IFRS 9 and IFRS 7: EFRAG Technical Review

EFRAG recommends amendments to IFRS 9 and IFRS 7 to improve financial reporting. Addressing ESG-linked instruments and electronic payments, these changes offer clearer guidance, better consistency, and enhanced disclosures.

Introduction

The European Financial Reporting Advisory Group (EFRAG) has recently issued a draft letter to the European Commission, recommending the endorsement of significant Amendments to IFRS 9 and IFRS 7. These amendments, designed to refine and enhance the existing standards, specifically target issues highlighted during the Post-implementation Review (PIR) and through comprehensive stakeholder feedback. This detailed technical analysis delves into the significance of these amendments, examining their profound impact on financial reporting and their rigorous alignment with the endorsement criteria set forth by Regulation (EC) No 1606/2002.

The Amendments

The Amendments to IFRS 9 and IFRS 7 are pivotal in addressing critical areas within the financial reporting landscape. IFRS 9, which deals with the classification, measurement, impairment, and hedge accounting of financial instruments, and IFRS 7, which mandates detailed disclosures about financial instruments, are foundational to ensuring transparent and accurate financial reporting. The recent amendments aim to resolve ambiguities and enhance the clarity and consistency of these standards.

Post-implementation Review (PIR)

The Post-implementation Review (PIR) of IFRS 9 revealed several areas where the standard could be improved. Stakeholders identified complexities in the application of the Solely Payments of Principal and Interest (SPPI) criteria, particularly for financial assets with Environmental, Social, and Governance (ESG)-linked features. Additionally, issues related to the recognition and derecognition of financial liabilities settled through electronic payment systems were brought to light. The PIR process facilitated a detailed evaluation of these challenges, guiding the formulation of the current amendments.

Stakeholder Feedback

Stakeholder feedback played a crucial role in shaping the amendments. Entities from various sectors, including commercial banks, investment banks, insurance companies, and asset management firms, provided insights into the practical difficulties encountered in applying IFRS 9 and IFRS 7. This feedback underscored the need for clearer guidance on assessing contractual cash flows, particularly for complex financial instruments, and highlighted the necessity for enhanced disclosures to improve transparency and user understanding.

Objectives of the Amendments

The primary objectives of the amendments are to:

- Enhance Clarity: Provide specific guidance on the application of the SPPI criteria, particularly for financial instruments with ESG-linked features, and clarify the treatment of non-recourse financial assets and Contractually Linked Instruments (CLIs).

- Improve Consistency: Ensure consistent application of recognition and derecognition principles, particularly for financial liabilities settled via electronic payment systems, by introducing narrowly scoped exceptions where appropriate.

- Augment Disclosures: Require additional qualitative and quantitative disclosures to provide users with a comprehensive understanding of the nature and extent of risks associated with financial instruments and the impact of contingent events on contractual cash flows.

Alignment with Regulation (EC) No 1606/2002

The alignment of the amendments with Regulation (EC) No 1606/2002 is critical. This regulation mandates that adopted international accounting standards must provide a true and fair view of the financial position and performance of entities. The amendments to IFRS 9 and IFRS 7 have been meticulously evaluated against these criteria to ensure they enhance the quality and reliability of financial reporting without introducing significant costs or operational burdens on preparers.

Assessing Whether the Amendments to IFRS 9 and IFRS 7 are Conducive to the European Public Good

The European Financial Reporting Advisory Group (EFRAG) conducted a comprehensive evaluation of the Amendments to IFRS 9 and IFRS 7, focusing on their potential impact on financial reporting quality, costs and benefits, and their broader effects on the European economy, including financial stability and economic growth. This analysis is crucial in determining whether these amendments align with the European public good, a key criterion for endorsement.

Key Considerations

Improvement in Financial Reporting

Derecognition Requirements: The amendments introduce a narrowly scoped solution for the derecognition of financial liabilities settled through electronic payment systems. This addresses stakeholder concerns regarding the timing and recognition of such settlements, where traditional derecognition criteria may not apply seamlessly. By allowing entities to derecognize liabilities before the settlement date, provided certain conditions are met, the amendments offer a practical resolution that enhances the accuracy and reliability of financial statements.

SPPI Assessment for ESG-Linked Features: The amendments offer detailed guidance on assessing whether financial assets with ESG-linked features meet the Solely Payments of Principal and Interest (SPPI) criteria. This is particularly important as ESG-linked financial instruments become more prevalent. The amendments clarify how to evaluate cash flows tied to non-traditional metrics, ensuring that such instruments are classified and measured appropriately. This timely resolution supports the accurate reflection of ESG-linked financial instruments in financial statements, promoting consistency and comparability.

Enhanced Disclosures: The amendments require additional disclosures about contingent events affecting contractual cash flows. These enhanced disclosure requirements aim to improve the transparency and comprehensiveness of financial information provided to users. Entities must now disclose qualitative and quantitative information about the nature and potential impact of contingent events, helping users better understand the risks and uncertainties associated with financial instruments.

Non-Recourse Features and CLIs: The amendments address issues identified during the Post-implementation Review (PIR) concerning financial assets with non-recourse features and Contractually Linked Instruments (CLIs). By providing clearer guidance on these complex instruments, the amendments aim to reduce diversity in practice and improve the reliability of financial reporting. This includes defining non-recourse features more explicitly and clarifying the application of requirements for CLIs.

Assessment of Financial Reporting Quality

EFRAG's analysis concludes that the amendments to IFRS 9 and IFRS 7 are likely to significantly improve the quality of financial reporting. This improvement stems from several key areas:

- Clearer Guidelines: The amendments provide specific, actionable guidance on complex areas such as the SPPI assessment for ESG-linked features and the derecognition of liabilities through electronic payment systems. These guidelines help ensure consistent application across entities, enhancing the reliability of financial statements.

- Additional Disclosures: By requiring entities to disclose more detailed information about contingent events and their impact on cash flows, the amendments increase the transparency and relevance of financial reports. Users gain a deeper understanding of the risks and potential changes in cash flows, aiding in better decision-making.

- Reduced Diversity in Practice: Addressing the issues related to non-recourse features and CLIs helps standardize the accounting treatment of these instruments. This reduction in diversity leads to more comparable financial statements across different entities and jurisdictions.

- Alignment with Regulatory Requirements: The amendments align with the broader regulatory framework, ensuring that financial reporting meets the high standards expected by regulators and stakeholders. This alignment supports the overall objective of providing a true and fair view of an entity's financial position and performance.

Costs and Benefits Analysis of Amendments to IFRS 9 and IFRS 7

EFRAG has conducted a detailed analysis of the costs and benefits associated with the Amendments to IFRS 9 and IFRS 7. These amendments, with their narrower scope compared to broader standards or interpretations, have specific implications for preparers and users of financial statements. This section delves into the technical details and provides an SEO-optimized overview focusing on the keywords: IFRS 9 and IFRS 7.

Cost Implications for Preparers

SPPI Assessment for ESG-Linked Features

Familiarity: Preparers are already familiar with the SPPI (Solely Payments of Principal and Interest) assessments since the initial implementation of IFRS 9. This familiarity reduces the learning curve and minimizes additional training costs.

Qualitative vs. Quantitative Analysis: The amendments to IFRS 9 do not mandate a quantitative analysis of interest components for ESG-linked features. Instead, qualitative assessments are often sufficient. This flexibility can significantly minimize implementation costs by allowing entities to use existing evaluation frameworks without extensive modifications.

Internal Processes: While some updates to internal processes, documentation, systems, and staff training will be necessary to accommodate the new guidance, EFRAG does not anticipate significant costs for preparers. The amendments are designed to integrate seamlessly into existing workflows with minimal disruption.

Disclosure Requirements

Additional Burden: The new disclosure requirements could be more burdensome, especially for entities with substantial portfolios of financial assets featuring ESG-linked characteristics. These entities might need to enhance their data collection and reporting capabilities to comply with the new standards.

Scope and Flexibility: Despite suggestions to exclude certain categories of financial instruments to reduce costs, the IASB decided against such exclusions. However, the final amendments include improvements aimed at cost reduction, such as narrowing the scope of disclosure requirements and providing flexibility in how quantitative disclosures are presented. This allows entities to tailor their reporting efforts to align with the amendments without incurring prohibitive costs.

Settling Financial Liabilities Using Electronic Payment Systems

Operational Adjustments: The amendments require updates to accounting and reporting systems to accommodate the new derecognition rules for financial liabilities settled via electronic payment systems. These operational adjustments could be significant, but entities can mitigate this burden by implementing top-level adjustments during the transition period.

Implementation Timeline: The effective date of January 1, 2026, for the amendments provides a reasonable timeframe for entities to prepare. Early application is permitted, offering entities the flexibility to adopt the changes sooner if they are ready.

Cost Implications for Non-Financial Entities

Limited Costs: Non-financial entities, which typically issue fewer financial instruments subject to the new requirements, are expected to incur limited costs. The incremental disclosure requirements for these entities are minimal, making compliance less burdensome.

Benefits for Preparers and Users

Improved Financial Reporting

SPPI Assessment: The amendments offer a robust solution for the classification and measurement of financial instruments with ESG-linked features. This improvement enhances the relevance and reliability of financial information by ensuring that these instruments are appropriately assessed and reported.

Enhanced Disclosures: Users benefit from additional information about contingent events affecting contractual cash flows and fair value gains or losses on equity investments. These enhanced disclosures provide greater transparency and help users make more informed decisions.

Consistent Application: Amendments related to electronic payment systems standardize the application of derecognition requirements. This consistency reduces diversity in practice, making financial statements more comparable across different entities and jurisdictions.

User Benefits

Improved Understanding and Comparability: The enhanced disclosures and clearer guidelines improve users' ability to understand and compare financial information across entities. This consistency is crucial for analysts, investors, and other stakeholders who rely on financial reports for decision-making.

Additional Useful Information: By providing more detailed insights into contingent events and their effects on cash flows, the amendments offer users valuable information that aids in better analysis and decision-making. This improved transparency supports a more robust financial reporting environment.

Net Benefit Assessment

EFRAG's assessment indicates that the benefits of improved financial reporting quality and user understanding significantly outweigh the costs of implementing the amendments. The net positive effect is conducive to the European public good, as it promotes higher standards of financial transparency and reliability.

Impact on Financial Stability and Economic Growth: A Deep Dive into IFRS 9 and IFRS 7 Amendments

The European Financial Reporting Advisory Group (EFRAG) has meticulously evaluated the potential impact of the Amendments to IFRS 9 and IFRS 7 on financial stability and economic growth within Europe. This detailed analysis ensures that the amendments not only enhance financial reporting but also contribute positively to the broader economic environment.

Key Findings on Financial Stability

Cohesive Interaction with Other IFRS Standards: The amendments to IFRS 9 and IFRS 7 are designed to integrate seamlessly with existing IFRS standards. This integration ensures that there are no negative interactions or conflicts, maintaining the cohesiveness and comprehensiveness of financial reporting frameworks. By aligning with the broader IFRS standards, the amendments support a unified approach to financial reporting, which is crucial for maintaining stability in financial markets.

Enhanced Reliability and Comparability: The amendments emphasize the importance of reliability and comparability in financial statements. By providing clearer guidelines and additional disclosures, the amendments ensure that financial information is reliable and comparable across different entities and jurisdictions. This consistency is vital for financial stability, as it allows investors, regulators, and other stakeholders to make informed decisions based on accurate and comparable data.

Mitigation of Financial Risks: The amendments address specific financial risks associated with electronic payment systems and ESG-linked features. By providing clear criteria for derecognition of financial liabilities and the assessment of ESG-linked features, the amendments help mitigate potential risks and uncertainties. This risk mitigation contributes to a more stable financial environment, reducing the likelihood of unexpected financial disruptions.

Economic Growth: Supporting a Predictable Financial Environment

Transparency and Consistency: One of the key benefits of the amendments to IFRS 9 and IFRS 7 is the enhanced transparency and consistency they bring to financial reporting. Transparent and consistent financial reporting is essential for a stable and predictable financial environment. It helps build investor confidence and encourages investment, which in turn supports economic growth.

Facilitation of Investment Decisions: The amendments improve the quality and clarity of financial information, making it easier for investors to analyze and compare financial statements. Enhanced disclosures about contingent events, contractual cash flows, and ESG-linked features provide investors with a deeper understanding of an entity's financial health and future prospects. This improved clarity facilitates better investment decisions, which is crucial for economic growth.

Reduction of Market Volatility: By ensuring that financial statements accurately reflect the economic realities of financial instruments, the amendments help reduce market volatility. Accurate and reliable financial information reduces uncertainty and speculation, leading to more stable financial markets. Stable financial markets are a cornerstone of economic growth, as they provide a secure environment for investment and economic activities.

Positive Impact on Financial Stability and Economic Growth

Comprehensive Evaluation: EFRAG's comprehensive evaluation concludes that the amendments to IFRS 9 and IFRS 7 are unlikely to have adverse effects on financial stability or economic growth. Instead, they support these objectives by improving the reliability, comparability, and transparency of financial information.

Support for Economic Objectives: The amendments are conducive to achieving broader economic objectives. By enhancing the quality of financial reporting, the amendments support a stable and predictable financial environment. This stability is crucial for fostering economic growth, as it encourages investment, supports economic activities, and reduces financial risks.

Compliance with the True and Fair View Principle

The true and fair view principle is a fundamental aspect of financial reporting, requiring that financial statements accurately represent an entity's financial position and performance without significant distortions or omissions. The amendments to IFRS 9 and IFRS 7 have been carefully crafted to uphold this principle.

Key Provisions

Avoidance of Distortions and Omissions: The amendments ensure accurate representation by addressing specific stakeholder concerns and providing clear guidelines for assessing and disclosing financial instruments with contingent features. By clarifying these aspects, the amendments prevent distortions and omissions, ensuring that financial statements provide a true and fair view of an entity's financial position and performance.

Necessary Disclosures: Comprehensive disclosure requirements are a central aspect of the amendments. These disclosures provide a complete and reliable depiction of an entity's financial position and performance, covering aspects such as ESG-linked features, electronic payment systems, and contractual cash flows. The detailed disclosures ensure that all relevant information is presented, supporting the true and fair view principle.

Assessment

Compliance with True and Fair View Principle: EFRAG's assessment confirms that the amendments to IFRS 9 and IFRS 7 comply with the true and fair view principle. The amendments do not lead to unavoidable distortions or significant omissions. Instead, they enhance the accuracy, reliability, and completeness of financial statements, ensuring that financial information faithfully represents the economic realities of financial instruments.

Ensuring Comprehensive Depiction of Financial Performance: By providing clear guidelines and comprehensive disclosures, the amendments ensure that financial statements offer a thorough and accurate depiction of an entity's financial performance. This comprehensive depiction is essential for stakeholders who rely on financial statements to make informed decisions.

Background and Key Changes in IFRS 9 and IFRS 7 Amendments

Settling Financial Liabilities Using an Electronic Payment System

The amendments to IFRS 9 and IFRS 7 address specific concerns related to the accounting treatment of financial liabilities settled through electronic payment systems. These concerns were highlighted in a submission to the IFRS Interpretations Committee (IFRS IC). The main objective of these amendments is to provide an exception to the general rules for recognition and derecognition of financial assets and liabilities, thus offering clearer guidance and improving the consistency of financial reporting.

Key Changes and Criteria:

Derecognition Before Settlement: The amendments stipulate that an entity can derecognize a financial liability before the actual settlement date under specific conditions:

- Inability to Cancel Payment Instruction: The entity must have no practical ability to cancel the payment instruction once it has been initiated.

- Inaccessibility of Settlement Cash: The entity should not be able to access the cash earmarked for settlement.

- Insignificant Settlement Risk: The risk associated with the settlement process must be considered insignificant.

These criteria ensure that the financial liability can be considered discharged in substance, reflecting the economic reality of the transaction.

Narrow Scope Application: The exception for derecognition applies narrowly to entities using electronic payment systems. This specific focus helps to maintain the integrity of the broader principles of IFRS 9 and ensures that the exception is not inappropriately applied to other financial assets or payment methods. By restricting the application to electronic payment systems, the amendments aim to address operational concerns without undermining the overall framework of IFRS

Assessing Contractual Cash Flow Characteristics of Financial Assets (Section 4.1 of IFRS 9)

EFRAG's assessment recognizes that the amortized cost measurement category provides valuable information about the amount, timing, and uncertainty of future cash flows. The amendments offer clarification on how to evaluate the contractual cash flow characteristics, particularly for financial assets with ESG-linked features, non-recourse features, and Contractually Linked Instruments (CLIs).

ESG-Linked Features: The amendments include detailed guidance on how to assess the interest component of financial assets with ESG-linked features. Paragraph B4.1.8A of IFRS 9 clarifies the circumstances under which the contractual cash flows of a financial asset are inconsistent with a basic lending arrangement:

- Assessment of Interest: Entities must determine whether the interest component reflects only the basic lending risks and costs. If the interest rate is linked to ESG metrics, it must still represent compensation for the time value of money and credit risk, among other basic lending risks.

- Consistency with Basic Lending Arrangement: Cash flows that vary based on non-lending-related factors (e.g., equity prices or commodity prices) are not considered consistent with a basic lending arrangement.

Non-Recourse Features: The amendments enhance the definition of non-recourse financial assets. Paragraph B4.1.16A specifies that non-recourse features limit the cash flows of the asset to those generated by specified assets:

- Clarification of Non-Recourse: Non-recourse financial assets are those where the lender's claim is limited to the cash flows generated by a specified asset or pool of assets. This characteristic affects the assessment of whether the asset's cash flows meet the SPPI criteria.

Contractually Linked Instruments (CLI): Paragraphs B4.1.20 and B4.1.23 provide clearer definitions and application guidelines for CLIs. These instruments involve a structured arrangement where the cash flows from a pool of underlying assets are redistributed according to a pre-defined structure (often referred to as a 'waterfall'):

- Characteristics of CLIs: The amendments clarify which financial instruments qualify as CLIs and how they should be assessed under IFRS 9. This includes detailed descriptions of the structure and the redistribution mechanisms.

- Application to Non-Recourse Assets: The amendments ensure that the principles applied to CLIs are consistent with those used for non-recourse financial assets, promoting consistency and reducing interpretative diversity.

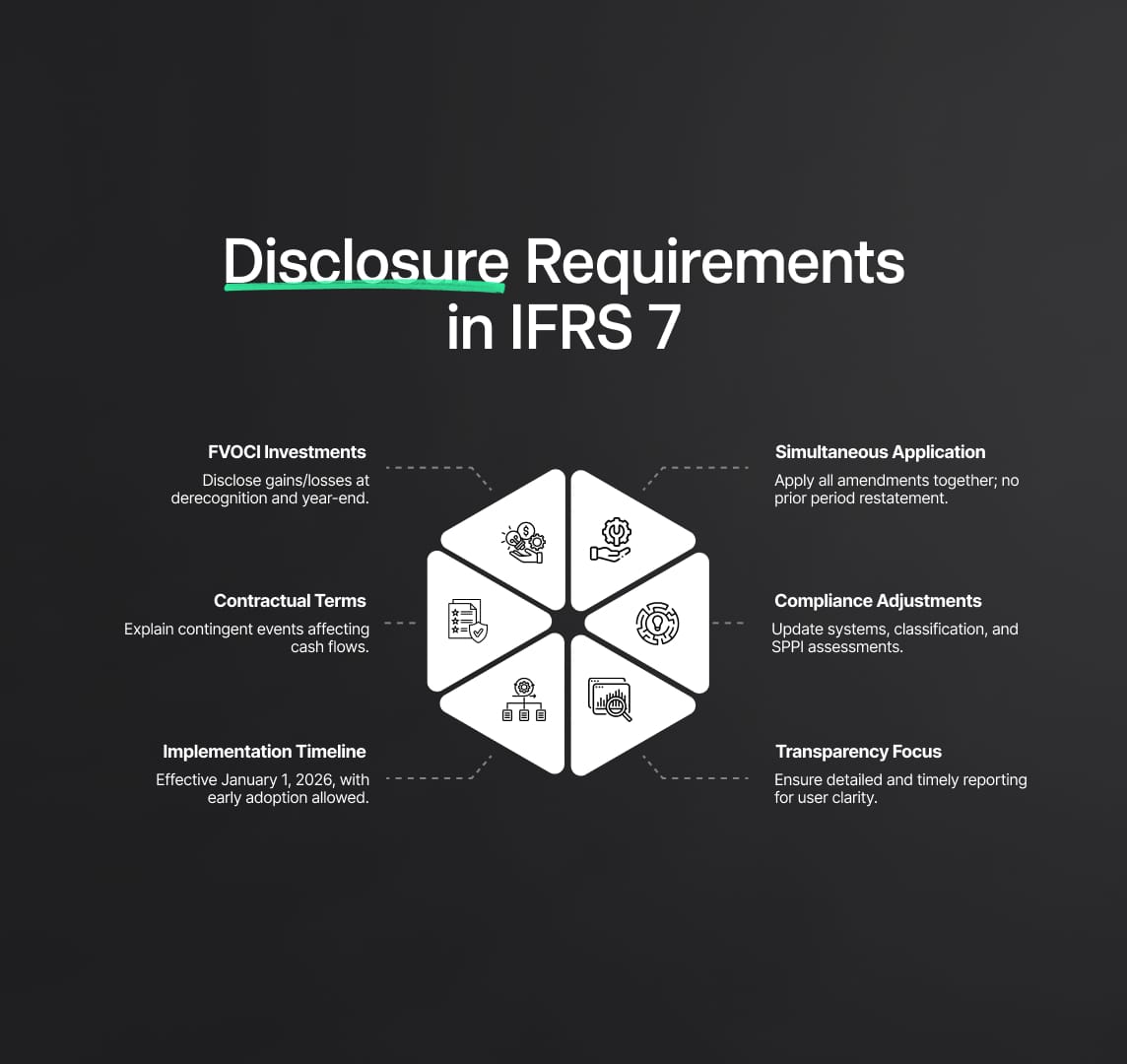

Disclosure Requirements in IFRS 7

The amendments to IFRS 7 are a significant step toward enhancing transparency and providing more comprehensive financial information to users. These changes are crucial for ensuring that financial statements offer a true and fair view of an entity’s financial position and performance, particularly regarding investments in equity instruments designated at Fair Value through Other Comprehensive Income (FVOCI) and the contractual terms affecting cash flows.

Investments in Equity Instruments Designated at FVOCI:

The amendments require detailed disclosures to provide a clearer picture of an entity's financial performance and position regarding equity investments. Specifically, Paragraph 11A(f) mandates the disclosure of fair value gains or losses presented in other comprehensive income (OCI), disaggregated by:

- Investments Derecognized During the Period: This involves detailing the fair value gains or losses realized upon disposal of the investments within the reporting period.

- Investments Held at the Period’s End: This involves disclosing the fair value gains or losses for investments that remain on the balance sheet at the end of the reporting period.

Contractual Terms Affecting Cash Flows:

The amendments introduce Paragraphs 20B-20D, which require entities to provide qualitative and quantitative disclosures about the contractual terms that could change cash flows. These include:

- Nature of Contingent Events: Disclosures must describe the contingent events that could affect cash flows, such as financial covenants or conditions tied to performance metrics.

- Possible Changes to Cash Flows: Entities must explain how these contingent events could impact future cash flows, providing scenarios or sensitivity analyses if necessary.

- Gross Carrying Amounts: Disclosures should include the gross carrying amounts of financial assets and liabilities subject to these terms, helping users assess the potential variability in cash flows and the associated risks.

Implementation Timeline

The amendments to IFRS 9 are set to be effective for annual reporting periods beginning on or after January 1, 2026. However, entities are permitted to adopt these amendments earlier if they choose. Key points regarding the implementation timeline include:

- Simultaneous Application: If an entity opts for early application, it must implement all amendments at the same time and disclose this decision in the financial statements.

- No Restatement of Prior Periods: Entities are not required to restate prior periods to reflect the application of these amendments. This simplifies the transition process and reduces the administrative burden on preparers.

Necessary Adjustments for Compliance

To ensure compliance with the new amendments to IFRS 9 and IFRS 7, financial institutions will need to undertake several key steps:

- Review and Update Classification and Measurement Practices: Financial institutions must reassess their current classification and measurement practices for financial instruments to align with the updated guidance.

- Assess Contractual Cash Flow Characteristics: Entities need to carefully evaluate the contractual cash flows of financial assets to determine if they meet the SPPI criteria.

- Account for Electronic Settlements: Financial liabilities settled through electronic payment systems must be appropriately accounted for to reflect their extinguishment correctly.

- Update Systems and Procedures: Institutions may need to update their accounting systems, policies, and procedures to incorporate the new disclosure requirements and ensure accurate and timely reporting.

Disclosure Requirements in IFRS 7

The amendments to IFRS 7 are a significant step toward enhancing transparency and providing more comprehensive financial information to users. These changes are crucial for ensuring that financial statements offer a true and fair view of an entity’s financial position and performance, particularly regarding investments in equity instruments designated at Fair Value through Other Comprehensive Income (FVOCI) and the contractual terms affecting cash flows.

Investments in Equity Instruments Designated at FVOCI:

The amendments require detailed disclosures to provide a clearer picture of an entity's financial performance and position regarding equity investments. Specifically, Paragraph 11A(f) mandates the disclosure of fair value gains or losses presented in other comprehensive income (OCI), disaggregated by:

- Investments Derecognized During the Period: This involves detailing the fair value gains or losses realized upon disposal of the investments within the reporting period.

- Investments Held at the Period’s End: This involves disclosing the fair value gains or losses for investments that remain on the balance sheet at the

Contractual Terms Affecting Cash Flows: The amendments introduce Paragraphs 20B-20D, which require entities to provide qualitative and quantitative disclosures about the contractual terms that could change cash flows. These include:

- Nature of Contingent Events: Disclosures must describe the contingent events that could affect cash flows, such as financial covenants or conditions tied to performance metrics.

- Possible Changes to Cash Flows: Entities must explain how these contingent events could impact future cash flows, providing scenarios or sensitivity analyses if necessary.

- Gross Carrying Amounts: Disclosures should include the gross carrying amounts of financial assets and liabilities subject to these terms, helping users assess the potential variability in cash flows and the associated risks.

Necessary Adjustments for Compliance

To ensure compliance with the new amendments to IFRS 9 and IFRS 7, financial institutions will need to undertake several key steps:

- Review and Update Classification and Measurement Practices: Financial institutions must reassess their current classification and measurement practices for financial instruments to align with the updated guidance.

- Assess Contractual Cash Flow Characteristics: Entities need to carefully evaluate the contractual cash flows of financial assets to determine if they meet the SPPI criteria.

- Account for Electronic Settlements: Financial liabilities settled through electronic payment systems must be appropriately accounted for to reflect their extinguishment correctly.

- Update Systems and Procedures: Institutions may need to update their accounting systems, policies, and procedures to incorporate the new disclosure requirements and ensure accurate and timely reporting.

Reduce your

compliance risks