Fundamental Review of the Trading Book (FRTB)

EBA issues opinion on the Fundamental Review of the Trading Book (FRTB), urging banks to adapt to delayed implementation and strengthen market risk management and capital requirements.

FRTB (Fundamental Review of the Trading Book): EU Implementation, Framework & Latest Regulatory Developments

The Fundamental Review of the Trading Book (FRTB), the Basel Committee on Banking Supervision’s post-crisis overhaul of market-risk capital, introduces far more risk-sensitive methodologies and a strict, transparent boundary between the trading and banking books. Under the EU’s Capital Requirements Regulation (CRR), the package now consists of:

- Boundary rules defining when an instrument must sit in the trading book;

- The Sensitivity-Based Standardised Approach (SA);

- The Internal Models Approach (IMA) with its desk-level back-testing and profit-and-loss attribution (PLA) regime; and

- Escalating capital floors designed to shore up resilience.

The European Commission and the European Banking Authority (EBA) have aligned the bloc’s timetable with other major jurisdictions, pushing the formal go-live to January 2026 and issuing a no-action letter to prevent cliff-edge effects in the interim. This article gives regulatory professionals a concise, expert-level map of the EU rule set and its latest amendments.

1 | FRTB in Global Context

Originally finalised in 2016 (updated 2019), the FRTB replaces the Value-at-Risk framework with an Expected Shortfall metric for internal models and a granular SA calibrated to real-world risk factors. Its four strategic objectives are:

- Enhanced Risk Sensitivity: Capital charges now track the true distribution of trading-book losses, capturing tail risk that legacy VaR ignored.

- Stricter Model Governance: Each trading desk must satisfy validation, back-testing and PLA hurdles to retain IMA approval; failures default to SA, preventing under-capitalisation.

- Clear Trading-Book Boundary: New prescriptive criteria (e.g., documented intent to trade, demonstrable liquidity) curb regulatory arbitrage by locking positions into the appropriate book and restricting subsequent transfers.

- Increased Capital Resilience: BCBS impact studies show materially higher market-risk requirements, bolstering banks’ buffers against shocks reminiscent of 2008.

Because FRTB is a global standard, convergent implementation across the EU, US and UK is essential to preserve competitive neutrality. The EU’s phased approach, set out in the CRR amendments and EBA technical standards, aims to harmonise deadlines while retaining the bloc’s signature granularity and supervisory expectations.

2 | EU FRTB Implementation Timeline: Key Regulatory Milestones (2016 – 2026)

European policymakers have chosen a phased, CRR-based approach to the Fundamental Review of the Trading Book (FRTB), balancing Basel-standard fidelity with operational readiness.

| Date | Milestone & Regulatory Action (EU Context) |

|---|---|

| Jan 2016 | Basel Committee issues the original FRTB standard—cornerstone of the Basel III market-risk reforms. |

| Jan 2019 | Basel finalises the revised FRTB (risk-factor definitions, capital calibration). |

| Jun 2019 | EU enacts CRR II (Reg. 2019/876)— introducing reporting-only FRTB requirements. From 2021, large banks submit Standardised Approach (SA) numbers to supervisors without capital impact. |

| Mid-2023 | New trading-book boundary rules scheduled for reporting by June 2023. An EBA opinion (Feb 2023) issues no-action guidance to avoid piecemeal enforcement before full FRTB is live. |

| May 2024 | CRR III (Reg. 2024/1623) makes FRTB binding from 1 Jan 2025 and empowers the Commission (Art. 461a) to align timelines internationally. |

| 24 Jul 2024 | Via an Art. 461a Delegated Act, the European Commission defers the FRTB start to 1 Jan 2026 to keep pace with the US and UK. |

| 12 Aug 2024 | EBA no-action letter extends boundary-rule forbearance until the full FRTB regime activates in 2026. |

| Early 2025 | Commission opens consultation on further Basel III adjustments—options include a 2027 go-live or transitional relief (e.g., phased NMRF capital, PLA as monitoring only). Official date remains 2026 pending outcome. |

| 1 Jan 2026 (Upcoming) | EU banks must calculate Pillar 1 market-risk capital under FRTB SA or IMA. Preparatory work on systems, models, and governance continues through 2025. |

This incremental roadmap shows how EU authorities synchronise Basel objectives with market realities, protecting competitive neutrality while giving firms the runway to embed new market-risk capital processes. In the next section we dissect the boundary framework, Standardised Approach, and Internal Models Approach in their European form.

3 | Trading-Book vs Banking-Book Boundary under the FRTB

A core pillar of the Fundamental Review of the Trading Book (FRTB) is its rules-based boundary framework that determines which positions attract market-risk capital (trading book) and which remain subject to credit-risk capital (banking book). The new boundary closes historical arbitrage gaps and, from 1 January 2026, will be enforced across the EU via CRR III Article 104.

Eligibility Tests for the Trading Book

| Must be booked to the Trading Book when … | Examples |

|---|---|

| Documented trading intent or short-term resale expectation exists | Listed equities, sovereign or corporate bonds held for market-making |

| Profit is sought from short-term price movements or arbitrage | Directional or basis trades, delta-one strategies |

| Derivative contracts used for dealing or hedging trading-book exposures | Interest-rate swaps, equity options, credit default swaps |

| Active participation in market-making or client facilitation | FX spot/forwards, commodity futures |

Capital impact: Positions are capitalised under the Standardised Approach (SA) or, where approved, the Internal Models Approach (IMA) with desk-level ES, back-testing and PLA hurdles.

Default Allocation to the Banking Book

Positions fall to the Banking Book, and its credit-risk and IRRBB rules, if they fail the trading tests or are held for long-term investment or amortisation. Typical examples include:

- Retail and corporate loans

- Hold-to-maturity securities

- Strategic or structural FX positions (e.g., capital investments in subsidiaries)

→ Exemptions exist, but firms must evidence that these are not actively traded.

Tight Restrictions on Transfers

- One-way gate: Once a position is designated, switching books is prohibited unless strict regulatory criteria (e.g., error correction, cessation of trading intent) are met and prior supervisory approval is obtained.

- Internal risk transfers: Hedging between books is allowed only at arm’s-length market terms and must be fully capitalised, preventing hidden leverage or double-counting.

EU Sequencing & Supervisory Forbearance

The EBA no-action letters (Feb 2023 & Aug 2024) acknowledged that applying the boundary ahead of the wider FRTB capital stack risked fragmented reporting and inconsistent capital outcomes. Consequently:

- Boundary enforcement is deferred until the full FRTB capital regime starts on 1 Jan 2026.

- National competent authorities have been directed not to prioritise early enforcement, giving banks a unified cut-over date.

Practical Implications for 2025–26

- Policy & governance: Banks must finalise boundary policies, desk mappings and control frameworks during 2025, ready for regulatory inspection.

- Data & reporting: MIS and regulatory reporting systems need to tag positions consistently, flag breaches, and record any supervisory re-designations.

- Capital consequences: Mis-classification: e.g., parking tradable assets in the banking book, will understate market-risk capital and invite supervisory penalties once FRTB is live.

- Transparency: A harmonised boundary enhances comparability of trading-book risk disclosures across EU institutions, strengthening market discipline.

4 | FRTB Standardised Approach (SA): The Basel-III Baseline for Market-Risk Capital

Under the Fundamental Review of the Trading Book (FRTB), every EU bank must compute market-risk capital with the Standardised Approach (SA), even if an Internal Models Approach (IMA) is also approved. The SA therefore acts as both (i) a comparability yard-stick across firms and (ii) the regulatory floor underpinning Basel III’s 72.5 % output-floor cap on model-driven capital relief.

Core Components of the FRTB-SA

| Pillar | Regulatory Objective | Practical Mechanics |

|---|---|---|

| 1. Sensitivity-Based Method | Capture delta losses from small shocks across all risk classes | Map positions to risk factors (IR, credit-spread, equity, commodity, FX). Multiply sensitivities by calibrated risk-weights; aggregate with regulator-set correlations to reach a 97.5 % stressed-loss metric. |

| 2. Default Risk Charge (DRC) | Cover jump-to-default risk in trading-book credit instruments | Apply PD/LGD grids to both non-securitised and securitised exposures; supersedes the legacy IRC. |

| 3. Residual Risk Add-On (RRAO) | Ensure exotic pay-offs still carry capital | Fixed add-on (percent of notional) for options with discontinuities, structured notes, path-dependent or correlation products. |

| 4. Simplified SA | Reduce burden for small trading books | Thresholds in CRR III let qualifying banks bypass full granularity, though large institutions must run the full SA engine. |

EU-Specific Enhancements under CRR III

- Granularity boost: Article 104 and Annexes introduce finer risk buckets and scenario sets, aligning capital more closely with true exposure profiles.

- New reporting stack: Articles 430b (supervisory templates) and 445 (Pillar-3 disclosures) oblige banks to publish SA sensitivities, risk weights, DRC inputs, and RRAO figures, strengthening transparency and market discipline.

- Interaction with the output floor: The European Commission’s July 2024 Q&A confirmed that FRTB-SA results feed directly into the Basel-III output-floor calculation during the 2025–30 phase-in, anchoring minimum risk-weighted assets at 72.5 % of the standardised total.

Implementation & Strategic Impact

- Data & systems: Banks must map thousands of positions to the prescribed risk factors and maintain historical time-series for DRC. Many have rebuilt risk engines to automate SA sensitivities and aggregation.

- Cost-benefit calculus: Large EU banks now benchmark each trading desk: where the IMA fails PLA/back-tests, or yields only marginal capital benefit, desks may revert to SA for simplicity. Small and mid-sized firms often rely on SA exclusively.

- Supervisory scrutiny: From 1 Jan 2026, regulators will expect full SA compliance, robust governance over risk-factor mappings, and clear reconciliation between SA, IMA (where used) and the output-floor metrics.

5 | FRTB Internal Models Approach (IMA): Advanced Market-Risk Modelling for EU Banks

The Internal Models Approach (IMA) sits at the high-end of the Fundamental Review of the Trading Book (FRTB) spectrum: it rewards sophisticated risk-management with potentially lower capital, but only after passing some of the toughest quantitative and governance hurdles ever set by the Basel III framework and the EU’s CRR III package.

Core Pillars of the IMA

| Pillar | What the Rule Requires | Capital Effect |

|---|---|---|

| Expected Shortfall (ES) | 97.5 % ES over stressed liquidity horizons (10‒120 days) for each risk class. | Replaces VaR; better captures tail losses and diversification, often cutting capital vs the Standardised Approach (SA) if models are robust. |

| Non-Modellable Risk Factors (NMRFs) | Risk factors lacking sufficient real-price data are carved out of ES and receive a separate scenario-based add-on. | Typically a major uplift; incentivises data improvements or portfolio restructuring. |

| Desk-Level Approval | Each trading desk must pass Back-testing (99 % VaR) and the FRTB-specific Profit & Loss Attribution (PLA) test. | Failure triggers an automatic switch to SA for that desk. |

| Regulatory Multipliers | ES is multiplied by factors linked to back-testing exceptions and PLA margins. | Can erase model benefits if performance deteriorates. |

EU-Specific Technical Standards

- EBA RTS & Guidelines: define modellability tests, threshold calibrations, application templates, and ongoing validation duties.

- CRR III flexibility: allows hybrid booking (IMA for some desks, SA for others) while insisting a meaningful share of the trading book remains under IMA where approved.

- Standardised Default Risk Charge (DRC): applies even to IMA desks, ensuring consistent treatment of jump-to-default risk across the bloc.

Implementation Burden

Banks pursuing IMA must invest in:

- Deep data reservoirs to prove modelability and run thousands of ES simulations daily.

- Real-time desk-level P&L tracking and automated breach alerts.

- Robust governance: model-risk policies, change-control, independent validation, and transparent audit trails for supervisors.

Transitional Relief Under Consideration

The European Commission’s 2025 Basel III consultation explores easing entry barriers, for example, treating the PLA test as monitoring-only until 2029 and phasing in NMRF capital. Such measures could prevent a sudden exodus from IMA by:

- Allowing banks time to refine data feeds and modelling infrastructure.

- Encouraging continued innovation without penalising early adopters.

No final decision has been taken; the official start date for full IMA enforcement remains 1 January 2026.

Strategic Take-aways

- “Use it or lose it” ethos: Only desks that can prove model accuracy keep IMA privileges.

- Cost-benefit calculus: Where ES + multipliers + NMRFs outweigh Standardised capital, desks may revert to SA.

- Regulatory scrutiny: Ongoing back-testing and PLA breaches can trigger supervisory multipliers or partial revocation at any time.

6 | FRTB: Standardised Approach vs Internal Models Approach (EU Perspective)

Under the Fundamental Review of the Trading Book (FRTB), EU banks must calculate market-risk capital with the Standardised Approach (SA) and, where approved, the Internal Models Approach (IMA). The table below preserves every key distinction while tightening structure for search queries such as “FRTB SA vs IMA comparison”.

| Aspect | Standardised Approach (SA) | Internal Models Approach (IMA) |

|---|---|---|

| Basis of calculation | Rule-based formulas: risk-factor sensitivities × regulator weights + DRC + RRAO | Bank’s own 97.5 % Expected-Shortfall model; diversification reflected, NMRFs capitalised separately |

| Risk sensitivity | Broad & granular but still parameter-driven; limited credit for bespoke hedges | Highly portfolio-specific; captures idiosyncratic hedges and tail risk, minus NMRF carve-outs |

| Regulatory approval | None—default method for all banks and the Basel III output-floor benchmark | Mandatory desk-level sign-off; must pass back-testing and Profit-&-Loss Attribution (PLA) tests |

| Complexity & data | Data-heavy mapping to buckets but conceptually straightforward; scalable for small books | Extreme data, IT and governance demands: modellability evidence, daily P&L feeds, real-time monitoring |

| Typical capital outcome | Generally more conservative for well-hedged desks; may be lower for directional books | Potentially lower—if diversification, ES and multipliers outperform SA; floored at 72.5 % of SA |

Supervisory reality: Even IMA-approved desks must still run SA in parallel for Pillar-3 disclosures and to feed the Basel III output floor, guarding against under-capitalisation.

7 | Capital Requirements & Business Impact of the EU FRTB

- Aggregate uplift: Regulators calibrated FRTB to raise market-risk capital by 30–50 % versus Basel 2.5, reflecting wider risk capture (credit spreads, NMRFs, DRC) and more conservative SA parameters.

- Capital allocation & desk incentives:

- Higher charges for desks with illiquid assets, heavy NMRFs or repeated PLA failures.

- Efficiency gains for desks that keep IMA approval and hedge effectively.

- Internal funds-transfer pricing is shifting to FRTB metrics, reshaping product mix and pricing.

- Own-funds disclosure: CRR III Articles 430b & 445 oblige banks to publish granular FRTB figures, SA, IMA, DRC, NMRFs, boosting market discipline and giving investors early sight of capital strain.

- Output-floor back-stop: The EU is phasing the Basel III 72.5 % floor (≈ 50 % in 2025 ➜ 55 % in 2026 ➜ full by 2030). Even stellar models cannot drag total RWAs below this threshold, forcing dual management of modelled and standardised capital views.

- Dynamic capital swings:

- Volatility-sensitive ES: Spikes in market stress feed directly into IMA capital.

- Cliff effects: PLA/back-test failure can push a desk from IMA to SA overnight.

- Supervisors may impose Pillar-2 buffers to smooth extreme swings but expect robust contingency planning.

- Transition runway (2023 – 2026): Banks must finish system builds, optimise portfolios and prove model robustness ahead of the 1 January 2026 EU go-live (later if Brussels adopts further postponement). Early remediation avoids punitive SA fallback and preserves competitive ROE.

8 | Latest EU Regulatory Developments: 2026 Delay, EBA No-Action & Industry Readiness

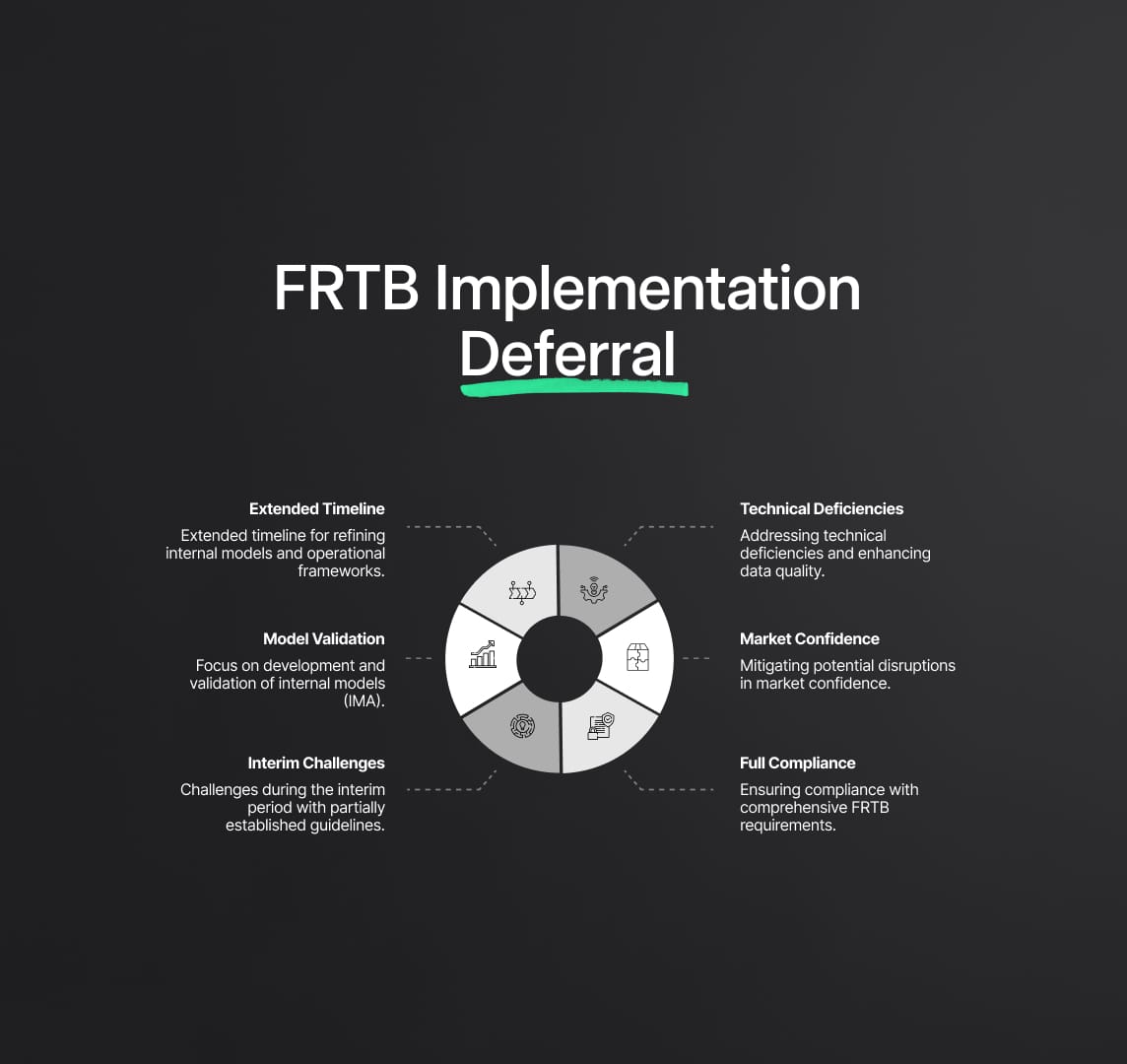

The EU’s recent timetable shift and supervisory forbearance mark a pragmatic, globally aligned pivot in the rollout of the Fundamental Review of the Trading Book (FRTB).

A. Commission’s One-Year Deferral (24 July 2024)

- New go-live: 1 January 2026 (from 2025).

- Rationale:

- Competitive parity – US rules were still in draft and the UK had already deferred Basel 3.1.

- Operational runway – banks were mid-testing on modellability data, desk structures and staff training.

- Official guidance: Commission Q&A stresses that capital-markets competition demands a synchronised start date across major jurisdictions.

B. EBA No-Action Letter on the Trading-Book Boundary (12 August 2024)

- Directive: National supervisors should refrain from enforcing the new boundary rules until the full FRTB package activates in 2026.

- Why it matters:

- Prevents a fragmented rollout (boundary first, capital later) that would distort disclosures and force costly interim system changes.

- Offers temporary regulatory forbearance without changing the legal text: boundary provisions still state 2025, but no penalties will be applied for deferral.

C. Ongoing Monitoring, Q&As & RTS Drafts

- Commission Q&A (July 2024): Instructs banks to continue reporting under the current framework through 2025 while parallel-running FRTB.

- EBA RTS pipeline:

- Modellability & “main risk-driver” definitions.

- PLA threshold calibration.

- Treatment of structural FX and internal hedges.

- Status (Jan 2025): Draft RTS on IMA topics issued, fully aligned with CRR III amendments.

D. Industry Preparedness Checklist (2024 – 2025)

| Priority | Action Item | Why Now? |

|---|---|---|

| Data quality | Fill historical price gaps; evidence modellability to shrink NMRFs. | Capital relief depends on passing modellability tests by 2026. |

| Model refinement | Stress-test PLA outcomes, back-testing breaches, desk granularity. | Avoid last-minute IMA rejection or SA fallback. |

| Parallel run | Produce full FRTB metrics alongside Basel 2.5 figures. | Validates systems, informs management planning and regulator dialogue. |

| Regulator engagement | Provide impact-study feedback on conservative SA buckets, persistent NMRFs. | Inputs could shape transitional relief or fine-tuning in RTS. |

E. Possible 2027 Phase-In: Still on the Table

- Commission consultation (early 2025) weighs:

- A 2027 go-live if US slips to 2028.

- Gradual NMRF and PLA phase-ins to 2029/30.

- Push-pull dynamic:

- ECB & some NCAs resist excessive delays.

- Industry highlights operational and liquidity concerns.

- Decision driver: Convergence of US/UK timelines vs EU prudential priorities.

Take-Aways for Risk & Regulatory Teams

- Delay ≠ Downgrade – All capital, governance and disclosure standards remain intact for 2026.

- Use the runway – Strengthen data pipelines, refine models, rehearse reporting.

- Stay plugged-in – Track Commission delegated acts, EBA RTS and global Basel-endgame moves.

- Engage early, often – Evidence-based feedback can shape transitional calibrations.

9 | trategic Outlook for the EU Fundamental Review of the Trading Book

By 1 January 2026, the Fundamental Review of the Trading Book (FRTB) will re-wire how European banks measure, manage and capitalise market-risk. Its interlocking pillars, the clarified trading-book boundary, the granular Standardised Approach (SA) and the exacting Internal Models Approach (IMA), should align capital with true trading risk, remedy past blind-spots and bolster financial-system resilience.

Key Take-Aways for Regulatory & Risk Professionals

- Phased, flexible rule-making pays off

CRR II ➜ CRR III sequencing, backed by EBA no-action guidance, contained transition frictions. Future Basel rollouts will likely mirror this “phase-and-fine-tune” model. - Data is destiny under FRTB

High-quality time-series, robust modellability evidence and powerful analytics engines are now competitive differentiators—lowering capital for well-run desks and passing ever-stricter supervisory scrutiny. - The rulebook is still moving

Stay alert to Commission delegated acts, EBA RTS/Q&As and global Basel-3.1 updates; FRTB figures feed the Basel-III output floor and cascade into group-wide capital planning. - Cross-functional coordination is indispensable

Front-office, Risk, Finance and IT must break silos: trading desks need live capital feedback; risk teams must flag model limits; finance must weave FRTB numbers into ICAAP and dividend decisions. - Post-2026: monitor, optimise, recalibrate

Supervisors will test whether FRTB truly captures tail risk; banks will track liquidity impacts—especially in thinly traded asset classes. Early impact studies may prompt tweaks to SA weights, NMRF add-ons or desk-level PLA tolerances.

Reduce your

compliance risks