ECAIs Under the Capital Requirements Regulation (CRR)

Recent amendments on July 1, 2024, ensure ECAI assessments stay accurate and aligned with evolving risks, supporting financial stability and regulatory compliance.

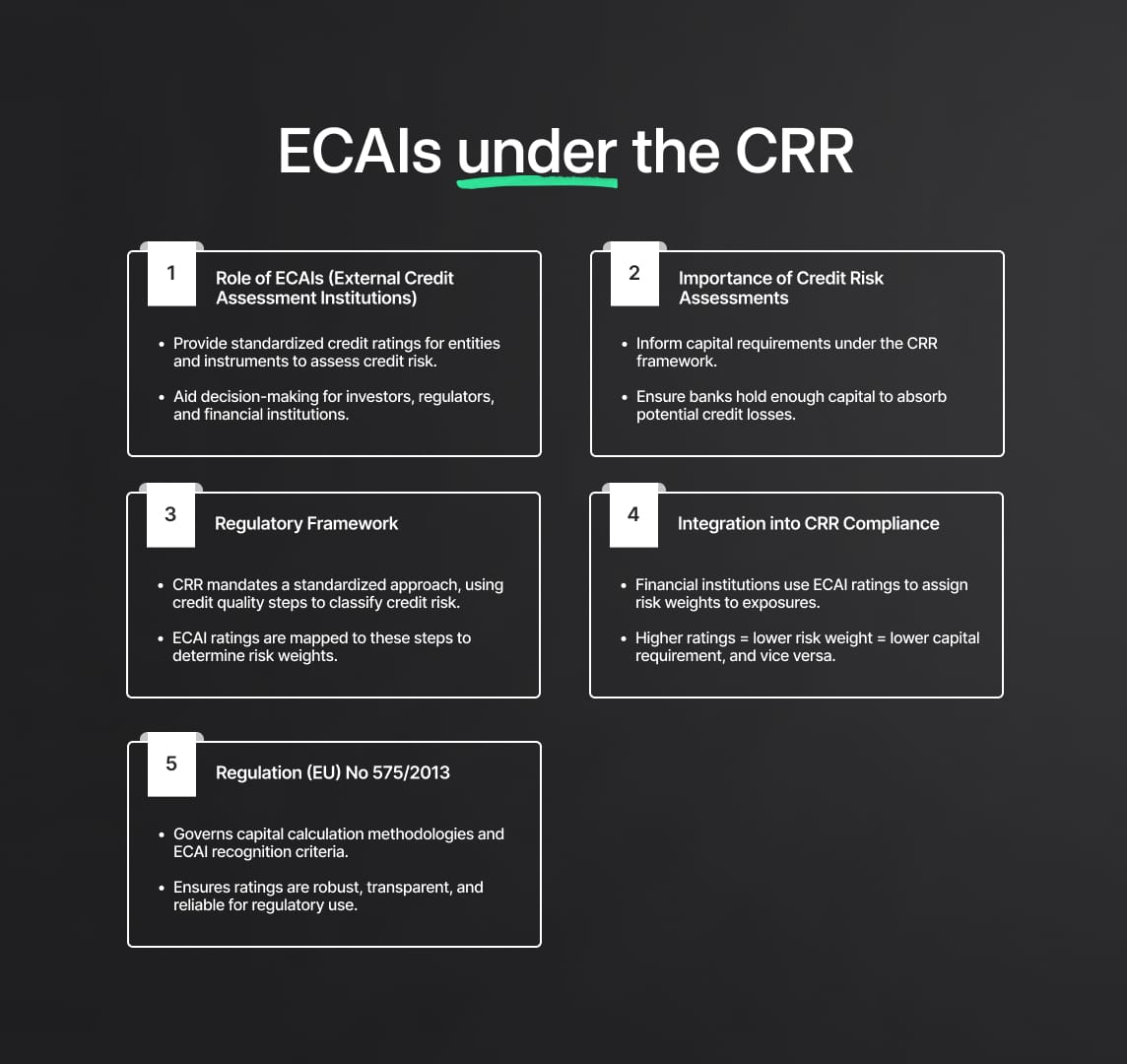

ECAIs under the CRR

External Credit Assessment Institutions (ECAIs) are fundamental to the financial regulatory framework established by the Capital Requirements Regulation (CRR). The CRR, codified in Regulation (EU) No 575/2013, sets out stringent prudential requirements for credit institutions and investment firms across the European Union. These requirements are designed to ensure the resilience and stability of the financial system, mitigating risks that could lead to financial instability or crises.

Source

[1]

[2]

Role of ECAIs in the Financial Ecosystem

ECAIs provide standardized credit risk assessments, commonly referred to as credit ratings. These ratings evaluate the creditworthiness of various entities, including corporations, sovereign nations, and financial instruments. By translating complex financial data into comprehensible ratings, ECAIs help investors, regulators, and institutions make informed decisions regarding credit risk.

Importance of Credit Risk Assessments

Credit risk assessments by ECAIs are crucial for determining the capital requirements of financial institutions. Under the CRR framework, the capital requirement is the amount of capital a bank or investment firm must hold to cover potential losses from credit risks. Accurate credit ratings ensure that these institutions hold sufficient capital to absorb losses, thereby protecting depositors and maintaining market confidence.

Regulatory Framework

The CRR establishes a standardised approach to credit risk assessment, which is essential for maintaining consistency and comparability across different jurisdictions and financial entities. This is achieved through detailed regulations that prescribe how ECAI ratings should be mapped to the CRR's credit quality steps. These steps form the basis for calculating risk-weighted assets and, consequently, the capital requirements for financial institutions.

Integration of ECAI Ratings into CRR Compliance

Financial institutions integrate ECAI ratings into their risk management frameworks to comply with the CRR. This integration involves mapping ECAI ratings to the CRR’s credit quality steps, which are predefined categories representing varying levels of credit risk. Each credit quality step corresponds to a specific risk weight, influencing the capital a financial institution must hold against a given exposure.

For example, a high credit quality step indicates lower risk and results in a lower capital requirement, whereas a lower credit quality step indicates higher risk and necessitates a higher capital reserve. This systematic approach ensures that capital reserves are proportional to the risk profile of the institution’s assets, thereby enhancing financial stability.

The Role of Regulation (EU) No 575/2013

Regulation (EU) No 575/2013 is the legislative foundation that enforces these prudential standards. It outlines the methodologies for calculating capital requirements and the criteria for recognizing ECAIs. The regulation ensures that ECAI assessments are robust, transparent, and reliable, providing a trusted basis for financial decision-making and regulatory compliance.

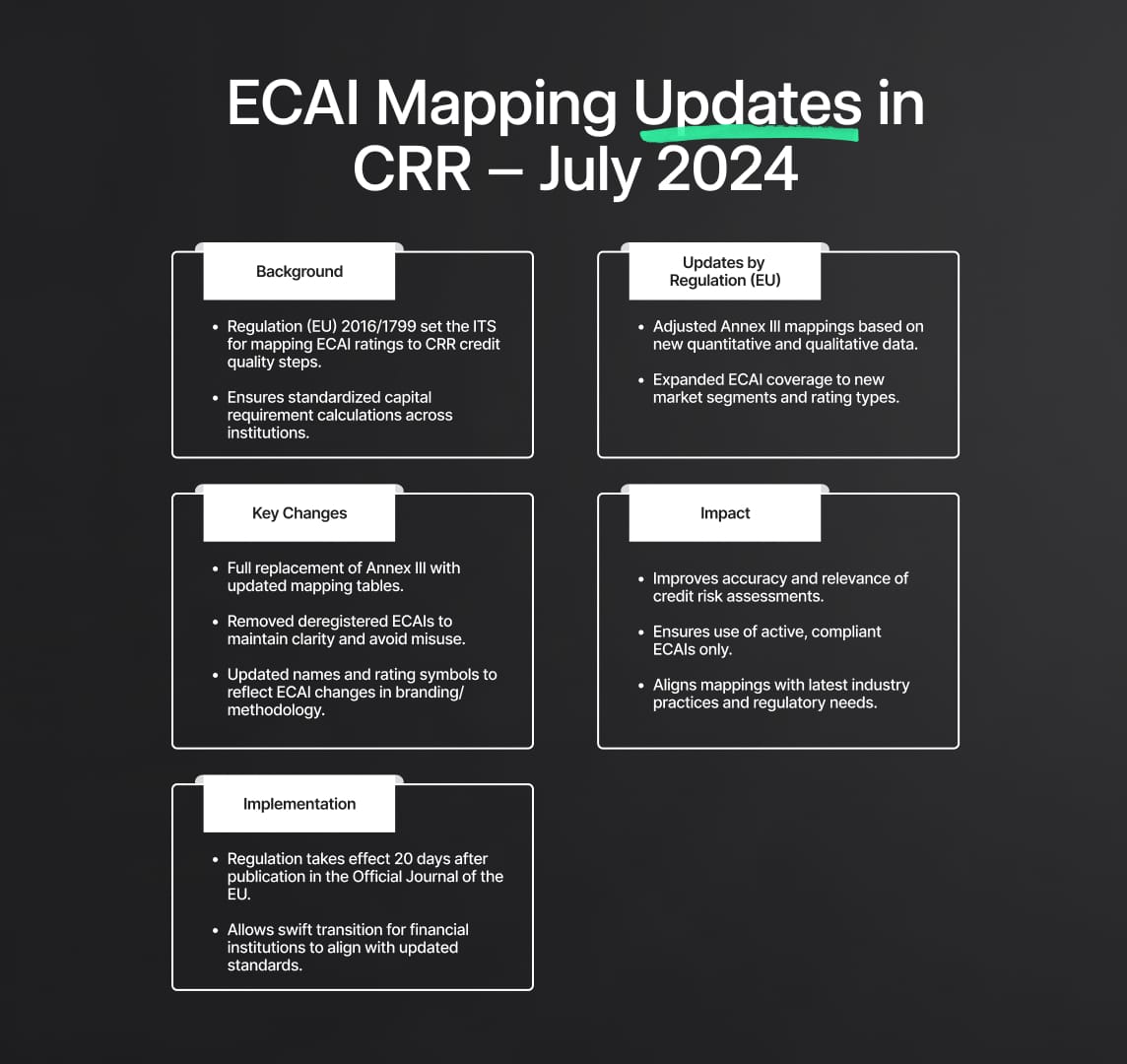

Recent Amendments to ECAI Credit Assessments Mapping

On July 1, 2024, the European Commission adopted a new Implementing Regulation amending the Implementing Technical Standards (ITS) specified in Commission Implementing Regulation (EU) 2016/1799. This amendment focuses on updating the mapping tables that define the correspondence between ECAI credit risk assessments and the credit quality steps outlined in the CRR.

Importance of the 2024 Amendments

These amendments are critical as they ensure that the ECAI credit assessments remain aligned with the evolving credit risk landscape. By keeping the mapping tables current, the amendments help maintain the accuracy and reliability of credit risk evaluations, which are fundamental to the integrity of the CRR framework.

Key Changes in the Draft Implementing Regulation

Overview of Commission Implementing Regulation (EU) 2016/1799

Commission Implementing Regulation (EU) 2016/1799, established on October 7, 2016, initially set forth the ITS for mapping ECAI credit assessments to the CRR’s credit quality steps. These mappings are essential for standardizing how different credit ratings translate into regulatory capital requirements.

Amendments by Commission Implementing Regulation (EU) 2021/2005

The 2021/2005 Regulation introduced significant updates to the original 2016/1799 Regulation. These updates were based on newly collected quantitative data and qualitative developments from various ECAIs. Key changes included:

- Adjustments to Annex III: Reflecting new quantitative information and qualitative advancements, resulting in updated mappings.

- Expansion of Credit Assessments: ECAIs extended their credit assessments to new market segments, necessitating new rating scales and credit rating types.

External Credit Assessment Institutions (ECAIs): Latest Amendments

The latest amendments, as outlined in the Commission Implementing Regulation of July 1, 2024, include several critical updates:

- Replacement of Annex III: Annex III of Regulation 2016/1799 is entirely replaced with updated mapping tables.

- Deregistration of ECAIs: Removal of mappings for deregistered ECAIs to maintain regulatory clarity.

- Name and Symbol Changes: Updates to the names and rating symbols of ECAIs to reflect current standards.

Implementation and Impact

The new amendments aim to:

- Remove Deregistered ECAIs: By eliminating the mappings for deregistered ECAIs, the regulation avoids potential confusion and maintains clarity.

- Update Names and Symbols: Reflect the updated names and rating symbols of existing ECAIs to ensure that the mappings remain relevant and accurate.

ECAI Credit Assessments Mapping in CRR

On July 1, 2024, the European Commission adopted a new Implementing Regulation that amends the Implementing Technical Standards (ITS) specified in Commission Implementing Regulation (EU) 2016/1799. This amendment focuses on updating the mapping tables that define the correspondence between ECAI credit risk assessments and the credit quality steps outlined in the Capital Requirements Regulation (CRR).

Overview of Commission Implementing Regulation (EU) 2016/1799

Commission Implementing Regulation (EU) 2016/1799, dated October 7, 2016, initially established the ITS for mapping ECAI credit assessments to the CRR’s credit quality steps. These mappings are essential for standardizing how different credit ratings translate into regulatory capital requirements. The purpose of these mappings is to create a consistent framework where ECAI ratings can be seamlessly integrated into the CRR’s capital calculation methodologies.

Amendments by Commission Implementing Regulation (EU) 2021/2005

The 2021/2005 Regulation introduced significant updates to the original 2016/1799 Regulation. These updates were based on newly collected quantitative data and qualitative developments from various ECAIs. The key changes included:

- Adjustments to Annex III: Reflecting new quantitative information and qualitative advancements, resulting in updated mappings. This ensures that the credit assessments accurately reflect the current credit risk environment.

- Expansion of Credit Assessments: ECAIs extended their credit assessments to new market segments, necessitating new rating scales and credit rating types. This expansion allows for a broader range of financial products and entities to be evaluated under the CRR framework.

Technical Details of the 2024 Amendments

The latest amendments, detailed in the Commission Implementing Regulation of July 1, 2024, include several critical updates that enhance the precision and applicability of the ECAI mappings:

- Replacement of Annex III: The complete overhaul of Annex III is designed to incorporate the latest data and methodological advancements in credit assessment. This ensures that the mapping tables are not only current but also more reflective of the diverse risk profiles encountered in the market today.

- Deregistration of ECAIs: With the deregistration of certain ECAIs, their mappings are removed to maintain regulatory clarity. This removal is essential to avoid any ambiguity in the application of credit assessments, ensuring that only active and compliant ECAIs are utilized in the CRR framework.

- Name and Symbol Changes: The regulation updates the names and rating symbols of ECAIs to reflect current standards. This includes recognizing changes in corporate identities and rating methodologies, thereby ensuring that the mappings are aligned with the latest practices and terminologies used by the ECAIs.

Implementation and Impact

The new amendments aim to:

- Remove Deregistered ECAIs: By eliminating the mappings for deregistered ECAIs, the regulation avoids potential confusion and maintains clarity. This ensures that financial institutions rely only on recognized and active ECAIs for their credit risk assessments.

- Update Names and Symbols: Reflect the updated names and rating symbols of existing ECAIs to ensure that the mappings remain relevant and accurate. This adaptation is crucial for maintaining the integrity and usability of the credit assessments within the CRR framework.

The draft Commission Implementing Regulation will enter into force on the twentieth day following its publication in the Official Journal of the EU. This prompt implementation ensures a swift transition to the updated regulatory standards, allowing financial institutions to adapt their risk management practices accordingly.

Role of Mapping in Credit Risk Assessment

The mapping process is a critical component of the Capital Requirements Regulation (CRR) framework, as it translates ECAI credit assessments into standardized credit quality steps. These steps are essential for calculating the capital requirements of credit institutions and investment firms. By standardizing these assessments, the CRR ensures consistency and comparability across various financial entities and jurisdictions, thereby enhancing the reliability and stability of the regulatory system.

Standardization and Consistency

The primary purpose of the mapping process is to create a uniform approach to evaluating credit risk across different institutions. This allows financial regulators and institutions to apply a consistent methodology when determining capital requirements. Without such a standardized approach, the subjective nature of credit assessments could lead to significant discrepancies in capital adequacy calculations, potentially undermining financial stability.

Integration into the CRR Framework

The CRR framework relies on these standardized mappings to integrate ECAI ratings into its capital calculation methodologies. Each ECAI rating is mapped to a specific credit quality step, which corresponds to a risk weight used in calculating risk-weighted assets. These risk weights are then used to determine the capital reserves that institutions must hold to cover potential losses.

For example, a high credit quality step, indicating lower risk, would result in a lower risk weight and thus a lower capital requirement. Conversely, a lower credit quality step, indicating higher risk, would result in a higher risk weight and a higher capital requirement. This systematic approach ensures that the capital reserves are proportional to the risk profile of the institution’s assets, enhancing the overall resilience of the financial system.

ECAI and CRR: Quantitative and Qualitative Factors

The mapping process incorporates both quantitative and qualitative factors to ensure that credit assessments are robust and comprehensive.

Quantitative Factors

Quantitative factors involve numerical data and statistical analysis, which provide an empirical basis for the mappings. Key quantitative factors include:

- Default Rates: Historical default rates of rated entities are crucial in determining the accuracy and reliability of ECAI ratings. Higher default rates may indicate a need for more conservative risk weights.

- Statistical Data: This includes a variety of metrics such as transition matrices, which track the movement of ratings over time, and loss given default (LGD) rates, which estimate the severity of losses if a default occurs.

- Historical Performance: The historical performance of credit ratings is analysed to assess their predictive power and stability over time. This analysis helps in calibrating the mappings to reflect actual risk levels accurately.

Qualitative Factors

Qualitative factors are equally important as they address aspects that quantitative data alone cannot capture. These include:

- Rating Methodologies: The methodologies used by ECAIs to assign ratings are scrutinized to ensure they are sound, transparent, and consistent. Any changes in methodologies are closely monitored and reflected in the mappings.

- Governance Structures: The governance and operational structures of ECAIs are evaluated to ensure they maintain high standards of integrity and independence. This includes assessing the processes in place for managing conflicts of interest and ensuring the accuracy of ratings.

- Market Developments: Changes in the broader financial market environment, such as economic cycles, regulatory changes, and emerging risks, are considered in the mapping process. These factors can influence the credit risk landscape and thus need to be integrated into the mappings.

Integration into the CRR Framework

The CRR framework relies on these standardized mappings to integrate ECAI ratings into its capital calculation methodologies. Each ECAI rating is mapped to a specific credit quality step, which corresponds to a risk weight used in calculating risk-weighted assets. These risk weights are then used to determine the capital reserves that institutions must hold to cover potential losses.

For example, a high credit quality step, indicating lower risk, would result in a lower risk weight and thus a lower capital requirement. Conversely, a lower credit quality step, indicating higher risk, would result in a higher risk weight and a higher capital requirement. This systematic approach ensures that the capital reserves are proportional to the risk profile of the institution’s assets, enhancing the overall resilience of the financial system.

Reduce your

compliance risks