MiCA Regulation & MIFID Alignment

MiFID II and MiCA Regulation transform the EU digital finance landscape, enhancing transparency, investor protection, and innovation. Bridging traditional and digital assets, they set global standards for a secure, equitable financial ecosystem.

Regarding regulations for digital assets, the European Securities and Markets Authority (ESMA) has released two consultation papers. Reverse solicitation is the subject of one paper, which requests feedback on the requirements and oversight procedures for the exemption. The other study seeks to bridge the gap between MiFID II and MiCA legislation by defining precise standards for categorizing cryptocurrency assets as financial instruments. ESMA anticipates publishing a final report in Q4 2024, and the consultations will remain available until April 29, 2024.

Source

[1]

On June 9, 2023, the European Union introduced the Markets in Crypto-Assets Regulation (MiCA), which is a significant step forward in the regulation of digital finance. MiCA, which was designed to smoothly incorporate crypto-assets into the European financial system, is a reflection of the EU's commitment to establishing a safe, transparent, and innovative market. This extensive legislative framework demonstrates the EU's progressive approach to guaranteeing a uniform regulatory framework among all EU members. MiCA's main goals are to protect investor interests, spur the development of financial technology advancements, and maintain the integrity and stability of the digital asset markets.

MiCA Regulation: Building a Unified Regulatory Environment for Crypto-Assets

The strategic goal of MiCA is to lessen the regulatory difficulties and inconsistencies around digital assets that have historically hampered the financial markets. MiCA makes it easier for cryptoassets to be integrated into the European financial system by creating a single set of guidelines and standards. In order to decrease market fragmentation, which is a major element that can erode investor trust and the integrity of the market as a whole, regulatory harmonization is important. By implementing such policies, MiCA hopes to level the playing field for all parties involved in the market and give investors more confidence and transparency while navigating the crypto-asset industry.

Enhancing Investor Protection and Market Integrity

Improving the degree of protection available to investors is one of MiCA's primary goals. MiCA aims to protect investors from the inherent risks associated with the volatile and occasionally opaque nature of crypto-assets by enforcing strict regulatory standards. This is made possible by thorough oversight procedures and precise regulations that control how crypto-asset services are run inside the European Union. Furthermore, the framework of MiCA is intended to suppress fraudulent activity and manipulative behaviours in the digital asset markets, strengthening the integrity and stability of the market.

Fostering Innovation in the Fintech Sector

In addition to regulating, MiCA seeks to promote innovation in the fintech industry. Acknowledging the ever-changing and dynamic realm of digital banking, the regulations have been designed to facilitate the advancement of novel technology and business strategies. MiCA inspires entrepreneurs and innovators to investigate and create blockchain and crypto-asset solutions that can improve financial services by offering a clear regulatory roadmap. In order to promote innovation without jeopardizing the security and safety of the market and its players, regulatory clarity is essential.

Market Transparency: MiFID and MiCA Regulation

A ground-breaking effort by the European Union to transform the digital asset ecosystem into a model of openness, justice, and resilience is the Markets in Crypto-Assets Regulation (MiCA). The establishment of a regulatory framework that guarantees investor safety and trust in the crypto-asset industry while simultaneously promoting innovation is fundamental to MiCA's philosophy. The smooth expansion and integration of digital assets into the EU's wider financial ecosystem depend on this strategic commitment.

In compliance with the Markets in Financial Instruments Directive II (MiFID II), MiCA takes a progressive, technology-neutral stance that successfully closes the gap between digital and conventional financial instruments, promoting an environment of regulation that upholds investor protection and market integrity.

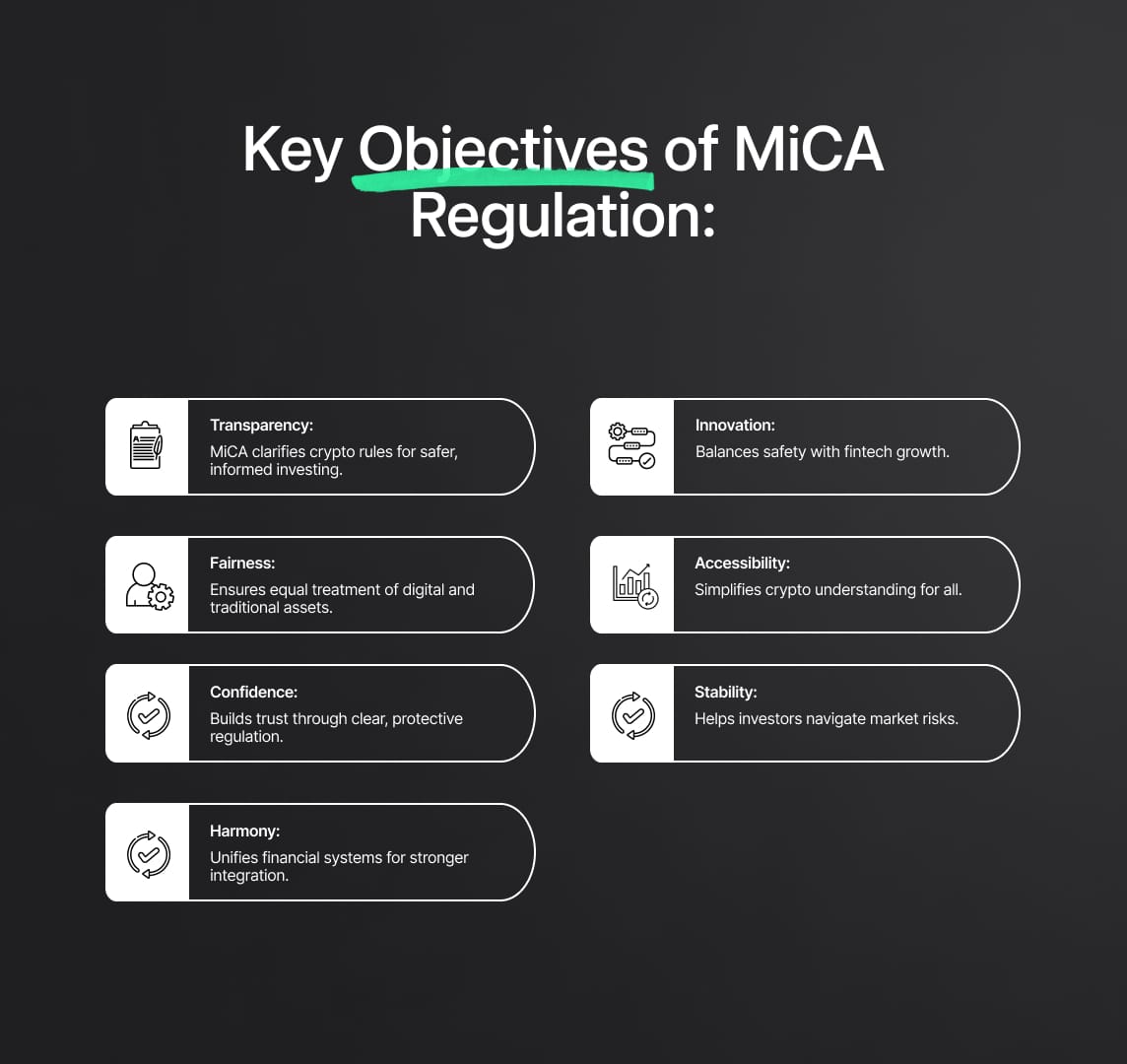

Key Objectives of MiCA Regulation:

- Enhancing Market Transparency: MiCA seeks to make the regulatory environment around cryptoassets clearer, easier to understand, and accessible to all parties involved in the market. Informed decision-making is made possible by this transparency, which also improves investor protection against the dangers and volatility that come with investing in the cryptocurrency market.

- Encouraging Fairness and Equity: MiCA highlights the EU's commitment to a single financial ecosystem by arguing for the equitable treatment of all financial instruments. This perspective promotes a market that fosters stability and economic prosperity by allowing traditional financial systems to coexist with digital advances.

- Increasing Investor Confidence: MiCA aims to increase investor confidence by implementing a thorough regulatory framework. The regulation makes that investors have the skills and information needed to securely navigate the digital asset market by outlining clear principles and standards.

- Ensuring Safety and Fostering Innovation: MiCA strikes a compromise between the need to safeguard investors and to foster technical innovation. In order to maintain market integrity and support continued growth and innovation in the digital asset sector, this equilibrium is necessary.

Impact on the Digital Asset Market:

- Enhanced Accessibility and Understanding: MiCA helps investors, regulators, and other stakeholders better understand the digital market by breaking down the misconceptions around crypto-assets. This enhanced comprehension is essential to creating a safe and trusting atmosphere.

- Making Well-Informed Decisions: MiCA shields investors from the volatility of the cryptocurrency market by implementing open and honest regulatory procedures.

- Harmonized Financial Environment: A harmonized financial ecosystem is made possible by MiCA's emphasis on technology neutrality and equal treatment. A stronger economy results from this integration, which promotes the coexistence and mutual reinforcement of traditional and digital financial systems.

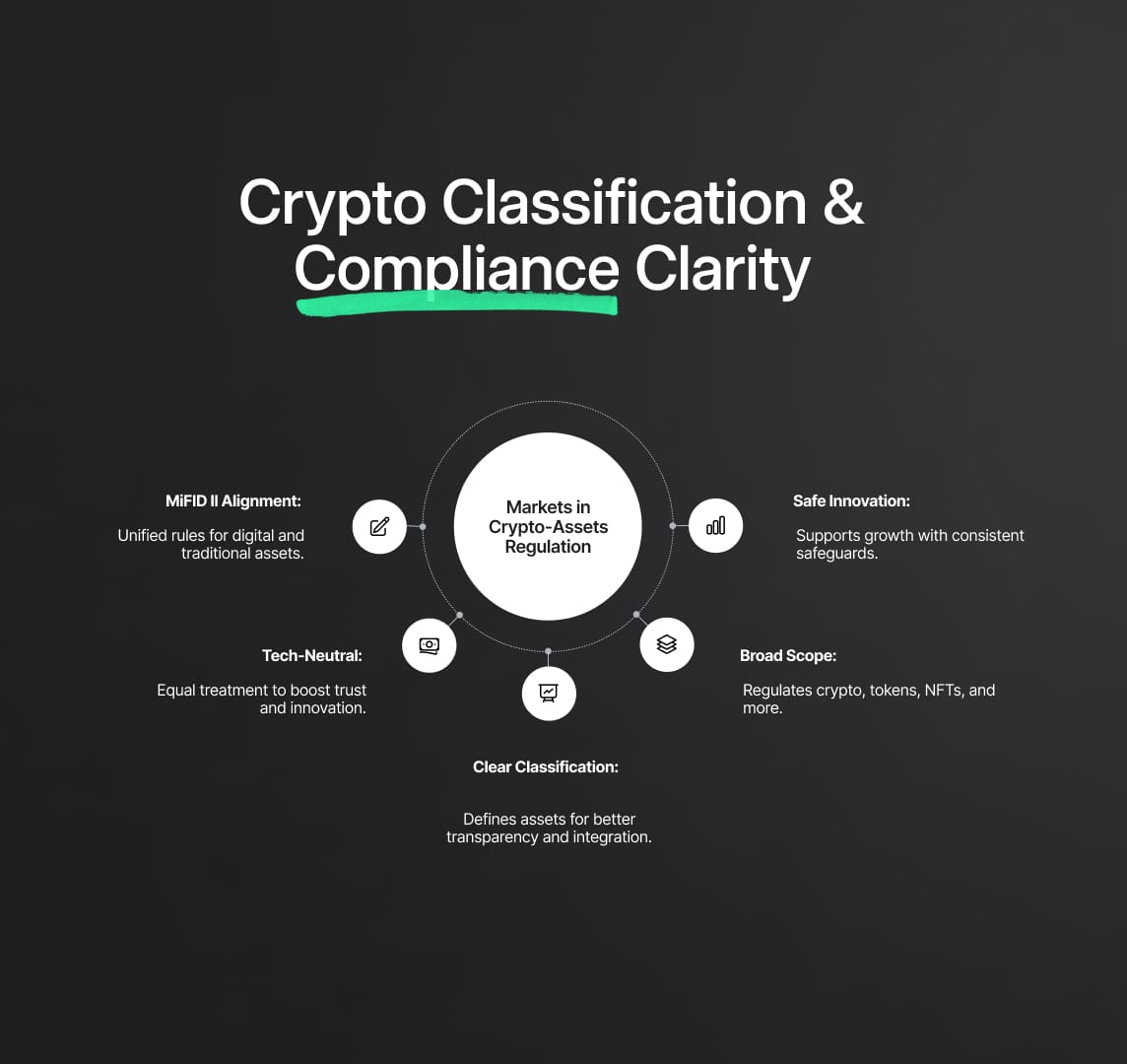

Clarifying Crypto-Asset Classifications and Compliance Requirements

One of the main accomplishments of the Markets in Crypto-Assets Regulation (MiCA) is the establishment of a regulatory framework that is balanced for crypto-assets. This regulation effortlessly complies with the Markets in Financial Instruments Directive II (MiFID II). A fair and growth-oriented regulatory environment for both digital and traditional financial assets is ensured by this strategic alignment. The salient features of this strategy consist of:

- Technology-Neutral Position: MiCA takes a technology-neutral stance, guaranteeing that all financial assets are treated equally. This crucial tactic:

- Encourages competition and innovation in the financial industry.

- Promotes investor trust by creating a safe and dependable regulatory framework.

- Creates an equitable environment for both traditional and digital assets, promoting a vibrant market ecology.

- Clarity in Compliance and Crypto-Asset Classifications: MiCA's sophisticated method to categorizing cryptoassets and defining compliance needs establishes a new standard for market integration and regulatory clarity. Important elements consist of:

- Increased Market Transparency: MiCA considerably increases market transparency by establishing precise standards for the categorization of cryptocurrency assets. This is accomplished by:

- Detailed explanations of transferability, interchangeability, and issuance.

- A well-defined framework that bridges the gap between cutting-edge technology and conventional financial practices by making it easier to integrate digital assets into traditional financial systems.

- This all-encompassing strategy guarantees that every class of digital assets is governed in line with its distinct features and functions, preserving the integrity of the market and encouraging innovation.

- Comprehensive Regulatory Scope: A vast range of digital assets are covered by MiCA's regulatory framework, including but not limited to:

- Cryptocurrencies

- Utility tokens

- Non-fungible tokens (NFTs)

- Other innovative digital asset forms

- Encouraging Innovation in a Safe Environment: The well-rounded approach of the regulation guarantees that the innovative potential of digital assets is fully realized while also protecting the integrity of the financial market. MiCA provides a safe and technologically-friendly regulatory environment by taking into account the unique characteristics of each digital asset class. This helps to:

- Safeguarding participants in the market and investors.

- Promoting the smooth transition between traditional financial systems and digital developments.

- Promoting the steady expansion of the digital economy by enforcing uniform, transparent regulations.

In conclusion, MiCA's technology-neutral strategy and strategic alignment with MiFID II result in a regulatory framework that is open, transparent, and conducive to innovation. MiCA sets a precedent for the regulation of digital finance by elucidating the classifications of cryptoassets and the requirements for compliance, so improving market transparency and fostering the integration of digital assets into the global financial ecosystem.

Regulatory and the Strategic Role of ESMA in MiCA Implementation

A key role in the coordination and execution of the MiCA regulatory framework is played by the European Securities and Markets Authority (ESMA). ESMA is responsible for the critical task of creating technical standards and guidelines, which plays a pivotal role in converting MiCA's ambitious regulatory goals into concrete, legally binding regulations. The importance of ESMA's involvement in guaranteeing the effective integration and consistent implementation of MiCA throughout the European Union is highlighted by this strategic function.

The fact that ESMA has released important Consultation Papers demonstrates how proactive it has been in elucidating the nuances and application of MiCA. These publications are essential tools for clarifying the finer points of reverse solicitation exemptions and the precise classification of crypto-assets, giving stakeholders a thorough grasp of MiCA's regulatory scope. The principles outlined in these Consultation Papers are essential for navigating the intricacies of the digital asset market since they provide a clear road map for MiCA's practical application and make it easier for EU member states to comply with its directives.

ESMA's tireless work is crucial in tackling the regulatory issues that arise from the ever-changing digital asset market. ESMA guarantees that the MiCA law accomplishes its goals of market transparency, investor protection, and the smooth integration of digital assets into the larger financial ecosystem by promoting regulatory synchronization and offering a clear framework for compliance. The cooperation between national regulatory bodies and ESMA enhances the efficacy of MiCA and establishes a standard for regulatory compliance and excellence in the digital era.

In conclusion, the goal of the law is to create a transparent, secure, and innovative digital banking ecosystem. This goal is greatly aided by the explanations offered by MiCA on crypto-asset classifications and compliance requirements, as well as the strategic role of ESMA. The European Union is now at the forefront of digital finance regulation thanks to these efforts, which also improve the efficiency and integrity of the digital asset market and open the door for future developments in the global financial system.

Markets in Crypto Assets Regulation: A Comprehensive Overview

Digital assets are now an essential part of the world's financial landscape in the ever changing financial environment of today. One noteworthy regulatory initiative that demonstrates the European Union's leadership in promoting regulatory innovation and foresight for the digital asset market is the Markets in Crypto-Assets Regulation (MiCA). This thorough analysis emphasizes MiCA's contribution to the development of a regulatory framework that is flexible and aware of the changing dynamics of digital finance.

Key Highlights of MiCA:

- Regulatory Innovation and Foresight: Specifically created to negotiate the intricacies of the constantly changing digital asset market, MiCA marks a substantial advancement in regulatory thought. It provides a strong framework that harmonizes innovation with fundamental ideas of investor protection and market integrity.

- Adaptable and Prospective Structure: Through MiCA, the European Union is demonstrating its commitment to creating a regulatory framework that is both ready for upcoming developments in the field of digital finance and sensitive to the dynamics of the market today.

- Empowering Stakeholders: MiCA is a vital resource for many different types of stakeholders, such as:

- Investors

- Financial Institutions

- Regulatory Bodies

By enhancing stakeholders' comprehension of the intricacies of digital money, this comprehensive legislation hopes to encourage efficient navigation and adherence within the ecosystem.

- Addressing Emerging Digital Asset Categories: MiCA expands its scope to include novel and developing asset classes in addition to conventional crypto-assets, such as:

- Non-fungible tokens (NFTs)

- Fractionalized NFTs (F-NFTs)

- Hybrid crypto-assets

- Utility tokens

MiCA creates a worldwide standard by addressing the particular regulatory issues these assets bring, enabling stakeholders to interact with the digital asset market in a secure and confident manner.

Setting a Global Standard for Crypto-Asset Regulation

The European Union's steadfast commitment to creating a secure, effective, and innovation-friendly environment for cryptoassets is demonstrated by the creation of MiCA. The regulation's all-encompassing strategy skillfully strikes a balance between the necessity of enabling market growth and the requirement for regulatory monitoring, establishing the EU as a leader in the world of crypto-asset regulation. This innovative approach has the potential to impact international norms for the regulation of digital assets in addition to revolutionizing the European market.

It is impossible to exaggerate the importance of MiCA in creating a robust and vibrant market as the landscape of digital assets keeps growing and changing. The European Securities and Markets Authority (ESMA) is leading the initiative on the regulation's proactive measures, which are essential to defining and upholding the regulatory framework. These actions are backed by extensive recommendations. This marks the beginning of a new era in the regulation of digital finance by ensuring a stable, transparent, and safe digital asset landscape throughout the EU.

MiCA strengthens the integrity of the digital asset market by facilitating market integration, reducing fragmentation, and enhancing investor trust through the establishment of explicit norms and standards. Consequently, MiCA is positioned strategically to not only accommodate the current environment but also to adjust to emerging breakthroughs and difficulties in the field of digital finance. This progressive stance highlights the EU's pivotal role in establishing a worldwide standard for regulating crypto-assets, guaranteeing the continued vitality, safety, and innovation-friendly nature of the digital finance sector.

Reduce your

compliance risks