EU Investment Fund Regulation: AIFMD/UCITS Directive Updates

On 25 March 2024, the EU's financial sector saw key advancements with new Delegated Regulations enhancing the UCITS Directive and AIFMD framework. These regulations, effective from 25 June 2024, aim to improve transparency, governance, and information exchange.

Overview of the 2024 AIFMD II and UCITS VI Reforms

In March 2024 the European Union adopted Directive (EU) 2024/927, an omnibus amending directive that upgrades its two flagship fund-management regimes, the Alternative Investment Fund Managers Directive (AIFMD II) and the Undertakings for Collective Investment in Transferable Securities Directive (UCITS VI). Effective implementation is scheduled for April 2026, with certain enhanced supervisory-reporting obligations commencing in 2027.

The reforms concentrate on five strategic pillars that are central to regulatory scrutiny of both AIFs and UCITS:

- Delegation oversight

- Liquidity-risk governance

- Supervisory reporting harmonisation

- Depositary and custody safeguards

- A new EU-wide framework for loan-originating funds

Compliance and legal teams across EU fund managers must now assess the revised text, map gaps, and build implementation roadmaps well ahead of the transposition deadline.

What This Guide Covers

- Background and Context – evolution of AIFMD and UCITS and their current scope.

- Key 2024 Changes – granular analysis of new AIFMD II and UCITS VI requirements.

- Comparative Matrix – where the two frameworks converge or diverge post-amendment.

- Regulatory Impact – implications for managers, depositaries, regulators, and investors.

- Forward Outlook – upcoming milestones and long-term trajectory of EU fund regulation.

2. Background: Evolution of AIFMD and UCITS in Europe

Understanding why the 2024 AIFMD II / UCITS VI package matters begins with the history behind the two foundational EU fund-regulation pillars: the Alternative Investment Fund Managers Directive (AIFMD) and the Undertakings for Collective Investment in Transferable Securities (UCITS) framework. Together, they create a dual-track system, one regime for alternative funds marketed mainly to professional investors and another for liquid, retail-oriented funds.

2.1 AIFMD: From Post-Crisis Oversight to AIFMD II

| Milestone | Purpose & Regulatory Significance |

|---|---|

| 2011 – Adoption of Directive 2011/61/EU | Established an EU-wide licence for alternative investment fund managers (AIFMs), imposing rules on authorisation, risk & leverage limits, valuation, depositary oversight, and systemic-risk reporting. |

| 2013-2014 – First transposition & go-live | Introduced the cross-border “AIFM passport,” allowing managers to market AIFs to professional investors across Member States. |

| 2018-2019 – First Commission review | Identified targeted improvements (delegation, liquidity tools, reporting burden). |

| Nov 2021 – Commission proposal for AIFMD II | Aimed to fix specific weaknesses without overhauling the framework. |

| Mar 2024 – Formal adoption of Directive (EU) 2024/927 | Launches the two-year countdown to national transposition by 16 Apr 2026; supervisory-reporting upgrades apply from 2027. |

Key concept: AIFMD is an actor directive, it regulates the manager, not the underlying fund. Strategy flexibility is high, but marketing is restricted chiefly to professional investors, balancing market innovation with systemic-risk oversight.

2.2 UCITS: The Gold-Standard Retail Fund Passport

| Generation | Core Enhancements |

|---|---|

| UCITS I (1985) | Created the first EU “product passport” for retail funds investing in transferable securities. |

| UCITS III (2001) | Broadened eligible assets (incl. derivatives) and required a simplified prospectus. |

| UCITS IV (2009) | Introduced the Management Company Passport, master-feeder structures, streamlined cross-border notifications, and the Key Investor Information Document (KIID). |

| UCITS V (2014) | Strengthened depositary liability, aligned remuneration with AIFMD, and harmonised sanctions. |

| UCITS VI (2024) | Amending package aligned with AIFMD II—updates liquidity-risk tools, reporting templates, and supervisory convergence. |

UCITS rules prescriptively limit asset classes, leverage, and liquidity, ensuring that even small retail investors receive a high level of protection. In exchange, compliant funds gain seamless EU-wide distribution and a globally recognised reputation for safety.

2.3 AIFMD vs UCITS at a Glance (Pre-2024)

| Feature | AIFMD | UCITS |

|---|---|---|

| Core Focus | Manager regulation | Product regulation |

| Eligible Investors | Primarily professional | Retail & professional |

| Passport Type | Marketing & management (professional only) | Product passport (retail) |

| Asset Flexibility | Broad; strategy-agnostic | Strict, liquid securities |

| Depositary Oversight | Mandatory | Mandatory |

Despite different scopes, both directives impose transparency, depositary independence, and disclosure obligations, setting the stage for the 2024 convergence.

2.4 Timeline to the 2024 Amendments

- 13 Nov 2021 — Commission publishes the AIFMD II / UCITS update proposal.

- 7 Feb 2024 — European Parliament approves final text.

- 13 Mar 2024 — Directive (EU) 2024/927 formally adopted.

- 26 Mar 2024 — Text appears in the Official Journal, triggering entry into force 20 days later.

- 15 Apr 2024 — AIFMD II / UCITS VI enter into force.

- 16 Apr 2026 — Member-State transposition deadline.

- 16 Apr 2027 — Enhanced supervisory-reporting obligations begin.

- 16 Apr 2029 — Commission must complete a post-implementation review.

3. Key Regulatory Changes Under Directive (EU) 2024/927

The March 2024 amendments, collectively branded AIFMD II and UCITS VI, deliver targeted reforms rather than a wholesale rewrite. The focus is five-fold:

- Governance & substance (anti “letter-box”)

- Delegation oversight

- Liquidity-risk toolkits (covered in Section 4)

- Depositary & custody alignment (Section 5)

- EU loan-originating-fund regime (Section 6)

This section analyses the first two themes, explaining how the Alternative Investment Fund Managers Directive and UCITS rules now converge.

3.1 Governance & Substance: Ending “Letter-Box” Managers

| Directive | New Minimum Standard | Practical Impact |

|---|---|---|

| AIFMD II |

• At least two reputable, appropriately qualified EU-resident senior managers who devote full-time attention to each authorised AIFM. • Granular disclosure at authorisation: roles, reporting lines, time commitment, human & technical resources. • Detailed explanation of how every AIFMD obligation will be met — including oversight of all delegates. |

Formalises the “four-eyes” principle. Ends reliance on shell entities with no on-shore substance. |

| UCITS VI | Mirrors AIFMD II: UCITS management companies (ManCos) must also have two senior persons effectively directing the business and robust internal-control frameworks. | Aligns retail-fund governance with alternative-fund norms; closes Member-State divergence. |

Conflict-of-interest upgrade

If an AIFM or UCITS ManCo manages a fund initiated or branded by a third party, it must now give regulators a detailed, pre-emptive explanation of how conflicts are identified, avoided, mitigated, and disclosed. The rule squarely targets “white-label” fund-hotel structures.

Compliance checklistConfirm two EU-based directors/officers are in place.Map each individual’s responsibilities, seniority, and time allocation.Refresh conflict-of-interest registers—specifically for third-party initiated or delegated funds.Prepare for forthcoming Level 2 technical standards that will define when a manager becomes a letter-box.

3.2 Delegation Controls & Letter-Box Safeguards

- Expanded notification duty – Every delegation or sub-delegation of an Annex I function, including portfolio, risk management, or any MiFID “top-up” service, must be notified to the home regulator, irrespective of the delegate’s jurisdiction.

- Unbroken accountability – The AIFM (or UCITS ManCo) remains fully responsible for the delegate’s compliance as if the delegate were subject to EU rules, even where the delegate is non-EU or unregulated.

- Regulatory data feed – Periodic reports must quantify AUM percentages delegated, name each delegate, specify its domicile/regulatory status, and describe oversight measures, giving supervisors a data-driven view of potential letter-box risks.

- Distribution ≠ delegation – Hiring an EU-licensed MiFID distributor or IDD intermediary to market a fund does not count as delegation of management; this preserves existing distribution models.

- No hard cap—yet – Legislators rejected a 50 % portfolio-delegation cap, opting for a principles-based approach. The Commission will revisit independent-director requirements for retail AIFs during the 2029 review.

- UCITS technical standards incoming – UCITS prospectuses must list all delegated functions and service providers. ESMA-drafted RTS will set quantitative and qualitative tests for determining letter-box status.

Compliance takeawayBuild a single inventory of every delegation (including intra-group and ancillary services).Document due-diligence, on-going monitoring, and oversight visit timetables for each delegate.Expect regulators to challenge any model where a high share of core functions—or of AUM—is outsourced.For host/third-party ManCo relationships, both the licensed ManCo and the delegate portfolio manager should prepare evidence packs demonstrating real decision-making and conflict controls.

4. Liquidity-Risk Management Toolkit: AIFMD II & UCITS VI

Episodes of redemption stress, most recently during the 2020-22 market swings, pushed EU legislators to harmonise liquidity-management tools (LMTs) across all open-ended funds. Both Alternative Investment Fund Managers Directive II (AIFMD II) and UCITS VI now oblige managers to pre-define, disclose, and govern at least two LMTs per fund.

4.1 Minimum Requirements for Open-Ended AIFs

| Obligation | New Standard | Compliance Pointer |

|---|---|---|

| Select ≥ 2 LMTs | Choose from a prescribed list: redemption gates, notice-period extensions, redemption fees, in-kind redemptions, swing pricing, dual pricing, anti-dilution levies, side pockets, or full suspension. | Match tools to the fund’s liquidity profile and redemption policy. |

| Written Policies & Procedures | Document activation / de-activation triggers, governance bodies, investor-communication steps, and fair-value methodology. | Integrate with risk-management and valuation manuals. |

| Regulatory Notice | Notify the home supervisor each time an LMT is activated or lifted; supervisors may order activation or suspension in exceptional circumstances. | Build notification templates and escalation flow-charts. |

Key point: Suspension is no longer the only back-stop; intermediate measures must be available and operationally tested.

4.2 Retail-Focused UCITS Funds

| Requirement | Alignment with AIFMD II | Retail-Specific Nuances |

|---|---|---|

| ≥ 2 LMTs | Same core list applies. | In-kind redemptions excluded (unless distribution is restricted to professional investors). |

| Money-Market Funds (MMFs) | MMFs remain subject to the specialised MMF Regulation; they may stick to a single LMT if that rule set so permits. | No extra tools required beyond MMF Regulation. |

| Rapid Activation | National pre-approval regimes for suspensions are abolished; managers may act immediately, then notify. | Removes cross-border timing frictions during crises. |

Supervisor Convergence

ESMA will issue pan-EU guidance detailing:

- What counts as “exceptional circumstances.”

- Best practice for swing-pricing calibration, side-pocket governance, and investor notices.

4.3 Implementation Roadmap

- Amend fund documents (prospectus, fund rules, KID/KIID) to list at least two LMTs and explain their use.

- Draft or update Liquidity Management Policies—include scenario analysis, governance flow, and IT readiness for tools such as swing pricing.

- Simulate LMT activation during internal risk drills and ensure registrar/transfer-agent systems can apply gates, fees, or pricing-adjustments intraday.

- Educate distribution partners so investor-facing staff can explain LMT mechanics and timing.

Investor benefit: A unified EU toolkit reduces first-mover advantage and protects remaining shareholders through anti-dilution levies or swing pricing, while allowing full suspension only as a last resort.

5. Enhanced Investor Transparency & Anti-Greenwashing Controls

The 2024 package tightens fee, cost, and naming disclosures to bolster investor trust and curb misleading marketing.

5.1 AIFMD II Disclosure Upgrades

| Disclosure Stage | New Obligation | Purpose |

|---|---|---|

| Pre-investment (Art. 23) | Provide a complete list of all fees, charges, and expenses—direct or indirect—accruing to the AIFM or its affiliates. Identify available LMTs and the conditions for use. | Eliminates hidden or opaque costs; prepares investors for potential gating or swing pricing. |

| Periodic / Annual | Report (i) aggregate fees and charges actually borne by investors; (ii) composition of any originated-loan portfolio; (iii) use of parent, subsidiary, or SPV structures. | Enables investors to gauge total cost of ownership and structural complexity. |

5.2 UCITS VI Alignment

UCITS already operate under robust prospectus and KIID/KID rules; the 2024 amendments:

- Extend undue-cost scrutiny to mirror AIFMD expectations.

- Require that any LMTs (swing pricing, anti-dilution levies, etc.) appear clearly in the prospectus.

- Embed the “name not misleading” principle into pre-contractual disclosures.

5.3 Fund Names & ESG Claims

- ESMA will issue cross-sector guidelines on names that are “unfair, unclear, or misleading,” especially around ESG, Green, Climate, or Sustainable labels.

- AIFs marketed to retail investors must state in the KID that the fund name must not mislead, reinforcing the obligation to substantiate product claims.

5.4 Action Steps for Compliance & Marketing

- Cost Mapping – Build a master spreadsheet of every fee/charge touching the fund, flagging those retained by the manager or group entities.

- Prospectus Redraft – Insert granular fee tables, LMT descriptions, and structural diagrams if SPVs or warehousing vehicles are used.

- Name Audit – Run an ESG and superlative keyword scan (“safe,” “absolute return,” “green”) against ESMA’s forthcoming naming rubric; re-brand early if needed.

- Investor Education – Produce Q&A sheets explaining swing pricing, anti-dilution levies, and gate mechanics in plain language to pre-empt surprises.

6. Regulatory Reporting Upgrades: AIFMD II & UCITS VI

The 2024 package transforms supervisory reporting from a niche quarterly task into a strategic, data-driven obligation touching every EU fund manager.

6.1 AIFMD Annex IV 2.0 — What’s New?

| New Data Bucket | Core Requirement | Supervisory Objective |

|---|---|---|

| Full portfolio look-through | Report all markets, instruments, and assets — not merely top holdings. | Systemic-risk mapping across asset classes. |

| Cross-border marketing map | Identify every Member State where each AIF is marketed. | Monitor passport use & compliance with notification rules. |

| Unified leverage metric | Provide aggregate leverage employed alongside gross & commitment figures. | Sharper view of liquidity & counterparty risk. |

| Delegation anatomy | Detail % AUM delegated, delegate identity, domicile, regulator, staff overseeing delegates, due-diligence cadence, sub-delegation chains, and dates of each agreement. | Detect “letter-box” practices and off-shored risk. |

Timeline

- By April 2027: New templates go live (ESMA has up to 36 months from April 2024 to finalise RTS/ITS).

- Action now: Conduct a gap analysis of current Annex IV data versus forthcoming fields; upgrade middle-office systems, LEI capture, and delegate-data feeds.

6.2 UCITS “Annex” Reporting — A First

UCITS managers face an EU-wide, harmonised report modelled on Annex IV:

- Portfolio & market exposure — full asset breakdown, derivatives, and liquidity buckets.

- Stress-test outputs — quantitative impact under prescribed scenarios.

- Leverage & VaR — even if limited, derivative exposure must be quantified.

- Delegation register — who performs portfolio/risk management, where, and under which licence.

- Cross-border distribution footprint — Member States of sale and channel used.

Benefit: Groups running both AIFs and UCITS can converge on a single internal reporting architecture, streamlining technology and controls.

6.3 Compliance Playbook

- Data taxonomy — Define each new field once, then map to both Annex IV and the new UCITS schema.

- Source-of-truth systems — Centralise delegate contracts, stress-test results, and distribution data; automate XML/ISO 20022 outputs where possible.

- Dry-run reporting — Pilot the new templates in 2026 to surface gaps before the April 2027 first filing.

- Regulator dialogue — Engage early with NCA tech-portals on submission specs to avoid first-day rejections.

7. Depositary & Custody Reforms: Towards a Flexible, Risk-Aligned Model

7.1 “Depositary Passport Lite”

- An AIF may appoint a depositary in another Member State if its home market lacks a provider able to service the strategy or scale.

- Approval is case-by-case and must show “necessity”; the foreign depositary undertakes to cooperate with all relevant NCAs.

- UCITS: While a full passport is not granted, parallel language permits similar case-by-case solutions in small markets.

7.2 CSD Custody Clarified

| CSD Role | Regulatory Treatment | Impact on Deposit-Taking Bank |

|---|---|---|

| Issuer CSD (home market infrastructure) | Not a delegation of custody. | No extra due-diligence layer required. |

| Investor CSD (cross-border custody) | Is a sub-custodian delegate. | Full look-through, liability, and record-keeping obligations apply. |

Depositaries may continue to use omnibus accounts, provided asset-segregation records remain accurate and auditable.

7.3 Third-Country Depositaries

For non-EU AIFs using local custodians:

- The depositary’s country must not be on the EU AML/CFT high-risk list or the non-co-operative tax list.

- If blacklisted later, the AIFM has ≤ 2 years to appoint a replacement in an eligible jurisdiction.

7.4 Manager & Depositary Action Points

- Cross-border option assessment — In smaller domiciles, document whether a local provider suffices; prepare a “necessity file” if a foreign depositary is required.

- CSD mapping — Categorise each CSD relationship as issuer or investor; update sub-custodian contracts and oversight questionnaires accordingly.

- Jurisdiction watchlist — Embed AML/tax-blacklist monitoring into vendor-risk frameworks; pre-plan migration paths for affected funds.

- Data handshake — Align depositary reporting feeds with upgraded Annex IV / UCITS reports to ensure consistent asset-holding data.

8. EU Framework for Loan-Originating AIFs

The 2024 Alternative Investment Fund Managers Directive II introduces the first EU-wide rulebook for loan-originating funds, a regime with no UCITS equivalent.

8.1 Scope & Definitions

| Term | Threshold | Consequence |

|---|---|---|

| Loan-Originating AIF | Fund whose primary strategy is lending or ≥ 50 % of NAV in originated loans | Subject to full loan-fund chapter (leverage caps, diversification, retention) |

| Occasional lender | Any AIF that originates some loans | Must follow general prudential rules (but lighter) |

8.2 General Prudential Rules (All Lending AIFs)

| Rule | Purpose | Detail |

|---|---|---|

| 5 % “skin-in-the-game” retention | Curtail originate-to-distribute models | Fund must keep ≥ 5 % of any loan it sells or transfers. |

| 20 % borrower cap | Prevent concentration risk | Exposure to any single borrower ≤ 20 % of fund capital (financial-institution carve-out applies). |

| No consumer lending | Member-State option | States may prohibit loans to individuals; rule remains nationally driven. |

| Cost transparency | Investor protection | All loan-administration costs disclosed; interest & proceeds flow exclusively to the fund. |

8.3 Extra Rules for “Loan-Originating AIFs”

| Dimension | Closed-Ended | Open-Ended |

|---|---|---|

| Leverage ceiling | ≤ 300 % of NAV | ≤ 175 % of NAV |

| Conflicts ban | Lending to affiliated financial entities restricted to avoid circular credit. | |

| Grandfathering | Existing funds have until April 2029 to meet leverage/diversification limits. |

Strategic upside: A harmonised framework effectively grants a professional-investor “lending passport,” allowing compliant credit funds to market across the EU under consistent rules.

Compliance checklist

- Map borrower exposures vs. 20 % cap.

- Monitor commitment-method leverage daily.

- Embed 5 % retention tracking in trade-capture systems.

- Update PPM/prospectus to reflect leverage limits, retention, and new risk factors.

9. Non-EU Managers & Funds: Tightened NPPR Gate

Non-EU AIFMs relying on National Private Placement Regimes (NPPR) now face higher eligibility hurdles under amended AIFMD Article 42.

9.1 Jurisdiction Screens

| Disqualifier | Effect on Marketing | Ongoing Obligation |

|---|---|---|

| AML/CFT high-risk list | NPPR prohibited if manager or fund is based in a listed country. | Monitor list updates; withdraw marketing within 30 days if added. |

| EU tax blacklist | Same absolute ban. | Continuous monitoring required. |

| No tax-information-exchange treaty | Marketing blocked until treaty in force. | Confirm bilateral agreements for each target Member State. |

9.2 Operational Impact

- Extended disclosures — Non-EU AIFMs must adopt the new Article 23 fee & liquidity disclosures and the enhanced Annex IV data fields when marketing into the EU.

- UK dimension — Post-Brexit UK firms are third-country AIFMs; while unlikely to breach blacklist tests, they must still upgrade reports and investor documents for every EU NPPR target state.

- Future passport groundwork — By filtering for well-regulated jurisdictions now, the EU paves the way for a potential third-country passport without compromising investor protection.

9.3 Action Plan for Third-Country Managers

- Jurisdiction audit — Verify manager and fund domicile status against AML and tax lists each quarter.

- Disclosure upgrade — Align offering docs with AIFMD II fee tables, liquidity-tool language, and loan-portfolio details (if applicable).

- Reporting build-out — Prepare to file Annex IV 2.0 (or UCITS-Annex equivalent if managing UCITS via sub-advisory).

- Contingency protocols — Draft exit strategies for EU marketing should domicile status change.

Comparative Analysis — AIFMD II vs UCITS VI (Post-2024)

The 2024 reforms draw AIFMD and UCITS closer together on governance, liquidity, and transparency, yet the two frameworks still target distinct segments of Europe’s fund market.

Core Purpose & Scope

| Directive | Primary Aim | Typical Investors | Product Limits |

|---|---|---|---|

| AIFMD II | Regulate fund managers of alternative strategies (hedge, private equity, real estate, infrastructure, private credit, etc.). | Professional & well-informed investors. | Few product-level limits; strategy flexibility remains high. |

| UCITS VI | Provide a product rulebook for retail-orientated, liquid mutual funds. | Mass-market retail & professionals. | Strict asset eligibility, diversification, leverage, and liquidity rules. |

9.2 New Points of Alignment After 2024

| Area | Converged Standard |

|---|---|

| Liquidity-risk tools | ≥ 2 pre-defined LMTs for every open-ended fund. |

| Delegation & substance | Two-person EU management, granular delegate oversight, anti-“letter-box” principles. |

| Supervisory reporting | Expanded Annex IV for AIFMs; first-ever harmonised UCITS report (go-live 2027). |

| Depositary oversight | Common treatment of CSD custody chains; tighter third-country criteria. |

| Fee & conflict disclosure | Full fee tables, conflict explanations, and “name not misleading” tests in both regimes. |

9.3 Key Divergences That Remain

| Topic | AIFMD II | UCITS VI |

|---|---|---|

| Investor passport | EU-wide marketing only to professionals; no generic retail passport. | Retail passport via simple host-state notification. |

| Eligible assets | Virtually any asset class, including loan origination (with new caps). | Transferable securities and liquid instruments; no direct lending. |

| Leverage rules | No hard cap (except 300 % / 175 % NAV for loan funds). | Derivative exposure ≤ 100 % NAV; borrowing ≤ 10 % short-term. |

| Liquidity model | Both open- and closed-ended funds allowed. | Must offer at least twice-monthly — in practice, daily — redemptions. |

| Retail disclosures | No KIID/KID unless selling to retail under special regimes. | Mandatory KIID/KID plus standardised prospectus review. |

9.4 Snapshot Matrix

| Aspect | AIFMD II | UCITS VI |

|---|---|---|

| Investor Passport | Professional only | Retail & professional |

| Asset Flexibility | Broad | Narrow |

| Hard Leverage Cap | None* | Yes |

| ≥ 2 LMTs | ✔ | ✔ |

| Two-Person Management | ✔ | ✔ |

| Harmonised Reporting | Annex IV+ | UCITS Annex |

| Depositary Location | Same MS (case-by-case relief) | Same MS (rare relief) |

* Loan-originating AIFs: 300 % (closed) / 175 % (open) of NAV.

Compliance Takeaways

- One policy, two regimes: Liquidity, delegation, and reporting controls can now be standardised across an AIF–UCITS platform.

- Respect strategic limits: UCITS remain unsuitable for high leverage, illiquid assets, or direct lending; AIFs still lack a universal retail passport.

- Data readiness: Prepare for dual filing of Annex IV+ and the new UCITS report by April 2027.

- Governance proof-points: Document EU-resident senior managers’ roles, delegate due-diligence cycles, and anti-conflict measures.

- Investor communications: Update UCITS KIIDs and AIF offering docs early to reflect fee tables, liquidity tools, and any ESG-related naming claims.

Implications of AIFMD II and UCITS VI for Key Stakeholders

The 2024 overhaul of the Alternative Investment Fund Managers Directive and the UCITS Directive reshapes day-to-day practice across Europe’s fund value-chain. Below is a stakeholder-by-stakeholder playbook that preserves every substantive detail.

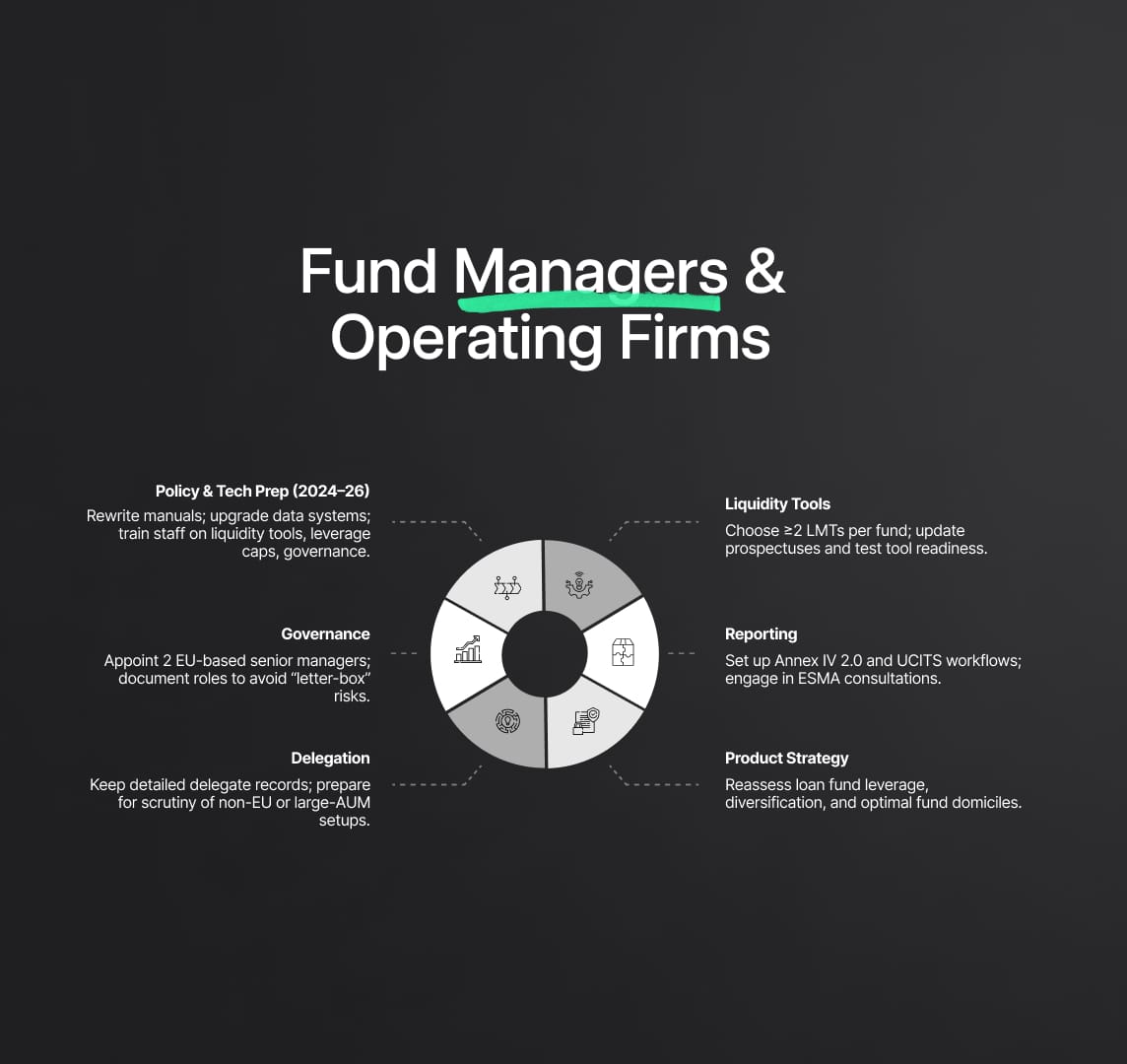

Fund Managers & Operating Firms

Implementation Wave (2024 – 2026)

- Policy refresh: rewrite manuals on liquidity, delegation, conflicts, fee disclosure, and Annex IV / UCITS-Annex reporting.

- Tech investment: expand data warehouses to capture LEIs, granular position data, delegate metrics, and LMT triggers.

- Staff training: brief portfolio, risk, and operations teams on new two-tool liquidity rule, leverage caps for loan funds, and two-person governance standard.

Governance & Substance

- Appoint two EU-resident, full-time senior managers for every AIFM/ManCo; adjust board composition where needed.

- Document responsibilities, time allocation, and reporting lines to pre-empt “letter-box” concerns.

Delegation Deep-Dive

- Maintain a delegate dossier: due-diligence reports, oversight minutes, KPIs, and escalation protocols.

- Expect regulators to interrogate high-AUM or non-EU delegations; some firms may on-shore key PM roles to avoid risk.

Liquidity-Tool Integration

- Select ≥ 2 LMTs per open-ended fund; amend prospectus/fund rules accordingly.

- Test operational readiness for swing-pricing, gates, notice-period extensions, etc.

Reporting Overhaul

- Build workflows for Annex IV 2.0 and the new UCITS report (live April 2027).

- Join industry consultations on ESMA templates to influence practicability.

Product Strategy Shifts

- Review leverage and diversification for loan-originating AIFs (300 % / 175 % NAV caps).

- Assess domicile options in light of case-by-case depositary passport and cross-border service flexibility.

Compliance & Regulatory Professionals

| Priority | What Changes | Action Items |

|---|---|---|

| Enhanced Supervision | Regulators receive richer data sets on delegation, liquidity, leverage. | Prepare evidence packs; rehearse answers to “why are you not a letter-box?” |

| Cross-Border Coordination | Shared UCITS reports + cross-border depositaries = multi-NCA oversight. | Harmonise compliance standards across EU entities; track ESMA opinions. |

| Timeline Governance | 2026 (core rules), 2027 (reporting), 2029 (loan-fund grandfathering & Level-2 reviews). | Create Gantt charts, allocate budget, monitor ESMA RTS/ITS drop-dates. |

| Third-Country Interface | NPPR gates based on AML/tax lists; UK managers now third-country. | Run jurisdiction checks quarterly; align NPPR filings with updated Article 23/24 disclosures. |

10.3 Investor & IR Perspectives

Transparency Dividend

- Comprehensive fee tables and SPV disclosures arm allocators with clearer cost analytics—expect tougher fee negotiations but deeper trust.

Improved Liquidity Safeguards

- Pre-defined LMTs reduce first-mover advantage and help avoid disorderly sell-offs; IR teams must educate clients on gate mechanics and swing-pricing effects.

Retail Confidence

- Stricter naming rules and harmonised disclosures reinforce brand integrity of UCITS and professional AIFs alike.

New Opportunity Set

- Harmonised loan-fund regime plus flexible depositary options may widen the menu of private-debt and niche-strategy vehicles accessible to pensions and insurers.

Cost Pass-Through Risk

- Smaller managers may embed compliance spend into TERs; however, EU-wide focus on “undue costs” should temper fee inflation over time.

Macro-Market & Regulatory Ecosystem

- Resilience Boost: System-wide LMT adoption and richer data allow earlier supervisory intervention, lowering contagion risk.

- Capital Markets Union Synergy: Clear rules for loan-originating AIFs enhance non-bank financing for EU corporates.

- Regulatory Credibility: Continuous adaptation to market lessons (e.g., liquidity stress, Brexit delegation patterns) fortifies the EU’s reputation for robust yet pragmatic oversight—an EEAT-aligned trust signal for global investors.

Future Outlook for AIFMD II and UCITS VI

The 2024 reforms set the stage for a multi-year implementation cycle and signal where EU fund regulation is heading next.

Transposition & Level-2 Timeline (2024 – 2026)

| Phase | Key Deliverables | What Firms Should Do |

|---|---|---|

| 2024 – Q1 2025 |

Member States begin drafting national laws. ESMA launches public consultations on: • Annex IV 2.0 / UCITS Annex templates • Liquidity-management-tool (LMT) guidelines • Name-not-misleading and undue-cost guidance |

Join industry responses; align internal data dictionaries with draft templates; map fund names against proposed ESG naming rules. |

| Q3 2025 – Q4 2026 | Final Regulatory Technical Standards (RTS) and ESMA guidelines published; national transpositions completed by 16 April 2026. | Freeze policy wording; update prospectuses, KIIDs, and LMT procedures; test reporting pipelines in UAT. |

Retail Investment Strategy (RIS) Convergence

- The EU Retail Investment Strategy—expected to crystallise by 2025—may graft new provisions onto both AIFMD II and UCITS VI, notably a statutory duty to prevent and reimburse “undue costs.”

- Anticipate a fiduciary pricing obligation: ManCos and AIFMs will have to certify that fees are commensurate with services rendered.

2029 Commission Review: Toward AIFMD III / UCITS VII

European Commission must assess, by April 2029, whether to:

- Mandate independent directors for retail AIFs and UCITS ManCos.

- Activate a full EU depositary passport to replace the current case-by-case model.

- Tighten delegation metrics if “letter-box” risks persist.

- Revisit loan-fund leverage caps and systemic-risk thresholds.

Expect a discussion paper in 2028 and a draft “AIFMD III/UCITS VII” proposal in 2029-2030.

11.4 Market Dynamics & Competitive Landscape

| Trend | Likely Impact |

|---|---|

| Compliance cost curve | Smaller AIFMs may consolidate or outsource; specialised RegTech and reporting vendors will scale rapidly. |

| ESG & SFDR overlay | Funds will refine strategies to meet both SFDR taxonomy and name-not-misleading tests, boosting demand for sustainability data solutions. |

| Rise of private-credit vehicles | Harmonised loan-originating AIF rules will attract institutional capital, but leverage limits may push sponsors toward closed-ended ELTIF structures. |

| Crypto & digital-asset funds | While not covered in AIFMD II, MiCA will impose additional licensing layers; expect hybrid compliance playbooks by 2026. |

Global Spill-Over Effects

- Gold-standard pull: Non-EU managers seeking EU capital will align with AIFMD II’s fee, liquidity, and reporting norms—even when marketing outside Europe.

- EU hubs over NPPR: With stricter private-placement filters (AML/tax screens), more US and Asian sponsors are expected to set up substance-rich platforms in Luxembourg or Ireland to access the AIFMD passport.

- Regulatory emulation: Other jurisdictions may craft “UCITS-like” labels or adopt liquidity-tool mandates, mirroring the EU’s enhanced framework.

Strategic Take-Aways for Compliance Leaders

- Start early, finish strong: Two-year lead times vanish quickly; lock in board approvals and tech budgets now.

- Monitor ESMA feeds: Subscribe to consultation alerts; Level-2 details will dictate data granularity and operational design.

- See compliance as competitive edge: Transparent fee tables, robust liquidity governance, and timely reporting can be leveraged in marketing decks to demonstrate Experience, Expertise, Authoritativeness, and Trustworthiness (EEAT).

- Plan for iteration: Build modular policies so updates for RIS, AIFMD III, or UCITS VII can be slotted in with minimal disruption.

By viewing the 2024 updates as an evolution, not a revolution, firms that invest in scalable governance and reporting infrastructure today will be positioned as industry leaders tomorrow, earning both regulatory confidence and investor trust while commanding top search visibility for AIFMD and UCITS-related content.

Reduce your

compliance risks