ML/TF Risks: EU Payment Firms

The EBA's assessment flags concerns over ineffective management of money laundering and terrorist financing risks in EU payment firms. It reveals inadequate risk strategies and supervisors' failure to adapt, emphasizing the need for stronger implementation of guidelines and legal changes.

EBA: Inadequate Money Laundering Management in EU Payments Firms

The European Banking Authority (EBA) has recently conducted an assessment highlighting concerns over the ineffective management of money laundering and terrorist financing risks within EU payment firms. This assessment was carried out under Article 9a(5) of Regulation (EU) 1095/2010, which mandates the EBA to evaluate significant money laundering and terrorist financing (ML/TF) risks within the EU's financial sector. The EBA leveraged a variety of sources, including data from its anti-money laundering/counter terrorist financing (AML/CFT) database, EuReCA, and findings from its peer review on the authorisation of payment institutions under the revised Payment Services Directive (PSD2). The key findings revealed that payment institutions' risk management strategies were not always effective, and that some supervisors did not adjust their approach to reflect the level of ML/TF risks. The resulting report underscores the need for more robust implementation of existing EBA guidelines and changes to the EU legal framework to mitigate the sector’s exposure to ML/TF risks.

ML/TF in EU Payment Firms: Compliance and Risk Management

The recent assessment conducted by the European Banking Authority (EBA) on the management of money laundering and terrorist financing (ML/TF) risks within EU payment firms has highlighted significant concerns. The findings of this assessment, carried out under Article 9a(5) of Regulation (EU) 1095/2010, shed light on the need for stronger risk management strategies and more robust implementation of existing EBA guidelines.

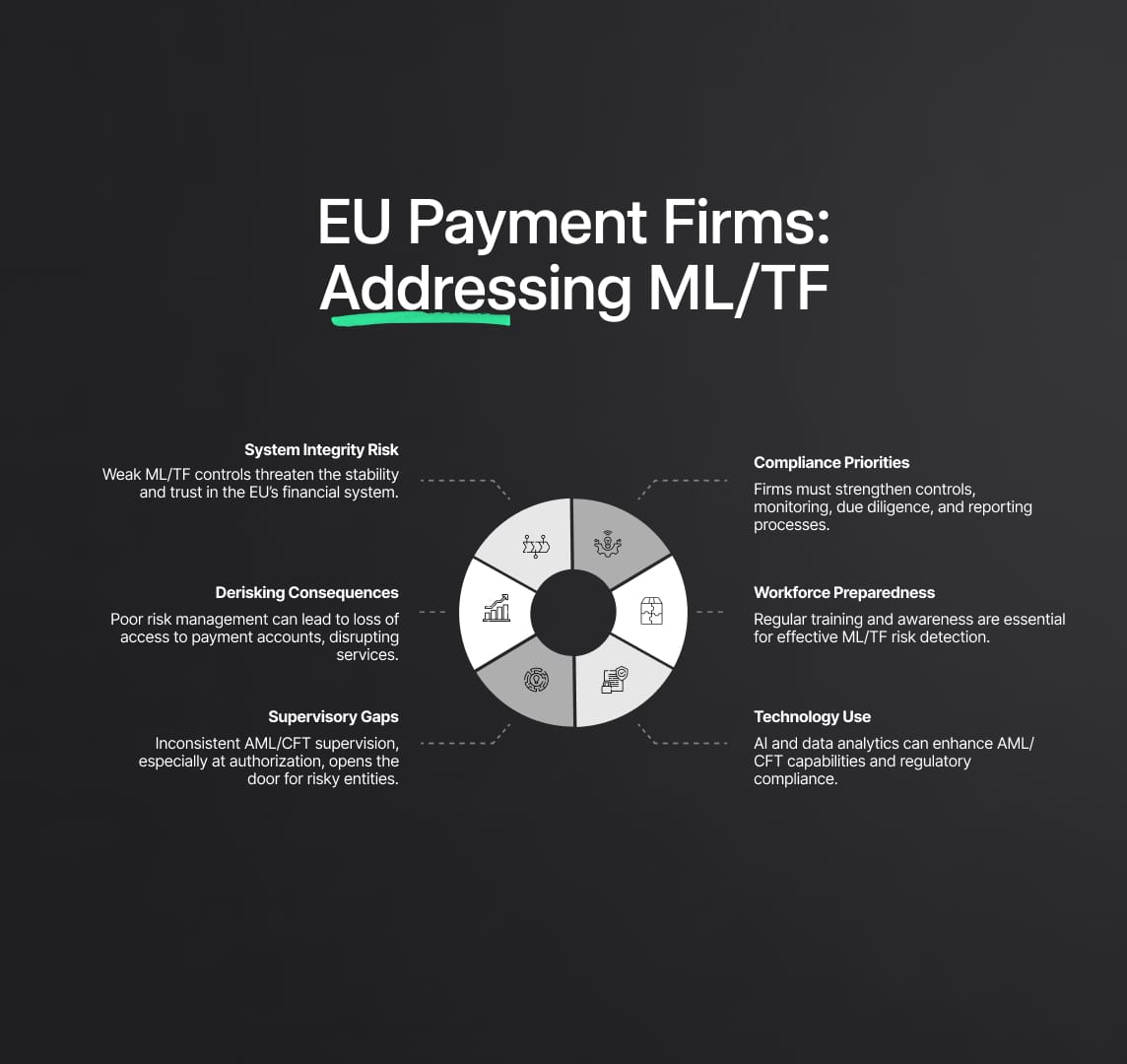

The report's implications extend beyond the operational realm of payment institutions and have potential far-reaching consequences. One of the key concerns is the undermining of the integrity of the EU's financial system. Poorly managed ML/TF risks can erode investor confidence, leading to unstable financial markets and potential economic downturns. This emphasizes the importance of addressing and mitigating these risks effectively.

Moreover, the report identifies the practice of derisking as a consequence of ineffective ML/TF risk management. Derisking involves financial institutions distancing themselves from clients or sectors perceived as high-risk. If payment institutions' ML/TF risks are not adequately managed, their access to payment accounts may decrease. This could disrupt system liquidity and impede the smooth functioning of the payment sector, with implications for businesses and individuals relying on these services.

Furthermore, the assessment reveals inconsistencies in the AML/CFT supervision of payment institutions, particularly during the authorization process. Such inconsistencies create a potential loophole for entities with weak AML/CFT controls to operate within the EU, increasing ML/TF risks. This poses significant threats to the financial stability and security of EU countries, necessitating a more consistent and effective approach towards AML/CFT supervision, especially in cross-border contexts.

To address these implications and stay compliant with Regulation (EU) 1095/2010, EU payment firms and payment institutions should focus on enhancing their risk management strategies. This includes reviewing and strengthening internal controls, customer due diligence procedures, transaction monitoring systems, and suspicious activity reporting processes. Collaboration with supervisors and proactive communication is vital to understand and address concerns related to ML/TF risks.

Additionally, ongoing staff training and awareness programs should be implemented to enhance employees' knowledge of ML/TF risks, detection techniques, and reporting obligations. Embracing advanced technologies such as artificial intelligence and data analytics can also bolster AML/CFT systems and processes.

Overall, the EBA's assessment reinforces the critical importance of effectively managing ML/TF risks in the EU's payment sector. By prioritizing robust risk management practices and regulatory compliance, payment institutions can contribute to the integrity, stability, and security of the EU's financial system while maintaining trust and confidence among investors and customers.

Read More

Reduce your

compliance risks