MiCA Regulation: EBA Guidelines and Draft RTS

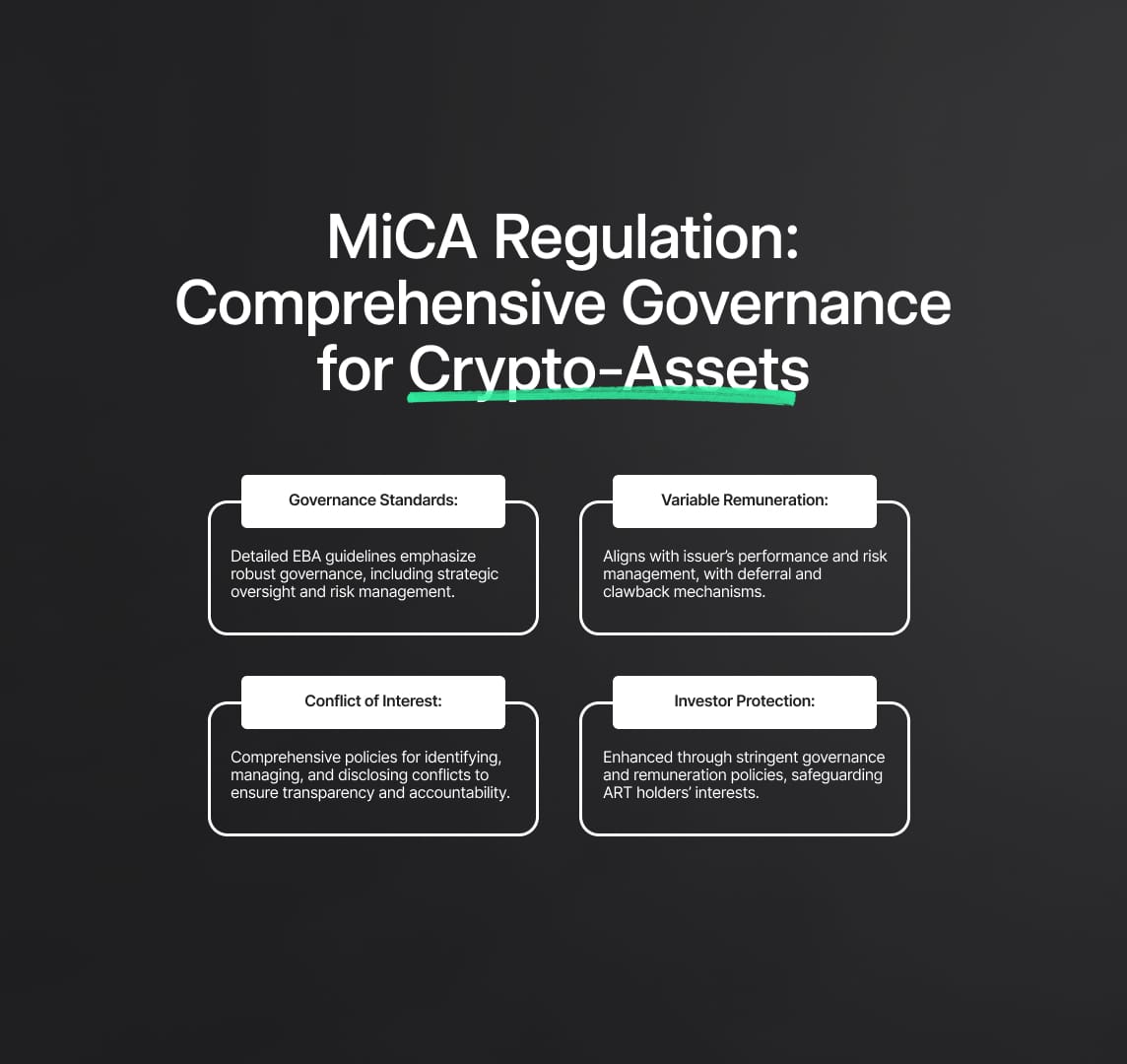

The MiCA Regulation establishes a comprehensive framework for crypto-assets in the EU, enhancing market integrity and consumer protection. The EBA provide guidelines and RTS for governance, remuneration, and conflict management for asset-referenced tokens (ARTs).

The Markets in Crypto-Assets Regulation (MiCA Regulation), formally known as Regulation (EU) 2023/1114, establishes a comprehensive and robust regulatory framework for the management and oversight of crypto-assets within the European Union. This landmark regulation aims to safeguard market integrity, enhance consumer protection, and ensure financial stability within the rapidly evolving and increasingly significant crypto-assets sector.

To ensure effective implementation of these regulatory standards, the European Banking Authority (EBA), in strategic collaboration with the European Securities and Markets Authority (ESMA) and the European Central Bank (ECB), has developed and issued detailed guidelines and Draft Regulatory Technical Standards (RTS). These regulatory tools are designed to enforce robust governance arrangements, formulate effective remuneration policies, and manage conflicts of interest comprehensively for issuers of asset-referenced tokens (ARTs).

The EBA guidelines provide a meticulous framework to help issuers of ARTs establish and maintain governance structures that align with the stringent requirements of the MiCA Regulation. The guidelines emphasize the importance of sound governance principles, such as transparency, accountability, and risk management. By adhering to these principles, issuers can ensure the stability and integrity of their operations.

The Draft Regulatory Technical Standards (RTS) further specify the technical and procedural requirements necessary to achieve compliance with the MiCA Regulation. These standards outline the essential elements of governance processes, remuneration policies, and conflict of interest management. They aim to create a uniform regulatory environment across the EU, fostering a level playing field and ensuring that all issuers operate under the same high standards of governance and risk management.

In this comprehensive analysis, we will delve into the intricate details of the EBA's regulatory products, focusing on the critical technical and governance aspects that are crucial for compliance under the MiCA Regulation. This analysis will provide valuable insights into the regulatory expectations for issuers of ARTs, elucidating the specific measures and frameworks that need to be adopted to meet the rigorous standards set forth by the MiCA Regulation.

Source

[1]

MiCA Regulatory Updates: Executive Summary

The EBA guidelines and Draft Regulatory Technical Standards (RTS) under the MiCA Regulation are meticulously crafted to ensure that issuers of asset-referenced tokens (ARTs) adhere to stringent governance standards, establish effective risk management frameworks, and implement comprehensive business continuity plans. These regulatory instruments emphasize the critical responsibilities of the management body, underscoring the necessity for robust internal controls to manage a spectrum of risks, including but not limited to money laundering, terrorist financing, operational risks, and cyber risks.

The guidelines delineate the minimum content of governance arrangements, specifying the requirements for a clear organizational structure, accountability mechanisms, and processes for risk identification and mitigation. This includes the establishment of effective monitoring tools, detailed business continuity plans, and rigorous internal control mechanisms. Furthermore, the guidelines advocate for thorough audit processes to ensure ongoing compliance and operational integrity.

The draft RTS extend these governance frameworks by detailing specific processes and policy elements required for effective remuneration and conflict of interest management. These standards ensure alignment with the overarching regulatory objectives of the MiCA Regulation, fostering a cohesive and transparent regulatory environment. The RTS cover key aspects such as the structure of variable remuneration, deferral and clawback mechanisms, and the management of conflicts of interest, ensuring that remuneration policies do not incentivize excessive risk-taking and that conflicts of interest are adequately identified, managed, and disclosed.

Background and Rationale

The rapidly evolving landscape of the crypto-assets market introduces significant risks to financial institutions and the broader financial system. These risks are multifaceted, encompassing operational vulnerabilities, cyber threats, compliance challenges, and market integrity issues. The MiCA Regulation, through the EBA’s guidelines and draft RTS, seeks to mitigate these risks by enforcing stringent governance and risk management standards.

Effective internal governance is paramount for ensuring the stability and integrity of issuers of ARTs. The EBA guidelines ensure that these entities have clear organizational structures, well-defined responsibilities, and robust processes for managing and reporting risks. This includes the development of comprehensive risk management frameworks that encompass all business lines and internal units, recognizing the economic substance of all risk exposures.

Remuneration policies are a critical component of this regulatory framework. The EBA’s draft RTS on remuneration ensure that these policies are designed to promote effective risk management and do not create incentives for excessive risk-taking. These standards detail the necessary governance processes for adopting and maintaining remuneration policies, ensuring that they align with the business and risk strategies of the issuer, including environmental, social, and governance (ESG) objectives.

Conflict of interest management is another essential aspect addressed by the EBA’s regulatory products. The draft RTS provide detailed requirements for identifying, preventing, managing, and disclosing conflicts of interest. This ensures that issuers of ARTs operate with transparency and integrity, safeguarding the interests of all stakeholders.

Markets in Crypto-Assets Regulation: Legal Basis

The legal foundation for the comprehensive regulatory framework established by the MiCA Regulation is detailed through several key articles that mandate specific governance, remuneration, and conflict of interest policies for issuers of asset-referenced tokens (ARTs). These mandates ensure a high level of consistency, transparency, and accountability within the crypto-assets market in the European Union.

Governance Arrangements

Article 34 of the MiCA Regulation is pivotal in defining the governance framework for issuers of ARTs. This article mandates that issuers must establish and maintain robust governance arrangements that include a clear organizational structure and effective risk management processes. Under Article 34(13), the European Banking Authority (EBA) is specifically tasked with developing detailed guidelines to further specify these governance requirements. These guidelines are crucial for ensuring that issuers of ARTs operate with a high degree of integrity, accountability, and transparency, thus fostering trust and stability in the crypto-assets market.

Remuneration Policies

Article 45(1) of the MiCA Regulation outlines the requirements for remuneration policies for issuers of significant ARTs. This article mandates that these issuers adopt, implement, and maintain remuneration policies that promote effective risk management and do not incentivize the relaxation of risk standards. The EBA, under the authority of Article 45(7)(a), is responsible for developing Regulatory Technical Standards (RTS) to specify the minimum content of these governance arrangements. These standards ensure that remuneration policies are aligned with the long-term interests of the issuer, including environmental, social, and governance (ESG) objectives, and that they contribute to the overall stability and integrity of the financial system.

Conflicts of Interest

Article 32(1) of the MiCA Regulation addresses the critical issue of conflicts of interest, requiring issuers of ARTs to implement comprehensive policies and procedures to identify, prevent, manage, and disclose conflicts of interest. The EBA’s draft RTS, developed under Article 32(5), provide detailed requirements for these policies and procedures. These standards are essential for maintaining the integrity of issuers’ operations and ensuring that conflicts of interest are managed in a way that protects the interests of all stakeholders, including investors and consumers.

MiCAR Detailed Guidelines

1. Application of the Proportionality Principle

The principle of proportionality is a core element of the MiCA Regulation, ensuring that governance arrangements are appropriately tailored to the size, complexity, and risk profile of each issuer. This principle is applied by considering several factors:

- Size of the Issuer: The balance sheet total and the overall scale of operations are critical in determining the proportionality of governance arrangements.

- Legal Form: The legal structure of the issuer, including whether it is a listed entity, influences the application of governance requirements.

- Significance of ARTs: The classification of ARTs as significant or non-significant under Articles 43, 44, 56, and 57 of MiCAR affects the governance framework.

- Business Model: The complexity and volume of ARTs issued, trading status, and the consensus mechanisms employed are vital considerations.

- Risk Profile: The inherent risks associated with the issuer’s activities and the complexity of these activities are fundamental to the proportionality assessment.

- Use of Third-Party Providers: Dependencies on external service providers and distribution channels must be factored into the governance arrangements.

2. Role and Composition of the Management Body

The management body plays a crucial role in defining, overseeing, and ensuring the implementation of sound governance arrangements. The responsibilities of the management body include:

- Strategic Oversight: Approving and overseeing the implementation of business strategies and policies to ensure alignment with regulatory requirements.

- Risk Management: Establishing the risk appetite, developing a risk management framework, and implementing internal controls to manage various risks effectively.

- Compliance and Audit: Ensuring the establishment of effective compliance functions and internal audit mechanisms to monitor adherence to regulatory standards.

- Conflict of Interest Management: Developing and implementing policies to identify, prevent, manage, and disclose conflicts of interest, ensuring transparency and accountability.

The management body must ensure that governance arrangements are well-documented, regularly reviewed, and updated to address any identified weaknesses. This includes ensuring effective interaction between management and supervisory functions and maintaining accountability throughout the organization.

3. Governance Framework

Issuers of ARTs are required to maintain a transparent organizational structure that facilitates effective internal controls and compliance with regulatory requirements. Key elements of the governance framework include:

- Internal Control Functions: Ensuring that compliance, risk management, and internal audit functions are adequately resourced and operate independently.

- Outsourcing: Developing robust policies for outsourcing critical functions, ensuring that accountability and compliance with regulatory obligations are maintained.

- Group Context: For issuers that are part of a group, ensuring that governance arrangements are consistent across the group and aligned with overall business and risk strategies.

The guidelines emphasize the importance of a “know your structure” approach, where the management body fully understands the legal, organizational, and operational structure of the issuer and ensures its alignment with the business and risk strategies.

4. Risk Culture and Business Conduct

A strong risk culture is integral to effective risk management. The guidelines advocate for policies that promote ethical behavior, accountability, and open communication. Specific requirements include:

- Tone from the Top: The management body should set and communicate core values and expectations to all staff.

- Accountability: Ensuring that staff at all levels understand and adhere to the issuer’s risk appetite and core values.

- Effective Communication: Encouraging open dialogue and constructive challenge within the organization to identify and address risks proactively.

- Incentives: Aligning risk-taking behavior with the issuer’s long-term interests, particularly for significant ARTs issuers.

The guidelines also address the need for gender-neutral policies, equal opportunities, and the monitoring of gender pay gaps to ensure fair and equitable treatment of all employees.

5. Internal Control Framework

Issuers of ARTs should establish a comprehensive internal control framework covering all aspects of their operations. This includes:

- Risk Management Framework: Adopting a holistic approach to risk management that encompasses all business lines and internal units, recognizing the economic substance of all risk exposures.

- Operational Risk Management: Developing policies for identifying, assessing, and mitigating operational risks to ensure operational resilience.

- Compliance: Ensuring compliance with legal, regulatory, and internal policy requirements through effective monitoring and reporting mechanisms.

- Audit: Conducting regular internal audits to review the effectiveness of internal controls and governance arrangements, identifying areas for improvement.

The internal control framework should be regularly reviewed and updated to reflect changes in the risk environment and business operations, ensuring that the issuer remains compliant with regulatory requirements.

6. Business Continuity Management

Issuers of ARTs should have robust business continuity plans to ensure the ongoing performance of core activities during disruptions. These plans should include:

- Data Preservation: Implementing measures to protect essential data and functions from loss or corruption.

- Operational Resilience: Developing strategies for the timely recovery and resumption of activities following a disruption.

- ICT Continuity: Ensuring the resilience of ICT systems and compliance with the Digital Operational Resilience Act (DORA), which sets standards for the security and continuity of digital operations.

MiCA Draft RTS on Governance Arrangements for Remuneration Policies

The Draft Regulatory Technical Standards (RTS) on governance arrangements for remuneration policies under the MiCA Regulation provide a detailed framework aimed at ensuring that remuneration practices within issuers of asset-referenced tokens (ARTs) promote sound risk management and align with the overarching objectives of market integrity and financial stability.

Markets in Crypto-Assets Regulation: Governance of Remuneration

The management body of the issuer is mandated to approve and retain ultimate responsibility for the remuneration policy. This includes the following key responsibilities:

- Policy Approval and Oversight: The management body must ensure that the remuneration policy is aligned with the issuer’s overall business and risk strategy. This involves regular reviews and updates to the policy to reflect changes in the operational and regulatory environment.

- Advisory Role of the Remuneration Committee: Where a remuneration committee is established, it must provide expert advice and recommendations to the management body on the structuring and implementation of the remuneration policy. This committee should be composed of individuals with the necessary expertise and independence to offer unbiased advice.

- Annual Compliance Review: The implementation of the remuneration policy must be reviewed annually to ensure compliance with regulatory standards and internal policies. This review can be outsourced to an external party to provide an independent assessment, thereby enhancing objectivity and transparency.

- Conflict of Interest Management: The governance framework must include mechanisms to identify and mitigate potential conflicts of interest that could arise from the payout of instruments as part of remuneration. This is crucial to maintaining the integrity of the remuneration practices and ensuring that they do not compromise the issuer’s risk management framework.

MiCAR Remuneration Policies

Issuers are required to establish remuneration policies that are consistent with the rights and interests of token holders, gender-neutral, and aligned with both business and risk strategies. These policies must adhere to the following principles:

- Alignment with Business and Risk Strategies: Remuneration policies must support the issuer’s long-term strategic goals, including environmental, social, and governance (ESG) objectives. This ensures that remuneration practices contribute positively to the issuer's sustainability and ethical standards.

- Avoidance of Conflicts of Interest: Policies should include clear guidelines to prevent conflicts of interest, particularly ensuring that control functions are remunerated independently of the business areas they oversee. This separation is vital for maintaining the objectivity and effectiveness of control functions.

- Transparency and Documentation: Remuneration policies must be well-documented and transparent. This includes clear communication of the policy’s objectives, criteria for performance evaluation, and procedures for variable remuneration. Transparent policies help build trust with stakeholders and ensure regulatory compliance.

Variable Remuneration

The RTS set forth specific criteria for the structure of variable remuneration to ensure it aligns with the issuer’s risk management framework and overall performance. Key requirements include:

- Risk Alignment: Variable remuneration should be directly linked to the issuer’s performance, considering both financial and non-financial criteria, including ESG factors. This alignment ensures that remuneration reflects the issuer’s long-term health and sustainability.

- No Guaranteed Variable Remuneration: Guarantees should only be provided for new staff during their first year of employment to attract talent without undermining long-term risk management practices.

- Deferral and Clawback Mechanisms: At least 40% of variable remuneration must be deferred for a period of 3-5 years, with higher deferral percentages for particularly high amounts. Additionally, malus and clawback provisions must be applied in cases of significant losses or misconduct to ensure that remuneration reflects true performance and risk outcomes.

- Balance of Remuneration: Fixed remuneration must be sufficiently high to allow the variable component to be reduced to zero if necessary. This ensures that staff are not unduly incentivized to take excessive risks to achieve variable pay targets.

- Payout in Instruments: At least 50% of variable remuneration should be paid in instruments such as shares, share-linked instruments, or significant tokens issued by the issuer. This practice aligns the interests of staff with those of the issuer and its stakeholders, promoting long-term commitment and performance.

Identification of Staff

Issuers must identify staff whose professional activities have a material impact on the risk profile of the issuer or the tokens issued. This process involves:

- Management and Senior Staff: This includes members of the management body, senior management, and staff with significant influence over the issuer’s operations and risk profile.

- Managerial Responsibility: Identifying staff with managerial responsibility over control functions or material business units. These individuals play a critical role in the issuer’s risk management and operational stability.

- Qualitative Criteria: The identification process should be based on qualitative criteria linked to the staff’s functions and responsibilities. This ensures that all relevant individuals are subject to appropriate remuneration policies and oversight.

Markets in Crypto-Assets Regulation Draft RTS on Conflicts of Interest

Definition and Scope

The Draft Regulatory Technical Standards (RTS) on conflicts of interest provide a comprehensive framework for identifying, preventing, managing, and disclosing conflicts of interest (CoI) within issuers of asset-referenced tokens (ARTs). A "conflict of interest" is defined as any situation where the issuer or connected persons—such as employees, management body members, or other stakeholders—have interests that may conflict with those of ART holders. The policies and procedures prescribed by the RTS must encompass all activities of the issuer, including the issuance, processing, redemption, and management of the reserve of assets. This broad scope ensures that potential conflicts are addressed at every stage of the ART lifecycle.

Governance Framework

The governance framework for managing conflicts of interest is a critical component of the RTS. The management body of the issuer holds the primary responsibility for defining, adopting, and ensuring the effective implementation of CoI policies and procedures. Key elements of this framework include:

- Identification of Conflicts: The management body must establish mechanisms for identifying potential conflicts of interest related to personal, professional, and economic interests. This involves conducting regular assessments and maintaining updated records of potential conflicts.

- Preventive Measures: Implementing robust preventive measures is crucial to mitigating conflicts before they arise. This includes separating conflicting duties, controlling information flows to prevent misuse, and establishing clear protocols for interaction between different parts of the organization.

- Management of Conflicts: When conflicts are unavoidable, the issuer must have procedures in place for managing them effectively. This includes mandatory abstention from decision-making in situations where conflicts are identified, thereby ensuring that decisions are made impartially and in the best interest of ART holders.

- Disclosure Requirements: Transparency is paramount in managing conflicts of interest. The RTS require issuers to disclose conflicts of interest adequately to ART holders. This involves providing clear and detailed information on the issuer's website and other relevant platforms, ensuring that ART holders are fully informed of any potential conflicts and the measures taken to address them.

Specific Provisions

The RTS outline specific requirements for managing various aspects of conflicts of interest, ensuring comprehensive coverage and effective management. These include:

- Personal Transactions: Establishing rules for identifying, notifying, and documenting personal transactions involving ARTs to prevent conflicts of interest. This includes maintaining a register of personal transactions and conducting regular audits to ensure compliance.

- Remuneration Policies: Ensuring that remuneration arrangements do not create conflicts of interest or incentives that could harm ART holders. This involves aligning remuneration policies with long-term performance and risk management objectives, avoiding short-term incentives that could lead to excessive risk-taking.

- Third-Party Relationships: Managing conflicts arising from third-party services, particularly those related to the reserve of assets. This includes conducting thorough due diligence on third-party providers, ensuring that contracts include clear conflict of interest clauses, and regularly reviewing third-party relationships to identify and mitigate potential conflicts.

Adequate Resources

To effectively manage conflicts of interest, issuers must allocate sufficient resources to this function. This includes:

- Dedicated CoI Manager: Appointing a dedicated person responsible for managing conflicts of interest. This individual should have direct access to the management body and the necessary authority to enforce CoI policies.

- Training and Awareness: Providing ongoing training and raising awareness among staff about conflict of interest policies and procedures. This ensures that all employees understand their responsibilities and can identify and report potential conflicts.

MiCA Disclosure and Transparency

The RTS place a strong emphasis on transparency in managing conflicts of interest. Issuers must:

- Detailed Disclosures: Provide detailed disclosures of the general nature and sources of conflicts, the associated risks, and the measures taken to mitigate them. This information must be easily accessible to ART holders and updated regularly to reflect any changes.

- Regular Updates: Ensure that disclosures are not static but are regularly reviewed and updated. This involves conducting periodic reviews of conflict of interest policies and procedures, and updating disclosures to reflect any new conflicts or changes in the management of existing conflicts.

- Accessibility: Make disclosures accessible through multiple channels, including the issuer's website and other relevant platforms. This ensures that ART holders can easily access and understand the information they need to make informed decisions.

MiCA Draft RTS: Accompanying Documents

Cost-Benefit Analysis / Impact Assessment

The European Banking Authority (EBA) conducted a comprehensive impact assessment to evaluate the potential costs and benefits of implementing the draft Regulatory Technical Standards (RTS) under the MiCA Regulation. This assessment is crucial for understanding the practical implications of the RTS on issuers of asset-referenced tokens (ARTs) and the broader market.

Costs

The impact assessment identified several areas where issuers might incur additional costs:

- Implementation Costs: Issuers will face initial costs associated with developing and implementing new conflict of interest (CoI) policies and procedures. This includes expenses related to the design, documentation, and integration of these policies into existing governance frameworks.

- Training and Development: Costs related to training staff on new CoI policies and procedures are expected. Continuous education and awareness programs are necessary to ensure all employees understand and comply with the new requirements.

- Compliance Monitoring: Ongoing costs will be incurred to maintain compliance with the RTS. This includes regular audits, monitoring activities, and potential adjustments to policies and procedures as the regulatory environment evolves.

- Disclosure Requirements: Issuers must allocate resources to ensure that disclosures related to conflicts of interest are detailed, accessible, and regularly updated. This might involve investments in IT systems to manage and publish disclosure information effectively.

Despite these moderate incremental costs, the assessment highlights that the benefits significantly outweigh the expenses.

Benefits

The EBA's impact assessment outlines several key benefits associated with the implementation of the draft RTS:

- Enhanced Investor Protection: By enforcing stringent CoI policies, the RTS significantly enhance the protection of investors. Transparent and well-managed conflict of interest frameworks ensure that the interests of ART holders are safeguarded against potential misalignments with those of the issuer or its employees.

- Improved Transparency: The RTS foster a culture of transparency within issuers of ARTs. Detailed disclosure requirements ensure that ART holders and other stakeholders have access to pertinent information about potential conflicts of interest and the measures taken to mitigate them.

- Stronger Governance Framework: The implementation of the RTS contributes to a more robust and reliable governance framework for issuers of ARTs. This leads to improved decision-making processes, better risk management, and increased overall operational integrity.

- Consistency Across the EU: The RTS aim to harmonize conflict of interest management across the European Union. This consistency helps maintain a level playing field, reducing regulatory arbitrage and ensuring that all issuers adhere to the same high standards of governance and transparency.

Feedback from Public Consultation

The EBA conducted a public consultation to gather feedback from various stakeholders, including private sector associations, academic institutions, and other industry participants. The consultation process is integral to refining and enhancing the draft RTS to ensure they are practical, effective, and aligned with industry needs.

- General Support: Feedback from the consultation generally supported the RTS, acknowledging their importance in enhancing transparency and protecting investors. Stakeholders recognized the necessity of robust CoI policies to maintain trust and stability in the crypto-assets market.

- Proportionality and Clarity: Some respondents requested greater proportionality in the requirements, suggesting that the RTS should be tailored to the size and complexity of different issuers. Additionally, there were calls for further clarification on specific aspects of the RTS to ensure they are easily interpretable and implementable.

- Additional Guidance: Stakeholders also sought additional guidance on implementing certain provisions of the RTS, particularly around the practical aspects of identifying and managing conflicts of interest.

In response to this feedback, the EBA refined the RTS to ensure they are proportionate, clear, and supported by comprehensive guidance. These adjustments help make the RTS more practical for issuers while maintaining their effectiveness in managing conflicts of interest.

Reduce your

compliance risks