MiFID II/MiFIR Regulations for Enhanced Market Transparency

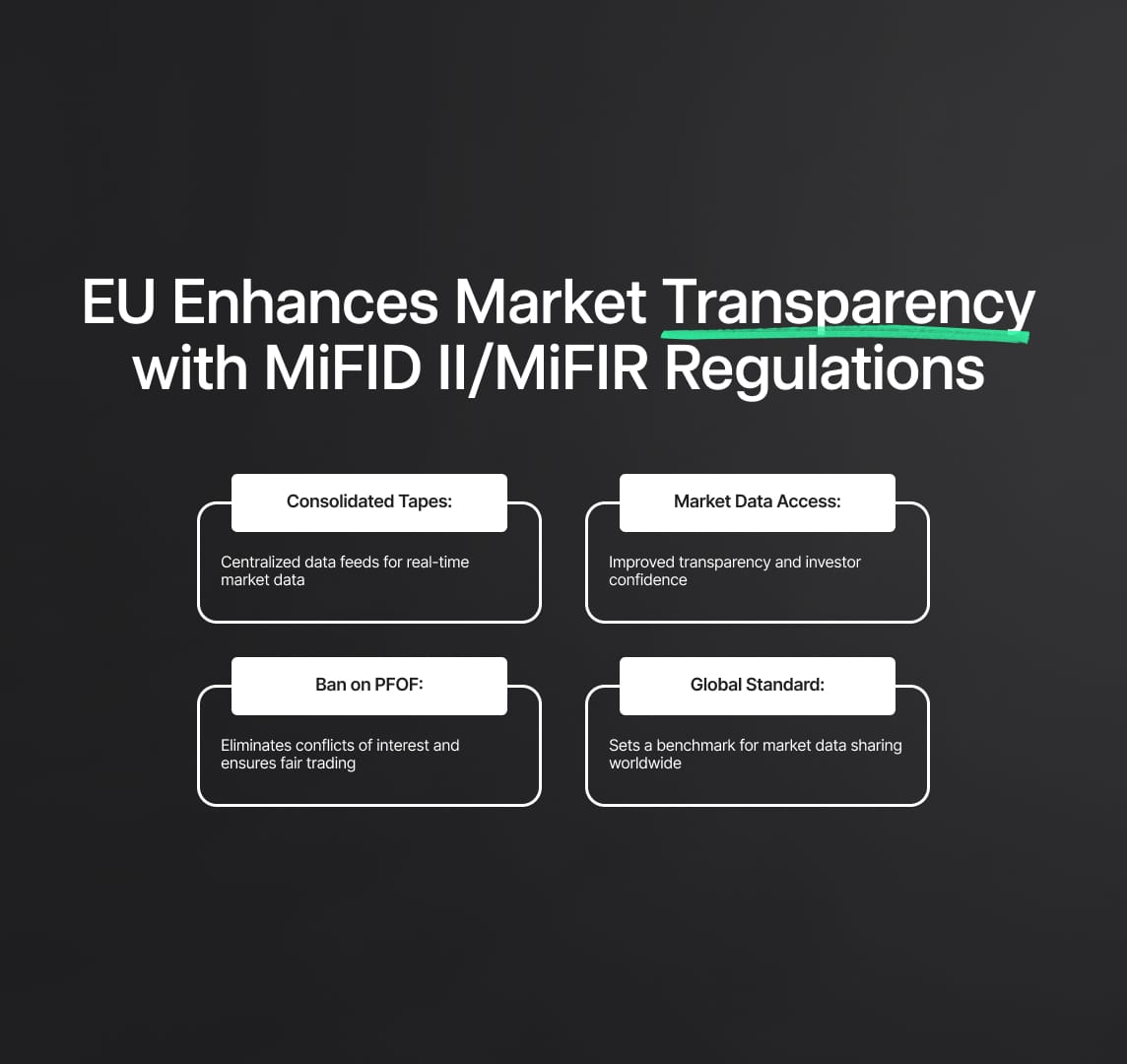

The EU Council adopted new MiFIR and MiFID II rules to improve market data transparency, offering better data access, establishing consolidated tapes, and banning payment for order flow, impacting compliance and trading in the EU.

The purpose of the EU's MiFID II and MiFIR laws is to improve market transparency by creating "consolidated tapes" [1]. These are centralized data feeds that aggregate market data from multiple platforms where these financial instruments are exchanged in the European Union for different kinds of assets [1]. To encourage a more open and effective market, these consolidated tapes aim to distribute information as nearly as real-time as feasible [1].

Source

[1]

The Markets in Financial Instruments Regulation (MiFIR) and Markets in Financial Instruments Directive II (MiFID II), two important legal frameworks, received major amendments from the European Union Council on February 21, 2024. The European Union's commitment to developing a more open, just, and competitive financial environment globally is demonstrated by these improvements, which have the potential to completely transform market data transparency and guarantee trading fairness across the board.

Key Enhancements to MiFID II and MiFIR:

- Revolutionising Market Transparency with EU-Wide Consolidated Tapes:

- Goal: Resolve the disparities in the distribution of trading data throughout Europe.

- Implementation: Market data from several trading platforms, such as stock exchanges and investment firms, is centralized and aggregated.

- Benefits:

- Offers thorough information on trade volumes, transaction timings, and instrument prices.

- Provides professional and ordinary investors with fast access to essential market information.

- Gives investors the ability to make knowledgeable decisions more confidently and effectively.

The EU's commitment to improving the integrity and accessibility of its financial markets is exemplified by these regulatory improvements. Through tackling the issues of dispersed market data and offering a centralized resource of all-encompassing market data, the European Union seeks to enable a more knowledgeable and effective investment environment. This action boosts the general fairness and competitiveness of the European financial markets in addition to providing benefits to investors.

Impact of EU-Wide Consolidated Tapes:

- For Investors: More strategic investing choices are made possible by enhanced access to real-time market data.

- For Markets: Improved openness and effectiveness in the markets will boost confidence and involvement from both local and foreign investors.

- For Regulation: Establishes a new benchmark for the sharing of market data, stimulating comparable projects around the world.

The European Union is setting a standard for financial regulation by implementing these revolutionary changes, with the goal of promoting a trading environment that is more open, equitable, and accessible to all market players. This strategic move is anticipated to represent a turning point in the development of the EU financial sector and offer a solid foundation for investment in Europe going forward.

By taking a firm stance against the contentious "payment for order flow" (PFOF) practice, the European Union has demonstrated its steadfast commitment to upholding trade integrity and market fairness through its recent regulatory overhaul. PFOF, a practice that has sparked intense discussion about its potential to lead to conflicts of interest and compromise the general fairness of the financial markets, is when brokers receive payment for referring client orders to particular trading platforms or market makers.

A Firm Stance Against Conflicts of Interest

The EU intends to actively address and alleviate these risks by focusing on PFOF. With a complete ban on PFOF, the regulations—which are scheduled to take full effect by June 30, 2026—mark a major advancement in the creation of a more open and fair trade environment. This schedule gives the practice a defined end point and permits a planned phase-out in areas where PFOF is presently ingrained in the trade environment.

Tailored Approaches for Member States

The European Union has incorporated measures for temporary exemptions with consideration, acknowledging the variation in financial policies among its constituent nations. These highly restricted exclusions are meant for members states where PFOF is a recognized practice. This sophisticated approach highlights a shared commitment to maintaining market integrity while respecting the distinct legislative and market systems within each member state, ensuring a fair and balanced transition towards the ultimate abolition of PFOF.

Enhancing Market Integrity and Fairness

The EU's strong commitment to protecting investor interests and preserving the integrity of its financial markets is demonstrated by the prohibition of PFOF. The EU is making great progress toward an investment environment where choices are made in the best interest of customers, free from undue influence or conflicts of interest, by doing away with financial incentives that might improperly influence broker behavior and decision-making.

MiFID II/MiFIR Amendments: Including Commodity Derivatives

Recent changes made by the European Union have significantly broadened its regulatory purview to include commodity derivatives trading. The purpose of this strategic extension is to improve the regulatory environment for commodities derivatives, a segment of the financial trading industry that requires increased structural integrity and transparency. The following are the main goals of these updated regulations:

- Enhancing Transparency: Making certain that all trade actions and their results are accessible to and intelligible to both regulators and market participants.

- Improving the Market Structure: Constructing a stronger, more effective market structure that encourages honest and competitive business activities.

- Ensuring that the market is free from manipulation: It functions in a way that is equitable for all players is known as "promoting market integrity and fairness."

These actions are a part of a larger endeavor to improve the EU's commodity derivatives trading regulations. By doing this, the EU hopes to promote a more fair, transparent, and competitive market environment that is in line with the larger objectives of market integrity and justice.

Implementing the MiFID and MiFIR Amendments: A Streamlined and Phased Approach

The implementation of these important regulation revisions has been carefully prepared to provide a consistent and immediate impact on all EU member states. After being approved by the European Council:

- Publication in the Official Journal: The revised texts will be formally announced as new regulations when they are published in the European Union's Official Journal.

- Effective Date: The new rules will take effect twenty days after they are published in the Official Journal, ushering in a new age of regulation.

- 18-Month Transition Period: National governments have been given 18 months to make the necessary changes to their local laws, rules, and administrative frameworks in order to ensure a smooth transition.

The EU's dedication to preserving investor protection and improving market integrity is emphasized by this phased implementation plan. It displays a methodical and effective approach to regulatory reform, guaranteeing that no member nation's financial markets would be disrupted as they adjust to the new standards.

Through the implementation of this methodical and incremental strategy, the European Union exhibits its commitment to attaining a more cohesive and robust financial regulatory structure. This project promotes a safer and more dependable market environment for traders and investors alike by strengthening the resilience and transparency of the EU's financial markets and solidifying the Union's leadership in global financial regulation.

Reduce your

compliance risks