MiFID Amendments and DORA Technical Standards

Navigating the complexities of EU's evolving financial regulations, the technical standards of DORA and MiFID amendments pose challenges and opportunities for institutions. While aiming to fortify sector resilience, there's concern over stifling innovation and raising costs.

MiFID Amendments and DORA Technical Standards: The DK's Stance

The German Banking Industry Committee (DK) submitted its response to the Joint Committee of the European Supervisory Authorities' (ESAs) consultation on the first drafts of the technical standards under the EU's Digital Operational Resilience Act (DORA). The ESAs, comprising the European Banking Authority (EBA), European Insurance and Occupational Pensions Authority (EIOPA), and the European Securities and Markets Authority (ESMA), published this consultation in June 2023. The DK emphasized that the detailed requirements of the technical standards offer little scope for proportional application. Additionally, the proposed form of the information register will require substantial resources for implementation and maintenance. The DK suggested that aligning it more with existing outsourcing registers would be beneficial. Moreover, the European Commission proposed a strategy for small investors in May 2023, which includes an amendment to the Markets in Financial Instruments Directive (MiFID).

DORA & MiFID: The Balancing Act of Financial Regulation

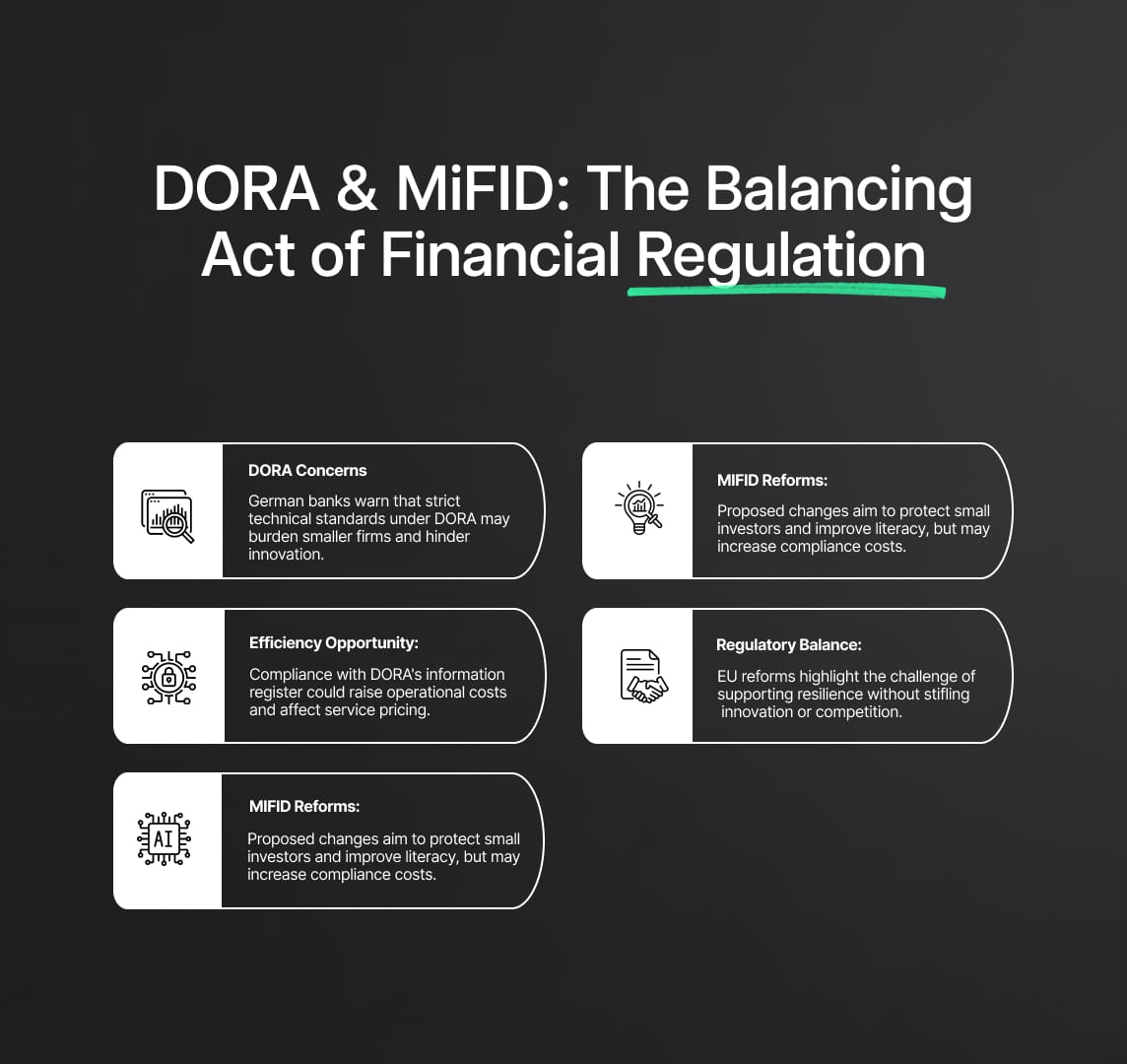

In recent regulatory developments within the European financial sector, the spotlight shines on two pivotal elements: the technical standards under the EU's Digital Operational Resilience Act (DORA) and the proposed amendments to the Markets in Financial Instruments Directive (MiFID). These regulatory moves seek to bolster the robustness of the financial sector, yet they stir conversations about their potential impact on competition, innovation, and cost structures.

The German Banking Industry Committee (DK), in response to the Joint Committee of the European Supervisory Authorities' (ESAs) consultation, has flagged concerns about DORA's technical standards. Central to the debate is the limited scope for proportional application, which could inadvertently disadvantage smaller institutions. By setting stringent standards, there's a lurking threat of stifling the very innovation that's driving the fintech revolution. Moreover, the resources required to adhere to these standards, especially concerning the new information register, could inflate operational costs, with repercussions potentially reaching consumers in the form of pricier services.

However, there's a silver lining. The proposal to align the information register with pre-existing outsourcing registers can be a game-changer. Such an alignment could usher in streamlined processes, cut down on redundancies, and be a more resource-efficient approach. This strategy resonates with the larger theme of integrating modern technology into traditional banking frameworks, a critical step for financial institutions aiming to remain competitive in the digital age.

On the MiFID front, the European Commission's strategy for small investors could redefine the landscape for retail investing. While designed to offer better protection and promote financial literacy among small investors, it's a double-edged sword. Greater regulatory oversight could mean heightened compliance costs for financial institutions. Yet, it’s essential to recognize that safeguarding consumer interests and ensuring transparent financial practices are cornerstones for a thriving financial ecosystem.

In summary, the evolving regulatory landscape in the European Union, marked by DORA's technical standards and MiFID's amendments, underscores the continuous balancing act of regulation. It’s a dance between ensuring market integrity and fostering an environment conducive to innovation. Financial institutions, regulators, and stakeholders must come together, ensuring the measures taken today lay the foundation for a resilient, inclusive, and forward-looking financial future.

Read More

Reduce your

compliance risks