Virtual assets are entering the mainstream financial world

What is cryptocurrency?

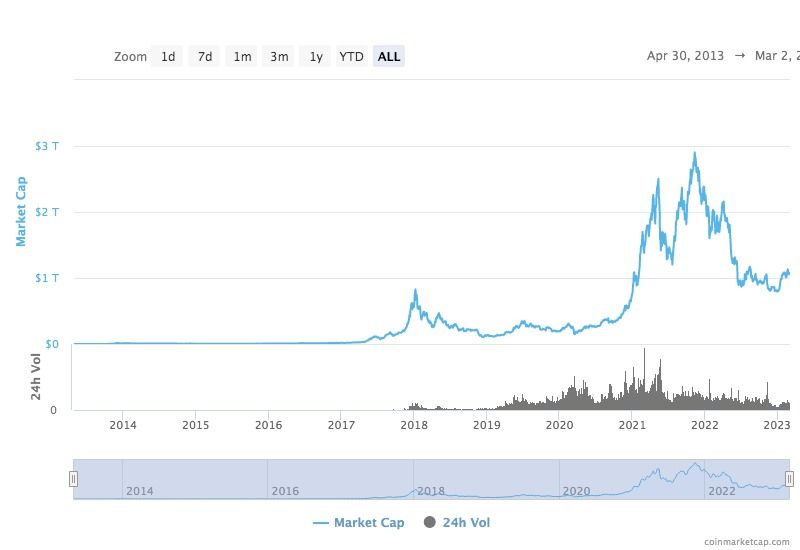

A cryptocurrency is a revolutionary form of digital or virtual currency that has taken the world by storm. Its unique feature is that it uses cryptography to secure and verify transactions, making it a highly secure and reliable medium of exchange. According to a report by Statista, the market capitalization of the global cryptocurrency market was around $950 billion in February 2021, indicating the growing popularity and adoption of cryptocurrencies worldwide.

Bitcoin Revolution

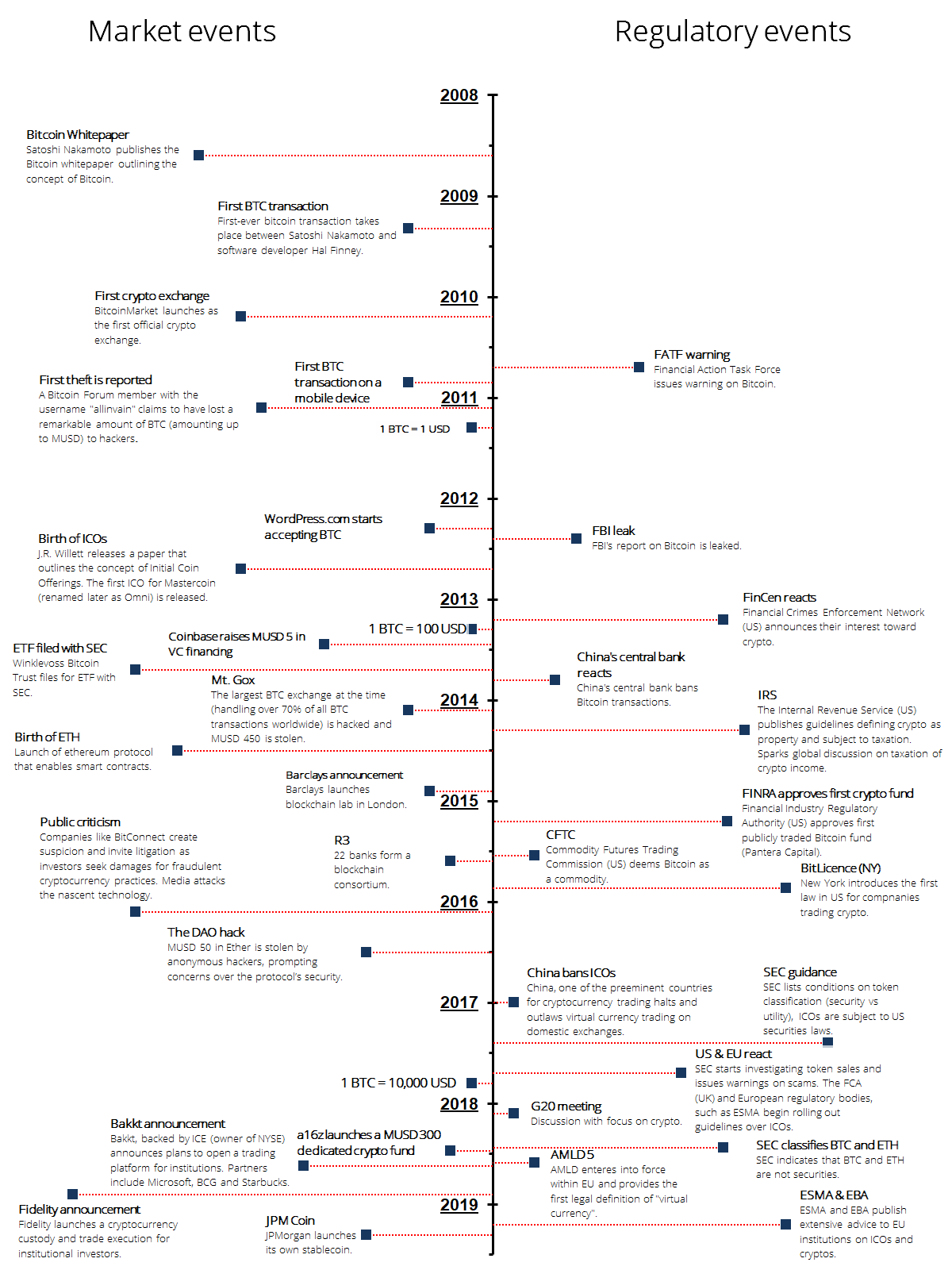

The concept of digital currency has been around since 1983, but it was not until the advent of Bitcoin in 2009 that the world of finance was forever transformed. Bitcoin, created by an unknown person or group using the pseudonym Satoshi Nakamoto, shook the financial world with its decentralized nature. Unlike traditional digital currencies, Bitcoin did not rely on centralized companies such as Paypal or eGold to operate.

Instead, it was a decentralized digital currency that could operate without a central authority. Its transactions were verified through a process called mining, making it highly secure. As of February 2021, the total number of Bitcoins in circulation was around 18.63 million.

Blockchain & Mining

Mining is a complex process that involves verifying transactions and adding them to the blockchain, a distributed public ledger that is used to maintain the integrity of the cryptocurrency. The blockchain is stored in a data structure called a Merkle Patricia tree, which is responsible for ensuring the security of the system. According to a report by Deloitte, the blockchain technology market is expected to reach $21.07 billion by 2026, indicating the growing demand for blockchain technology across various industries.

Crypto Market Rise

Since the creation of Bitcoin, numerous other cryptocurrencies have emerged, each with its unique features and purposes. Some cryptocurrencies focus on limiting the number of transactions that can be validated per unit of time, while others focus on providing fast and lightweight services. The world of cryptocurrency is ever evolving, and it will be fascinating to see how it continues to shape the future of digital currency. As of February 2021, the total number of cryptocurrencies in circulation was around 4,000.

However, as with any new technology, cryptocurrency has its share of challenges. One of the most significant challenges is the lack of regulation, which has raised concerns about fraud, money laundering, and other illegal activities. Additionally, the decentralized nature of cryptocurrency means that transactions cannot be reversed or refunded, making it challenging for some users. According to a report by the Cambridge Center for Alternative Finance, only 39% of cryptocurrency exchanges have some form of regulatory oversight.

Despite these challenges, more and more businesses and individuals are accepting cryptocurrency as payment. Its potential benefits are too great to ignore, and as the technology continues to develop, it is sure to become even more widespread. The future of cryptocurrency is bright, and it is exciting to think about how it will shape the financial world in the years to come. According to a survey by HSB, 36% of small and medium sized businesses in the US accept cryptocurrency as a form of payment.

Understanding cryptocurrency evolving popularity

Revolutionizing the Financial Industry: The Emergence of Blockchain Technology and Cryptocurrencies

In recent years, the financial industry has undergone a profound transformation with the emergence of blockchain technology and cryptocurrencies. This game-changing innovation facilitates direct value transfers between parties, eliminating the need for intermediaries and ensuring secure transactions. The technology also addresses the double-spending problem that has plagued the digital realm.

Crypto enhancing Payment Options

Cryptocurrencies such as Bitcoin leverage blockchain technology to provide speedy and efficient payment options on the public internet. The use of blockchain technology in financial applications tackles the cost of trust, a critical component of the financial system encompassing intermediary fees, contract costs, settlement procedures, cybersecurity, and user authentication.

Simplifying Payments and Reducing Commissions

By simplifying payments through cryptocurrencies, businesses can perform instant money transfers, thereby reducing the commissions required to pay for goods and services. Cryptocurrencies have the potential to transform cash flows and supply chain structures, enabling exchange partners to trade, exchange value, and settle payments using cryptocurrencies. Cryptocurrencies prevent fraudulent exchanges and payments, making service transactions uncomplicated and efficient.

Empowering Individuals Economically

The rise of cashless payments and credit card usage has made cryptocurrencies a popular payment option on the internet. Small businesses can also benefit from micropayments and exchange party transactions, not just large corporations. Empirical evidence suggests that cryptocurrencies have a positive impact on financial inclusion and sector development, highlighting their potential to empower individuals economically.

A New Type of Speculative Asset

However, cryptocurrencies are also a new type of speculative asset that appeals to investors seeking returns. A report by Coinbase and ARK Invest indicates that most users view cryptocurrencies, particularly Bitcoin, strictly as an investment, which presents obstacles to implementing them as an exchange medium of value and a source of profits.

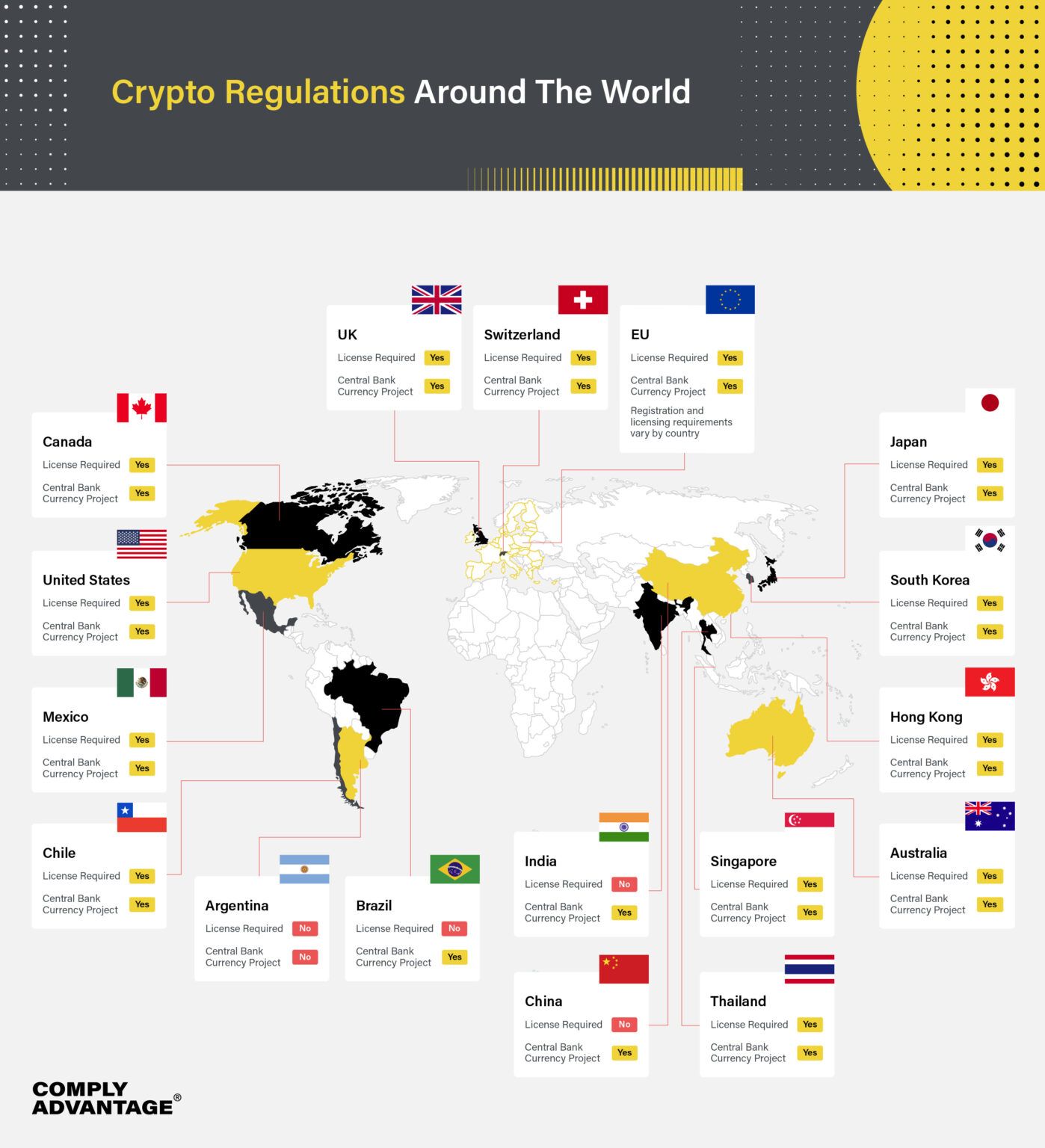

Cryptocurrencies regulatory process: a global overview

Cryptocurrency framework

The FSB has just unveiled an exciting proposed framework and recommendations for the international regulation of crypto assets and global stablecoin agreements. This new development marks a pivotal moment in the world of cryptocurrency, as it seeks to address a number of pressing challenges and concerns that have been previously overlooked.

One of the main issues the FSB is keen to address is the complex and often fragmented nature of national crypto asset regulation and supervision. The proposed framework aims to close existing regulatory gaps and ensure that regulatory powers extend to all areas of crypto asset operations. The FSB is also advocating for enhanced cross-border cooperation to ensure that regulatory standards are harmonized globally.

DLT discussions

Another crucial area of concern is the risks associated with wallets and custody services, trading, lending, and borrowing activities. The FSB recognizes that the use of Distributed Ledger Technology (DLT) has made it possible for crypto assets to be traded and transferred more efficiently and securely than ever before. However, this also means that the risks associated with these activities have become more complex and challenging to mitigate.

To address these challenges, the FSB is recommending that all crypto and stablecoin firms, including issuers, service providers, exchanges, and wallets, be subjected to comprehensive regulatory requirements. These requirements should include effective governance and risk management practices, as well as robust frameworks for collecting, storing, and reporting data in a precise manner.

Overall, this new framework and recommendations put forth by the FSB are a significant step towards greater regulatory clarity and oversight in the world of cryptocurrency. The proposals are a timely reminder that the benefits of crypto assets can only be fully realized if they are subject to appropriate and effective regulatory controls.

AML & CFT Obligations for VASP providers

Virtual assets and Virtual Asset Service Providers (VASPs) have become a major concern for regulators worldwide as they strive to maintain global prudential standards in the financial industry. The rapid growth of the crypto market has raised questions about Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) obligations in relation to virtual assets, which led to the Financial Action Task Force (FATF) releasing updated guidelines in October 2021.

FATF Directive

The FATF guidance aims to help regulators develop regulatory and supervisory directives for virtual asset activities and assist VASPs in understanding and executing their AML/CFT obligations. The guidance promotes a risk-based approach, technological neutrality, and future proofing while acknowledging the borderless nature of virtual assets. Additionally, the FATF recommends that all jurisdictions enforce AML/CFT requirements, including the travel rule on financial institutions.

The travel rule requires financial institutions to share insights on transactions beyond a specified threshold. The FATF recommends VASPs, such as exchanges, banks, Over the Counter desks, hosted wallets, and other financial institutions, to gather personally-identifying information about the receiver and sender for crypto movements exceeding USD/EUR 1,000 globally.

Despite the FATF's recommendations, the implementation of the travel rule has been limited, and many jurisdictions have yet to pass legislation or enforce supervisory measures. In July 2022, the FATF reported that most jurisdictions have not fully implemented its Recommendation for AML/CFT Standards for virtual assets and VASPs.

To ensure global AML/CFT Standards for virtual assets and VASPs, countries must regulate VASPs for AML/CFT purposes and subject them to effective monitoring systems. The Committee on Payments and Market Infrastructures and the International Organization of Securities Commissions (CPMI-IOSCO) issued a final report in July 2022 providing clarity on the Principles for Financial Market Infrastructures to stablecoin arrangements.

Stablecoins are considered systemically important financial market infrastructures. The report proposes guidance on governance, risk management, settlement finality, and money settlements to assist national authorities in determining whether a stablecoin arrangement is systemically important.

Crypto-Assets Roadmap

In July 2022, IOSCO's Fintech Task Force issued a Crypto-Asset Roadmap for 2022-2023 that focuses on two workstreams: Crypto and digital assets and DeFi. The roadmap address issues related to market integrity, investor protection and stability, as well as managing crypto and DeFi risks within regulatory frameworks. The two workstreams are expected to publish their final policy by the end of 2023.

Overall, regulators worldwide must ensure that virtual assets and VASPs are subject to the same prudential standards as traditional financial institutions to maintain financial integrity and safeguard against financial crimes such as money laundering and terrorism financing. The implementation of the FATF's guidelines and other regulatory frameworks will be crucial in achieving these goals.

Framework differences across the world

EU MiCA crypto Regulation

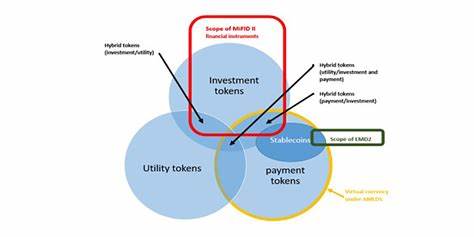

The Markets in Crypto-Assets Regulation (MiCA) is a pioneering cross jurisdictional regulatory and supervisory framework for crypto-assets, which is expected to take effect in 2024 following its ratification by the European Parliament. The introduction of MiCA is in line with the European Commission's objective of establishing a regulatory framework that fosters distributed ledger technology (DLT) and crypto assets in the financial services industry.

MiCA: between clarity and innovation

One of MiCA's main objectives is to ensure legal clarity and provide consumer and investor protection while promoting innovation and addressing challenges arising from fragmented national frameworks. This regulation aims to guarantee market integrity and financial stability while enabling the adoption of DLT and crypto-assets in the EU.

Business activities related to crypto-assets in the EU are expected to fall under MiCA's purview. Furthermore, non-EU crypto-asset companies that provide services to EU clients are required to comply with MiCA's requirements. However, MiCA exempts non-EU companies from complying with its provisions if they are responding to an initiative from an EU customer under strict terms defined in the regulation, a principle known as "reverse solicitation."

It should be noted that MiCA does not specify whether lending crypto-assets is a regulated activity. This may be regulated at the national level, or lending activities with crypto-assets may be conducted in the context of a lender giving other regulated activities, triggering MiCA's authorization needs.

Overall, MiCA represents a crucial step towards regulating the crypto-asset market in the EU, providing a framework that ensures legal clarity, consumer protection, and financial stability while promoting innovation and addressing the challenges posed by fragmented national regulations.

US enforcing SEC

The digital assets market has experienced tremendous growth over the years. Millions of people worldwide have invested in digital assets, which reached a market capitalization of $3 trillion globally in 2022. The US government worked with various firms to develop frameworks and policies advancing priorities identified in the Executive Order from consumer and investor protection U.S. leadership in the global financial system advancing his economic competitiveness.

EO's Reports for Responsible Digital Asset Development

Nine reports have been submitted to the President in line with the EO's deadlines. These reports summarise the information provided by diverse stakeholders across government, industry, and civil society. Together, they provide a clear guide for responsible digital asset development and develop the line for further international actions.

The reports encourage regulatory bodies such as the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) to aggressively follow investigations and sanctions against unlawful practices in the digital assets space. The Consumer Financial Protection Bureau (CFPB) and Federal Trade Commission (FTC) are urged to monitor consumer complaints and enforce against unfair, deceptive, or abusive practices.

The reports also encourage government organs to issue guidance and rules to address current and emergent risks in the digital asset ecosystem. They need regulatory and law enforcement agencies to cooperate in order to address and manage risks facing consumers, investors, and businesses. In addition, agencies are encouraged to share data on consumer issues regarding digital assets to ensure that their activities are maximally effective.

US paving the way for crypto management

The Financial Literacy Education Commission (FLEC) will lead efforts to help consumers understand the emerging risks with digital assets, identify common fraudulent behaviors and learn how to report misconduct.

The United States has been a leader in applying its anti-money laundering and countering the financing of terrorism (AML/CFT) policies in the digital asset ecosystem. However, digital assets have been used by bad actors to launder illicit businesses and conduct various other crimes. The President will evaluate gathering Congress to inform relevant laws and raise penalties for unlicensed money transmission.

The United States will continue to monitor the future of the digital assets sector and its associated fraud risks. Treasury will complete an illicit finance risk assessment on DeFi by the end of February 2023 and an policy on NFT by July 2023. Relevant departments and agencies will find and disrupt illicit actors and address the abuse of digital assets, holding cybercriminals and other malign actors responsible for their illicit activity.

CHINA PBOC Circular

The People’s Bank of China (PBOC) made headlines by issuing a regulatory document aimed at curbing the "speculative risks of cryptocurrency trading" in the country. The move was a joint effort by the PBOC and nine other regulatory authorities, including the Supreme People’s Court, Supreme People’s Procuratorate, the Ministry of Public Security, and the State Administration of Foreign Exchange.

The circular delivered a stark message to cryptocurrency traders, reiterating that cryptocurrencies do not hold equal legal status with fiat currencies, and therefore cannot be legally used as a currency in China. This message is consistent with the PBOC's 2017 circular that banned initial coin offerings (ICOs) and imposed restrictions on cryptocurrency trading in the country.

However, this new circular takes the crackdown a step further by declaring all cryptocurrency transactions illegal. This includes conversion, buying and selling, ICOs, and cryptocurrency derivative transactions, which have all been deemed illegal financial activities. Banks and other financial institutions are prohibited from providing any service to cryptocurrency transactions, effectively shutting down any remaining avenues for cryptocurrency trading.

Moreover, the circular also extends to overseas cryptocurrency exchanges providing services to Chinese residents through the internet, which are now deemed illegal. This puts companies, organizations, and individuals who provide services to these overseas exchanges in a precarious position, as they will be held liable if they know or should know the exchanges are carrying out cryptocurrency transactions.

The circular also warns of the legal risks of investing in cryptocurrencies and related derivatives, stating that civil legal actions will be invalid and the losses caused thereby will be borne by those investing in cryptocurrencies and related derivatives if they violate public order and good customs. This is an ominous warning for traders who continue to invest in cryptocurrencies despite the regulatory crackdown.

China's position for the future

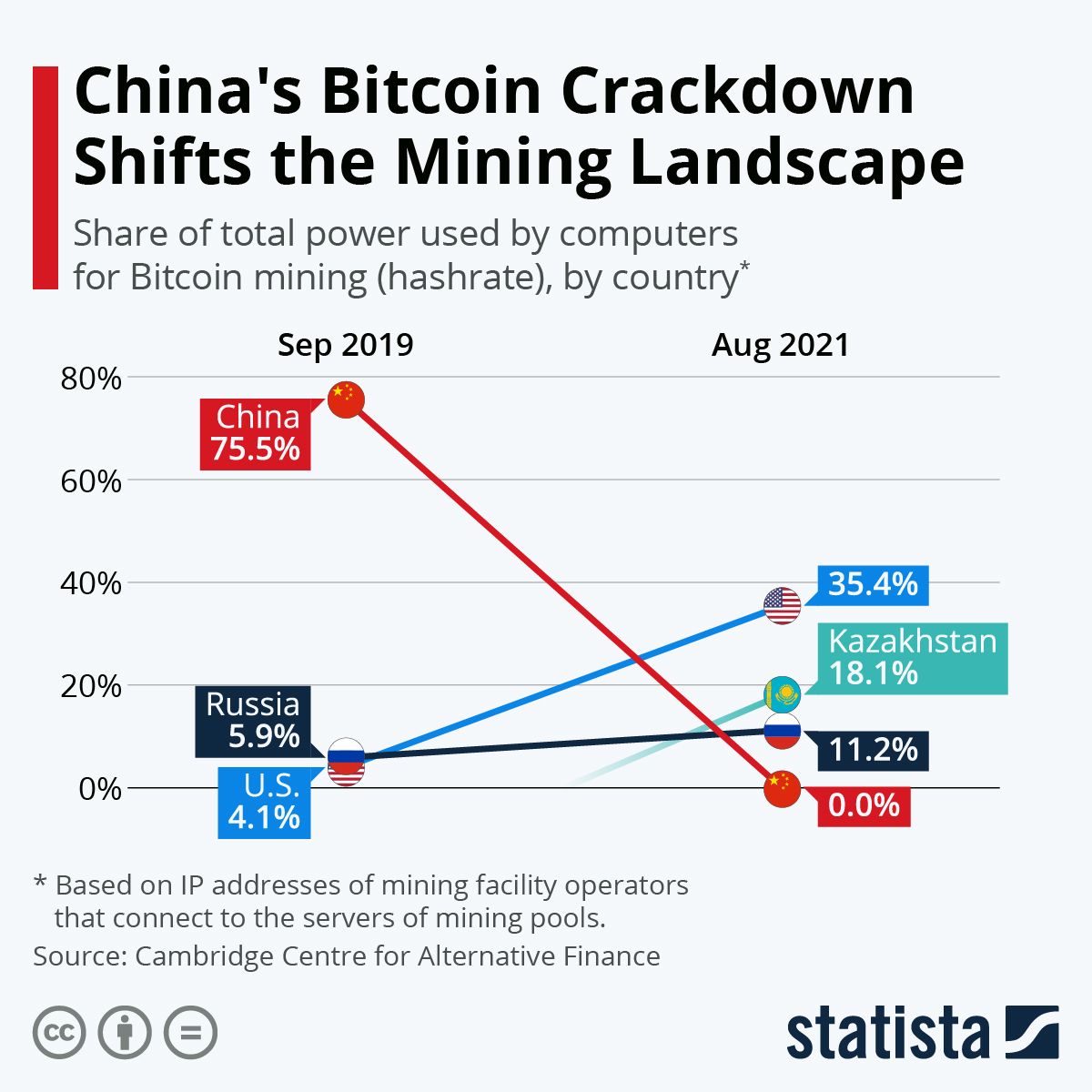

The move is significant, given that China has been a key player in the cryptocurrency market, with a significant portion of Bitcoin mining taking place in the country. China accounts for approximately 65% of global Bitcoin mining, with significant mining activity taking place in the provinces of Sichuan, Xinjiang, Inner Mongolia, and Yunnan. The crackdown on cryptocurrency related activities is likely to have significant implications for the global cryptocurrency market, as China is one of the largest players in the industry.

The reasons behind China's crackdown on cryptocurrencies are manifold. On one hand, the country is concerned about the potential risks to its financial stability. Cryptocurrencies are notoriously volatile and pose a risk to financial stability.

On the other hand, China is also concerned about money laundering, cross-border gambling, and other illegal activities that have been facilitated by cryptocurrencies. The country has been on a mission to regulate the industry since the 2017 ban on ICOs, and this new circular is the latest move in that direction.

In conclusion, the PBOC's circular is a clear signal that China is not backing down from its crackdown on cryptocurrencies. The move is likely to have significant implications for the global cryptocurrency market, as China is one of the largest players in the industry. However, it remains to be seen how effective the regulatory measures will be in curbing cryptocurrency-related activities in the country.

Impact on the industry: Crypto monitoring

Cryptocurrencies have gained tremendous popularity in the past decade, with a vast range of digital assets and tokens available in the market. This digital currency has the potential to transform the traditional financial system, but it also raises critical questions about education and regulations in the crypto world.

As cryptocurrencies continue to gain mainstream acceptance, there is a pressing need for clear and concise regulations. In this article, we will examine the impact of Bitcoin regulations on the market and the factors that are driving the regulatory landscape.

Bitcoin regulation is a complex and evolving issue with far-reaching implications for the future of digital currencies. Regulations can provide clarity and stability to the market, making it easier for investors to understand the risks and benefits of investing in Bitcoin. Additionally, it can increase investor confidence and demand, thereby increasing the value of Bitcoin.

Influence on the regulatory framework

However, overly restrictive regulations can stifle innovation and make it difficult for people to use Bitcoin, which can negatively affect the market. Finding a balance between promoting innovation and growth while safeguarding consumers is one of the primary challenges in Bitcoin regulation.

Many governments are still grappling with how to safeguard citizens from fraud and other illegal practices while promoting the growth of the cryptocurrency sector. Since the Bitcoin industry is still in its infancy, many of the risks associated with it are still little recognized. Therefore, governments must carefully study and determine the appropriate strategy to balance innovation with consumer protection.

Several factors influence the regulatory framework for cryptocurrencies. One of the most significant factors is the rapid pace of invention in the field. Regulators must adapt to the evolving market as new cryptocurrencies and tokens are released to ensure adequate consumer protection.

Governments are currently debating how to address the problems that Bitcoin has created regarding money laundering and other financial crimes. As cryptocurrencies gain popularity, it is essential to have safeguards in place to prevent unlawful activities such as financing terrorism and tax evasion.

Another crucial point is the growing recognition of the disruptive potential of Bitcoin for the traditional monetary system. While many regulators are still skeptical about cryptocurrencies, there is increasing recognition that they have the potential to transform the way money is stored, exchanged, and transferred. This is especially true in countries with less developed financial systems, as Bitcoin offers a new way for people to participate in the global economy.

Finally, there is a growing recognition of the potential for cryptocurrencies to be used for speculative purposes. As the market continues to mature, it is becoming increasingly clear that cryptocurrencies are attractive as speculative investments. This is driving demand for cryptocurrencies, but it is also making the market more volatile and increasing the risk of fraud and other illegal activities. Therefore, regulators must balance the need to protect consumers with the desire to allow the market to grow and evolve.

Decentralized exchanges: Threats to investors and companies

IT risks

The risk of technology or Information Technology (IT) refers to the potential technological failures that can disrupt business operations. In the context of cryptocurrencies, various technological risks are emphasized, including infrastructure component outages, scalability limitations, and cybersecurity risks. Inadequate power and computing resources for cryptocurrency mining can adversely affect the performance and security features of cryptocurrency technologies.

For example, the emergence of bugs due to encoding problems contributed to a theft of 150,000 ETH worth approximately $30 million. Technical failures can lead to devastating consequences. Moreover, the low scalability of cryptocurrency technologies, such as the Bitcoin network, can only process seven transactions per second, weakening their performance and security features. This represents an additional IT risk called the “cybersecurity risk” or “hacking risk.”

The literature highlights various aspects of hacking risk, such as the loss of private keys, unintentional key sharing, and infectious codes or “trojan malwares” that can steal cryptocurrencies and damage the market. Hacking can be costly, and it requires powerful computers to fathom the block. However, the additional privacy can be a double-edged sword, as it can also be a source of problems, an incentive to manipulation and fraud.

Fraud Risks

Cryptocurrencies are particularly prone to identity theft and fraud risks, where the fakeness of trading volume is one of the main scandals. Around 95% of Bitcoin trading volume reported by CoinMarketCap is fake, and only $273 million is the actual daily Bitcoin trading volume. To address this, Transparency Institute Blockchain launched the “BTI Verified program” to detect “wash trading” activity, i.e., fake transactions.

It revealed that 17 among the top 25 of the CoinMarketCap exchanges decipher over 99% as fictitious volumes. A later report by Transparency Institute Blockchain (2019b) shows that only around 25% of the exchanges reveal accurate data on their volume patterns. This highlights the need for transparency and accurate reporting to address the identity theft and fraud risks in cryptocurrencies.

Market Risks

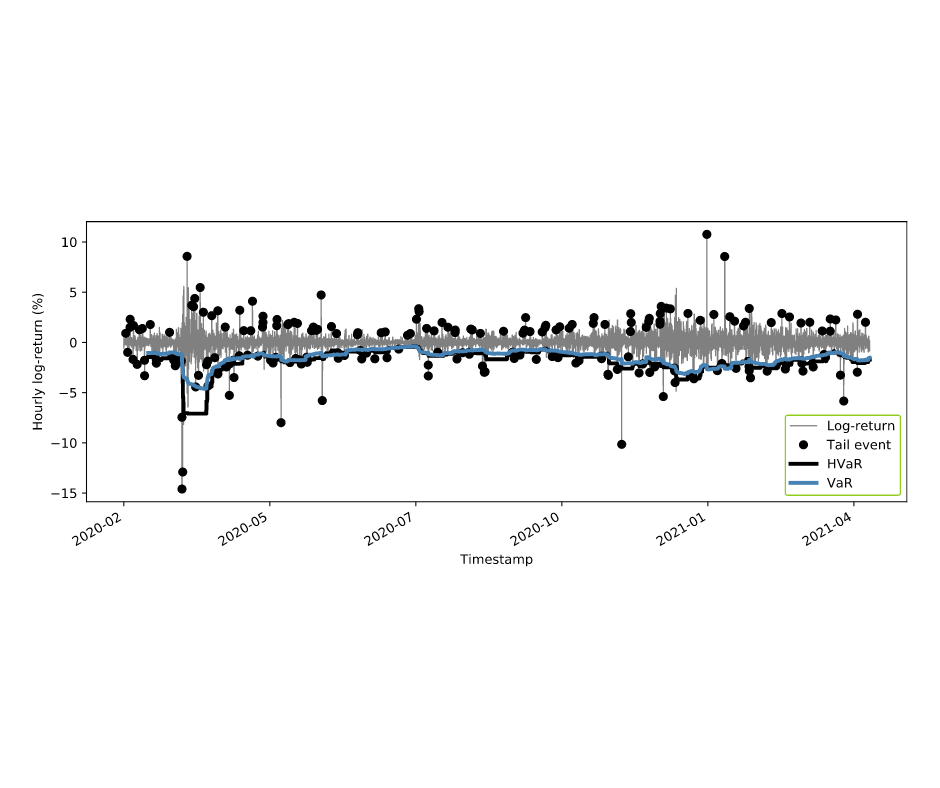

The market risk of cryptocurrencies refers to the decrease in investment value due to factors that can impact overall financial market performance and cannot be reduced through diversification. Cryptocurrency markets, like traditional financial markets, can be influenced by potential losses due to excess volatility.

Hundreds of studies highlight the implications of volatility risk for asset-pricing analysis, portfolio selection, market efficiency, capital budgeting decisions, and risk management practices. High volatility in the cryptocurrency market can lead to risks such as bubbles. According to Siswantoro et al. (2020), high volatility in the cryptocurrency market is qualified as huge when evaluating the suitability of cryptocurrency as money from the Islamic perspective, and cryptocurrency is prohibited in Islam as it is used for speculation.

To summarize, the risks associated with cryptocurrencies are many and varied. They include technological risks such as infrastructure component outages, scalability limitations, and cybersecurity risks, as well as identity theft and fraud risks due to the fakeness of the trading volume. Market risk is another significant concern due to the high volatility in the cryptocurrency market, which can lead to risks such as bubbles. To address these risks, transparency, and accurate reporting are critical, as well as a robust risk management strategy to mitigate potential losses.

Ripple Lawsuit case study

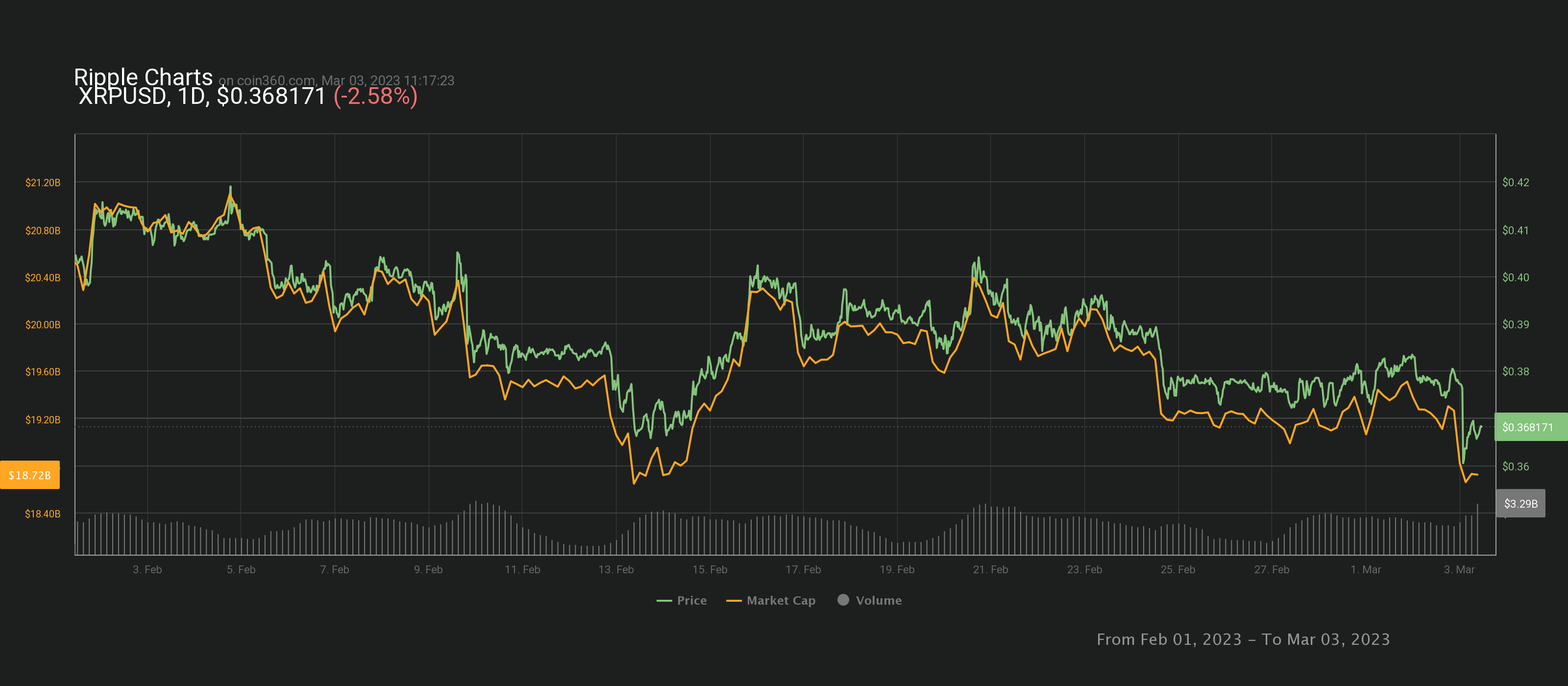

In December 2020, the SEC filed a lawsuit against Ripple Labs, Inc., a major cryptocurrency company, for alleged violations of federal securities laws. Ripple, founded in San Francisco in 2012, is a well-known company in the crypto industry, with its founders regarded as pioneers.

The SEC alleges that Ripple sold its cryptocurrency, XRP, as an unregistered security, arguing that it is a security because it was generated, distributed, and sold in a centralized manner. The Ripple case outcome depends on whether XRP is an investment contract under U.S. securities laws, subjecting it to registration requirements.

The U.S. Supreme Court's decision in SEC v. W.J. Howey Co. states that an investment contract exists when there is an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others. Unlike bitcoin and Ethereum, which the SEC has already stated are not securities due to their decentralized nature, Ripple is viewed differently because of its centralized development and distribution of XRP.

SEC and Ripple: Impact on the Crypto Industry

Critics argue that the SEC's lawsuit against Ripple could hurt a nascent industry seeking to make finance and technology more accessible to more people, and the lawsuit was hastily conceived. The Ripple lawsuit is a major crypto case that could have a significant impact on the future regulation of not only cryptocurrencies but also blockchain and FinTech applications. The SEC may implement reasonable, measured regulations for crypto, blockchain, and FinTech companies, while Congress could provide a framework for regulating digital assets.

The parties in the Ripple lawsuit have engaged in settlement discussions, and the newly appointed SEC Chair, Gary Gensler, an authority on cryptocurrency, may take an interest in the case and the resulting regulatory framework. While the SEC seeks to protect the public and ensure compliance with securities laws, it also seems to understand the potential benefits of blockchain technology. Cryptocurrency proprietors must stay updated on rapidly developing laws and regulations and consult experienced counsel with any questions.

Crypto Market: which new trends will need a new body of law?

Predicting the future trends in the cryptocurrency market can be challenging due to its constant evolution. However, analyzing the existing market conditions can help us gain insight into the future of the crypto market and make informed predictions about the top trends and emerging technologies, as well as their regulatory frameworks.

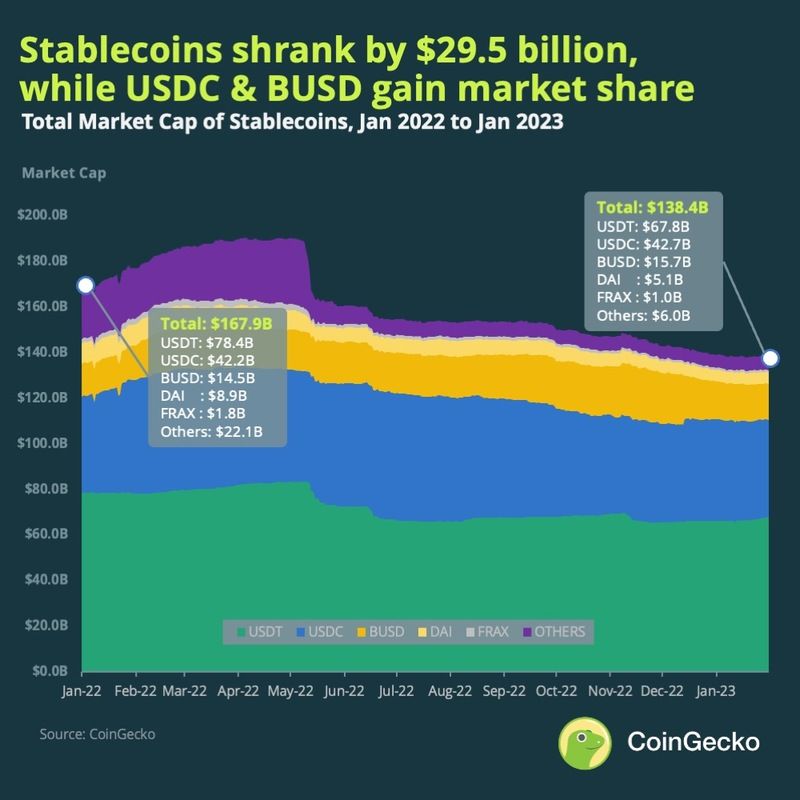

Stablecoins Arise

Stablecoins have become increasingly popular in the cryptocurrency market due to their ability to provide stability. They are digital assets designed to maintain their value by being pegged to a specific fiat currency, such as the US Dollar, Euro, or Pound. This eliminates the volatility associated with traditional cryptocurrencies. In recent times, the number of stablecoins in circulation has increased, with several new projects emerging, each with its own version of stablecoins.

For example, the use of stablecoins like USDT, TUSD, and USDC has gained widespread acceptance in the industry and is being used to facilitate payments and investments. As more projects enter the market, it is expected that the demand for stablecoins will continue to grow. This is because they offer several advantages over traditional cryptocurrencies, including lower fees, reduced chances of market manipulation, and improved liquidity.

DeFi as a Key Component of Future Financial Services

Decentralized finance (DeFi) is another hot topic in the cryptocurrency space. It refers to a network of blockchain-based financial applications that offer various financial services, such as lending, borrowing, trading, and insurance.

The main idea behind DeFi is to allow users to access financial services without relying on traditional financial institutions. It also allows users to participate in financial markets and access a larger pool of capital while controlling their own funds or assets. DeFi has the potential to reduce the cost of traditional financial services, such as remittances, payments, and trading.

Additionally, it offers users the ability to earn passive income by providing liquidity to decentralized exchanges and staking their assets to earn rewards. As the DeFi trend gains more traction, there will likely be new protocols, products, and markets developed to meet the needs of users.

This could include more developments in trustless trading, automated market makers, and advanced lending solutions. There could also be the emergence of tokenized derivatives products, such as futures and options. With more developers entering the space, we can expect to see more a powerful increase in customers using this new financial approach.

Main Sources:

- Swartz, L. (2018). What was bitcoin, what will it be? The techno-economic imaginaries of a new money technology. Cultural Studies

- Tomkies, M. C., & Valentine, L. P. (2018). Virtual currency: A commodity, property, security, or payment substitute. Banking & Financial Service Policy Report

- Tiwari, A. K., Adewuyi, A. O., Albulescu, C. T., & Wohar, M. E. (2020). Empirical Evidence of Extreme Dependence and Contagion Risk between Main Cryptocurrencies. North American Journal of Economics and Finance

- Yi, S., Xu, Z., & Wang, G. J. (2018). Volatility Connectedness in the Cryptocurrency Market: Is Bitcoin a Dominant Cryptocurrency? International Review of Financial Analysis

- Soehartono, & Pati, U. K. (2019). The Regulation of Cryptocurrency Investation in Indonesia. 3rd International Conference on Globalization of Law and Local Wisdom

- Rejeb, A., & Rejeb, K. (2020). Blockchain and supply chain sustainability. Logforum

- (2021). Establishing Cyber Security Programs Through the Community Cyber Security Maturity Model (CCSMM)

- REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL on Markets in Crypto-assets, and amending Directive (EU) 2019/1937

- White House, SEPTEMBER (2022)FACT SHEET: White House Releases First-Ever Comprehensive Framework for Responsible Development of Digital Assets

- https://finbold.com/category/cryptocurrency-news/

- https://coinmarketcap.com/

- https://link.springer.com/article/10.1007/s42521-021-00037-3

Reduce your

compliance risks