MiFIR and MiFID II Regulation: AFME Guide to EU and UK Market Reforms

AFME and Linklaters release guidance on MiFIR and MiFID II regulation, detailing updates on market structure, transparency, and data access to enhance compliance in EU and UK secondary markets.

On October 24, 2024, the Association for Financial Markets in Europe (AFME), in partnership with Linklaters, published a comprehensive guide to assist financial institutions in navigating and implementing regulatory changes under the Markets in Financial Instruments Regulation (MiFIR) and Directive (MiFID II) in both the EU and UK. The primary aim of this document is to equip sell-side firms operating in wholesale secondary markets with a thorough understanding of the latest regulatory developments and implementation challenges, although its insights are likely valuable for a broader audience within the financial sector.

This publication delves into key changes across critical areas, including market structure, transparency, market data, consolidated tape providers, investment research, and client order execution. By analyzing these topics, AFME and Linklaters provide firms with a detailed overview of upcoming regulatory requirements, along with technical and operational considerations to help streamline compliance and optimize market engagement in a changing regulatory environment.

Source

[1]

1. MiFID II/MiFIR: Market Structure and Systematic Internalisers (SIs)

The MiFIR/MiFID II reforms introduce significant changes to the roles and definitions of SIs, especially regarding the transparency and obligations tied to both equity and non-equity instruments.

- Redefinition of Systematic Internalisers: The revised SI definition now emphasizes a qualitative assessment over quantitative calculations for EU firms, particularly limiting SI status to entities dealing off-venue on an organized basis. However, unlike the EU, the UK’s Financial Conduct Authority (FCA) continues to apply a broader SI definition, maintaining the SI framework for both equity and non-equity instruments. In the EU, this shift could simplify SI categorization, yet firms will need to consider any obligations under the forthcoming Level 2 regulatory texts and related guidance to ensure compliance with new transparency requirements.

- Implications for Market Participants: This redefinition aligns with a broader trend of reducing regulatory obligations for SIs, particularly around non-equity instruments. Nonetheless, the FCA’s potential to reintroduce SI-specific obligations for non-equity could impact firms operating under UK jurisdiction. To mitigate regulatory risk, entities must reassess their standing against the revised definitions, especially regarding SI status for specific non-equity transactions, which may require adjustments to internal reporting and compliance structures.

- PISCES Platform: The UK’s proposal for the Private Intermittent Securities and Capital Exchange System (PISCES) introduces a new trading platform for secondary trading of unlisted shares. The PISCES platform aims to enable private companies to expand and eventually transition to public markets, while also facilitating increased investor access to private shares. This initiative is set for a five-year sandbox testing period and will require potential PISCES operators and intermediaries to comply with evolving disclosure requirements and tailored transaction reporting obligations as finalized by the FCA.

2. Transparency: Pre-Trade and Post-Trade Obligations

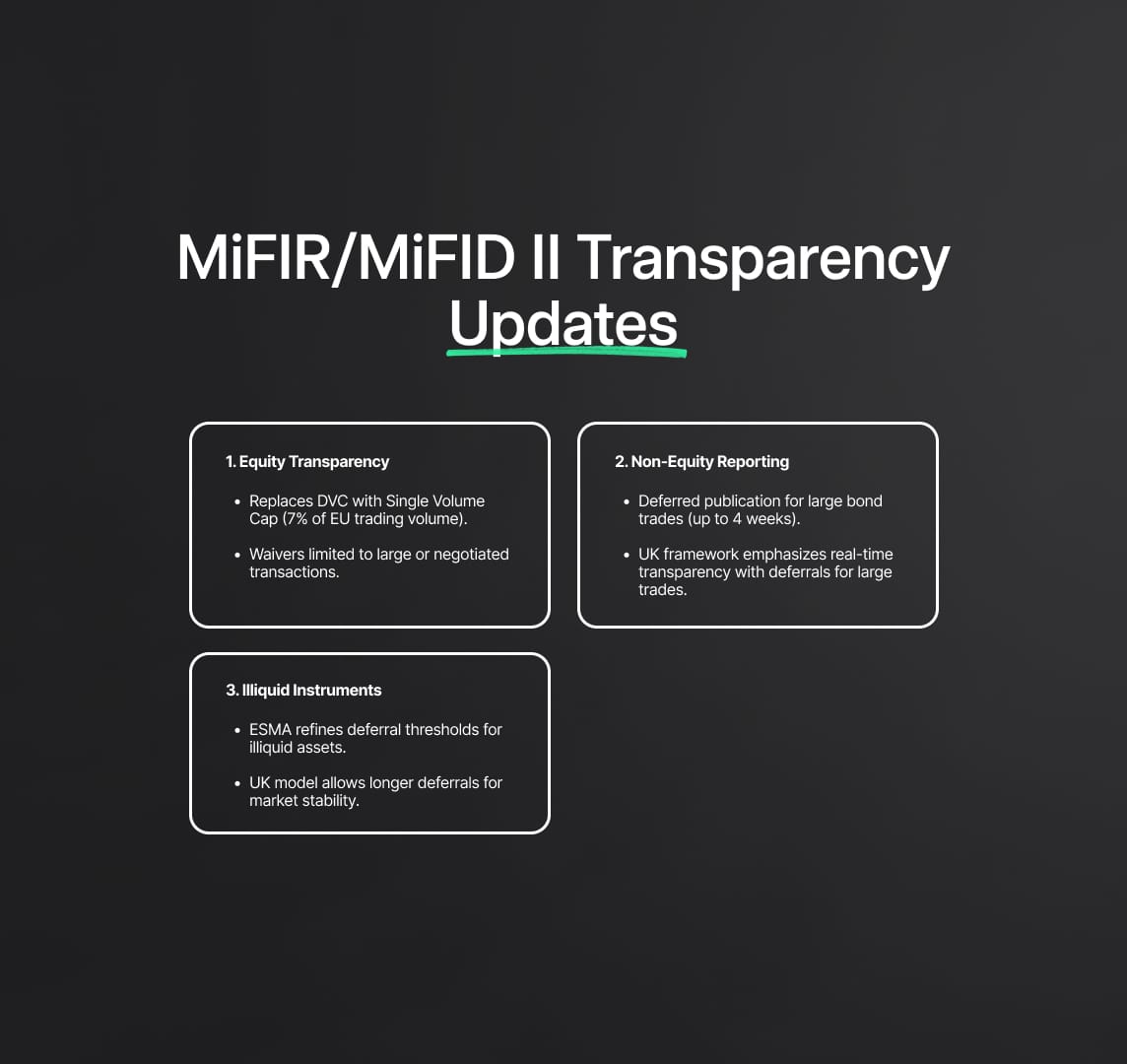

Revisions to MiFIR/MiFID II transparency rules are primarily aimed at clarifying reporting obligations for both equity and non-equity instruments, including bonds, derivatives, and structured finance products (SFPs).

- Equity Transparency and Volume Caps: The former double volume cap (DVC) mechanism, which limited dark trading across EU markets, is replaced with a Single Volume Cap (SVC) capped at 7% of EU-wide trading volume for certain transactions. This measure simplifies compliance while standardizing transparency, limiting waiver usage primarily to large transactions or negotiated trade waivers.

- Pre-Trade and Post-Trade Reporting for Non-Equities: New rules under MiFIR/MiFID II introduce deferred publication mechanisms for non-equity trades based on transaction size and liquidity, reducing the reporting burden on SIs. The deferral model employs a “designated publishing entity” (DPE) framework, which decouples post-trade reporting from SI status. Firms in the EU can now defer publication of transaction details up to four weeks for large bond trades, depending on the liquidity of the instrument. Meanwhile, UK firms are subject to an FCA-designed deferral model emphasizing real-time transparency, except in cases where deferrals apply for large transactions, thus balancing the need for both transparency and transaction confidentiality.

- Deferred Publication for Illiquid Instruments: ESMA’s transparency requirements refine deferral thresholds, particularly for illiquid assets, and distinguish reporting needs by instrument type and trade size. The UK’s framework allows for longer volume deferrals in specific cases, supporting market stability by preserving transaction confidentiality in highly illiquid trades, especially large bond and derivative transactions.

3. Market Data and Consolidated Tape Providers (CTPs)

High market concentration in data provision and escalating costs have been significant pain points in the wholesale markets. The new MiFIR/MiFID II directives introduce critical steps toward mitigating these challenges by fostering a more competitive market data environment.

- Data Access and Cost Regulation: The MiFIR/MiFID II reforms aim to curb data access costs by linking market data pricing to actual production costs. Data providers are required to justify prices using cost-plus models, making data access fairer and more accessible across the trading landscape. This change primarily benefits buy-side firms and smaller market participants who depend on competitive, transparent data pricing to optimize investment strategies.

- Role of CTPs: The establishment of CTPs under MiFIR regulation is designed to provide consolidated, real-time transaction data for equity and bond markets, standardizing data access across the EU. In the UK, revenue-sharing options for CTPs aim to reduce financial pressures, thereby encouraging CTPs to participate in the UK market. This approach aims to provide investors with a more comprehensive view of trading activity, fostering market inclusivity by enabling broader access to essential market insights.

4.MiFID II/MiFIR framework: Investment Research and Payment Optionality

The MiFID II/MiFIR framework has reevaluated the investment research ecosystem in both the EU and UK, streamlining payment options to sustain the quality and availability of research.

- CSA-Like Payment Model: The EU and UK’s adoption of a Commission Sharing Arrangement (CSA)-like model offers financial institutions a flexible and simplified approach to research payments. In the UK, the new “CSA-like” payment model took effect in August 2024, accommodating additional payment optionality to enhance access to high-quality research. This revision is expected to bolster investment research availability, especially in small-cap and mid-cap sectors, where tailored analysis can benefit from a more flexible payment model.

- Enhancing Research Ecosystem: These changes are particularly beneficial for the UK, where HM Treasury’s Investment Research Review has recommended a flexible framework to attract high-caliber investment analysis. The EU has also enacted the EU Listing Act, which introduces additional research payment options for firms and is set to be adopted by member states by the end of 2025. These adjustments collectively aim to increase market access and participation by making investment research more attainable and aligning it with broader goals of financial market integration.

5. Execution of Client Orders

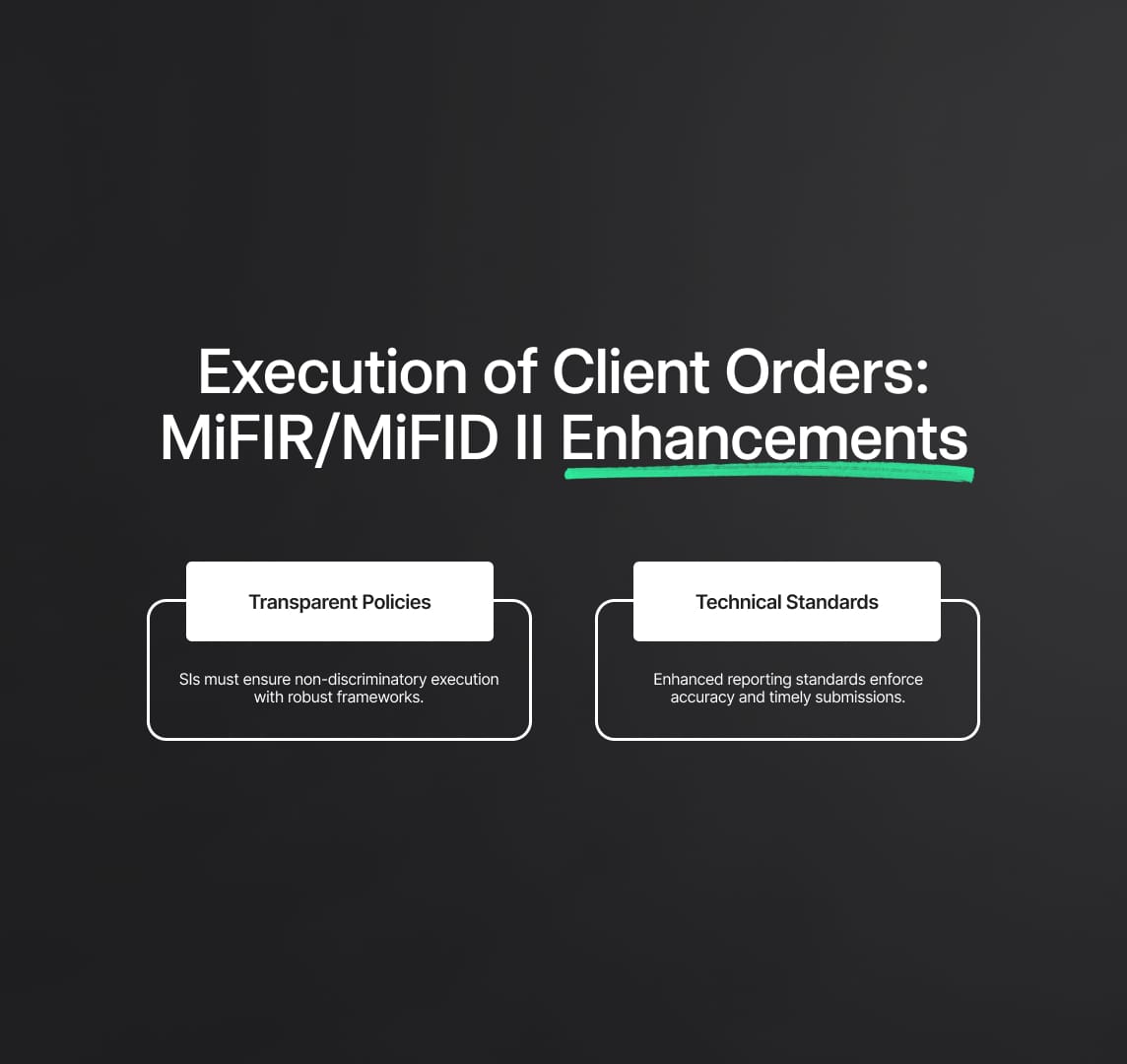

MiFIR/MiFID II reforms have enhanced client order execution, introducing clearer criteria for transparency and efficiency.

- Order Execution Policies: Systematic internalisers (SIs) are now required to apply transparent, non-discriminatory criteria in executing client orders under MiFIR/MiFID II. This includes implementing a robust policy framework that specifies best execution practices and addresses operational risk management in client transactions.

- Enhanced Technical Standards: ESMA has introduced enhanced standards for SI reporting and order execution notifications to National Competent Authorities (NCAs), ensuring that firms report transactions accurately and in a timely manner. These adjustments to reporting standards are intended to reduce compliance risks by enforcing rigorous technical standards, while enabling firms to manage transactions effectively within the revised MiFIR/MiFID II regulatory framework.

MiFIR and MiFID II regulations: Challenges and Technical Considerations

The varying timelines for regulatory changes across the EU and UK introduce unique challenges for firms, particularly in the following areas:

- Divergence in Requirements: The MiFIR and MiFID II regulations have introduced several critical differences between EU and UK requirements, particularly with recent updates to the definitions and obligations of Systematic Internalisers (SIs), transparency thresholds, and reporting requirements. For instance, the UK’s deletion of the double volume cap (DVC) mechanism contrasts with the EU’s implementation of a Single Volume Cap (SVC), requiring firms to develop region-specific systems to manage these compliance discrepancies. These regional differences necessitate that firms operating across both jurisdictions tailor their compliance systems to handle varied reporting obligations, market data access, order execution policies, and deferral protocols effectively, adapting both pre-trade and post-trade transparency measures as required by each authority.

- Data Synchronization and Reporting: Firms must upgrade systems to comply with the MiFIR/MiFID II regulations, which impose exacting data synchronization and reporting requirements. Under MiFIR, for example, the European Securities and Markets Authority (ESMA) mandates synchronization of trading and reporting clocks to sub-microsecond accuracy in high-frequency environments, with trading venues and Systematic Internalisers (SIs) required to synchronize to Coordinated Universal Time (UTC).

The UK FCA imposes similar standards, albeit with specific allowances for non-electronic or voice-trading activities. These demands place significant technical pressure on existing infrastructure, particularly for firms engaged in cross-border trades that must coordinate timing accuracy and reporting across multiple jurisdictions.

- Cost and Resource Allocation: The technical upgrades and compliance monitoring mechanisms required by MiFIR and MiFID II reforms present substantial resource demands for firms. For example, firms must allocate resources to adapt to the designated reporting requirements for non-equity instruments under the new transparency protocols, implementing systems that can distinguish between deferred and real-time reporting obligations across asset classes.

These updates include modifying data collection systems for transaction reporting, managing post-trade reporting waterfalls under ESMA's “designated publishing entity” (DPE) framework, and ensuring that data storage and retrieval systems align with both EU and UK deferral schedules and transparency standards.

- Review of Systemic Internalisation Status: The shift to a qualitative definition of SIs in the EU and the differing thresholds for SI status in the UK require firms to assess and frequently revisit their systemic internalisation status, especially in non-equity instruments like bonds and derivatives. The EU’s revised SI definition focuses on firms’ trading frequency and systematic practices rather than the prior quantitative model, while the UK retains a more inclusive definition that applies to additional asset classes. This divergence means that firms must continually monitor their trading activities to confirm whether they meet SI thresholds in both regions, especially since compliance with SI status affects reporting obligations, pre-trade transparency for non-equity instruments, and transaction reporting requirements.

Reduce your

compliance risks