ELTIF Regulation: Impact on Long-Term Investment Funds

The ELTIF Regulation, updated through the Corrigenda of March 2023 and September 2024, refines key aspects like investment policies, portfolio diversification, and borrowing limits. Changes to Article 1(11)(b) enhance transparency in investor transfers, supporting long-term investment strategies.

The European Long-Term Investment Funds (ELTIF) Regulation has been shaped by significant regulatory refinements, particularly through the Corrigenda of 20 March 2023 and 17 September 2024. These amendments focus on core operational elements like investment policies, portfolio diversification, and borrowing limits, which are essential for the continued viability and risk management of ELTIFs. The updates primarily address Article 1(11)(b), which deals with the transfer of units or shares between exiting investors and potential investors, aiming to enhance the transparency and fairness of transfer processes, while tightening rules on portfolio composition and leverage to better align with the evolving needs of long-term investment strategies.

Source

[1]

[2]

Overview of the ELTIF Regulation

The ELTIF Regulation was initially introduced under Regulation (EU) 2015/760 to promote investment in long-term, illiquid assets that support sustainable economic growth across the European Union. The regulation’s design allows for both retail and professional investors to participate in the financing of projects that typically require patient capital, such as infrastructure development, real estate, and small and medium enterprises (SMEs). These asset classes are crucial for the EU’s objectives to bolster innovation, job creation, and sustainability while offering investors access to high-value, long-term investment opportunities.

ELTIFs provide a carefully regulated platform for such investments by imposing stringent controls over the types of assets that can be included, how portfolios are constructed, and the limits on borrowing to minimise risk exposure. The regulation's core objectives are twofold: to offer a reliable channel for long-term capital deployment and to protect investors from the higher risks typically associated with illiquid investments.

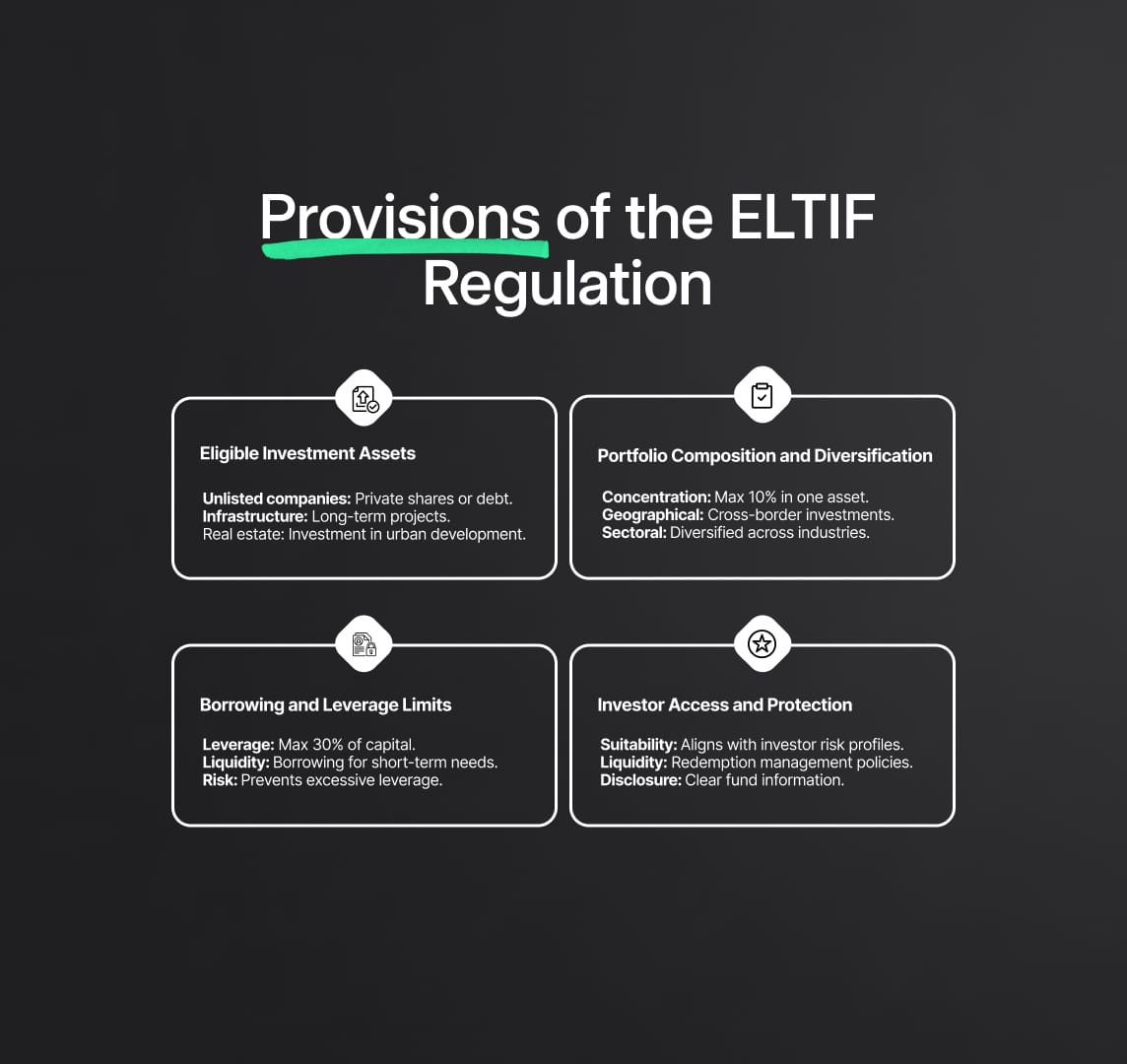

Provisions of the ELTIF Regulation

- Eligible Investment Assets: Under the ELTIF Regulation, eligible assets are restricted to a defined subset that aligns with the long-term, illiquid nature of the fund. These assets include:The strict categorisation of eligible assets ensures that ELTIFs remain focused on investments that genuinely require long-term commitment, as opposed to highly liquid or speculative investments.

- Unlisted companies: ELTIFs are permitted to invest in shares or debt instruments of unlisted companies, fostering access to capital for private enterprises that may not have access to public equity markets.

- Infrastructure projects: Investments in infrastructure, such as transport, energy, and telecommunication networks, are encouraged due to their typically stable and long-term returns.

- Real estate: ELTIFs can acquire properties or invest in real estate-related projects that support urban development, housing, or commercial spaces, provided these assets meet the regulatory criteria for long-term investments.

- Other illiquid assets: These can include debt instruments, loans, or equity stakes in projects that require patient capital and have a clear timeline for returns, often exceeding 10 years.

- Portfolio Composition and Diversification: The ELTIF Regulation imposes rigorous rules on portfolio composition to mitigate the risks associated with concentrated investments in a single asset class or sector. ELTIFs must adhere to minimum diversification thresholds, ensuring that no single investment or asset class disproportionately affects the fund's overall risk profile.Key diversification rules include:These portfolio requirements are designed to ensure that ELTIFs are not overexposed to the failure of any single investment, aligning with the fund's long-term objectives of stability and growth.

- Concentration limits: ELTIFs are typically not permitted to invest more than 10% of their assets in a single project or entity, with some exceptions based on the size and nature of the investments.

- Geographical diversification: The regulation encourages cross-border investments, particularly within the EU, to reduce exposure to local market risks and enhance the pan-European nature of ELTIFs.

- Sectoral diversification: Funds are advised to spread their investments across different sectors, such as energy, transportation, and technology, to cushion against sector-specific downturns.

- Borrowing and Leverage Limits: Borrowing restrictions are a critical part of the ELTIF framework, aimed at preventing excessive leverage that could magnify risks for investors, particularly in the event of a market downturn. The regulation sets clear caps on how much an ELTIF can borrow, both for investment purposes and to meet liquidity needs.These rules are especially important for retail investors, who might otherwise be exposed to significant risks if the ELTIF employs high levels of leverage.

- Leverage cap: ELTIFs are generally limited to borrowing up to 30% of their capital base, ensuring that funds are not over-leveraged and do not expose investors to excessive risks.

- Borrowing for liquidity management: While ELTIFs primarily deal in illiquid assets, they are permitted to borrow funds to manage short-term liquidity needs, such as paying out dividends or meeting redemptions. However, such borrowing must remain within prescribed limits to avoid undue risk.

- Investor Access and Protection: The ELTIF framework is designed to be inclusive, providing access to both professional and retail investors. However, additional layers of protection are in place for retail investors, given their limited ability to absorb significant losses or withstand long periods of illiquidity.

- Suitability assessments: For retail investors, fund managers are required to conduct thorough suitability assessments to ensure that the ELTIF’s long-term and illiquid nature aligns with the investor's risk profile and investment objectives.

- Liquidity management: Despite their illiquid nature, ELTIFs are required to have mechanisms in place for managing investor redemptions, particularly when such funds are not listed on secondary markets. This includes policies for handling early redemptions under exceptional circumstances.

- Disclosure requirements: Fund managers must provide clear and comprehensive disclosures to investors, including details on the fund’s investment strategy, risk factors, and fees, ensuring that retail investors can make informed decisions.

ELTIF Regulation: Examination of the Corrigenda

1. Corrigendum to Regulation 2023/606 (Published 20 March 2023)

The March 2023 corrigendum introduced key updates to Article 1(11)(b) of the ELTIF Regulation, focusing on improving the process of matching transfer requests between exiting and potential investors. These updates were designed to ensure that the process is handled in a transparent and fair manner, minimizing the risk of liquidity shortfalls and promoting a more structured approach to investor exit and entry.

Original Text of Article 1(11)(b): The original wording of the article permitted the matching of transfer requests between existing and potential investors but lacked precision regarding the types of investors involved. This ambiguity created operational challenges, particularly when it came to determining how the matching process should apply to fund exit strategies and new investor onboarding.

Updated Text (Post-Corrigendum): The corrigendum resolved this issue by replacing "existing investors" with "exiting investors," thereby clarifying that the matching process applies explicitly to those looking to exit the fund. This small but critical change ensured that fund managers could now clearly distinguish between current holders of ELTIF shares and those who wish to leave the fund, thus enhancing both operational efficiency and transparency. This distinction is particularly important given the illiquid nature of the assets held by ELTIFs, as it affects how liquidity is managed when investors wish to transfer their shares.

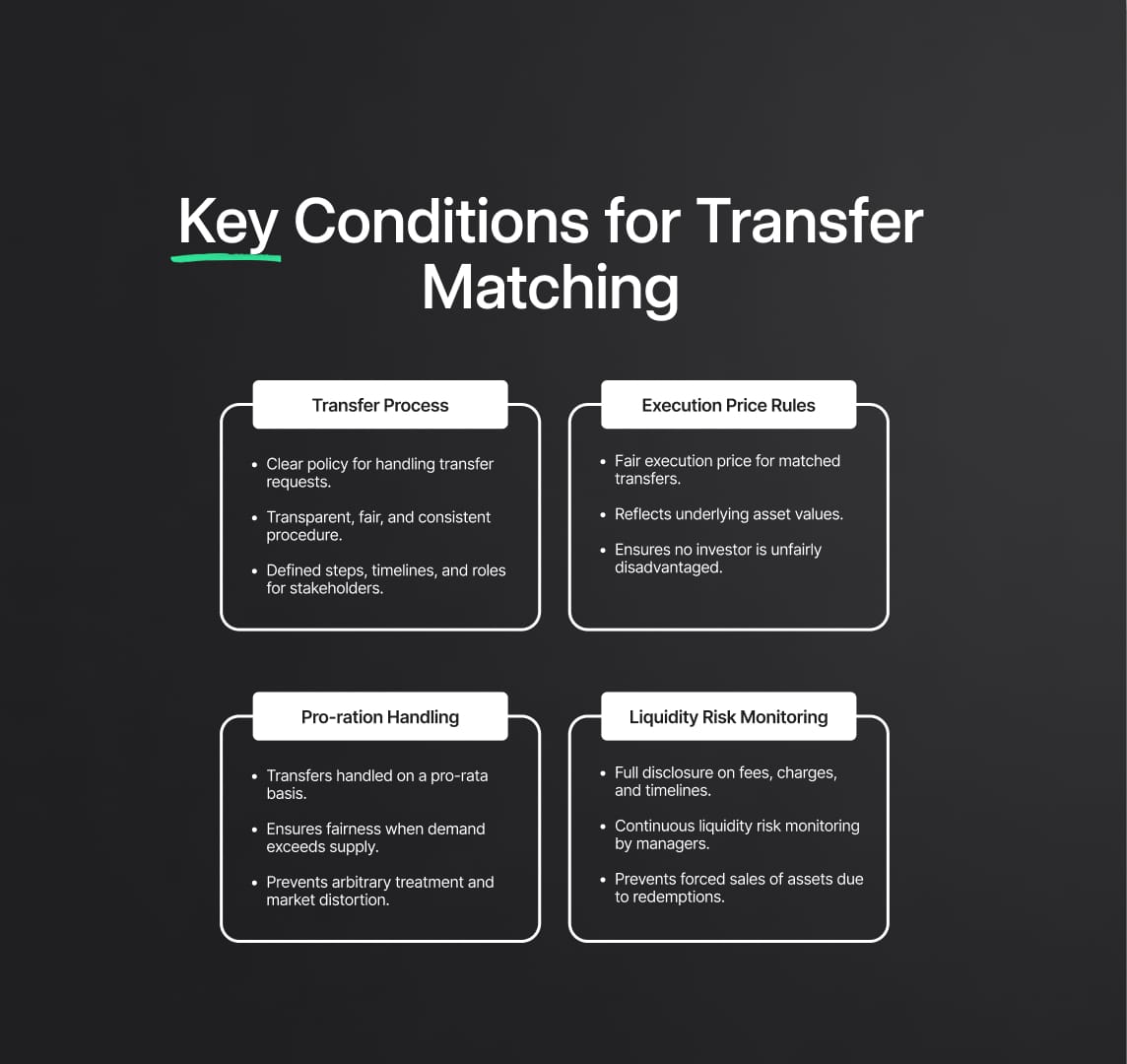

Key Conditions for Transfer Matching

The corrigendum introduces detailed provisions governing the transfer matching process to safeguard both exiting and potential investors while ensuring that the ELTIF manager maintains control over the fund’s liquidity risk and long-term strategy. These conditions include the following:

- Transfer Process: ELTIF managers or fund administrators are now required to establish a clear policy for handling transfer requests, ensuring that the process is transparent, fair, and consistent. The policy must include detailed steps on how both exiting and potential investors can submit requests, the timeframe within which these requests must be processed, and the roles of different stakeholders in facilitating these transfers. By mandating this level of procedural detail, the corrigendum seeks to create a more structured and efficient approach to investor transfers, reducing operational delays and errors.

- Execution Price Rules: One of the central elements introduced by the corrigendum is the requirement for transparent rules on the execution price for matched transfers. The execution price must be calculated in a way that is fair to both exiting and potential investors, ensuring that neither party is unfairly disadvantaged by the transfer process. This is particularly important in the context of ELTIFs, where illiquid assets such as infrastructure or real estate can fluctuate in value over time. By enforcing clear execution price rules, the corrigendum ensures that the valuation of shares remains accurate and reflective of the underlying asset values.

- Pro-Ration and Mismatch Handling: In cases where there is a mismatch between the number of exiting investors and potential investors, the corrigendum mandates that transfers be conducted on a pro-rata basis. This means that if the demand to exit or enter the fund exceeds the available supply of counterparties, the transfer requests must be fulfilled proportionally, rather than favoring one group over another. This provision ensures fair treatment for all investors, preventing arbitrary or preferential treatment and reducing the risk of market distortions caused by transfer mismatches.

- Disclosure and Transparency: Transparency is a core principle of the revised ELTIF Regulation, and the corrigendum strengthens the requirement for full disclosure regarding the transfer process. Fund managers are required to provide detailed information on fees, charges, and the timeline for processing transfer requests, ensuring that investors have full visibility into the costs and timeframes associated with exiting or entering the fund. This level of disclosure is particularly important for retail investors, who may have less experience in navigating complex financial instruments like ELTIFs.

- Liquidity Risk Monitoring: Given that ELTIFs invest in long-term, illiquid assets, maintaining adequate liquidity is a significant challenge. The corrigendum addresses this by requiring fund managers to closely monitor the liquidity risk associated with the transfer matching process. Specifically, managers must ensure that the liquidity needs arising from investor exits do not compromise the fund’s ability to continue meeting its long-term investment objectives. This is particularly relevant when ELTIFs invest in infrastructure projects, private equity, or other assets that do not have easily accessible secondary markets. By enforcing liquidity risk monitoring, the corrigendum aims to prevent scenarios where ELTIFs are forced to sell assets at unfavorable prices to meet redemption requests.

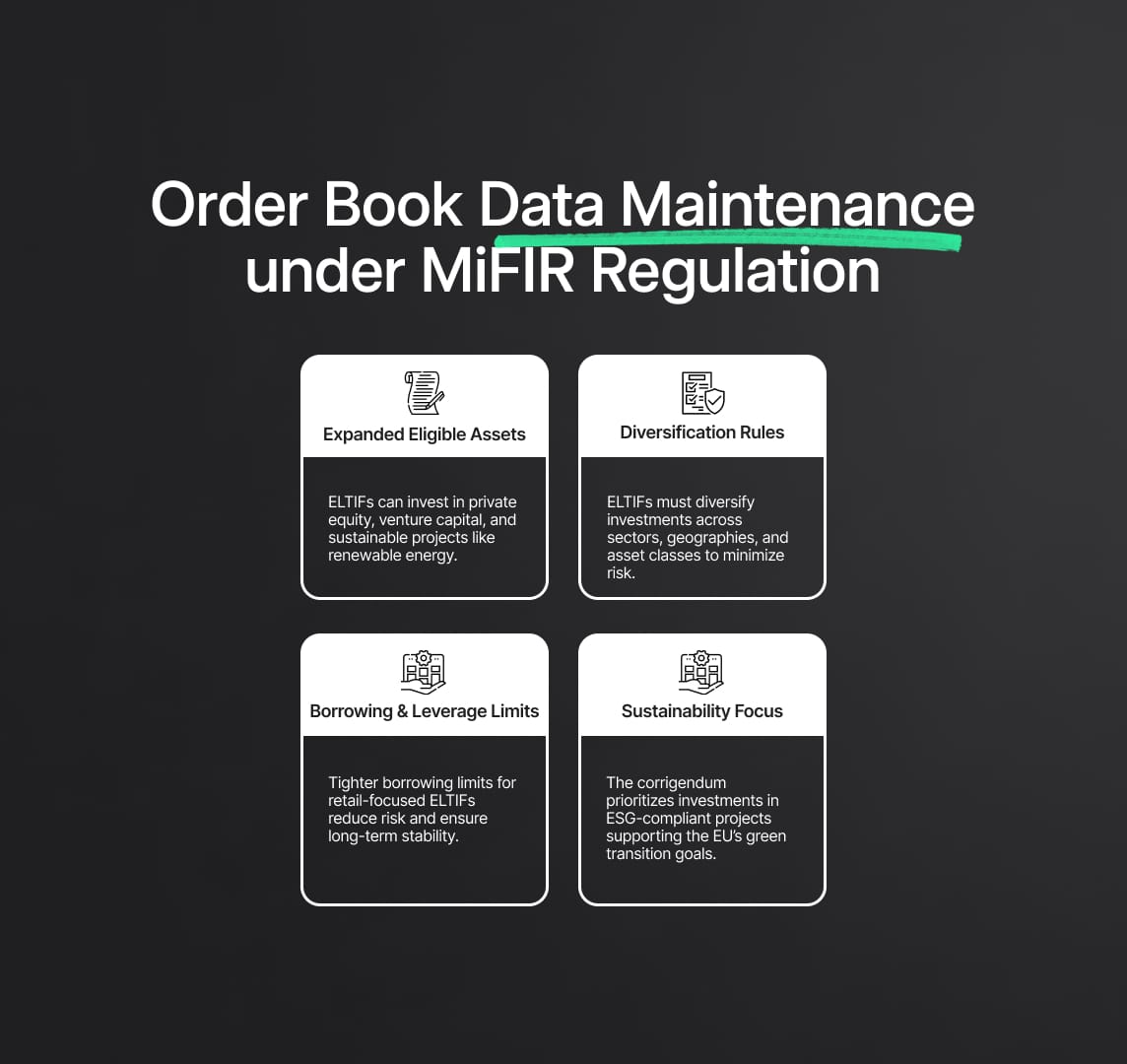

2. ELTIF Corrigendum Published on 17 September 2024

The September 2024 corrigendum to the ELTIF Regulation introduced a series of significant updates to Article 1(11)(b), expanding its scope beyond the transfer of units or shares between exiting and potential investors. This latest regulatory change goes deeper into the core areas of investment policies, portfolio composition, and borrowing limits, reinforcing the overall governance of European Long-Term Investment Funds. These modifications reflect the European Union's ongoing commitment to ensuring that ELTIFs remain financially sound and sustainable vehicles for long-term investments, particularly in illiquid assets.

The corrigendum targets several crucial elements, including the types of assets ELTIFs can hold, diversification rules, and the limits imposed on borrowing, especially for retail-focused ELTIFs. By tightening these operational parameters, the European Commission aims to strike a balance between promoting long-term investments in crucial sectors like infrastructure and ensuring robust protection for investors, particularly retail investors, from undue risk.

Investment Policies and Operating Conditions

The 2024 corrigendum introduced important changes to the way ELTIFs invest in eligible assets. The regulation clarified the types of investments that fall within the scope of an ELTIF’s portfolio, particularly in asset classes that support sustainable development and green finance.

This update requires ELTIF managers to realign their internal investment strategies to reflect the broader emphasis on:

- Private equity: Investments in unlisted companies that require long-term capital. Private equity is now explicitly supported as an eligible investment category, broadening ELTIFs' ability to invest in innovative enterprises and growth-stage companies.

- Venture capital: ELTIFs are now encouraged to invest in early-stage businesses, particularly those focused on technology and sustainable innovations. This change is aligned with the EU’s agenda to promote innovation and entrepreneurship.

- Sustainable development projects: The corrigendum further extends eligibility to investments tied to projects supporting environmental sustainability, aligning with ESG (Environmental, Social, Governance) criteria. Fund managers are expected to prioritize projects that contribute to the EU’s green transition, such as renewable energy and energy-efficient infrastructure.

Scope of Eligible Assets

The corrigendum significantly expanded the definition of eligible assets for ELTIFs, offering greater flexibility in structuring portfolios. This expansion provides fund managers with more latitude to incorporate a diverse range of asset classes into their portfolios, while maintaining a strong focus on sustainability and long-term growth.

One of the most significant areas of change is the explicit inclusion of green finance projects. This aligns with broader EU policies, particularly the European Green Deal, aimed at achieving carbon neutrality by 2050. The regulation now encourages ELTIFs to channel capital into environmentally friendly initiatives, such as:

- Renewable energy projects: Wind, solar, and hydropower initiatives now fall clearly under the umbrella of eligible ELTIF investments.

- Sustainable urban development: Real estate projects that promote energy efficiency or green building certifications can now be financed by ELTIFs.

This expanded scope not only enhances the attractiveness of ELTIFs to investors interested in ESG-compliant assets but also positions ELTIFs as critical vehicles for financing the EU’s climate goals.

Portfolio Diversification Rules

To further mitigate risks associated with concentrated portfolios, the 2024 corrigendum introduced updated rules governing portfolio diversification. Given the illiquid nature of many ELTIF-eligible assets, diversification is essential to reduce systematic risk.

The key updates include:

- Diversification within illiquid assets: ELTIFs must ensure that no single illiquid asset or sector dominates the portfolio. The rules provide stricter guidance on limiting exposure to non-EU investments, ensuring that ELTIFs do not over-concentrate in markets outside of Europe.

- Sectoral diversification: Fund managers are encouraged to spread their investments across multiple sectors to minimise the risk of sector-specific downturns, particularly in volatile industries such as energy or real estate.

- Cross-border diversification: ELTIFs should consider investments across different EU member states to avoid being overly reliant on a single national market. This reflects the broader objective of fostering a single capital market across the EU.

Borrowing Limits and Cash Rules

A significant aspect of the 2024 corrigendum is the tightening of borrowing limits, particularly for ELTIFs marketed to retail investors. The changes reflect the EU’s focus on investor protection, ensuring that ELTIFs do not engage in excessive leverage, which could expose retail investors to heightened risks in adverse market conditions.

Key changes include:

- Leverage caps: The corrigendum imposes stricter caps on the amount of leverage an ELTIF can use. For retail investor-focused funds, the borrowing limits are now significantly lower, reducing the potential for high-risk, highly-leveraged strategies that could negatively impact retail investors.

- Borrowing for liquidity management: While ELTIFs can borrow to manage short-term liquidity needs, such as redemptions or cash flow imbalances, the corrigendum enforces stricter controls on the amount and duration of borrowing. This change aims to prevent fund managers from overextending the fund’s leverage to maintain liquidity, thereby protecting long-term investors.

ELTIF Operational Impacts for Fund Managers and Investors

The combined effect of the 2023 and 2024 corrigenda results in profound operational impacts for both fund managers and investors. These changes introduce new challenges in terms of compliance, investment policy adjustments, and risk management, but also create new opportunities, particularly in the realm of sustainable investments.

Compliance and Policy Adjustments

Fund managers must undertake comprehensive reviews of their investment policies, ensuring that their portfolios are aligned with the updated eligibility criteria and diversification rules. The stricter borrowing limits and the emphasis on sustainable development require fund managers to refine their risk management frameworks and investment strategies. This means implementing stronger compliance controls and conducting thorough due diligence on new investments to ensure alignment with the updated regulatory requirements.

Enhanced Investor Protection

The updates strengthen investor protection, particularly for retail investors, who now benefit from greater transparency and risk mitigation. Fund managers are required to implement more robust liquidity risk management strategies and ensure that all aspects of the transfer matching process are transparent and equitable, safeguarding investors from undue risk exposure, particularly in illiquid markets.

Reduce your

compliance risks