EU Securitisation Framework: Solvency II and AIFMD

The European Commission’s 2024 updates to the Securitisation Regulation, Solvency II, and AIFMD focus on reducing issuance barriers, adjusting risk weights, and increasing insurer participation for greater market resilience.

On 9 October 2024, the European Commission launched a targeted consultation aimed at assessing the functionality of the EU securitization framework. This review is particularly relevant to the scope and operation of several key regulatory frameworks, including the Securitisation Regulation, Solvency II Regulation, and the Alternative Investment Fund Managers Directive (AIFMD). These frameworks are critical to the structure and resilience of the EU financial system, especially regarding securitization, capital requirements, and investment fund regulations.

Background of the EU Securitisation Framework

Securitization has long been a vital tool for financial markets, allowing institutions to pool and redistribute risk. However, the 2008-2009 global financial crisis led to a sharp decline in the EU securitization market. Unlike the U.S. and other jurisdictions where securitization markets have recovered to pre-crisis levels, the EU's market has remained subdued. As highlighted in the European Commission’s Targeted Consultation Document (2024), the securitization market in Europe fell from €2 trillion in 2008 to just €1.2 trillion by 2023, signaling a major reduction in activity. To address this, the European Commission introduced a securitization framework in 2019, intending to revive and stimulate the market through increased transparency and standardization.

Core Elements of the Securitisation Framework

The 2019 securitization framework includes several key regulatory elements that shape how institutions operate in the EU:

- The Securitisation Regulation (EU 2017/2402): This legislation sets overarching rules for all securitizations within the EU, with additional guidelines for simple, transparent, and standardized (STS) securitizations. This is especially important for ensuring that securitization processes are standardized, reducing the systemic risk across markets. The Commission’s 2024 consultation seeks feedback on expanding or refining this regulation’s scope to ensure it covers the necessary transactions.

- Prudential Requirements: The Capital Requirements Regulation (CRR) (EU 575/2013) and the Solvency II Delegated Regulation (EU 2015/35) impose prudential capital rules for holding securitization positions, ensuring that financial institutions maintain sufficient capital buffers. Specifically, CRR requires banks to retain a certain percentage of risk through mechanisms such as risk-weight floors, designed to protect against structural risks inherent in securitization, including model and agency risks. The Solvency II regime further ensures that insurance companies, who are major investors in securitizations, are adequately capitalized to handle risks in their portfolios. As noted in the 2024 Consultation, there is an ongoing debate about whether current risk weight floors under Solvency II and CRR are too conservative, and the Commission is exploring whether these floors could be adjusted to encourage more securitization issuance, especially by insurers.

- Liquidity Requirements: The Liquidity Coverage Requirement (LCR) Delegated Regulation (EU 2015/61) governs liquidity risk, ensuring that institutions can manage short-term obligations in securitization transactions. The inclusion of securitization tranches as Level 2B high-quality liquid assets (HQLA) under LCR is a critical factor, although uptake by banks has been minimal, with just 0.2% to 0.7% of liquidity buffers consisting of securitizations. The consultation also asks stakeholders if the liquidity treatment for securitizations should be relaxed to further incentivize their use.

While the framework has provided enhanced clarity and improved transparency, market participants have expressed concerns that barriers to issuance and investment persist. The consultation launched by the European Commission seeks to address these concerns and explore potential amendments to the existing regulations, with particular focus on the Securitisation Regulation, Solvency II Regulation, and Alternative Investment Fund Managers Directive (AIFMD).

Additional Regulatory Insights

The Targeted Consultation Document (2024) further deepens the regulatory landscape by acknowledging several pivotal challenges that stakeholders have raised:

Risk Weight Floors and Prudential Treatment

The consultation document emphasizes concerns about the current risk weight floors applied under CRR and Solvency II. As securitization inherently involves the tranching of credit risk, these risk weight floors, ranging from 10% for STS securitizations to 15% for non-STS, act as key safeguards to mitigate structural risks. However, the 2024 Consultation is gathering feedback on whether these floors are disproportionate, particularly for originators who retain a large portion of the securitization risks. The Commission is considering potential reductions in the risk weight floors to incentivize more issuances, particularly in sectors such as SME securitizations.

STS Label and Alternative Investment Fund Managers Directive (AIFMD)

A major topic in the consultation is the role of Alternative Investment Fund Managers (AIFMs) in securitization markets. The AIFMD (2011/61/EU) currently restricts AIFMs from acting as sponsors in originate-to-distribute models, creating a regulatory bottleneck. The consultation document asks stakeholders if this restriction should be amended to enable AIFMs to participate more fully in securitization transactions, potentially boosting the volume of securitizations in the EU. Amending the AIFMD to allow AIFMs to act as sponsors could significantly impact the market, particularly in the private debt and real estate sectors.

Insurance Companies and Solvency II Regulation

Insurers play a critical role as investors in securitizations, and their capital requirements are governed by Solvency II. However, insurers currently allocate only 0.33% of their assets to securitization positions. The Solvency II capital charges, particularly for senior tranches of STS securitizations, may be viewed as overly conservative. Insurers may find that the spread risk capital requirements under Solvency II disincentivize investments in securitization compared to other asset classes. The consultation seeks input on whether reducing capital charges by 5% to 10% for senior tranches could stimulate greater investment by insurers.

Jurisdictional Scope of the Securitisation Regulation

Another important issue under review is the jurisdictional scope of the Securitisation Regulation. The European Supervisory Authorities (ESAs) issued an opinion in 2021 to clarify the application of Articles 5 to 7 of the regulation to third-country entities and investment fund managers. However, legal uncertainties persist, particularly in cases where securitization transactions involve non-EU entities. The 2024 Consultation asks if further legislative clarification is needed to ensure the regulation applies to securitizations where at least one party is based or authorized in the EU.

Supervision and Transparency Requirements

Feedback from stakeholders highlights that the transparency regime under the Securitisation Regulation is seen as burdensome. Article 7 of the regulation requires detailed reporting to securitization repositories, which some stakeholders feel imposes high costs without proportional benefits, particularly for private securitizations. The Commission is considering whether to simplify the disclosure templates for private securitizations and clarify the definition of “public securitizations” to ensure a more balanced reporting regime.

By addressing these issues, the European Commission aims to refine the regulatory framework in a way that supports market growth while maintaining prudential oversight and safeguarding financial stability.

Key Issues in the Consultation Paper

The Commission’s consultation paper poses several significant questions related to the efficacy of the EU securitization framework, asking stakeholders to provide feedback on a range of topics, including jurisdictional scope, prudential requirements, and transparency obligations. Below are the key areas of inquiry:

1. Scope and Application of the Securitisation Regulation

A critical aspect of the consultation is the clarification of the Securitisation Regulation’s jurisdictional scope. Stakeholders are invited to provide feedback on whether the definition of a securitization transaction needs further refinement, particularly regarding transactions that involve third-country entities. The 2024 Targeted Consultation Document highlights that legal uncertainties still persist, especially when not all parties involved in a securitization are located within the EU. The Joint Committee of the European Supervisory Authorities (ESAs) has issued opinions to the European Commission to clarify these jurisdictional issues, yet stakeholders have indicated that the current framework does not sufficiently delineate the cross-border application of the Securitisation Regulation.

In addition, the consultation addresses potential amendments to the Alternative Investment Fund Managers Directive (AIFMD). Currently, AIFMD prohibits the use of the originate-to-distribute model by Alternative Investment Fund Managers (AIFMs), which limits their role in sponsoring securitizations. The Commission asks whether this prohibition should be relaxed, which would allow AIFMs to take on broader roles in the securitization market, including acting as sponsors. This potential amendment could align AIFMD more closely with the broader goals of the Securitisation Regulation, thus fostering increased participation in securitization transactions. Such changes would make it easier for AIFMs to structure deals in various sectors, particularly private debt and real estate, areas where securitization has significant potential to unlock capital.

2. Prudential Requirements: CRR and Solvency II Regulation

Another pivotal issue under review involves the prudential framework outlined in the Capital Requirements Regulation (CRR) and Solvency II Regulation. These frameworks are essential for ensuring that banks, insurers, and other financial institutions engaging in securitization activities maintain adequate capital and manage their risks appropriately. The Targeted Consultation Document (2024) emphasizes the importance of reassessing the current prudential requirements to better facilitate securitization issuance while maintaining the integrity of the financial system.

A key area of focus is the risk weight floors for securitization positions, which define the minimum capital that institutions must hold. Under CRR, the current risk weight floors are 10% for STS securitizations and 15% for non-STS securitizations. The Commission is particularly interested in whether these floors should be adjusted, especially for banks that are originators of securitizations. Stakeholders are asked to provide feedback on whether lowering these floors could encourage greater issuance and investment in securitizations without compromising financial stability.

Similarly, the Solvency II Regulation governs the prudential treatment of insurance companies’ exposure to securitization positions. Solvency II capital charges, especially for senior tranches of STS securitizations, may discourage insurers from investing in these products. The Commission seeks stakeholder input on whether the Solvency II framework should be adjusted to ease the capital burden on insurers, thereby increasing their participation in the market. Insurers, who currently allocate only 0.33% of their assets to securitization positions, could become more significant investors if capital requirements were relaxed, particularly for safer tranches of securitizations. Adjusting these rules would be a key step toward building a deeper and more liquid EU securitization market.

3. Transparency and Supervision: Enhancing the Securitisation Regulation’s Framework

Transparency is a cornerstone of the EU securitization framework, and the consultation focuses on assessing the current transparency requirements and their associated costs. Article 7 of the Securitisation Regulation outlines strict disclosure requirements, mandating that securitization issuers provide detailed information to both investors and supervisory authorities. However, the 2024 Consultation notes that some stakeholders view these disclosure requirements as overly prescriptive, leading to increased compliance costs that disproportionately affect smaller institutions.

The Commission is exploring whether more streamlined transparency rules could reduce administrative burdens without sacrificing market integrity. For example, the document raises the possibility of introducing a more nuanced definition of "public securitization," which could better capture the diverse types of transactions in the market. The Commission is also examining whether the reporting obligations for private securitizations could be relaxed, given that these transactions typically involve fewer external investors and less systemic risk.

On the supervision front, the consultation questions whether national supervisory authorities have sufficient powers and resources to monitor compliance with the Securitisation Regulation effectively. The Commission is considering whether a more centralized supervisory mechanism, such as the creation of a pan-European supervisory hub, would be beneficial in ensuring that compliance across different Member States is consistent and efficient. Such measures would streamline oversight processes, helping to avoid regulatory fragmentation and promoting a more cohesive European market for securitizations.

4. STS Securitisations and Standardisation

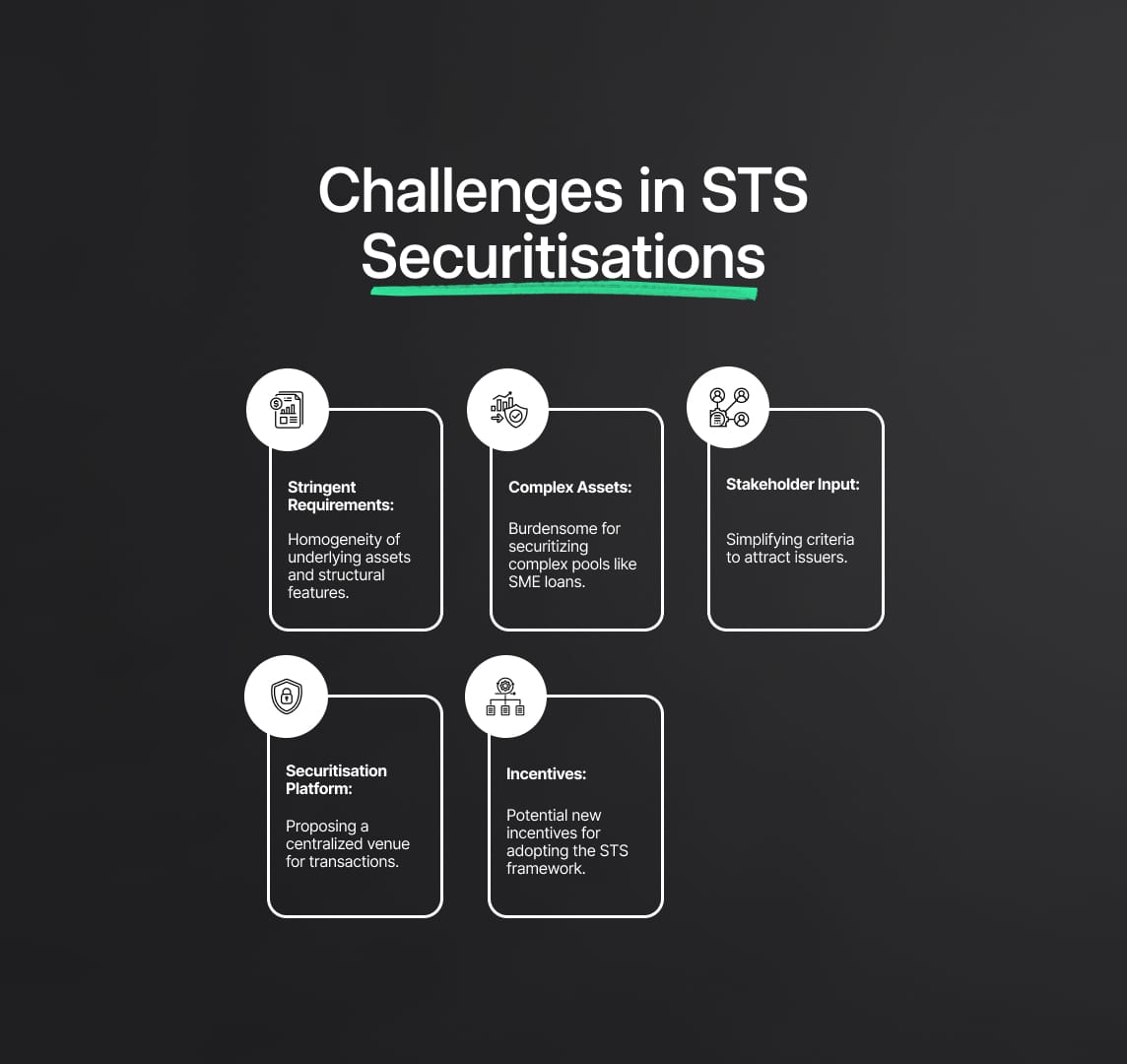

The Simple, Transparent, and Standardised (STS) securitization framework was introduced to promote safer and more transparent securitization transactions. However, uptake of the STS label has been slower than expected, and the 2024 Consultation aims to understand the challenges that market participants face in meeting the STS criteria.

One of the key issues is that the STS framework imposes stringent requirements on the homogeneity of underlying assets and other structural features. These criteria can be burdensome for issuers, especially those securitizing more complex asset pools like SME loans. Stakeholders are asked to provide input on how the STS standard could be made more attractive, such as by simplifying certain criteria without compromising the framework’s objectives.

The 2024 Consultation also explores the possibility of creating a European securitization platform that could enhance the appeal of STS securitizations. This platform could serve as a centralized venue for transactions, standardizing processes, reducing issuance costs, and potentially offering new incentives for market participants to adopt the STS framework.

5. Securitisation Platform: A Pan-European Solution?

One of the more innovative proposals in the consultation paper is the potential creation of a pan-European securitisation platform. This platform would serve as a centralized marketplace for securitization transactions, increasing transparency, reducing fragmentation, and lowering barriers to entry for smaller market participants. The 2024 Consultation suggests that such a platform could help streamline securitization processes by providing a single point of access to standardized documentation, legal frameworks, and reporting mechanisms.

The Securitisation Regulation and Solvency II Regulation would play a central role in shaping the design and function of such a platform. For example, the platform could help smaller issuers comply with transparency and reporting requirements by providing standardized templates and centralized data repositories. Additionally, the platform could potentially include a liquidity support mechanism for securitizations, ensuring that these assets remain attractive to institutional investors, including those subject to Solvency II liquidity and capital requirements.

6. Impact on Small and Medium-Sized Enterprises (SMEs)

Finally, the Commission is particularly concerned about the impact of the securitization framework on Small and Medium-Sized Enterprises (SMEs). Securitization can be a valuable financing tool for smaller businesses, providing access to more affordable credit. However, current regulatory burdens, including high capital charges and stringent transparency requirements, may be limiting SMEs’ ability to tap into securitization markets.

The 2024 Consultation invites stakeholders to suggest ways to amend the securitization framework to make it more accessible to SMEs. This could involve lowering capital requirements for SME securitizations under CRR or introducing simplified STS criteria that are tailored to SME securitizations. By making securitization a more viable financing option for smaller businesses, the EU can foster broader economic growth and resilience.

Prudential Framework and Liquidity Risk: Solvency II and LCR Delegated Regulation

The prudential treatment of securitization positions is heavily influenced by both the Liquidity Coverage Requirement (LCR) Delegated Regulation and the Solvency II Regulation. Liquidity risk, in particular, is a key concern for institutions holding securitization positions, as insufficient liquidity can exacerbate systemic risk in times of financial stress.

The 2024 Consultation asks whether adjustments to the LCR Delegated Regulation could make securitizations more attractive as Level 2B High-Quality Liquid Assets (HQLA). This change could allow banks to hold more securitizations in their liquidity buffers, increasing demand for these assets. Similarly, the Solvency II framework may be adjusted to provide insurers with greater flexibility in investing in securitizations, particularly in times of market stress.

By reassessing these regulatory frameworks, the European Commission aims to strike a balance between safeguarding financial stability and promoting a vibrant, resilient securitization market across the EU.

Reduce your

compliance risks