Governance, Risk and Compliance(GRC) Challenges

Navigating future compliance in financial services requires adaptability to emerging trends and technologies. With rising cyber threats, AI use, data privacy concerns, and the advent of crypto-assets and blockchain, fostering a compliance culture is paramount for financial institutions.

In a rapidly evolving global landscape marked by major technological breakthroughs, sweeping regulatory reforms, and volatile socio-economic conditions, the financial services industry finds itself in the throes of unprecedented change. Compliance professionals, once primarily seen as gatekeepers, are now playing a pivotal role as strategic advisors, helping navigate complex business decisions amidst this landscape of constant flux. This evolution, though peppered with challenges, also unveils exciting opportunities for growth and innovation.

At the heart of the shift lies an increasing complexity of rules and regulations, driven by a number of factors: the relentless advancement of technology and its subsequent integration into financial services, emerging geopolitical situations, a growing emphasis on environmental, social, and governance (ESG) factors, and the rise of new asset classes such as cryptocurrencies, among others.

In this milieu, the role of compliance is becoming increasingly critical. The task at hand for compliance professionals is no longer just about abiding by the letter of the law; it’s about understanding and interpreting the spirit of the regulation in the context of the firm's business model and market dynamics. It's about providing strategic advice that can steer businesses through a labyrinth of new regulations without stifling growth or innovation. Above all, it’s about creating a culture of compliance that is deeply entrenched in the fabric of the organization.

The purpose of this comprehensive analysis is to delve into the future of compliance in financial services, highlighting the challenges that lie ahead, the threats that could potentially disrupt the industry, and the role of compliance professionals in shaping the future of the sector. It’s a deep dive into the intricacies of the evolving compliance landscape, offering insights on how to navigate the challenges, mitigate the risks, and leverage the opportunities that the future holds.

The Rising Prominence of Environmental, Social, and Governance Criteria

The principles of Environmental, Social, and Governance (ESG) are taking center stage in the financial services industry, fundamentally reshaping the compliance landscape. Financial institutions across the globe are increasingly integrating ESG factors into their investment strategies in response to rising investor demand, stricter regulatory requirements, and a growing societal expectation for businesses to act responsibly.

Regulatory bodies worldwide, including the International Sustainability Standards Board and the Task Force on Climate-Related Financial Disclosures, are introducing new standards and guidelines, enhancing the importance of ESG disclosures. These bodies are essentially pushing companies to be more transparent about their ESG risks and opportunities, compelling them to disclose a wide array of ESG-related data that goes beyond the traditional financial metrics.

For compliance professionals, this presents a monumental challenge. They must first gain a deep understanding of these new ESG regulations, which encompass a broad spectrum of factors ranging from carbon emissions and water usage to human rights and corporate governance. They must then ensure that their firms are not only adhering to these regulations but are also able to accurately measure and report their ESG performance in a way that is meaningful to investors and stakeholders.

Furthermore, they must guide their firms towards making ethical investments, without compromising financial returns. This involves conducting comprehensive ESG risk assessments, monitoring portfolio companies' ESG performance, and engaging with them to promote better ESG practices. This is no small feat given the lack of standardized ESG data, the subjective nature of ESG ratings, and the inherent difficulty in quantifying some ESG risks.

In addition, compliance professionals need to help their firms navigate the reputational risks associated with poor ESG performance. In an age where information is readily available and public opinion can quickly sway, a company's ESG missteps can lead to significant reputational damage, negatively impacting its market value and stakeholder relationships.

The Impact of Global Geopolitical Tensions

The impact of global geopolitical tensions on the financial services industry cannot be overstated. From the ongoing crisis in Ukraine to escalating trade tensions between the world's major economic powers, geopolitical uncertainties have the potential to disrupt global financial markets and, by extension, the compliance function within financial institutions.

Geopolitical tensions often result in economic sanctions, effectively putting financial institutions at the frontlines of these conflicts. They must ensure compliance with various sanctions regimes, prohibiting transactions with specific countries, entities, or individuals. Failure to comply with these sanctions can result in severe penalties, including hefty fines and damage to the institution's reputation.

The challenges for compliance professionals in this context are manifold. They must keep pace with the ever-changing geopolitical landscape and understand the complex legal frameworks that govern sanctions. They must ensure that their organizations' compliance programs are robust enough to detect and prevent any involvement in prohibited transactions, even as the list of sanctioned entities continues to evolve.

To effectively manage these challenges, compliance professionals must develop a nuanced understanding of the geopolitical dynamics that drive these sanctions. They must stay informed about changes in sanctions laws, understand the implications of these changes for their firms, and swiftly adjust their compliance programs accordingly. They must also cultivate a culture of compliance within their organizations, where all employees understand the importance of sanctions compliance and the consequences of non-compliance.

The Cryptocurrency Challenge: Navigating a Dynamic Regulatory Landscape

The meteoric rise of cryptocurrencies has brought forth an entirely new asset class for the financial industry. As digital currencies such as Bitcoin, Ethereum, and numerous altcoins gain mainstream acceptance, they also bring with them a plethora of regulatory and compliance challenges. Financial institutions are grappling with the task of understanding and managing these unique risks, while also trying to seize the opportunities presented by this transformative technology.

Cryptocurrencies operate in a somewhat nebulous regulatory environment, with regulations varying significantly across jurisdictions. This creates a complex scenario for financial institutions that are increasingly incorporating these assets into their product and service offerings. With no globally accepted regulatory framework for cryptocurrencies, compliance professionals must navigate a patchwork of national laws, all the while keeping a close eye on evolving global regulatory trends.

Fraud, money laundering, and terrorism financing are among the major risks associated with cryptocurrencies. As these digital assets often provide anonymity to users, they have become an attractive tool for illicit activities. Financial institutions offering cryptocurrency services must therefore implement robust anti-money laundering (AML) and counter-terrorism financing (CTF) compliance programs. These programs should be equipped to identify and report suspicious activities, conduct comprehensive customer due diligence, and ensure transaction monitoring in line with regulatory requirements.

Moreover, the volatile nature of cryptocurrency markets poses significant financial risks. Price fluctuations can be extreme and unpredictable, potentially leading to significant financial losses for investors. Compliance professionals must work closely with risk management teams to assess and mitigate these risks, while also ensuring that customers are adequately informed about the potential downsides of cryptocurrency investments.

The technological intricacies of blockchain – the technology that underpins cryptocurrencies – pose yet another challenge. Compliance professionals need to understand how blockchain technology works, how it can be used and abused, and how it fits into the existing regulatory framework. This requires not only technical knowledge but also the ability to translate this knowledge into effective compliance strategies.

Cybersecurity and Data Privacy: Protecting Sensitive Information in the Digital Age

As financial institutions embrace digital transformation, they are becoming increasingly vulnerable to cyber threats. Cybersecurity breaches can result in the theft of sensitive data, financial loss, disruption of business operations, and damage to the institution's reputation. Given the highly regulated nature of the financial services industry, these breaches can also lead to non-compliance with data privacy laws, attracting hefty fines and legal sanctions.

Compliance professionals have a crucial role to play in managing these cyber risks. They must understand the diverse range of cyber threats, from malware and phishing attacks to insider threats and supply chain vulnerabilities. They must also be familiar with the regulatory requirements related to cybersecurity and data privacy, which vary across jurisdictions and are continually evolving.

To effectively manage cyber risks, compliance professionals must work closely with their organization's IT and security teams. They must ensure that the organization has robust cybersecurity controls in place, including firewalls, intrusion detection systems, encryption technologies, and incident response plans. They must also ensure that employees are trained on cyber hygiene practices, as human error is often a major contributor to cyber breaches.

In addition to managing cyber risks, compliance professionals must ensure that their organizations comply with data privacy regulations. This involves understanding the rights of data subjects under laws such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), and ensuring that these rights are upheld. It also involves monitoring changes in data privacy laws, and adjusting the organization's data management practices accordingly.

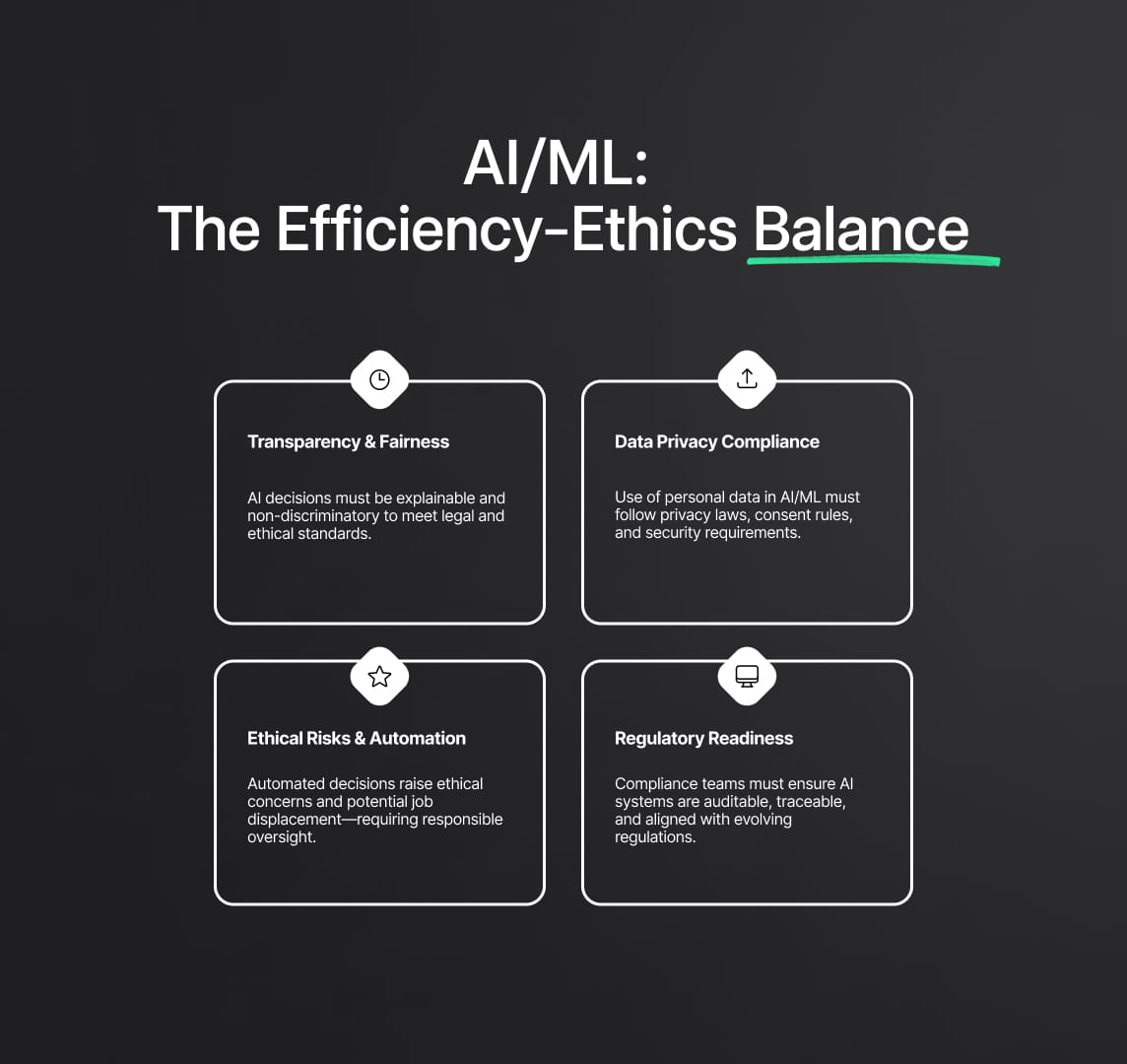

Adapting to AI and Machine Learning: Balancing Efficiency and Ethics

Artificial Intelligence (AI) and Machine Learning (ML) have made significant inroads into the financial services sector, offering tremendous potential for improved efficiency, accuracy, and innovation. Financial institutions are harnessing these technologies for a wide range of applications, including risk management, fraud detection, customer service, and algorithmic trading. However, the use of AI and ML also raises novel compliance challenges that must be carefully managed.

AI systems can make decisions or recommendations based on complex algorithms that learn from vast amounts of data. This raises concerns about the transparency and fairness of these decisions. For instance, an AI system could inadvertently discriminate against certain groups of people in its credit scoring or insurance underwriting decisions, leading to potential breaches of anti-discrimination laws. Compliance professionals must therefore ensure that their organization’s AI systems are transparent and auditable, and that they do not lead to unfair outcomes.

AI and ML also raise privacy concerns, as they often rely on the collection and processing of large amounts of personal data. Compliance professionals must ensure that their organization's use of these technologies complies with data privacy laws. This involves obtaining valid consent from data subjects, ensuring that data is securely stored and processed, and implementing measures to mitigate the risk of data breaches.

Furthermore, the use of AI and ML can result in the automation of decision-making processes that were previously performed by humans. This can lead to job displacement and ethical concerns. Compliance professionals must navigate these challenges, ensuring that their organizations strike a balance between harnessing the benefits of AI and ML, and mitigating the associated risks and ethical issues.

Tackling the ESG Compliance Challenge: Moving Beyond Check-the-Box Compliance

Environmental, Social, and Governance (ESG) factors have taken center stage in the financial services industry, with investors, regulators, and stakeholders increasingly demanding that financial institutions integrate ESG considerations into their operations and strategies. This shift towards sustainable finance presents new compliance challenges for financial institutions.

Traditionally, ESG compliance has often been a check-the-box exercise, focusing on meeting minimum regulatory requirements. However, this approach is no longer sufficient. Stakeholders are demanding more proactive and meaningful ESG commitments from financial institutions. They expect institutions to not only comply with ESG regulations, but to also take steps to positively impact society and the environment.

This requires a shift in mindset for compliance professionals. They must move beyond mere compliance towards a more holistic and strategic approach to ESG. This involves understanding the broader societal and environmental impacts of their organization's activities, and developing strategies to manage and mitigate these impacts.

Compliance professionals also have a crucial role to play in ESG reporting. They must ensure that their organization's ESG disclosures are accurate, transparent, and in line with regulatory requirements. They must also monitor changes in ESG regulations and reporting standards, and ensure that their organization's ESG strategies and disclosures are updated accordingly.

The integration of ESG factors into compliance also requires strong collaboration across different parts of the organization. Compliance professionals must work closely with their organization's ESG, risk management, and corporate social responsibility teams to ensure a coordinated approach to ESG compliance.

Keeping Pace with Crypto-Assets and Blockchain Technology: Navigating the New Frontier of Compliance

The rapid rise of crypto-assets and blockchain technology has revolutionized the financial services industry. It has not only opened new opportunities for innovation and growth, but has also presented a host of compliance challenges for financial institutions.

Crypto-assets, such as Bitcoin and Ethereum, operate on a decentralized, peer-to-peer network, which is fundamentally different from the traditional, centralized financial system. This raises unique compliance challenges in terms of customer identification, transaction monitoring, and fraud prevention. Compliance professionals must therefore adapt their procedures and controls to effectively manage the risks associated with crypto-assets.

The anonymous and transnational nature of crypto-assets also poses significant risks in terms of money laundering and terrorist financing. Financial institutions that deal in crypto-assets must therefore ensure robust Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) controls. This includes conducting thorough customer due diligence, monitoring transactions for suspicious activity, and reporting suspicious transactions to relevant authorities.

At the same time, financial institutions must also navigate the rapidly evolving regulatory landscape for crypto-assets. This includes keeping pace with changes in regulations, understanding the implications of these changes for their operations, and implementing necessary changes in a timely manner.

Blockchain technology, the underlying technology behind crypto-assets, also presents compliance challenges. For instance, the immutability of blockchain transactions raises issues in terms of data privacy and the right to erasure under regulations such as the General Data Protection Regulation (GDPR). Compliance professionals must therefore balance the benefits of blockchain technology with the need to comply with data privacy laws.

Cultivating a Proactive and Adaptive Compliance Culture

In the face of these emerging challenges, it is essential for financial institutions to cultivate a proactive and adaptive compliance culture. This involves continuously monitoring changes in the regulatory landscape, adapting compliance procedures and controls accordingly, and fostering a culture of compliance throughout the organization.

The role of compliance professionals in this process cannot be overstated. They must not only have a deep understanding of the regulatory requirements and risks associated with these emerging trends, but also have the foresight and adaptability to anticipate and respond to future changes.

Ultimately, navigating the future of compliance in financial services is not just about reacting to changes in regulations or technologies. It's about being proactive, strategic, and forward-thinking. It's about striking a balance between innovation and risk, between growth and ethics. And most importantly, it's about ensuring that financial institutions not only comply with the law, but also act in the best interests of their customers, stakeholders, and society at large.

Let’s make

compliance fun again

Grand is not your average GRC platform. Our primary focus is to make the lives of GRC practitioners easier and more fun. We do this by reducing workload through workflow automation, collaboration, advanced AI and all the rest, but what truly sets us apart is our continuous feed of out-of-the-box content that has been curated by industry leading experts.

Reduce your

compliance risks