GRC Software for Finance: Importance, Key Functions & Benefits

For financial institutions, implementing GRC software is crucial. It safeguards data during transactions, mitigates risks, ensures compliance, streamlines operations, and enhances decision-making. In the digital age, GRC software is vital to preserve trust and integrity.

Why Financial GRC Solutions Are Essential

Financial institutions operate under some of the most stringent regulatory requirements worldwide. Banks, insurance companies, and investment firms face an ever-evolving landscape of oversight and complex risk exposures. In 2023 alone, organizations in the finance sector managed an average of 185 regulatory updates per day, highlighting the scale of the compliance burden. Balancing this regulatory deluge with operational and cyber-risk management is a monumental challenge for compliance teams and executives alike.

In this environment, GRC software for finance, also known as a financial GRC solution or financial compliance software, becomes indispensable. Rather than juggling fragmented spreadsheets, siloed databases, and ad-hoc email chains, a unified GRC platform brings governance, risk management, and compliance into a single automated system. By centralizing workflows, automating routine compliance tasks, and offering a “single source of truth” for all risk and compliance data, these solutions deliver greater transparency, consistency, and operational efficiency across the enterprise.

The stakes of inadequate GRC are high. Industry analysis shows that the cost of non-compliance can be more than double the expense of maintaining an effective compliance program. In late 2024, U.S. regulators increased enforcement penalties by 83% to $5.4 billion, even as the number of cases declined. Major banks have faced individual fines in the hundreds of millions, with compliance failures also eroding customer trust and market valuation. Modern financial compliance software embeds risk and compliance controls directly into daily operations—giving boards of directors, executives, and compliance officers real-time insight into the organization’s risk profile and regulatory status. In the sections that follow, we’ll dive into how these platforms work, their key features, and best practices for selecting and optimizing a GRC solution for finance.

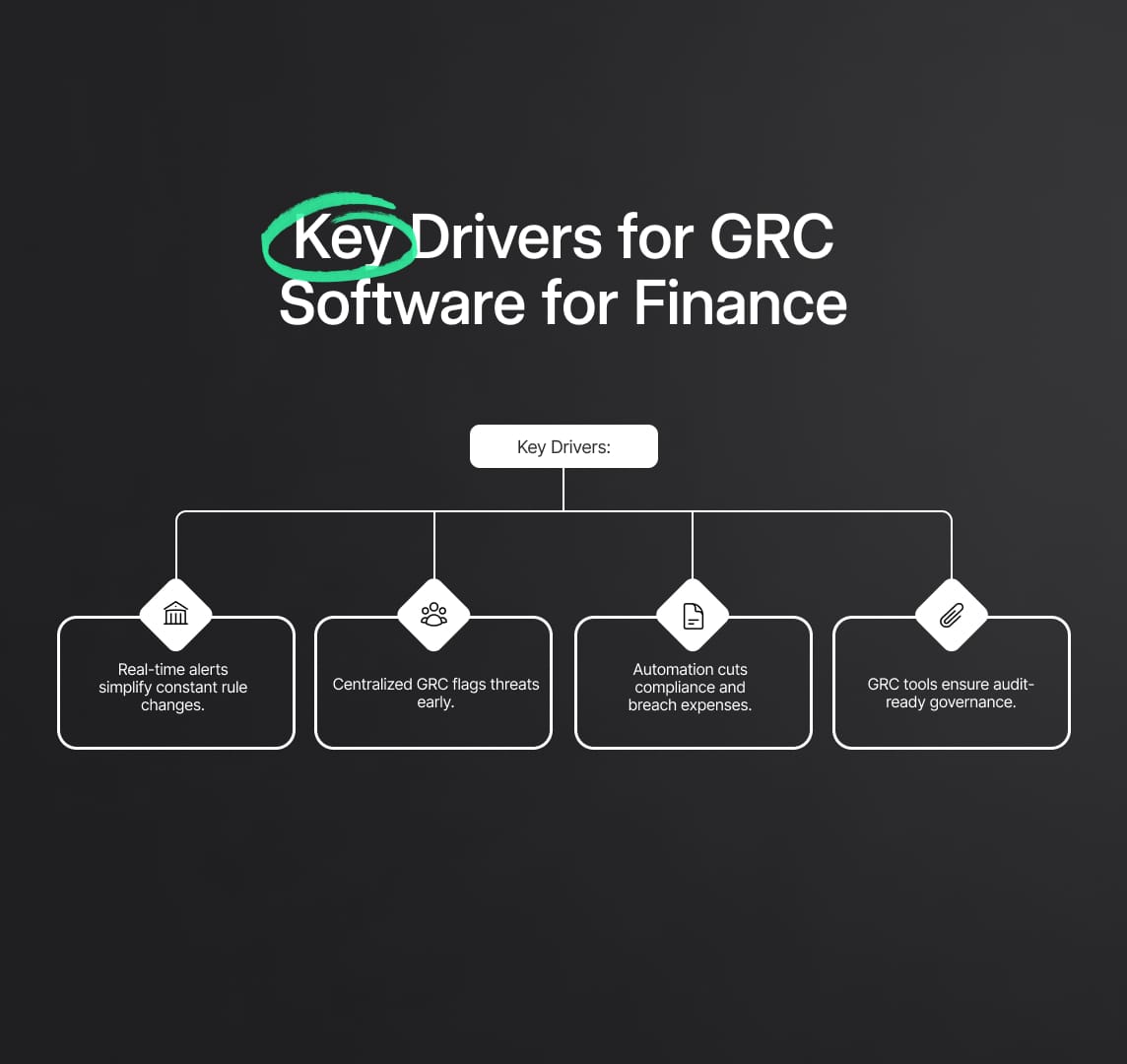

Key Drivers for GRC Software for Finance

Financial institutions today confront pressures that make GRC software for finance not just beneficial, but essential. Manually tracking thousands of regulations and risk exposures is unsustainable and error-prone. Below are the primary forces driving banks, credit unions, insurers, and asset managers to adopt a unified financial GRC solution:

1. Rapid Regulatory Change

- Hundreds of updates per year across multiple jurisdictions, from Basel III capital rules to GDPR data-privacy mandates and anti-money-laundering requirements, create a moving target for compliance teams.

- Automated regulatory libraries and real-time alerts in financial compliance software ensure institutions never miss a new SEC ruling or EU directive, empowering teams to react immediately without manual research.

2. Increasingly Complex Risk Landscape

- Modern finance must manage credit risk, market volatility, operational disruptions, cyber threats, fraud, and more, all of which can cascade globally.

- A centralized GRC platform aggregates risk data enterprise-wide, enabling teams to assess likelihood and impact at a glance. Emerging trends, such as spikes in IT incidents or growing third-party vulnerabilities, become visible before they escalate.

3. High Cost of Compliance (and Non-Compliance)

- U.S. financial firms spend roughly $30.9 million annually on compliance activities (reporting, training, audits).

- Yet a single compliance lapse can cost over $4 million in lost revenue, plus legal fees and remediation expenses. Cyber breaches add further risk: the average data breach in 2023 cost organizations about $3.86 million.

- By embedding automated controls monitoring and streamlined workflows, GRC software for finance drives down both compliance and non-compliance costs, delivering a clear return on investment.

4. Demand for Transparency and Accountability

- Regulators, investors, boards, and customers insist on visible governance and ethical conduct. ESG criteria and anti-corruption measures add new layers of scrutiny.

- A robust financial GRC solution centralizes policies, procedures, and control documentation to create a complete audit trail. It assigns clear ownership of tasks, ensuring every policy update, approval, and employee attestation is tracked and enforced.

Core Functions of a Financial GRC Solution

A financial GRC solution delivers a unified platform to manage governance, risk, and compliance processes efficiently. By centralizing data and automating key workflows, GRC software for finance breaks down silos and enhances collaboration across teams. Below are the essential modules and functions commonly found in robust financial compliance software:

1. Governance & Policy Management

- Centralized Policy Repository: Store and update codes of conduct, IT security policies, anti-fraud guidelines, and more in one accessible library.

- Version Control & Employee Attestation: Track policy revisions, manage approval workflows, and record staff acknowledgments to ensure everyone works from the latest governance framework.

- Policy-to-Risk Mapping: Link each governance policy directly to relevant regulations (e.g., GDPR, SOX) and associated risk controls, creating full traceability within your GRC platform.

2. Risk Management & Assessment

- Comprehensive Risk Register: Catalog credit, market, operational, cybersecurity, liquidity, and reputational risks in a central hub, then evaluate each using qualitative scales or quantitative metrics.

- Automated Risk Surveys: Schedule and distribute risk-assessment questionnaires to department heads; aggregate responses in real time to generate heat maps and dashboards.

- Key Risk Indicator (KRI) Monitoring: Integrate with core systems to track metrics—like fraud incident counts or delinquency rates, and trigger alerts when thresholds are breached for proactive mitigation.

3. Compliance Management & Automation

- Regulatory Requirements Library: Maintain an always-current database of laws and standards (SOX, Dodd-Frank, MiFID II, PCI DSS, AML, data privacy) within your financial GRC solution.

- Automated Workflows: Replace manual email reminders with system-driven notifications for tasks such as quarterly access reviews, transaction monitoring checks, and training completions.

- Evidence Collection & Audit-Ready Reporting: Upload documents (policies, test results, meeting minutes) into the GRC system; generate comprehensive reports that map each regulation to tested controls and outcomes.

4. Audit Management Integration

- Audit Planning & Issue Tracking: Schedule internal audits, assign findings to owners, and track remediation plans within a dedicated audit module.

- Seamless Data Synchronization: Automatically update risk assessments and compliance status based on audit results, ensuring governance, risk, and compliance teams work with the same information.

By leveraging these core functions, financial institutions can shift from reactive, siloed processes to a proactive, enterprise-wide GRC strategy. Leading GRC software for finance platforms embed these capabilities to help organizations maintain audit-readiness, reduce compliance costs, and protect their reputation.

Centralized and Streamlined Compliance with GRC Software for Finance

Implementing a financial GRC solution unifies all compliance activities in one place, policies, controls, regulatory requirements, and tasks, eliminating departmental silos and duplicate effort. A single-entry approach means a control that satisfies both SOX and GDPR can be documented once and mapped to multiple obligations, ensuring consistency and full traceability. When an examiner requests evidence, you simply generate the report from your financial compliance software, rather than scrambling through disparate files. As a result, audit preparation and regulatory exams shift from chaotic data collection to smooth, system-driven reporting, boosting confidence that nothing gets overlooked.

Automation & Reduced Human Error via Financial GRC Software

By automating routine workflows, risk assessments, control tests, incident escalations, and certification tracking, GRC software for finance slashes administrative burden and minimizes mistakes. Manual processes (emailing spreadsheets, tracking training on whiteboards) are replaced with automated reminders, deadline enforcement, and direct data integrations. The platform auto-populates metrics from source systems and flags anomalies in real time, ensuring calculations remain consistent. This not only reduces gaps and misreports but also frees compliance and risk teams to focus on strategic analysis rather than chasing paperwork.

Improved Risk Visibility and Early Warning with GRC Solutions

A robust financial GRC solution consolidates risk data from every business unit, credit, market, operational, cyber, liquidity, reputational, into unified dashboards. Executives and risk committees gain a real-time view of top risks, emerging trends, and whether exposures align with the institution’s risk appetite. Crucially, built-in alerting acts as an early warning system: spikes in phishing attempts or a failed control test trigger immediate notifications to relevant managers. This proactive insight allows teams to remediate vulnerabilities before they escalate into costly incidents.

Real-Time Monitoring and Reporting in Financial Compliance Software

GRC software for finance delivers live monitoring of key risk indicators (KRIs), compliance statuses, and outstanding issues across the enterprise. Whether it’s a CRO checking risk heat maps or a compliance officer reviewing training completion rates, every stakeholder sees current data, no waiting for quarterly reports. Customizable dashboards and on-demand report builders let you produce board-level risk appetite summaries, regulator-ready compliance updates, or internal audit findings with a few clicks. By pulling directly from your GRC system, these reports maintain accuracy, build stakeholder trust, and demonstrate audit-readiness at all times.

Cost Savings and Avoidance of Fines through Financial GRC Software

While deploying a financial GRC solution requires upfront investment, it quickly pays dividends by reducing operational costs and preventing expensive violations. Automation enables compliance teams to manage broader scopes with fewer resources, and audit cycles become shorter, translating into lower consulting fees and labor hours. More importantly, continuous monitoring and rapid remediation help avoid multi-million-dollar fines, legal fees, and reputational damage. Many institutions find that averting just one significant breach or enforcement action delivers a return on investment that far exceeds the software cost.

Enhanced Decision-Making & Strategic Alignment with Financial GRC Solutions

When risk and compliance data live in a single, authoritative platform, executives can integrate those insights directly into strategic planning. If your financial compliance software signals rising risk in a particular business line, leadership can proactively adjust lending criteria or bolster controls. Assigning clear owners for each risk and compliance task fosters a culture of accountability and risk-awareness at every level. In board meetings, having concrete metrics, risk trends, compliance performance indicators, from the GRC system elevates discussions from intuition-based to evidence-driven, ensuring growth initiatives align with risk appetite and regulatory requirements.

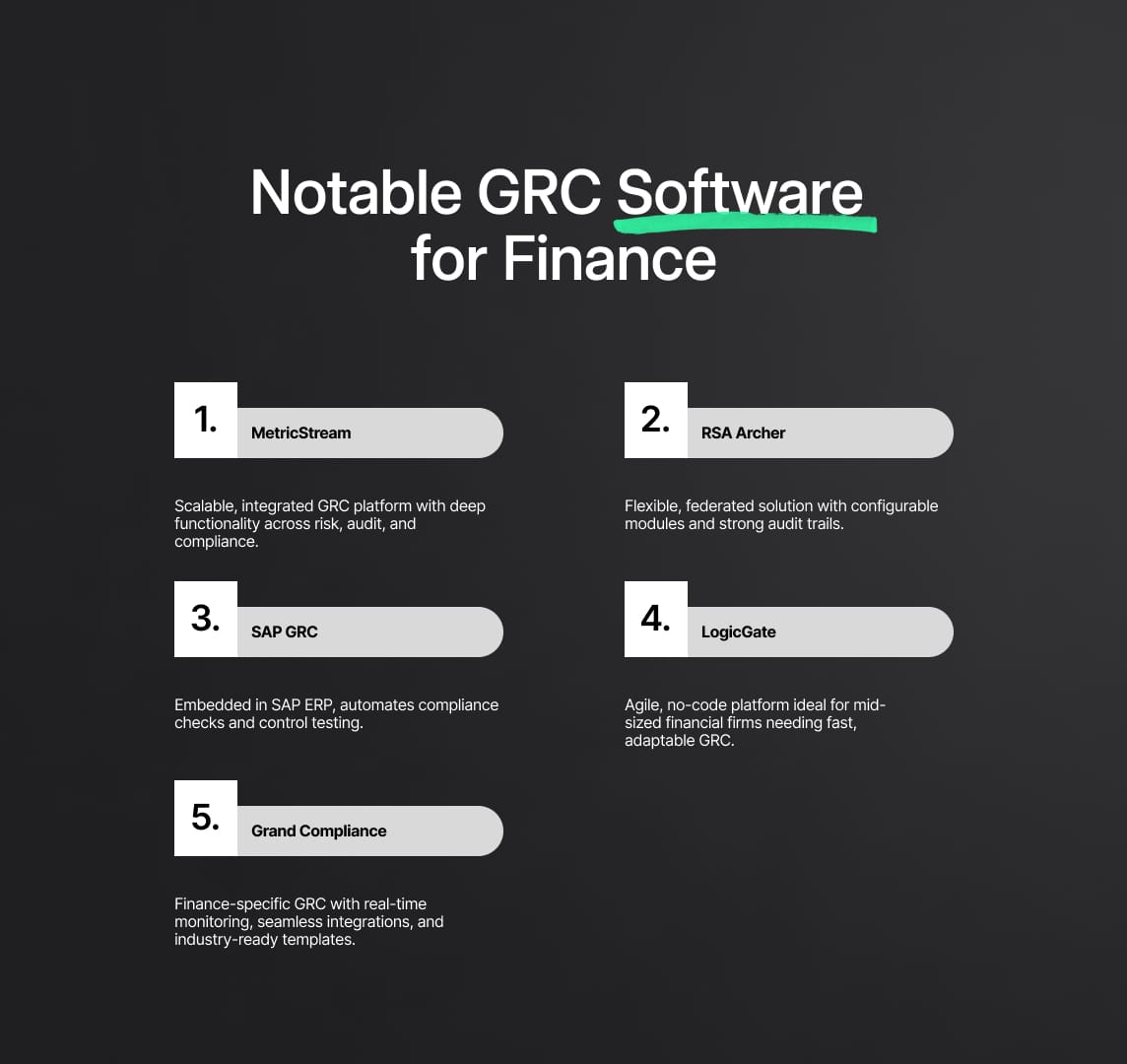

Notable GRC Software for Finance

The global market for GRC software for finance reached $49.2 billion in 2024 and is projected to surge to $127 billion by 2033, underscoring how critical a financial GRC solution has become for banks, insurers, and asset managers. Below are some leading financial compliance software platforms widely adopted in the finance sector:

1. MetricStream

- Comprehensive Platform: Integrated modules for operational risk, audit, third-party risk, IT risk, and compliance.

- Scalability & Depth: Handles large user bases and complex frameworks, enabling a truly “connected GRC” view across governance, risk, and compliance functions.

2. RSA Archer (Archer IRM)

- Flexible Workflow Engine: Configurable, use-case driven modules (e.g., SOX, vendor risk, business continuity).

- Federated GRC Approach: Supports decentralized teams collaborating on a single financial GRC solution with strict access controls and strong audit documentation.

3. SAP GRC

- ERP Integration: Embeds compliance checks into SAP financial transactions, monitoring Segregation of Duties conflicts and automating control tests in real time.

- Module Suite: Includes SAP Risk Management, Process Control, and Audit Management for seamless data flow from core financials to compliance dashboards.

4. LogicGate

- Agile & No-Code: Cloud-native platform with drag-and-drop workflow builders, ideal for mid-sized banks and fintechs seeking rapid deployment.

- Modular Design: Easily adapts to evolving regulations and internal processes, making financial compliance software more accessible without heavy IT involvement.

5. Grand Compliance

- Finance-Focused GRC: Built by Grand specifically for financial services, Grand Compliance offers real-time regulatory monitoring, policy and control management, and integrated risk assessment tailored to banking and capital-markets workflows.

- Seamless Integrations: Connects via robust APIs to core banking systems, ERP platforms, and third-party data feeds, ensuring automated KRI tracking and compliance reporting.

- User-Centric Design: Includes industry-specific templates (CCAR, AML, GDPR) and a modern dashboard for executives, risk managers, and audit teams, streamlining end-to-end governance and audit readiness.

Beyond these five, the GRC software for finance ecosystem also features NAVEX Global, OneTrust GRC, ServiceNow Integrated Risk, and IBM OpenPages. When evaluating solutions, financial institutions should weigh:

- Feature Depth (risk, compliance, audit)

- Integration Capability (data feeds, ERP connectivity)

- Scalability & Performance

- User Adoption & Ease of Use

- Regulatory Alignment (support for CCAR, Solvency II, GDPR, etc.)

Successful implementation pairs the right financial GRC solution with executive sponsorship, clear processes, and cross-functional collaboration. Starting with high-impact pain points, like regulatory reporting or risk assessments, builds momentum for a phased rollout, enabling finance organizations to launch new products confidently while maintaining tight control over governance, risk, and compliance.

Strengthening Finance Through Integrated GRC

By unifying governance, risk management, and compliance into a single GRC software for finance platform, organizations gain real-time intelligence that transforms GRC from a reactive, “box-ticking” exercise into a proactive driver of business value. Banks, insurers, and investment firms can automate compliance workflows, continuously monitor emerging risks, and enforce governance policies across all business units, ensuring they not only meet regulatory obligations but also anticipate and mitigate threats before they materialize.

Adopting a robust financial compliance software fosters a culture of accountability and empowers every team member to “do the right thing.” Cross-functional visibility breaks down silos, so decision-makers at the executive, risk, and audit levels operate from the same trusted dataset. As fintech innovations accelerate, new regulations arise, and global markets evolve, a scalable financial GRC solution equips institutions to adapt swiftly, confidently launching new products, expanding into new regions, and maintaining operational resilience. Investing in integrated GRC tools thus underpins sustainable growth: it safeguards reputation, reduces compliance costs, and delivers the transparent governance framework that regulators, customers, and stakeholders demand.

Reduce your

compliance risks