ESMA's Third Consultation on Revised MiFIR and MiFID II

ESMA’s third consultation on revised MiFIR and MiFID II, effective March 2024, aims to boost EU market transparency and investor protection. Key updates: a single volume cap, refined SI framework, expanded reporting.

The European Securities and Markets Authority (ESMA) has published its third consultation paper focusing on the future technical standards and technical advice for the revised Markets in Financial Instruments Regulation (MiFIR) and the Markets in Financial Instruments Directive (MiFID II). This consultation is critical for the financial industry as it addresses significant changes introduced by the recent amendments to MiFID II and MiFIR, which came into force on 28 March 2024. These changes are aimed at enhancing market transparency, improving investor protection, and ensuring the robustness of the financial markets within the European Union.

Source

[1]

[2]

Background on MiFID II and MiFIR

MiFID II and MiFIR are cornerstone regulations that govern the financial markets in the European Union. They aim to increase transparency, improve investor protection, and enhance the functioning of financial markets. The recent amendments, published on 8 March 2024, mandate ESMA to develop new technical standards and provide technical advice across various areas. These areas include equity transparency, volume cap mechanisms, organisational requirements for trading venues, and post-trade transparency, among others.

The revised regulations require detailed technical standards to ensure proper implementation and operationalisation. These standards address various aspects of market structure, including pre-trade and post-trade transparency, systematic internalisers (SIs), and the consolidated tape provider (CTP) for equity instruments. ESMA's consultation paper provides a comprehensive framework for these updates, ensuring alignment with the overarching goals of MiFID II and MiFIR.

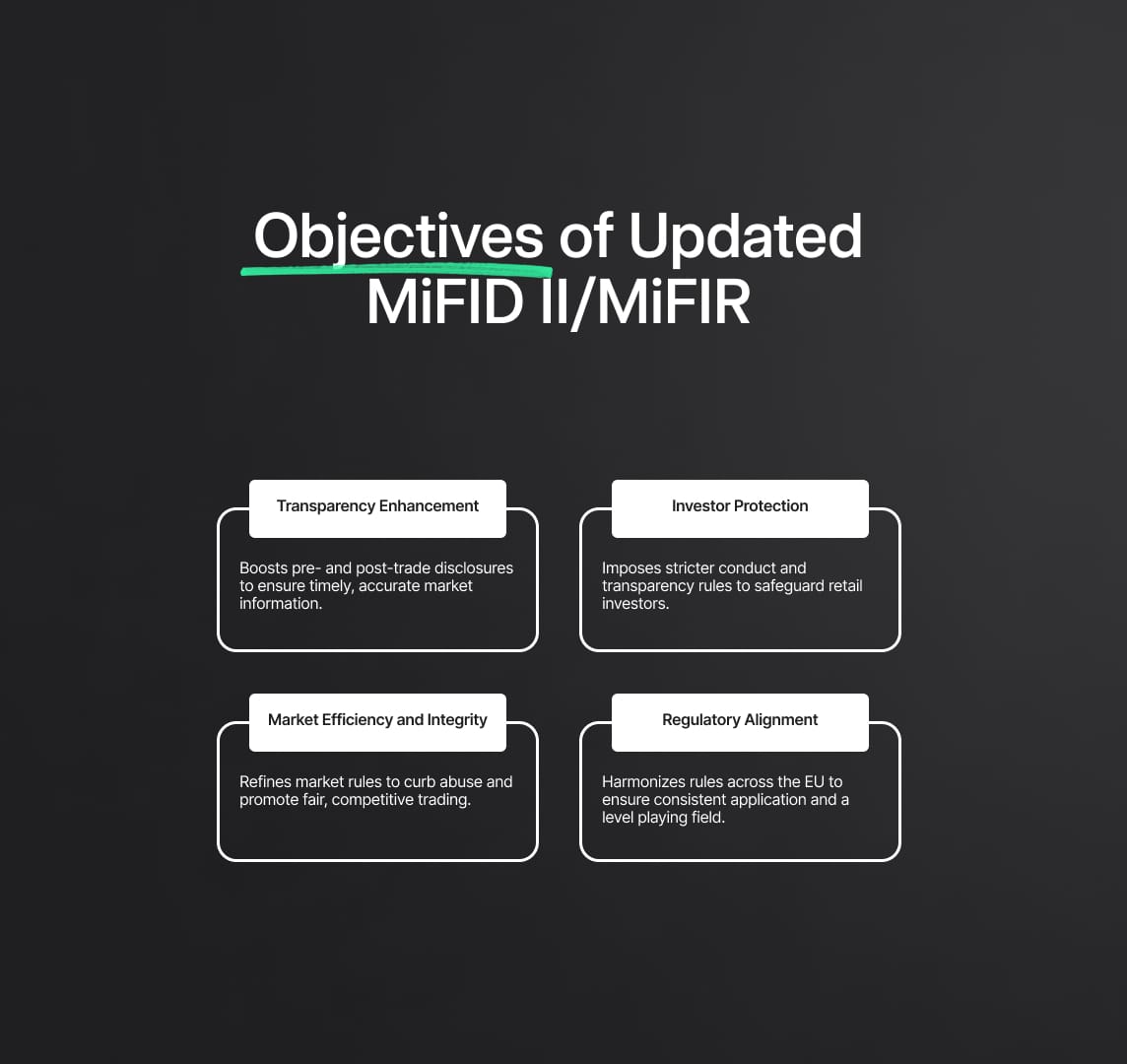

Key Objectives of MiFID II and MiFIR Amendments

- Transparency Enhancement: The amendments aim to increase both pre-trade and post-trade transparency. This includes more detailed disclosure requirements for trading venues and investment firms to ensure that market participants have access to accurate and timely information.

- Investor Protection: Strengthening the protections afforded to investors remains a critical objective. This includes ensuring that investment firms adhere to higher standards of conduct and transparency, particularly in their dealings with retail clients.

- Market Efficiency and Integrity: The amendments seek to enhance the efficiency and integrity of financial markets. This involves refining the rules governing market infrastructures and trading practices to prevent market abuse and ensure fair competition.

- Regulatory Alignment and Consistency: Ensuring consistency in the application of rules across EU member states is vital. The amendments provide a harmonized regulatory framework that minimizes discrepancies and fosters a level playing field for all market participants.

Detailed Aspects of the Consultation

ESMA's consultation paper delves into several technical and regulatory aspects necessary for the comprehensive implementation of MiFID II and MiFIR amendments. These include:

- Equity Transparency (RTS 1): Revisions to the Level 2 provisions on equity transparency, focusing on the definition of liquid markets and the calibration of transparency requirements for various market participants.

- Volume Cap Mechanism (RTS 3): Adjustments to the volume cap mechanism, transitioning from a Double Volume Cap to a Single Volume Cap, and the implications for market liquidity and integrity.

- Organizational Requirements for Trading Venues (RTS 7): Enhanced requirements for trading venues, including the implementation of circuit breakers and compliance with the Digital Operational Resilience Act (DORA).

- Post-trade Transparency for Non-equity Instruments (RTS 2): Introduction of specific flags and reporting requirements to improve the transparency of non-equity markets.

- Systematic Internalisers (SIs): Calibration of pre-trade transparency requirements for SIs, ensuring they provide meaningful and proportional information to the market.

- Equity Consolidated Tape Provider (CTP) Requirements (RTS 8): Detailed standards for the data input and output requirements for CTPs, ensuring consistency and reliability in market data dissemination.

MiFID II and MiFIR: Key Proposals in the Third Consultation Paper

1. Equity Transparency (RTS 1)

One of the significant proposals in ESMA's third consultation paper concerns amendments to the Level 2 provisions on equity transparency, specifically under Commission Delegated Regulation 2017/587 (RTS 1). These proposed changes aim to refine the definition of a liquid market for equity instruments and update pre-trade transparency requirements. These refinements are crucial for ensuring market integrity and transparency, which are central objectives of MiFIR and MiFID II.

Definition of Liquid Market (Section 3.1)

ESMA proposes substantial changes to the criteria defining a liquid market, which will have direct implications for the transparency obligations of trading venues and investment firms. The new criteria focus on:

- Free Float Market Capitalization: This is a measure of the market value of a company’s publicly traded shares, excluding restricted shares held by company insiders. By focusing on free float market capitalization, ESMA aims to more accurately assess the liquidity of an equity instrument.

- Average Daily Turnover (ADT): This parameter measures the total trading volume of a security over a given period, divided by the number of trading days. It provides a clear indicator of how frequently an instrument is traded.

- Average Daily Number of Transactions (ADNTE): This metric calculates the total number of trades executed in a security over a specified period, divided by the number of trading days. It helps in understanding the trading activity and liquidity of the instrument.

Pre-trade Transparency (Section 4.1)

The consultation emphasises the need for detailed specifications regarding the information to be disclosed for pre-trade transparency. This is essential for aligning with the requirements for the equity consolidated tape (CTP). Key aspects include:

- Range of Bid and Offer Prices: Trading venues must disclose the range of bid and offer prices or market-maker quotes, providing insights into the available liquidity and pricing at various levels.

- Depth of Trading Interest: Information on the depth of trading interest at different price levels must be made public. This includes the number of orders and the volume of shares available at each price point.

Systematic Internalisers (SIs) Pre-trade Transparency (Section 4.2)

The review also focuses on the pre-trade transparency requirements for Systematic Internalisers (SIs). SIs are investment firms that, on an organized, frequent, and systematic basis, deal on their own account by executing client orders outside regulated markets or Multilateral Trading Facilities (MTFs). Key elements include:

- Calibration of Quoting Sizes: The consultation suggests specific quoting sizes for SIs, which are critical for ensuring that the pre-trade transparency requirements are both meaningful and proportionate. The calibration aims to balance the need for transparency with the operational capabilities of SIs, ensuring they can meet the requirements without undue burden.

- Firm Quotes: SIs will be required to publish firm quotes for equity instruments. These quotes must reflect the prices at which they are willing to buy and sell the instrument, along with the corresponding volumes.

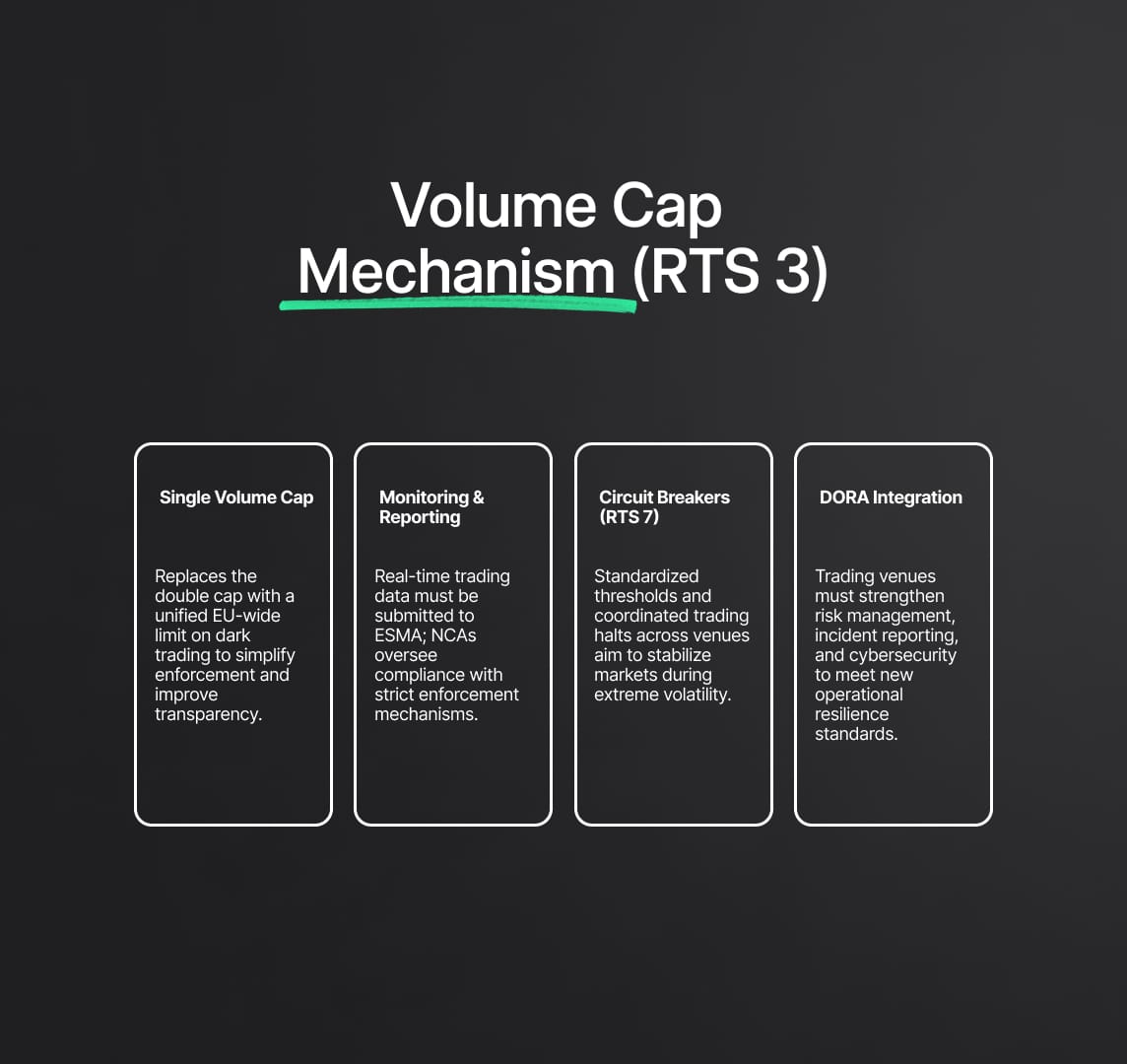

2. Volume Cap (RTS 3)

The amendments to the regulatory technical standards on the volume cap, specified in Commission Delegated Regulation 2017/577 (RTS 3), represent another critical focus area in ESMA's third consultation paper. The MiFIR review has transitioned from a Double Volume Cap to a Single Volume Cap, necessitating significant changes to the related RTS to ensure the regulatory framework remains robust and effective in maintaining market integrity.

MiFID and MiFIR Single Volume Cap

The shift from a Double Volume Cap to a Single Volume Cap is one of the pivotal changes proposed in the consultation. The Double Volume Cap mechanism, which previously involved two distinct thresholds—one for individual trading venues and one for the EU market as a whole—has been streamlined into a Single Volume Cap. This change aims to simplify the regulatory landscape and enhance the effectiveness of volume caps in preventing excessive dark trading, thereby promoting market transparency.

- Volume Cap Mechanism: The Single Volume Cap will apply uniformly across all trading venues within the EU. This cap restricts the proportion of trading in equity instruments that can be conducted in dark pools (off-exchange trading venues) to a specified percentage of the total trading volume. By imposing a unified cap, the regulation seeks to prevent any single venue from disproportionately conducting dark trading, which can obscure market prices and reduce transparency.

- Monitoring and Enforcement: The revised RTS will include detailed provisions for the monitoring and enforcement of the Single Volume Cap. This involves setting up robust mechanisms to track trading volumes across all venues and ensuring compliance with the cap. National Competent Authorities (NCAs) will be tasked with the oversight and enforcement of these provisions, ensuring that any breaches are promptly addressed.

- Transparency and Reporting: Enhanced transparency and reporting requirements are central to the effective implementation of the Single Volume Cap. Trading venues will be required to submit detailed trading data to ESMA, enabling continuous monitoring of volume cap compliance. This data will be crucial for assessing market trends and making informed regulatory decisions.

3. Organisational Requirements for Trading Venues (RTS 7)

The consultation paper also proposes a comprehensive recast of the regulatory technical standards specifying the organisational requirements for trading venues, under Commission Delegated Regulation 2017/584 (RTS 7). These updates focus on integrating the new mandate on circuit breakers and reflecting changes stemming from the Digital Operational Resilience Act (DORA).

Circuit Breakers and DORA

Circuit breakers are essential tools for maintaining market stability and protecting investors during periods of extreme market volatility. The proposed amendments to RTS 7 include:

- Implementation of Circuit Breakers: The revised RTS will provide detailed guidelines for the implementation of circuit breakers across trading venues. Circuit breakers are mechanisms that temporarily halt trading in a security or market to prevent extreme price movements and provide a cooling-off period. This is crucial during periods of significant market stress, helping to maintain orderly markets and protect investors from excessive volatility.

- Parameters for Circuit Breakers: The RTS will specify the parameters for activating circuit breakers, including the price movement thresholds that trigger trading halts and the duration of such halts. These parameters will be calibrated to reflect the unique characteristics of different financial instruments and market conditions.

- DORA Compliance: The amendments also incorporate requirements from the Digital Operational Resilience Act (DORA), which aims to enhance the operational resilience of trading venues against cyber threats and other operational disruptions. This includes guidelines on risk management, incident reporting, and recovery plans to ensure that trading venues can withstand and recover from disruptions effectively.

- Enhanced Operational Resilience: By integrating DORA provisions, the revised RTS 7 aims to bolster the overall operational resilience of trading venues. This involves setting higher standards for IT infrastructure, data security, and continuity planning, ensuring that trading venues are well-prepared to handle both market volatility and operational challenges.

4. Equity Consolidated Tape Provider (CTP) Requirements (RTS 8)

The draft Regulatory Technical Standards (RTS) on the equity Consolidated Tape Provider (CTP) have been developed to align with the proposed amendments to the RTS on equity transparency, ensuring a coherent and efficient framework for the dissemination of market data. This alignment is crucial for enhancing market transparency and fostering a more integrated financial market within the European Union, as mandated by MiFIR and MiFID II.

Input and Output Data

The consultation paper outlines specific technical standards that CTPs must handle, focusing on both input and output data to ensure consistency and reliability in the dissemination of market data. These standards are designed to guarantee that the data processed and disseminated by CTPs is accurate, timely, and comprehensive.

- Input Data Requirements: CTPs are required to collect and process a wide range of data from various trading venues. This includes pre-trade and post-trade data, covering bid and offer prices, trading volumes, and transaction prices. The input data must be sourced in real-time to ensure that the consolidated tape reflects the most current market conditions.

- Pre-trade Data: This includes information such as the best bid and offer prices and the depth of trading interest at different price levels. This data is essential for providing a clear picture of the market dynamics and available liquidity.

- Post-trade Data: CTPs must also process transaction data, including the prices and volumes of executed trades. This data is critical for ensuring post-trade transparency and helping market participants assess market activity and trends.

- Output Data Requirements: The processed data must be disseminated in a standardized format that is easily accessible and usable by market participants. This involves the aggregation and publication of data from multiple sources to create a comprehensive and consolidated view of the market.

- Real-time Dissemination: The output data must be disseminated in real-time to provide market participants with up-to-date information. This is crucial for making informed trading decisions and maintaining market efficiency.

- Standardization: The data must be standardized to ensure compatibility and ease of use. This includes using consistent formats and protocols for data transmission and publication.

- Quality Assurance: To maintain the integrity and reliability of the data, CTPs must implement robust quality assurance processes. This includes regular validation and verification of the data to ensure accuracy and completeness.

- Error Handling: Procedures for identifying and correcting errors in the data must be established. This is essential for maintaining trust in the consolidated tape and ensuring that market participants have access to reliable information.

- Data Reconciliation: Regular reconciliation of data with trading venues is necessary to ensure consistency and accuracy. This involves cross-checking data from different sources to identify and resolve discrepancies.

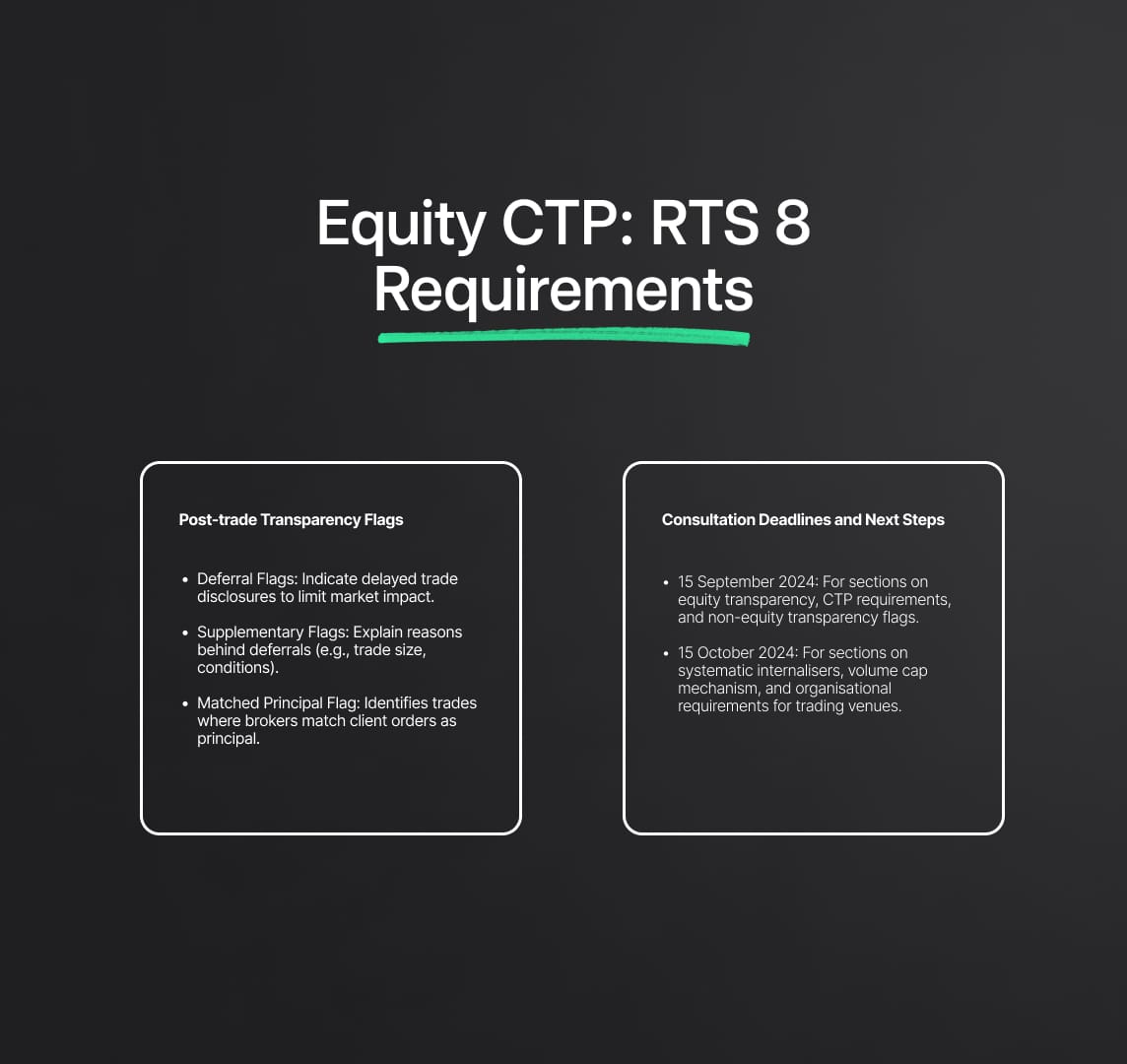

5. Post-trade Transparency for Non-equity Instruments (RTS 2)

The final section of the consultation paper proposes specific flags for post-trade transparency for non-equity instruments, as outlined in Commission Delegated Regulation 2017/583 (RTS 2). These flags are designed to enhance the transparency of non-equity markets, providing clearer and more detailed post-trade information to market participants.

Post-trade Transparency Flags

The introduction of post-trade transparency flags aims to improve the granularity and clarity of post-trade data for non-equity instruments, such as bonds and derivatives. These flags will help market participants better understand the context and conditions under which trades were executed, thereby enhancing market transparency and investor confidence.

- Types of Flags: Various flags will be introduced to indicate different aspects of post-trade transparency. These include deferral flags, supplementary deferral flags, and matched principal trading flags.

- Post-trade Deferral Flags: These flags indicate that the publication of certain trade details has been deferred. This is often necessary for large trades to prevent market impact and allow for orderly execution.

- Supplementary Deferral Flags: Additional flags that provide further details about the nature and reasons for the deferral. These flags offer greater transparency and allow market participants to better understand the conditions leading to the deferral.

- Matched Principal Trading Flag: This flag identifies trades executed by a broker-dealer as a principal in a manner that matches clients' buy and sell orders. This flag is crucial for distinguishing such trades from other types of principal trading and ensuring transparency.

- Implementation and Compliance: The proposed RTS will include detailed guidelines on the implementation and use of these flags. Trading venues and investment firms will be required to integrate these flags into their reporting systems and ensure compliance with the new standards.

- Data Integration: Trading venues must ensure that these flags are correctly applied to relevant trades and accurately reported in post-trade transparency data.

- Monitoring and Enforcement: Regulators will monitor compliance with these requirements and enforce penalties for non-compliance. This ensures that the integrity of the post-trade transparency regime is maintained.

MiFIR and MiFID II: Technical Analysis of the Proposals

Equity Transparency (RTS 1)

The revised MiFIR and MiFID II introduce substantial changes to the regulatory technical standards concerning equity transparency, particularly under RTS 1. These revisions are designed to enhance market transparency and integrity by refining the criteria that define a liquid market and updating pre-trade transparency requirements.

Definition of Liquid Market

The definition of a liquid market is critical for determining the transparency obligations of trading venues and investment firms. The revised MiFIR introduces new criteria to better capture the liquidity characteristics of equity instruments:

- Free Float Market Capitalization: This metric represents the total market value of a company’s publicly traded shares, excluding restricted shares held by company insiders. The focus on free float market capitalization ensures that the liquidity assessment reflects the true trading potential of the shares available to the public.

- Average Daily Turnover (ADT): ADT measures the total trading volume of a security over a given period, divided by the number of trading days. This criterion provides insight into the liquidity and trading activity of an instrument, helping to identify how easily shares can be bought or sold in the market.

- Average Daily Number of Transactions (ADNTE): ADNTE calculates the total number of trades executed in a security over a specified period, divided by the number of trading days. This metric is crucial for understanding the frequency and regularity of trades, which are key indicators of market liquidity.

Pre-trade Transparency Requirements

The proposed amendments to pre-trade transparency requirements are aimed at ensuring that market participants have access to detailed and timely information, which is essential for making informed trading decisions. The requirements focus on:

- Bid and Offer Prices: Trading venues are required to disclose the range of bid and offer prices or market-maker quotes for equity instruments. This information provides a snapshot of the current market conditions and the price levels at which participants are willing to trade.

- Depth of Trading Interest: Information on the depth of trading interest at various price levels must also be disclosed. This includes the number of orders and the volume of shares available at different prices, which helps market participants assess the liquidity and potential price impact of large trades.

Volume Cap Mechanism (RTS 3)

The transition from a Double Volume Cap to a Single Volume Cap mechanism under the revised MiFIR introduces significant amendments to RTS 3. The aim is to simplify the volume cap mechanism while maintaining its effectiveness in promoting market integrity and transparency.

Single Volume Cap

The Single Volume Cap replaces the previous Double Volume Cap, which included separate thresholds for individual trading venues and the entire EU market. The new Single Volume Cap is designed to provide a more straightforward and enforceable framework for limiting dark trading, thereby enhancing market transparency.

- Unified Threshold: The Single Volume Cap applies uniformly across all trading venues in the EU, setting a clear and consistent limit on the proportion of trading that can occur in dark pools (off-exchange trading venues). This threshold is intended to prevent excessive dark trading, which can obscure market prices and reduce transparency.

- Monitoring and Enforcement: Detailed provisions for monitoring and enforcing the Single Volume Cap are included in the revised RTS. This involves setting up robust mechanisms to track trading volumes across all venues and ensuring compliance with the cap. National Competent Authorities (NCAs) will play a key role in overseeing these activities and addressing any breaches.

- Transparency and Reporting Requirements: Enhanced transparency and reporting requirements are central to the effective implementation of the Single Volume Cap. Trading venues must submit detailed trading data to ESMA, which will be used to monitor compliance and assess market trends. This data must be provided in real-time to enable timely and accurate monitoring.

Organisational Requirements for Trading Venues (RTS 7)

The recast of Regulatory Technical Standards (RTS) 7, as proposed in the third consultation paper for MiFIR and MiFID II, introduces critical updates to the organisational requirements for trading venues. These updates are designed to enhance market stability and ensure the operational resilience of trading venues, thereby contributing to the overall integrity and efficiency of the financial markets within the European Union.

Circuit Breakers

Circuit breakers are mechanisms implemented in trading systems to temporarily halt trading in the event of significant price movements. The goal is to prevent extreme volatility, allow market participants to assess information, and maintain orderly markets. The proposed RTS 7 includes detailed specifications for the implementation and operation of circuit breakers:

- Activation Thresholds: The RTS will define specific price movement thresholds that trigger circuit breakers. These thresholds will vary based on the type of financial instrument and market conditions. For instance, highly liquid instruments might have different thresholds compared to less liquid ones to reflect their unique trading dynamics.

- Duration of Halts: The duration of trading halts will be specified to provide sufficient time for market participants to digest new information and make informed decisions. Short-term halts might be implemented for brief price spikes, while longer halts could be necessary during severe market disruptions.

- Market-wide Coordination: To ensure consistency and prevent regulatory arbitrage, the RTS will include provisions for the coordination of circuit breakers across different trading venues. This involves harmonizing activation thresholds and halt durations to ensure a synchronized response to market events.

- Resumption of Trading: Clear guidelines will be provided for the resumption of trading after a circuit breaker is triggered. This includes the conditions under which trading can resume and any additional transparency requirements to inform market participants about the resumption process.

DORA Integration

The Digital Operational Resilience Act (DORA) introduces a framework to ensure that trading venues can withstand and recover from various operational disruptions, including cyberattacks and technical failures. The integration of DORA into RTS 7 aims to bolster the operational resilience of trading venues through several key amendments:

- Risk Management: Trading venues must implement robust risk management frameworks to identify, assess, and mitigate operational risks. This includes regular risk assessments, the establishment of contingency plans, and the implementation of preventive measures to reduce the likelihood of disruptions.

- Incident Reporting: The RTS will specify requirements for incident reporting, mandating that trading venues promptly report significant operational disruptions to the relevant authorities. This ensures that regulators are aware of issues and can take appropriate actions to safeguard market stability.

- Business Continuity Planning: Detailed guidelines will be provided for business continuity planning, ensuring that trading venues have comprehensive strategies in place to maintain critical operations during and after a disruption. This includes provisions for backup systems, data recovery, and communication plans to keep market participants informed.

- Cybersecurity Measures: The integration of DORA will also enhance cybersecurity requirements for trading venues. This includes implementing advanced security protocols, conducting regular security audits, and ensuring that systems are resilient against cyber threats.

Equity Consolidated Tape Provider (CTP) Requirements (RTS 8)

The draft RTS on equity Consolidated Tape Providers (CTPs) specify detailed requirements for the input and output data handled by CTPs, ensuring consistency and reliability in the dissemination of market data. This alignment with equity transparency standards is crucial for creating a comprehensive and integrated market data framework.

Input Data

- Data Collection: CTPs are required to collect data from multiple trading venues, including real-time pre-trade and post-trade data. This ensures that the consolidated tape provides a complete and accurate representation of market activity.

- Data Quality: To maintain high data quality, CTPs must implement stringent data validation processes. This includes verifying the accuracy and completeness of data received from trading venues and promptly addressing any discrepancies.

- Data Standardization: The RTS will specify standardised formats for data submission, ensuring that data from different sources is compatible and can be seamlessly integrated into the consolidated tape.

Output Data

- Real-time Dissemination: The consolidated tape must disseminate data in real-time to provide market participants with up-to-date information. This real-time access is essential for informed trading decisions and market transparency.

- Data Accessibility: The output data must be made easily accessible to all market participants. This includes ensuring that the data is available through multiple channels and in formats that are user-friendly and compatible with various trading systems.

- Quality Assurance: CTPs must implement robust quality assurance measures to ensure the reliability and accuracy of the data they disseminate. This includes regular audits and monitoring to detect and correct any errors.

Post-trade Transparency for Non-equity Instruments (RTS 2)

The proposed RTS 2 introduces specific flags for post-trade transparency in non-equity instruments, enhancing the granularity and clarity of post-trade data. These flags are designed to provide market participants with detailed information about trade conditions and execution contexts.

Post-trade Transparency Flags

- Post-trade Deferral Flags: These flags indicate that certain trade details have been deferred to prevent market impact, particularly for large trades. The RTS will specify the conditions under which deferrals are allowed and the duration of such deferrals.

- Supplementary Deferral Flags: Additional flags will provide further details about the nature and reasons for the deferral. This includes specifying whether the deferral is due to the size of the trade, market conditions, or other factors.

- Matched Principal Trading Flag: This flag identifies trades executed by a broker-dealer acting as a principal to match client orders. This distinction is important for transparency, as it differentiates matched principal trades from other types of principal trading.

Consultation Deadlines and Next Steps

Stakeholders are invited to provide comments on the consultation paper by:

- 15 September 2024: For sections on equity transparency, CTP requirements, and non-equity transparency flags.

- 15 October 2024: For sections on systematic internalisers, volume cap mechanism, and organisational requirements for trading venues.

Based on the responses and feedback received, ESMA will prepare a Final Report, including draft technical standards for submission to the European Commission. The expected timeline for submission is December 2024 for sections 3, 4, 8, and 9, while the remaining mandates will be delivered by March 2025.

Reduce your

compliance risks