eIDAS 2.0 Regulation

Explore the impact of eIDAS 2.0 on financial security & identity. Banks seek clarity on SCA to balance innovation with regulatory compliance, ensuring EU market growth & digital trust.

eIDAS 2.0 SCA Obligations: Citing PSD2 Framework

European Banking Associations and eIDAS 2.0:

- Objective:

- Ask for more clarification regarding how the eIDAS 2.0 regulation's Strong Customer Authentication (SCA) procedures are being implemented.

- Recognition of Significance:

- Recognize the importance of eIDAS 2.0 and its potential advantages in the financial ecosystem as well as other businesses, particularly with regard to the EU Digital Identity Wallet (EUDIW).

- Concerns Raised:

- Voice your concerns over the absence of precise rules for implementing SCA in financial transactions.

- Draw attention to the EUDIW framework's potential for misuse by huge technology corporations, procedural delays, and legal confusion.

- Necessity of Regulatory Clarity:

- Emphasize the importance of having a clear regulatory framework.

- Emphasize that stability and security may be jeopardized by ambiguity in SCA applications under eIDAS 2.0.

- SCA within PSD2 Framework:

- Remind stakeholders that the Revised Payment Services Directive (PSD2), which regulates electronic payments, has SCA firmly established within its framework.

- Financial Burden Caution:

- Avoid requiring the SCA protocols of eIDAS 2.0 for all financial transactions.

- Draw attention to possible financial costs, particularly those associated with creating and implementing EUIDW-compliant solutions.

- Advocacy for a Balanced Approach:

- Encourage a well-rounded strategy that protects the security advantages of SCA while sparing financial institutions from needless expenses or complexity.

- Dialogue with Policymakers:

- Have a conversation with regulators and lawmakers.

- Encourage the creation of clear, concise standards that will match the goals of eIDAS 2.0 with the actual needs of the financial industry.

- Support for Innovation and Competition:

- Demand the creation of a legal framework that protects digital identities and encourages competition and innovation.

- Respond to any possible issues raised by popular tech platforms.

- Overall Goal:

- Make it easier for eIDAS 2.0 to be integrated into the world of digital payments.

- Make sure the change improves consumer protection, fosters confidence in online transactions, and helps the European financial sector expand and become more competitive.

eIDAS 2.0 Regulation: Redefining Financial Security and Digital Identity

Financial Sector Transformation with eIDAS 2.0:

- Transformative Journey:

- With the implementation of the eIDAS 2.0 law, the financial industry is about to embark on a revolutionary adventure.

- Paradigm Shift:

- eIDAS 2.0 is a paradigm shift as well as an update.

- Intended to improve the security of digital transactions and change the way that digital identification is managed in the EU.

- European Banking Associations' Involvement:

- European Banking Associations are heavily involved, with a wide range of financial institutions represented.

- Focus on Strong Customer Authentication (SCA):

- Carefully weighing the effects of SCA measures, a crucial eIDAS 2.0 feature.

- Integration with EUDIW:

- Expecting unheard-of security advantages from the SCA's integration with the EU Digital Identity Wallet (EUDIW).

- Intends to create a new benchmark for financial transactions.

- Recognition of Innovation Potential:

- Potential for innovation is acknowledged through the combination of EUDIW and SCA.

- Urgent Call for Regulatory Guidance:

- Urgent call for precise regulatory guidance to ensure a smooth transition.

- A focus on encouraging progressive use of new financial technologies and legal clarity.

- Anticipated Benefits Across Industries:

- Expectations that security will have an impact on a number of businesses outside of banking.

- Ensuring Legal Certainty:

- Highlights the requirement for regulatory guidance in order to guarantee legal clarity.

- Strives for a smooth transition that makes implementing new financial technologies easier.

- Setting a New Standard:

- Eager to introduce improved security and effective digital identity management to establish new benchmarks for financial processes.

Deciphering SCA Under the eIDAS 2.0 Regulation: A Call for Clarity

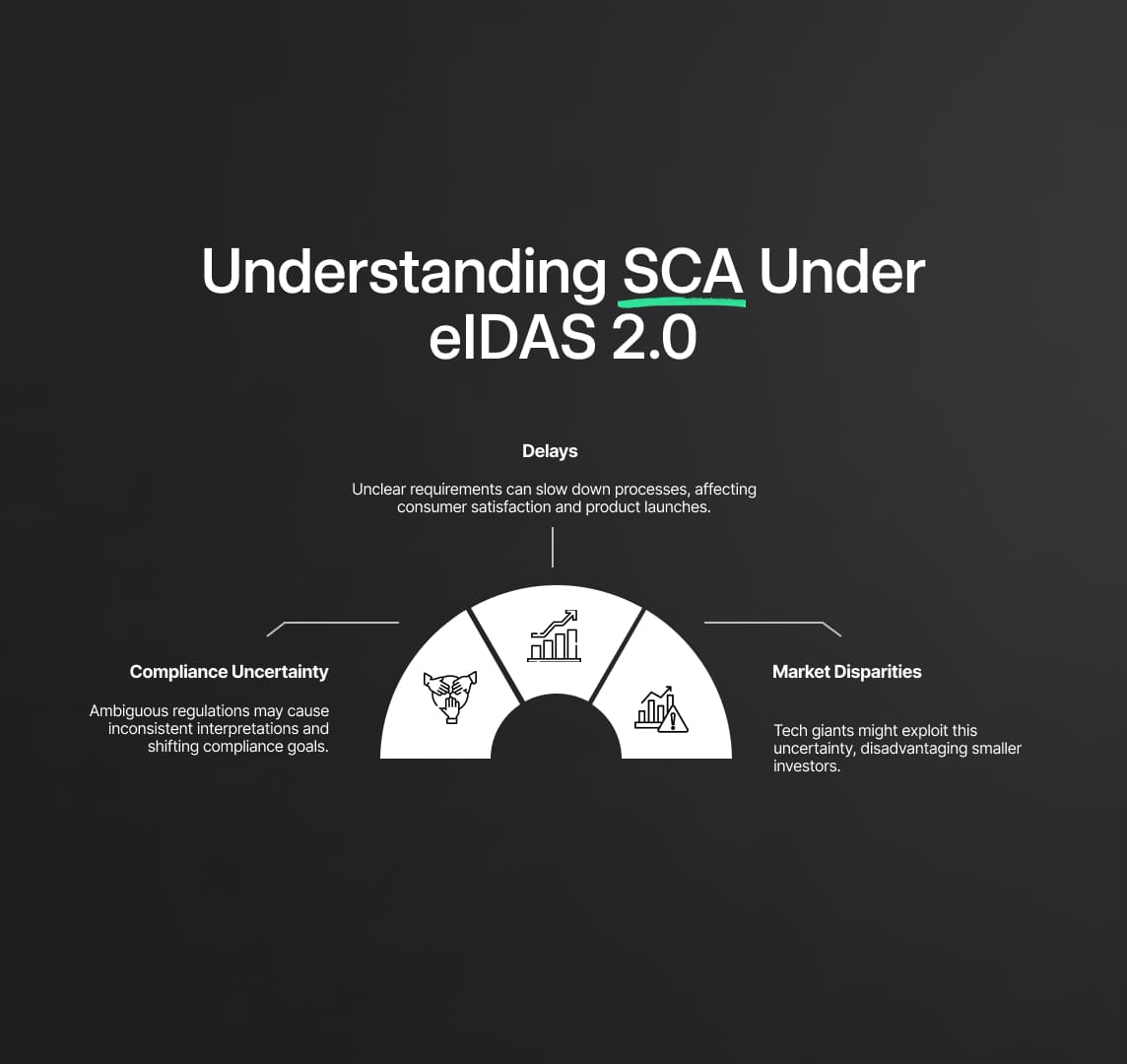

Financial institutions are becoming increasingly concerned about the finer points of implementing SCA in accordance with eIDAS 2.0 regulation. The absence of clear guidelines carries a danger of multiple negative consequences:

- For financial companies, compliance can become a moving goal due to legal ambiguity that can result in a patchwork of interpretations.

- Uncertain requirements might cause procedural delays, which can negatively impact consumer satisfaction and postpone the release of innovative products.

- There's a chance that tech behemoths will take advantage of this unpredictability, which might tilt the odds against smaller investors.

The European Banking Associations must keep pushing for a clear alignment of SCA measures with the current PSD2 framework in light of these concerns. Through their advocacy, they hope to prevent unexpected consequences for the institutions that are the foundation of the European economy from arising from future financial regulation.

eIDAS 2.0 Regulation Guidelines

The banking industry's pursuit of fair eIDAS 2.0 regulatory norms emphasizes the importance of a crucial conversation between legislators and financial institutions. The associations are promoting a set of values that support:

- A regulatory framework that promotes digital innovation while simultaneously maintaining security.

- SCA procedures that prevent fraud without making transactions with customers too complicated or expensive.

- A market that is competitive and free from the hegemony of big tech companies, allowing innovations to flourish.

The European Banking Associations' cooperative strategy seeks to balance the industry's demand for flexibility and innovation with the strict security standards of eIDAS 2.0, guaranteeing that the final rules will be advantageous to all parties involved in the digital economy.

eIDAS 2.0 Regulation and Its Impact on Investment Dynamics

It is anticipated that market dynamics and investment will be significantly impacted by the financial sector's adaption to the eIDAS 2.0 law. The goal of financial institutions is to make sure this shift happens:

- Builds customer trust and creates a safe atmosphere for online transactions.

- Stimulates the market and raises the level of global competitiveness of the European banking sector.

- Prevents the adoption of unnecessary regulations that can hinder the industry's innovation and growth.

The goal of the European Banking Associations' voluntary acceptance of SCA procedures is to focus investments on legitimate market demands, protecting the EU's financial sovereignty and promoting a robust, demand-driven market.

Strategic Compliance Initiatives in the Wake of eIDAS 2.0 Regulation

As the eIDAS 2.0 rule ushers in a new era of compliance, financial institutions are taking calculated steps to make sure they are prepared and flexible. Among these actions are:

- Proactively negotiating with regulatory agencies to shape and get ready for the upcoming changes.

- Developing innovative, adaptable technology solutions that enable current and upcoming developments while satisfying the requirements of the eIDAS 2.0 law.

- Identifying and reducing any risks related to the new regulation's integration with the current systems by carrying out thorough impact evaluations.

For financial institutions to successfully negotiate the regulatory changes brought about by eIDAS 2.0 and maintain their compliance, competitiveness, and leadership position in secure digital banking, several forward-thinking tactics are crucial.

The way the eIDAS 2.0 regulation is developing is evidence of how the financial industry is changing. The European Union's financial landscape will become more secure, inventive, and competitive as financial organizations and regulators work together to improve the SCA standards. The European Banking Associations' foresight and proactive actions will surely influence the successful integration of eIDAS 2.0 and open the door for a robust and vibrant digital economy.

Read More

Reduce your

compliance risks