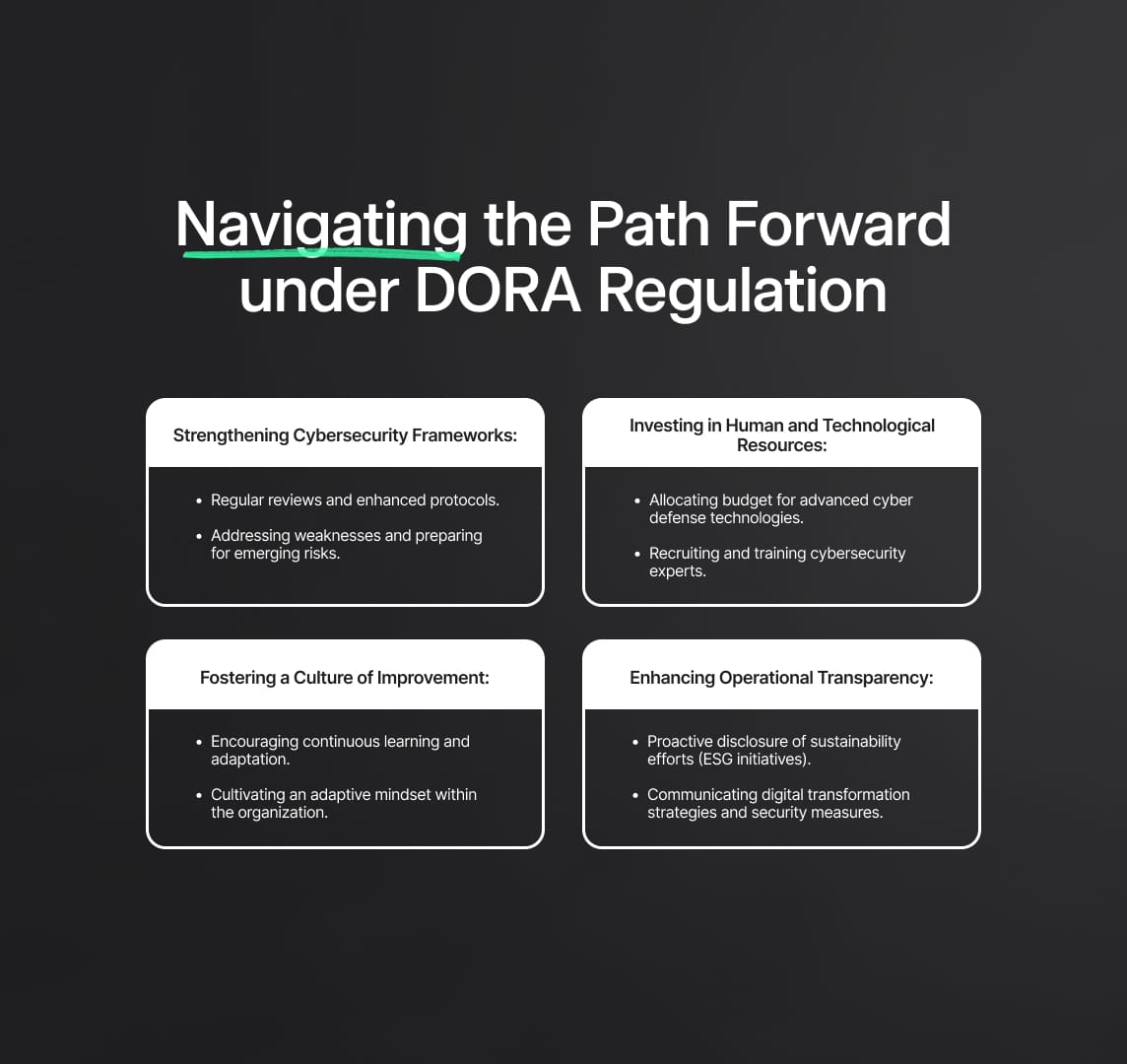

Navigating the Path Forward under DORA Regulation

As financial institutions set their course to comply with the Digital Operational Resilience Act (DORA) regulation, a clear roadmap is essential. Here's a detailed exploration of the strategies and actions they should consider to successfully navigate this path:

1. Strengthening Cybersecurity Frameworks

- Regular Reviews: Financial institutions must conduct regular, comprehensive reviews of their IT and cyber risk management strategies. This includes assessing vulnerabilities, updating threat assessments, and ensuring that cybersecurity measures are aligned with evolving digital threats.

- Enhanced Protocols: Strengthening cybersecurity frameworks involves not only addressing existing weaknesses but also proactively preparing for emerging cyber risks. Institutions should employ the latest technologies and methodologies to bolster their defenses against potential threats.

2. Investing in Human and Technological Resources

- Allocating Resources: Financial institutions need to allocate adequate budget and resources to fortify their cybersecurity infrastructure. This encompasses investments in advanced cyber defense technologies, security software, and state-of-the-art tools.

- Skilled Personnel: In tandem with technology investments, institutions should prioritize the recruitment and training of cybersecurity experts. Skilled personnel are indispensable in the ongoing battle against cyber threats.

3. Fostering a Culture of Improvement

- Continuous Learning: Encouraging continuous learning and adaptation within the company is vital. Financial institutions should provide training programs and resources to keep their employees up to date with the latest cybersecurity best practices.

- Adaptive Mindset: Cultivating a culture of improvement means fostering an adaptive mindset within the organization. Employees at all levels should be encouraged to identify vulnerabilities and suggest improvements, creating a collective sense of responsibility for cybersecurity.

4. Enhancing Operational Transparency

- Sustainability Efforts: In light of DORA's emphasis on transparency, financial institutions should be proactive in disclosing their sustainability efforts. This includes detailed reporting on environmental, social, and governance (ESG) initiatives, enabling stakeholders to assess their commitment to sustainability.

- Digitalisation Initiatives: Transparency should extend to digitalisation initiatives as well. Financial institutions should communicate their digital transformation strategies, security measures, and their impact on operations, fostering trust among customers, investors, and regulators.

By strategically implementing these steps, financial institutions can not only ensure compliance with DORA but also enhance their cybersecurity posture and transparency. This comprehensive approach will enable them to navigate the path forward successfully, reinforcing their position in the financial sector while aligning with the evolving landscape of regulatory and cybersecurity standards. Moreover, optimising content with these insights ensures that the discussion on DORA regulation remains relevant and valuable to those seeking guidance in this dynamic regulatory landscape.

Reduce your

compliance risks