EU Banking: need for a strong Regulatory Framework

ECB Vice President Luis de Guindos stresses on finalizing EU banking package CRR3/CRD6 for the digital age. Citing US and Swiss banking issues, he underscores robust regulation, praises euro area banks' resilience, but warns against complacency.

Strengthening EU Banking Framework in the Digital Age

European Central Bank Vice President Luis de Guindos emphasized the importance of finalizing the EU banking package, CRR3/CRD6, in light of the digital age. He highlighted recent stress episodes in the US and Swiss banking sectors as evidence for the need for a strong regulatory framework. Guindos praised the resilience of the euro area banks, with a common equity tier one capital ratio average of 15.3% and liquidity well above regulatory minima. However, he warned against complacency and urged for the continuation of strong regulation and supervision. Lessons from these episodes emphasize the importance of strong rules for maintaining strong banks and empowering prudential authorities. The digital age presents new challenges, such as the rapid spread of trust issues and the potential for faster bank runs. Therefore, it is crucial to ensure bank managers are committed to sound business models and establish trust in the financial sector.

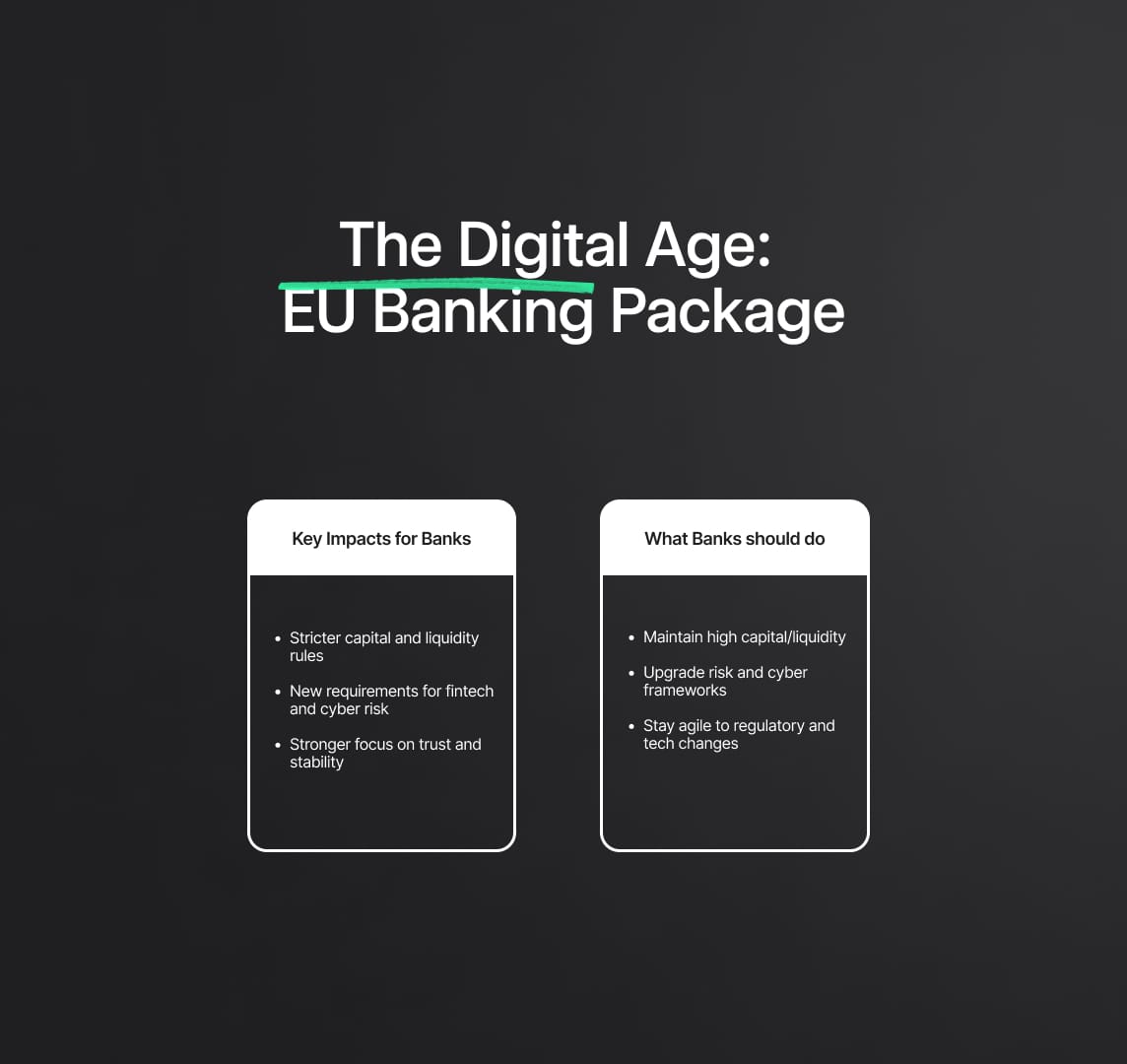

The Digital Age: EU Banking Package

European Central Bank Vice President Luis de Guindos recently stressed the critical importance of finalizing the EU banking package, CRR3/CRD6, in response to the challenges posed by the digital age. Guindos emphasized the need for a robust regulatory framework, citing stress episodes in the banking sectors of the United States and Switzerland as evidence. While acknowledging the resilience of euro area banks with a commendable average common equity tier one capital ratio of 15.3% and ample liquidity above regulatory minima, Guindos warned against complacency. He urged the continuation of strong regulation and supervision, highlighting the lessons learned from recent crises that underscore the importance of maintaining strong banks and empowering prudential authorities.

The digital age brings forth various implications for the EU banking framework. The rapid dissemination of information and the increased interconnectedness of the global financial system facilitate the swift spread of trust issues among banks. This, in turn, heightens the risk of faster bank runs and threatens the stability of the entire financial system. Consequently, the article emphasizes the crucial role of robust regulation and supervision to mitigate these risks effectively.

Furthermore, the emergence of new financial technologies and business models in the digital age necessitates additional regulatory measures. Ensuring the stability and security of the financial system is of paramount importance, requiring regulators to adapt to these advancements proactively. Additionally, the digital age introduces heightened cyber risks, which can have severe consequences for banks and their customers. Consequently, regulatory authorities must respond by implementing appropriate measures to protect the financial system from cyber threats.

Despite the challenges, the digital age also presents opportunities for financial inclusion and innovation. It has the potential to contribute to overall economic growth and development. However, it is essential for regulators to strike a delicate balance between promoting innovation and ensuring the stability and security of the financial system.

Financial institutions operating within the European Union must closely monitor the developments related to the EU banking package, CRR3/CRD6, and be prepared for potential changes. If modifications are made to the regulation, banks and financial institutions can expect various impacts. These may include stricter capital requirements and liquidity standards, an increased focus on addressing trust issues and preventing faster bank runs, the introduction of additional regulatory measures to address new financial technologies and business models, enhanced measures to mitigate cyber risks, and the necessity of striking a balance between financial innovation and the stability and security of the financial system.

To stay compliant with CRR3/CRD6, financial institutions should implement specific mitigating efforts. These include continuously monitoring and maintaining a strong common equity tier one capital ratio, ensuring liquidity levels remain well above regulatory minima, implementing robust risk management frameworks to address trust issues and prevent faster bank runs, adapting to new financial technologies and business models through the implementation of necessary regulatory measures, enhancing cybersecurity measures to mitigate potential cyber risks, and collaborating closely with regulatory authorities to strike the right balance between promoting innovation and maintaining stability and security.

Grand is live 🎈, check out our GPT4 powered GRC Platform

Reduce your

compliance risks