ICT Third-Party Service Providers Regulation

Effective May 2024, EU's Regulation 2024/1502 targets ICT third-party service providers to enhance financial stability and operational resilience in Europe.

Stability and continuity of financial services are increasingly reliant on sophisticated Information and Communication Technology (ICT) systems, the European Union (EU) has proactively enhanced its regulatory framework to manage these critical dependencies effectively. The introduction of Commission Delegated Regulation (EU) 2024/1502, effective from May 2024 and supplementing the foundational Regulation (EU) 2022/2554, marks a significant step forward in formalizing the oversight of ICT third-party service providers that are integral to the financial sector across Europe.

Source

[1]

Overview of EU Regulation on ICT Third-Party Service Providers

Regulatory Background and Objectives:

The regulatory landscape for financial services within the EU has been evolving in response to the increasing digitalisation of financial operations and the corresponding risks associated with ICT dependencies. Regulation (EU) 2024/1502 is designed to supplement and enhance the directives set out in Regulation (EU) 2022/2554, also known as the Digital Operational Resilience Act (DORA), which aims to consolidate and upgrade ICT risk management requirements across the EU financial sector.

Key Provisions of Regulation 2024/1502:

This regulation introduces detailed criteria and processes to identify, categorize, and manage the risks posed by ICT third-party service providers to financial entities. Its main objectives are to ensure that these providers do not become single points of failure that could disrupt the financial markets and to enhance the overall operational resilience of the financial ecosystem.

Detailed Criteria for Designating Critical ICT Service Providers

1. Assessment Framework:

Regulation 2024/1502 lays out a comprehensive assessment framework that requires financial entities and supervisory bodies to evaluate the significance of third-party ICT service providers based on several criteria:

- Systemic Importance: This includes assessing the extent to which key financial services depend on the provider, considering factors such as the number and type of financial entities served, the critical nature of the services provided, and the impact on the financial markets if the provider were to fail.

- Impact on Financial Stability: The regulation mandates an analysis of how the failure or significant disruption of a service provider could affect the broader financial system. This involves looking at the interconnectedness of services, the substitutability of the provider, and the potential for systemic shocks.

2. Regulatory Requirements for Critical Providers:

Providers identified as critical under these criteria are subject to heightened regulatory scrutiny and must adhere to stringent operational resilience requirements. These include mandatory incident reporting, robust business continuity and disaster recovery plans, and regular audits and stress tests to assess their ability to withstand various operational shock scenarios.

3. Compliance Obligations:

ICT third-party service providers designated as critical are required to comply with a set of operational and security standards that align with the highest industry benchmarks. They must also ensure transparent reporting and provide regular updates to the regulatory authorities and their financial sector clients about their risk management practices and any significant changes to their service delivery models.

Implementation Strategy and Compliance Timeline

Effective Date and Transitional Arrangements:

The regulation is set to take effect on June 19, 2024, with a phased implementation period allowing financial entities and third-party ICT providers adequate time to adjust to the new requirements. During this transitional phase, entities are encouraged to conduct thorough risk assessments, revise their contractual agreements, and implement enhanced oversight mechanisms.

Enforcement and Regulatory Oversight:

The European Supervisory Authorities (ESAs) play a crucial role in overseeing the application of the regulation, ensuring consistent enforcement across member states, and providing guidance and support to financial entities and ICT service providers in implementing the regulatory provisions.

Regulation 2024/1502: Financial Stability through Rigorous ICT Third-Party Service Providers Regulation

The European Union’s Regulation 2024/1502 represents a pivotal development in financial regulatory practices, specifically targeting ICT third-party service providers whose operations are crucial to the stability and integrity of the financial ecosystem. This regulation acknowledges the significant role these providers play and the systemic risks that their operational disruptions could pose. In this detailed examination, we will explore the scope, implications, and technical specifics of Regulation 2024/1502, emphasizing its goal to enhance the operational resilience of financial entities.

Purpose of Regulation 2024/1502:

Regulation 2024/1502, supplementing the broader framework of Regulation (EU) 2022/2554 (Digital Operational Resilience Act - DORA), aims to mitigate the risks associated with the dependency on ICT third-party service providers by financial institutions. It introduces stringent measures to ensure these providers do not become a source of financial instability due to their critical functions within the financial sector.

Targeted Approach:

The regulation specifically targets providers whose failure or disruption could lead to significant adverse effects on the market integrity, financial stability, or the continuous provision of critical services to financial entities. This targeted approach is essential for maintaining the systemic stability of the financial markets across Europe.

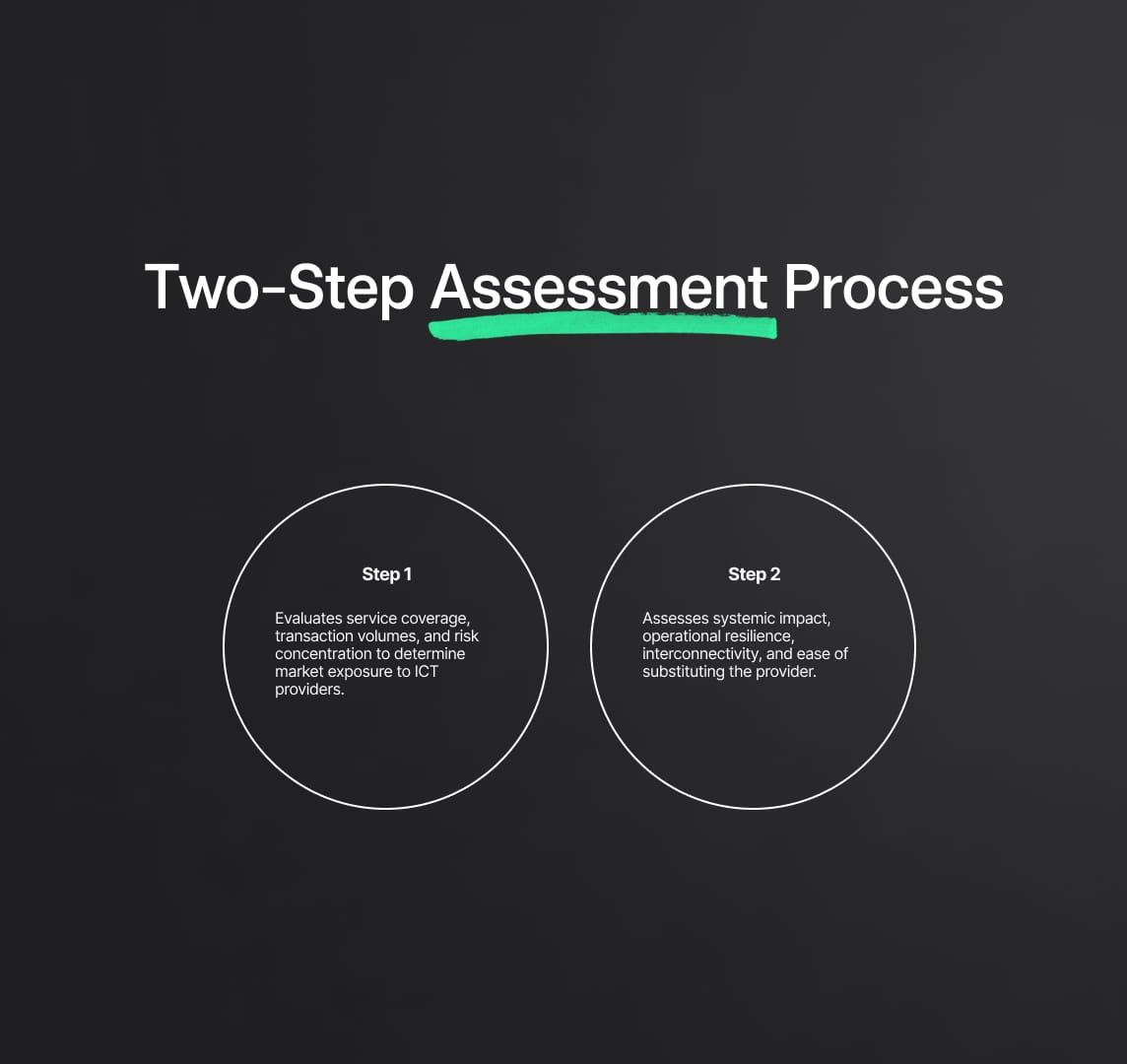

Two-Step Assessment Process

Step 1: Quantitative Analysis

- Service Coverage and Utilization: This initial phase assesses the extent to which financial services depend on the third-party ICT providers. Metrics such as the number of financial entities relying on the provider, the volume of transactions processed, and the overall exposure of the financial market to these services are evaluated.

- Risk Exposure: Regulators examine the critical functions provided by the ICT service providers to determine their risk exposure. This includes analyzing transaction volumes, service dependencies, and the concentration risk within certain financial sectors or geographies.

Step 2: Qualitative Analysis

- Systemic Impact and Risk Assessment: For providers meeting the criteria in Step 1, a more in-depth analysis is conducted. This stage assesses the potential systemic impact and the operational resilience of the ICT providers. Factors such as the complexity of services, the critical nature of the provided functions, and the provider's role within the financial infrastructure are scrutinised.

- Interconnectivity and Substitutability: This phase also evaluates the interconnectivity of the financial entities with the ICT providers and the substitutability of the services they provide. The aim is to gauge how easily financial entities could switch to alternative providers without disrupting their operations, thus assessing the potential market impact if a key provider fails.

ICT Third-Party Service Providers: Regulatory Compliance and Enforcement

Under Regulation 2024/1502, designated critical providers are subject to enhanced oversight and compliance requirements. These include mandatory incident reporting, resilience testing, and adherence to established best practices for cybersecurity and data protection.

Implementation and Monitoring:

The European Supervisory Authorities (ESAs) are tasked with the continuous monitoring and assessment of the compliance of these ICT third-party service providers. They ensure that the regulation's standards are met through regular audits, stress tests, and resilience exercises.

Strategic Impact:

The implementation of Regulation 2024/1502 is designed not only to protect individual financial entities but also to safeguard the broader financial market from potential cascading effects of ICT disruptions. It strengthens the overall digital operational resilience of the financial sector, promoting a more stable and secure financial environment across the EU.

Designation Criteria for Critical ICT Third-Party Service Providers Under EU Regulation

The European Union has adopted a robust framework under the ICT Third-Party Service Providers Regulation to ensure the resilience of its financial sector against operational disruptions posed by ICT service providers. This regulatory approach involves a meticulous two-step process to evaluate and designate ICT service providers as critical, emphasizing their systemic impact and the potential risk they pose to financial stability. This analysis is crucial for mitigating systemic risks and ensuring uninterrupted financial services across Europe.

Step-by-Step Criteria for Designating Critical ICT Service Providers

1. Systemic Impact Analysis (Quantitative Phase):

This phase marks the initial step in the criticality assessment framework. Regulatory authorities conduct a quantitative evaluation focusing on several key metrics:

- Service Utilization Metrics: This involves assessing the number of financial entities that rely on a specific ICT service provider. Metrics include the total number of clients within the financial sector, the extent of service utilization, and the critical functions these services support.

- Asset Impact Analysis: Regulators evaluate the total value of assets that are managed, influenced, or directly supported by the ICT services provided. This helps in understanding the scale of impact that any disruption in services might cause to the financial sector.

- Market Share and Penetration: The assessment also considers the market share of the ICT provider in terms of the number of financial entities served within specific categories, such as banks, insurance companies, investment firms, etc. This is measured against the overall market to gauge the provider's systemic importance.

2. Financial Stability Assessment (Qualitative Phase):

Upon determining that a service provider meets the quantitative thresholds, a deeper, more nuanced qualitative analysis is undertaken:

- Critical Function Analysis: This involves evaluating the nature of the functions provided by the ICT service providers to financial entities. The focus is on whether these functions are essential for the day-to-day operations and the overall functioning of the financial entities.

- Interconnectivity Assessment: Regulators assess the degree of interconnectedness between the ICT service providers and financial entities. This includes examining network dependencies, service overlaps, and the potential for cascading failures across the financial system should the ICT provider face disruptions.

- Substitutability and Vendor Lock-In: A crucial part of the qualitative analysis is to determine the substitutability of the ICT provider. This examines how easily financial entities can switch to alternative providers without significant costs or disruptions, thereby assessing the market's resilience to the failure of a single provider.

Designation Thresholds and Criteria

For an ICT service provider to be designated as critical under the EU regulation, it must meet the following criteria:

- Market Influence: The provider supports at least 10% of the financial entities in any given category, indicating a significant market influence and dependency by critical sectors of the financial industry.

- Asset Impact: The provider significantly impacts the total asset value within the financial market, making its operations vital for the continuity and quality of financial operations.

Implementation and Use of Data in Criticality Assessments under ICT Third-Party Service Providers Regulation

The European Union's strategic implementation of ICT Third-Party Service Providers Regulation is fundamentally reliant on sophisticated data utilization strategies to assess the criticality of ICT service providers. This rigorous approach ensures financial entities' resilience against potential disruptions posed by third-party ICT service providers. The European Supervisory Authorities (ESAs) play a pivotal role in this process, employing comprehensive data from various sources to facilitate informed, accurate evaluations of service provider criticality.

Framework for Data Utilization in Regulatory Assessments

1. Data Sources and Collection:

Under Article 28(3) of Regulation (EU) 2022/2554, a specific mandate is given for the creation and maintenance of registers by financial entities, which include detailed information on their ICT third-party service providers. These registers form the primary database for initial assessments and are complemented by:

- Additional Data Sources: ESAs integrate external data, including industry reports, service performance data, market analysis, and risk assessments from independent audits. This multi-source approach helps capture a comprehensive view of the service provider’s operational landscape and its integration within the financial sector.

- Real-Time Data Feeds: To ensure that the criticality assessments reflect current conditions, real-time data feeds concerning ICT operational statuses, incident reports, and even social media analytics are considered. These inputs help assess immediate or emerging risks associated with ICT service providers.

2. Data Analysis Techniques:

The ESAs employ advanced data analytics techniques to process and analyze the collected data. This involves:

- Predictive Analytics: Using machine learning models to predict potential disruptions or failures based on patterns and trends identified in the data. This proactive approach aids in preempting issues before they manifest into critical disruptions.

- Network Analysis: To evaluate the interconnectedness mentioned in the qualitative phase of criticality assessments, network analysis tools are used to visualize and quantify the dependencies between financial entities and their ICT providers.

- Risk Assessment Models: Custom-built models assess the aggregate risk posed by each ICT provider based on various factors such as their market share, the criticality of the services they provide, and their historical performance in terms of reliability and incident response.

3. Data Governance and Compliance:

To support the effective implementation of these assessments, robust data governance frameworks are established. These frameworks ensure that:

- Data Integrity and Security: All data used in the assessment process are handled according to strict data security and privacy standards, ensuring that sensitive information is protected against unauthorised access or breaches.

- Compliance Monitoring: Continuous monitoring mechanisms are in place to ensure that all data handling and processing activities comply with relevant EU regulations, including GDPR, and specific financial sector standards.

Impact of Data-Driven Assessments on Financial Stability

The strategic use of data in the criticality assessments under the ICT Third-Party Service Providers Regulation enables a dynamic regulatory approach that adapts to the evolving technological landscape and its integration within the financial sector. This approach not only enhances the accuracy and timeliness of the assessments but also:

- Supports Decision Making: Provides regulators and financial entities with actionable insights to make informed decisions regarding risk management strategies and compliance practices.

- Enhances Operational Resilience: By identifying potential vulnerabilities early, financial entities can strategize more effectively to mitigate risks associated with their ICT third-party service providers.

- Promotes Market Stability: Ensures that the broader financial market is protected from significant disruptions that could arise from the failure of critical ICT service providers, thereby maintaining overall economic stability and trust in the financial system.

Enhanced Regulatory Requirements for Financial Institutions

1. Enhanced Due Diligence:

Financial institutions are now mandated to engage in comprehensive due diligence processes. This involves:

- Regulatory Criteria Familiarisation: Institutions must thoroughly understand the new regulatory criteria introduced by the ICT Third-Party Service Providers Regulation. This includes familiarising themselves with the specifics of the two-step assessment process—systemic impact analysis and financial stability assessment—and the criteria for designating ICT providers as critical.

- Risk Management Strategy Adjustment: Based on the understanding of these criteria, financial institutions are required to recalibrate their existing risk management frameworks to incorporate considerations specific to the operational risks presented by ICT providers. This may involve integrating new risk assessment tools, enhancing monitoring systems, and adopting more dynamic risk mitigation strategies to address the specific vulnerabilities associated with critical ICT service providers.

2. Operational Resilience:

To comply with the regulation, financial institutions must develop and continuously refine their operational resilience strategies. This entails:

- Development of Resilience Plans: Crafting detailed plans that outline actions for maintaining essential functions in the event of ICT service failure. These plans should include practical recovery solutions and alternative arrangements that can be quickly activated to ensure service continuity.

- Regular Testing and Updates: Conducting regular drills to test the effectiveness of these resilience plans and making necessary adjustments based on test outcomes and evolving regulatory requirements. Continuous improvement in operational resilience practices is expected to be documented and demonstrable during regulatory reviews.

Stringent Compliance Landscape for ICT Providers

1. Increased Compliance Requirements:

ICT providers identified as critical under the new regulation will encounter increased regulatory scrutiny. This includes:

- Adherence to Stricter Standards: Meeting higher operational and security standards, which might involve significant investments in technology upgrades, process improvements, and employee training to comply with enhanced regulatory expectations.

- Regular Reporting and Audits: Submitting to more frequent audits and mandatory reporting of their operational status, incident management outcomes, and compliance with the established continuity plans.

2. Strategic Adjustments:

ICT providers must reassess and possibly overhaul their service delivery models to align with the new regulatory environment. Key areas of focus include:

- Service Model Reevaluation: Examining current service delivery frameworks to identify areas where enhancements are necessary to meet the heightened standards. This might involve redesigning service architectures, enhancing data security measures, or implementing more robust data handling and storage solutions.

- Innovation in Service Continuity Practices: Developing innovative solutions that enhance the resilience of their services. This could include adopting advanced cloud storage solutions, decentralizing data centers, and integrating state-of-the-art cybersecurity technologies.

Timeline and Enforcement of the ICT Third-Party Service Providers Regulation

The ICT Third-Party Service Providers Regulation, embodied by Commission Delegated Regulation (EU) 2024/1502, marks a pivotal advancement in the European Union's regulatory framework. Set to enhance the operational resilience of the financial sector, this regulation specifies a clear timeline and staged enforcement strategy to ensure smooth compliance and adaptation by all stakeholders involved. Here, we delve into the technical aspects of the regulation’s timeline and enforcement, emphasising its significance in the digital and financial landscape of Europe.

Enforcement Timeline of Regulation 2024/1502

Effective Date and Staged Implementation:

- Initial Effectiveness: The regulation will take effect on June 19, 2024. This date marks the beginning of the transitional period for all parties affected by the regulation, providing them time to understand and integrate the new requirements into their operational frameworks.

- Official Enactment: Following its publication in the Official Journal of the European Union, the regulation will officially enter into force 20 days later. This short gap between publication and enforcement ensures that the regulation's text is accessible and that the final preparations for compliance can be made.

- Critical Compliance Deadline: By January 16, 2025, specific criteria outlined in the regulation become applicable. This staged approach allows financial institutions and ICT service providers ample time to adjust their systems, conduct necessary training, and implement required changes to meet the new standards.

Ongoing Reviews and Updates

The dynamic nature of both the financial and technological landscapes necessitates continual adaptation of regulatory measures. To this end, Regulation 2024/1502 includes provisions for:

- Regular Monitoring: Continuous monitoring by the European Supervisory Authorities (ESAs) ensures that the regulation remains effective and that regulated entities remain compliant. This involves periodic assessments and audits.

- Adaptive Framework: The regulation is designed to be adaptive, with provisions for updates and amendments as necessary based on emerging trends, technological advancements, and new risks identified in the ICT and financial sectors.

- Feedback Mechanisms: Structured feedback mechanisms from financial institutions, ICT service providers, and other stakeholders are integral to the ongoing improvement of regulatory measures, ensuring that the regulation evolves in line with industry needs and challenges.

Reduce your

compliance risks