MiFIR: Regulation (EU) 2024/791

On May 2, 2024, the EU Official Journal published a Commission Notice clarifying transitional provisions under MiFIR Amendment (EU) 2024/791. This notice addresses the implementation challenges posed by the amended MiFIR provisions, ensuring regulatory continuity during the transitional period.

A Commission Notice addressing the transitory measures within MiFIR (Regulation (EU) 2024/791) was published in the EU Official Journal on May 2, 2024. This notice seeks to clarify how changes made to improve data transparency, allow consolidated trading tapes to emerge, maximize trading obligations, and forbid order flow payment receipts should be interpreted and put into effect. Although the MiFIR review formally started on March 28, 2024, certain of its elements still need to be further supplemented through regulations delegated by the Commission in order to be fully operationalised. Up until new regulations are explicitly formed to replace them, current regulations continue to apply alongside new MiFIR provisions throughout this transitional era.

Understanding the Scope of MiFIR Transitional Arrangements: A Clarification Notice

The scope of Regulation (EU) No 600/2014, also referred to as MiFIR, is outlined in this notice. Regulation (EU) 2024/791, also known as the "MiFIR review," amended MiFIR. It primarily aims to clarify the transitional arrangement described in MiFIR's Article 54(3) as modified by the MiFIR review. It's crucial to remember that the explanations and interpretations offered here neither change the rights and obligations set forth in the MiFIR review nor place new demands on pertinent operators or the appropriate authorities. The ideas and statements made here represent the viewpoint of the European Commission. The Court of Justice, however, has the sole jurisdiction to interpret the actions of EU institutions, as stipulated in the Treaty on the Functioning of the EU.

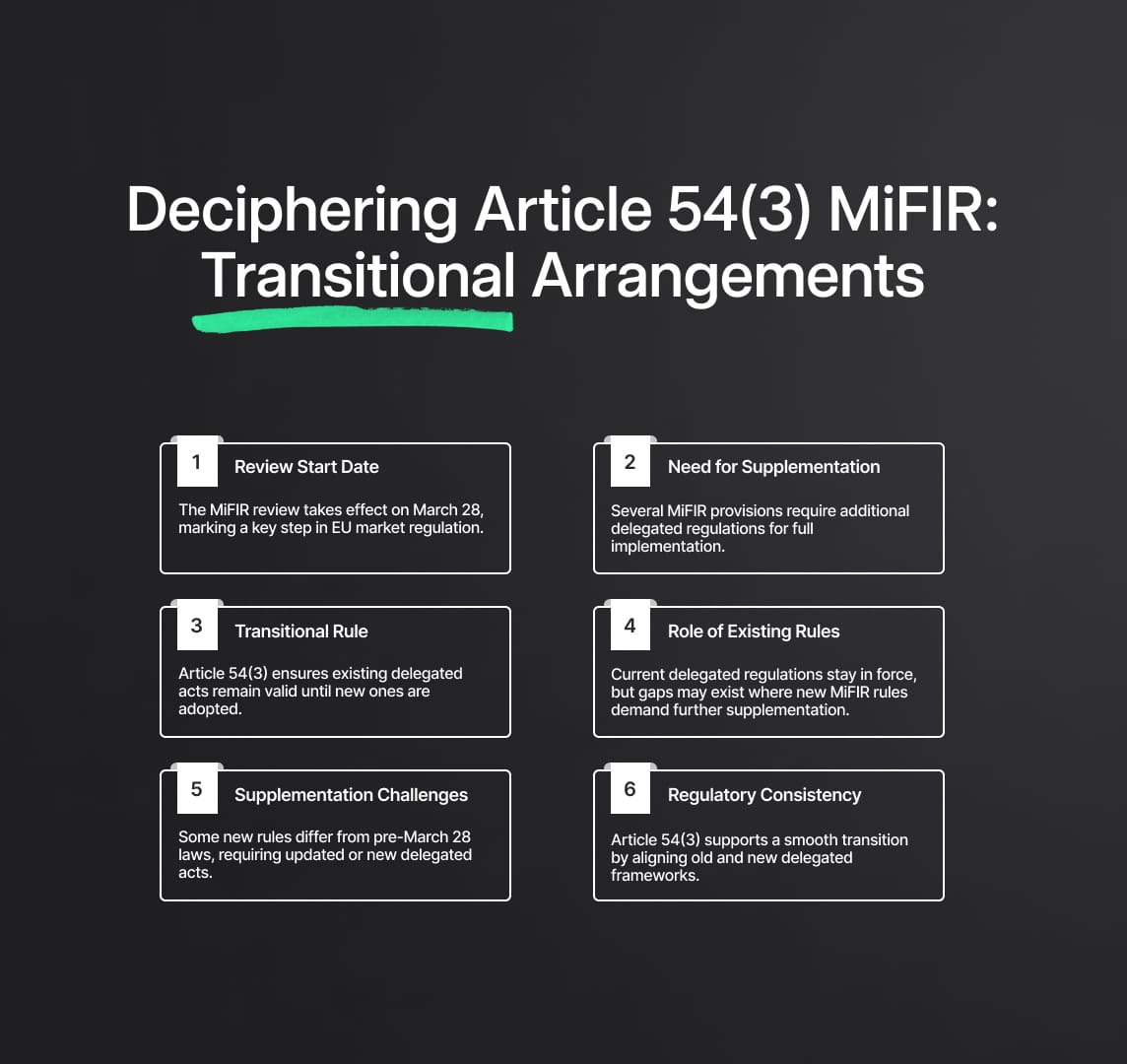

Deciphering Article 54(3) MiFIR: Transitional Arrangements

It is important to understand the consequences of Article 54(3) MiFIR as the MiFIR review moves closer to implementation. The purpose of this provision is to facilitate a smooth transition for market players in the interim until the modified MiFIR is fully operationalized by regulations delegated by the Commission. We examine the Commission's reading of Article 54(3) MiFIR in this section, along with how it affects regulatory continuity:

- Start of the MiFIR Review: The MiFIR review is scheduled to go into effect on March 28, which is a big step forward for financial market regulation.

- Supplementation of rules: In order to attain full operational status, a number of rules found in the MiFIR review must be supplemented through regulations delegated by the Commission.

- Transitional Continuity: During the transitional phase, market participants are kept informed by Article 54(3) MiFIR. It states that until the new delegated acts presented under the MiFIR review take effect, the provisions of the delegated acts that were in effect before to March 28, 2024, will remain in effect.

- Function of Current Delegated Regulations: In compliance with Article 54(3) MiFIR, current Commission delegated regulations are still in effect. Nonetheless, a more nuanced approach is necessary when new MiFIR rules call for supplementation that isn't sufficiently addressed by current laws.

- Challenges with Supplementation: In order to provide a thorough supplement, certain new MiFIR rules call for new or modified Commission-delegated regulations. This is because the regulations that were in effect prior to March 28, 2024, and the new MiFIR provisions differ.

- Ensuring Regulatory coherence: Throughout the transition phase, Article 54(3) MiFIR maintains regulatory consistency by ensuring coherence between new and existing delegated rules.

Single Volume Cap Mechanism under Article 5 MiFIR

The single volume cap mechanism is outlined in Article 5 of the Markets in Financial Instruments Regulation (MiFIR). It sets a threshold that regulates equities trading under the reference price waiver. A Commission delegated regulation that specifies how the European Securities and Markets Authority (ESMA) gathers, computes, and disseminates the transaction data required to establish the single volume cap is needed in order to operationalize Article 5 MiFIR.

But the dataset used to calculate the double volume cap is not the same as the one used to calculate the single volume cap. As such, the new single volume cap restrictions cannot be sufficiently supplemented by the current Commission delegated regulation (EU) 2017/577 (often referred to as "RTS 3"), which deals with the double volume cap.

Because of this, the regulations pertaining to the double volume cap outlined in RTS 3 remain in effect in line with Article 54(3) MiFIR until the Commission publishes a delegated regulation in line with Article 5(9) MiFIR, which will outline the operationalisation of the single volume cap mechanism.

Regulatory Changes: Deferred Publication Rules in MiFIR

The Markets in Financial Instruments Regulation (MiFIR) contains provisions pertaining to the postponed disclosure of transaction data for a number of financial instruments, including as derivatives, bonds, emission allowances, and structured finance products. However, additional clarification—specifically, establishing the calibration of deferral schedules—must be provided through Commission-delegated regulations before these articles can be operationalized. Significant changes to the calibration criteria have been brought about by the MiFIR review; hence, current rules, including Commission delegated regulation (EU) 2017/583, also referred to as "RTS 2," may not sufficiently address these modifications. Consequently, in order to maintain consistency in regulatory requirements, interim measures are implemented until new regulations are approved:

- Postponed disclosure regulations: The regulations pertaining to the postponed disclosure of transaction data for derivatives, bonds, emission allowances, and structured finance instruments are introduced in Articles 11 and 11a of MiFIR.

- Supplementation by Commission Delegated Regulations: Commission delegated regulations must specify the calibration of deferral schedules in order to operationalize Articles 11 and 11a, guaranteeing uniformity and clarity in their execution.

- Impact of MiFIR Review: The MiFIR review brought about substantial modifications to the calibration standards, which required modifying regulatory frameworks to take these changes into account.

- Continuity Measures: Transitional measures described in Article 54(3) of MiFIR guarantee that the deferral rules provided in RTS 2 continue to apply until new regulations are implemented in light of the differences between the current laws and the updated criteria.

- Future Implementation: In accordance with Articles 11(4) and 11a(3) of the MiFIR, respectively, the new deferral schedules for bonds, structured financial instruments, emission permits, and derivatives will go into force upon the adoption of Commission-delegated regulations.

Data Accessibility: Obligations under Article 13 MiFIR

Regarding the availability of pre-trade and post-trade data on financial instrument transactions, market operators, investment firms operating trading venues, approved publication arrangements, consolidated tapes, and systematic internalisers (SIs) are subject to obligations under Article 13 of the Markets in Financial Instruments Regulation (MiFIR). In order to provide fair access for all users, these organisations must make this information available to the general public on a reasonable commercial basis.

A Commission-delegated rule is required to establish several features, such as the computation of costs and appropriate margins, in order to provide clarity regarding the application of Article 13 MiFIR. On the other hand, a new principle introduced by the MiFIR review forbids charging users based on the value that the data represents to them. As such, current legislation, including ESMA guidelines (ESMA70-156-4263) and Commission delegated regulations (EU) 2017/565 and 2017/567, might not sufficiently support these modifications.

The requirement to make pre-trade and post-trade data available on a reasonable commercial basis, as specified in the current regulations, by March 28, 2024, is still in effect, as per Article 54(3) MiFIR. Until new regulations are implemented, transitional measures guarantee continuity. The modified duties, which reflect the changing state of data accessible in financial markets, will come into force upon the adoption of the Commission delegated regulation in accordance with Article 13(5) MiFIR.

Quotation Rules and Transaction Reporting Obligations in MiFIR

A new Commission delegated regulation would define the minimum quotation size and threshold for pre-trade transparency standards for Systematic Internalisers (SIs) in equity instruments, according to Article 14 of the Markets in Financial Instruments Regulation (MiFIR). Regulating bodies already in place, like Commission delegated rule (EU) 2017/587, do not, however, sufficiently address these aspects. Consequently, until new regulations are established, the quote requirements for SIs in equity instruments as defined prior to March 28, 2024, remain in effect.

In a similar vein, Article 26 MiFIR provides guidelines for investment firms' transaction reporting responsibilities. While some sections of Article 26 are supplemented by Commission delegated regulation (EU) 2017/590 ('RTS 22'), it does not address all essential adjustments. Therefore, until new regulations are adopted, the transaction reporting rules as outlined in RTS 22 that apply before March 28, 2024, will continue in effect. These regulatory adjustments maintain consistency while taking into account the modifications made by the MiFIR review, reflecting the dynamic nature of the financial markets.

Reduce your

compliance risks