ECON: Investor Protection Rules

On April 3, 2024, ECON published a report reinforcing investor protection rules in the EU. It focuses on amending key directives, including (EU) 2016/97, the Insurance Distribution Directive.

A major move was taken on April 3, 2024, by the Committee on Economic and Monetary Affairs (ECON) of the European Parliament to improve investor protection in the EU. This action took the form of a report that was released and included recommendations for changes to a number of directives that were meant to strengthen laws protecting investors. The directives in dispute are the Insurance Distribution Directive, the Markets in Financial Instruments Directive, the Solvency II Directive, and the Undertakings for Collective Investments in Transferable Securities IV.

A draft resolution detailing ECON's suggested changes to the law, which was approved following a vote in March 2024, is included in the report. Through these modifications, financial intermediaries will be forced to provide clients and consumers with more transparent, intelligible, and customized advice, thereby revolutionizing the current advise environment. Ensuring that people understand the information they are provided and obtain items that are specifically customized to their needs is the ultimate goal. This action is a major step in the right direction toward protecting and enhancing investor confidence in the financial system of the European Union.

Source

[1]

Directive 2009/65/EC: Safeguarding Investors and Fostering Market Confidence

Undertakings for Collective Investments in Transferable Securities IV (UCITS IV), commonly known as Directive 2009/65/EC, covers a number of important features that are meant to safeguard individual investors and promote trust in the financial system:

- Investor Protection: By requiring investment products to adhere to strict guidelines and disclosure requirements, UCITS IV seeks to protect the interests of individual retail investors. This involves informing investors in a transparent and thorough manner about the expenses and dangers connected with investment products.

- Harmonization: A unified regulatory framework for collective investment schemes functioning inside the EU is established by the regulation. This harmonization facilitates cross-border investment operations by making it easier for fund managers to offer their products throughout EU member states.

- Regulation of Fund Management: Fund managers are subject to operational, risk-management, and governance structure regulations under UCITS IV. This lessens the possibility of investor losses as a result of poor management by ensuring that fund managers conduct themselves wisely and responsibly.

- Investment limits: For UCITS funds, the directive lays forth precise standards for diversification and investment limits. By preventing money from being unduly concentrated in one asset class or investment, these limitations seek to reduce investment risks and safeguard investors.

- Disclosure Requirements: Under UCITS IV, fund managers must provide detailed information about the investing goals, strategies, risks, and fees of their funds, among other things. Investors are empowered to make well-informed choices regarding which funds to invest in thanks to this transparency.

- Cross-Border Distribution: By creating a uniform legal framework for marketing and selling funds inside the EU, the directive makes it easier for UCITS funds to be distributed across national borders. This increases market efficiency and gives investors more options and competition.

In general, the European Union's collective investment market benefits greatly from the promotion of investor protection, market transparency, and cross-border investment activity according to Directive 2009/65/EC.

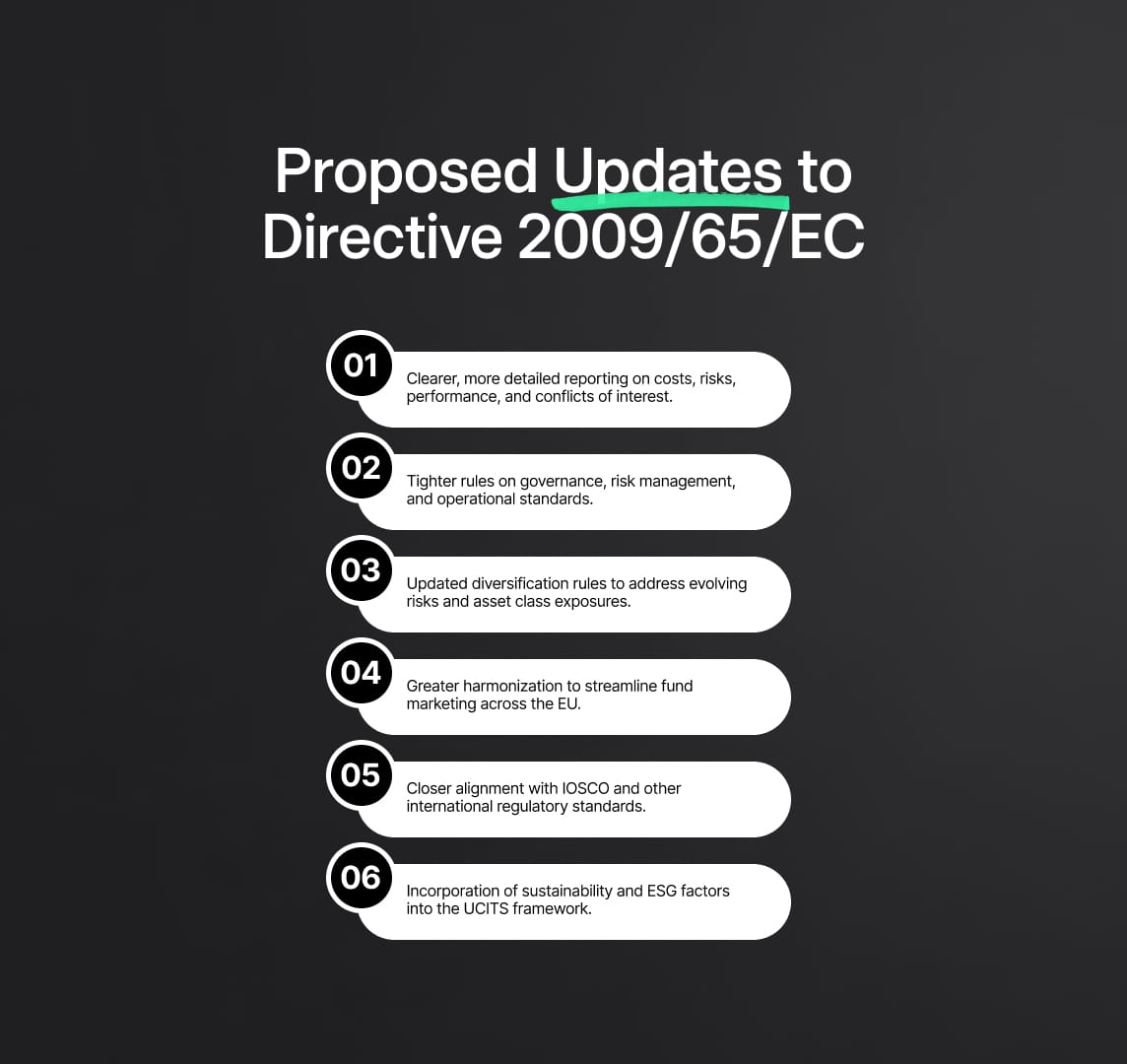

Proposed Regulatory Changes for Directive 2009/65/EC: Strengthening Investor Protection and Market Integrity

Regulations pertaining to Directive 2009/65/EC (UCITS IV) are frequently amended with the intention of strengthening market transparency, protecting investors, and encouraging cross-border investing activity. The following are a few possible regulatory adjustments for this directive:

- Enhanced Investor Disclosure Requirements: Strengthening the requirements for fund managers to give investors clear and thorough information about the costs, performance, and risks associated with investment products is known as "Enhanced Investor Disclosure Requirements." Further disclosures regarding fees, charges, and conflicts of interest might be part of this.

- Stricter Fund Management Regulations: To guarantee the sensible and accountable management of investment funds, more stringent rules have been placed on fund managers with respect to risk management procedures, governance frameworks, and operational requirements.

- Extension of Investment limitations: UCITS funds' investment limitations and diversification standards will be updated to take into account new risks and reflect changing market conditions. This could entail strengthening risk management procedures or placing restrictions on exposure to particular asset classes.

- Harmonization of Cross-Border Distribution Regulations: To facilitate fund managers' work and encourage more investor choice and market efficiency, further unifying regulatory requirements for the cross-border marketing and distribution of UCITS funds is necessary.

- Alignment with International Standards: In order to improve regulatory coherence and promote global market integration, regulatory standards under Directive 2009/65/EC shall be aligned with international best practices and standards, such as those established by the International Organization of Securities Commissions (IOSCO).

- Overview of ESG and Sustainability Considerations: The regulatory framework for UCITS funds will incorporate environmental, social, and governance (ESG) elements in order to fulfill the growing demand from investors for responsible investment options and to encourage sustainable investing.

The objectives of these regulation modifications are to enhance market integrity, safeguard investors, and promote the growth of a more robust and sustainable investment environment inside the European Union.

Enhancements originally intended by Directive 2009/65/EC: Enhancing Market Dynamics and Investor Protection

Directive 2009/65/EC, often known as UCITS IV, aims to strengthen the European financial landscape and is expected to bring about a number of noteworthy enhancements. These improvements are expected to strengthen protections for investors and stimulate market dynamics in the EU.

First and foremost, the directive aims to improve transparency standards by making certain that investors receive clear and thorough information about the prices, risks, and performance indicators of investment products. Investors can make better selections that are in line with their financial goals and risk tolerance by encouraging greater openness.

Additionally, the goal of UCITS IV is to improve regulatory supervision by imposing stricter rules on risk management procedures, governance structures, and operational procedures for fund managers. These kinds of steps play a crucial role in strengthening the cautious and accountable management of investment money, which reduces the possibility that investor losses would result from improper handling. Modernizing investment limitations and diversification requirements for UCITS funds is another goal of the directive, which takes into account changing market conditions and new risk profiles. The directive aims to mitigate excessive concentration risks in investment portfolios and maximize risk-adjusted returns by adjusting these parameters.

In addition, UCITS IV aims to harmonize regulatory frameworks and market access criteria to reduce cross-border distribution rules and enable the smooth marketing and distribution of investment funds among EU member states. In addition to improving market efficiency, this harmonization increases investor choice and accessibility to a wider range of investment possibilities.

In the end, Directive 2009/65/EC's suggested enhancements represent a determined attempt to strengthen investor rights, promote market transparency, and cultivate a robust and vibrant investment environment throughout the European Union.

Enhancing Retail Investor Protection: Insights on Directive 2009/138/EC (Solvency II)

The foundation of insurance regulation in the European Union is Directive 2009/138/EC, sometimes known as the Solvency II Directive. Solvency II is a risk-based regulatory framework that was implemented to strengthen policyholder protection and the financial stability of insurers. This introduction explores the main features of the directive, summarizing its regulations including reporting requirements, governance, capital requirements, and supervision. By implementing these steps, Solvency II hopes to strengthen risk management techniques, accountability, and openness throughout the insurance sector, making it more resilient to changing market conditions:

- Risk-Based Regulatory Framework: For insurance firms doing business in the European Union, Solvency II creates a thorough risk-based regulatory framework. Its objectives are to improve policyholder protection and guarantee the insurers' financial stability.

- Capital Requirements: The regulation lays out the precise capital levels that insurance providers must maintain in order to cover a range of risks, including operational, market, and underwriting risks. The purpose of these standards is to provide sufficient financial resources to fulfill policyholder obligations, and they are determined by taking into account the risk profile of the organization.

- Supervisory Review procedure: In order to make sure insurance businesses follow the law and continue to be financially stable, the regulation requires a supervisory review procedure. The capital sufficiency, governance structures, and risk profiles of insurers are routinely evaluated by supervisory bodies.

- Reporting and Disclosure Requirements: In order to maintain transparency with stakeholders, such as investors, regulators, and policyholders, insurers must comply with a number of reporting and disclosure requirements placed on them by Solvency II. Regular reports on the financial standing, risk exposures, and solvency positions of insurers are mandated.

- Group Supervision: Under the rules of the directive, supervisory agencies can now supervise insurance groups that operate throughout several EU member states. This guarantees uniform oversight and regulation of insurance companies that operate internationally.

Regulatory Transformations Under Directive 2009/138/EC: Solvency II Implications

The Solvency II Directive marks a substantial regulatory change for the insurance industry in the European Union. In the first place, it presents a dynamic risk-based approach to capital requirements, which substitutes more sophisticated evaluations catered to the unique risk profiles of insurers for earlier static models. Second, in order to successfully mitigate risks, Solvency II requires strict governance and risk management standards, which calls for strong internal controls and supervision procedures. The regulation also creates a thorough supervisory framework that gives regulatory bodies the ability to regularly evaluate insurers' solvency status and compliance with legal obligations. In addition, Solvency II places significant reporting and disclosure requirements on insurers, encouraging openness and responsibility towards stakeholders. The overall goal of the regulatory modifications made in accordance with Directive 2009/138/EC is to improve the insurance sector's stability and resilience, which will ultimately protect policyholder interests and increase market trust.

Solvency II Directive: Navigating Regulatory Evolution in the Insurance Landscape

The Solvency II Directive is a significant turning point in the regulatory environment that surrounds the insurance industry in the European Union. It represents a dramatic break from conventional regulatory paradigms with its dynamic risk-based approach to capital needs, strict governance norms, extensive supervisory framework, and increased reporting duties. Through the prioritization of financial stability, transparency, and policyholder protection, Solvency II cultivates an insurance ecosystem that is both resilient and accountable. The directive's lasting impact rests in its capacity to foster sustainability, inspire trust, and protect the integrity of the insurance market for the good of all parties involved, even while insurers adjust to these regulatory changes.

MiFID II (Directive 2014/65/EU): Investor Security and Market Clarity

The Markets in Financial Instruments Directive (MiFID II), also known as Directive 2014/65/EU, is an important piece of EU legislation that aims to improve investor protection and foster financial market transparency. It tackles a number of issues that retail investors confront, such as the requirement for more transparent disclosure documents, risk mitigation related to deceptive marketing tactics, and handling of conflicts of interest in financial advice. Here are the principal aspects and regulation modifications:

- Openness and Disclosure: MiFID II places a strong emphasis on the necessity of giving retail investors access to transparent, pertinent, and interesting disclosure materials. To help with better decision-making, this includes making information about investment offers more transparent.

- Supervision of Marketing Activities: The directive recognizes the dangers associated with deceptive marketing tactics and materials, especially when they are distributed via digital platforms. In order to shield retail investors from misleading advertising, it proposes measures to tighten oversight and regulation of marketing activities.

- Conflicts of Interest: Investment firms and intermediaries may get fees, commissions, or other benefits from other parties. MiFID II tackles these types of conflicts of interest. By putting stronger regulations into place and improving openness around inducement payments, it seeks to lessen these conflicts.

- Best Interest Obligations: The directive restates financial advisors' duty to behave in their clients' best interests. It suggests doing away with current standards for service quality enhancement in inducement payments and establishing a new unified test to make advisors' duties to put clients' interests first clear.

- Improved Investor Protection Framework: In general, MiFID II aims to improve the EU's investor protection framework, providing retail customers with uniform protection across a range of product categories and distribution methods. It seeks to increase financial market transparency and trust while advancing efficient and just investment practices.

The Impact of MiFID II Directive on European Financial Markets

The European Commission states that Directive 2014/65/EU, also referred to as MiFID II, offers investors and the European financial markets the following opportunities:

- Enhanced Investor Protection: By raising standards for disclosure, transparency, and the caliber of financial advice, MiFID II seeks to fortify investor protection. This may boost investor faith and confidence in the financial system, encouraging more involvement and investment activity.

- Better Market Integrity: To counter market abuses including insider trading and manipulation, the directive adds stronger regulations and oversight procedures. MiFID II promotes more equitable and effective financial markets by strengthening market integrity, drawing in both domestic and foreign investors.

- Enhanced Innovation and Competition: MiFID II encourages competition amongst financial institutions by leveling the playing field and making clearinghouses and trading venues more accessible. This may encourage financial services and product innovation, increasing efficiency and lowering costs for investors.

- Harmonization of laws: The goal of MiFID II is to reduce regulatory fragmentation and obstacles to cross-border investment by harmonizing laws among EU member states. As a result, there will be just one market for financial services, which will facilitate investors' access to a wider range of options and allow them to take advantage of economies of scale.

- Increased Accountability and Transparency: Under the mandate, financial institutions must provide additional details about their services, goods, and pricing policies. As a result of the greater transparency, investors will eventually benefit from improved market efficiency and the ability to make more informed judgments.

Overall, it is believed that MiFID II would protect investor interests and maintain market integrity while acting as a stimulus for the growth, integration, and competitiveness of the European financial markets.

Retail Investor Safeguards under Directive EU 2016/97

Within the Capital Markets Union (CMU), the European Parliament and Council of the European Union are moving forward with initiatives to fortify protections for individual investors and increase consumer trust. The EU Retail Investment Strategy's proposed guidelines aim to address some shortcomings that have been discovered, such as challenges in understanding investment possibilities, dangers related to digital marketing, and prejudices in investment advice.

Third-party payments, or "inducements," are a particular source of worry, leading to proposals for stronger safeguards to guarantee uniform protection of retail customers throughout the Union. The purpose of amendments is to make financial intermediaries provide clear, customised advice so that consumers may make well-informed decisions. Significantly, as long as openness and legal compliance are upheld, the proposed amendments to Directive (EU) 2016/97 emphasise the value of insurance intermediaries providing unbiased advice to evaluate a wide range of insurance products.

Furthermore, the purpose of the modifications is to improve the standards that regulate inducements by highlighting the importance of putting the client's best interests first. When recommending products to clients, financial advisors are supposed to take performance, risk, and cost into account. In order to enhance retail investors' comprehension of inducements and related conflicts of interest, more stringent disclosure regulations are also planned.

Robust assessment processes will be put in place to guarantee that these policies are effective in improving consumer protection and market efficiency. In order to guarantee the equity and rationale of expenses imposed on individual investors, member states are urged to make certain that companies producing or selling investment products follow open pricing procedures. All things considered, the goal of these legislative initiatives is to foster a more open and consumer-focused investing environment, enabling ordinary investors to make wise choices and take full advantage of opportunities in the capital markets.

Enhancing Retail Investor Protection: Key Regulatory Changes under Directive (EU) 2016/97

Significant regulatory changes are brought about by Directive (EU) 2016/97 with the goal of improving the protection of retail investors in the financial system of the European Union. The European Parliament and the Council of the European Union have proposed revisions to the Capital Markets Union (CMU) that try to improve the perceived deficiencies. The directive aims to empower retail investors to make well-informed decisions while maintaining transparency and fairness in financial transactions. It does this by enforcing tougher safeguards, strengthening disclosure standards, and placing an emphasis on tailored advice:

- More Robust Protection for Retail Investors: The directive adds more robust protections for retail investors, guaranteeing consistent coverage throughout the European Union. This includes steps to reduce conflicts of interest and improve financial advice's transparency.

- Enhanced Disclosure Requirements: Financial intermediaries are subject to greater disclosure requirements under the directive, especially with relation to inducements and conflicts of interest. The goal of this is to increase retail investors' comprehension of the goods and services that are available to them.

- Focus on Tailored Advice: It is required for financial intermediaries to furnish customers and consumers with advice that is more clear, comprehensible, and customized. The purpose of this change is to make sure that investment recommendations meet the unique requirements and goals of individual retail investors.

- Evaluation of Insurance Products: A wide range of insurance products that are on the market must be evaluated by insurance intermediaries that provide impartial counsel. The purpose of this rule is to guarantee that advice made to retail investors are thorough and informed.

- Refinement of Inducement Criteria: The directive emphasizes the value of operating in the client or customer's best interest while clarifying the rules pertaining to the payment or acceptance of inducements. It is required of financial advisors to suggest products that best meet the needs of their clients, taking into account a range of characteristics like performance, risks, and costs.

- Strict Assessment Procedures: The directive requires the establishment of strict assessment procedures in order to determine how well the regulatory modifications have improved market efficiency and consumer protection. This entails consistent observation and documentation to guarantee that the intended goals are fulfilled.

By making investments more transparent and focused on the needs of the customer, these legislative amendments hope to enable retail investors to make wise choices and take full advantage of capital market opportunities.

The Impact of Directive (EU) 2016/97 on Investor Protection

To sum up, the regulation modifications brought about by Directive (EU) 2016/97 provide a noteworthy advancement in improving the safeguarding of individual investors in the European Union. The directive seeks to promote an investment environment that is more focused on the needs of the customer by tightening regulations, increasing transparency through disclosure requirements, and placing greater emphasis on customized advice. Retail investors will be better equipped to make educated decisions and confidently negotiate the complexity of the financial markets thanks to these reforms. The execution of the directive should ultimately lead to a more robust and transparent financial environment, which will be advantageous to investors and the stability of the Capital Markets Union as a whole.

Reduce your

compliance risks