IFRS 15 and IFRS 7: Financial Reporting Standards

UKEB's interactions with the IASB spotlight evolving IFRS standards, emphasizing refined adjustments in IFRS 15 and greater transparency via IAS 7 and IFRS 7 amendments.

UK Draft Comment Letter on IFRS 15 and IFRS 7: Supplier Finance Arrangements Outlined

In response to the International Accounting Standards Board's (IASB) call for input on the post-implementation review (PIR) of IFRS 15 - Revenue from Contracts with Customers, the UK Endorsement Board (UKEB) has made a draft comment letter available to the public. The UKEB acknowledged several operational challenges but praised IFRS 15's efficacy nonetheless. The letter also emphasized the need for improvements that won't materially hinder companies that are already putting the standard into practice, including possible standard-setting initiatives. In addition, a Draft Endorsement Criteria Assessment (DECA) on Supplier Finance Arrangements was released by the UKEB. This came about following the 25th of May, 2023, release by the IASB of revisions to IAS 7 - Statement of Cash Flows and IFRS 7 - Financial Instruments: Disclosures. The changes are intended to give users of financial statements thorough information regarding the implications of supplier finance agreements on entities. Stakeholders have been invited by the UKEB to express their opinions regarding the possible adoption of these amendments in the UK.amendments in the UK.

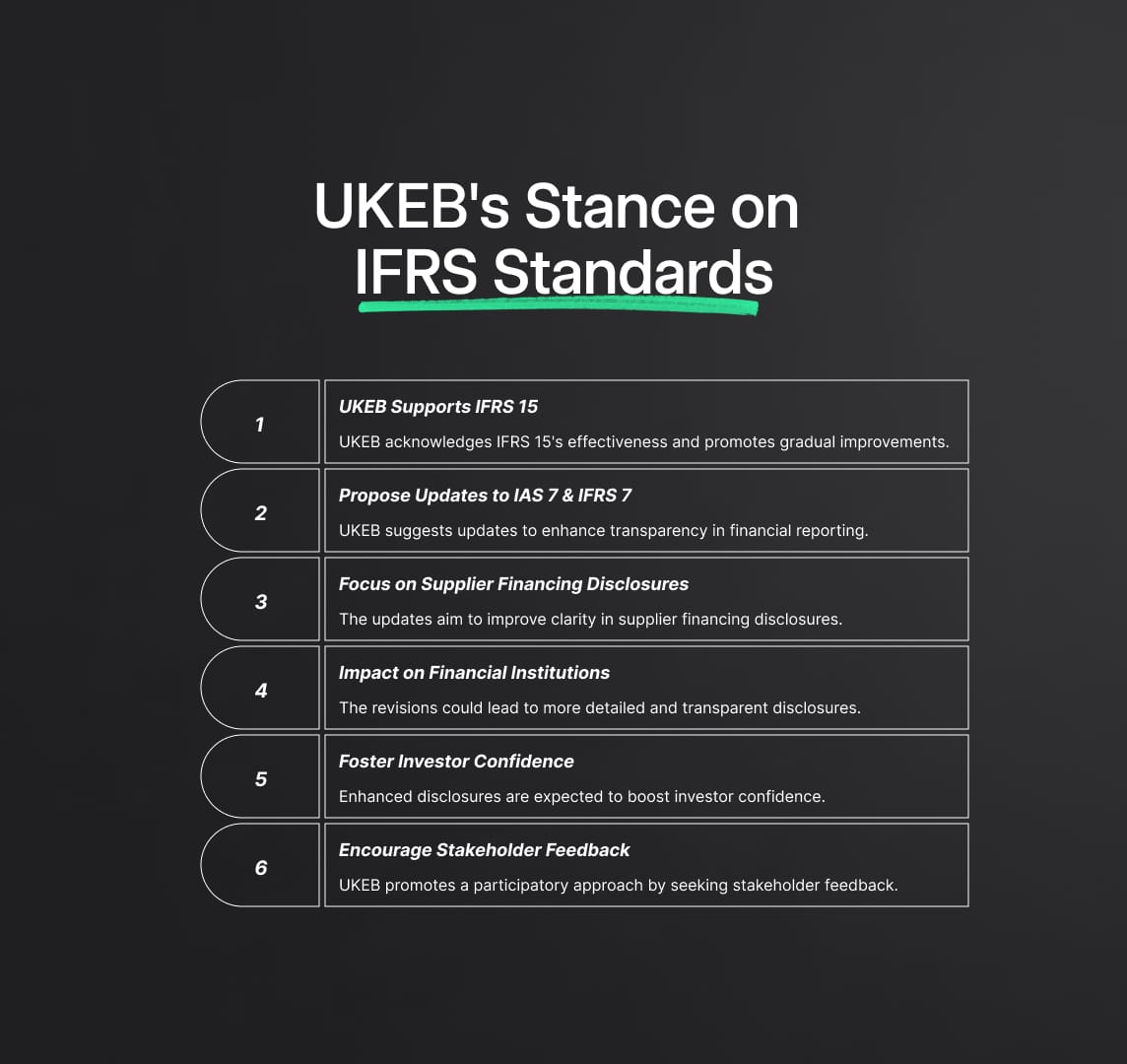

Financial Reporting: UKEB's Stance on IFRS Standards

The financial industry is always changing, particularly when it comes to reporting and accounting regulations. Recent exchanges between the International Accounting Standards Board (IASB) and the UK Endorsement Board (UKEB) offer insightful information about the direction that international financial reporting standards (IFRS) may take in the future. A closer look at IFRS 15, IAS 7, and IFRS 7 can provide financial industry stakeholders with a more defined path forward.

A Progressive View on IFRS 15 - Revenue Recognition

The UKEB's praise of IFRS 15's efficacy, in contrast to its knowledge of operational difficulties, suggests that this crucial revenue recognition standard may change in the future. UKEB's approach highlights the significance of stability and predictability in financial reporting by promoting fine-tuned improvements that won't upset presently implementing entities. Such viewpoints might spur a movement toward accounting standard modifications that are more systematic and progressive.

Amplifying Transparency: IAS 7 and IFRS 7

ModificationsIn the financial sector, transparency continues to be essential to building trust. The UKEB's emphasis on the most recent revisions to IFRS 7 and IAS 7 highlights a general desire for clarification, particularly with regard to supplier financing arrangements. The proposed modifications have the potential to significantly impact companies globally that are struggling with liquidity issues and the complexities of financial reporting. We should expect a cascading effect where financial institutions improve the level of detail and transparency in their disclosures, leading to a better-informed investing community, should these revisions be approved in the UK.

The recent messages from UKEB have extended an open invitation to stakeholders to offer their ideas, which may be one of their most notable features. By requesting feedback on proposed changes, the UKEB is a prime example of a contemporary, inclusive approach to financial regulation. Such actions point to a potential change in financial reporting standards development toward more participatory frameworks.

These changes indicate that financial institutions using IFRS must be aware of them and flexible. The dynamics of financial reporting requirements are always changing, thus it will be essential to engage in proactive learning and to have strategic foresight. The intersecting stories of openness, diversity, and steady development that UKEB promotes offer a path forward.

Reduce your

compliance risks