Financial Data Access Framework (FiDA): Regulatory Insights

The Financial Data Access framework (FiDA) is a transformative EU regulatory initiative designed to standardise and secure data management across the financial sector. AFME proposes a phased approach to FiDA's implementation, market alignment, customer value, and data security.

The Financial Data Access framework (FiDA) represents a groundbreaking regulatory initiative within the European Union, designed to fundamentally reshape data management practices across the financial sector. As the financial industry increasingly leans on digital technologies and data-driven decision-making, the necessity for a structured, secure, and efficient data access framework has never been more critical.

The Association for Financial Markets in Europe (AFME), with strategic operations across London, Brussels, and Frankfurt, has proposed a meticulously detailed, impact-led, and phased approach to the implementation of FiDA. This strategy emphasizes the alignment of FiDA with market demand, the assurance of customer value, and the stringent safeguarding of data security. In this article, we delve deeply into AFME’s comprehensive recommendations and explore the intricate technical and regulatory considerations essential for the successful implementation of FiDA.

Source

[1]

Overview of the Financial Data Access Framework (FiDA)

The Financial Data Access framework (FiDA) is engineered to create an integrated and innovative data economy within the EU's financial sector by standardising and streamlining financial data sharing processes. At its core, FiDA seeks to enhance transparency, foster innovation, and improve customer experiences by facilitating more efficient data flows among financial institutions, FinTech companies, and other key market participants. However, the implementation of FiDA is not without significant challenges. The scope of FiDA necessitates substantial investments in infrastructure and technology and poses potential risks to the competitiveness of financial institutions. These challenges underscore the critical need for a well-orchestrated, technically robust implementation strategy.

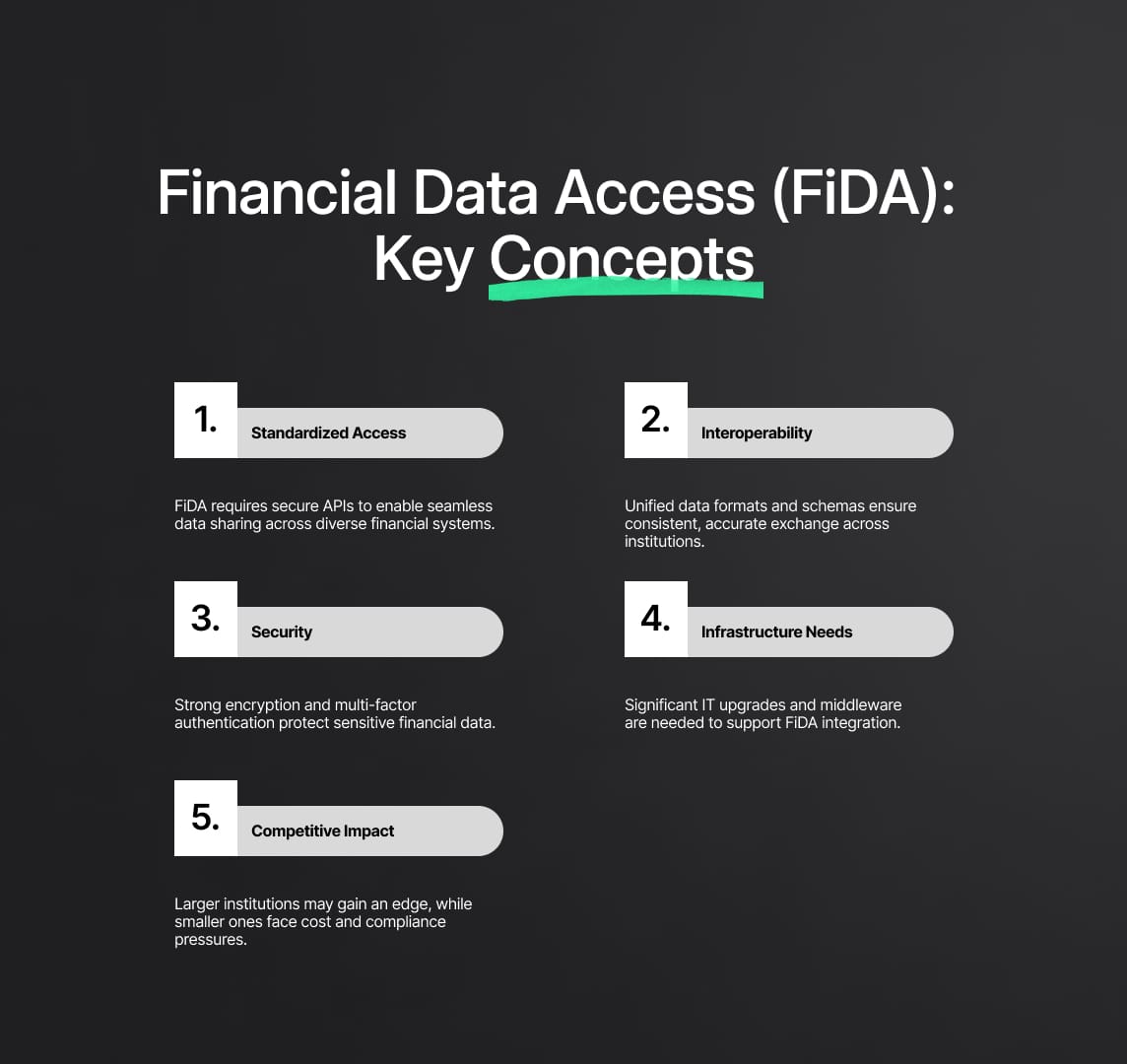

Technical Aspects of FiDA Implementation:

The technical foundation of FiDA is built on the premise of standardising data access across a diverse range of financial services and products. To achieve this, FiDA requires the development of advanced data-sharing protocols and the integration of secure Application Programming Interfaces (APIs) that enable seamless interoperability between disparate financial systems. The process must account for the technical heterogeneity that exists across financial institutions, where legacy systems often coexist with newer, more agile technologies.

Data Interoperability and Standardization:

One of the foremost technical challenges in implementing FiDA lies in achieving data interoperability across the EU’s highly fragmented financial landscape. Financial institutions vary widely in terms of the maturity of their digital infrastructure, data management capabilities, and compliance with existing regulations such as PSD2 (Payment Services Directive 2). To address this, FiDA mandates the development of data schemas and communication protocols that ensure consistent data formats, definitions, and access methodologies across all participating entities.

The standardisation of data schemas is particularly critical, as it enables financial institutions to share data in a manner that is both secure and easily interpretable by other entities. This process involves the meticulous definition of data fields, the establishment of common data taxonomies, and the implementation of validation mechanisms to ensure data integrity and accuracy.

Security and Data Protection Mechanisms:

Security is paramount in the FiDA framework, given the sensitive nature of financial data. FiDA mandates the adoption of state-of-the-art encryption technologies to secure data both in transit and at rest. This includes the implementation of end-to-end encryption protocols, which ensure that data is protected from unauthorized access at every stage of the data sharing process.

Additionally, FiDA requires the establishment of robust identity verification and authentication mechanisms. These mechanisms are designed to prevent unauthorised entities from gaining access to financial data, thereby reducing the risk of data breaches and cyber-attacks. Multi-factor authentication (MFA) and the use of cryptographic keys are essential components of this security framework.

Infrastructure and Investment Requirements:

The successful implementation of FiDA will necessitate significant investments in IT infrastructure. Financial institutions will need to upgrade their existing systems to support the new data-sharing protocols and security requirements mandated by FiDA. This includes investments in cloud computing infrastructure, which provides the scalability and flexibility needed to handle the increased data volumes and complex processing tasks associated with FiDA.

Moreover, the integration of FiDA into existing financial systems will require the development of sophisticated middleware solutions. These solutions act as intermediaries, facilitating the seamless exchange of data between legacy systems and modern, API-driven platforms. The middleware must be capable of handling high transaction volumes while maintaining data integrity and security.

Impact on Financial Institutions' Competitiveness:

While FiDA aims to drive innovation and improve customer experiences, its implementation could have mixed implications for the competitiveness of financial institutions. On one hand, institutions that successfully adopt FiDA could gain a competitive edge by offering more personalized and data-driven financial products. On the other hand, the substantial investments required to implement FiDA could strain the resources of smaller financial institutions, potentially leading to market consolidation.

AFME’s Strategic, Impact-Led Implementation Approach for the Financial Data Access Framework (FiDA)

AFME’s approach to implementing the Financial Data Access Framework (FiDA) is centered around a meticulously planned, three-step, phased strategy that takes into account the complexities of the financial data landscape. This strategy is designed to ensure that FiDA is rolled out effectively, sustainably, and in a manner that aligns with the diverse needs of all stakeholders. The phased approach not only facilitates smoother implementation but also allows for continuous feedback and adaptation, ensuring that FiDA evolves in response to market demands and technological advancements.

Step 1: FiDA-Readiness Assessment by Data Category

The first and most critical step in AFME’s strategy involves conducting a comprehensive FiDA-readiness assessment for each financial data category. This step is essential to determine the suitability of each data category for inclusion in FiDA and to identify the necessary conditions for their successful integration into the broader framework. This readiness assessment is not merely a preliminary check but a deep, multifaceted analysis that sets the foundation for the entire implementation process.

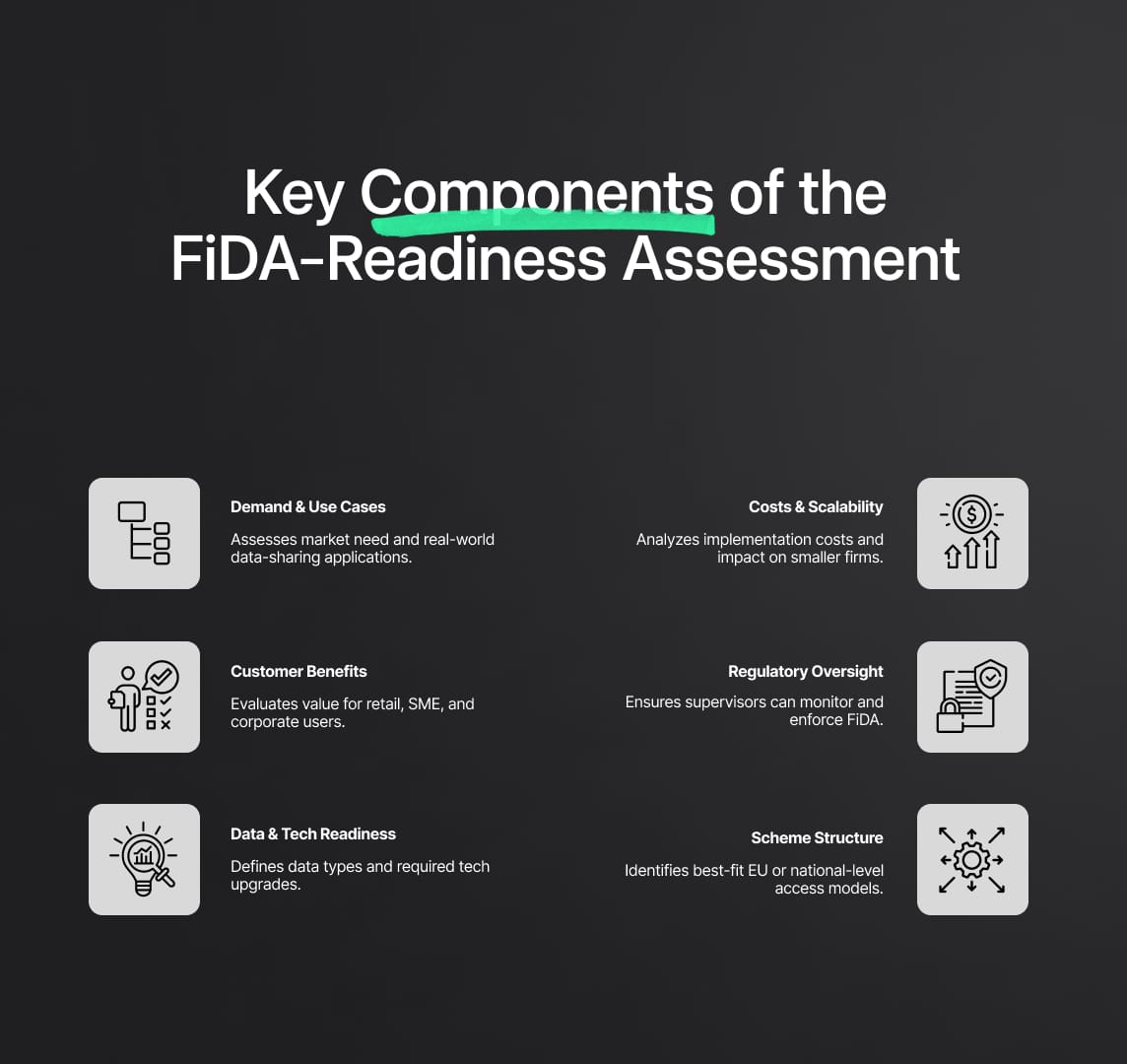

Key Components of the FiDA-Readiness Assessment:

- Market Demand Analysis:

- Detailed Examination: The readiness assessment begins with an in-depth analysis of market demand, conducted by the European Supervisory Authorities (ESAs) in collaboration with key FiDA stakeholders, including data holders, data users, customers, and prospective Financial Information Service Providers (FISPs). This analysis is designed to capture a comprehensive view of the current and projected demand for data sharing across various financial products and services.

- Customer Appetite: It involves assessing the appetite of different customer segments, including retail clients, small and medium-sized enterprises (SMEs), and larger corporate entities, for engaging in data-sharing practices. Understanding customer needs and preferences is crucial for tailoring FiDA to deliver meaningful benefits.

- Use Case Identification: The analysis also identifies potential use cases for data sharing at both the product and service levels. This step is vital for ensuring that FiDA is not just a regulatory requirement but a practical tool that addresses real-world needs.

- Benefits Assessment by Customer Category:

- Segment-Specific Benefits: The readiness assessment evaluates the specific benefits that FiDA could provide to various customer categories, ensuring that the framework offers tangible value across different segments of the financial services market. This includes evaluating how natural persons, SMEs, and non-SME legal entities might benefit from enhanced data access, and how these benefits align with broader market trends.

- Tailored Value Propositions: By understanding the unique needs of each customer segment, the assessment ensures that FiDA’s implementation is strategically aligned with the demand dynamics of the market. This customer-centric approach is designed to maximize the framework’s impact by focusing on areas where the demand for data access is highest and where the benefits are most significant.

- Data Category Definition and Quality:

- Standardization and Clarity: The readiness assessment involves defining each data category with precision, ensuring that all stakeholders have a clear understanding of what data is included and how it should be handled. This includes developing standardized data definitions and ensuring that these standards are universally applicable across the EU.

- Technical Complexity: The assessment also evaluates the technical complexity associated with accessing each data category. This involves analyzing the current state of data infrastructure, such as the availability and quality of data, the level of digitization within financial institutions, and the existing technological frameworks like PSD2 that could be leveraged for FiDA.

- Infrastructure Adjustments: Based on this analysis, the assessment identifies the necessary infrastructure adjustments required to support the seamless integration of each data category into FiDA. This may include the development or enhancement of Application Programming Interfaces (APIs), data storage solutions, and data processing capabilities.

- Implementation Cost Analysis:

- Cost-Benefit Analysis: A thorough cost analysis is conducted to determine the financial implications of implementing data access for each category. This analysis is critical for ensuring that the benefits of FiDA outweigh the associated costs, particularly for financial institutions that may face significant investment requirements.

- Scalability Considerations: The assessment also considers the scalability of implementation costs, ensuring that the framework can be applied broadly without disproportionately impacting smaller institutions. This is particularly important for maintaining a level playing field in the financial services market.

- Supervisory Effectiveness:

- Regulatory Oversight: The ability of supervisory bodies to oversee the implementation and ongoing operation of FiDA is a key focus of the readiness assessment. This involves evaluating whether the current regulatory framework is equipped to handle the new demands that FiDA will place on it, including monitoring compliance, managing risks, and enforcing data protection standards.

- Risk Mitigation: The assessment ensures that all potential challenges related to supervisory oversight are identified and addressed before FiDA is rolled out. This proactive approach helps to minimize regulatory bottlenecks and ensures a smoother implementation process.

- Scheme Structure Relevance:

- Optimal Structuring: The readiness assessment also examines the most effective structure for implementing data access schemes. It considers whether a single EU-level data access scheme, a national-level scheme, or a combination of both would be most appropriate for each data category. This determination is crucial for ensuring that FiDA is both practical and scalable, allowing for variations in national regulations while maintaining a cohesive EU-wide framework.

- Harmonization and Flexibility: The goal is to strike a balance between harmonization and flexibility, ensuring that FiDA can be implemented uniformly across the EU while allowing for necessary adaptations to local market conditions and regulatory environments.

Outcome of the FiDA-Readiness Assessment:

The results of the FiDA-readiness assessment serve as a crucial decision-making tool for the European Commission (EC) and the European Supervisory Authorities (ESAs). Based on the comprehensive analysis, the EC, in consultation with industry stakeholders, will determine which data categories are suitable for inclusion in FiDA and proceed to the next phase of implementation. The readiness assessment also informs the timeline for the rollout, ensuring that the implementation aligns with market demand, operational readiness, and the broader strategic objectives of FiDA.

Step 2: Definition of Financial Data Access Schemes in the Financial Data Access Framework (FiDA)

Once the readiness of specific data categories has been thoroughly assessed, the next critical step in the implementation of the Financial Data Access Framework (FiDA) is the definition of financial data access schemes. This phase is pivotal as it establishes the foundational rules, protocols, and governance structures that will dictate how data is accessed, shared, and utilized within the FiDA framework. The careful design of these schemes ensures that the framework operates effectively, securely, and in alignment with the regulatory landscape across the European Union.

Key Elements of the Scheme Definition Phase:

Data Category Specification:

The initial and essential task in this phase involves the precise specification of each data category and the related services at a functional level. This specification process is crucial for establishing a common understanding among all participants—ranging from data holders to users—regarding the scope and objectives of the data access scheme.

- Functional Clarity: The specification process must delineate the types of data that fall under each category, ensuring that all stakeholders are clear on what data will be accessible. This includes defining data points such as account balances, transaction histories, loan details, and investment holdings, tailored to the specific requirements of each category.

- Standardised Definitions: To facilitate seamless data sharing, it is necessary to establish definitions for each data point within a category. This ensures consistency and compatibility across different systems and institutions, which is essential for maintaining the integrity and usability of the shared data.

Compensation Methodology:

A fair and transparent compensation framework is critical to the sustainability of the FiDA framework. This methodology must ensure that the costs of data sharing are equitably distributed among all participants in the scheme, thereby maintaining the financial viability of the framework and encouraging broad participation.

- Cost Distribution: The compensation framework must account for the various costs associated with data sharing, including infrastructure upgrades, data management, and compliance efforts. These costs need to be distributed in a manner that reflects the value derived by each participant, whether they are data providers or users.

- Incentive Alignment: The framework should also include mechanisms to incentivize participation by smaller institutions, which may face higher relative costs. By aligning incentives with the benefits of data sharing, FiDA can encourage a more inclusive and comprehensive participation across the financial ecosystem.

Governance and Data Protection:

Establishing a robust governance framework is a cornerstone of the FiDA implementation process. This framework must set clear rules for data protection, liability, and the operationalisation of these rules, ensuring that data sharing occurs within a secure and compliant environment.

- Data Protection Protocols: The governance framework should incorporate stringent data protection protocols that align with EU regulations such as the General Data Protection Regulation (GDPR). This includes specifying the technical and organizational measures required to safeguard data integrity and confidentiality.

- Liability Framework: Clear guidelines on liability must be established, detailing the responsibilities of each participant in the event of data breaches or misuse. This aspect of governance is critical for building trust among participants and ensuring that risks are appropriately managed.

- Operationalisation of Governance: The framework must also include detailed procedures for governance, such as the appointment of data protection officers, the establishment of audit trails, and the implementation of continuous monitoring systems.

Dispute Management System:

To address conflicts that may arise during the implementation and operation of the data access schemes, a robust dispute management system should be established. This system is integral to maintaining the integrity and smooth functioning of FiDA.

- Independent Arbitration: The dispute management system should include provisions for the appointment of an independent third party to handle conflicts. This independent body would be responsible for resolving disputes impartially and efficiently, ensuring that disagreements do not disrupt the overall operation of the framework.

- Structured Resolution Processes: The system should also outline structured processes for dispute resolution, including timelines, documentation requirements, and escalation procedures. These processes are essential for ensuring that disputes are resolved swiftly and transparently.

Testing and Validation:

Before proceeding to full-scale implementation, it is crucial to conduct thorough testing and validation of the data access schemes. This step ensures that the schemes function as intended and that any potential issues are identified and addressed before they can impact the broader market.

- Pilot Programs: Testing should involve pilot programs that simulate real-world data sharing scenarios. These pilots can provide valuable insights into the operational feasibility of the schemes, as well as their performance under different conditions.

- Feedback Integration: The validation process should include mechanisms for gathering feedback from participants during the testing phase. This feedback is vital for refining the schemes and making necessary adjustments to enhance their effectiveness and user-friendliness.

Phased Approach to Scheme Definition:

AFME strongly recommends a phased approach to the definition and implementation of financial data access schemes, recognising the varying levels of readiness among different data categories. This phased approach is designed to manage complexity and ensure that each category is integrated into FiDA in a manner that aligns with its technical and operational maturity.

- Level 1 (High FiDA-Readiness): Categories such as non-payment accounts and savings products, which are relatively straightforward to integrate and have high readiness, should be prioritized for the first phase. These categories typically involve data that is already well-structured and accessible, making them ideal candidates for early implementation.

- Level 2 (Medium FiDA-Readiness): Categories such as credit agreements and mortgage credit agreements require more extensive infrastructure and stakeholder engagement before they can be integrated. These categories may involve more complex data types and higher regulatory scrutiny, necessitating a more cautious approach.

- Level 3 (Low FiDA-Readiness): The final phase should focus on more complex categories, such as investments in financial instruments, insurance-based investment products, and crypto assets. These categories pose significant technical and operational challenges, and their integration should only proceed once sufficient infrastructure, regulatory clarity, and stakeholder readiness are in place.

Step 3: Implementation Phase of the Financial Data Access Framework (FiDA)

The final and arguably most critical step in AFME’s strategic approach to the Financial Data Access Framework (FiDA) is the implementation phase. This phase is where the theoretical framework and predefined data access schemes are put into practice, requiring a meticulous focus on operational and technical challenges. Successfully navigating this phase is essential for ensuring that FiDA delivers on its promises of enhanced transparency, innovation, and improved customer experiences across the European financial sector.

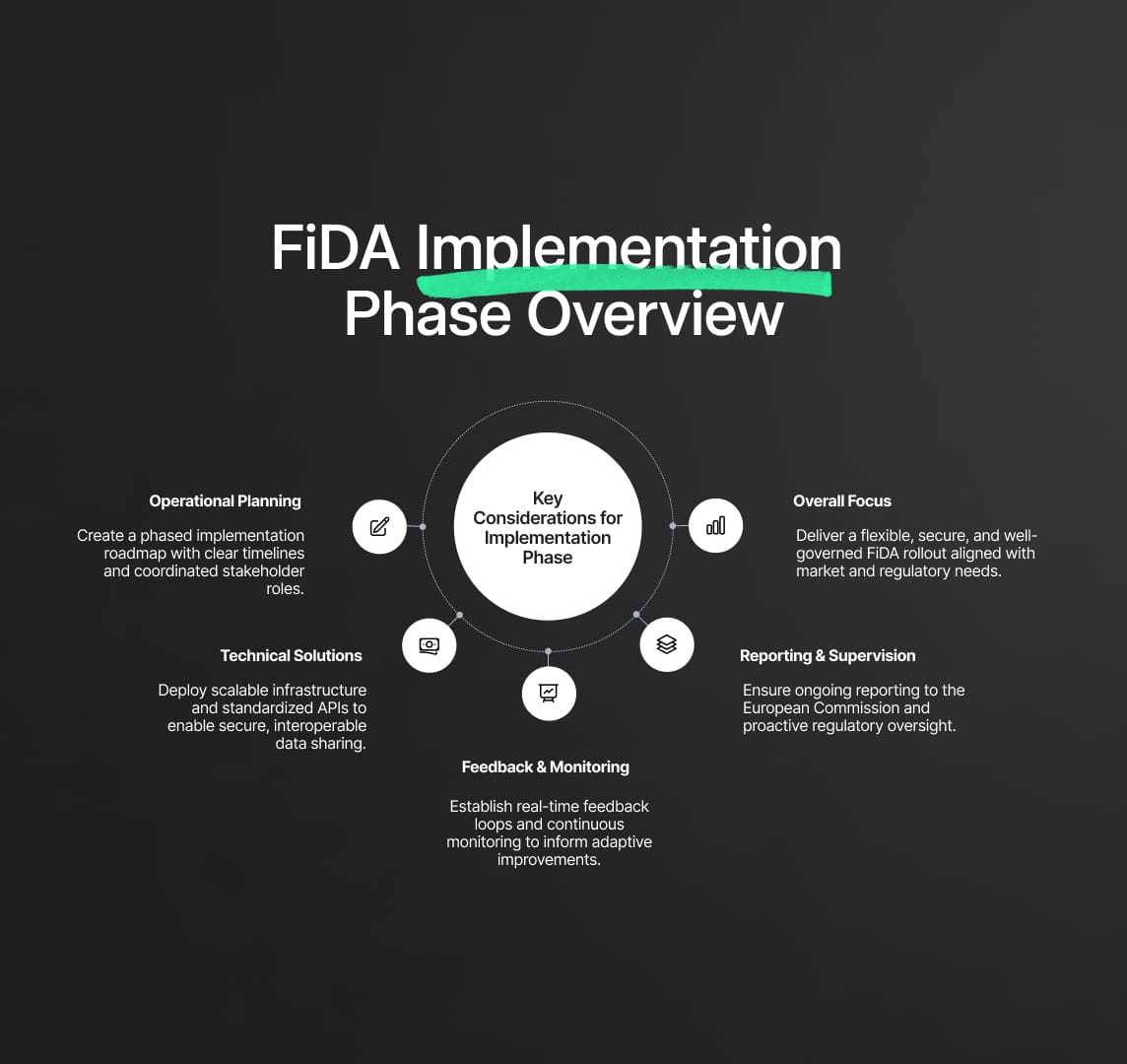

Key Considerations for the Implementation Phase

Operational Planning:

Operational planning is the cornerstone of the implementation phase, requiring a detailed roadmap that outlines the specific steps, timelines, and responsibilities for bringing the financial data access schemes to life.

- Development of an Implementation Plan: A comprehensive implementation plan must be developed that incorporates input from a wide array of stakeholders, including European Supervisory Authorities (ESAs), National Competent Authorities (NCAs), financial institutions, and other key players. This plan should clearly define the sequence of actions needed to operationalise the data access schemes, taking into account the readiness levels of different data categories, the required infrastructure adaptations, and the need for synchronisation across various financial entities.

- Timeline Management: The implementation plan should include well-defined milestones and deadlines, ensuring that each phase of the rollout is completed within the stipulated timeframe. This timeline must be flexible enough to accommodate adjustments based on real-time feedback and evolving circumstances but rigid enough to maintain momentum and ensure timely completion.

- Stakeholder Coordination: Effective implementation requires robust coordination among all stakeholders involved. This includes setting up governance structures that facilitate communication, decision-making, and conflict resolution. Regular meetings, progress reports, and updates are essential to keep all parties aligned and informed throughout the implementation process.

Technical Solutions:

The implementation of FiDA necessitates the deployment of advanced technical solutions that can handle the complexities of modern financial data sharing. These solutions must be both scalable and secure, capable of supporting the vast amounts of data that will flow through the FiDA framework.

- Infrastructure Adaptations: Financial institutions may need to undertake significant infrastructure upgrades to support the new data access standards introduced by FiDA. This includes enhancing data storage capabilities, upgrading network infrastructure, and ensuring that systems are capable of handling increased data traffic and processing demands. The integration of cloud computing technologies may be necessary to provide the scalability and flexibility required by FiDA.

- API Development and Integration: A critical component of the technical implementation is the development and integration of Application Programming Interfaces (APIs) that facilitate seamless data exchange between different financial entities. These APIs must adhere to the standardized protocols defined during the scheme definition phase, ensuring interoperability and compatibility across the diverse financial landscape of the EU.

- Third-Party Service Onboarding: The implementation phase may also involve onboarding third-party service providers, such as FinTech companies and data aggregators, who will play a crucial role in the FiDA ecosystem. This process requires rigorous vetting to ensure that these providers meet the security, compliance, and operational standards required by FiDA.

Feedback and Monitoring Mechanisms:

To ensure that the FiDA framework remains responsive to market conditions and emerging challenges, it is crucial to establish robust feedback and monitoring mechanisms.

- Real-Time Feedback Loops: Scheme members should have access to platforms and tools that allow them to provide real-time feedback on the implementation process. This feedback should be systematically collected, analyzed, and used to make data-driven decisions about potential adjustments or improvements to the framework.

- Continuous Monitoring: Continuous monitoring systems should be established to track the performance of the data access schemes, ensuring that they function as intended and that any issues are promptly identified and addressed. This includes monitoring data flow volumes, transaction times, system latency, and any security incidents.

- Adaptive Adjustments: Based on the feedback received and the data collected through monitoring, the FiDA framework should be flexible enough to accommodate necessary adjustments. This could involve tweaking data access protocols, modifying security measures, or refining governance structures to better align with market needs and technological advancements.

Reporting and Supervision:

Ongoing reporting and supervision are critical to maintaining the integrity and success of the FiDA framework. These activities ensure that the implementation stays on track and that the framework continues to meet its regulatory and operational objectives.

- Regular Reporting to the European Commission: The European Supervisory Authorities (ESAs) should be mandated to report regularly to the European Commission on the progress of the FiDA implementation. These reports should provide comprehensive updates on the status of the rollout, highlight any obstacles encountered, and propose solutions to address these challenges. Reporting should also include assessments of compliance with the defined objectives and any deviations from the planned timelines.

- Supervisory Oversight: Effective supervision is necessary to ensure that all participants adhere to the standards and protocols established under FiDA. This includes regular audits, compliance checks, and risk assessments conducted by the ESAs and NCAs. The supervision should be proactive, identifying potential risks before they escalate and ensuring that all entities involved in FiDA are operating in a manner that aligns with the framework’s goals.

- Transparency and Accountability: Transparency in the reporting and supervision processes is essential for building trust among all stakeholders. The outcomes of supervision activities should be communicated clearly and openly, with accountability mechanisms in place to address any non-compliance or failures to meet the established standards.

Security Considerations in the Implementation of the Financial Data Access Framework (FiDA)

The implementation of the Financial Data Access Framework (FiDA) is a complex endeavor that requires careful alignment with existing European Union regulations, particularly in the areas of data protection and financial stability. These considerations are not merely procedural; they are foundational to the success of FiDA.

Ensuring robust regulatory compliance and security protocols is essential for fostering trust, ensuring the integrity of financial data, and maintaining the stability of the financial sector as a whole. This section delves into the critical regulatory and security aspects that must be meticulously addressed to ensure that FiDA achieves its objectives without compromising legal or operational standards.

Data Security: The Cornerstone of FiDA Implementation

Data security is paramount in the FiDA framework, as the entire initiative revolves around the safe and efficient sharing of sensitive financial information. In the digital age, financial data is a prime target for cyber threats, making the implementation of stringent security measures non-negotiable.

- Advanced Encryption Technologies: FiDA mandates the use of cutting-edge encryption methods to protect data both in transit and at rest. Encryption serves as the first line of defense against unauthorized access, ensuring that even if data is intercepted, it cannot be read or exploited. Implementing end-to-end encryption is particularly critical, as it ensures that data remains secure throughout its entire lifecycle—from the moment it leaves the originating financial institution until it is received and processed by the intended recipient.

- Secure Data Transfer Protocols: The framework also requires the adoption of secure data transfer protocols, such as Transport Layer Security (TLS) and Secure Sockets Layer (SSL), to safeguard data during transmission. These protocols create encrypted connections between systems, preventing data from being exposed to vulnerabilities during the exchange process. Ensuring that all participating institutions adhere to these protocols is essential for maintaining a consistent level of security across the FiDA ecosystem.

- Comprehensive Access Controls: FiDA’s security strategy includes implementing robust access controls that restrict data access to authorized individuals and systems only. This involves the use of multi-factor authentication (MFA), role-based access control (RBAC), and the principle of least privilege (PoLP) to minimize the risk of unauthorized access. By limiting access to those who need it for specific, predefined purposes, FiDA reduces the potential for internal threats and accidental data exposure.

- Security Audits and Penetration Testing: To maintain a high security standard, regular security audits and penetration testing should be conducted. These assessments help identify and address vulnerabilities before they can be exploited. Continuous monitoring and updating of security measures are crucial, given the evolving nature of cyber threats.

Ensuring Customer Value Through FiDA

The ultimate goal of FiDA is to deliver tangible benefits to customers, which requires a framework that enhances the transparency and personalisation of financial services. AFME’s position paper underscores the importance of demonstrating clear customer value as a core criterion for FiDA’s success.

- Enhanced Control Over Financial Data: FiDA is designed to provide customers with greater control over their financial data. This includes the ability to easily access, share, and manage their data across different financial services. By empowering customers with more control, FiDA aims to increase customer trust and engagement with financial institutions.

- Transparency in Financial Services: Another key objective of FiDA is to enhance the transparency of financial services. By enabling seamless data sharing between institutions, customers can gain clearer insights into their financial positions, better understand the products and services available to them, and make more informed financial decisions.

- Personalized Financial Products: The data access facilitated by FiDA enables financial institutions to offer more personalized financial products tailored to individual customer needs. This level of customization is made possible by analyzing comprehensive data sets that provide insights into customer behaviors, preferences, and financial goals. Personalized offerings not only improve customer satisfaction but also enhance the competitiveness of financial institutions.

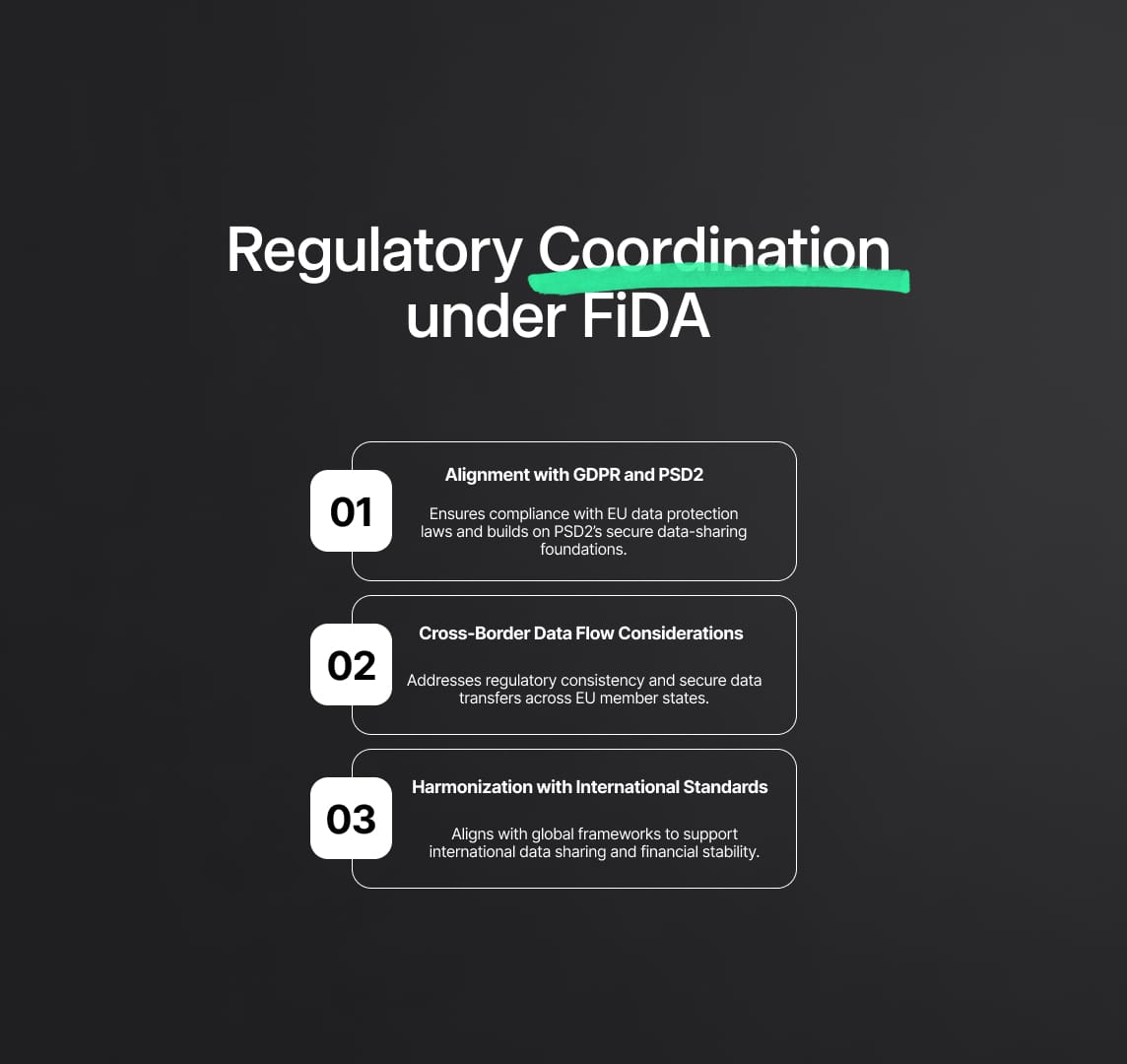

FiDA Regulatory Coordination and Compliance

The implementation of FiDA must be meticulously coordinated with other regulatory initiatives within the EU and globally. This coordination is essential to avoid regulatory conflicts and ensure that FiDA complements, rather than contradicts, existing legal frameworks.

- Alignment with GDPR and PSD2: FiDA must be fully compliant with the General Data Protection Regulation (GDPR), which governs data protection and privacy in the EU. This includes adhering to GDPR principles such as data minimization, purpose limitation, and data subject rights. Additionally, FiDA should integrate seamlessly with the Payment Services Directive 2 (PSD2), which has already set the groundwork for open banking and secure data sharing.

- Cross-Border Data Flow Considerations: Given the EU’s diverse regulatory landscape, FiDA’s implementation must account for cross-border data flows. The framework should include provisions for ensuring that data shared between institutions in different member states complies with both local and EU-wide regulations. This may involve harmonizing data protection standards across borders and ensuring that data transfers are conducted in a manner that does not compromise security or regulatory compliance.

- Harmonization with International Standards: As financial markets are increasingly globalised, FiDA’s implementation should consider alignment with international standards and regulations, such as the Basel III framework for banking supervision and the ISO/IEC 27001 standard for information security management. Ensuring compatibility with these standards will help facilitate international cooperation and data sharing, which is essential for global financial stability.

Reduce your

compliance risks