EMIR 3 : emergency collateral requirements

The latest EMIR 3 amendment, effective from 2024, brings significant changes to the EU’s financial regulatory framework. Key updates include the eligibility of uncollateralized public guarantees and permanent liquidity support measures.

Introduction to EMIR 3 Regulation

The European Market Infrastructure Regulation (EMIR) is a cornerstone of the EU’s financial regulatory framework, designed to bolster the stability and transparency of the over-the-counter (OTC) derivatives market. Initially introduced to mitigate systemic risks and enhance market resilience following the 2008 financial crisis, EMIR has undergone several amendments to address evolving market needs. The latest amendment, known as EMIR 3, represents a substantial development in this regulatory landscape.

On July 10, 2024, the European Securities and Markets Authority (ESMA) issued a pivotal public statement concerning the eligibility of uncollateralised public guarantees, public bank guarantees, and commercial bank guarantees for non-financial counterparties (NFCs) acting as clearing members. This statement is crucial in light of the provisional agreement reached by the European Parliament and the Council of the EU on the proposal to amend EMIR, marking the third iteration of this essential regulation.

The EMIR 3 Regulation aims to refine and expand the regulatory framework to ensure greater financial stability, transparency, and market integrity. By integrating lessons learned from previous financial crises and addressing contemporary market dynamics, EMIR 3 introduces several key provisions designed to enhance the regulatory environment for NFCs and CCPs (Central Counterparties).

Source

[1]

[2]

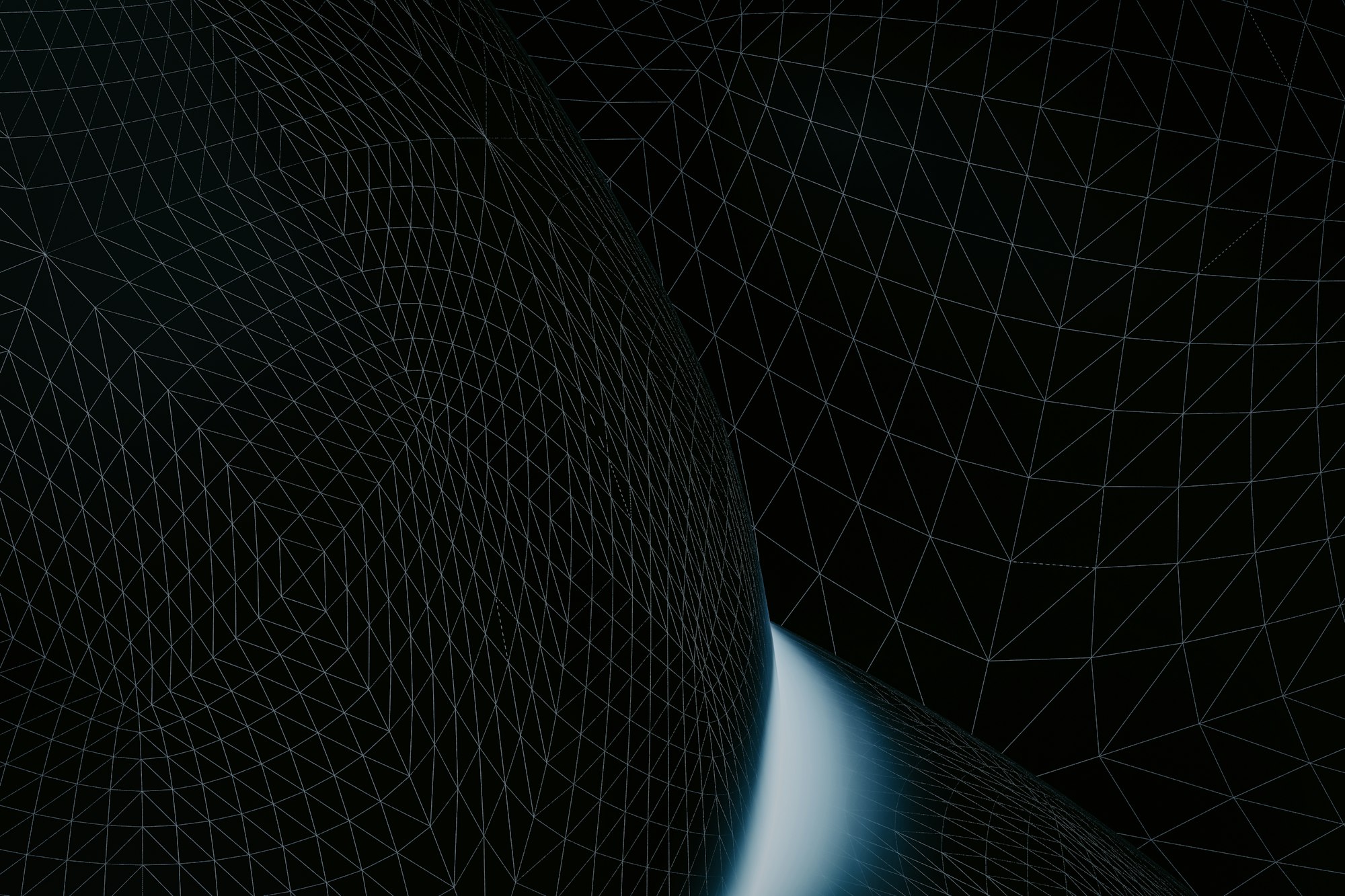

Technical Aspects and Key Provisions

One of the primary focuses of EMIR 3 is the eligibility criteria for various types of guarantees used as collateral by CCPs. The regulation acknowledges the importance of providing flexibility and mitigating liquidity risks for NFCs. Key provisions in EMIR 3 include:

- Eligibility of Public Guarantees, Public Bank Guarantees, and Commercial Bank Guarantees:

- Uncollateralised Public Guarantees: EMIR 3 recognizes uncollateralised public guarantees as eligible collateral, enabling NFCs to utilize government-backed assurances without requiring additional collateral. This provision is particularly beneficial for entities facing liquidity constraints.

- Public Bank Guarantees: These guarantees, provided by state-owned or state-supported banks, are also deemed eligible under EMIR 3. This inclusion aims to leverage the stability and credibility of public financial institutions to support market participants.

- Commercial Bank Guarantees: The regulation extends eligibility to guarantees issued by private commercial banks, provided they meet specific conditions outlined by the CCPs. This measure broadens the pool of available collateral, thereby enhancing market liquidity.

- Permanent Adoption of Temporary Measures:

- During the energy crisis, temporary amendments to Delegated Regulation (EU) No 153/2013 were adopted to expand the pool of eligible collateral and alleviate liquidity concerns for NFCs. EMIR 3 incorporates these temporary measures permanently, ensuring ongoing support for NFCs and addressing potential liquidity shortages.

- Conditions and Compliance Requirements:

- EMIR 3 sets forth stringent conditions under which CCPs can accept uncollateralised guarantees. These conditions are designed to balance the flexibility provided to NFCs with the need to maintain robust risk management practices within CCPs.

- Compliance with these conditions is mandatory, and CCPs must establish comprehensive frameworks to assess and monitor the eligibility and creditworthiness of the guarantees they accept.

- Risk Management Enhancements:

- The regulation emphasizes the need for enhanced risk management practices among CCPs. This includes rigorous stress testing, collateral valuation, and liquidity risk management to ensure that the acceptance of uncollateralised guarantees does not compromise the financial stability of the clearing system.

Importance of EMIR 3 Regulation

The introduction of EMIR 3 is a response to the evolving needs of the financial markets and the lessons learned from past financial disruptions. By expanding the types of eligible collateral and formalizing temporary crisis measures, EMIR 3 aims to enhance the resilience and stability of the financial system. This regulation is particularly significant for NFCs, which play a crucial role in the European economy but often face unique liquidity challenges.

ESMA’s public statement on July 10, 2024, underscores the regulatory commitment to providing clarity and stability in the market. The endorsement by the European Parliament and the Council of the EU further reinforces the importance of these regulatory changes. As the financial sector prepares for the implementation of EMIR 3, stakeholders can anticipate a more robust and adaptable regulatory environment that addresses both current and future market challenges.

Background and Legislative Journey of EMIR 3 Regulation

The journey of the EMIR 3 Regulation commenced on December 7, 2022, when the European Commission unveiled a proposal to amend Regulation (EU) No 648/2012. This proposal aimed to refine the existing framework to better address the needs of the evolving financial market landscape. The publication of this proposal marked the beginning of an extensive and rigorous negotiation process involving multiple EU institutions and stakeholders.

Key Milestones in the Negotiation Process

- European Commission's Proposal:

- On December 7, 2022, the European Commission introduced a comprehensive proposal to amend EMIR, known as EMIR 3. This proposal sought to incorporate several significant changes, including the eligibility of various types of guarantees as collateral by central counterparties (CCPs).

- Stakeholder Consultations and Feedback:

- Following the publication of the proposal, extensive consultations were held with key stakeholders, including financial institutions, industry groups, and regulatory bodies. These consultations were crucial in gathering feedback and identifying potential areas of concern or improvement within the proposed amendments.

- Council and European Parliament Agreement:

- After thorough discussions and negotiations, a provisional agreement on the EMIR 3 text was reached between the Council of the European Union and the European Parliament on February 7, 2024. This agreement represented a significant milestone in the legislative process, reflecting a consensus on the key provisions of EMIR 3.

- Endorsement by COREPER:

- The Committee of Permanent Representatives of the Governments of the Member States of the European Union (COREPER) endorsed the political agreement on February 14, 2024. COREPER's endorsement was a critical step, signifying the collective support of EU member states for the proposed amendments.

- Formal Adoption by the European Parliament:

- On April 24, 2024, the European Parliament formally adopted the EMIR 3 Regulation. This adoption underscored the legislative commitment to enhancing the stability and transparency of the financial markets through the updated regulatory framework.

EMIR III: Anticipated Adoption and Implementation

Following the rigorous legislative process, it is anticipated that the final text of EMIR 3 will be adopted and published in the Official Journal of the EU by the end of 2024. This publication is a pivotal step, as it marks the official entry of EMIR 3 into the EU’s legal framework.

Implementation Timeline and Key Dates

- Publication in the Official Journal:

- The publication of the final EMIR 3 text in the Official Journal of the EU is expected by the end of 2024. This publication is essential for formalizing the regulation and making it legally binding across all EU member states.

- Effective Date:

- The EMIR 3 Regulation will come into force 20 days after its publication in the Official Journal. This effective date is crucial for stakeholders, particularly non-financial counterparties (NFCs), as it dictates the timeline for compliance with the new regulatory provisions.

Impact on Stakeholders

The timeline for the adoption and implementation of EMIR 3 is critical for all stakeholders within the financial sector. For NFCs, in particular, understanding and preparing for these regulatory changes is paramount. The transition period provided by the 20-day window post-publication allows stakeholders to align their operations and compliance strategies with the new requirements set forth by EMIR 3.

The comprehensive negotiation and legislative process underscores the EU’s commitment to refining and strengthening the financial regulatory framework. By incorporating stakeholder feedback and achieving broad consensus among EU institutions, the EMIR 3 Regulation is poised to enhance market stability, transparency, and resilience.

Key Provisions of EMIR 3 Regulation

Eligibility of Guarantees as Collateral

A cornerstone of the EMIR 3 Regulation is the inclusion of provisions that delineate the eligibility criteria for various types of guarantees used as collateral by central counterparties (CCPs). This enhancement in regulatory scope is crucial for non-financial counterparties (NFCs), especially those acting as clearing members. Here, we delve deeper into the technical specifics of these provisions and their implications.

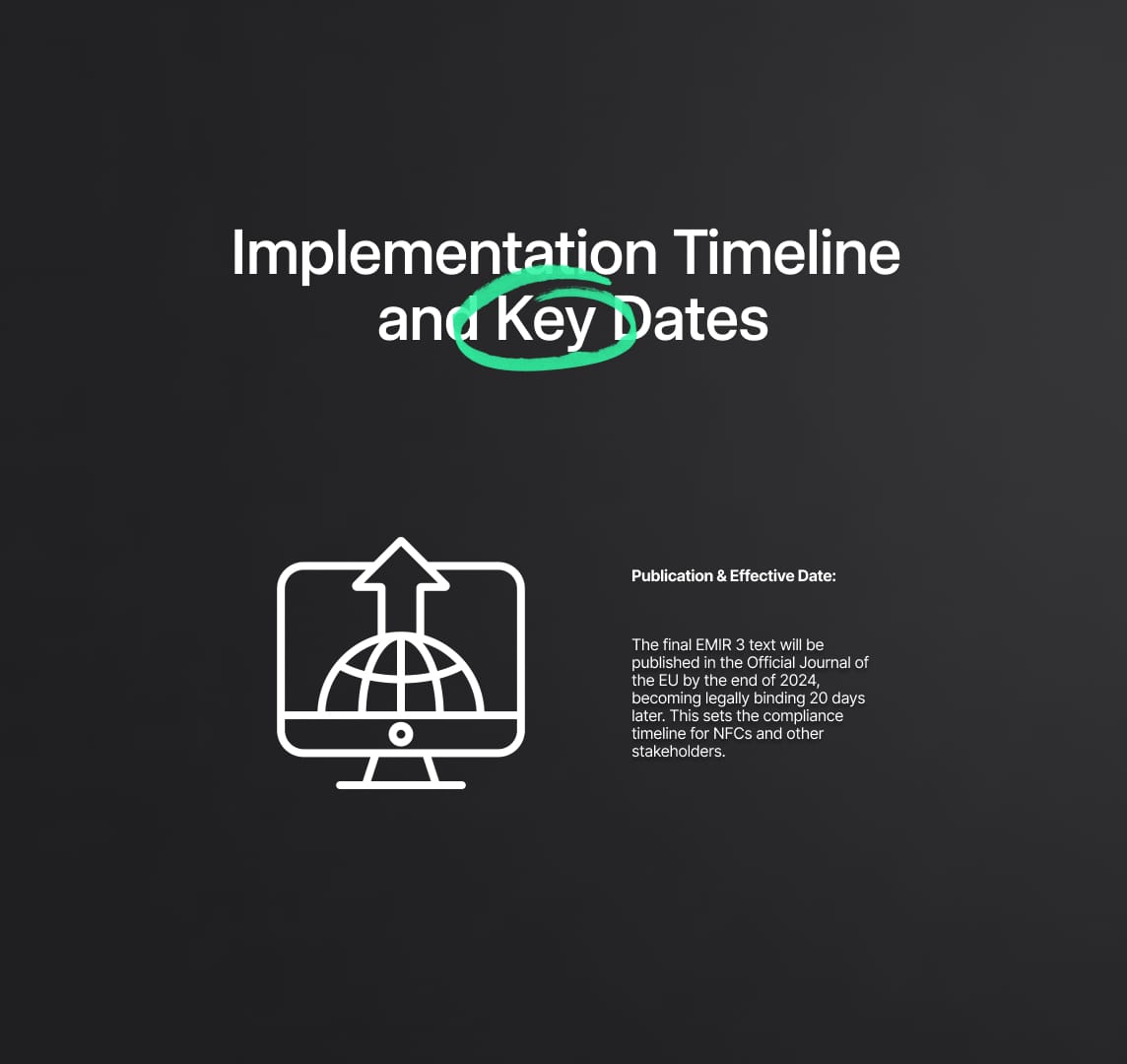

Types of Eligible Guarantees

- Uncollateralised Public Guarantees:

- Under EMIR 3, uncollateralised public guarantees are deemed eligible collateral. This means that NFCs can leverage government-backed assurances without needing to provide additional collateral. This provision is designed to alleviate liquidity constraints for NFCs, allowing them to maintain smoother operations in the derivatives market.

- Public Bank Guarantees:

- These guarantees, provided by state-owned or state-supported banks, are now recognized as eligible collateral. The inclusion of public bank guarantees aims to utilize the inherent stability and credibility of public financial institutions, thereby bolstering market confidence and reducing systemic risk.

- Commercial Bank Guarantees:

- EMIR 3 extends eligibility to commercial bank guarantees, subject to specific conditions outlined by CCPs. This broadened eligibility pool enhances flexibility for NFCs, enabling them to meet collateral requirements more effectively. Commercial banks, given their extensive reach and financial capacity, can thus play a more active role in supporting market participants.

Permanent Adoption of Temporary Measures

Historical Context: Energy Crisis Response

The temporary amendments to Delegated Regulation (EU) No 153/2013 were initially adopted as an emergency response to the energy crisis. These measures expanded the pool of eligible collateral to include various guarantees, addressing acute liquidity concerns for NFCs. These amendments, set to expire on September 7, 2024, have now been incorporated permanently into EMIR 3. This integration ensures continuity and stability, preventing potential market disruptions that could arise from the expiration of these temporary measures.

Specified Conditions for Guarantee Acceptance

To maintain robust risk management, EMIR 3 outlines stringent conditions under which CCPs can accept uncollateralised guarantees. These conditions include:

- Creditworthiness Assessment: CCPs must perform rigorous credit assessments of the entities issuing guarantees to ensure their financial stability and reliability.

- Collateral Valuation and Monitoring: Continuous valuation and monitoring of accepted collateral are mandated to manage and mitigate risks effectively. This includes regular stress testing to assess the collateral's performance under adverse market conditions.

- Legal and Operational Criteria: Guarantees must meet specific legal and operational criteria to be eligible, ensuring they are enforceable and liquid under various scenarios.

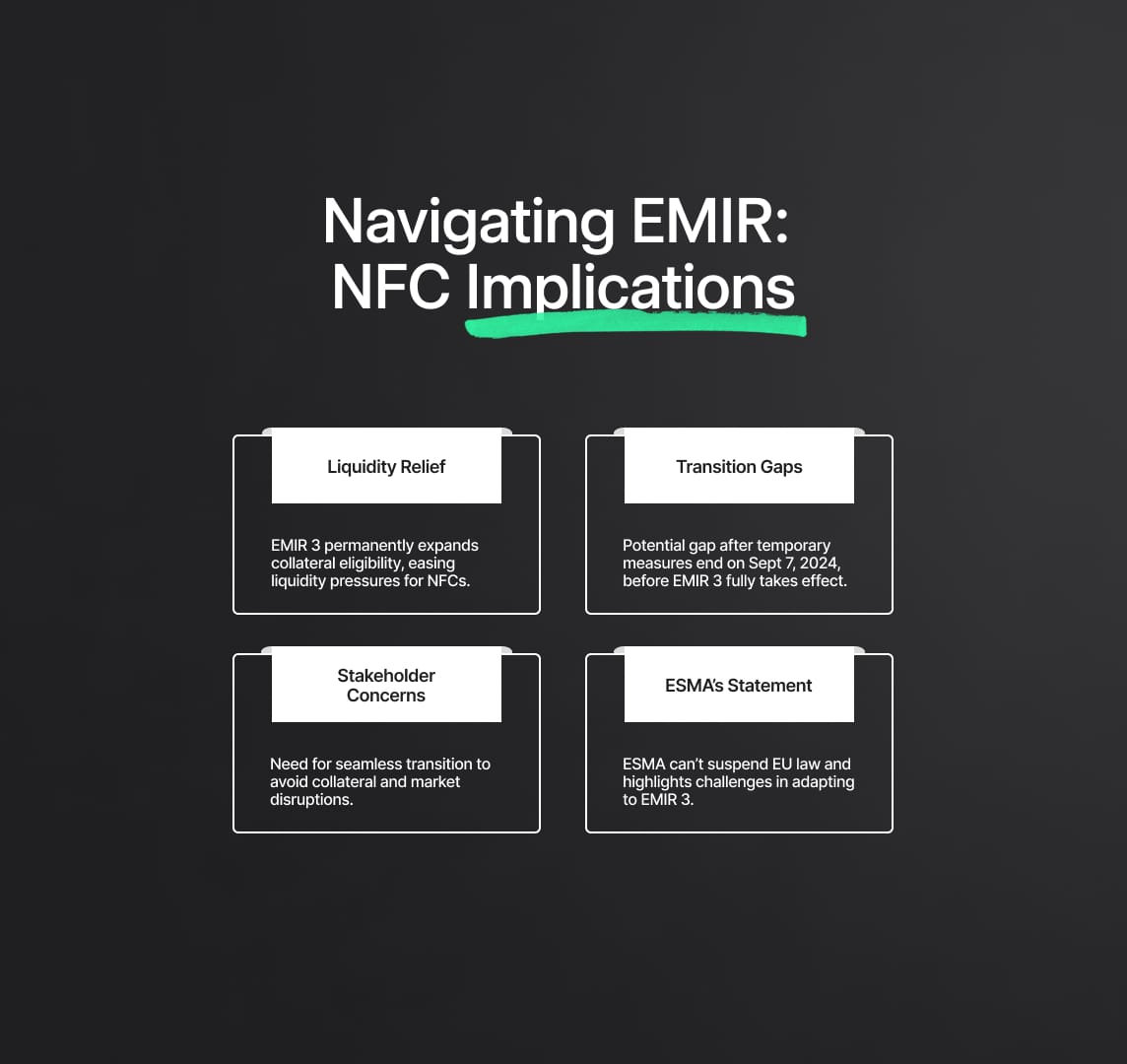

Implications for Non-Financial Counterparties (NFCs) In the European Market Infrastructure Regulation

Relief from Liquidity Pressures

The permanent adoption of provisions allowing uncollateralised guarantees provides significant liquidity relief to NFCs. This regulatory flexibility is critical, particularly in periods of financial stress or market volatility. By expanding the collateral pool, NFCs can more readily meet their margin requirements, thereby maintaining their market activities without undue financial strain.

Transition Period Considerations

The transition from temporary to permanent measures is a focal point of concern for stakeholders. With the temporary measures expiring on September 7, 2024, before EMIR 3 takes full effect, there is a potential gap that could impact NFCs' collateral management strategies. Stakeholders have emphasized the need for a seamless transition to avoid disruptions in the derivatives market.

Stakeholder Concerns

Risk of Regulatory Gaps

Stakeholders have raised concerns about the risks associated with the lapse of emergency measures. The primary worry is the temporary reduction in the pool of eligible collateral before the new EMIR 3 provisions are fully implemented. This gap could pose significant challenges for NFCs in meeting their collateral requirements, potentially leading to increased market volatility.

Need for Seamless Transition

To mitigate these risks, stakeholders advocate for a seamless transition from the temporary to the permanent framework. Ensuring continuity in the eligibility of guarantees is crucial for maintaining market stability and preventing liquidity crises. This requires coordinated efforts between regulatory authorities, CCPs, and market participants to align their practices and compliance strategies with the new regulatory landscape.

Supervisory and Legal Perspective on EMIR 3 Regulation

ESMA's Public Statement

On July 10, 2024, the European Securities and Markets Authority (ESMA) issued a pivotal public statement addressing the eligibility of uncollateralised public guarantees, public bank guarantees, and commercial bank guarantees for non-financial counterparties (NFCs) acting as clearing members. This statement is integral to understanding the supervisory and legal landscape under the EMIR 3 Regulation.

Legal Constraints and Authority Limitations

ESMA's statement acknowledges a critical legal limitation: neither ESMA nor national competent authorities (NCAs) possess the formal power to dis-apply a directly applicable EU legal text, even in exceptional circumstances. This constraint underscores the rigidity of EU regulations and the challenges regulatory bodies face in responding swiftly to market exigencies without formal legislative changes. ESMA also highlighted its lack of tools or powers to grant forbearance, which would allow temporary relief from regulatory requirements under extraordinary conditions. This legal backdrop sets the stage for understanding how supervisory bodies are expected to navigate the transition to EMIR 3.

EMIR III: Risk-Based Supervisory Approach

Despite these limitations, ESMA's statement offers guidance on how NCAs should approach the supervision of NFCs under the new EMIR 3 framework.

Proportional Supervision

ESMA anticipates that NCAs will not prioritize immediate supervisory actions related to the eligibility of uncollateralised guarantees for NFCs acting as clearing members, in light of the EMIR 3 agreement. Instead, a risk-based supervisory approach is recommended. This approach emphasizes proportionality, where supervisory actions are calibrated based on the assessed risk profile of the NFCs and the overall market conditions. Such a strategy aims to balance strict regulatory compliance with practical market considerations, ensuring that the transition period does not unduly disrupt market stability.

Practical Considerations

By advocating for a proportional application of supervisory powers, ESMA seeks to provide NCAs with the flexibility to focus on more pressing risks while allowing NFCs time to adjust to the new regulatory requirements. This approach is designed to mitigate potential market disruptions that could arise from a rigid enforcement of the new rules immediately upon their implementation. It also reflects a pragmatic understanding of the operational challenges NFCs may face during the transition period.

Energy Crisis Response

The backdrop to EMIR 3 includes significant temporary measures adopted during the energy crisis. In response to acute liquidity concerns, temporary amendments to Delegated Regulation (EU) No 153/2013 were introduced. These measures expanded the pool of eligible collateral, allowing CCPs to accept a broader range of guarantees. This expansion was crucial for maintaining market liquidity and stability during the crisis.

Expiry and Permanent Solutions

The temporary measures are set to expire on September 7, 2024. EMIR 3 aims to make permanent the core features of these temporary amendments. By doing so, EMIR 3 provides a long-term solution to the liquidity challenges faced by NFCs, ensuring that the broader pool of collateral remains available beyond the expiry of the emergency measures. This permanent adoption is intended to prevent a sudden contraction in available collateral, which could lead to liquidity crunches and heightened market volatility.

Reduce your

compliance risks