MiCA Regulation: Stability and Resilience for ARTs and EMTs

EU updates the MiCA Regulation for ARTs and EMTs, requiring a 20% increase in own funds and mandatory stress tests to address systemic risks and ensure financial stability.

On December 13, 2024, the European Commission introduced a Delegated Regulation supplementing the Markets in Crypto-Assets Regulation (MiCA). This update specifically addresses the regulatory technical standards (RTS) governing Asset-Referenced Tokens (ARTs) and E-Money Tokens (EMTs). The development of this Delegated Regulation was coordinated with the European Banking Authority (EBA), alongside the European Central Bank (ECB) and the European Securities and Markets Authority (ESMA).

The purpose of this update is twofold:

- Strengthening Financial Resilience: By requiring ART and EMT issuers to maintain higher levels of own funds, the regulation mitigates potential systemic risks associated with these tokens.

- Introducing Stress Testing Requirements: Ensuring issuers regularly conduct both liquidity and solvency stress tests to assess vulnerabilities in adverse financial scenarios.

The ultimate aim is to build a resilient and sustainable regulatory environment that protects investors and strengthens financial stability within the European crypto-asset market. By addressing risks related to reserve asset management, redemption processes, and liquidity, the MiCA Regulation seeks to establish ARTs and EMTs as trustworthy financial instruments.

Source

[1]

[2]

Asset-Referenced Tokens (ARTs) and E-Money Tokens (EMTs): The Need for Regulatory Intervention (MiCA)

The MiCA Regulation, adopted in 2023, created the first comprehensive legal framework for crypto-assets across the European Union. As the crypto-asset market rapidly evolves, Asset-Referenced Tokens (ARTs) and E-Money Tokens (EMTs) have emerged as key players. ARTs are tokens pegged to the value of underlying assets such as fiat currencies, commodities, or baskets of assets. EMTs, on the other hand, closely resemble electronic money and are primarily used for payments and large-scale transactions.

The explosive growth of ARTs and EMTs has raised regulatory concerns regarding their stability, particularly in scenarios involving mass redemptions or failures of reserve assets. Historically, financial crises have demonstrated that poorly capitalized financial products can create cascading risks across broader financial systems. Recognizing this, regulators prioritized stronger capital requirements and stress testing frameworks for issuers of ARTs and EMTs.

This update ensures that issuers are not only well-capitalized but also prepared to respond to financial and operational stress. By requiring competent authorities to perform risk assessments and issuers to adjust capital reserves, the European Commission aims to preemptively address vulnerabilities that could destabilize the crypto-asset ecosystem.

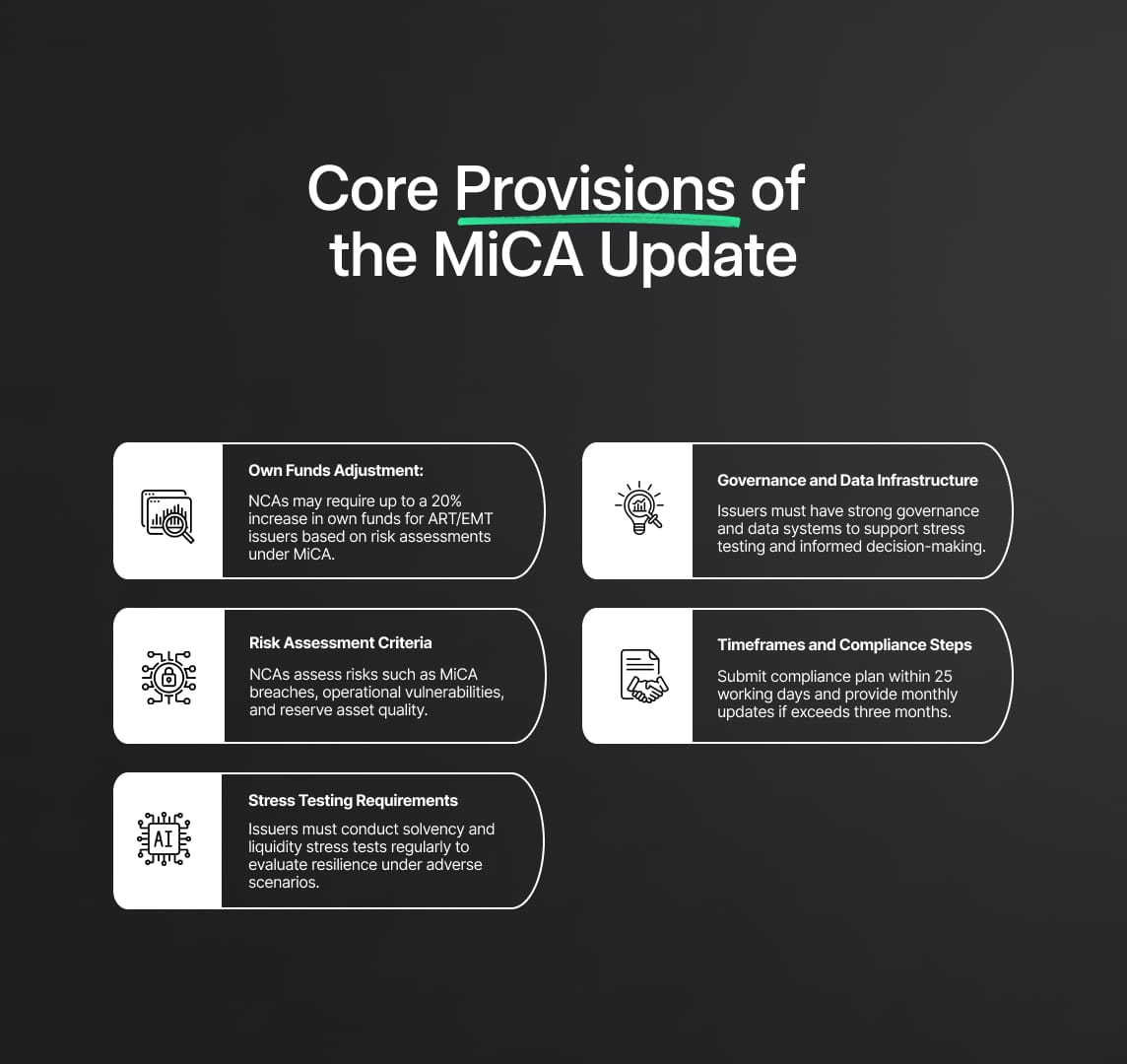

Core Provisions of the MiCA Update

The MiCA Delegated Regulation introduces a robust set of requirements targeting capital adequacy, risk management, and stress testing for issuers of ARTs and EMTs. These measures aim to address systemic risks and enhance the financial resilience of issuers. Below are the most critical provisions:

- Adjustment of Own Funds Requirements

- Competent Authorities (NCAs) are empowered to require issuers of ARTs and EMTs to increase their own funds by up to 20% above the baseline requirement established under Article 35 of MiCA.

- The decision to increase own funds must be based on a risk assessment conducted by the NCA. This assessment will identify risks such as weaknesses in governance, operational deficiencies, or the potential for market instability.

- The issuer must submit a detailed plan outlining steps to achieve the increased own funds within a maximum timeframe of 6 months. This plan must include specific measures, timelines, and confirmation of compliance with MiCA’s requirements for eligible own fund instruments.

- Risk Assessment Criteria

NCAs must consider the following factors when determining whether an issuer poses a higher degree of risk:- Breach Risk: Likelihood of non-compliance with MiCA requirements within the next 12 months.

- Redemption Risks: Whether the issuer can ensure redemption at par value during normal and stressed market conditions.

- Operational Risks: Threats arising from distributed ledger technologies, third-party custodians, or market infrastructure failures.

- Reserve Asset Risks: Potential deterioration in the value or liquidity of the reserve assets backing ARTs and EMTs.

- Stress Testing Requirements

The regulation mandates two key types of stress tests for all issuers of ARTs and EMTs:Stress tests must consider both financial and operational disruptions, including liquidity shocks, large-scale redemption events, reserve asset devaluations, and system failures. Issuers must document the stress testing programme comprehensively and ensure active involvement of senior management in its design, execution, and oversight.- Solvency Stress Test: Designed to evaluate the impact of adverse scenarios (e.g., economic downturns, credit shocks) on the issuer's capital position.

- Frequency: Quarterly for significant issuers, semi-annually for non-significant issuers.

- Liquidity Stress Test: Focuses on assessing the issuer’s ability to meet redemption requests under stressed conditions, including sudden surges in withdrawals.

- Frequency: Monthly for all issuers.

- Solvency Stress Test: Designed to evaluate the impact of adverse scenarios (e.g., economic downturns, credit shocks) on the issuer's capital position.

- Internal Governance and Data Infrastructure

- Issuers must establish internal governance frameworks that prioritize stress testing and risk management as core operational functions.

- Data infrastructure must be robust and transparent, capable of supporting the extensive data needs of stress testing programmes.

- Senior management and boards are held accountable for monitoring stress tests, challenging assumptions, and making data-driven decisions based on test results.

- Timeframes and Compliance Steps

Once an NCA identifies risks and requires an adjustment to own funds, issuers must:- Submit compliance plans within 25 working days.

- Provide monthly updates if the adjustment timeline exceeds three months.

- Immediately inform NCAs of any delays or deviations from the approved plan.

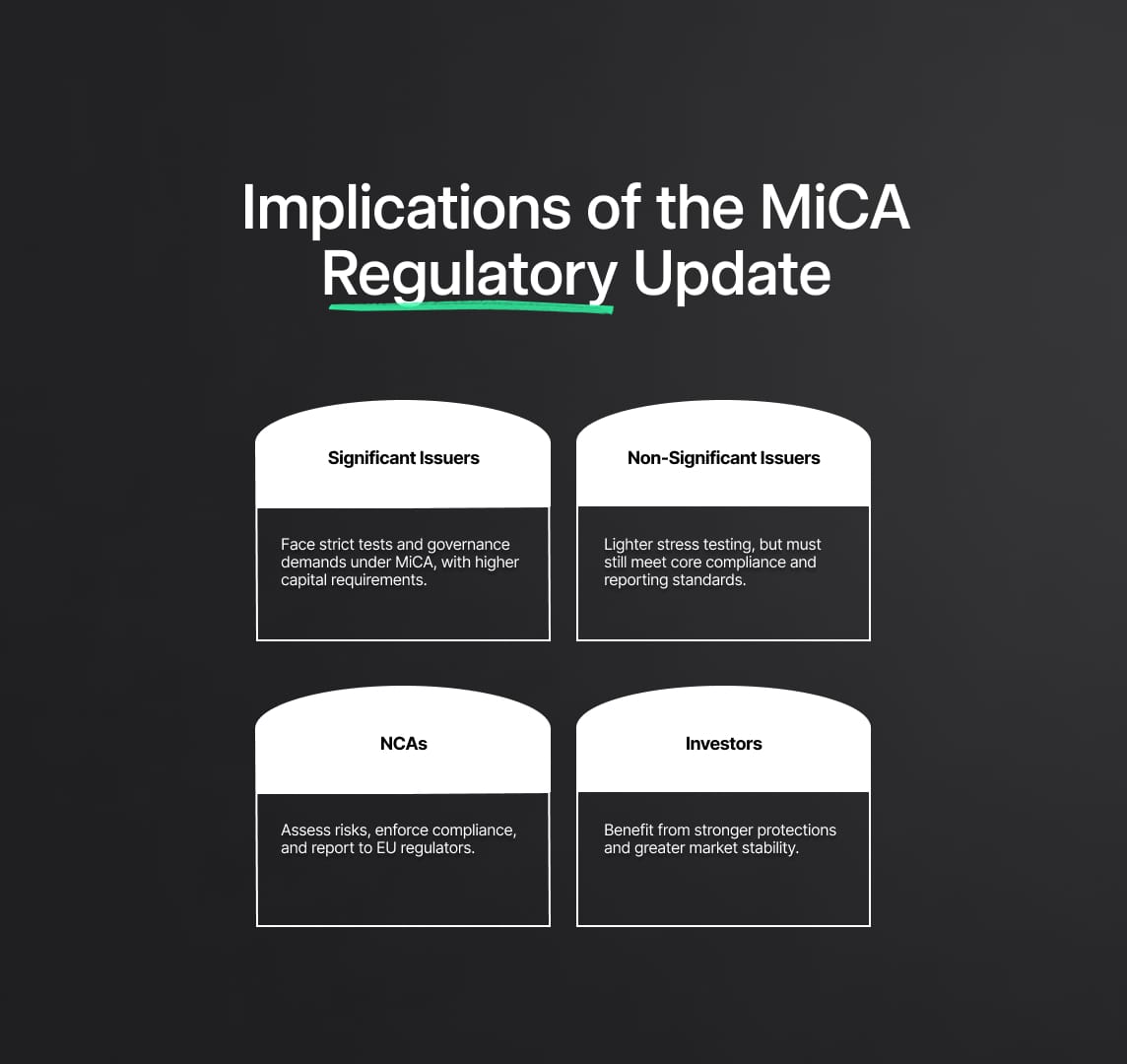

Implications of the MiCA Regulatory Update

The Delegated Regulation has far-reaching implications for issuers of ARTs, EMTs, and National Competent Authorities (NCAs). The key areas of impact include regulatory compliance, operational adjustments, and risk mitigation strategies.

- Impact on Issuers of Significant ARTs and EMTs

Significant issuers—those with large-scale issuance or systemic importance—face the most stringent requirements. They must conduct quarterly solvency stress tests and monthly liquidity stress tests to monitor capital and liquidity adequacy. These issuers must also strengthen governance and risk management frameworks to align with MiCA’s requirements.- Operational Changes: Significant issuers must develop sophisticated models for stress testing, allocate substantial resources to data infrastructure, and engage senior management in ongoing oversight.

- Financial Impact: Adjusting own funds by up to 20% could require significant capital reserves, affecting profitability and funding strategies.

- Impact on Non-Significant Issuers

While non-significant issuers have lighter regulatory burdens, they must still conduct semi-annual solvency stress tests and monthly liquidity tests. They must ensure proportional governance and data infrastructure that supports the stress testing requirements.- Compliance Efforts: Non-significant issuers need to develop simplified stress testing models while ensuring accurate and reliable data reporting.

- Timeframes: Compliance with NCA-issued risk adjustments remains a priority, with tight timelines for submission and implementation of plans.

- Impact on National Competent Authorities (NCAs)

NCAs are tasked with conducting comprehensive risk assessments to identify systemic threats posed by ART and EMT issuers. These assessments involve evaluating governance structures, operational risks, and reserve asset stability.- Monitoring Responsibilities: NCAs must closely monitor issuers' compliance with own funds adjustments and stress testing requirements.

- Reporting: They must ensure transparency by sharing decisions and updates with relevant EU regulatory bodies, such as the EBA.

- Impact on Investors and Market Stability

For investors, the regulation enhances confidence in the safety and stability of ARTs and EMTs. The stricter capital requirements and stress testing measures ensure that issuers are better equipped to withstand financial shocks and honor redemption obligations.- Market Impact: By fostering greater stability, the regulation reduces systemic risks and builds trust in the European crypto-asset market.

MiCA Own Fund Requirements and Stress Testing: Regulatory Outlook

The MiCA Regulation update represents a significant step toward ensuring the stability and resilience of ARTs and EMTs in the European Union. By introducing stringent own funds requirements and mandatory stress testing programmes, the European Commission aims to mitigate systemic risks and promote financial stability in the evolving crypto-asset market.

Looking ahead, regulatory trends suggest a continued focus on enhancing risk management and financial oversight for crypto-asset issuers. As the crypto market expands, regulators will likely introduce further measures addressing emerging risks, such as environmental, social, and governance (ESG) factors, cross-border regulatory harmonization, and technological innovations in blockchain infrastructure.

For issuers, aligning with the MiCA Regulation’s requirements will require significant investment in governance, data infrastructure, and stress testing capabilities. By proactively adopting these measures, ART and EMT issuers can build investor trust, ensure compliance, and contribute to a more resilient financial ecosystem.

Reduce your

compliance risks