Enhanced Environmental Compliance: EU Regulation Amendments

EU's environmental regs affect financial institutions. Stricter targets & transparency; reassess portfolios for sustainability. EBA's new IRRBB standards reshape EU banks; benefit small ones. Key compliance strategy needed by Sep 2024 deadline.

European Parliament Proposes Regulation Amendments for Enhanced Environmental Compliance

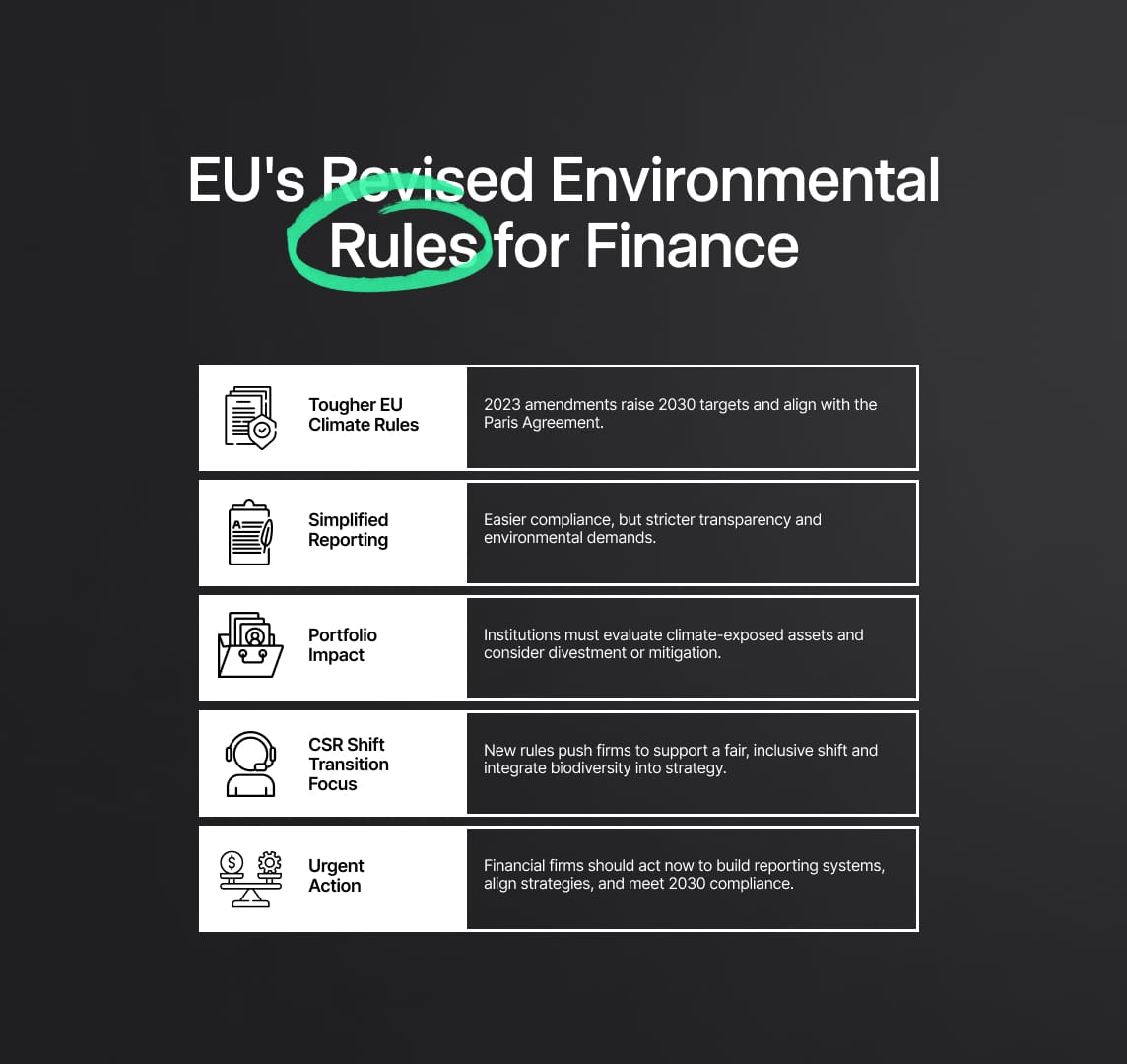

The European Parliament has adopted a proposal to amend Regulation (EU) 2018/841 and Regulation (EU) 2018/1999 at its first reading on 14 March 2023. This proposal aims to simplify reporting and compliance rules, set targets for member states for 2030, and enhance monitoring, reporting, and reviewing of progress. The proposed amendments align with the Paris Agreement’s objectives, which seek to limit the global temperature increase to 1.5°C above preindustrial levels. Additionally, the amendments address the ongoing worldwide erosion of biodiversity, as highlighted in the 2019 Global Assessment Report on Biodiversity and Ecosystem Services. The proposal also takes into account the EU Biodiversity Strategy for 2030, the New EU Forest Strategy for 2030, and the EU Soil Strategy for 2030, which all emphasize the need to protect and restore biodiversity. The proposed legislation aims to ensure that all sectors contribute to achieving the EU’s climate target and that the transition is fair and inclusive.

EU's Revised Environmental Regulations: A Comprehensive Guide for Financial Institutions

In March 2023, the European Parliament made a bold move towards enhanced environmental governance by adopting amendments to Regulation (EU) 2018/841, pertaining to land use, land use change, and forestry, as well as Regulation (EU) 2018/1999, governing the Energy Union and Climate Action. This move represents a significant pivot towards more stringent and unified environmental standards across all member states, ultimately aiming to align the European Union (EU) with the Paris Agreement's objectives and promoting a fair, inclusive green transition.

Financial institutions such as banks, insurance companies, investment funds, and pension funds, operating under the EU's jurisdiction, will inevitably feel the impact of these new measures. To effectively navigate this new regulatory landscape, institutions must understand both the challenges and opportunities that lie ahead.

The revised regulations introduce streamlined reporting and compliance rules. By making the process more efficient, it is anticipated that member states and institutions will find it easier to comply, potentially reducing administrative burdens and compliance costs. However, the simplification is accompanied by an intensification of environmental targets for 2030 and enhanced transparency requirements through monitoring and reporting.

This shift means that financial institutions will need to reassess their portfolios, considering the effects of stricter regulations and penalties on sectors contributing significantly to climate change and biodiversity loss. Such sectors might see their financial performance impacted, forcing institutions to consider divestment or risk mitigation strategies. Furthermore, the regulations underline the necessity for a fair and inclusive transition, potentially reshaping institutions' corporate social responsibility strategies.

To stay ahead of the curve, financial institutions should consider the following proactive steps:

- Develop and implement robust reporting systems to meet new regulatory requirements.

- Conduct thorough assessments of portfolios to identify investments at risk due to new regulations and consider divestment or risk mitigation strategies.

- Integrate sustainability and biodiversity protection measures into core business models and strategies.

- Increase efforts towards an equitable green transition, possibly by providing financial products and services that directly support this goal.

Institutions are urged to act promptly, as these amendments have already been adopted and are expected to come into full effect soon. The countdown to 2030 has begun, and financial institutions are expected to be fully compliant by this date. By adopting proactive measures now, institutions can position themselves as leaders in the drive towards a sustainable and inclusive economy.

Reduce your

compliance risks