Master Regulatory Reporting Agreement (MRRA)

The Master Regulatory Reporting Agreement (MRRA), introduced on Dec 6, 2023, revolutionizes financial regulatory reporting. A collaborative effort of FIA, ICMA, ISLA, and ISDA, it streamlines compliance with EMIR and SFTR, enhancing transparency and efficiency in the financial sector.

Master Regulatory Reporting Agreement: Obligations and Financial Transactions

A noteworthy milestone in the financial sector was reached on December 6, 2023, with the publication of a comprehensive guidance on the Master Regulatory Reporting Agreement (MRRA). Four significant financial associations collaborated to create this guide: International Swaps and Derivatives Association, Inc. (ISDA), International Capital Market Association (ICMA), International Securities Lending Association (ISLA), and Futures Industry Association (FIA). Their objective was to clarify the function and implications of the MRRA for market players.

The MRRA is a crucial framework that was created to standardize and expedite financial firms' regulatory reporting procedures. Those that disclose financial transactions to trade repositories will find this agreement especially important. The creation of the MRRA is evidence of these influential trade associations' cooperative efforts, which included input and discussions from their varied memberships.

The MRRA places a strong emphasis on regulatory reporting requirements. It focuses on the requirements for securities financing transactions (SFTs) under the Securities Financing Transactions Regulation (SFTR) and for derivative transactions under the European Market Infrastructure Regulation (EMIR). Because of this, the MRRA is a crucial tool for organizations trying to abide by these rules.

It's crucial to realize that the MRRA guide is not a comprehensive manual, nevertheless. It does not address every facet of adhering to the laws and rules that are discussed. As a result, organizations intending to implement the MRRA ought to think about seeking legal advice. This stage is essential to ensuring that the MRRA is implemented appropriately and effectively in accordance with each entity's unique regulatory obligations and needs.

The implementation of the MRRA represents a major advancement in the effectiveness of regulatory reporting. It helps simplify procedures and make clear responsibilities, which lowers complexity and improves compliance in the financial industry. Understanding and putting the MRRA into practice could help organizations participating in derivative and securities financing transactions operate more efficiently and conform to regulations more closely.

Master Regulatory Reporting Agreement (MRRA): A Switch in Financial Regulation

A major development in the field of financial regulatory reporting will be brought about by the implementation of the Master Regulatory Reporting Agreement (MRRA) on December 6, 2023. The International Securities Lending Association (ISLA), the Futures Industry Association (FIA), the International Capital Market Association (ICMA), and the International Swaps and Derivatives Association, Inc. (ISDA) collaborated to create this agreement, which is designed to simplify and handle the intricacies of regulatory reporting. Entities engaged in derivative transactions under the Securities Financing Transactions Regulation (SFTR) and securities financing transactions under the European Market Infrastructure Regulation (EMIR) are the main focus of this regulation.

Understanding the MRRA's Role in Enhancing Compliance

- Targeted legislation: The MRRA is an essential tool for organizations that operate under the EMIR and SFTR regulatory frameworks because it carefully complies with these important EU legislation.

- The Need for Expert Consultation: Although the MRRA is a comprehensive handbook, it is not exhaustive. It is recommended that entities get advice from legal specialists to ensure that the application is accurate and effectively aligned with their particular regulatory needs.

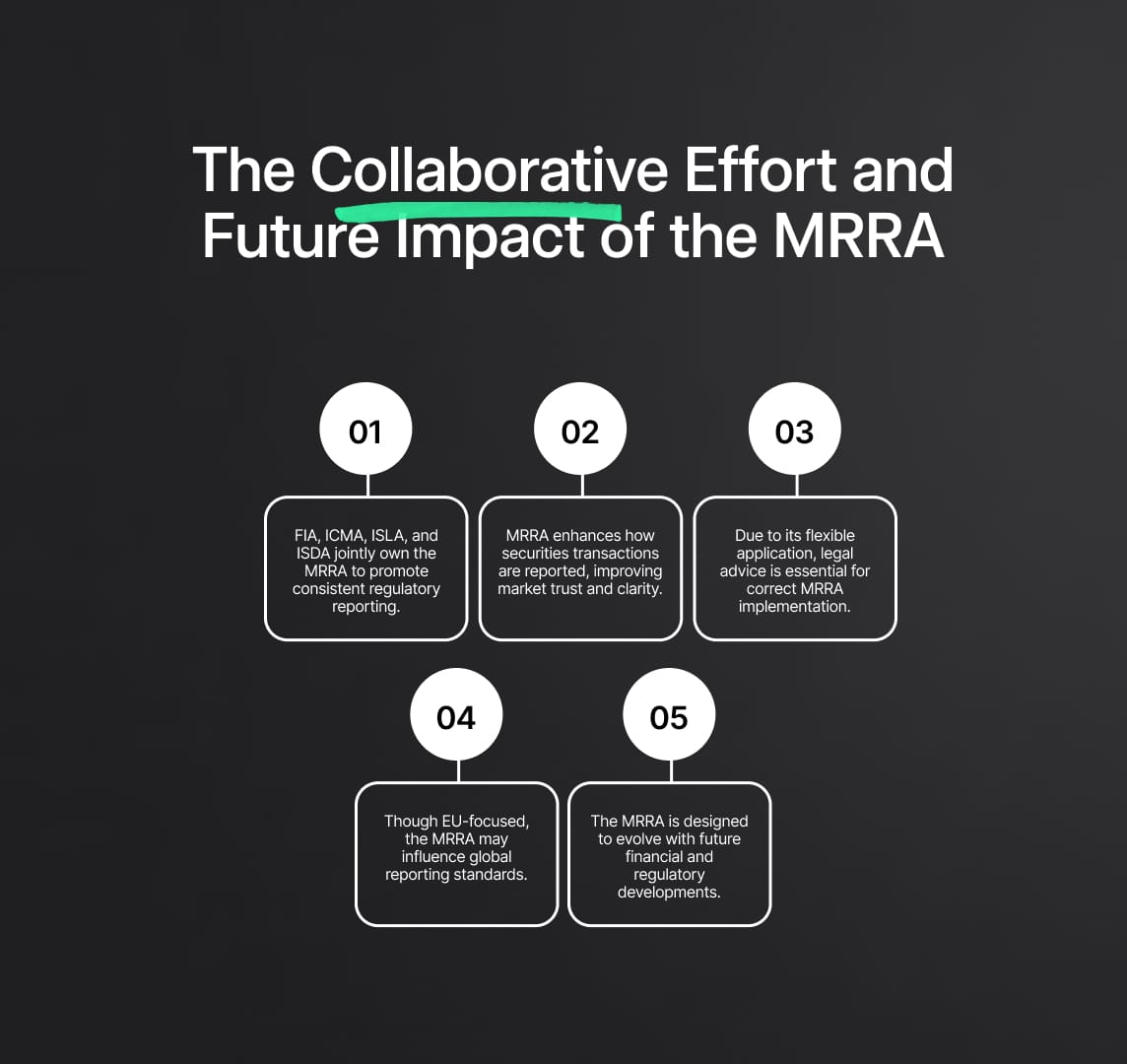

The Collaborative Effort and Future Impact of the MRRA

- Unified Regulatory Reporting: The FIA, ICMA, ISLA, and ISDA have shared the copyright of the MRRA, signifying a joint endeavor to standardize regulatory reporting practices.

- Improving Market Transparency: The MRRA is going to modify the way securities transactions are recorded in a big way, which will make the financial markets more transparent and trustworthy.

- Legal Considerations: Because the MRRA is a template that can be interpreted and applied in a variety of ways, legal advice is crucial when overcoming possible regulatory obstacles.

Expanding the Scope: Broader Implications of the MRRA

- Encouraging International Compliance: The MRRA's procedures and guiding principles may have an impact on regulatory reporting standards all over the world, despite its primary focus on the EU.

- Adapting to Market Dynamics: The MRRA provides a dynamic framework that may be adjusted to future market developments and is made to change with the financial landscape.

In the financial industry, the Master Regulatory Reporting Agreement (MRRA) establishes a new benchmark by providing a more simplified, effective, and transparent method of regulatory reporting. With its debut, financial entities underwent a sea change. It now emphasizes the value of being educated and seeking legal advice in order to fully utilize its potential. The Monetary Reserve Act (MRRA) is a critical regulatory framework that will shape the financial sector's future and should be taken into account by all companies that engage in derivative and securities financing operations.

Reduce your

compliance risks