EMIR: Third-Country Pension Scheme Clearing

ESMA advises EU authorities to ease supervision on derivative transactions involving exempted third-country pension schemes, aligning with EMIR 3's provisional agreement.

Impact of EMIR III

The European Market Infrastructure Regulation (EMIR) is undergoing a pivotal transformation with the introduction of EMIR III, representing a significant evolution in the European Union's regulatory framework for derivatives clearing. This latest iteration, often referred to as EMIR 3.0, shifts beyond the original goals of enhancing transparency and mitigating systemic risk. The new focus of the European Market Infrastructure Regulation is to strategically bolster the appeal and robustness of the EU's clearing ecosystem. A primary motivation for EMIR III is to diminish the European Union's dependence on systemically important third-country Central Counterparties (CCPs), a move designed to cultivate greater financial stability and support the overarching objectives of the Capital Markets Union (CMU).

Several key amendments are introduced under EMIR 3.0. A notable change is the establishment of a new exemption regime for Third-Country Pension Scheme Arrangements (TC PSAs), aimed at easing specific operational complexities. A central and innovative component of EMIR III is the Active Account Requirement (AAR), which will compel market participants to clear a specified portion of their trades through EU-authorized CCPs. Moreover, this update to the European Market Infrastructure Regulation refines the methodology for calculating clearing thresholds and reinforces the transaction reporting framework, imposing stricter data quality standards and substantial penalties for breaches.

While the legislative text for EMIR 3.0 was published in the Official Journal, its practical application is phased. Critical elements of the regulation, including the Active Account Requirement and the revised clearing thresholds, are contingent upon the development and implementation of detailed Level 2 Regulatory Technical Standards (RTS) by the European Securities and Markets Authority (ESMA). This staggered timeline introduces a complex compliance landscape. Firms must therefore engage in proactive planning and significant operational adjustments to meet the evolving demands of EMIR III. A thorough and nuanced comprehension of the updated European Market Infrastructure Regulation is essential for navigating this period, especially considering temporary measures like ESMA's supervisory deprioritization for TC PSAs. Ultimately, EMIR 3.0 highlights the EU's resolute commitment to strengthening its financial infrastructure and securing strategic autonomy within the derivatives clearing sector, fundamentally shaping the future of European financial markets. Here is the revised and SEO-optimised version of the first paragraph.

Source

[1]

Executive Summary: Mastering the European Market Infrastructure Regulation (EMIR) 3.0

The European Market Infrastructure Regulation (EMIR) is undergoing a pivotal transformation with the introduction of EMIR III. This latest iteration signals a significant evolution in the European Union's regulatory framework for derivatives clearing. The focus of the European Market Infrastructure Regulation now extends beyond its original goals of mitigating systemic risk and increasing market transparency. EMIR III is strategically designed to bolster the appeal and resilience of the EU's clearing ecosystem. A primary catalyst for this reform is the critical need to diminish the Union's dependence on systemically important third-country Central Counterparties (CCPs). This move is integral to reinforcing the EU's financial stability and is a cornerstone of the broader Capital Markets Union (CMU) initiative.

The amendments introduced under EMIR III are substantial. A key change is the creation of a new exemption framework for Third-Country Pension Scheme Arrangements (TC PSAs), aimed at easing specific operational complexities. A landmark provision within the European Market Infrastructure Regulation is the Active Account Requirement (AAR). This mandate necessitates that a specified portion of clearing activities must be conducted through EU-authorized CCPs. Furthermore, EMIR III overhauls the calculation methods for clearing thresholds and reinforces the transaction reporting framework, imposing stricter data quality standards and substantial penalties for non-compliance.

Although the European Market Infrastructure Regulation (EMIR) 3.0 officially came into force on December 24, 2024, the full scope of its operational impact is progressively materializing. Crucial elements, such as the Active Account Requirement and the updated clearing thresholds, await the finalization and implementation of forthcoming Level 2 Regulatory Technical Standards (RTS) by the European Securities and Markets Authority (ESMA). This phased implementation introduces a complex compliance landscape for market participants. It demands proactive readiness, significant operational adjustments, and a sophisticated grasp of the evolving regulatory landscape, as highlighted by ESMA's temporary deprioritization of supervision for TC PSAs. Ultimately, the rollout of EMIR III highlights the EU's unwavering commitment to fortifying its financial infrastructure, aiming for greater strategic independence in the derivatives clearing sector and thereby charting the future course of European financial markets.

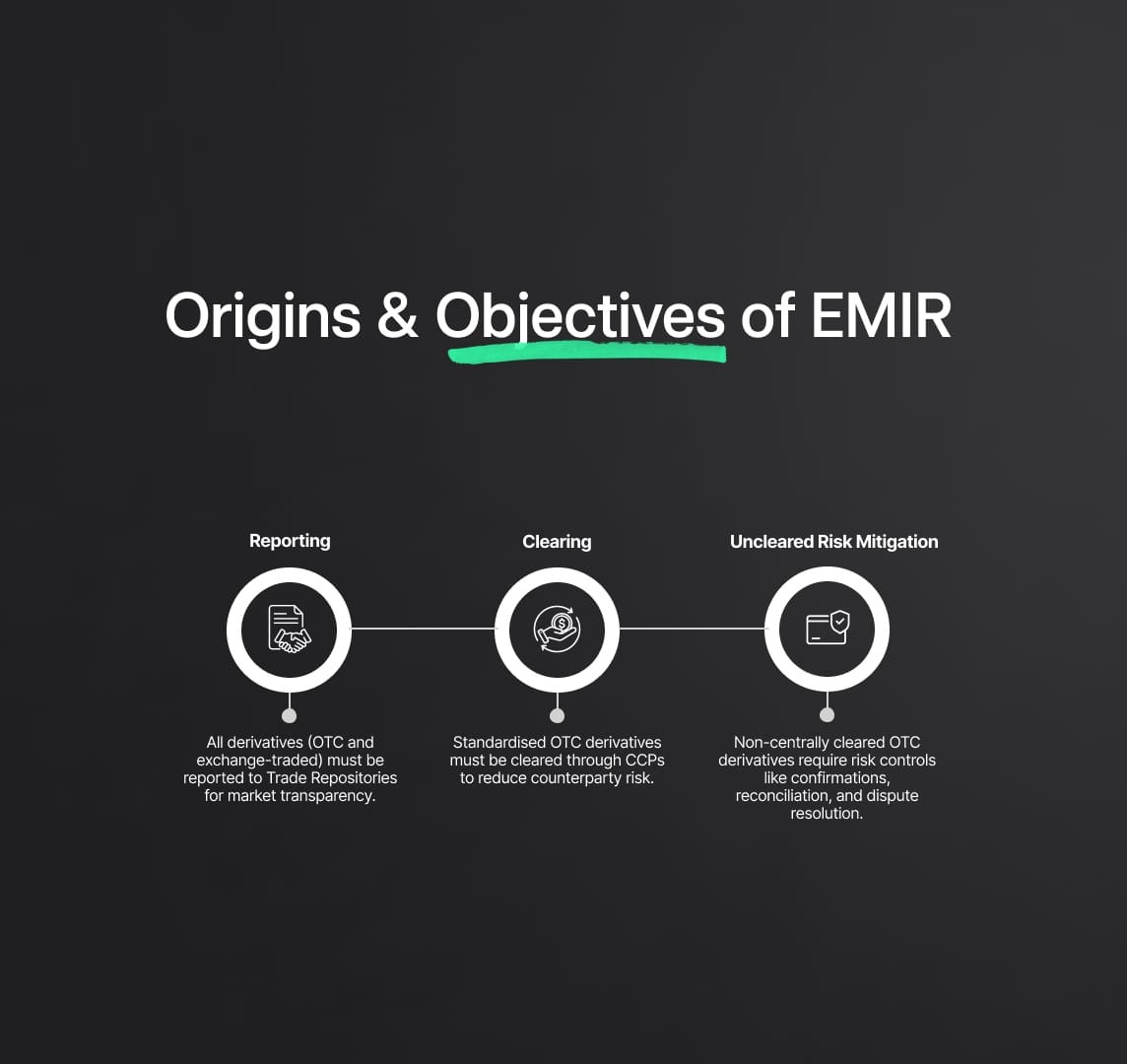

Origins and Core Objectives of the European Market Infrastructure Regulation

The European Market Infrastructure Regulation (EMIR), officially Regulation (EU) No 648/2012, was enacted in 2012 and took effect on March 15, 2013. Its creation was a direct policy response to the systemic failures exposed during the 2008 global financial crisis, particularly the turmoil following the collapse of Lehman Brothers. The core mandate of the European Market Infrastructure Regulation was to implement the G20 leaders' commitments from the 2009 Pittsburgh Summit, which aimed to tackle the significant risks and lack of transparency within the Over-The-Counter (OTC) derivatives market.

The primary goals of EMIR were to lower systemic counterparty and operational risk while boosting transparency to prevent future financial system failures. To meet these objectives, the European Market Infrastructure Regulation established a framework based on three essential pillars:

- Reporting Obligation: EMIR requires that all derivative contracts, both OTC and exchange-traded, be reported to Trade Repositories (TRs). This provides supervisory authorities with a clear and comprehensive view of market activities, enabling effective monitoring and management of systemic risks.

- Central Clearing Obligation: A central feature of EMIR is the mandatory clearing of standardised OTC derivative contracts through Central Counterparties (CCPs). CCPs act as an intermediary, becoming the buyer to every seller and the seller to every buyer. This process drastically reduces counterparty credit risk by centralising and managing exposures, thereby enhancing market stability.

- Risk Mitigation for Uncleared Derivatives: For OTC derivative contracts not subject to the central clearing obligation, EMIR mandates strict risk mitigation techniques. These include the timely confirmation of trades, regular portfolio reconciliation, and established dispute resolution procedures to minimise operational and counterparty credit risks in bilateral transactions.

The implementation of the European Market Infrastructure Regulation marked a strategic shift from reactive crisis management to proactive systemic risk mitigation, ensuring risks are managed by highly regulated CCPs and monitored by authorities.

B. The Evolution of EMIR: From Refit to the Dawn of EMIR III

Financial regulation must adapt to changing market dynamics. The journey of the European Market Infrastructure Regulation (EMIR) since its 2012 inception highlights this continuous evolution, leading eventually to EMIR III.

In June 2019, the EMIR Refit regulation was introduced to simplify and create a more proportionate approach to clearing and reporting obligations. The goal was to reduce the regulatory burden on smaller market participants without compromising the core financial stability objectives of the European Market Infrastructure Regulation.

A subsequent amendment, EMIR 2.2, followed in January 2020. This update focused specifically on the authorisation and supervision of CCPs, placing significant emphasis on third-country CCPs. This was an early indicator of the EU's growing focus on strategic autonomy over its financial infrastructure, a theme that has become central to the EMIR III reforms. This continuous recalibration of EMIR shows that compliance is an ongoing process, requiring constant adaptation to a developing regulatory landscape that now includes the significant changes under EMIR III.

EMIR 3.0: A Strategic Imperative for EU Clearing Resilience

A. Rationale and Policy Drivers Under the European Market Infrastructure Regulation

The European Market Infrastructure Regulation (EMIR) 3.0, proposed by the European Commission on December 7, 2022, marks a strategic pivot for the EU's financial framework. The central goal of EMIR III is to "make EU clearing services more attractive and resilient, supporting the EU's open strategic autonomy and preserving financial stability." This initiative is a direct response to market shifts following the UK's departure from the EU, which led to a significant reliance on UK-based Central Counterparties (CCPs). This concentration of risk outside the Union's direct oversight was identified as a potential systemic threat.

To counter this "excessive concentration risk," EMIR III incentivises financial firms to manage their exposures to CCPs more systematically, especially those deemed systemically important in third countries. The regulation aims to strengthen the EU's post-trade ecosystem, enhancing its global competitiveness. The focus on "reducing excessive reliance on systemically important third-country CCPs" elevates this version of the European Market Infrastructure Regulation from a purely technical update to a matter of geopolitical and strategic importance. EMIR III is thus a tool for the EU to assert greater financial sovereignty.

Furthermore, EMIR III is a key component of the EU's wider Capital Markets Union (CMU) initiative. The CMU seeks to create more integrated capital markets to foster sustainable growth and bolster economic resilience. By making EU clearing more attractive, the European Market Infrastructure Regulation directly supports a more unified trading and post-trading landscape, aligning with the CMU's objectives.

B. The Legislative Journey of EMIR III

The path to enacting EMIR 3.0 involved extensive negotiations across EU institutions, highlighting the detailed process of European law-making.

- Initial Proposal: The process began with the European Commission's proposal on December 7, 2022, as part of a capital markets union package.

- Political Agreement: After "trilogue negotiations" between the Commission, the European Parliament, and the Council of the EU, a provisional political agreement on the EMIR III text was achieved on February 7, 2024.

- Member State Endorsement: COREPER, representing the EU Member States, confirmed the agreement on February 14, 2024.

- Formal Adoption: The European Parliament formally adopted the EMIR 3.0 Regulation on April 24, 2024, followed by the Council of the EU on November 19, 2024.

- Entry into Force: The final text, Regulation (EU) 2024/2987, was published in the Official Journal on December 4, 2024. The European Market Infrastructure Regulation (EMIR) 3.0 officially entered into force 20 days later, on December 24, 2024.

While EMIR III is now legally binding, the application of key provisions, including the Active Account Requirement (AAR) and new clearing thresholds, is pending the finalisation of Regulatory Technical Standards (RTS) by ESMA. This staggered implementation requires firms to prepare for new obligations even as specific details are still being defined. An associated Amending Directive must be transposed into national law by June 25, 2026.

To ensure a stable transition, the European Commission extended the equivalence decision for UK CCPs until June 30, 2028. This pragmatic extension provides market participants with the necessary time to adapt to the new measures under the European Market Infrastructure Regulation and gradually reduce their reliance on UK-based clearing infrastructure. This entire process underscores the complexity of EU financial regulation, demanding proactive and flexible implementation strategies from all affected entities.

Table: EMIR 3.0 Legislative Timeline: Key Milestones and Dates

| Date | Event | Key Details & Significance |

|---|---|---|

| December 7, 2022 | European Commission proposes EMIR 3.0 | Formal start of the legislative process, part of a broader CMU package. |

| February 7, 2024 | Provisional political agreement between European Parliament and Council | Key political consensus reached after trilogue negotiations. |

| February 14, 2024 | COREPER confirms provisional agreement | Signifies broad support from EU Member States. |

| March 27, 2024 | ESMA statement on deprioritisation of supervisory actions for TC PSAs | Interim guidance to NCAs, addressing operational concerns before EMIR 3.0's formal effect. |

| April 24, 2024 | European Parliament formally adopts EMIR 3.0 | Legislative commitment to the updated framework. |

| November 19, 2024 | Council of the EU formally adopts EMIR 3.0 | Final legislative adoption by the Council. |

| November 20, 2024 | ESMA consults on Active Account Requirement (AAR) conditions (draft RTS) | Begins the process of defining detailed Level 2 rules for a key EMIR 3.0 provision. |

| December 4, 2024 | EMIR 3.0 published in Official Journal of the EU (Regulation (EU) 2024/2987) | Official publication, making the regulation legally binding. |

| December 24, 2024 | EMIR 3.0 enters into force (general application) | The date from which the regulation generally applies across EU Member States. |

| January 30, 2025 | European Commission extends UK CCP equivalence until June 30, 2028 | Pragmatic measure to allow time for EMIR 3.0 implementation and transition. |

| April 8, 2025 | ESMA consults on new clearing thresholds (draft RTS) | Further development of Level 2 rules for revised clearing obligations. |

| June 25, 2026 | Deadline for Member States to transpose related Amending Directive | National implementation deadline for the accompanying directive. |

| June 30, 2028 | Extended expiry date for UK CCP equivalence | End of the temporary transition period for reliance on UK CCPs. |

In-Depth Analysis of Key EMIR 3.0 Amendments

The European Market Infrastructure Regulation (EMIR) 3.0 introduces critical amendments to the existing clearing and margining framework. These changes, core to the EMIR III update, reflect the EU's strategic goals for its derivatives markets.

A. The Third-Country Pension Scheme Arrangements (TC PSAs) Exemption Regime

The original EMIR clearing obligation posed significant operational hurdles for pension scheme arrangements, especially those in third countries. Their long-term investment strategies were often incompatible with the liquidity requirements of posting cash collateral for cleared derivatives.

The EMIR III framework directly resolves this issue by establishing a new exemption from the clearing obligation for Third-Country Pension Scheme Arrangements (TC PSAs). This relief under the European Market Infrastructure Regulation is conditional: it applies only if the TC PSA is already exempt from clearing under its own country's national laws. Consequently, EU counterparties trading OTC derivatives with these exempt TC PSAs are no longer required to clear those transactions, reducing costs and operational burdens for both parties.

Anticipating the finalisation of EMIR 3.0, the European Securities and Markets Authority (ESMA) issued a statement on March 27, 2024. ESMA advised National Competent Authorities (NCAs) to deprioritize supervisory actions related to the clearing obligation for these TC PSAs. This pragmatic step provided temporary relief, acknowledging that the rule would soon be formally changed by EMIR III.

This situation highlights a crucial aspect of EU financial regulation. ESMA's guidance does not legally disapply the law; only formal EU legislation, like the European Market Infrastructure Regulation (EMIR) 3.0 itself, can provide permanent regulatory relief. This distinction ensures legal certainty for market participants.

B. The Active Account Requirement (AAR): Mandating EU Clearing Activity

A transformative pillar of EMIR 3.0 is the Active Account Requirement (AAR). This provision is a direct legislative measure designed to reduce the EU's "excessive exposure to systemically important third-country central counterparties (CCPs)" and is central to the strategic autonomy objectives of EMIR III.

The AAR applies to Financial Counterparties (FCs) and Non-Financial Counterparties (NFCs) who are subject to the EMIR clearing obligation and exceed certain clearing thresholds. The specific derivative contracts targeted by this new rule within the European Market Infrastructure Regulation include:

- Interest rate derivatives denominated in Euro or Polish Zloty.

- Short-term interest rate (STIR) derivatives denominated in Euro.

Firms falling under the AAR's scope must maintain at least one "permanently functional" active account at an EU-authorised CCP. Those with clearing volumes over a €6 billion notional threshold for specific derivatives must also clear a "representative" number of trades through these EU accounts. This requires having the necessary legal documentation, IT connectivity, and internal processes in place. Firms must notify ESMA and their competent authority within six months of becoming subject to the AAR.

The specific operational details of the AAR, such as what constitutes a "representative" volume, are being finalised by ESMA through Regulatory Technical Standards (RTS). A consultation paper was published on November 20, 2024, with final draft standards expected within six months of EMIR 3.0's entry into force. This direct intervention aims to shift clearing volumes to the EU, potentially creating a more fragmented global landscape but strengthening the EU's internal market. Firms must now assess their clearing arrangements and prepare for significant operational and legal adjustments to comply with the new EMIR framework.

C. Revisions to Clearing Thresholds Calculation Methodology

The European Market Infrastructure Regulation (EMIR) 3.0 revises how clearing thresholds are calculated, refining the scope of the clearing obligation for greater proportionality.

For Financial Counterparties (FCs), the EMIR III methodology is more detailed. FCs must now perform two separate calculations: one based on their "uncleared positions" and another on their aggregated "cleared and uncleared positions." This dual approach under the European Market Infrastructure Regulation aims to capture a more complete picture of an FC's total derivatives exposure.

For Non-Financial Counterparties (NFCs), EMIR 3.0 simplifies the calculation. NFCs will only need to calculate their uncleared positions, with hedging transactions continuing to be excluded. This adjustment reduces the regulatory burden on NFCs, focusing the EMIR clearing obligation on their speculative, uncleared activities.

These changes are not yet in effect. Their application is deferred until the related Clearing Threshold Regulatory Technical Standards (RTS) are finalised. ESMA is required to submit draft RTS to the European Commission by December 25, 2025, and launched a consultation on these new thresholds on April 8, 2025. This new methodology aims to create a more risk-based and proportionate EMIR regime.

D. Enhanced Transaction Reporting Framework

EMIR 3.0 introduces significant enhancements to the transaction reporting framework, focusing on data quality and stricter enforcement. This builds upon the major reporting rule changes that took effect separately on April 29, 2024.

A key development under EMIR III is the explicit mandate for derivatives users to implement procedures that ensure high-quality data reporting. ESMA will draft guidelines to specify these procedures.

Critically, the European Market Infrastructure Regulation now introduces a new penalty regime for "manifest errors" in reporting. National Competent Authorities (NCAs) must impose administrative or periodic penalty payments on entities with repeated reporting errors. For the first time, a specific financial penalty is set in the primary EMIR legislation, with periodic penalties of up to 1% of the firm's average daily turnover for each day of a breach. This elevates the importance of data integrity from a technical issue to a major financial risk.

Furthermore, EMIR III adds a new reporting layer for Non-Financial Counterparties subject to clearing (NFC+s). If an NFC+ has an EU parent company, that parent must now report the NFC+'s net aggregate intragroup positions weekly to its competent authority, adding complexity for multinational corporations operating under the EMIR framework.

E. Increased Transparency in Margin Requirements for CCPs

The EMIR 3.0 regulation enhances transparency regarding margin requirements for Central Counterparties (CCPs), expanding on rules introduced in EMIR Refit.

Under the new EMIR III rules, EU CCPs are now required to provide their clearing members with detailed information on their initial margin models and any add-ons they use. A crucial new requirement is that CCPs must also provide a margin simulation tool. This allows clearing members to analyse potential margin calls under different scenarios, including market stress, leading to better risk management.

Additionally, clearing members have new disclosure obligations to their own clients. They must inform clients about potential costs or losses from default management procedures and provide details on their clearing activity at non-EU CCPs. The European Market Infrastructure Regulation (EMIR) 3.0 also establishes a more robust framework for the supervision of Initial Margin (IM) models, with greater focus on larger counterparties. These measures under EMIR aim to empower market participants with clearer information, strengthening the entire clearing ecosystem.

F. Amendments to Cross-Border Intragroup Exemptions

The European Market Infrastructure Regulation (EMIR) 3.0 introduces important amendments to the cross-border intragroup exemption from clearing. This change aims to streamline internal risk management for multinational groups while upholding essential risk controls.

Under the new EMIR III provisions, group entities can benefit from this exemption even if the third country where one of the counterparties is located does not have an equivalence decision in place. This is a significant relaxation of a previous requirement under the European Market Infrastructure Regulation. However, this expanded exemption is conditional; it does not apply if the counterparty is in a jurisdiction identified by the EU as high-risk, such as for anti-money laundering purposes.

This change within the EMIR framework shows a pragmatic approach, balancing the operational needs of large financial groups with systemic risk management. By removing the blanket need for an equivalence decision, EMIR 3.0 facilitates more efficient internal derivatives operations, while the caveat for high-risk jurisdictions maintains a crucial safeguard. Multinational groups must carefully assess the jurisdictions of their counterparties to ensure they qualify for this updated exemption.

G. Strengthening the Supervision and Authorization of EU Central Counterparties (CCPs)

A key focus of EMIR 3.0 is to significantly enhance the authorization and ongoing supervision of EU Central Counterparties (CCPs). The primary objective is to make them safer, more efficient, and ultimately more attractive, bolstering the EU's clearing ecosystem. The European Market Infrastructure Regulation (EMIR) 3.0 grants the European Securities and Markets Authority (ESMA) new and expanded supervisory tools to achieve this. These include:

- Aligning Supervisory Practices: ESMA will use opinions and compliance reviews to foster greater consistency among National Competent Authorities (NCAs).

- Leading Supervisory Colleges: ESMA will now co-chair the 14 supervisory colleges for EU CCPs to drive consistent oversight.

- Enhancing Accountability: A new "comply or explain" procedure will strengthen the accountability of NCAs when supervisory disagreements occur.

These measures, central to the EMIR III reforms, are designed to create a more convergent supervisory culture across the EU. This will enhance risk management and promote fair competition among EU CCPs. Furthermore, the European Market Infrastructure Regulation aims to streamline supervisory processes to accelerate the time-to-market for new products offered by EU CCPs, boosting their competitiveness. This stronger, more integrated supervisory framework is a vital component of the EU's Capital Markets Union initiative, building greater confidence in the Union's financial infrastructure.

Operational and Legal Challenges of EMIR 3.0 for Stakeholders

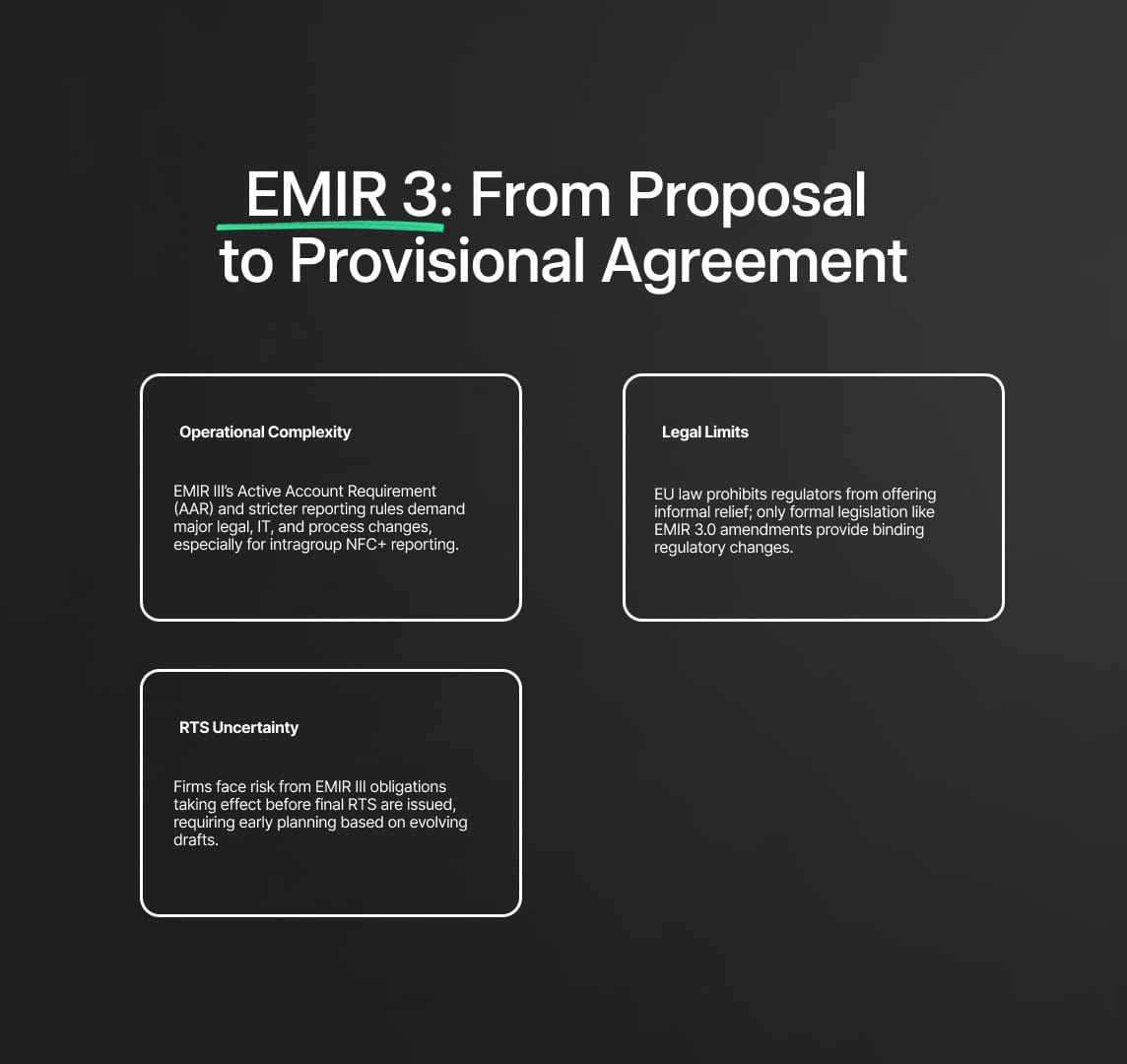

The implementation of the European Market Infrastructure Regulation (EMIR) 3.0 presents significant operational and legal challenges for all market participants as they adapt to the new framework.

A. Navigating Implementation: Operational Complexities

Stakeholders face considerable operational and execution difficulties in implementing the changes mandated by EMIR III. The complexities arise from several key amendments within the European Market Infrastructure Regulation.

The Active Account Requirement (AAR) is particularly demanding, requiring substantial operational adjustments. Firms must establish and maintain fully functional active accounts at EU CCPs, which involves significant investment in:

- Legal Documentation: Creating or updating legal agreements with EU CCPs.

- IT Connectivity: Building or enhancing IT systems for seamless integration with EU CCPs.

- Internal Processes: Designing new workflows for trade routing, clearing, and collateral management specific to EU accounts.

The enhanced transaction reporting framework under EMIR 3.0 also creates a heavy operational lift. Stricter data quality standards and the risk of severe financial penalties for errors demand investment in data governance, validation tools, and internal controls. The new intragroup reporting for NFC+s adds another layer of complexity for multinational firms navigating the EMIR landscape.

B. Legal Constraints: The Limits of Forbearance in EU Law

A core legal principle within the EU is that neither the European Securities and Markets Authority (ESMA) nor National Competent Authorities (NCAs) can formally disapply EU law or offer "forbearance." This highlights the strict separation of powers in the EU legal system.

Any change to how regulations like EMIR are applied must be enacted through formal EU legislation. This means that "no-action letters," common in the U.S., are not a tool available to EU regulators. This legal reality was evident in ESMA's March 2024 statement on TC PSAs. While it provided practical relief by deprioritizing supervision, it was not a legal exemption. The formal relief only came with the legislative enactment of the exemption within the EMIR 3.0 text itself.

This distinction provides crucial legal certainty. Firms can use supervisory guidance to manage risk but must understand that only formal amendments to the European Market Infrastructure Regulation provide a permanent and legally binding basis for relief from their obligations.

C. Uncertainty and Preparation: The Role of Level 2 Technical Standards

A major challenge in implementing EMIR 3.0 is the staggered application of its key provisions. Many critical elements, including the specific conditions of the Active Account Requirement (AAR) and the new clearing threshold calculations, depend on forthcoming Level 2 Regulatory Technical Standards (RTS) from ESMA.

There is significant industry concern that firms will be bound by the main Level 1 obligations of EMIR III before the detailed Level 2 RTS are finalised. This creates a "prepare for the unknown" scenario, forcing firms to allocate resources and make strategic decisions based on draft proposals. ESMA is working to develop these standards, having launched consultations on the AAR in November 2024 and clearing thresholds in April 2025.

This time lag between the enforcement of the main European Market Infrastructure Regulation and the finalisation of its technical details creates risk and uncertainty. To manage this, firms must engage proactively with ESMA consultations and build agile compliance systems that can be adapted once the final RTS for EMIR 3.0 are published.

EMIR 3.0's Broader Impact: Advancing the Capital Markets Union

The European Market Infrastructure Regulation (EMIR) 3.0 is more than a technical update; it is a strategic initiative designed to advance the European Union's core objectives, namely the Capital Markets Union (CMU) and the pursuit of strategic autonomy.

Contribution to EU Financial Stability and Integrated Markets

By strengthening EU clearing services, EMIR III directly enhances the resilience of the EU's financial system. Central clearing is a cornerstone of financial stability, and by reinforcing the EU's domestic clearing capacity, this latest update to the European Market Infrastructure Regulation fortifies the bloc against market shocks.

The EMIR 3.0 regulation is an essential part of the CMU's goal to create a more integrated trading and post-trading landscape. This integration fosters deeper, more liquid capital markets, which support economic growth and provide diverse financing sources. The enhanced supervisory framework for CCPs, a key feature of EMIR, aims to create uniform rule implementation, reduce regulatory arbitrage, and build greater confidence in the EU's financial infrastructure.

Strategic Autonomy: Reducing Reliance on Third-Country CCPs

A primary driver for EMIR 3.0 is the EU's ambition to reduce the systemic risk from over-reliance on third-country CCPs, particularly those in the UK. This goal is central to the EU's push for greater financial autonomy, ensuring critical market infrastructure remains under its direct oversight.

The Active Account Requirement (AAR) is the key legislative tool within EMIR III to achieve this re-orientation, mandating that certain EU firms clear a portion of their derivatives at EU-authorized CCPs. To manage this transition smoothly, the European Commission extended the equivalence for UK CCPs until June 30, 2028. This provides a structured pathway for market participants to shift activity, representing a strategy of "managed de-risking." This approach signals a long-term commitment from the EU to strengthen its domestic financial infrastructure under the European Market Infrastructure Regulation.

Shaping the Future of EU Derivatives Markets

The European Market Infrastructure Regulation (EMIR) 3.0 represents a profound evolution of the EMIR framework. It extends beyond its original risk mitigation purpose to embody the EU's strategic goals for financial resilience and autonomy, fundamentally reshaping the derivatives landscape.

The core shifts introduced by EMIR III are diverse. They include targeted relief for Third-Country Pension Scheme Arrangements, the landmark Active Account Requirement to influence clearing behaviour, and an enhanced transaction reporting framework with severe penalties for data quality issues. These changes, alongside revised clearing thresholds and greater CCP margin transparency, refine the European Market Infrastructure Regulation for greater proportionality and risk management.

While EMIR 3.0 is now in force, its full impact awaits the finalisation of Level 2 Regulatory Technical Standards from ESMA. This phased rollout requires proactive and agile preparation from all stakeholders. For financial institutions, complying with EMIR III is a strategic necessity that demands significant investment in operations, governance, and technology. By embracing these changes, market participants will not only ensure compliance but also contribute to the broader objectives of the Capital Markets Union, shaping a more resilient and strategically independent EU derivatives market.

Reduce your

compliance risks