EBA Guidance for Financial Reporting

The EBA's recent directive on FSIs improves data harmonization and reporting efficiency in the EEA banking sector. Benefits include precise analyses, reduced reporting burdens, transparency, and alignment with global standards. Swift action is crucial for leveraging these advantages.

EBA Guidance to Enhance Financial Soundness Indicators in European Economic Area

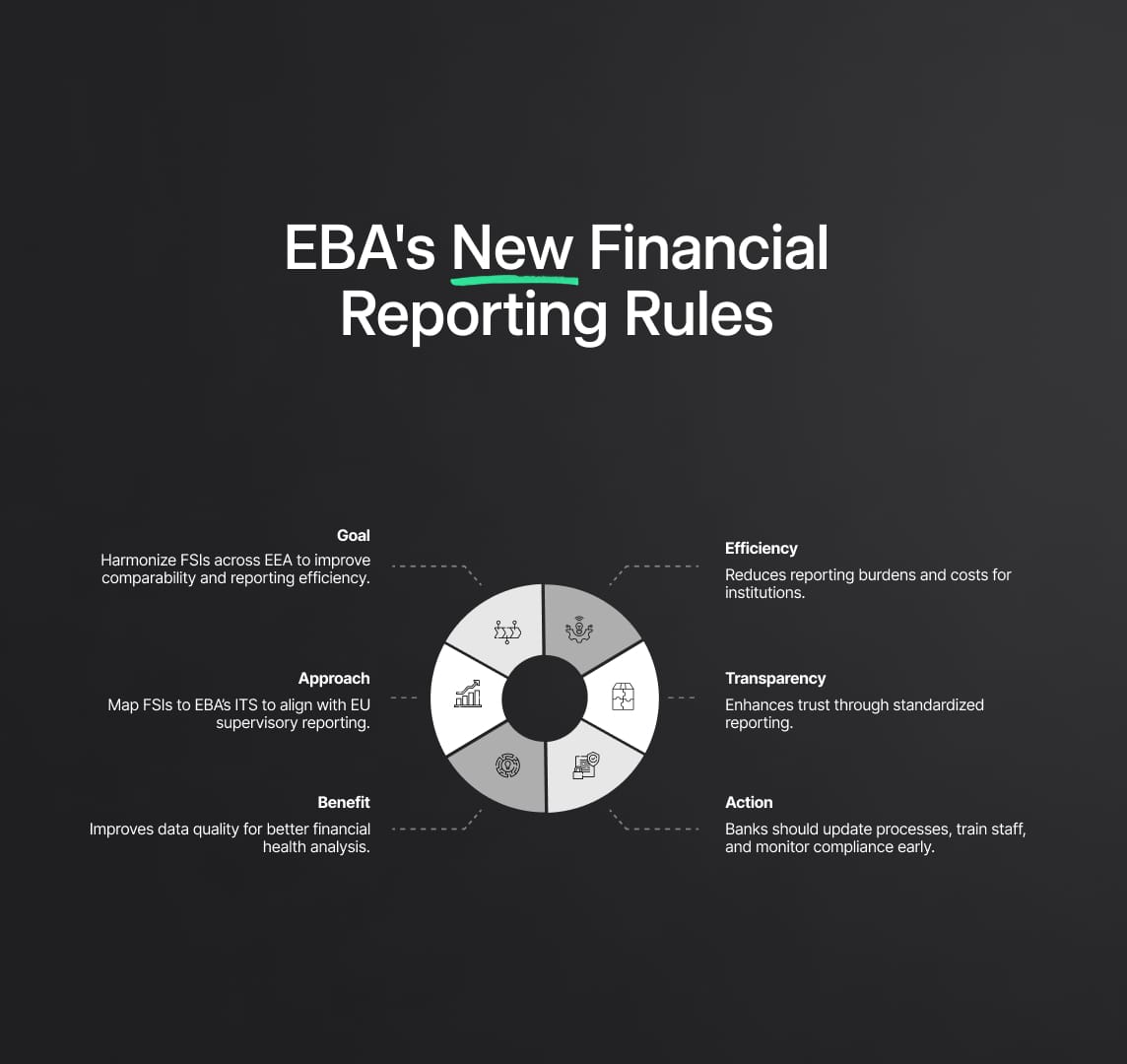

On August 2, 2023, the European Banking Authority (EBA) released guidance on the compilation of the International Monetary Fund's (IMF) Financial Soundness Indicators (FSIs) for 'Deposit Takers' within the European Economic Area (EEA). The FSIs, which are statistical aggregates, offer a snapshot of the financial health and stability of a country's financial sector, including its corporate and household segments. However, the comparability of FSIs across EU and EEA member states has been limited due to differences in source data definitions. In response, the EBA has provided a detailed mapping of FSI forms to their Implementing Technical Standards (ITS) on supervisory reporting templates. This guidance aims to improve the quality, comparability, and ability to aggregate and disaggregate the FSIs, thus reducing the reporting burden for banks in the EU and EEA. The EBA's initiative offers an optimistic outlook for increased transparency and harmonisation in the European banking sector.

EBA's New Directive: Financial Reporting in the EEA Banking Sector

In an era of continuous regulatory evolution, the European Banking Authority's (EBA) recent guidance on the Financial Soundness Indicators (FSIs) represents a promising advancement for deposit-taking institutions across the European Economic Area (EEA). Promoting data harmonization and reporting efficiency, this development presents potential game-changing implications for the EEA banking sector, and by extension, the European Union (EU).

The directive's goal is to enhance the comparability of FSIs across EU and EEA jurisdictions, a necessity given the global interconnectedness of financial markets. By providing a detailed mapping of FSI forms to the EBA's Implementing Technical Standards (ITS) on supervisory reporting, the initiative intends to strengthen the quality, reliability, and consistency of FSIs, key statistical aggregates used to evaluate a country's financial sector health.

Expected benefits of the directive span several key areas. Firstly, a surge in data quality will enable more precise analyses of financial health and stability across EEA countries, crucial for risk management and regulatory oversight. Secondly, a decrease in reporting burdens, resulting from clearer guidance on utilizing existing statistical inputs for FSI computation, suggests potential cost savings and increased efficiency for financial institutions.

Furthermore, the initiative fosters an environment of enhanced transparency. By aligning FSI reporting with EBA's ITS, it sets a precedent for standardization and trust-building amongst stakeholders, including investors, regulators, and the public. Lastly, the harmonization of concepts and definitions as per international banking supervision standards reinforces the EEA's alignment with global best practices.

To leverage these benefits, financial institutions must act swiftly. Implementing the new guidance demands a strategic review and alignment of data collection, analysis, and reporting processes. Investing in staff training to comprehend and execute the new reporting requirements will also be key. A robust compliance monitoring system, potentially strengthened by internal audits, will help ensure seamless adherence to these new guidelines.

While no definitive timeline for implementation is specified, prompt action is recommended. In light of the wide-ranging impacts, the EBA's new directive truly underscores the authority's commitment to financial stability and harmonization within the EEA banking sector, setting the stage for an exciting new chapter in European banking regulation.

Reduce your

compliance risks