GRC Software evolution

GRC Software redefines financial governance, evolving from mere compliance to a strategic resource. It integrates AI to enhance risk management, adapt to regulatory changes, and streamline operations, pivotal in today's dynamic financial sector

Grand “Answer”:

Organizations' need to monitor and optimize their governance structure, reduce risks, and guarantee regulatory compliance has had a significant impact on the development of Governance, Risk, and Compliance (GRC) software. One such piece of software is Oracle GRC, which was created by industry pioneers with more than 20 years of experience. The necessity to give businesses a complete solution for efficiently managing their GRC needs led to the development of this program. Nevertheless, the background offered does not include specifics regarding Oracle GRC's origins. Thus, more investigation would be required to offer a more thorough explanation of how GRC software, such as Oracle's, evolved.

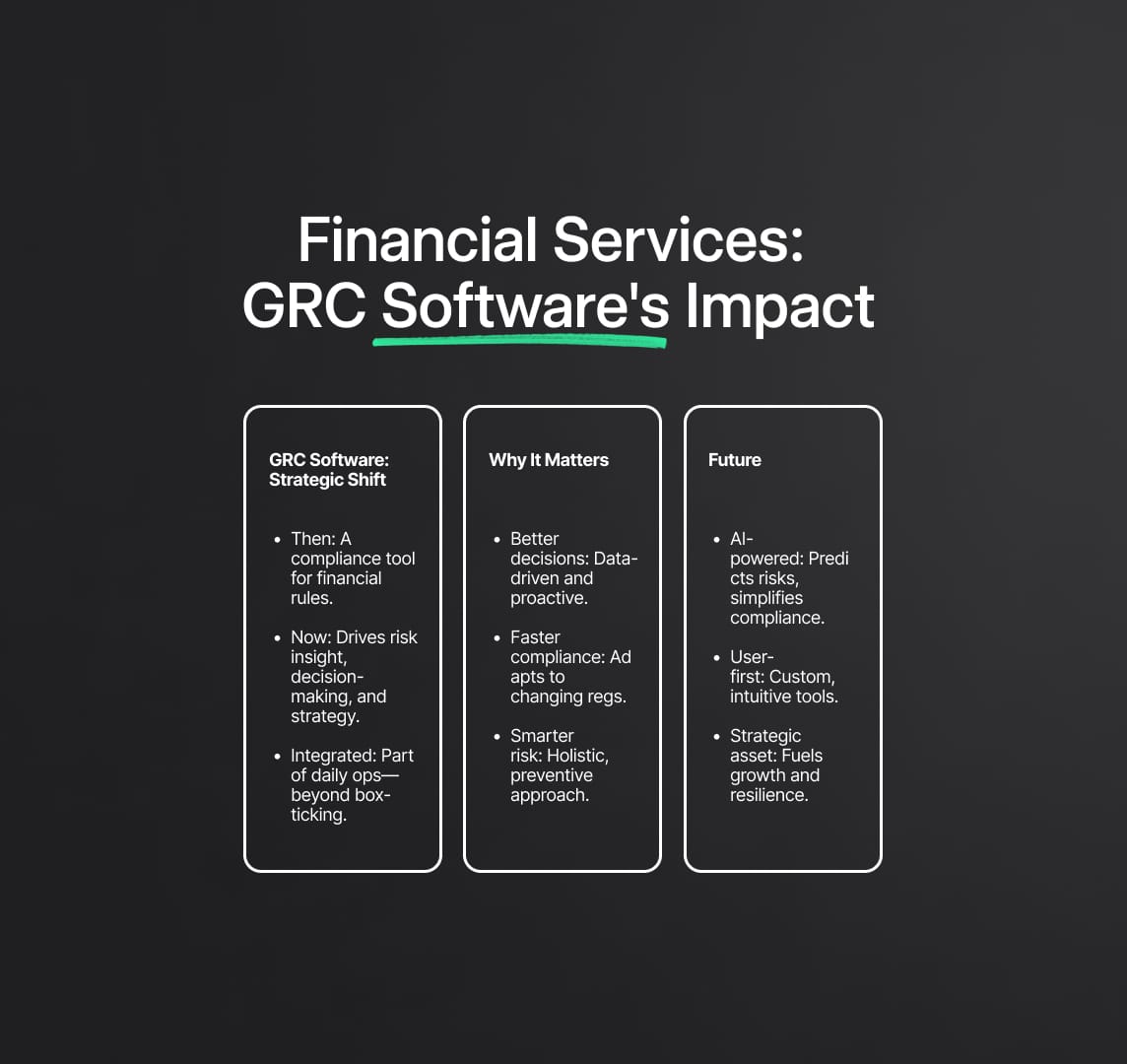

GRC Software: A Game-Changer in Financial Services

The introduction and development of Governance, Risk, and Compliance (GRC) software has completely changed the financial services industry. GRC software was once thought to be only a tool for guaranteeing regulatory compliance, but it has now evolved into a vital tool for strategic company operations and decision-making. This in-depth analysis looks at how GRC software changed the financial services sector, how important it is now, and how it might affect the sector going forward.

The Paradigm Shift: From Compliance Tool to Strategic Asset

- Early Adoption and Perception: When GRC software was first introduced, it was mostly thought of as a way to accomplish regulatory compliance, specifically following financial rules and regulations.

- Transition to Strategic Importance: The use of GRC software has grown considerably over time. Financial organizations started to see its potential for providing strategic insights, supporting decision-making, and coordinating risk management with operational objectives.

- Integration with Business Operations: GRC software is now intricately woven into the daily operations of businesses. It can do more than just comply; it may also be used for risk assessment, operational effectiveness, and strategic planning.

GRC Software's Impact on Financial Governance

- Enhancing Decision-Making: Financial organizations can foresee possible risks and opportunities and make well-informed decisions by using data-driven insights from GRC software.

- Risk Management Evolution: The program has developed to provide a holistic perspective of hazards, making it possible to take a proactive rather than reactive approach to risk management.

- Regulatory Adaptability: The dynamic nature of financial rules has made GRC software indispensable for enabling organizations to promptly adjust to new compliance mandates.

The Current State of GRC Software in Financial Services

- Market Trends and Adoption Rates: The growing importance of GRC software is reflected in the notable increase in its use by financial institutions, according to an analysis of current market trends.

- Technological Advancements: The capabilities of GRC software have been further improved by the incorporation of cutting-edge technology like AI and machine learning, making it more effective and user-friendly.

The Future Prospects of GRC Software

- Predictive Analytics and AI Integration: GRC software's future is in using AI and predictive analytics to anticipate risks and changes in regulations so that it can stay ahead of possible obstacles.

- Customisation and User Experience: Customization and user-friendly interfaces are becoming increasingly important as software advances, guaranteeing that GRC solutions meet the particular requirements of any financial institution.

- Broader Strategic Applications: It is anticipated that GRC software will play an increasingly bigger role in the future, contributing significantly to both long-term organizational growth and corporate strategy.

In conclusion, GRC software has evolved from being a tool primarily used for compliance to being an important component of strategic decision-making in the financial services industry. Its development, marked by improvements in technology and an emphasis on user experience, places it in a position where it is crucial for managing risk, governance, and compliance. As technology advances, it will play an ever-more-important role in determining the direction of financial governance.

Integrating GRC Software into Corporate Strategy

Seamless Integration into Strategic Frameworks

GRC software is becoming a crucial component of financial institutions' strategic planning. These companies now approach their long- and short-term objectives differently because of its capacity to provide a single perspective of governance, risk, and compliance (GRC) features. Beyond simple compliance, GRC software integration helps companies to better match their risk management procedures with corporate goals, creating an operating environment that is more resilient and flexible.

Enhancing Risk Managemen

The ability of GRC software to improve risk management is one of its main advantages. It gives financial institutions a thorough understanding of the risks, enabling them to make wise judgments. This all-encompassing method of risk management entails spotting possible dangers, evaluating their implications, and coming up with workable mitigation plans. The software's real-time data capabilities and sophisticated analytics provide invaluable insights for proactive risk management, enabling businesses to be ready for unforeseen obstacles.

Streamlining Risk Assessment

Due to the constantly shifting risk landscape and dynamic nature of the financial sector, tools need to be both flexible and efficient. This need is met by GRC software, which makes the risk assessment procedure more efficient. The complexity and amount of time needed for risk analysis are decreased by its automated features and user-friendly interface. This effectiveness is essential for upholding compliance and promptly controlling risks, particularly in circumstances where prompt action is required.

Compliance Transformation

In an environment where regulatory frameworks are constantly changing, GRC software is an invaluable asset to financial organizations. It prevents possible non-compliance risks by smoothly adjusting to changing legislation and compliance standards. This adaptability involves more than just satisfying legal requirements; it also entails comprehending the spirit of these laws and incorporating them into the organization's fundamental business operations GRC Software as a Valuable Resource.

GRC software's real worth comes from its capacity to serve as more than just a compliance tool. It is a tactical advantage that enhances an organization's general efficacy and efficiency. GRC software guarantees that governance, risk management, and compliance are not isolated but rather form a unified approach that advances the goals of the company by providing integrated solutions for these three crucial areas.

The Future of GRC Software: AI Integration

More than just a new trend, the incorporation of artificial intelligence (AI) into Governance, Risk, and Compliance (GRC) software is a fundamental shift that heralds a new era in the financial services industry. In-depth discussion of how AI is changing GRC software is provided in this part, which shows how it's becoming more than just a cool new technology.

Transforming Regulatory Management with AI

Of those in the sector, almost one-third believe artificial intelligence (AI) has the ability to completely transform regulatory management. This technology improves the capabilities of GRC software in a number of ways.

Smart Alerts for Regulatory Changes: Real-time regulatory modifications can be tracked and analyzed by AI algorithms, which can then generate intelligent warnings to guarantee timely compliance. By doing this, businesses can lower their risk of non-compliance and remain ahead of regulatory changes.

Automated Compliance Processes: AI-powered GRC software can automate a wide range of compliance operations, including the creation of reports and data collecting. This guarantees more accurate compliance by accelerating the compliance process and lowering human error.

Enhancing Risk Assessment with AI

An essential part of GRC is risk assessment, and AI is revolutionizing the field in this regard:

Predictive Risk Analysis: Via the analysis of patterns and trends in enormous data sets, AI algorithms are able to forecast possible hazards. Financial organizations can proactively reduce risks before they manifest thanks to this foresight.

Real-time Risk Monitoring: It is essential to keep an eye on risk variables all the time. Real-time tracking and analysis of risk indicators using AI-enabled GRC systems results in updated risk assessments that facilitate quick decision-making.

Streamlining GRC Processes

GRC software with AI integration offers major efficiencies:

Process Automation: By automating processes like data input, report creation, and compliance checks, human resources can be allocated to more strategically important duties.

Enhanced Data Management: AI enhances the management and interpretation of massive amounts of data in GRC applications. As a result, decisions are made with greater knowledge and more accurate insights.

Customisation and User Experience

AI technology enables GRC software to offer personalized experiences:

Customised Risk Profiles: AI may customize risk profiles according to particular business requirements, resulting in a risk assessment that is more useful and efficient.

User-friendly Interfaces: AI improves user interfaces, which increases accessibility and intuitiveness for GRC software for a range of stakeholders, including compliance officers and senior executives.

The Road Ahead: AI's Growing Influence

There is a bright future for AI in GRC, and new developments will probably lead to even more changes:

- Advanced Predictive Analytics: AI's capacity to deliver sophisticated predictive analytics in GRC will grow as technology develops, giving greater in-depth understanding of possible risks and regulatory requirements.

- Integration with Emerging Technologies: AI's confluence with other technologies, including as IoT and blockchain, will result in more reliable and secure GRC systems.

- Continual Learning and Improvement: With further learning and development, AI-powered GRC solutions will provide ever-more-effective and efficient risk and compliance management.

Embracing AI in GRC for Strategic Advantage

For financial institutions, incorporating AI into GRC software is not only a proactive step but also a strategic need. The benefits of AI-driven GRC solutions in risk management, operational effectiveness, and regulatory compliance are unmatched. AI in GRC will become more and more important as financial services continue to change, helping businesses succeed in a constantly shifting environment, participation of Employees and Technological Change.

The democratization of GRC management decision-making processes represents a change in focus toward employee participation at all levels. This improves an organization's efficacy and compliance culture in conjunction with the use of cutting-edge technology solutions.

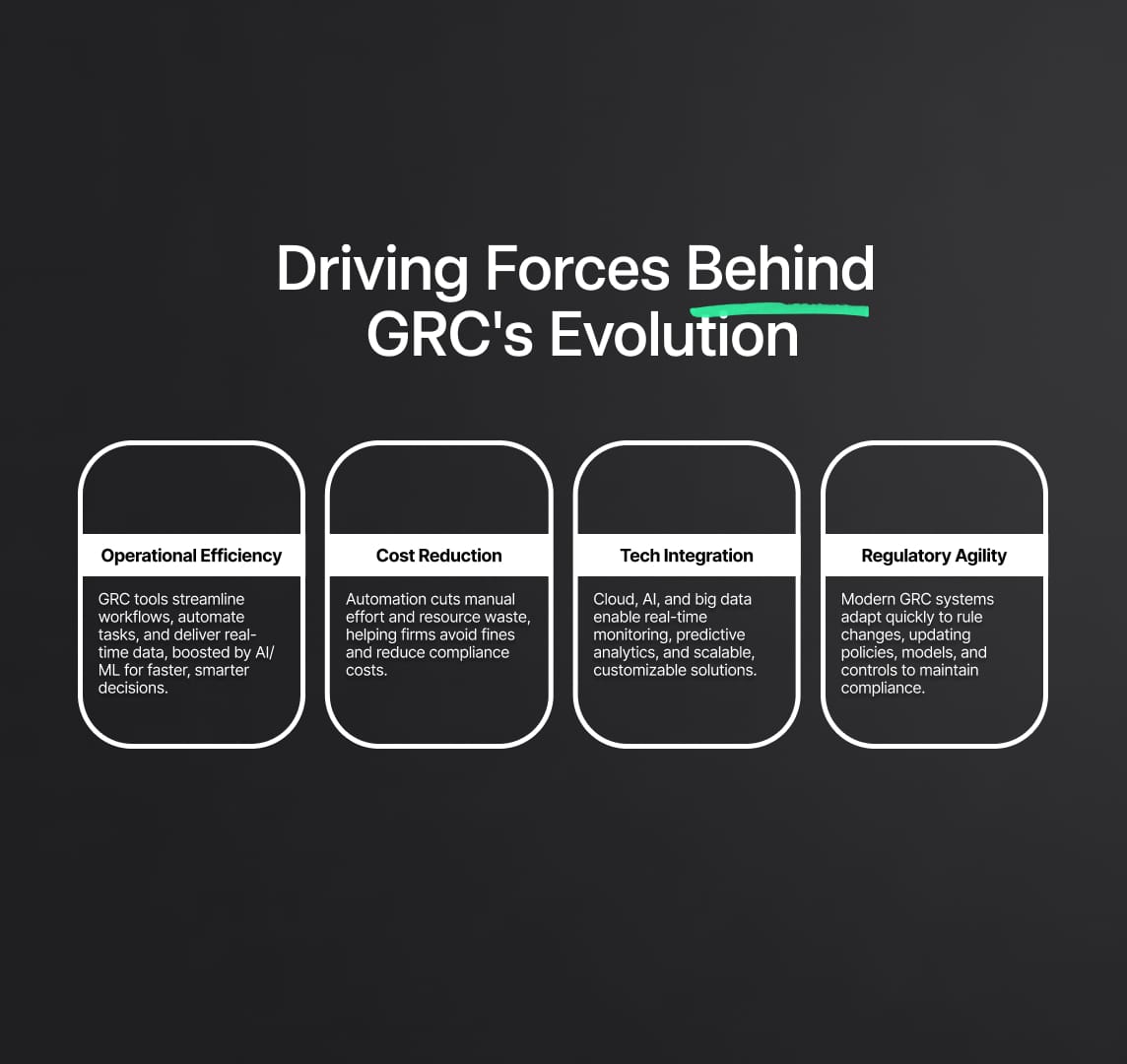

Driving Forces Behind GRC Evolution

The concerning increase in cyber dangers is one of the main factors driving the development of GRC (Governance, Risk, and Compliance) software. Financial institutions face an unprecedented degree of cyber threats in an era where digital transformation is crucial, from sophisticated cyber-attacks to data breaches.

This increase calls for a more comprehensive and integrated approach to GRC solutions, with a focus on cybersecurity as a crucial element. Modern GRC software incorporates sophisticated cyber threat detection and response systems, making it more capable of defending businesses against these constantly changing dangers. This advancement emphasizes the significance of cybersecurity in risk management frameworks by being more than just a reactive action.

Need for Operational Efficiency

Another important factor influencing the development of GRC software is operational effectiveness. Businesses want to simplify their procedures and lessen the complexity of governance, risk management, and compliance in today's hectic financial industry. GRC software is essential for this because it automates repetitive processes, offers real-time data, and promotes more efficient internal workflows. This efficiency is further increased by the incorporation of AI and machine learning technology, which allows GRC systems to analyze enormous amounts of data quickly and accurately. This guarantees more accurate and knowledgeable risk assessments and compliance solutions in addition to expediting decision-making processes.

Reduction of Operating Costs

One major reason driving the evolution of GRC software is the desire to cut operating costs. Cutting expenses associated with risk management and compliance is essential in the financial services sector, where margins can be thin and competition is intense. To mitigate this issue, GRC software provides efficient and automated solutions that reduce the necessity for significant user intervention.

These solutions save companies money on operating expenses by eliminating redundancies and allocating resources optimally. Furthermore, by guaranteeing compliance with the dynamic compliance landscape, efficient GRC software can avert expensive regulatory fines and penalties. For financial organizations that operate across numerous jurisdictions with disparate regulatory requirements, this aspect of cost reduction is especially crucial.

Integration of Advanced Technologies

A major factor in the development of GRC software has been the incorporation of cutting-edge technology like cloud computing, big data analytics, and artificial intelligence. With the use of these technologies, GRC systems can now offer more features like automated compliance monitoring, risk modeling, and predictive analytics.

AI, for example, makes it possible for compliance databases to be automatically updated and to receive real-time notifications when regulations change, greatly cutting down on the time and effort required to be compliant. Because of the flexibility and accessibility provided by cloud computing, GRC technologies are more versatile and can be tailored to meet the demands of various organizations.

Adaptation to Regulatory Changes

Finally, the evolution of GRC software is driven by the dynamic nature of regulatory regimes, particularly in the financial sector. Financial institutions need to adjust swiftly to new regulations and changes in current ones in order to minimize the risk of non-compliance. These days, GRC software is made to be flexible and agile, with capabilities that let businesses react quickly to changes in the law. This involves the ability to adapt risk assessment models, update compliance frameworks, and realign internal policies to new legislation.

Adapting to New Standards: ISO 27001:2022 and Beyond in the Era of GRC Software

In the dynamic landscape of 2023, when digital transformation is at its peak, companies must comply with developing standards like ISO 27001:2022. This is about strengthening security postures in a time when sophisticated cyber assaults are becoming more frequent; it's not just about complying with regulations. As a standard for information security management, ISO 27001:2022 creates a baseline for businesses aiming to attain resilience and robustness in their security frameworks.

ISO 27001:2022 - A Closer Look

The most recent version of the highly regarded standard, ISO 27001:2022, offers a more dynamic and adaptable approach to information security. This edition takes into account the current era's rapid technical breakthroughs and evolving threat landscapes. It emphasizes how important it is for businesses to safeguard their information and modify their security plans in reaction to the constantly shifting cyber landscape.

Integration with GRC Software

In 2023, the use of Governance, Risk, and Compliance (GRC) software will be essential to ensuring compliance with ISO 27001:2022. Because of their scalability and adaptability, these cutting-edge technologies are appropriate for changing compliance requirements. GRC software makes it easier to handle information security threats continuously and keeps businesses compliant with ISO requirements.

Scalability and Adaptability

Future cybersecurity challenges necessitate GRC methods that are not just extremely adaptive and scalable, but also robust. Modern GRC software can predict risks and adjust to changes in the regulatory environment, including new standards like ISO 27001:2022, thanks to the integration of AI and machine learning. Firms must be able to adapt in order to keep up a strong defense against new threats.

GRC and Continuous Improvement

ISO 27001:2022 places a strong emphasis on continuous improvement. Through the use of GRC software, businesses may integrate a continuous improvement mindset into their security procedures. These technologies use AI and data analytics to deliver actionable insights that help firms improve their compliance and security procedures.

Grand: Your AI Compliance Software

Designed to support compliance officers, legal counsels, and other professionals responsible for adhering to regulatory standards, Grand aims to facilitate an efficient and straightforward compliance process.

Reduce your

compliance risks