IFR/IFD compliance: how financial services can achieve it?

The 2019-introduced IFR/IFD sets new requirements for financial firms. Firms must identify compliance gaps, adjust governance and reporting, and create a thorough plan with staff training, tech upgrades, and ongoing checks to meet the 2023 deadline.

Grand “Answer”:

To achieve IFR/IFD compliance in 2023, financial services should first understand the new prudential framework introduced by European regulatory authorities in December 2019. The Investment Firms Regulation (IFR) and Investment Firms Directive (IFD) aim to strengthen the financial stability of investment firms by setting capital requirements, liquidity requirements, and other governance and reporting standards [1]. To comply with the IFR/IFD, financial services companies should start by assessing their current operations and identifying any gaps in their compliance with the new regulations. This may require updating internal governance structures, risk management practices, and reporting systems to align with the new requirements [2]. Additionally, firms should develop a comprehensive implementation plan that outlines the necessary steps to achieve compliance, including staff training, technological upgrades, and ongoing monitoring of compliance efforts [3]. By proactively addressing these requirements, financial services companies can ensure that they are well-prepared for the 2023 deadline and beyond.

Source

[1]

EU Investment Firms Regulatory Evolution: Pre-IFR/IFD to Post-IFR/IFD Transition

Historically, the operations of investment firms within the European Union (EU) fell under the EU prudential framework for banks, which comprised the Capital Requirements Regulation (CRR) and the Capital Requirements Directive (CRD). This framework was predominantly developed for banks, failing to reflect the diverse business models, risks, and sizes of investment firms.

Recognising this gap, the EU introduced a novel regulatory approach tailored specifically for investment firms, known as the Investment Firms Regulation (IFR) and the Investment Firms Directive (IFD), which came into effect on 26th June 2021.

This groundbreaking IFR-IFD framework reflects the distinct nature and risk profile of investment firms in a more comprehensive and precise manner compared to the previous banking-centric CRR/CRD rules. It does this by establishing three capital requirements unique to the risk characteristics and activities of investment firms:

-

A Fixed Overheads Requirement (FOR), equating to one-quarter of the firm's annual fixed overheads. This requirement acts as a safety net, ensuring firms have adequate resources to cover their routine operating costs.

-

A Permanent Minimum Capital Requirement (PMR), set at either EUR 75,000, EUR 150,000, or EUR 750,000, contingent on the type of activities the firm undertakes. This requirement safeguards the firm's financial health by providing a baseline capital buffer.

-

A pioneering K-factor capital requirement, which considers risks related to the firm's clients (RtC), the markets they operate in (RtM), and the internal risks faced by the firm itself (RtF). This component serves to encapsulate the risk heterogeneity across different investment firms, allowing for a more nuanced and targeted regulatory approach.

Moreover, to accommodate for the wide variety of investment firms in the EU, the IFR-IFD framework classifies firms into different categories— Class 2 and 3— based on their size, interconnectedness, and business activities. While Class 3 firms, being smaller and less interconnected, are subject to lighter regulatory requirements than Class 2 firms, both categories collectively encapsulate the majority of EU investment firms.

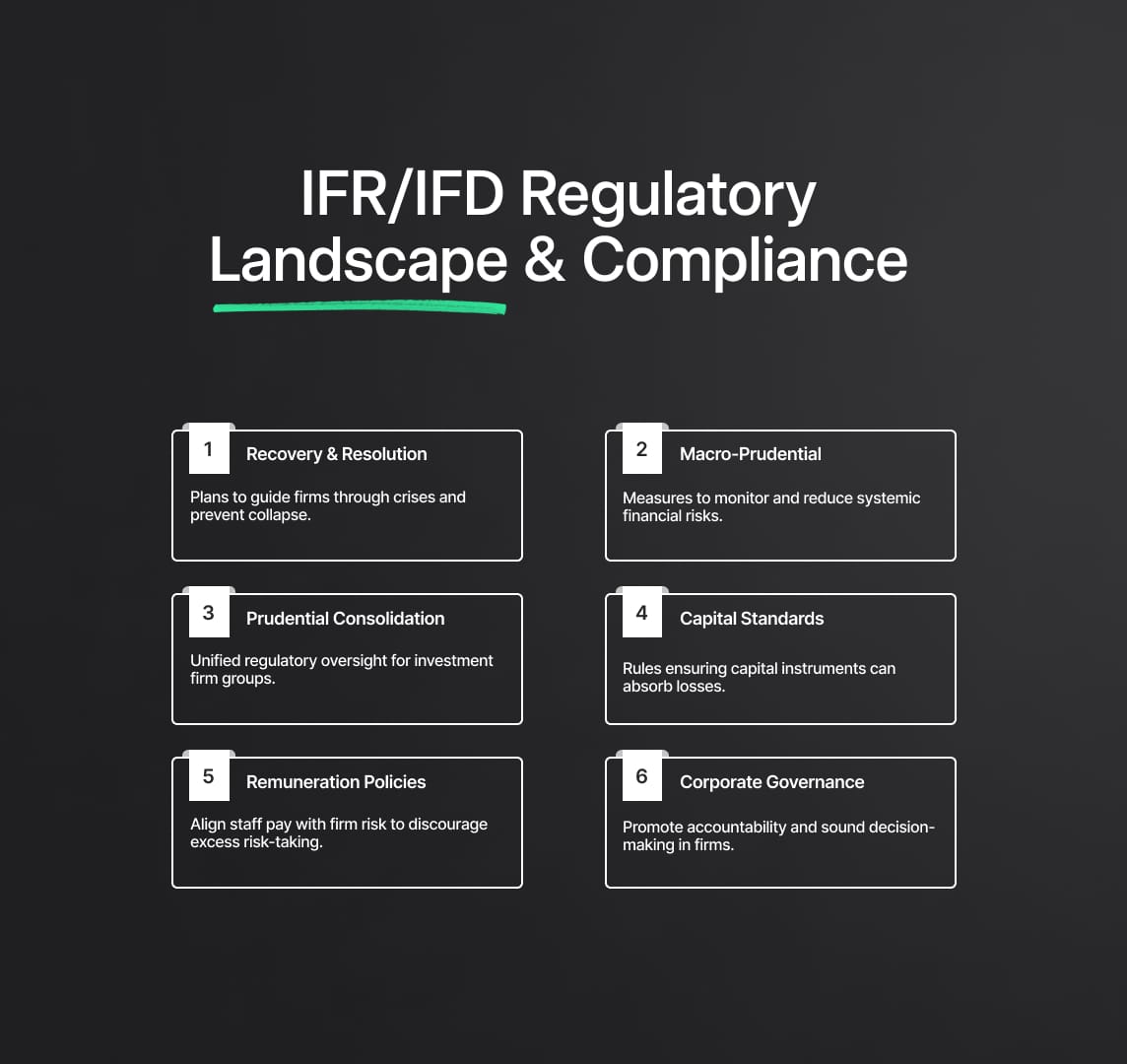

IFR/IFD Regulatory Landscape & Compliance

Despite the introduction of the IFR-IFD framework, larger investment firms, categorised as Class 1 and "Class 1 minus", continue to operate under the original CRR/CRD rules due to their systemic significance. Class 1 firms, which are involved in activities such as dealing on account or underwriting of financial instruments, must exceed a consolidated assets threshold of EUR 30 bn and apply for authorisation as credit institutions. Conversely, "Class 1 minus" firms undertake similar activities but meet a lower consolidated assets threshold— either EUR 15 bn or EUR 5 bn with a designation by competent authorities based on specific criteria.

These firms maintain their authorisation as investment firms.

This revised regulatory landscape underscores the essential roles of the European Banking Authority (EBA) and the European Securities and Markets Authority (ESMA). Working in unison, these regulatory bodies shape new instruments under the IFR-IFD framework. Their tasks include:

-

Recovery and Resolution Planning: They form strategies to help investment firms recover from financial difficulties and prevent their collapse. These plans serve as a roadmap for investment firms to follow in case of a crisis.

-

Macro-Prudential Measures: The EBA and ESMA establish broad-based measures to prevent systemic risks that could destabilize the financial system. They aim to monitor and mitigate risks to the financial stability of the EU.

-

Prudential Consolidation: They organize the merging of regulatory requirements for investment firm groups, enabling a more holistic oversight and management of risks.

-

Capital Instruments Standards: The regulatory bodies set standards for the instruments that investment firms can use to meet their capital requirements. This ensures that these instruments can adequately absorb losses and contribute to the firm's financial stability.

-

Remuneration Policies: They devise policies concerning the pay and benefits of staff at investment firms. These policies aim to align the personal incentives of staff with the risk profiles of the firms, discouraging excessive risk-taking.

-

Corporate Governance: Lastly, the EBA and ESMA ensure investment firms adopt sound governance practices, fostering accountability, transparency, and good decision-making within these firms.

The transition towards the IFR-IFD framework marks a pivotal progression in EU financial regulation. This new model of supervision addresses the unique characteristics and risks inherent in the activities of investment firms, thus offering a more customised, risk-sensitive, and robust regulatory approach than before. It helps ensure that these firms maintain a strong financial standing and risk management strategies, consequently reducing potential threats to financial stability.

Moreover, this transition symbolizes the EU's commitment to foster a more resilient and effective financial sector. By accurately reflecting the nature, size, and complexity of investment firms' activities, it enhances investor protection and promotes market integrity. Consequently, this progressive framework helps to reinforce the EU's goal of maintaining a stable, competitive, and transparent financial market that is better prepared to withstand future economic shocks.

Finally, the IFR-IFD framework is a testament to the dynamic and responsive nature of the EU's financial regulatory approach. By staying attuned to the evolving landscape and adjusting the rules accordingly, the EU is not only improving the robustness of its financial system but also setting a precedent for other jurisdictions, potentially influencing the trajectory of global financial regulation.

Grand Answer: Your AI Partner

Reduce your

compliance risks